Summary Of the Markets Today:

- The Dow closed down 68 points or 0.20%,

- Nasdaq closed up 0.22%,

- S&P 500 closed up 0.02%,

- Gold $1894 down $25,

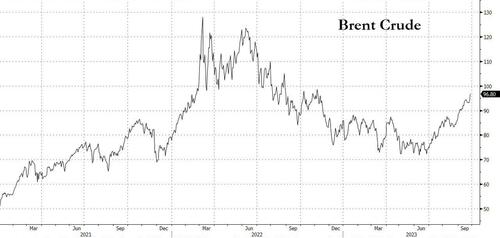

- WTI crude oil settled at $94 up $3.25,

- 10-year U.S. Treasury 4.612% up 0.054 points,

- USD index $106.70 up $0.47,

- Bitcoin $26,233 up $25

Click here to read our Economic Forecast for September 2023

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

New orders for manufactured durable goods in August 2023 were up 3.0% year-over-year (down 0.5% inflation-adjusted) – blue and red lines respectively on the graph below. Most sectors were little changed from the previous month with civilian aircraft significantly down and defense spending significantly up.

Here is a summary of headlines we are reading today:

- Fusion Experiments Shatter Previous Energy Records

- Saudi Arabia Forms Joint Venture With Greece To Link Power Grids

- Bulgaria Pledges $2.7 Billion For Military Upgrade As Black Sea Tensions Rise

- $40B Deal With U.S. Companies Kickstarts Poland’s Nuclear Power Ambitions

- Government Shutdown Could Slow Down U.S. Clean Energy Rollout

- UAW again threatens to expand strikes at Detroit automakers if progress isn’t made by Friday

- 10-year Treasury yield reaches level not seen in more than 15 years

- Landmark marijuana financing bill clears big hurdle in the Senate

- US Shale Giant Agrees With JPMorgan: Oil Headed For $150

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Fusion Experiments Shatter Previous Energy RecordsThe conversation around nuclear fusion is changing. For years, the idea of commercial nuclear fusion has been a pipe dream at best and science fiction at worst. But now, a series of increasingly promising scientific breakthroughs, an influx of private and public funding, and burgeoning governmental support has drastically changed the outlook for commercial nuclear fusion. All of a sudden, we’re talking about the technology in terms of “when” and not “if.” The dramatic turnaround has taken place… Read more at: https://oilprice.com/Energy/Energy-General/Fusion-Experiments-Shatter-Previous-Energy-Records.html |

|

India’s Rising Aluminum Appetite Shakes Global Market DynamicsVia Metal Miner In an otherwise down market staring at a slow recovery in 2023, only India stands apart from the rest of the world in terms of aluminum production and consumption. Indeed, the government’s push for new infrastructure, especially for green energy, continues to drive domestic consumption and overall stability for aluminum prices. The country is already the second-biggest aluminum producer and also the third-largest consumer in the world. However, many industry analysts predict India’s aluminum appetite will double within… Read more at: https://oilprice.com/Metals/Commodities/Indias-Rising-Aluminum-Appetite-Shakes-Global-Market-Dynamics.html |

|

Saudi Arabia Forms Joint Venture With Greece To Link Power GridsSaudi Arabia has signed a deal with Greece for the establishment of a jointly-owned company to link up the two countries’ power grids with the goal of supplying Europe with clean energy, Reuters reports. The new company, Saudi Greek Interconnection, joins Greece’s IPTO and Saudi Arabia’s National Grid, each with a 50% stake. Greece’s energy mix is already 40% renewable, and the country is seeking to boost this further, while lowering costs. To that end, Greece is also seeking to build an undersea cable that will link… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Saudi-Arabia-Forms-Joint-Venture-With-Greece-To-Link-Power-Grids.html |

|

Bulgaria Pledges $2.7 Billion For Military Upgrade As Black Sea Tensions RiseFor years, Bulgaria has delayed again and again the modernization of its armed forces. Even though a member of NATO since 2004, Bulgaria’s army still relies on old Soviet arms. Russia’s full-scale invasion of Ukraine in 2022, however, appears to have served as a wake-up call, and a batch of major Western arms purchases could be clinched by the end of this year. In particular, Sofia is looking to acquire warships and weapons for its coast guard, according to Prime Minister Denkov, who has said Russian threats in the Black Sea have caused concern… Read more at: https://oilprice.com/Geopolitics/International/Bulgaria-Pledges-27-Billion-For-Military-Upgrade-As-Black-Sea-Tensions-Rise.html |

