Summary Of the Markets Today:

- The Dow closed up 288 points or 0.87%,

- Nasdaq closed up 1.60%,

- S&P 500 closed up 1.18%, (low 4,220)

- Gold $1,845 up $12.80,

- WTI crude oil settled at $83 up $0.57,

- 10-year U.S. Treasury 4.795% up 0.079 points,

- USD Index $106.07 down $0.260,

- Bitcoin $27,980 up $484,

- Baker Hughes Rig Count: U.S. -4 to 619 Canada -11 to 180

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our Economic Forecast for October 2023

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

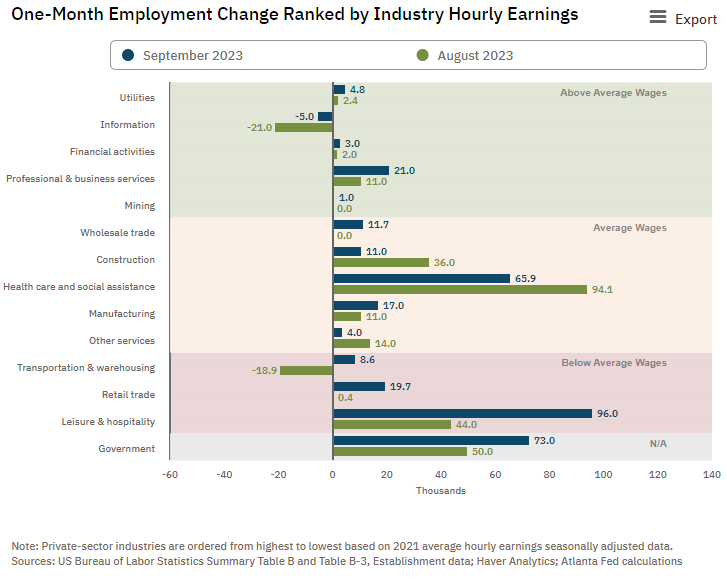

The markets were hoping for small employment gains in expectation that the Fed would stop raising the federal funds rate but instead, the total nonfarm payroll employment rose by 336,000 in September 2023 with the unemployment rate unchanged at 3.8%. The largest job gains occurred in leisure and hospitality (96,000); government (73,000); and health care (65,900). Any job gains over 150,000 is considered enough to provide jobs to those newly entering the workforce. The September employment gain was the second largest of 2023.

Interestingly, the household survey of the employment report showed only 90,000 employment gains against the headline establishment survey gain of 336,000 which throws into question the large gains of the establishment survey.

In August 2023, consumer credit decreased at a seasonally adjusted annual rate of 3.8%. Revolving credit increased at an annual rate of 13.9%, while nonrevolving credit decreased at an annual rate of 9.8%. I personally do not like the Federal Reserve’s methods for calculating changes in growth – I use year-over-year growth to remove the volatility. Using year-over-year methodology, consumer credit growth fell to 4.0% (blue line on the graph below), and adjusting for inflation growth was 2.0% year-over-year (red line on the graph below). The bottom line is that overall consumer credit is growing around the historical average, however, credit card (revolving credit) use has returned to the levels seen in the higher inflation periods of 1970s to 2000.

Here is a summary of headlines we are reading today:

- WTO Forecasts Global Trade Slowdown Amid Economic Headwinds

- U.S. Oil Rigs Decrease for Second Week Running, Gas Rigs Rise

- Central Banks Continue To Boost Gold

- Oil Traders Should Be Weary Of A Bear Trap

- Russia Escalates War With Nuclear Tests And Civilian Killings

- Dow soars nearly 300 points Friday as stocks reverse sharp losses after hot jobs report: Live updates

- Here’s where the jobs are for September 2023 — in one chart

- Wall Street will seek confirmation inflation is easing in the week ahead after Friday’s jobs report

- 10-year Treasury yield rises after strong U.S. jobs report

- Market Extra: Why 5% bond yields could wreak havoc on the market

- Treasury yields are climbing: ‘There’s never really been such an attractive opportunity for fixed-income investments’

