Summary Of the Markets Today:

- The Dow closed up 127 points or 0.39%,

- Nasdaq closed up 1.35%,

- S&P 500 closed up 0.81%, (low 4,110)

- Gold $1,838 down $3.20,

- WTI crude oil settled at $85 down $4.50,

- 10-year U.S. Treasury 4.720% down 0.082 points,

- USD Index $106.71 down $0.290,

- Bitcoin $27,654 up $375,

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our Economic Forecast for October 2023

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

ADP Private sector employment increased by 89,000 jobs in September 2023 and annual pay was up 5.9 percent year-over-year. We will see if the BLS employment report agrees on Friday – but the gain is worse than any month since January 2021.

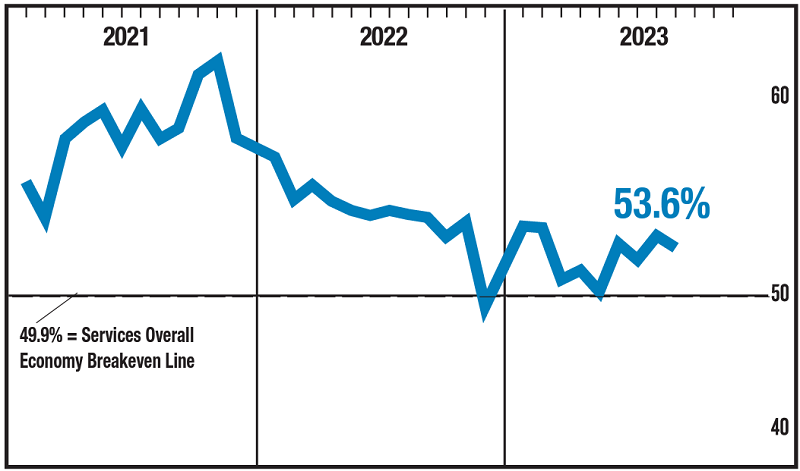

In September 2023, the Institute of Supply Management Services PMI registered 53.6 percent, 0.9 percentage point lower than August. The composite index indicated growth in September for the ninth consecutive month after a reading of 49.2 percent in December 2022, which was the first contraction since June 2020 (45.4 percent). A reading below 55 indicates a slow economy.

New orders for manufactured goods in August 2023 improved 0.5% year-over-year – 0.6% inflation-adjusted. Manufacturing remains in the doldrums.

Here is a summary of headlines we are reading today:

- U.S. Delays Aid To Ukraine Amid Domestic Political Disputes

- Battery Lifespan Could Double With New Breakthrough

- Investors Prioritize Profits Over Green Credentials

- Germany Reactivates Coal Plants For Winter Power Boost

- Oil Prices Tumble As The EIA Reports A Significant Gasoline Build

- OPEC+ Leaves Oil Production Levels Unchanged

- Dow adds 100 points to snap 3-day losing streak as Treasury yields ease from 16-year highs: Live updates

- GM secures new $6 billion credit line as UAW strike costs reach $200 million

- Economic Report: U.S. jobs report forecast: 170,000 new workers and 3.7% unemployment

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Middle East Gas Giants Look To Capitalize On Booming DemandGlobal gas demand is projected to rise in the next decade, thus influencing a 12.5% surge in production between 2023 and 2030. However, Rystad Energy forecasts that even in scenarios of 1.9 and 2.5 degrees Celsius warming, with rapid growth in renewable energy sources, the current set of existing gas fields will not meet global demand, requiring rapid growth in unconventional gas supply. Gas-rich geographies such as the Middle East, with basins such as Rub al Khali, will play an essential role in bridging that gap, providing an estimated 20 million… Read more at: https://oilprice.com/Energy/Natural-Gas/Middle-East-Gas-Giants-Look-To-Capitalize-On-Booming-Demand.html |