|

SEC Flags Deutsche’s DWS Over False ESG Investment ClaimsToday in “the ESG narrative continues to crumble to the ground” news, it was announced that the Securities and Exchange Commission charged a subsidiary of Deutsche Bank, in two enforcement actions. The subsidiary, investment adviser DWS Investment Management Americas Inc., was charged once for a “failure to develop a mutual fund Anti-Money Laundering (AML) program”, an SEC press release read, and again for “misstatements regarding its Environmental, Social, and Governance investment process”. Color us not surprised, as we have been vociferous… Read more at: https://oilprice.com/Energy/Energy-General/SEC-Flags-Deutsches-DWS-Over-False-ESG-Investment-Claims.html |

|

$40B Deal With U.S. Companies Kickstarts Poland’s Nuclear Power AmbitionsPoland’s first nuclear power plant moved forward on Wednesday with the signing of a deal between the Polish government and a consortium of U.S. companies including Westinghouse and Bechtel. The nuclear plant will be built in the Pomerania region near the Baltic Sea and is being billed as part of Poland’s effort to ditch fossil fuels. The agreement with Polish state-owned Polskie Elektrownie Jadrowe (PEJ) will see $40 billion spent on two plants with three reactors each. The first of the three reactors is expected to go online… Read more at: https://oilprice.com/Latest-Energy-News/World-News/40B-Deal-With-US-Companies-Kickstarts-Polands-Nuclear-Power-Ambitions.html |

|

Financial Uncertainty Surrounds Oil And Gas FundingThe world of hydrocarbon project financing remains a contentious topic for many investors, with conflicting reports challenging their commitments to energy transition and climate change goals. Even as recent reports suggest a continued influx of capital into the global oil and gas sector, backed by prominent financial institutions, Norway’s sovereign wealth fund, Norges Bank, has taken a bold stance. In a statement by Carine Smith Ihenacho, a senior executive at Norges Bank Investment Management, the largest global stock shareholder, criticism… Read more at: https://oilprice.com/Energy/Energy-General/Financial-Uncertainty-Surrounds-Oil-And-Gas-Funding.html |

|

TotalEnergies Promises More Distributions, Buybacks As Oil Prices SoarAs oil prices soar and investors wait for signs that oil company stocks will start to catch up, French TotalEnergies has announced plans to boost production and shareholder distributions, lifting its stock price by almost a percentage point in morning trading. TotalEnergies said it planned to return some 44% of its operations cash flow to shareholders in 2023, as well as add another $1.5 billion to buybacks, which will hit $9 billion. Additionally, distribution guidance will be pushed to more than 40% of the company’s cash flow from… Read more at: https://oilprice.com/Latest-Energy-News/World-News/TotalEnergies-Promises-More-Distributions-Buybacks-As-Oil-Prices-Soar.html |

|

Oil Moves Higher On EIA Inventory DrawCrude oil prices moved higher today after the Energy Information Administration reported a crude oil inventory draw of 2.2 million barrels for the week to September 22. This compared with an inventory draw of 2.1 million barrels for the previous week, which in turn followed a build of around 4 million barrels for the week before that. In fuels, the EIA reported inventory builds. Gasoline stocks added 1 million barrels in the week to September 22, which compared with a decline of 800,000 barrels for the previous week. Gasoline production averaged… Read more at: https://oilprice.com/Energy/Crude-Oil/Oil-Moves-Higher-On-EIA-Inventory-Draw.html |

|

Airlines Ready To Embrace Higher Sustainable Aviation Fuel CostsThe airline industry would be ready to embrace the fact that sustainable aviation fuel (SAF) will always be more expensive than oil-based jet fuel, Willie Walsh, Director General at the International Air Transport Association (IATA), said on Wednesday. SAF is likely to always be more expensive than kerosene even when SAF supply grows in scale from the current very low volumes, the industry association’s head said at a conference in Lisbon, Portugal. “I believe the industry is ready to embrace that,” Walsh said as carried… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Airlines-Ready-To-Embrace-Higher-Sustainable-Aviation-Fuel-Costs.html |

