Summary Of the Markets Today:

- The Dow closed down 10 points or 0.03%,

- Nasdaq closed down 0.12%,

- S&P 500 closed down 0.13%, (low 4,226)

- Gold $1,835 down $0.30,

- WTI crude oil settled at $82 down $1.73,

- 10-year U.S. Treasury 4.712% down 0.023 points,

- USD Index $106.33 down $0.470,

- Bitcoin $27,475 down $175,

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our Economic Forecast for October 2023

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

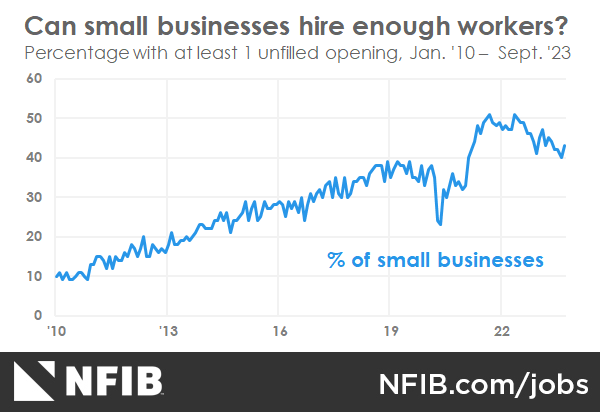

The labor shortage continues to hinder Main Street as 43% (seasonally adjusted) of all small business owners reported job openings they could not fill in the current period, up three points from August. Bill Dunkelberg, NFIB Chief Economist stated:

Small business owners have spent the first three quarters of 2023 working to recruit and retain qualified employees for their businesses, but it still remains a top challenge. Owners continue to raise compensation to attract the right employees.

The goods and services deficit was $58.3 billion in August, down $6.4 billion from $64.7 billion in July. August exports were down 6.9% year-over-year. August imports were down 6.3% year-over-year. The graph below adjusts the import and export year-over-year values for inflation and deflation. The bottom line is that imports are telling us that consumer spending is weak.

In the week ending September 30, the advance figure for seasonally adjusted initial unemployment claims 4-week moving average was 208,750, a decrease of 2,500 from the previous week’s revised average. The previous week’s average was revised up by 250 from 211,000 to 211,250.

Here is a summary of headlines we are reading today:

- Zirconium Nitride Outshines Platinum In Fuel Cell Performance

- The Rise Of Nuclear Power In The Middle East

- Argentina’s Oil Production Surges As Political Instability Soars

- India Warns That OPEC+ Oil Supply Cuts Could Have Unintended Consequences

- U.S. Shale Is Reluctant To Drill Despite Rising Oil Prices

- S&P 500 closes slightly lower as traders brace for Friday’s big jobs report: Live updates

- GM’s stock hits three-year low amid UAW strike, potential air bag recall

- Trust In Congress Below 20% Third Month In A Row

- As 75,000 Kaiser healthcare workers walk off the job, Tenet Healthcare could be next to face a strike

- Cathie Woods’ ETFs sold more than $25 million worth of Tesla stock

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Chile’s $2 Billion Energy Storage Boost Challenges U.S. SupremacyChile is on track to become the largest energy storage market in the Americas. The position is currently held by the United States, which expects to deploy another 10 GW of energy storage by the end of 2023, but Chile’s ambitious energy storage ambitions and massive lithium supply have given the South American country a pathway to becoming number one in the near future. Across the world, a race to build out energy storage infrastructure is unfolding. The sector is poised for explosive growth on a global scale as clean energy… Read more at: https://oilprice.com/Energy/Energy-General/Chiles-2-Billion-Energy-Storage-Boost-Challenges-US-Supremacy.html |

|

Saudi Aramco Shakes Up Markets With November Oil Price HikeThe world’s largest oil exporter, Saudi Aramco, has lifted the price of its crude oil for November, according to a company document released on Thursday. Aramco’s Official Selling Prices (OSPs) typically lead the pricing moves for the oil industry, including for oil from Iran, Kuwait, and Iraq, who let Saudi Arabia lead. While crude oil prices for all grades were unchanged to the North American market, crude oil prices for all grades to Northwest Europe and the Mediterranean saw substantial increases. For North West Europe, barrel… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Saudi-Aramco-Shakes-Up-Markets-With-November-Oil-Price-Hike.html |

