Summary Of the Markets Today:

- The Dow closed up 39 points or 0.12%,

- Nasdaq closed down 1.23%,

- S&P 500 closed down 0.50%, (low 4,328)

- Gold $1,941 up $58.30,

- WTI crude oil settled at $88 up $4.72,

- 10-year U.S. Treasury 4.623% down 0.088 points,

- USD Index $106.62 up $0.030,

- Bitcoin $26,758 up $45,

- Baker Hughes Rig Count: U.S. +3 to 622 Canada +13 to 193

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our Economic Forecast for October 2023

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

Export and import prices continue to deflate. Prices for U.S. imports declined 1.7 percent for the year ending in September 2023, whilst U.S. exports decreased 4.1 percent over the past year. This makes some sense as international trade is flat.

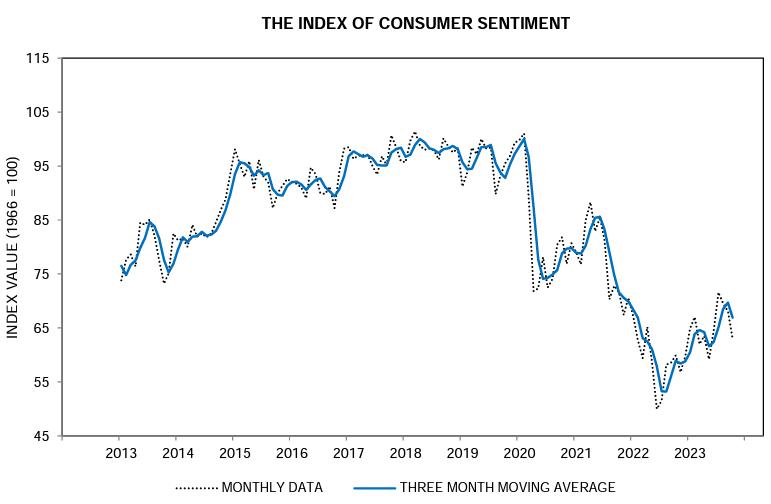

University of Michigan preliminary consumer sentiment fell back about 7% this October following two consecutive months of very little change. Assessments of personal finances declined about 15%, primarily on a substantial increase in concerns over inflation, and one-year expected business conditions plunged about 19%. However, long-run expected business conditions are little changed, suggesting that consumers believe the current worsening in economic conditions will not persist. Nearly all demographic groups posted setbacks in sentiment, reflecting the continued weight of high prices.

Here is a summary of headlines we are reading today:

- JPMorgan CEO Dimon: World Is Facing Most Dangerous Time In Decades

- U.S. Oil Drillers Add 4 Rigs, Brent Crude Hits $90

- The U.S. Allocates $7 Billion Of Grants To Hydrogen Production Hubs

- Desperate And Incompetent: Hamas May Have Acted Alone

- Oil Prices Rally As The U.S. Enforces Sanctions On Russian Exports

- Israel-Hamas war live updates: Civilians scramble to flee north Gaza ahead of expected Israeli ground offensive

- S&P 500 closes lower on Friday, but notches second straight positive week: Live updates

- Pharmacy staff from Walgreens, other chains could stage nationwide walkout and rallies in coming weeks

- Crypto’s role in the Israel-Hamas war comes under scrutiny: CNBC Crypto World

- Economists Warn Of “Bigger” Middle East War, But Yellen Downplays Its Economic Impact

- Market Snapshot: Dow turns lower as U.S. stocks fall amid Middle East tensions

- Bond Report: 10-, 30-year yields have biggest weekly drops in months as investors flock to safety on Middle East tensions