|

Rosebank Gets Green Light For North Sea Oil DevelopmentThe Rosebank development, the first major new oilfield in the North Sea for many years, will go ahead after private investors and government both signalled final approval. Equinor and Ithaca Energy will invest around £3bn in the project which was finally given government go-ahead this morning. The project is the largest undeveloped field in the North Sea and is expected to lead around £8bn-worth of investment. Approval was received from the North Sea Transition Authority this morning – with the project passing environmental hurdles… Read more at: https://oilprice.com/Energy/Crude-Oil/Rosebank-Gets-Green-Light-For-North-Sea-Oil-Development.html |

|

France Boosts Energy Transition Investments In 2024 BudgetThe French government will significantly increase public spending on green energy projects while curbing the support to households to help them with the high energy prices, according to the 2024 budget. Budget 2024 will be “the greenest in our history,” France’s Finance Minister Bruno Le Maire said on Wednesday, announcing that the government plans to spend more than $42 billion (40 billion euros) next year on investments to advance the energy transition, a jump by $10.54 billion (10 billion euros) compared to this year’s… Read more at: https://oilprice.com/Latest-Energy-News/World-News/France-Boosts-Energy-Transition-Investments-In-2024-Budget.html |

|

Government Shutdown Could Slow Down U.S. Clean Energy RolloutA government shutdown could slow down U.S. clean energy investments as it could delay billions of dollars worth of incentives under the Inflation Reduction Act (IRA) for which the Administration is still fine-tuning the details, according to senior White House adviser John Podesta. The IRA, passed in August last year, has nearly $370 billion in climate and clean energy provisions, including investment and production credits for solar, wind, energy storage, critical minerals, funding for energy research, and credits for clean energy technology manufacturing… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Government-Shutdown-Could-Slow-Down-US-Clean-Energy-Rollout.html |

|

The UK Approves A Controversial $3.8-Billion Oil And Gas ProjectUK regulators approved on Wednesday the development plan for the Rosebank oil and gas project in the North Sea, paving the way for operator Equinor to proceed with a $3.8-billion investment in the field, which has stirred controversy in Britain amid debates about the need for new oil and gas projects. The North Sea Transition Authority (NSTA) on Wednesday granted development and production consent for the Rosebank field northwest of Shetland, the largest discovered untapped resource on the UK Continental Shelf. “We have today… Read more at: https://oilprice.com/Latest-Energy-News/World-News/The-UK-Approves-A-Controversial-38-Billion-Oil-And-Gas-Project.html |

|

China Set To Raise Fuel Exports Amid Higher Demand And MarginsChina is set to raise its fuel exports in October as refining margins and international jet fuel demand rise and refiners are expecting another batch of fuel export quotas, analysts and industry sources have told Reuters. China’s exports of refined petroleum products are set to rise in October compared to September, with gasoline and jet fuel seeing the biggest increases month-over-month, according to industry estimates compiled by Reuters. The third batch of fuel export quotas for refiners is also expected to lead to higher exports next… Read more at: https://oilprice.com/Energy/Energy-General/China-Set-To-Raise-Fuel-Exports-Amid-Higher-Demand-And-Margins.html |

|

Meta CEO Mark Zuckerberg looks to digital assistants, smart glasses and AI to help metaverse pushMeta is rolling out new AI software in addition to its Quest 3 virtual reality headset and latest smart glasses as it tries to move the world to the metaverse. Read more at: https://www.cnbc.com/2023/09/27/meta-ceo-zuckerberg-looks-to-digital-assistants-ai-to-push-metaverse.html |

|

UAW again threatens to expand strikes at Detroit automakers if progress isn’t made by FridayAuto workers initially went on strike on Sept. 15, shutting down one assembly plant each for GM, Ford and Stellantis. Read more at: https://www.cnbc.com/2023/09/27/uaw-threatens-to-expand-strikes-again-at-gm-ford-stellantis.html |