|

Zirconium Nitride Outshines Platinum In Fuel Cell PerformanceA Tohoku University group of researchers have unraveled the mysteries behind a recently identified material – zirconium nitride (ZrN) – that helps power clean energy reactions. Their proposed framework will help future designs for transition metal nitrides, paving a path for generating cleaner energy. The study was published in the journal Chemical Science, where was it featured as the front cover article. Anion exchange membrane fuel cells (AEMFC) are devices that use hydrogen and oxygen to make clean electricity through chemical reactions,… Read more at: https://oilprice.com/Energy/Energy-General/Zirconium-Nitride-Outshines-Platinum-In-Fuel-Cell-Performance.html |

|

Lukoil Pivots To Turkey With $1.5B Refinery Deal Amid SanctionsRussian Lukoil will lend $1.5 billion to Azerbaijan’s state-run Socar to enable its Turkish STAR refinery to receive Russian crude oil imports again, after sanctions-related financial restrictions forced a cut-off this summer, Reuters reported exclusively on Thursday. As European refiners halted purchases of Russian oil under the sanctions regime, Lukoil, a private company, is seeking refining customers situated near Russian ports to recapture market share. Socar’s STAR refinery in Turkey has a 200,000 barrel-per-day refining… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Lukoil-Pivots-To-Turkey-With-15B-Refinery-Deal-Amid-Sanctions.html |

|

Trafigura Sees Potential $12,000 High For CopperVia Metal Miner It’s safe to say that the copper price index witnessed an interesting 2023 thus far. Indeed, the market’s been volatile, so there were more than the usual ups and downs. Mid-year, prices registered a major tumble because of the fumble in China’s economy. However, soon after, they began clawing back to a respectable level. Prices began over US $8,000 per metric ton, even touching a high of $9,356 per MT in January. But by the end of Q2, they dropped back to $8,315 per MT. Now, investment bank Goldman Sachs reports… Read more at: https://oilprice.com/Metals/Commodities/Trafigura-Sees-Potential-12000-High-For-Copper.html |

|

UAE Harnesses Wind Energy With New Utility-Scale ProjectThe United Arab Emirates (UAE), one of the world’s largest oil producers and exporters, launched on Thursday the UAE Wind Program with a project that added utility-scale wind power to its grid for the first time, the developer Abu Dhabi Future Energy Company PJSC – Masdar said. The program was kickstarted with a 103.5 megawatt (MW) project developed by Masdar with material science and aerodynamics to make wind power possible in the country. The UAE Wind Program is expected to power over 23,000 UAE… Read more at: https://oilprice.com/Latest-Energy-News/World-News/UAE-Harnesses-Wind-Energy-With-New-Utility-Scale-Project.html |

|

The Rise Of Nuclear Power In The Middle EastThe Middle East region is expressing increasing interest in developing its nuclear energy industry as the UAE and Saudi Arabia both announce new nuclear power projects. Several governments around the globe are showing renewed interest in low-carbon nuclear power as a means of shifting their reliance away from fossil fuels and supporting the security needs of growing populations while undergoing a green transition. The U.S., the U.K., and several European countries have recently announced plans for the development of new nuclear plants, building… Read more at: https://oilprice.com/Energy/Energy-General/The-Rise-Of-Nuclear-Power-In-The-Middle-East.html |

|

Argentina’s Oil Production Surges As Political Instability SoarsThe exploitation of South America’s largest shale formation the Vaca Muerta, which is the size of Belgium, continues delivering impressive results at a crucial time for Argentina. The geological formation spanning 7.5 million acres is believed to be the world’s second-largest shale gas deposit, surpassed only by the U.S. situated Eagle Ford shale, and the fourth largest shale oil deposit. The Vaca Muerta’s development is responsible for halting the decline of oil and natural gas production in Argentina. Even with hydrocarbon production… Read more at: https://oilprice.com/Energy/Energy-General/Argentinas-Oil-Production-Surges-As-Political-Instability-Soars.html |