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

WTO Forecasts Global Trade Slowdown Amid Economic HeadwindsOne day after the Geneva-based UN Conference on Trade and Development (Unctad) warned central banks are at risk of triggering a full-blown global recession in their pursuit of higher interest rates to reach their 2% inflation targets, World Trade Organization economists published a report on Thursday morning outlining global growth will be sharply lower than forecasted for the remainder of 2023. WTO economists said world trade and output began to slow in the fourth quarter of 2022 due to the Federal Reserve’s tighter monetary policy and tighter… Read more at: https://oilprice.com/Geopolitics/International/WTO-Forecasts-Global-Trade-Slowdown-Amid-Economic-Headwinds.html |

|

Germany Considers Extending Energy Price Caps Through March 2024Germany is considering extending the price caps on gas and electricity prices until the end of the coming winter in March 2024, Reuters reported on Friday, quoting an unnamed source. Last year, Germany introduced a package of 200 billion euros for a so-called “defensive shield” to protect companies and consumers against the impact of soaring energy prices. At the end of September 2022, the German government said that it would ditch earlier plans for a gas levy on consumers and instead would introduce a… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Germany-Considers-Extending-Energy-Price-Caps-Through-March-2024.html |

|

Cornish Metals Aims To Make Europe A Key Player In Tin ProductionVia Metal Miner For years, the tin price index in Europe depended largely on foreign supply. However, Vancouver-headquartered Cornish Mining plans to start pumping out groundwater from its South Crofty tin project as early as October. The firm is currently preparing its mine water treatment plant, which can treat up to 25,000 cubic meters of water per day directly from South Crofty into the nearby Red River. As of September 27, the company said that preparation and testing before full commissioning will take around three weeks. Cornish Metals… Read more at: https://oilprice.com/Metals/Commodities/Cornish-Metals-Aims-To-Make-Europe-A-Key-Player-In-Tin-Production.html |

|

EU Environment Commissioner Warns Against Politicizing Clean Energy LawsThe ongoing work of the European Union on green energy regulations and laws risks being politicized ahead of the June 2024 EU elections, Virginijus Sinkevicius, European Commissioner for the Environment, Oceans and Fisheries, told Bloomberg in an interview on Friday. “I don’t want new files to be politicized because of the elections coming,” Sinkevicius said. “I don’t want to open files and leave them in limbo,” the commissioner told Bloomberg. The EU is holding elections for the European… Read more at: https://oilprice.com/Latest-Energy-News/World-News/EU-Environment-Commissioner-Warns-Against-Politicizing-Clean-Energy-Laws.html |

|

U.S. Oil Rigs Decrease for Second Week Running, Gas Rigs RiseThe total number of active drilling rigs in the United States fell by 4 this week, after falling 7 last week, according to new data from Baker Hughes published Friday. The total rig count fell to 619 this week. So far this year, Baker Hughes has estimated a loss of 160 active drilling rigs. This week’s count is 456 fewer rigs than the rig count at the beginning of 2019 prior to the pandemic. The number of oil rigs fell by 5 for the second week in a row to 497, down by 124 so far in 2023. The number of gas rigs rose by 2 this week to… Read more at: https://oilprice.com/Energy/Crude-Oil/US-Oil-Rigs-Decrease-for-Second-Week-Running-Gas-Rigs-Rise.html |

|

Central Banks Continue To Boost GoldVia SchiffGold.com, Central bank gold buying continues to sizzle. Central banks globally added a net 77 tons to their reserves in August, according to the latest data compiled by the World Gold Council. It was the third straight month of net purchases. Over the last three months, net gold buying by central banks totaled 219 tons. In March, April and May, central banks reported net gold sales, primarily due to Turkey selling 160 tons of gold over that three-month period. According to the World Gold Council, this was a specific response to local… Read more at: https://oilprice.com/Metals/Gold/Central-Banks-Continue-To-Boost-Gold.html |

|

Shell Anticipates Gas Trading Surge In Q4Shell expects its third-quarter earnings to receive a boost from stronger trading results in its natural gas and chemicals and products divisions compared to the second quarter, the UK-based supermajor said on Friday in an update on the expected Q3 results. Trading helped Shell and other majors active in the gas trading business to post record earnings for 2022 amid natural gas price spikes and the overall extreme market volatility in energy commodities. But the second quarter of 2023 was not so good for trading at the supermajors, which saw their… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Shell-Anticipates-Gas-Trading-Surge-In-Q4.html |