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Russia Denies Talks Of A Gas CartelThere are no plans for the creation of a natural gas cartel similar to the OPEC cartel in crude oil, Russia’s Deputy Prime Minister Alexander Novak said on Friday. “There are no discussions to set up a (gas) cartel,” Novak told RT Arabic TV as quoted by Reuters. The Gas Exporting Countries Forum (GECF) is an organization of gas producers and exporters but it is not coordinating supply to the market the way OPEC does. Russia is a member of the GECF and its top energy official Novak said in the televised interview… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Russia-Denies-Talks-Of-A-Gas-Cartel.html |

|

JPMorgan CEO Dimon: World Is Facing Most Dangerous Time In DecadesJamie Dimon, chief executive of JP Morgan, said the early 2020s were shaping up to be “the most dangerous time the world has seen in decades” as the Wall Street banking giant reported another increase in profit. Citing geopolitical tensions, “extremely high government debt levels” and the unknown longer-term consequences of quantitative tightening in reducing liquidity, Dimon suggested the global economy faced difficult years ahead. “The war in Ukraine compounded by last week’s attacks on Israel may… Read more at: https://oilprice.com/Finance/the-Economy/JPMorgan-CEO-Dimon-World-Is-Facing-Most-Dangerous-Time-In-Decades.html |

|

Bulgarian Opposition: Government Energy Policies Are “Risk For National SecurityThe Bulgarian government faces a vote of no-confidence in parliament on October 13 over plans for a transition to cleaner energy and other policies in the energy sector that have sparked angry protests from miners and other workers. The motion, filed by the nationalist and pro-Russian party Vazrazhdane and backed by the Bulgarian Socialist Party (BSP), and the small populist party There Is Such People (ITN), is seen as having little chance of succeeding as the three parties do not have enough seats in the parliament.Members of the three opposition… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Bulgarian-Opposition-Government-Energy-Policies-Are-Risk-For-National-Security.html |

|

France Mulls Extending Windfall Tax On Oil And Power GiantsFrance is considering an extension of its windfall tax for oil and power companies into the new year, according to French lawmaker Jean-Rene Cazeneuve, who shared the plan on X. The plan, hatched by the National Assembly’s finance committee, is part of a proposed amendment to France’s budget bill for 2024 and would serve to offset higher costs for French consumers of gasoline, diesel, and electricity. The budget bill still must be adopted by parliament to go into effect. Last November, when the original windfall tax plan was being crafted,… Read more at: https://oilprice.com/Latest-Energy-News/World-News/France-Mulls-Extending-Windfall-Tax-On-Oil-And-Power-Giants.html |

|

U.S. Oil Drillers Add 4 Rigs, Brent Crude Hits $90The total number of active drilling rigs in the United States rose by 3 this week after falling 4 last week, according to new data from Baker Hughes published Friday. The total rig count rose to 622 this week. So far this year, Baker Hughes has estimated a loss of 157 active drilling rigs. This week’s count is 453 fewer rigs than the rig count at the beginning of 2019 prior to the pandemic. The number of oil rigs rose by 4 to 501, down by 120 so far in 2023. The number of gas rigs fell by 1 this week to 117, a loss of 39 active gas rigs from… Read more at: https://oilprice.com/Energy/Energy-General/US-Oil-Drillers-Add-4-Rigs-Brent-Crude-Hits-90.html |

|

Finland Restricts Access To LNG Infrastructure After Suspected Pipeline SabotageFinland prepares to restrict access to a port area hosting one of its two floating LNG import terminals after an offshore natural gas pipeline between Finland and Estonia was shut down this weekend following a leak suspected to be caused by sabotage. The authorities are preparing a decree to restrict access to the area around the Inkoo LNG floating terminal, the Interior Ministry said on Friday, days after Finland’s President Sauli Niinisto said that the damage to the Balticconnector gas pipeline is likely to have been caused… Read more at: https://oilprice.com/Energy/Natural-Gas/Finland-Restricts-Access-To-LNG-Infrastructure-After-Suspected-Pipeline-Sabotage.html |

|

Treasury Targets Firms Ignoring $60 Cap On Russian CrudeThe U.S. Treasury Department has announced sanctions on two companies for allegedly violating a price cap on Russian oil agreed last year by Western countries. Vessels owned by companies based in the United Arab Emirates and Turkey were cited as having violated a price cap set in December by the countries in the Group of Seven leading economies, the European Union, and Australia.The coalition set the price cap at $60 per barrel for Russian crude to restrict income for Russian oil that could then be used to fund its invasion of Ukraine.A vessel… Read more at: https://oilprice.com/Energy/Oil-Prices/Treasury-Targets-Firms-Ignoring-60-Cap-On-Russian-Crude.html |

