Summary Of the Markets Today:

- The Dow closed up 66 points or 0.19%,

- Nasdaq closed up 0.71%,

- S&P 500 closed up 0.43%, (low 4,261)

- Gold $1,887 up $12.10,

- WTI crude oil settled at $84 down $1.98,

- 10-year U.S. Treasury 4.571% down 0.084 points,

- USD Index $105.78 down $0.005,

- Bitcoin $26,759 down $638,

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our Economic Forecast for October 2023

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

The Producer Price Index for final demand advanced 2.2% for the 12 months that ended in September 2023 (blue line on the graph below). My forecast is that inflation will continue to worsen for the rest of this year.

The meeting minutes for the Federal Reserve’s Federal Open Market Committee (FOMC) minutes for September 19-20, 2023 show participant’s views [major concerns or comments listed below]:

… participants remarked that the finances of some households were coming under pressure amid high inflation and declining savings and that there had been an increasing reliance on credit to finance expenditures. In addition, tighter credit conditions, waning fiscal support for families, and a resumption of student loan payments were viewed by several participants as having the potential to weigh on the growth of consumption.

… participants noted improved business conditions from an increased ability to hire and retain workers, better-functioning supply chains, or reduced input cost pressures. A few participants commented that their business contacts had reported difficulties passing on cost increases to customers. Several participants judged that, over coming quarters, business activity would be restrained by tighter financial conditions, such as higher interest rates and more constrained access to bank credit.

… Many participants commented that they expected that the autoworkers’ strike would, in the near term, result in a slowdown in production of motor vehicles and parts and possibly put upward pressure on automobile prices, but that these effects would be temporary.

… Some participants observed that payroll growth remained strong but had slowed in recent months to a pace closer to that consistent with maintaining a constant unemployment rate over time. Most participants commented that the pace of nominal wage increases had moderated, and a few also mentioned that the wage premium for job switchers had come down. They noted, however, that nominal wages were still rising at rates above levels generally assessed to be consistent with the sustained achievement of the Committee’s 2 percent inflation objective, given current estimates of trend productivity growth.

… Several participants remarked that, despite the recent rise in energy prices, food and energy prices over the past year had contributed to a decline in overall inflation. … Participants observed that, notwithstanding recent favorable developments, inflation remained well above the Committee’s 2 percent longer-run objective and that elevated inflation was continuing to harm businesses and households—particularly low-income households.

… Participants generally noted there was still a high degree of uncertainty surrounding the economic outlook. One new source of uncertainty was that associated with the autoworkers’ strike, and many participants observed that an intensification of the strike posed both an upside risk to inflation and a downside risk to activity. A majority of participants pointed to upside risks to inflation from rising energy prices that could undo some of the recent disinflation or to the risk that inflation would prove more persistent than expected.

… A majority of participants judged that one more increase in the target federal funds rate at a future meeting would likely be appropriate, while some judged it likely that no further increases would be warranted. All participants agreed that the Committee was in a position to proceed carefully and that policy decisions at every meeting would continue to be based on the totality of incoming information and its implications for the economic outlook as well as the balance of risks.

… Several participants commented that, with the policy rate likely at or near its peak, the focus of monetary policy decisions and communications should shift from how high to raise the policy rate to how long to hold the policy rate at restrictive levels.

… A vast majority of participants continued to judge the future path of the economy as highly uncertain. Many noted data volatility and potential data revisions, or the difficulty of estimating the neutral policy rate, as supporting the case for proceeding carefully in determining the extent of additional policy firming that may be appropriate.

Here is a summary of headlines we are reading today:

- New Process Makes Green Hydrogen And Graphene From Plastic

- Israel-Hamas Conflict Sends Shockwaves Through Steel Market

- The Nuclear Microreactor Race Is Heating Up

- Qatar Signs 27-Year Deal To Supply France With LNG

- U.S. Treasury: G7 Price Cap Has Significantly Reduced Russia’s Oil Income

- Fed officials see ‘restrictive’ policy staying in place until inflation eases, minutes show

- Birkenstock slides about 10% in stock market debut after opening at $41 per share

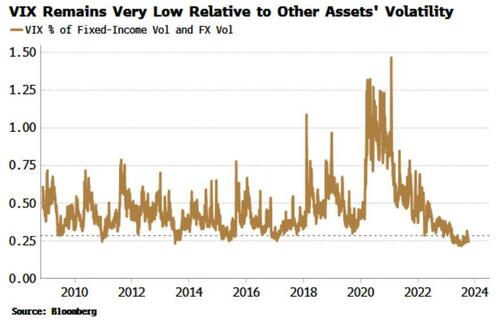

- Days Of Low VIX Numbered As Financial Conditions Turn The Screw

- FOMC Minutes Echo ‘Hawkish Tone’ From Meeting; Fed To “Proceed Carefully”