|

10-year Treasury yield reaches level not seen in more than 15 yearsInvestors assessed the state of the U.S. economy following the latest economic data. Read more at: https://www.cnbc.com/2023/09/27/us-treasury-yields-investors-assess-state-of-the-economy.html |

|

UAW leader condemns Trump ahead of Michigan visit during union strikeUAW President Shawn Fain criticized Trump’s track record with unions as well as his Wednesday visit being at a nonunion company called Drake Enterprises. Read more at: https://www.cnbc.com/2023/09/27/uaw-leader-condemns-trump-ahead-of-michigan-visit-during-union-strike.html |

|

CEO of private credit giant Ares says his firm is benefitting from rising ratesMichael Arougheti, who helms one of the largest private credit firms in the world, said he’s not too concerned about a major default cycle. Read more at: https://www.cnbc.com/2023/09/27/ceo-of-private-credit-giant-ares-says-his-firm-is-benefitting-from-rising-rates.html |

|

Yields on inflation-protected bonds spiked after the Fed’s tough outlook. What’s next for investorsTIPS, beloved by retirees, are seeing their yields run higher. Read more at: https://www.cnbc.com/2023/09/27/yields-on-inflation-protected-bonds-spiked-on-the-feds-tough-outlook.html |

|

Microsoft technology chief says supply of Nvidia’s AI chips is improvingKevin Scott, Microsoft’s chief technology officer, said supply of Nvidia’s graphics processing units is improving now that generative AI hype has cooled a bit. Read more at: https://www.cnbc.com/2023/09/27/microsoft-technology-chief-says-supply-of-nvidia-ai-chips-is-improving.html |

|

Flexport fires CFO, HR chief departs weeks after sudden ouster of Dave Clark as CEOAfter firing CEO Dave Clark earlier this month, Flexport has removed its finance chief, and its head of human resources has resigned Read more at: https://www.cnbc.com/2023/09/27/flexport-loses-cfo-hr-chief-weeks-after-ouster-of-ceo-dave-clark.html |

|

Landmark marijuana financing bill clears big hurdle in the SenateThe Secure and Fair Enforcement Regulation Banking Act advanced out of a Senate committee. Read more at: https://www.cnbc.com/2023/09/27/marijuana-financing-bill-safer-banking-to-move-forward-in-congress.html |

|

Costco is selling gold bars and they are selling out within a few hoursThe retail warehousing giant is your one-stop shop for one-ounce gold bars, handsomely detailed and ready for purchase. Read more at: https://www.cnbc.com/2023/09/27/costco-is-selling-gold-bars-and-they-are-selling-out-within-a-few-hours.html |

|

Will a government shutdown affect your wallet? Here’s what’s at stakeCongress has until Sept. 30 to agree on a budget, but the U.S. could be headed for a government shutdown. Here’s how that could affect you and your money. Read more at: https://www.cnbc.com/2023/09/27/what-a-government-shutdown-means-for-student-loans-social-security.html |

|

House lawmakers push SEC Chair Gensler to approve spot bitcoin ETF applications: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, Jennifer Schulp, the director of financial regulation studies at the Cato Institute’s Center for Monetary and Financial Alternatives, who testified before lawmakers a few weeks after FTX filed for bankruptcy, weighs in on crypto regulatory developments in the U.S. Read more at: https://www.cnbc.com/video/2023/09/27/house-lawmakers-push-sec-chair-gensler-approve-spot-bitcoin-etf-applications-cnbc-crypto-world.html |

|

All Philly Liquor Stores Closed After Mass LootingUpdate (1450ET): The Philadelphia Inquirer reports that all Philadelphia Fine Wine & Good Spirits stores are closed on Wednesday after looters targeted at least 18 locations on Tuesday night. The decision to shutter more than two dozen Fine Wine & Good Spirits locations was “in the interest of employee safety and while we assess the damage and loss that occurred,” Shawn M. Kelly, press secretary for the Pennsylvania Liquor Control Board, said in a statement. The stores will reopen “when it is safe to do so and when the damage is repaired,” Kelly said. He continued, “We apologize to our customers for the inconvenience,” and “we appreciate their patience and understanding.” Here’s what happened last night when teen looters targeted retail shops:

Read more at: https://www.zerohedge.com/markets/watch-all-hell-breaks-out-philadelphia-teen-looters-target-retail-stores |

|

False, Misleading Information About COVID-19 Vaccines And Myocarditis Spreads WidelyAuthored by Zachary Stieber via The Epoch Times (emphasis ours), False and misleading information about COVID-19 vaccines and heart inflammation is being spread widely, including by doctors.