|

U.S. Delays Aid To Ukraine Amid Domestic Political DisputesWhen Ukrainian President Volodymyr Zelenskiy met with U.S. senators at the Capitol on September 21 during a blitz visit to Washington to rally support for more aid, he reportedly told them that without U.S. backing his nation would lose its potentially existential battle against the Russian invasion. Less than two weeks later, a U.S. Congress embroiled in fierce partisan and interparty fighting over a new budget passed a temporary spending bill on September 30, averting a government shutdown for the time being. It included nothing for Zelenskiy’s… Read more at: https://oilprice.com/Geopolitics/International/US-Delays-Aid-To-Ukraine-Amid-Domestic-Political-Disputes.html |

|

Europe’s Gas Rally Reignited By Chillier Weather PredictionsEuropean natural gas futures have reversed their steep decline after forecasts of cooler weather in the coming months increased the prospects of higher heating demand. Benchmark futures climbed as much as 4% on Tuesday’s session, before paring some gains. Dutch front-month gas traded 2.3% higher at €37.85 a megawatt-hour at 0800 hrs ET in Amsterdam, partly reversing the 12% the contract had lost over the past two sessions. Europe’s unseasonably warm autumn has so far curbed demand for gas, but an expected cold spell in the months… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Europes-Gas-Rally-Reignited-By-Chillier-Weather-Predictions.html |

|

Battery Lifespan Could Double With New BreakthroughCity University of Hong Kong researchers believe they have achieved a pivotal breakthrough in battery technology that has profound implications for our energy future. The new development overcomes the persistent challenge of voltage decay and can lead to significantly higher energy storage capacity. The paper titled “A Li-rich layered oxide cathode with negligible voltage decay”, has been published in Nature Energy. The first authors are Dr Luo Dong, Postdoc, Yin Zijia, PhD student from CityU PHY, Dr Zhu He from Nanjing University of… Read more at: https://oilprice.com/Energy/Energy-General/Battery-Lifespan-Could-Double-With-New-Breakthrough.html |

|

Albemarle’s Liontown Ambitions Challenged By Billionaire’s Bold MoveIn a move designed to thwart a takeover bid by American lithium giant Albemarle Corp (NYSE:ALB), Australia’s richest woman, Gina Rinehart, has once again boosted her position in Liontown Resources Ltd, Bloomberg reports. This is the fourth time in recent weeks that Rinehart, through Hancock Prospecting Pty, has added to her Liontown Resources stake, which now sits at 14.67%, just shy of the 15% needed to potentially block Albemarle’s ~$4.2-billion takeover bid for the Australian lithium miner. In mid-September, Rinehart owned… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Albemarles-Liontown-Ambitions-Challenged-By-Billionaires-Bold-Move.html |

|

Investors Prioritize Profits Over Green CredentialsGreen credentials and ESG claims are failing to win over investors as money managers and retail punters hunt for firms with healthy bottom lines, a new survey has suggested. In a new temperature check of investor sentiment across the UK, communication agency MHP found that just one per cent of investors said environmental, social and governance (ESG) concerns were top of their list when making decisions around whether to back companies. Conversely, some 39 per cent said the health of the bottom line was the top driver of their investment decision… Read more at: https://oilprice.com/Energy/Energy-General/Investors-Prioritize-Profits-Over-Green-Credentials.html |

|

Germany Reactivates Coal Plants For Winter Power BoostGermany’s government is bringing back online several coal-fired units for this winter in an attempt to save natural gas and avoid power supply shortfalls, the Economy and Climate Action Ministry said on Wednesday. Several coal-fired blocks operated by RWE and LEAG at their Niederaußem, Neurath, and Jaenschwalde power plants will be temporarily reactivated until March 2024 as a precautionary measure to safeguard electricity supply in the coming winter, the ministry said, referring to a government decision to bring… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Germany-Reactivates-Coal-Plants-For-Winter-Power-Boost.html |

|

Panasonic’s $4 Billion Coal-Powered Battery Plant Sparks ESG ConcernsPanasonic’s new battery plant in Kansas will require an amount of energy equivalent to that used by a small city, forcing a nearby utility to halt the shutdown of a coal-fired power plant. This has sparked criticism that electric vehicle production and electric vehicles aren’t ‘ESG-friendly.’ According to The Kansas City Star, citing documents filed by power company Evergy with the Kansas Corporation Commission, Panasonic’s 4-million-square-foot plant in Johnson County will double the utility’s load and require two new substations and upgrades… Read more at: https://oilprice.com/Energy/Coal/Panasonics-4-Billion-Coal-Powered-Battery-Plant-Sparks-ESG-Concerns.html |