|

Supply Chain Issues Push French Trainmaker To The BrinkShares of the French train maker Alstom crashed as much as 38%, and its bonds fell the most on record on Thursday, following the company’s disclosure of preliminary financial information indicating a significant decline in its free cash flow projections, attributed to rising inventories. The results showed Alstom’s free cash flow had plunged from -45 million euros to a whopping -1.15 billion euros. It now expects negative 500-750 million euros for the full year, compared with earlier forecasts that were “significantly positive.” FIRST-HALF… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Supply-Chain-Issues-Push-French-Trainmaker-To-The-Brink.html |

|

India Warns That OPEC+ Oil Supply Cuts Could Have Unintended ConsequencesThe supply-side management of the oil market from OPEC+ in recent months could lead to demand destruction as fragile economies may not be able to bear with high oil prices much longer, Hardeep Singh Puri, the oil minister of the world’s third-largest crude oil importer, India, has told Argus in an interview. It is the right of the OPEC+ producers to decide how much oil they would pump, but they should not be “unmindful of the consequences,” the minister said. “And it can become a self-fulfilling prophecy, that the demand… Read more at: https://oilprice.com/Latest-Energy-News/World-News/India-Warns-That-OPEC-Oil-Supply-Cuts-Could-Have-Unintended-Consequences.html |

|

Trade Tensions Escalate As EU Delves Into Chinese EV SubsidiesThe European Union has officially started its anti-subsidy investigation into Chinese electric vehicles. The EU is investigating because it claims that emerging data indicates a probable surge in government-backed, low-cost imports, putting an already fragile EU sector at immediate risk. The inquiry will focus specifically on newly produced electric vehicles intended for carrying nine or fewer passengers; motorcycles, however, are not part of the current probe and the investigation is expected to wrap up within a year, according to an update by… Read more at: https://oilprice.com/Geopolitics/International/Trade-Tensions-Escalate-As-EU-Delves-Into-Chinese-EV-Subsidies.html |

|

Russia To Regulate Fuel Oil Prices During Heating SeasonRussia’s President Vladimir Putin has ordered the regulation of fuel oil prices for the heating season in Russia while Moscow’s ban on exports of gasoline and diesel will remain in place “for as long as necessary,” the Kremlin said on Thursday. Fuel oil, heavily used in Russia’s Arctic regions during the severe winters, will see prices regulated for the 2023/2024 heating season with funds provided by the government, according to a Kremlin document quoted by Reuters. Meanwhile, Russia will keep the ban on exports of… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Russia-To-Regulate-Fuel-Oil-Prices-During-Heating-Season.html |

|

U.S. Shale Is Reluctant To Drill Despite Rising Oil PricesThe U.S. shale oil industry is in a wait-and-see mode and likely to remain there for the foreseeable future despite rising oil prices on international markets. While up until two years ago, production growth was priority number one, now things have changed, and they have changed for good. It’s capital discipline that is the number one priority now. Earlier this month, the Wall Street Journal reported that capital efficiency, funding challenges, and shareholder outflow were among the top concerns of the industry that prompted it to be careful… Read more at: https://oilprice.com/Energy/Energy-General/US-Shale-Is-Reluctant-To-Drill-Despite-Rising-Oil-Prices.html |

|

UN’s Green Fund Secures $9.3 Billion In Pledges For Climate ActionThe Green Climate Fund (GCF) of the United Nations saw on Thursday 25 countries pledging support worth $9.3 billion to help vulnerable developing nations tackle the effects of climate change over the next four years, GCF said on Thursday. The Green Climate Fund, set up by 194 countries party to the UN Framework Convention on Climate Change in 2010, aims to mobilize funding at scale to invest in low-emission and climate-resilient development in vulnerable nations which are typically the first ones to feel the impacts of climate change with drought… Read more at: https://oilprice.com/Latest-Energy-News/World-News/UNs-Green-Fund-Secures-93-Billion-In-Pledges-For-Climate-Action.html |