- The Fed: Fed minutes show officials wary about the outlook and wanting to move carefully

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

New Process Makes Green Hydrogen And Graphene From PlasticRice University researchers have found a way to harvest hydrogen from plastic waste using a low-emissions method that generates graphene as a by-product, which could help offset production costs. Hydrogen is viewed as a promising alternative to fossil fuel, but the methods used to make it either generate too much carbon dioxide or are too expensive. Rice University researchers have found a way to harvest hydrogen from plastic waste using a low-emissions method that could more than pay for itself. Kevin Wyss, a Rice doctoral alumnus and lead author… Read more at: https://oilprice.com/Energy/Energy-General/New-Process-Makes-Green-Hydrogen-And-Graphene-From-Plastic.html |

|

Azerbaijan And Iran Relations Warm As Tensions EaseThere are signs that tensions are abating in relations between Azerbaijan and Iran. They come in the wake of Baku’s lightning offensive to take back Nagorno-Karabakh and the subsequent exodus of the region’s ethnic Armenian population. Iran officially welcomed the region’s return to Azerbaijan’s fold. On October 7, Iran’s road and urban planning minister, Mehrdad Bazrpash, while on a visit to Azerbaijan, said that Azerbaijan’s embassy in Tehran could resume its work soon. “The Iranian side has asked for the quick restoration of the… Read more at: https://oilprice.com/Energy/Energy-General/Azerbaijan-And-Iran-Relations-Warm-As-Tensions-Ease.html |

|

Sheffield: Oil Prices Will Spike If Iran Jumps Into Hamas-Israel ConflictPioneer Natural Resources CEO Scott Sheffield has warned that while oil prices have given up their brief rally following Hamas’ attack on Israel over the weekend, prices could soar significantly if Iran becomes directly involved in the conflict. “If Iran enters the war, we’re going to see much higher oil prices, obviously,” Sheffield said Wednesday on CNBC’s Squawk Box. After gaining more than $3.50 on Monday and closing at $88.15 on Monday, October 9, Brent crude prices have now fallen to $86.63 as… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Sheffield-Oil-Prices-Will-Spike-If-Iran-Jumps-Into-Hamas-Israel-Conflict.html |

|

Israel-Hamas Conflict Sends Shockwaves Through Steel MarketVia Metal Miner The fresh conflict between Israel and Hamas in Palestine has started to ring warning bells throughout supply chains for oil, steel, and various metals. Indeed, if prolonged, the conflict could adversely affect steel prices as well as many other commodities. Already under strain because of the more than year-old Russian invasion of Ukraine, this new conflict has raised concerns in India as well as among Turkish and Russian steel exporters. The President of the trade representative organization PHDCCI, Sanjeev Agarwal, said the conflict… Read more at: https://oilprice.com/Metals/Commodities/Israel-Hamas-Conflict-Sends-Shockwaves-Through-Steel-Market.html |

|

Putin Says OPEC+ Output Cuts ‘Likely’ To Continue Into 2024Russian President Vladimir Putin told an energy conference in Moscow on Wednesday that Russia and Saudi Arabia would “most likely” extend output cuts into 2024 and warned that clashes in the Middle East could impact oil exports with higher shipping and insurance costs. “I am sure that the coordination of the OPEC+ partners’ actions will continue,” Putin told the conference. “This is important for the predictability of the oil market, and ultimately for the well-being of all mankind,” Putin added, noting that while Russia… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Putin-Says-OPEC-Output-Cuts-Likely-To-Continue-Into-2024.html |

|

The Nuclear Microreactor Race Is Heating UpDuring a wide-ranging interview with The Epoch Times, the leadership of Nano Nuclear Energy Inc. predicted they would win the race to commercialize a reactor small enough to fit in a shipping container. “By 2030, we’re pretty convinced we’ll be the first company to sell microreactors,” said Nano Nuclear CEO James Walker, a nuclear physicist who previously led the development of the Rolls-Royce Nuclear Chemical Plant. Nuclear microreactors are meant to be nimble, mobile sources of heat or up to 20 megawatts of electricity. Microreactors are utterly… Read more at: https://oilprice.com/Alternative-Energy/Nuclear-Power/The-Nuclear-Microreactor-Race-Is-Heating-Up.html |