|

The U.S. Allocates $7 Billion Of Grants To Hydrogen Production HubsThe U.S. Administration announced on Friday it had selected seven regional hubs for hydrogen production that would receive a total of $7 billion in grants to produce hydrogen, as part of President Biden’s goal to boost the clean hydrogen economy and decarbonize industries. Projects in the seven selected hubs will include several ways of hydrogen production, including the so-called green hydrogen from water electrolysis using renewable electricity, the ‘pink’ hydrogen using nuclear electricity for electrolysis, and the ‘blue… Read more at: https://oilprice.com/Latest-Energy-News/World-News/The-US-Allocates-7-Billion-Of-Grants-To-Hydrogen-Production-Hubs.html |

|

Europe’s Natural Gas Price Rally Stokes Supply Concerns1. ExxonMobil-Pioneer Merger May Spark Further Giant Deals- The largest upstream deal since Shell’s 2015 acquisition of BG for $82 billion, ExxonMobil’s acquisition of Pioneer Natural Resources has become the crown jewel of post-Covid E&P consolidation. – With the Pioneer deal, ExxonMobil will gain over 700,000 boe/d of production in the Midland Basin as well as 5 billion of annual free cash flow, creating the world’s largest tight oil company with a Permian resource base of over 16 billion boe. – By 2024, the Permian is set… Read more at: https://oilprice.com/Energy/Energy-General/Europes-Natural-Gas-Price-Rally-Stokes-Supply-Concerns.html |

|

Huge Build In Crude Inventories Is A Red Flag For Oil MarketsDecember West Texas Intermediate (WTI) crude oil futures experienced a volatile week, with prices swaying due to geopolitical tensions and shifts in supply and demand metrics. The market started the week strong, driven by concerns of supply disruptions following the terrorist attacks by Hamas on Israel. However, the bullish sentiment quickly faded. Israel-Hamas Conflict and Oil Supply Initially, oil prices surged to a weekly high of $85.56 due to fears that the escalating conflict between Israel and the Palestinian Islamist group Hamas could morph… Read more at: https://oilprice.com/Energy/Energy-General/Huge-Build-In-Crude-Inventories-Is-A-Red-Flag-For-Oil-Markets.html |

|

Desperate And Incompetent: Hamas May Have Acted AloneRegardless of any possible involvement of Iran in the attacks on Israel last weekend, which resulted in an Israeli declaration of war, Hamas found itself in an untenable situation. It needed escalation. Desperately. There is a case for this attack having been a solo endeavor by Hamas. And that in itself is indicative of the unsustainability of Israel’s endless military control of the Palestinian Territories. In that sense, Iran’s “involvement” is as irrelevant as it is difficult to define. Hamas has found… Read more at: https://oilprice.com/Energy/Energy-General/Desperate-And-Incompetent-Hamas-May-Have-Acted-Alone.html |

|

Brent Nears $90 As The U.S. Signals Stricter Sanctions EnforcementWhile oil prices had fallen back after soaring at the start of the week, signs that the U.S. is set to step up its sanctions action against both Russia and Iran have boosted prices, with Brent now nearing $90.Friday, October 13th, 2023. The sanctions hammer wielded by the Biden administration this week has been inadvertently supporting oil prices, with ICE Brent set to finish this week at 88 per barrel, an unlikely prospect given the huge US inventory builds reported mid-week. However, a pledged ramp-up in Russia’s oil price cap enforcement,… Read more at: https://oilprice.com/Energy/Energy-General/Brent-Nears-90-As-The-US-Signals-Stricter-Sanctions-Enforcement.html |

|

A Trading Strategy For Energy EarningsEarnings season, the gift that keeps on giving for US stock traders and investors, is underway, with results for the quarter that ended at the end of September beginning to trickle in. On the energy side, big oil and other significant companies in the sector aren’t typically among the first to release results, and this quarter is no exception. There will be a couple of reports of interest in the coming week, Tesla (TSLA) on Wednesday and Schlumberger (SLB) on Friday, but energy doesn’t really get going until the following week when… Read more at: https://oilprice.com/Energy/Energy-General/A-Trading-Strategy-For-Energy-Earnings.html |