|

$100 Oil Is Now Firmly Out Of ReachWith oil prices having crashed this week and demand concerns only mounting, it seems bullish traders will have to forget about triple-digit oil prices for now. Friday, October 6th, 2023The worst week for crude since March, oil prices have shed $10 per barrel this week, pressurized by the US bond selloff that soured the economic outlook into 2024 and then suffered another blow from this week’s EIA numbers that indicated a steep drop in gasoline demand across the US. With Friday focused on US non-farm payroll data, ICE Brent climbing to triple… Read more at: https://oilprice.com/Energy/Energy-General/100-Oil-Is-Now-Firmly-Out-Of-Reach.html |

|

Europe Is Struggling To Attract Solar ManufacturersEurope is losing the global race for solar components manufacturing due to high energy and labor costs and supply chain issues, according to solar industry executives who say the EU lacks incentives for manufacturers to plan future investments. Following the Russian invasion of Ukraine and facing competition from China and the U.S. in clean energy technology, the European Union has recently unveiled the so-called Green Deal Industrial Plan to boost the EU’s manufacturing capacity for the net-zero technologies and products required… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Europe-Is-Struggling-To-Attract-Solar-Manufacturers.html |

|

The Middle East’s Critical Role In Natural Gas Production1. Q3 Earnings Calls to Focus on Capex Direction and Cost Management- The news of ExxonMobil being in advanced talks to purchase US shale producer Pioneer Natural Resources for some $60 billion has set the scene for a very interesting period of Q3 earnings calls in the second half of October. – When it comes to drilling costs, widespread expectations for 2024 to see lower well costs have been moderated on the back of the recent oil price rally, ongoing labor shortages, and sticker-than-expected oil service costs. – Drilling activity has subsided… Read more at: https://oilprice.com/Energy/Energy-General/The-Middle-Easts-Critical-Role-In-Natural-Gas-Production.html |

|

The Revival Of Venezuela’s Oil Industry Is Emboldening MaduroPolitics, Geopolitics & Conflict Amid an easing of sanctions on Venezuela and Chevron’s return to production, Maduro is taking advantage of the situation to quash his opponents. This week, he issued an arrest warrant for opposition leader Juan Guaido, whom he has accused of embezzling state oil money. Guaido is living in exile in Miami at present and is recognized by Washington as the rightful leader of Venezuela. As the push and pull continues, however, now that certain doors have been opened, Brazil’s state-run Petrobras is also… Read more at: https://oilprice.com/Energy/Energy-General/The-Revival-Of-Venezuelas-Oil-Industry-Is-Emboldening-Maduro.html |

|

Oil Traders Should Be Weary Of A Bear TrapMarket Tremors US benchmark West Texas Intermediate (WTI) crude oil and international benchmark Brent crude oil are on edge as a sudden decline in prices puts traders and investors on alert. Prices have taken a nosedive, falling around 2% on Thursday. This comes on the heels of a near 6% drop in the previous session, marking the most significant percentage loss in both Brent and WTI crude benchmarks since May. Brent futures settled at $84.07, a decline of 2.03%, while WTI came in at $82.31, down 2.3%. Demand Worries One of the leading culprits… Read more at: https://oilprice.com/Energy/Energy-General/Oil-Traders-Should-Be-Weary-Of-A-Bear-Trap.html |

|

Russia Escalates War With Nuclear Tests And Civilian KillingsOn the Ukraine war front, there has been another uptick in saber-rattling between Moscow and Washington this week. Both events carry a fair amount of ironic symbolism, which is the point at which we find ourselves in this protracted conflict. Washington has transferred thousands of weapons it seized from Iran’s Islamic Revolutionary Guard Corp (IRGC) to Ukraine. The weapons were seized by the U.S. Navy en route to Yemen, where Iran has been fighting a proxy war with Saudi Arabia (though this conflict venue has cooled off somewhat following… Read more at: https://oilprice.com/Energy/Energy-General/Russia-Escalates-War-With-Nuclear-Tests-And-Civilian-Killings.html |