|

Oil Prices Tumble As The EIA Reports A Significant Gasoline BuildCrude oil prices continued to move lower despite the Energy Information Administration report that inventories had shed 2.2 million barrels in the week to September 29. This compared with a draw of the same size estimated for the previous week by the EIA. A day earlier, the American Petroleum Institute reported an estimated inventory decline of 4.2 million barrels for the last week of September. In fuels, meanwhile, the EIA reported mixed inventory changes, but it was a build in gasoline and fears of weakening gasoline demand that traders paid… Read more at: https://oilprice.com/Energy/Energy-General/Oil-Prices-Tumble-As-The-EIA-Reports-A-Significant-Gasoline-Build.html |

|

Asia Pacific To Invest $3.3 Trillion In Power Generation Over 10 YearsThe Asia Pacific region is poised to invest as much as $3.3 trillion in power generation over the next 10 years, half of which in solar and wind power, as India and China lead the growth in power demand and investments, Wood Mackenzie said in an analysis on Wednesday. Of the expected investment in power generation, a total of 49% is set to go to wind and solar power and another 12% to energy storage, according to the energy consultancy. India and China, the two largest markets, are looking to boost generation capacity as power demand soars,… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Asia-Pacific-To-Invest-33-Trillion-In-Power-Generation-Over-10-Years.html |

|

What Fossil Fuel Lobbyists Are Getting WrongMaybe we have been watching too many westerns, but we get the feeling that the fossil fuel industry lobbyists are psychologically somewhere between circling the wagons and preparing for a last stand. In August, the Edison Electric Institute (EEI), the investor-owned electric industry lobbying group, selected a new chief executive, a climate change denying, fossil fuel executive and former member of the Trump administration. Environmentalists denounced the EEI for picking a climate denier as CEO. The EEI and its top honchos replied with the most… Read more at: https://oilprice.com/Energy/Energy-General/What-Fossil-Fuel-Lobbyists-Are-Getting-Wrong.html |

|

Russia’s Oil And Gas Revenues Rose By 15% In SeptemberRussia’s oil and gas revenues increased by 15% from August to $7.4 billion (739.9 billion Russian rubles) in September, due to higher budget proceeds from the extraction tax and export duties, finance ministry data showed on Wednesday. Rising oil prices in September led to higher budget proceeds from the so-called mineral extraction tax, according to the data. For January to September, Russia’s oil and gas revenues dropped by 34.5% year-over-year to $56 billion (5.576 trillion rubles). The decline was due to lower natural… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Russias-Oil-And-Gas-Revenues-Rose-By-15-In-September.html |

|

Why Institutional Traders Started Selling Oil And Fuel FuturesInstitutional traders in oil and fuels became net sellers after weeks of buying crude and fuel futures as higher oil prices triggered a rush to take profit. Reuters’ market analyst John Kemp reported in his latest column that funds and other large oil traders had sold the equivalent of 25 million barrels of oil and fuel futures in the week to September 26 after buying a cumulative 155 million barrels in the prior three weeks. The selloff came as both Brent and West Texas Intermediate hovered above $90 per barrel thanks to the supply squeeze from… Read more at: https://oilprice.com/Energy/Energy-General/Why-Institutional-Traders-Started-Selling-Oil-And-Fuel-Futures.html |

|

OPEC+ Leaves Oil Production Levels UnchangedThe OPEC+ panel reviewing the oil market ended a brief meeting on Wednesday without recommending any changes to the current oil production policy, hours after Saudi Arabia and Russia said in separate statements they would stick to their respective voluntary supply cuts by the end of the year. The Joint Ministerial Monitoring Committee (JMMC) of the OPEC+ group, which met via videoconference today, affirmed the commitment of the several OPEC+ members and thanked Saudi Arabia and Russia for their voluntary supply cuts and “expressed its full… Read more at: https://oilprice.com/Latest-Energy-News/World-News/OPEC-Leaves-Oil-Production-Levels-Unchanged.html |