|

U.S. Official: Russia Will Never Be Seen As A Reliable Energy SupplierRussia will never again be seen as a reliable supplier of energy, Geoffrey R. Pyatt, U.S. Assistant Secretary of State for Energy Resources, said on Friday. During talks in Japan this week and in Europe in the past weeks, “In all those conversations, it’s very clear to me that Russia is never again going to be viewed as a reliable energy supplier,” Pyatt said on a special briefing today, ahead of a U.S.-Japan Energy Security Dialogue. “So the question is how best to phase out our exposure to Russian supplies,” the… Read more at: https://oilprice.com/Latest-Energy-News/World-News/US-Official-Russia-Will-Never-Be-Seen-As-A-Reliable-Energy-Supplier.html |

|

Oil Prices Rally As The U.S. Enforces Sanctions On Russian ExportsOil prices jumped by nearly 4% early on Friday after the United States took a tougher stance on the Western sanctions against Russia, adding to growing concerns about supply amid fears of escalation in the Hamas-Israel war. As of 7:00 a.m. EST, the U.S. benchmark WTI Crude was up by 3.63% on the day at $85.95, and the international benchmark, Brent Crude, traded 3.50% higher at $88.99. Both benchmarks were headed for a weekly gain after the Hamas attack on Israel pushed prices higher on Monday. But fears of economic slowdown and a build in U.S.… Read more at: https://oilprice.com/Energy/Energy-General/Oil-Prices-Rally-As-The-US-Enforces-Sanctions-On-Russian-Exports.html |

|

What to make of the UAW’s shifting strike tactics after the latest escalationThe union initiated a surprise strike of 8,700 workers at Ford Motor’s Kentucky Truck Plant, the most crucial plant affected by the disruptions so far. Read more at: https://www.cnbc.com/2023/10/13/uaw-strikes-what-to-make-of-the-latest-escalation-at-ford.html |

|

Israel-Hamas war live updates: Civilians scramble to flee north Gaza ahead of expected Israeli ground offensiveThe Israeli military has instructed civilians in Gaza City to evacuate southward, as concerns of a ground offensive grow. Read more at: https://www.cnbc.com/2023/10/13/israel-hamas-gaza-live-updates.html |

|

Deflation is the anti-inflation. Here’s where prices fell in September 2023 in one chartConsumers saw prices deflate in several categories in September, according to the consumer price index. This chart shows which prices have fallen. Read more at: https://www.cnbc.com/2023/10/13/deflation-is-the-anti-inflation-heres-the-september-2023-breakdown.html |

|

S&P 500 closes lower on Friday, but notches second straight positive week: Live updatesStocks were lower Friday as traders pored through major bank earnings, and Treasury yields pulled back. Read more at: https://www.cnbc.com/2023/10/12/stock-market-today-live-updates.html |

|

House speaker race injects chaos into high-dollar Republican fundraisingRepublican donors are moving to fight back against House members like Reps. Matt Gaetz and Nancy Mace, who voted to oust Kevin McCarthy as speaker. Read more at: https://www.cnbc.com/2023/10/13/house-speaker-race-creates-fundraising-chaos-as-scalise-withdraws.html |

|

Bond manager with $1 trillion on the line says you will be ‘well rewarded’ by doing thisThe volatility in the bond market can provide a great opportunity for investors, said Pimco chief investment officer Dan Ivascyn. Read more at: https://www.cnbc.com/2023/10/13/1-trillion-bond-manager-says-youll-be-well-rewarded-by-doing-this.html |

|

Pharmacy staff from Walgreens, other chains could stage nationwide walkout and rallies in coming weeksThe plans come after separate walkouts staged by pharmacy staff from CVS stores in the Kansas City area and Walgreens locations around the country. Read more at: https://www.cnbc.com/2023/10/13/walgreens-pharmacy-staff-could-stage-nationwide-walkout.html |

