Summary Of the Markets Today:

- The Dow closed down 74 points or 0.22%,

- Nasdaq closed up 0.67%,

- S&P 500 closed flat 0.01%,

- Gold $1,840 down $21.10,

- WTI crude oil settled at $89 down $2.01,

- 10-year U.S. Treasury 4.687% up 0.116 points,

- USD Index $107.01 up $0.790,

- Bitcoin $27,843 up $714,

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our Economic Forecast for October 2023

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

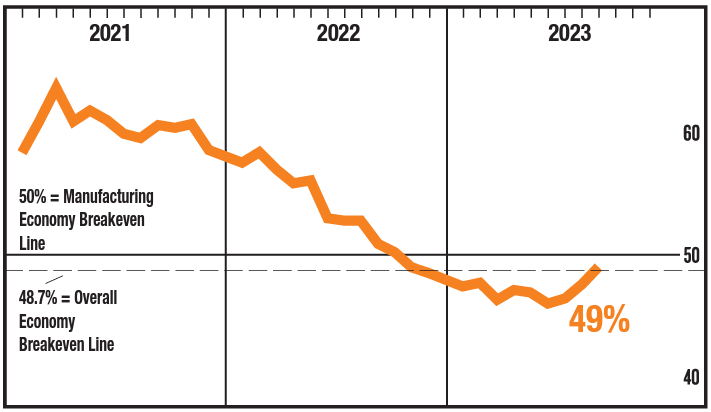

The Institute of Supply Management Manufacturing PMI® registered 49% in September 2023 – 1.4 percentage points higher than the 47.6% recorded in August. A Manufacturing PMI® above 48.7%, over a period of time, generally indicates an expansion of the overall economy. The New Orders Index remained in contraction territory at 49.2 percent, 2.4 percentage points higher than the figure of 46.8 percent recorded in August.

Construction spending during August 2023 is 7.4% above August 2022 – 3.3% inflation-adjusted. Construction now appears to be expanding year-over-year.

Here is a summary of headlines we are reading today:

- Rising Oil Prices Threaten Economic Stability

- OPEC+ On Alert As World Bank Slashes China’s Growth Forecasts

- Clash Over Electric Vehicle Battery Plants Stall UAW Negotiations

- China’s Power Sector Investments Set To Top $13.9 Trillion By 2060

- Dow slides to begin October even as Congress staves off government shutdown: Live updates

- The benchmark for small-cap stocks — the Russell 2000 — turned negative for the year

- Bill Ackman says the economy is starting to slow and the Fed is likely done hiking

- Bonds, Bullion, & Black Gold Battered As Hawkish FedSpeak & Inflation Fears Lift The Dollar

- Market Extra: Why stock-market investors aren’t finding comfort in averted government shutdown

- Court strikes down federal rule that sharply increased prescription costs for many patients

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Rising Oil Prices Threaten Economic StabilityAfter dropping below $70 a barrel (bbl) in early summer, the price of West Texas Intermediate (WTI) crude has been steadily marching higher. Last week, the price breached $90/bbl for the first time in a year, and there are no signs that the rise is slowing. Further increases would negatively impact consumers, especially for gasoline and transportation costs. While the Federal Reserve’s rate hikes have helped curb inflation, factors like oil supply dynamics are outside their control. Rising oil prices put the Fed’s attempts to engineer… Read more at: https://oilprice.com/Energy/Crude-Oil/Rising-Oil-Prices-Threaten-Economic-Stability.html |

|

Top 10 Oil Titans Account For Over 70% of Global ProductionIn 2022 oil prices peaked at more than $100 per barrel, hitting an eight-year high, after a full year of turmoil in the energy markets in the wake of the Russian invasion of Ukraine. Oil companies doubled their profits and the economies of the biggest oil producers in the world got a major boost. But which countries are responsible for most of the world’s oil supply? Using data from the Statistical Review of World Energy by the Energy Institute, Visual Capitalist’s Pallavi Rao and Christina Kostandi visualized… Read more at: https://oilprice.com/Energy/Crude-Oil/Top-10-Oil-Titans-Account-For-Over-70-of-Global-Production.html |