|

Venezuela’s Growing Dark Fleet Highlights Maduro’s Dependence On IranVenezuela is deploying a secret weapon to defeat strict U.S. sanctions aimed at blocking the OPEC member’s economically crucial crude oil exports, a dark fleet of tanker vessels using a range of strategies to conceal their location. Recently the dark fleet shipping Venezuela’s oil to key customers, mainly in Asia, grew significantly with the assistance of Russia and Iran. Indeed, from 2020 authoritarian Iran emerged as a key strategic ally that is propping up the autocratic Maduro regime. Tehran supplies Venezuela not only with a steady… Read more at: https://oilprice.com/Energy/Energy-General/Venezuelas-Growing-Dark-Fleet-Highlights-Maduros-Dependence-On-Iran.html |

|

EIA: Population Growth Means High-Rising Energy ConsumptionThanks to global population growth, rising living standards and related increases in manufacturing from now until 2050, the Energy Information Administration (EIA) sees energy consumption growing faster than advancements in efficiency. The EIA projects that global energy-related CO2 emissions will increase by 2050 as a result of this increased consumption. “Non-fossil fuel-based resources, including nuclear and renewables, produce more energy through 2050, but in most of the IEO2023 cases we examined, that growth is not sufficient… Read more at: https://oilprice.com/Latest-Energy-News/World-News/EIA-Population-Growth-Means-High-Rising-Energy-Consumption.html |

|

NATO Chief Warns Of Potential ‘Response’ To Sabotage Of Finland PipelineFinland and other Baltic countries are on high alert as a natural gas undersea pipeline leak was detected on Sunday from Finland to Estonia. EU officials already suspect the leak was caused by a ‘deliberate act of destruction,’ which fuels concerns about ‘Nordstream 2.0’ and Europe’s energy security ahead of the Northern Hemisphere winter. On Wednesday, NATO Secretary General Jens Stoltenberg met with EU officials about the damage sustained on the 77-kilometer (48-mile) Balticconnector pipeline, first detected by one of the two pipeline operators,… Read more at: https://oilprice.com/Energy/Natural-Gas/NATO-Chief-Warns-Of-Potential-Response-To-Sabotage-Of-Finland-Pipeline.html |

|

India’s Diesel Exports To Europe Soar To Record HighIndia’s diesel exports loading for Europe hit a record high in September amid open arbitrage for westbound shipments, Reuters reported on Wednesday, citing tanker-tracking data and analysts. Last month, diesel cargoes loading from India and bound for Europe averaged between 280,000 barrels per day (bpd) and 303,000 bpd – or roughly half of all Indian diesel shipments in September, according to vessel-tracking data by LSEG, Vortexa, and Kpler cited by Reuters. At the same time, Indian diesel shipments eastwards to Singapore slumped in… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Indias-Diesel-Exports-To-Europe-Soar-To-Record-High.html |

|

NATO On Alert After Baltic Pipeline IncidentPresident Alar Karis says Estonia is demanding answers for damage to a Baltic Sea gas pipeline running to Finland that the Baltic nation’s defense minister said was the result of “quite heavy force” that could have been caused by “mechanical impact.” Finland said it had raised its preparedness level on October 11 after damage was discovered to the Balticconnector pipeline over the weekend as an investigation into the incident continues amid suspicions it was caused by outside interference. “We know that the cause is not… Read more at: https://oilprice.com/Geopolitics/International/NATO-On-Alert-After-Baltic-Pipeline-Incident.html |

|

Namibia Expects First Oil Production By 2030One of the world’s exploration hotspots, Namibia, expects first oil from the recent major offshore discoveries by 2030, the country’s Petroleum commissioner Maggy Shino told Reuters on Wednesday. “For the oil project, deep water we are thinking of having an FPSO and then exporting the crude to the market,” the commissioner told Reuters on the sidelines of a petroleum conference in South Africa. Over the past two years, TotalEnergies and Shell have made large discoveries offshore Namibia. The supermajors are currently carrying… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Namibia-Expects-First-Oil-Production-By-2030.html |

|

Norway Beefs Up Oil And Gas Security After Suspected Pipeline SabotagePolice in west Norway have increased security measures and patrols at and around oil and gas infrastructure, after the suspected sabotage of the gas pipeline between Finland and Estonia in the Baltic Sea, a police representative told Norwegian daily Bergensavisen (BA). “We have increased our focus on preventive patrolling at oil and gas installations in our area,” operations manager Helge Blindheim in the West police district told BA in Bergen, which is home to or close to many oil and gas installations. The West police district in… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Norway-Beefs-Up-Oil-And-Gas-Security-After-Suspected-Pipeline-Sabotage.html |