|

A Solar Stock To Watch Despite Industry DifficultiesJust about every trader has some stocks, currency pairs, or commodities that, no matter what, they just don’t seem to ever get right. Even when everything points to trading in one direction, they just seem destined to make a loss. It is infuriating, and most people’s response is the perfectly logical one of not getting involved in that security anymore, no matter how clear a signal might be, or how much fundamentals point to a trade. If they took the time to analyze why that happens, I think that in most cases they would find that there… Read more at: https://oilprice.com/Energy/Energy-General/A-Solar-Stock-To-Watch-Despite-Industry-Difficulties.html |

|

Can Oil Prices Remain Below $90?The nearly four-month-long oil price rally has finally come unstuck, with oil prices crashing spectacularly over the past week thanks to a smaller-than-expected weekly decline in domestic crude supplies accompanied by a much larger-than-expected increase in fuel inventories. WTI crude for November delivery has crashed from $93.68 per barrel on September 27 to $82.50 per barrel on October 6, good for an 11.9% decline while Brent crude for December delivery has declined by more than 10.5% to trade at $84.23 per barrel over the timeframe, both… Read more at: https://oilprice.com/Energy/Energy-General/Can-Oil-Prices-Remain-Below-90.html |

|

Dow soars nearly 300 points Friday as stocks reverse sharp losses after hot jobs report: Live updatesStocks were higher Friday while Treasury yields eased from their 16-year highs. Read more at: https://www.cnbc.com/2023/10/05/stock-market-today-live-updates.html |

|

Here’s where the jobs are for September 2023 — in one chartLeisure and hospitality was the strongest sector for job growth in September, while information lost jobs. Read more at: https://www.cnbc.com/2023/10/06/heres-where-the-jobs-are-for-september-2023-in-one-chart.html |

|

UAW will not expand strikes at Detroit automakers after last-minute GM proposalThe United Auto Workers will not expand strikes against GM, Ford or Stellantis this week amid progress in the talks, UAW President Shawn Fain said Friday. Read more at: https://www.cnbc.com/2023/10/06/uaw-will-not-expand-strikes-this-week-at-gm-ford-stellantis-.html |

|

This trade is where big investors are hiding out amid choppy markets, Goldman Sachs saysThe trade is a key way that institutions and wealthy investors are adjusting to the surge in long-term interest rates that have roiled markets lately. Read more at: https://www.cnbc.com/2023/10/06/where-big-investors-are-hiding-amid-choppy-markets.html |

|

Wall Street will seek confirmation inflation is easing in the week ahead after Friday’s jobs reportThe producer price index comes out Wednesday, while the consumer price index is due out Thursday. Read more at: https://www.cnbc.com/2023/10/06/wall-street-will-seek-proof-inflation-is-easing-after-fridays-jobs-report.html |

|

Amazon launches first internet satellite prototypesAmazon’s first pair of prototypes for its Project Kuiper satellite internet system launched on Friday. Read more at: https://www.cnbc.com/2023/10/06/amazon-launch-project-kuiper-satellite-internet-prototypes.html |

|

FTX’s Gary Wang tells court Alameda got ‘special privileges’ to exchange’s funds: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, Paul Tuchmann, former federal prosecutor and partner at Wiggin and Dana, discusses possible defense strategies for Sam Bankman-Fried. Read more at: https://www.cnbc.com/video/2023/10/06/ftx-gary-wang-alameda-special-privileges-exchange-funds-crypto-world.html |

|

How Apple made its first ‘carbon neutral’ productIn September, Apple announced its new smartwatch series would have “carbon neutral” options. Here is what that means. Read more at: https://www.cnbc.com/2023/10/06/how-apple-made-its-first-carbon-neutral-product-apple-watch.html |

|

Tesla cuts Model 3 and Model Y prices in the U.S. after car deliveries fallThe starting price for the Model 3 is listed at $38,990 on Tesla’s website, down from $40,240 previously. Read more at: https://www.cnbc.com/2023/10/06/tesla-cuts-model-3-model-y-prices-in-the-us-after-deliveries-fall.html |