|

U.S. To Lose 2.5M BPD In Refining Capacity This Maintenance SeasonFall refinery maintenance in the United States will see almost 2.5 million barrels per day of capacity taken offline, Bloomberg reports, with more capacity cuts possibly coming early next year. In what Bloomberg describes as the “heaviest” maintenance season since before the COVID-19 pandemic, between September and December this year, the U.S. will lose nearly 2.5 million bpd of refining capacity, citing data from Energy Aspects LTD. That 2.5 million bpd represents an 11% hike in offline capacity compared to the same period… Read more at: https://oilprice.com/Latest-Energy-News/World-News/US-To-Lose-25M-BPD-In-Refining-Capacity-This-Maintenance-Season.html |

|

The Metals Behind Our Clean Energy FutureA very observant longtime friend of mine opined recently that the clean energy economy is really just a metals energy economy where metals provide the basis for energy production and transmission. The idea that this emerging economy is going to be light on resources compared to our current fossil-fuel based economy is a fantasy. And you don’t have to take his word for it. The International Energy Agency (IEA) has attempted to project the needs of this new economy. The IEA’s report entitled “The Role of Critical Minerals in Clean Energy Transitions”… Read more at: https://oilprice.com/Metals/Commodities/The-Metals-Behind-Our-Clean-Energy-Future.html |

|

OPEC+ On Alert As World Bank Slashes China’s Growth ForecastsOPEC+ continues to work to balance oil markets, cautiously eyeing China growth, the UAE Minister of Energy told a conference just two days ahead of the alliance’s October 4 ministerial panel meeting. “Many dynamics are moving on and we hope that the growth in China picks up … because the whole world economy is dependent on China,” UAE Minister of Energy and Infrastructure Al Mazrouei told the Adipec conference. “My worry is not an undersupplied market in the short term. My worry is an undersupplied market in the longer and mid… Read more at: https://oilprice.com/Latest-Energy-News/World-News/OPEC-On-Alert-As-World-Bank-Slashes-Chinas-Growth-Forecasts.html |

|

Rolls-Royce Beats Out Gates’ Terrapower In UK Nuclear CompetitionBill Gates’ nuclear reactor design company Terrapower has not been shortlisted for the next round of the government’s competition for scaled-down power plants. Industry vehicle GB Nuclear has selected six companies to advance to the latest stage, including rumoured front-runner Rolls-Royce which has already secured over £200m in government funding. ‘Satisfaction’ for Mick Jagger and Partner, Melanie Hamrick, After Couple Sells Home Outside Sarasota, Florida, for $3.25 MillionMansion Global | Sponsored The remaining… Read more at: https://oilprice.com/Alternative-Energy/Nuclear-Power/Rolls-Royce-Beats-Out-Gates-Terrapower-In-UK-Nuclear-Competition.html |

|

Clash Over Electric Vehicle Battery Plants Stall UAW NegotiationsThe CEOs of Ford Motor Co. and General Motors Co. blasted United Auto Workers boss Shawn Fain for expanding strikes on Friday – now in its third week. Fain said meaningful progress on a new four-year labor contract with Chrysler-parent Stellantis would allow the automaker to avoid additional strikes. GM CEO Mary Barra was furious with Fain: “It’s clear that there is no real intent to get to an agreement.” Ford CEO Jim Farley said, “UAW is holding the deal hostage over battery plants.” Farley warned UAW pay hike demands “have… Read more at: https://oilprice.com/Energy/Energy-General/Clash-Over-Electric-Vehicle-Battery-Plants-Stall-UAW-Negotiations.html |

|

Power Price Subsidies Spark Tensions In EU Market Reform TalksThe European Union member states are weighing the possibility to scrap a part of the electricity market reform due to disagreements over proposed fixed-price subsidies for power contracts, Reuters reported on Monday, quoting a draft compromise on the issue. The EU is seeking to reform the way its electricity market works to avoid a repeat of last year’s energy crisis which hit households and industries with soaring power prices. But a part of the reform concerning state… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Power-Price-Subsidies-Spark-Tensions-In-EU-Market-Reform-Talks.html |