|

Qatar Signs 27-Year Deal To Supply France With LNGQatarEnergy and TotalEnergies have signed two long-term LNG agreements under which Qatar will supply up to 3.5 million tons per year of LNG to France for 27 years beginning in 2026, Qatar’s state giant said on Wednesday. TotalEnergies is a minority partner in Qatar’s huge LNG expansion projects North Field East (NFE) and North Field South (NFS), from which the volumes to be delivered to France will be sourced. TotalEnergies’ partnership in the expansion projects is made up of a 6.25% share in the NFE project and a 9.375% interest… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Qatar-Signs-27-Year-Deal-To-Supply-France-With-LNG.html |

|

U.S. Treasury: G7 Price Cap Has Significantly Reduced Russia’s Oil IncomeThe U.S.-led price cap on Russian oil exports has “significantly” cut revenues from oil sales for Russia, U.S. Treasury Secretary Janet Yellen said on Wednesday. The G7 price cap on Russian oil has “significantly reduced Russian revenue over the last 10 months while promoting stable energy markets,” Reuters quoted Yellen as saying at a news conference during the International Monetary Fund (IMF) and World Bank meetings in Morocco. The price cap of $60 per barrel of Russian crude oil set by the G7 and the EU says that Russian… Read more at: https://oilprice.com/Latest-Energy-News/World-News/US-Treasury-G7-Price-Cap-Has-Significantly-Reduced-Russias-Oil-Income.html |

|

Fed officials see ‘restrictive’ policy staying in place until inflation eases, minutes showThe Federal Reserve on Wednesday released minutes from its Sept. 19-20 policy meeting. Read more at: https://www.cnbc.com/2023/10/11/fed-minutes-october-2023-.html |

|

Goldman Sachs warns of hit to third-quarter earnings on deal to offload GreenSkyThe move is the latest step CEO David Solomon has taken to retrench from his ill-fated push into consumer finance. Read more at: https://www.cnbc.com/2023/10/11/goldman-sachs-warns-of-hit-to-third-quarter-earnings-on-deal-to-offload-greensky.html |

|

Steve Scalise nominated as House speaker candidate by GOP lawmakersScalise defeated Judiciary Committee Chair Jim Jordan in a 113 to 99 vote during a closed-door meeting. Read more at: https://www.cnbc.com/2023/10/11/steve-scalise-and-jim-jordan-vie-to-become-house-speaker-with-gop-set-to-vote-on-candidate.html |

|

Israel-Hamas war live updates: 22 U.S. citizens confirmed dead; Israel to form emergency governmentGaza’s only power plant has run out of fuel amid an ongoing complete siege by Israel, whose war with Palestinian militant group Hamas entered its fifth day. Read more at: https://www.cnbc.com/2023/10/11/live-updates-latest-news-on-gaza-and-israel-hamas-conflict.html |

|

Ether to soar to $8,000 in 3 years and eventually may hit $35,000, predicts Standard CharteredThe price of ether could rocket 5x as soon as 2026 as ethereum reclaims its dominance in crypto’s smart contracts space. Read more at: https://www.cnbc.com/2023/10/11/ether-may-eventually-hit-35000-predicts-standard-chartered.html |

|

Caroline Ellison recounts ‘constant state of dread’ over Alameda’s mounting debts: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, Josh Frank of The Tie reacts to the latest testimony from Caroline Ellison in the trial of Sam Bankman-Fried. Read more at: https://www.cnbc.com/video/2023/10/11/caroline-ellison-constant-state-of-dread-alameda-mounting-debts-crypto-world.html |

|

Birkenstock slides about 10% in stock market debut after opening at $41 per shareGerman shoe brand Birkenstock made its market debut Wednesday after pricing its IPO at $46. Read more at: https://www.cnbc.com/2023/10/11/birkenstock-ipo-birk-starts-trading-on-the-nyse.html |

|

Bankman-Fried was very concerned about his image, including his big hair, ex-girlfriend Ellison testifiesIn her second day on the stand, Caroline Ellison told jurors that Sam Bankman-Fried wanted her to hide FTX customer funds that were on Alameda’s balance sheet. Read more at: https://www.cnbc.com/2023/10/11/caroline-ellison-said-sbf-considered-raising-from-mbs-to-repay-ftx.html |