|

Exxon Picks BlackRock As Buyer Of Its 71% Stake In Italian LNG TerminalExxonMobil has selected the world’s largest asset manager, BlackRock, as a buyer for its 70.7% stake in Adriatic LNG, Italy’s first regasification import terminal, the U.S. supermajor told Reuters on Wednesday. Exxon currently holds 70.7% of Adriatic LNG via its subsidiary ExxonMobil Italiana Gas. The other shareholders in Italy’s main LNG import terminal off the Adriatic coast in northern Italy are a unit of QatarEnergy with a 22% stake and Italian state-controlled gas grid operator Snam with 7.3%. According to anonymous sources… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Exxon-Picks-BlackRock-As-Buyer-Of-Its-71-Stake-In-Italian-LNG-Terminal.html |

|

Dow adds 100 points to snap 3-day losing streak as Treasury yields ease from 16-year highs: Live updatesThe S&P 500 rose Wednesday as Treasury yields pulled back from multiyear highs following the release of much weaker-than-expected jobs data. Read more at: https://www.cnbc.com/2023/10/03/stock-market-today-live-updates.html |

|

Biden cancels $9 billion in student debt for 125,000 borrowersPresident Joe Biden has approved $9 billion in student loan forgiveness for 125,000 Americans. Read more at: https://www.cnbc.com/2023/10/04/biden-cancels-9-billion-in-student-debt-for-125000-borrowers-.html |

|

‘The Donald Trump show is over,’ AG says after ex-president leaves New York fraud trialJudge Arthur Engoron issued a gag order against former President Donald Trump after he attacked the judge’s principal law clerk during the fraud trial. Read more at: https://www.cnbc.com/2023/10/04/trump-fraud-trial-ex-president-in-court-after-judge-issues-gag-order.html |

|

GM secures new $6 billion credit line as UAW strike costs reach $200 millionThe new line of credit is “prudent” to bolstering GM’s balance sheet amid expectations that the union may expand and prolong strikes against the company. Read more at: https://www.cnbc.com/2023/10/04/gm-secures-new-6-billion-credit-line-as-uaw-strike-costs-200-million.html |

|

This AI company wants to help you control your dreamsProphetic is a tech startup creating what’s billed as the “world’s first wearable device for stabilizing lucid dreams.” Read more at: https://www.cnbc.com/2023/10/04/ai-startup-prophetic-aims-to-build-headset-that-lets-you-control-dreams.html |

|

Bill Gross is down on both stocks and bonds and says these are the best opportunities nowBill Gross, widely followed investor once known as the bond king, said he’s negative about both stocks and bonds, only seeing very limited opportunities. Read more at: https://www.cnbc.com/2023/10/04/bill-gross-is-down-on-both-stocks-and-bonds-and-says-these-are-the-best-opportunities-now.html |

|

Opening statements begin in the trial of Sam Bankman-Fried: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, Zack Shapiro of the crypto-focused law firm Rains discusses what the trial could mean or the crypto industry. Read more at: https://www.cnbc.com/video/2023/10/04/opening-statements-begin-trial-sam-bankman-fried-crypto-world.html |

|

House GOP boots Pelosi, Hoyer from House hideaways after Speaker Kevin McCarthy ousterHouse Republican leaders have abruptly booted two high-profile Democrats from their longtime Capitol hideaway offices without explanation. Read more at: https://www.cnbc.com/2023/10/04/gop-boots-democrats-from-hideways-after-kevin-mccarthy-ouster.html |

|

Lab owner who defrauded Medicare to forfeit $187 million, FerrariLab owner Minal Patel filed nearly $500 million in false claims to Medicare for genetic tests. Read more at: https://www.cnbc.com/2023/10/04/georgia-man-forfeits-ferrari-money-for-medicare-fraud.html |