|

Biden praises Kaiser Permanente labor agreement after worker strike: ‘Collective bargaining works’The Biden administration helped broker a deal between more than 85,000 health workers and Kaiser Permanente. Read more at: https://www.cnbc.com/2023/10/13/biden-praises-kaiser-permanente-agreement-collective-bargaining-works.html |

|

Crypto’s role in the Israel-Hamas war comes under scrutiny: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. James Koutoulas, CEO of Typhon Capital Management, weighs in on reports that Hamas militants behind the surprise attacks in Israel raised millions in crypto. He discusses how blockchain technology can help track this kind of illicit activity. Read more at: https://www.cnbc.com/video/2023/10/13/cryptos-role-israel-hamas-war-under-scrutiny-crypto-world.html |

|

Novo Nordisk hikes outlook on soaring demand for Wegovy, OzempicNovo Nordisk’s forecast only confirms the frenzy for Wegovy and Ozempic, which patients seek for their ability to help them lose significant weight over time. Read more at: https://www.cnbc.com/2023/10/13/novo-nordisk-hikes-outlook-on-soaring-demand-for-wegovy-ozempic.html |

|

‘There is nowhere to hide from the bombs’: Civilians trapped in Gaza can’t escape Israel’s siegeIn the Gaza Strip survival is increasingly a game of chance. Read more at: https://www.cnbc.com/2023/10/13/civilians-trapped-in-gaza-cant-escape-israels-siege.html |

|

Iran-backed Hezbollah joining Israel-Hamas conflict would be a ‘game changer’With an Israeli ground incursion potentially imminent in the north of the Gaza Strip, the conflict could grow to involve other regional actors, analysts say. Read more at: https://www.cnbc.com/2023/10/13/hezbollah-joining-conflict-in-neighboring-israel-would-be-a-gamechanger.html |

|

Student loan borrowers hit snags as payments resume: ‘It’s a challenging environment,’ head of loan servicer group saysAs payments resume after a multi-year break, borrowers describe receiving incorrect bills and incredibly long wait times trying to contact their servicers. Read more at: https://www.cnbc.com/2023/10/13/student-loan-borrowers-hit-snags-as-payments-resume.html |

|

US Sanctions Two Tanker Owners For Breaching Russian Oil Price CapBy Irina Slav of OilPrice.com The United States has slapped sanctions on two tanker owners for carrying Russian oil sold for over $60 per barrel.

This is the first time the U.S. is imposing sanctions for a breach of the price cap that the G7 and the European Union agreed to impose on Russia last year. For several months, Russian crude traded lower than the price cap anyway, which made the cap easily enforceable. This year, however, as benchmark prices began to climb so did the prices for Russian crude, and by September the gap between the G7 price cap and the actual price at which Russian crude sold was over $20 per barrel. Read more at: https://www.zerohedge.com/markets/us-sanctions-two-tanker-owners-breaching-russian-oil-price-cap |

|

Israel Gives Major Hospital In Northern Gaza 2 Hours To Evacuate Staff & PatientsUpdate(1425ET): Fears of an imminent all-out ground and aerial assault are growing, after one of northern Gaza’s main hospitals has sent out an SOS message. Hospital officials say they’ve been given two hours to evacuate. The WHO has decried this as life-threatening for patients there:

A Gaza activist organization describes of the hospital:

But where will they go? Read more at: https://www.zerohedge.com/geopolitical/israel-gives-11-million-gazans-24-hours-evacuate-northern-strip-hamas-says-ignore |

|

Turley: Federal Court Asked To Address 14th Amendment Effort To Bar TrumpAuthored by Jonathan Turley, Legal academics are divided on the new popular theory that former President Donald Trump can be removed from ballots under Section 3 of the Fourteenth Amendment. While I respect many of the academics who view this as a credible interpretation, I have long opposed it as textually and historically flawed. In addition to some exaggerated claims of precedent, I view the theory as one of the most dangerous in my lifetime. One thing, however, we agree upon: it is time for the federal courts to rule on this theory to bring clarity to the election. That may now occur in West Virginia where Attorney General Patrick Morrisey wants a federal court to throw out a lawsuit attempting to remove Donald Trump from the ballot in the state. What is most striking about the filing is the accusation of judge-shopping by advocates like John Anthony Castro in seeking to remove Donald Trump from the ballot in the state. Read more at: https://www.zerohedge.com/political/turley-federal-court-asked-address-14th-amendment-effort-bar-trump |