|

Former U.S. Army sergeant charged with offering classified information to ChinaFormer U.S. Army sergeant Joseph Daniel Schmidt is charged with two felonies for allegedly offering secret U.S. intelligence information to China, DOJ said. Read more at: https://www.cnbc.com/2023/10/06/former-army-sergeant-offered-china-classified-information-doj.html |

|

The ‘urban doom loop’ threatening American cities like New York and San Francisco, explainedMajor American cities such as New York and San Francisco face serious problems — mass migration, empty offices and declining tax revenues. Read more at: https://www.cnbc.com/2023/10/06/the-urban-doom-loop-threatening-cities-like-new-york-and-san-francisco.html |

|

A new Chile? Argentina is at the epicenter of a new ‘white gold’ rushMomentum behind Argentina’s lithium mining boom is picking up fast. Read more at: https://www.cnbc.com/2023/10/06/lithium-boom-argentina-is-at-the-epicenter-of-a-new-white-gold-rush.html |

|

10-year Treasury yield rises after strong U.S. jobs reportU.S. Treasury yields rose on Friday as investors parsed the all-important jobs report. Read more at: https://www.cnbc.com/2023/10/06/us-treasury-yields-investors-look-to-september-jobs-report.html |

|

Slack Will Halt Normal Business Hours Next Week For Worker Boot Camp Amid ‘Slacking’ ConcernsSalesforce-owned work chat platform Slack will pause regular business operations next week. Thousands of workers are advised to complete an educational boot camp about the Fourth Industrial Revolution and learn more about Amazon AWS for upskilling purposes amid internal chatter by management that some employees are ‘slacking.’ Fortune spoke with a company insider who said a majority of the 3,000 employees had fallen behind on internal training and will spend next week in the company’s Trailhead online learning platform to learn 40 hours of topics like “Learn about the Fourth Industrial Revolution” and “Healthy Eating.

The boot camp for slackers is a move by the company to “upskill” employees. Fortune speculates that lazy employees are terrible optics for the company. In a memo from mid-September, Slack’s CEO Lidiane Jones informed employees about the one-week boot camp called “Ranger Week … Read more at: https://www.zerohedge.com/markets/slack-will-halt-normal-business-hours-next-week-worker-boot-camp-amid-slacking-concerns |

|

10,000 Illegal Immigrants To Arrive Daily At US Border, Warns Mexican PresidentAuthored by Naveen Athrappully via The Epoch Times (emphasis ours), Mexican President Andrés Manuel López Obrador has warned that the United States will soon see about 10,000 illegal immigrants per day arrive at its border with Mexico.

Hundreds of illegal immigrants line up outside of the Jacob K. Javits Federal Building in New York City on June 6, 2023. (David Dee Delgado/Getty Images)Such a large number of illegal immigrants are reaching Mexico’s northern border with the United States partly due to about 6,000 illegal immigrants crossing from Guatemala into Mexico every day for the past week, President Obrador Read more at: https://www.zerohedge.com/political/10000-illegal-immigrants-arrive-daily-us-border-warns-mexican-president |

|

“Unsustainable Business”: Lucid Loses $338,000 Per Vehicle As Tesla Price War Heats UpShares of Lucid hit record lows in New York this week as concerns mount about ongoing demand woes for its Air electric luxury sedan. A new report reveals Lucid loses a staggering $338k per unit. According to Bloomberg Intelligence, “Lucid may burn $338,000 per vehicle in EBITDA this year, an increase from $325,000 just months ago, demonstrating how its unsustainable business model requires significant scaling and additional funding — likely before 2025.”

Even though Lucid can compete with more prominent brands like Tesla, Mercedes, and Porsche, the real question is whether its largest shareholder, the Kingdom of Saudi Arabia, will continue funding the troubled EV maker amid a price war sparked by Elon Musk earlier this year. Lucid will continue to lose money through 2025, adding pressure to its liquidity and access to capital: A warning sign that any economic downturn could accelerate the demise of the money-losing company. Read more at: https://www.zerohedge.com/markets/unsustainable-business-lucid-loses-338000-vehicle-tesla-price-war-heats |

|

Jeftovic: Canada’s Multi-Generational Gold GaffeAuthored by Mark Jeftovic via DollarCollapse.com, Canadian leaders don’t just hate gold. They must hate prosperity itself.