|

Former Trump lawyer Rudy Giuliani sues Biden for defamation over ‘Russian pawn’ crackFormer New York mayor Rudy Giuliani said he would seek millions or billions of dollars in damages from President Joe Biden calling him a Russian pawn in 2020. Read more at: https://www.cnbc.com/2023/10/04/former-trump-lawyer-rudy-giuliani-sues-biden-for-defamation.html |

|

New York’s floods weren’t a one-off — here’s how the city is preparing for the futureNew York experienced record rainfall on Friday, overwhelming transit systems and flooding apartmtents. Read more at: https://www.cnbc.com/2023/10/04/new-york-city-flood-infrastructure-climate-chief.html |

|

Apple releases fix for overheating iPhone 15 bug in iOS 17.0.3Over the weekend, Apple confirmed reports on social media that its new iPhones had a tendency to get warm. Read more at: https://www.cnbc.com/2023/10/04/apple-iphone-15-overheating-fix-released-in-ios-update.html |

|

Tilray Brands revenue jumps, losses narrow as it pivots away from cannabisCannabis producer Tilray Brands Inc. reported first-quarter earnings that beat expectations as it expands its portfolio Read more at: https://www.cnbc.com/2023/10/04/tilray-brands-revenue-jumps-losses-narrow-as-it-pivots-away-from-cannabis.html |

|

GM Taps JPMorgan For $6 Billion Credit Line As Strikes Hit Third WeekThe strike by the United Auto Workers union against Detroit’s three major automakers (Ford Motor Co., General Motors Co., and Chrysler-parent Stellantis) entered its third week on Monday, with seemingly little progress made. Notably, General Motors has activated a multi-billion dollar credit line from JPMorgan Chase Bank, an indication the automaker might be bracing for the strike to continue for an extended period. GM issued a filing on Wednesday morning detailing how it “entered into a new 364-Day Revolving Credit Agreement with JPMorgan Chase Bank, NA” for “an available borrowing capacity of $6 billion” that matures on Oct. 1, 2024. Bloomberg pointed out GM’s total automotive liquidity was around $39 billion, and there is no fear of the automaker depleting funds anytime soon. However, it noted, “But the new credit line is a sign GM may be buckling in for a prolonged work stoppage by the United Auto Workers.”

Last Friday, UAW boss Shawn Fain launched Read more at: https://www.zerohedge.com/markets/gm-taps-jpm-6-billion-credit-strikes-hit-third-week |

|

RNC Threatens To Ban Ramaswamy, Christie From Next GOP Debate For ‘Unsanctioned Dialogue’Authored by Naveen Athrappully via The Epoch Times, GOP presidential hopefuls—Vivek Ramaswamy and Chris Christie—have been threatened with expulsion from future debates by the Republican National Committee (RNC) after the duo decided to hold a discussion on Fox News.

However, it was later revealed that the RNC threatened to ban them from the next GOP primary debate if they took part in the discussion.

“Every campaign was offered that opportunity by Fox News and they have now been effectively banned by the RNC,” he said.

|

|

“This Will Make Your Blood Boil” – Biden Admin Goes Full Orwell Denying Vaxx Mandates Ever HappenedAuthored by Bobbie Anne Flower Cox via The Brownstone Institute, If you have not yet read the book 1984 by George Orwell, you absolutely must. I loathed that novel when I read it as a teen, because I hated the entire idea of an authoritarian government controlling its people so deftly. The dystopian world it described was just so depressing, so wrong, from the first page to the last. And yet, here we are, almost 75 years after Orwell first penned the book, and we see how that hellish science fiction novel is now playing out before us. Even the left-leaning Wikipedia describes the book as a “cautionary tale” whose theme centers on “the consequences of totalitarianism, mass surveillance and repressive regimentation of people and behaviours within society.” Modeled on the authoritarian states of Stalin’s Soviet Union and of Nazi Germany, the book takes a deep dive into the role of truth within a society, and the ways in which truth and facts can be manipulated by government to control the population. Read more at: https://www.zerohedge.com/political/will-make-your-blood-boil-biden-admin-goes-full-orwell-denying-vaxx-mandates-ever |

|

Victor Davis Hanson: Who’s The Real ‘Danger To Democracy’?Authored by Victor Davis Hanson, Suddenly after three years, a number of angry former Trump appointees – some on the prompt of potential or real book promotions, or in anger about firings, or their own legal exposure – are replaying all the supposedly atrocious things Trump said in private to them between 2017-21.