|

OPEC’s Oil Production Grows For A Second Month Despite Saudi CutOPEC’s crude oil production rose by 120,000 barrels per day (bpd) in September from August – the second monthly increase in a row – as higher output in Iran and Nigeria offset the Saudi cuts, the monthly Reuters survey showed on Monday. All OPEC members produced 27.73 million bpd in September, as Nigeria and Iran boosted production the most, according to the survey based on vessel-tracking data, consultants, and sources at OPEC and oil firms. Nigeria, which has been lagging behind its quota in the OPEC+… Read more at: https://oilprice.com/Energy/Crude-Oil/OPECs-Oil-Production-Grows-For-A-Second-Month-Despite-Saudi-Cut.html |

|

Bulgarian Energy Workers Escalate Protest Over Green TransitionProtesters in Bulgaria blocked roads in three districts for a third day on October 1 in protest of government plans to shut down coal-burning power plants as part of a transition away from fossil fuels and toward green energy sources. Bulgarian miners and other energy-sector workers who are taking part in the protest declined an invitation from Prime Minister Nikolay Denkov to meet on October 1 with the Council of Ministers in Sofia, union leader Dimitar Manolov said. Manolov said late on September 30 the protestors’ refusal was categorical, and… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Bulgarian-Energy-Workers-Escalate-Protest-Over-Green-Transition.html |

|

South Africa Allows TotalEnergies To Drill For Offshore Oil And GasSouth Africa has dismissed an appeal against TotalEnergies’ offshore drilling plans, allowing the French supermajor to explore for oil and gas in a block off its southwest coast, Reuters reported on Monday, citing a ruling by the environment minister Barbara Creecy. TotalEnergies has been looking to explore for oil and natural gas in Block 5/6/7, located offshore the southwest coast of South Africa, between Cape Town and Cape Agulhas. TotalEnergies is proposing to drill up to five offshore wells on the block. In April, South Africa’s… Read more at: https://oilprice.com/Latest-Energy-News/World-News/South-Africa-Allows-TotalEnergies-To-Drill-For-Offshore-Oil-And-Gas.html |

|

The World Bank Cuts China’s Growth Forecast For 2024The World Bank has cut its economic growth forecast for China for 2024, citing continued difficulties in the domestic market including the property crisis and a fading rebound from the re-opening this year. Slower Chinese gross domestic product (GDP) growth could hit commodity demand and prices since China is the world’s largest commodity consumer and the biggest importer of crude oil. In its latest East Asia and Pacific October 2023 Economic Update on Sunday, the World Bank kept its Chinese growth estimate for 2023 at 5.1% compared to the… Read more at: https://oilprice.com/Energy/Energy-General/The-World-Bank-Cuts-Chinas-Growth-Forecast-For-2024.html |

|

China’s Power Sector Investments Set To Top $13.9 Trillion By 2060Investments in the Chinese power sector are set to top $13.9 trillion (100 trillion Chinese yuan) by 2060, Xinhua news agency reported on Monday, quoting the State Grid Corporation of China. China has pledged to achieve net-zero emissions by 2060 and to see a peak in its carbon emissions by the end of this decade. “The development of a new power system will promote the expansion of the scale of both the power industry and the power market,” the Chinese news agency quoted a book published by the State Grid Corporation of China last week.… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Chinas-Power-Sector-Investments-Set-To-Top-139-Trillion-By-2060.html |

|

Pakistan’s First-Ever Private-Sector Shipment Of Russian Crude OilPrivate Pakistani refiner Cnergyico has recently imported the first Russian crude cargo in the private sector in the South Asian country, a company spokesman has told Reuters. Pakistan has so far imported Russian crude on a government-to-government basis in a trial run of imports with cargoes that arrived in June. Cnergyico’s import of a cargo of the Russian Urals grade is the first purchase of Russian oil from the private Pakistani sector. The private refiner, which operates Pakistan’s largest refinery with 156,000 barrels per day… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Pakistans-First-Ever-Private-Sector-Shipment-Of-Russian-Crude-Oil.html |