|

Europe gives Mark Zuckerberg 24 hours to respond about Israel-Hamas conflict and election misinformationEU urges Meta to be “vigilant” about removing disinformation during conflict, ahead of elections. Read more at: https://www.cnbc.com/2023/10/11/europe-gives-zuckerberg-24-hours-to-respond-about-israel-hamas-misinfo.html |

|

These regional banks are at risk of being booted from the S&P 500This year’s regional banking crisis has already caused changes in the S&P 500 index. More changes may be coming if the industry faces a protracted slump. Read more at: https://www.cnbc.com/2023/10/11/zions-comerica-at-risk-of-being-booted-from-sp-500.html |

|

Satellite images show the scale of destruction in Gaza as Israel responds to surprise Hamas attackIsrael is expected to launch a ground offensive on the Gaza Strip in an attempt “to make sure Hamas won’t have any military capabilities.” Read more at: https://www.cnbc.com/2023/10/11/israel-hamas-war-satellite-images-show-the-scale-of-gaza-destruction.html |

|

How to donate to help victims of the Israel-Gaza crisisPeople looking to help those affected by the Israel-Gaza crisis can consider donating to charities working on the ground. Read more at: https://www.cnbc.com/2023/10/11/how-to-donate-to-help-victims-of-the-israel-gaza-crisis.html |

|

The CPI trade: Here’s where JPMorgan sees the market going, based on these scenariosJPMorgan laid out the potential market outcomes from Thursday’s CPI report. Read more at: https://www.cnbc.com/2023/10/11/cpi-trade-where-jpmorgan-sees-the-market-going-based-on-these-scenarios.html |

|

Days Of Low VIX Numbered As Financial Conditions Turn The ScrewAuthored by Simon White, Bloomberg macro strategist, The VIX, a measure of implied equity volatility, is biased much higher in the coming months as the lagged impact of tighter financial conditions increasingly ripple through the economy and markets. Also, the VIX curve has flattened over the last month, meaning there is less negative carry on long VIX positions. From the vantage point of an equity investor, inter-day implied volatility has been remarkably subdued. While the MOVE (fixed-income vol) and the CVIX (FX vol) are both notably above where they were in late 2019, the VIX is barely higher than its level just prior to the beginning of the pandemic.

There are several reasons for this. The narrowness of this year’s rally in the S&P has led to implied correlations dropping. Inter-day stock moves largely cancelling each other out will subdue volatility. Further, investors’ preference for buying puts and sel … Read more at: https://www.zerohedge.com/markets/days-low-vix-numbered-financial-conditions-turn-screw |

|

US Sending Two Carrier Strike Groups To Mideast Region, Taps Qatar To Assist Hostage Mediation With HamasUpdate(1425ET): US National Security Council Coordinator John Kirby confirmed that the United States will be sending the USS Dwight D. Eisenhower aircraft carrier to the Eastern Mediterranean, after it was already announced that the USS Gerald R. Ford would be deployed as part of “support” operations related to the Israel-Gaza conflict. However, Kirby said that the Eisenhower will not be directly joining or escorting. Instead, the carrier will be in the region for availability if called upon. While in a press briefing Kirby tried to downplay the dual carrier deployment as somewhat routine or expected, they will certainly be on standby to potentially intervene if all hell continues breaking loose in the Middle East.

Kirby also confirmed that the US administration is in talks with Qatar as part of mediation efforts to free the hostages being held by Hamas. It’s believed there are Americans among the captives in … Read more at: https://www.zerohedge.com/geopolitical/israel-now-actively-fighting-secondary-front-northern-border-hezbollah-idf |

|

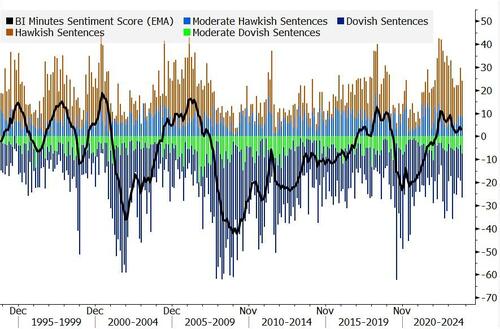

FOMC Minutes Echo ‘Hawkish Tone’ From Meeting; Fed To “Proceed Carefully”The Minutes echoed the hawkish tone of the statement and press conference: “a majority” of Fed officials saw one more rate increase “would likely be appropriate”. The Bloomberg Intelligence US interest-rate strategy team’s NLP model of the minutes showed the Fed was somewhat more dovish than at the July meeting, with the exponential moving average declining back to levels experienced for the June FOMC gathering.