If, in fact, they are accurate, then by all means they were certainly atrocious things to have said even in private – and should never have been spoken by a president. But what is mysterious about their outrage are three other considerations that we hear nothing about from such now quite public critics: 1) Is there not a difference between atrocious bluster in private and public, methodical weaponization and destruction of our institutions? < … Read more at: https://www.zerohedge.com/political/victor-davis-hanson-whos-real-danger-democracy |

|

HS2: Why Rishi Sunak’s big gamble may not pay offRishi Sunak is taking an economic risk by spending money on everyday transport upgrades instead of a grand project. Read more at: https://www.bbc.co.uk/news/business-67003881?at_medium=RSS&at_campaign=KARANGA |

|

Rishi Sunak promises more rail, road and bus linksIt comes after the section of the HS2 high-speed train line between Birmingham and Manchester was scrapped. Read more at: https://www.bbc.co.uk/news/business-67005036?at_medium=RSS&at_campaign=KARANGA |

|

Tesco doing all it can to lower prices, boss saysThe pace of price rises will continue to ease this year, says chief of UK’s biggest supermarket. Read more at: https://www.bbc.co.uk/news/business-66932287?at_medium=RSS&at_campaign=KARANGA |

|

World Cup 2023 can turn Zomato, 10 other stocks into wealth churnersWith the World Cup 2023 beginning from Thursday, cricket fever is running high in the country as India is exclusively hosting the ICC WC after a 12-year hiatus. In all, 48 matches will be played over the next one and half months. The Indian stock markets will not remain untouched from the carnival as fans spend on hotel bookings, travel, and food & beverages.Brokerage firm Way2Wealth has identified its playing 11 which could potentially turn out to be the stock market’s run machine. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/icc-cricket-world-cup-2023-can-turn-zomato-10-other-stocks-into-wealth-churners/way2wealths-playing-xi/slideshow/104158640.cms |

|

Marico Q2 Update: Revenue to dip on rural recovery dragRevenue in the quarter was marginally lower on a year-on-year basis, dragged by pricing corrections in key domestic portfolios over the last 12 months, which will progressively come into the base going ahead, Marico said. Read more at: https://economictimes.indiatimes.com/markets/stocks/earnings/marico-q2-update-revenue-to-dip-on-rural-recovery-drag/articleshow/104165380.cms |

|

IPO scorecard in H1FY24: Only 1 loser, average listing gains at 29%Ideaforge topped the charts with a stupendous return of 93%, followed by Utkarsh Small Finance Bank at 92% and Netweb Technologies at 82%. The largest IPO in the first half was from Mankind Pharma (Rs 4,326 crore), followed by JSW Infrastructure (Rs 2,800 crore) and RR Kabel (Rs 1,964 crore) Read more at: https://economictimes.indiatimes.com/markets/ipos/fpos/ipo-scorecard-in-h1fy24-only-1-loser-average-listing-gains-at-29/articleshow/104158778.cms |

|

Economic Report: U.S. jobs report forecast: 170,000 new workers and 3.7% unemploymentThe post-pandemic boom in hiring appears to be over, and businesses are adding fewer workers. Will the slowdown in employment continue? Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7274-D4A6C0CF7F15%7D&siteid=rss&rss=1 |

|

Austin rider’s missing cat has ‘clean bill of health’ after Lyft driver mishapA cat owner went viral after a Lyft driver took off with his pet in the back seat. A company rep said there’d be a $20 ‘returned item fee’ if the cat was found. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7273-57C432C49D9B%7D&siteid=rss&rss=1 |

|

Biden says he’ll make ‘major speech’ on Ukraine aidPresident Joe Biden says he’ll be making a major speech on the issue of Ukraine aid, which faces a more uncertain future due to the House’s speaker drama. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7275-E083F95E1BAF%7D&siteid=rss&rss=1 |