|

India’s Oil Imports From Russia Surged 80% In SeptemberImports of Russian crude oil to India last month posted a substantial increase of 80% on the year, after a dip over the summer. Citing data from Vortexa, Indian media reported the subcontinent had taken in an average of 1.56 million barrels daily of Urals crude in September, up from 865,000 bpd a year ago. Compared with August, the September import rate was 8% higher. According to Kpler data, total crude oil imports into India from Russia in September stood at 1.8 million barrels daily, which compared with 977,000 barrels daily a year ago. “Indian… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Indias-Oil-Imports-From-Russia-Surged-80-In-September.html |

|

The inside story of Dave Clark’s tumultuous last days at Flexport: Standoffs, politics, and spinFlexport founder Ryan Petersen claimed in public that Dave Clark’s tenure as CEO featured too much spending, but internal documents tell a different story Read more at: https://www.cnbc.com/2023/10/02/the-inside-story-of-dave-clarks-tumultuous-last-days-at-flexport.html |

|

Dow slides to begin October even as Congress staves off government shutdown: Live updatesLegislators passed an 11th-hour deal to keep the government funded. Read more at: https://www.cnbc.com/2023/10/01/stock-market-today-live-updates.html |

|

Trump tax accountant takes witness stand at $250 million New York fraud trialNew York Attorney General Letitia James accuses Donald Trump, the Trump Organization and others in engaging in business fraud for years. Read more at: https://www.cnbc.com/2023/10/02/trump-fraud-trial-to-kick-off-in-new-york-court.html |

|

Congress, DC wonders if Biden and McCarthy cut secret Ukraine funding dealA stopgap bill to fund the federal government until November avoided a shutdown but also lacked aid to Ukraine that President Joe Biden wants. Read more at: https://www.cnbc.com/2023/10/02/congress-wonders-if-biden-mccarthy-struck-ukraine-fund-deal.html |

|

Morgan Stanley says investors are overlooking a $4 trillion opportunity in AI. These are the top stocks to play itThese stocks look poised to benefit from a multitrillion-dollar opportunity emerging in artificial intelligence. Read more at: https://www.cnbc.com/2023/10/02/morgan-stanleys-top-stocks-to-play-a-4-trillion-opportunity-in-ai.html |

|

The benchmark for small cap stocks — the Russell 2000 — turned negative for the yearThe index fell into the red for the year, in stark comparison to the large-cap focused S&P 500. Read more at: https://www.cnbc.com/2023/10/02/the-benchmark-for-small-cap-stocks-the-russell-2000-turned-negative-for-the-year.html |

|

Sen. Bob Menendez bribery trial set for May 2024Sen. Bob Menendez of New Jersey and his wife are charged in federal court with accepting bribes of cash, gold, a car, and more to help three businessmen. Read more at: https://www.cnbc.com/2023/10/02/sen-bob-menendez-bribery-trial-set-for-may-2024.html |

|

Drugmakers opt in to Medicare drug price negotiations – here’s what happens nextThe lengthy negotiation process with Medicare won’t end until August 2024, with reduced prices going into effect in January 2026. Read more at: https://www.cnbc.com/2023/10/02/drugmakers-agree-to-medicare-price-negotiations-whats-next.html |

|

Oddity Tech expects revenue growth up to 31%, according to preliminary third-quarter resultsIl Makiage and Spoiled Child parent company Oddity Tech started trading on the Nasdaq in July and has seen shares fall by about 50%. Read more at: https://www.cnbc.com/2023/10/02/oddity-tech-expects-q3-2023-sales-to-grow-up-to-31percent.html |

|

Bill Ackman says the economy is starting to slow and the Fed is likely done hikingPershing Square’s Bill Ackman on Monday sounded alarms on the economy, which he believes has begun to decelerate on the back of aggressive rate hikes. Read more at: https://www.cnbc.com/2023/10/02/bill-ackman-says-the-economy-is-starting-to-slow-and-the-fed-is-likely-done-hiking.html |