After looking poised to rack up fresh all-time-highs (in USD terms) earlier this year, the gold price has experienced somewhat of a dump lately. It’s possible the market believes the likes of Paul Krugman – who is taking victory laps because inflation has been supposedly been defeated without bringing on a recession (he calls it a win for “Team long transitory”, whatever that‘s supposed to mean).

Read more at: https://www.zerohedge.com/commodities/jeftovic-canadas-multi-generational-gold-gaffe |

|

Taxpayers to pay £40bn due to threshold freeze, think tank saysNew analysis suggests the Treasury will now net £40bn in income tax due to inflation. Read more at: https://www.bbc.co.uk/news/business-67031930?at_medium=RSS&at_campaign=KARANGA |

|

House price falls expected into new year, Halifax saysThe UK’s biggest mortgage lender says prices are still falling, but the rate of reduction has slowed. Read more at: https://www.bbc.co.uk/news/business-67028467?at_medium=RSS&at_campaign=KARANGA |

|

Metro Bank: What’s going on and is my money safe?Bosses say there are no concerns about its finances after reports it was looking to raise millions. Read more at: https://www.bbc.co.uk/news/business-67027436?at_medium=RSS&at_campaign=KARANGA |

|

Like in Russia & China, strong governments who think too much of themselves are dangers to stock market returns:Ajit DayalQuantum is launching a smallcap fund and the smallcap approach is a very disciplined research and portfolio approach. No stock will have less than 2% and no stock will have more than 4% at cost. Between 25 and 50 stocks, probably 40 stocks, will be there once we build out the portfolio. There would not be style drift. Read more at: https://economictimes.indiatimes.com/markets/expert-view/like-in-russia-china-strong-governments-who-think-too-much-of-themselves-are-dangers-to-stock-market-returnsajit-dayal/articleshow/104211432.cms |

|

These 6 commodity stocks hit their fresh 52-week highsDuring Friday’s trading session, the Sensex benchmark index gained around 364 points, ending the day at 65,996. Amid this upward movement, 6 stocks listed on the BSE Commodities Index reached their highest price in the last 52 weeks. The 52-week high is of considerable importance to particular traders and investors, as it serves as a crucial technical indicator for assessing a stock’s current worth and forecasting potential price changes. This figure signifies the highest price at which a stock traded throughout the previous year Read more at: https://economictimes.indiatimes.com/markets/stocks/news/6-commodity-stocks-hit-fresh-52-week-high-deliver-up-to-50-gains-in-a-month/new-highs/slideshow/104219323.cms |

|

Tech View: Nifty may show resistance at 19,800. What traders should do next weekThe short-term trend of Nifty has turned positive. The overall positive chart pattern indicates next overhead resistance for the Nifty around 19,800 levels for the coming week. Any dip down to 19,550-19,500 levels could be a buying opportunity, said Nagaraj Shetti of HDFC Securities Read more at: https://economictimes.indiatimes.com/markets/stocks/news/tech-view-nifty-may-show-resistance-at-19800-what-traders-should-do-next-week/articleshow/104216508.cms |

|

Market Extra: Why 5% bond yields could wreak havoc on the marketInvestors are likely to demand greater compensation for taking risk as yields keep climbing. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7278-415BCC60B9E0%7D&siteid=rss&rss=1 |

|

Market Extra: Investors are hiding out in cash, putting 20.4% aside, as volatility erupts, State Street saysLong-term institutional players are increasingly hiding out in cash this fall, according to a new State Street Global Markets report. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7278-6FEAB02ACDCD%7D&siteid=rss&rss=1 |

|

Treasury yields are climbing: ‘There’s never really been such an attractive opportunity for fixed-income investments’High-yield savings accounts, certificates of deposit and money market-mutual funds have all become alluring ways to reap rewards. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7277-343517A5D6AD%7D&siteid=rss&rss=1 |