|

Economists Warn Of “Bigger” Middle East War, But Yellen Downplays Its Economic ImpactAuthored by Andrew Moran via The EPoch Times, The war between Hamas and Israel is unlikely to spill over into the global economy, Treasury Secretary Janet Yellen told delegates at the annual meetings of the International Monetary Fund (IMF) and World Bank, in Morocco.

Despite the initial volatility in global financial markets on Oct. 9, investors have largely dismissed concerns that the latest conflict in the Middle East will impact the international economy, pricing in various scenarios. Ms. Yellen does not think the events will result in anything “very significant” for the global economic outlook.

|

|

Bank boss warns world facing ‘most dangerous time in decades’Jamie Dimon says conflicts in Ukraine and Israel may hit energy and food markets, and global trade. Read more at: https://www.bbc.co.uk/news/business-67104734?at_medium=RSS&at_campaign=KARANGA |

|

Microsoft completes $69bn takeover of Call of Duty-maker Activision BlizzardIt comes after the UK approved the $69bn takeover of Activision Blizzard, which makes Call of Duty. Read more at: https://www.bbc.co.uk/news/business-67080391?at_medium=RSS&at_campaign=KARANGA |

|

Next confirms takeover of Fatface in £115m dealThe retailer has added the clothing chain to the growing list of High Street names it has bought. Read more at: https://www.bbc.co.uk/news/business-67105142?at_medium=RSS&at_campaign=KARANGA |

|

Show of Strength: These 5 auto stocks record their new 52-week highIn Friday’s trading session, the Sensex benchmark index saw a drop of approximately 126 points, ending the day at 66,283. Nevertheless, amid this market decline, 5 stocks from the auto index achieved their highest prices in the last 52 weeks.The 52-week high metric functions as a vital technical indicator for evaluating a stock’s current value and projecting potential price fluctuations. This value represents the highest price at which a stock has been trading in the past year. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/these-5-auto-stocks-hit-a-52-week-high-do-you-own-any/show-of-strength/slideshow/104404039.cms |

|

Tech View: Nifty giving consolidation signs. What traders should do next weekThe positive chart pattern like higher tops and bottoms is intact as per daily chart and Friday’s swing low of 19,635 could be considered as a new higher bottom of the sequence Read more at: https://economictimes.indiatimes.com/markets/stocks/news/tech-view-nifty-giving-consolidation-signs-what-traders-should-do-next-week/articleshow/104402414.cms |

|

Top 3 most-valued stocks erode wealth in last 2 years. Are bluechips new backbenchers?In the last 2 years, India’s three most valued stocks – Reliance Industries (RIL), Tata Consultancy Services (TCS) and HDFC Bank – have all given negative returns. RIL is down 12%, TCS 2% and HDFC Bank around 6%. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/top-3-most-valued-stocks-erode-wealth-in-last-2-years-are-bluechips-new-backbenchers/articleshow/104389302.cms |

|

Market Snapshot: Dow turns lower as U.S. stocks fall amid Middle East tensionsU.S. stocks are lower Friday afternoon, giving up most of their opening gains on geopolitical fears and concerns about inflation expectations. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-727D-BAE64180A478%7D&siteid=rss&rss=1 |

|

Bond Report: 10-, 30-year yields have biggest weekly drops in months as investors flock to safety on Middle East tensionsTreasury yields drop on Friday as traders flock to bonds amid concerns about an escalating conflict between Israel and Hamas. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-727D-D25A8891B1B3%7D&siteid=rss&rss=1 |

|

Jim Jordan vies for House speaker job again amid worries over government shutdown and support for IsraelGOP Reps. Jim Jordan and Austin Scott vie to become the House speaker, as analysts warn that drama is preventing the chamber from addressing crucial matters. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-727E-0441D57E8873%7D&siteid=rss&rss=1 |