|

FTX customers who lost a fortune on the bankrupt exchange are doubling down on cryptoFTX’s multibillion-dollar cryptocurrency blowup hasn’t shaken some of its customers’ faith in the industry. Read more at: https://www.cnbc.com/2023/10/02/ftx-customers-who-lost-fortune-are-doubling-down-on-crypto-.html |

|

Fast-food drive-thru lanes speed up as fewer drivers wait in lineThe average total time spent in a drive-thru lane shrank 29 seconds this year, according to Intouch Insight. Read more at: https://www.cnbc.com/2023/10/02/fast-food-drive-thru-lanes-speed-up-as-fewer-drivers-wait-in-line.html |

|

These are JPMorgan’s top stocks for OctoberJPMorgan shares its top stocks list for October, including three new additions. One stock has rallied more than 155% this year but still has 25% upside. Read more at: https://www.cnbc.com/2023/10/02/these-are-jpmorgans-top-stocks-for-october-2023.html |

|

Bonds, Bullion, & Black Gold Battered As Hawkish FedSpeak & Inflation Fears Lift The DollarRate-change expectations shifted hawkishly today, after drifting dovishly for the last week, on the heels of the Manufacturing PMI’s report which showed the rate of inflation quickened to the sharpest pace in five months and FedSpeak which confirmed Powell’s “higher for longer” messaging.

Source: Bloomberg In the US, S&P Global noted

Globally, JPMorgan warned that there were further signs of price pressures building in September.

|

|

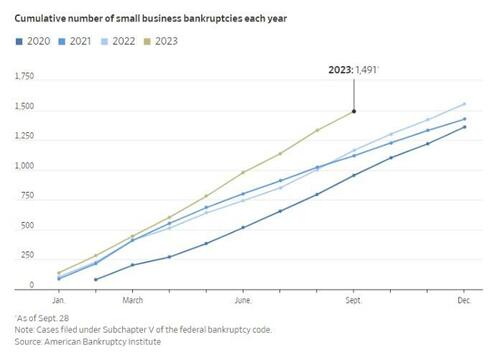

Small Business Bankruptcies Surge In 2023, Five Reasons WhyAuthored by Mike Shedlock via MishTalk.com, Small business bankruptcies are at a much higher pace than any year since the Covid pandemic…

Small business bankruptcies from the American Bankruptcy Institute via the Wall Street Journal The Wall Street Journal reports There’s No Soft Landing for These Businesses

|

|

Lindsay Graham Suggests If Conservatives Want Border Security They Will Have To Support Funding For UkraineThe root narrative around the next government funding bill is slowly taking shape and it is uglier than many people suspected – Neo-cons within the GOP are determined to oppose the majority of Americans and will continue funding the war in Ukraine, and they are planning on using the border security issue as leverage. In a recent interview with CBS Face The Nation, Lindsay Graham suggested that any new government funding bill would require many billions more in Ukraine military aid well beyond the $24 billion already slated, and that if conservatives want funding for border security, they will have to submit to an ongoing proxy war in Ukraine. In other words, the plan is to hold conservatives and America hostage using the immigration crisis. Let’s not forget that Graham has had a longstanding interest in using Ukraine as a powerkeg to start a war with Russia. Listen to his rhetoric in a speech given to Ukrainian soldiers in 2016, and it’s easy to understand why Russia would attack to secure the Donbas: Peddling propaganda that would have worked during the Iraq War but not so much today, Graham asserts a number of falsehoods. First, border security does not have to be tied to Ukraine funding, that is a construct created by House speaker Kevin McCarthy and his backroom negotiations with Demo … Read more at: https://www.zerohedge.com/political/lindsay-graham-suggests-if-conservatives-want-border-security-they-will-have-support |

|

Turley: Four Biden Impeachment Articles & What The House Will Need To ProveAuthored by Jonathan Turley, With the commencement of the impeachment inquiry into the conduct of President Joe Biden, three House committees will now pursue key linkages between the president and the massive influence peddling operation run by his son Hunter and brother James.