|

Germany’s Top Utility Still Sees Risks Of Gas ShortagesGas supply disruptions continue to be a risk for Germany, the chief executive of the country’s biggest utility, RWE, told German publication WirtschaftsWoche in an interview published on Thursday. “We don’t have any buffer in the gas system,” RWE’s chief executive officer Markus Krebber told WirtschaftsWoche, adding that Europe’s biggest economy must accelerate the construction of gas import infrastructure to avoid future shortages. “If there is very cold winter or supply disruptions it can lead to very critical… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Germanys-Top-Utility-Still-Sees-Risks-Of-Gas-Shortages.html |

|

Why borrowing costs for nearly everything are surging, and what it means for youViolent moves in bonds have hammered investors and renewed fears of an impending recession, as well as concerns about housing, banks and the U.S. deficit. Read more at: https://www.cnbc.com/2023/10/05/why-borrowing-costs-for-nearly-everything-are-surging.html |

|

S&P 500 closes slightly lower as traders brace for Friday’s big jobs report: Live updatesThe three major averages ticked down Thursday as the market looked to Friday’s jobs report. Read more at: https://www.cnbc.com/2023/10/04/stock-market-today-live-updates.html |

|

Weight loss drugs may be linked to stomach paralysis, other rare but severe issues, study saysThe study comes as Novo Nordisk’s Wegovy, Ozempic and similar treatments skyrocket in popularity in the U.S. for causing dramatic weight loss over time. Read more at: https://www.cnbc.com/2023/10/05/weight-loss-drugs-wegovy-ozempic-may-be-linked-to-stomach-paralysis.html |

|

Trump seeks dismissal of D.C. election interference case, cites ‘presidential immunity’Former President Donald Trump denies charges from special counsel Jack Smith that he conspired to overturn his electoral loss to President Joe Biden in 2020. Read more at: https://www.cnbc.com/2023/10/05/trump-asks-to-dismiss-dc-election-interference-charges-citing-presidential-immunity.html |

|

Beware these debt-laden stocks breaking down under the weight of higher ratesElevated interest rates that stay high will disproportionately hurt companies with above-average debt loads, like these 17 that turned up in a CNBC screen. Read more at: https://www.cnbc.com/2023/10/05/beware-debt-laden-stocks-buckling-under-the-weight-of-higher-rates.html |

|

Ken Griffin’s hedge fund Citadel bucks the downtrend in September, up nearly 13% this yearCitadel’s multistrategy flagship Wellington fund gained 1.7% in September, bringing its 2023 performance to 12.6%. Read more at: https://www.cnbc.com/2023/10/05/ken-griffins-citadel-bucks-the-downtrend-in-september-up-nearly-13percent-this-year.html |

|

GM’s stock hits three-year low amid UAW strike, potential air bag recallThe last time shares of GM dropped below $30 a share during intraday trading was on Oct. 1, 2020, according to FactSet. Read more at: https://www.cnbc.com/2023/10/05/gms-stock-falls-amid-strikes-potential-air-bag-recall.html |

|

Happy meal? Steady demand for french fries is good news for U.S. economyThe fast-food staple has remained popular even as the broader economy has soured. Read more at: https://www.cnbc.com/2023/10/05/consumers-are-still-ordering-french-fries-with-meals-in-a-good-sign-for-the-economy.html |

|

DuckDuckGo CEO testified that Apple was ‘really serious’ about replacing Google as default for private browsingApple’s contract with Google to be the default search engine on its Safari browser “was often the elephant in the room,” said DuckDuck Go CEO Gabriel Weinberg. Read more at: https://www.cnbc.com/2023/10/05/duckduckgo-ceo-testified-about-talks-with-apple-to-replace-google.html |

|

‘The Exorcist: Believer’ and Hispanic audiences: A match made in horror movie heaven“The Exorcist: Believer,” featuring “Hamilton” star Leslie Odom Jr. and Ellen Burstyn, opens in theaters Friday. Read more at: https://www.cnbc.com/2023/10/05/the-exorcist-believer-attracts-hispanic-audiences.html |