* * * Since The FOMC meeting on September 20th, when the various Fed members dropped their now infamously hawkish SEP (dot plot), things have gone just a little bit turbo ac … Read more at: https://www.zerohedge.com/markets/fomc-10 |

|

Gaza Doctors Issue ‘SOS To Whole World’ As US Proposes Evacuation Corridor To EgyptDoctors in Gaza have sent out an “SOS message” to the world, saying that after four straight nights of the biggest Israeli air campaign in years (or perhaps history), all civil services including electricity, fuel and water are suffering collapse. Officials at Shifa Hospital in Gaza City have further claimed the Israelis are targeting first responders, as the death toll among Palestinians has soared passed 940, with at least 140 children among the dead. An estimated 263,000 Palestinians have been displaced thus far. Israel has also revised its numbers, announcing the gruesome Hamas attack on Saturday into Sunday killed over 1,200 Israelis. Among these were at least 14 Americans and many other foreign citizens.

Read more at: https://www.zerohedge.com/geopolitical/gaza-doctors-issue-sos-whole-world-us-proposes-evacuation-corridor-egypt |

|

British Airways suspends Israel flights after plane U-turnsA BA flight was diverted back to the UK amid security concerns, not long before it was due to land. Read more at: https://www.bbc.co.uk/news/business-67081696?at_medium=RSS&at_campaign=KARANGA |

|

Safe Hands: Fraud inquiry launched into collapsed funeral firmSafe Hands went into administration last year with thousands of people likely to lose money they set aside. Read more at: https://www.bbc.co.uk/news/business-67080927?at_medium=RSS&at_campaign=KARANGA |

|

Next set to buy rival brand Fat Face in latest High Street buyHigh Street chain Next is understood to be close to buying rival fashion chain Fat Face. Read more at: https://www.bbc.co.uk/news/business-67080108?at_medium=RSS&at_campaign=KARANGA |

|

5 IT stocks hit 52-week highs; rally up to 55% in a monthOn Wednesday, benchmark index Sensex saw a significant increase of approximately 394 points, ending the day at 66,473. During this upswing, 5 stocks from the BSE IT index reached their peak prices in the past 52 weeks.The 52-week high holds significant significance for specific traders and investors as it functions as a vital technical gauge for evaluating a stock’s current value and projecting potential price fluctuations. This value represents the highest price at which a stock was traded over the past year. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/5-it-stocks-hit-fresh-52-week-highs-rally-up-to-55-in-a-month/pinnacle-point/slideshow/104347956.cms |

|

High-conviction picks: 6 mid, smallcap stock ideas for 9-29% returnsPrabhuas Lilladher’s six top picks from midcap and smallcap space have the scope to offer up to 29% returns to investors. Take a look: Read more at: https://economictimes.indiatimes.com/markets/stocks/news/high-conviction-picks-6-mid-smallcap-stock-ideas-for-9-29-returns/stock-ideas/slideshow/104347386.cms |

|

Tech View: Momentum indicator triggers positive crossover. What traders should do on ThursdayThe short-term trend of Nifty continues to be positive. A decisive move above 19,800 levels is likely to pull Nifty towards the next upside levels of 20,000-20,200 in the near term Read more at: https://economictimes.indiatimes.com/markets/stocks/news/tech-view-momentum-indicator-triggers-positive-crossover-what-traders-should-do-on-thursday/articleshow/104346646.cms |

|

‘Barbie’ was the rare original-film summer blockbuster. It will not reverse the franchise flood.As studios and advertisers search for takeaways, analysts say the success of “Barbie” will be hard to repeat and is unlikely to stop the deluge of franchise movies. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-726A-0DCA31C556A4%7D&siteid=rss&rss=1 |

|

The Fed: Fed minutes show officials wary about the outlook and wanting to move carefullyFederal Reserve officials were uncertain and decided that they would move carefully in coming months, according to minutes of their September meeting. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-727B-70BF863AA642%7D&siteid=rss&rss=1 |

|

Biden administration moves to eliminate all junk fees. ‘Folks are tired of being taken advantage of.’Consumers pay a mountain of meritless and hidden ‘junk fees’ that cost them billions each year, Biden administration officials said. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-727A-EF1DDBD7C4B6%7D&siteid=rss&rss=1 |

Nurphoto/Getty ImagesA Gaza health

Nurphoto/Getty ImagesA Gaza health