The impeachment inquiry should allow the House to finally acquire long-sought records of Hunter, James, and Joe Biden, as well as to pursue witnesses involved in their dealings. I testified this week at the first hearing of the impeachment inquiry on the constitutional standards and practices in moving forward in the investigation. In my view, there is ample justification for an impeachment inquiry. If these allegations are established, they would clearly constitute impeachabl … Read more at: https://www.zerohedge.com/political/turley-four-biden-impeachment-articles-what-house-will-need-prove |

|

John Lewis boss Dame Sharon White to step down after five yearsDame Sharon White will leave at the end of her term, making her the shortest-serving chair in the retailer’s history. Read more at: https://www.bbc.co.uk/news/business-66981035?at_medium=RSS&at_campaign=KARANGA |

|

Water firms want bill rises to cut leaks and spillsCompanies in England and Wales want to charge up to £84 a year more in 2025, rising to £156 extra by 2030. Read more at: https://www.bbc.co.uk/news/business-66979271?at_medium=RSS&at_campaign=KARANGA |

|

Abercrombie & Fitch ex-CEO accused of exploiting men for sexAn organised network recruited men for sex with Abercrombie & Fitch’s then-CEO – BBC investigation. Read more at: https://www.bbc.co.uk/news/world-66889779?at_medium=RSS&at_campaign=KARANGA |

|

Vedanta dollar bonds slip after plan to split up India businessAll four junk-rated notes were indicated lower on Monday, Bloomberg-compiled data showed. The August 2024 bond posted the biggest drop, down 0.6 cents on the dollar to 62.6 cents at 1:45 p.m. in Hong Kong, its biggest decline in more than three weeks. Of the four bonds, three were trading below the 80 cents-on-the-dollar mark typically considered distressed. Read more at: https://economictimes.indiatimes.com/markets/bonds/vedanta-dollar-bonds-slip-after-plan-to-split-up-india-business/articleshow/104108724.cms |

|

Breakout Stocks: How are Eris Lifesciences, Aurobindo Pharma and NTPC looking on charts for Tuesday’s trade?The Indian market rebounded after a previous drop, with the S&P BSE Sensex rising over 300 points and the Nifty50 closing above 19600 levels. Metal, healthcare, public sector, and oil & gas stocks saw buying activity, while IT stocks experienced selling. Eris Lifesciences, Aurobindo Pharma, and NTPC were highlighted as stocks to watch. Eris Lifesciences broke out of its consolidation zone, Aurobindo Pharma showed momentum with a breakout above the 5 and 10-day average, and NTPC demonstrated consistent upward movement with support at moving averages. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/breakout-stocks-how-are-eris-lifesciences-aurobindo-pharma-and-ntpc-looking-on-charts-for-tuesdays-trade/articleshow/104089407.cms |

|

Citi expects Brent to plunge to low $70s next yearChief executive officers of Shell Plc, TotalEnergies SE and Occidental Petroleum Corp., among others, will later Monday discuss plans for the energy transition. UAE Energy Minister Suhail Al Mazrouei and OPEC Secretary-General Haitham al-Ghais are also scheduled to speak. Read more at: https://economictimes.indiatimes.com/markets/commodities/news/citi-expects-brent-to-plunge-to-low-70s-next-year/articleshow/104102858.cms |

|

Market Extra: Why stock-market investors aren’t finding comfort in averted government shutdownThe U.S. government’s move to avert a weekend shutdown removes near-term uncertainty in financial markets, enabling Treasury yields to keep climbing. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7272-E728BED763AD%7D&siteid=rss&rss=1 |

|

Court strikes down federal rule that sharply increased prescription costs for many patientsDrugmakers’ copay assistance is at issue in patient-advocacy groups’ lawsuit. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7273-569BE513388F%7D&siteid=rss&rss=1 |

|

The Human Cost: $24 billion in pandemic-era funding for child-care programs just expired. Will it impact your family?More than 70,000 child-care programs could eventually close now that pandemic-era federal funding has expired. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7272-62BE640533F2%7D&siteid=rss&rss=1 |