|

There’s a fun new way to spice up your iPhone group chatsWith iOS 17, you can turn your very own photos into iMessage stickers that are static or GIF style. Read more at: https://www.cnbc.com/2023/10/05/how-to-create-custom-stickers-in-ios-17-for-imessage-on-iphone.html |

|

Ex-FTX engineer testifies he alerted SBF of bug that revealed Alameda liabilities: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, Paul Tuchmann, a former federal prosecutor and current partner with Wiggin and Dana, provides legal insight into the SBF trial, including the charges and procedures involved. Read more at: https://www.cnbc.com/video/2023/10/05/ex-ftx-engineer-testifies-he-alerted-sbf-of-bug-that-revealed-alameda-liabilities-cnbc-crypto-world.html |

|

Something Popped: Google Searches For “Sell My Airbnb” Surge As Travel Downturn WorsensWe told readers in late July, “Why AirBnB Owners Are About To Be Forced Property Sellers.” Then, one month later, in late August, we wrote “The AirBnB Bubble Popping Will Pop The Housing Bubble,” followed by “AirBnB Bubble Bursts: Investor Home Purchases Crash 45% In Biggest Drop Since 2008.” Airbnb owners who snapped up homes in the last several years during the era of ‘free’ money are facing a downturn in the short-term rental market that started in the second half of 2022, with some Airbnb operators in cities facing 50% revenue declines, according to a recent note published by Reventure Consulting CEO Nick Gerli. “I believe these losses will cause a wave of distressed selling from Airbnb operators in 2023 and 2024,” Gerli said. Airbnb’s CEO recently warned of a “booking slowdown,” while airlines and retailers have warned of a consumer spending downturn. JPMorgan, Goldman, Bank of America, Barclays, and Citi have added more gloom as consumer credit card spending crashed in September. Clearly, the Fed pinning interest rates at two-decade highs is leading to major economic … Read more at: https://www.zerohedge.com/markets/something-popped-google-searches-sell-my-airbnb-surge-travel-bubble-downturn-worsens |

|

The Degradation And Humiliation Of The U.S. ConsumerSubmitted by QTR’s Fringe Finance I’ve often written about how inflation is nefarious because it cripples people’s purchasing power 24 hours a day, seven days a week. Whether it is dark out or light out, whether people are paying attention or not, inflation is, in essence, a piece of machinery that eats away at your purchasing power at all times—whether you know about it and expect it or not. I discussed the effects of inflation in a video I made a long time ago, called “The Weighted Blanket Theory.” In it, I explained that rising prices are like a weighted blanket falling on the consumer. At first, they feel okay and even comforting, but then you realize the blanket weighs far too much—before you know it, you’re trapped under a blanket that has completely incapacitated and smothered you. Something else that has slipped away—largely unnoticed—is the standard of quality of service offered to consumers around the country. As the United States has transitioned from treating spending on discretionary items as a luxury to considering it a right—and even an obligation for all consumers, even if it means taking on debt—companies have had to fight less and less to provide good service. Now, service is basically bordering on sub-human, both literally and figuratively. In other words, because our fractional-reserve, debt-based system is built on the fantasy of modern monetary theory and prioritizes nothing but spending mon … Read more at: https://www.zerohedge.com/markets/degradation-and-humiliation-us-consumer |

|

Trust In Congress Below 20% Third Month In A RowIn the first few months after President Joe Biden took office in January 2021, Congress approval ratings among the general public were at their highest points in over a decade. However, as Statista’s Florian Zandt details below, the picture is decidedly different today, with the percentage of people satisfied with how lawmakers in the House and Senate are doing their jobs dropping below or just at 20 percent since the beginning of the year.

You will find more infographics at Statista According to results from the most recent Gallup Poll Social Series conducted from September 1 to 23, 17 percent of respondents thought Congress was doing a good job, only one percent shy of this presidential term’s lowest approval ratings of 16 percent in June 2022 and April 2023. While no specific reasons are given for the low ratings, March 2023 saw the U.S. face several disastrous tornado outbreaks and Read more at: https://www.zerohedge.com/political/trust-congress-below-20-third-month-row |

|

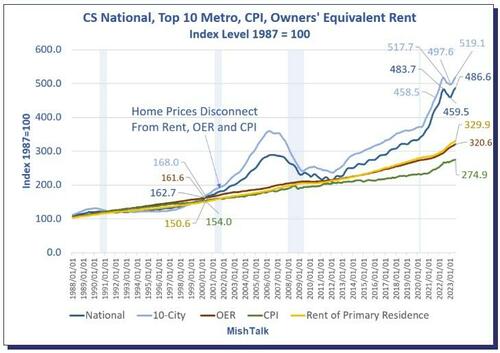

How The Fed Destroyed The Housing Market And Created Inflation In PicturesAuthored by Mike Shedlock via MishTalk.com, The Fed erroneously does not consider rising home prices as inflation. Here’s the result in pictures.

Case-Shiller national and 10-city home prices vs CPI, Rent, and Owners’ Equivalent Rent Chart Note

For 12 years, home prices, OER, Rent, and the overall CPI all rose together. That changed in 2000 with another trendline touch in 2012. Then it was … Read more at: https://www.zerohedge.com/personal-finance/how-fed-destroyed-housing-market-and-created-inflation-pictures |

|

HS2 will not go to Euston without private fundsIf the money cannot be raised then passengers travelling to and from central London will have to change. Read more at: https://www.bbc.co.uk/news/business-67021225?at_medium=RSS&at_campaign=KARANGA |

|

Metro Bank shares plunge on fund raising reportsIts shares sank by as much as a third in early trading, after reports it needs to raise £600m. Read more at: https://www.bbc.co.uk/news/business-67016375?at_medium=RSS&at_campaign=KARANGA |

|

Electric car sales to private buyers fall sharplyNo incentives for consumers to buy electric has affected sales, but overall the car market is growing. Read more at: https://www.bbc.co.uk/news/business-67017972?at_medium=RSS&at_campaign=KARANGA |

|

As Nifty trades at make-or-break level, will RBI Das play the good or bad cop for D-Street?The market correction had nothing to do with the monetary policy, and was rather a reflection of the weak global sentiment. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/as-nifty-trades-at-make-or-break-level-will-rbi-das-play-the-good-or-bad-cop-for-d-street/articleshow/104174774.cms |

|

Nifty forms Bullish Island Reversal pattern. What traders should do nextThe broader negative chart pattern like lower tops and bottoms is intact as per the daily timeframe chart and further upside from here could open chances of new lower top formation. The display of further strength in the current upside bounce could possibly pull the Nifty towards 19,726 levels Read more at: https://economictimes.indiatimes.com/markets/stocks/news/tech-view-nifty-forms-bullish-island-reversal-pattern-what-traders-should-do-on-friday/articleshow/104190123.cms |

|

Mankind, HUL among 6 top stock ideas from Kotak Securities for up to 24% returnsAccording to Kotak Securities banks and financials continue to remain exceptions as they trade at relatively reasonable levels. One should follow a stock-specific approach based on the fundamental merits of the stock, the brokerage said. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/mankind-hul-among-6-top-stock-ideas-from-kotak-securities-for-up-to-24-returns/slideshow/104182776.cms |

|

Futures Movers: Oil prices post fifth loss in six sessions as demand worries spark sharp pullbackOil futures hold ground on Thursday at their lowest prices since August, a day after data showing a large increase in U.S. gasoline inventories sparked the biggest one-day selloff of 2023. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7276-6AA353175BB9%7D&siteid=rss&rss=1 |

|

As 75,000 Kaiser healthcare workers walk off the job, Tenet Healthcare could be next to face a strikeHospital stocks are under pressure amid labor strife. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7277-3C3208CDAAB9%7D&siteid=rss&rss=1 |

|

Cathie Woods’ ETFs sold more than $25 million worth of Tesla stockCathie Wood’s Ark Invest ETFs trimmed their stakes in Tesla’s stock by a total of more than $25 million on Wednesday. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7277-2B704877F939%7D&siteid=rss&rss=1 |