A health care worker prepares a COVID-19 vaccine in a file photograph. (Bay Ismoyo/AFP via Getty Images) That includes claims that data clearly show myocarditis, or heart inflammation, is more prevalent after COVID-19 infection when compared to COVID-19 vaccination. “Teen boys have been up to five times as likely to have heart inflammation after having a COVID infection than after getting vaccinated,” Dr. Mandy Cohen, director of the U.S. Centers for Disease Control and Prevention ( … Read more at: https://www.zerohedge.com/political/false-misleading-information-about-covid-19-vaccines-and-myocarditis-spreads-widely |

|

Peter Schiff: It’s The Beginning Of The End Of This Whole Phony EconomyVia SchiffGold.com, Interest rates continue to push relentlessly higher.

As Peter Schiff explained in his podcast, that’s a big problem when the entire economy is built on a foundation of cheap money. But most people in the mainstream don’t seem to grasp the gravity of the situation. They don’t realize that we are at the beginning of the end of this whole phony economy. In a nutshell, the economy is buried under trillions in debt. The cost of the debt is rising. The economy simply isn’t built to handle an even moderately high interest rate environment. But here we are.

Read more at: https://www.zerohedge.com/markets/peter-schiff-its-beginning-end-whole-phony-economy |

|

US Shale Giant Agrees With JPMorgan: Oil Headed For $150Slowly but surely, the market is waking up to a jarring realization: the price of oil is now higher than where it was a year ago, and also where it was right before the start of the Ukraine war, but in the meantime the Biden administration has drained 240 million barrels of oil in pursuit of short-term popularity gains. Alas, those gains are now all gone, as are the oil price declines, but the SPR is down to half of where it was at its peak.

What happens next is even less pleasant. As JPM discussed last week when it predicted the return of the oil “supercycle”, crude is about to rise much higher as a result of what JPM sees as a staggering 7mmb/d deficit by 2030… Read more at: https://www.zerohedge.com/markets/us-shale-giant-agrees-jpmorgan-oil-headed-150 |

|

Rosebank oil field: What is the row over the project?Regulators have approved the development of a controversial oil field in the North Sea. Read more at: https://www.bbc.co.uk/news/business-66933832?at_medium=RSS&at_campaign=KARANGA |

|

Meta announces AI chatbots with ‘personality’At Meta’s first in-person event since before the pandemic, Mark Zuckerberg announced his AI plans. Read more at: https://www.bbc.co.uk/news/technology-66941337?at_medium=RSS&at_campaign=KARANGA |

|

H&M admits it needs to improve sizing consistencyThe retailer admits sizing needs to be more consistent after its new returns fee sparks a backlash. Read more at: https://www.bbc.co.uk/news/business-66933363?at_medium=RSS&at_campaign=KARANGA |

|

Breakout Stocks: How HUDCO, Thermax and Indian Bank are looking on charts for Thursday’s tradeStocks that were in focus include names like HUDCO which was up more than 3%, Thermax closed with gains of over 2% to hit a fresh lifetime high and Indian Bank pared gains and closed with gains of nearly 1% on Wednesday. All stocks hit a fresh all-time high. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/breakout-stocks-how-hudco-thermax-and-indian-bank-are-looking-on-charts-for-thursdays-trade/articleshow/103989794.cms |

|

IT poised for rebound post 2-3 weak quarters, says Mahesh Patil“India offers the best kind of market where one could see that runway of growth lasting for many years. That is what will draw global investment. This month till date, the FII outflows have been negative. That trend can continue for some time but long-term money would look to buy into the dips.” Read more at: https://economictimes.indiatimes.com/markets/expert-view/long-term-money-will-continue-to-buy-the-dips-in-india-mahesh-patil/articleshow/103981866.cms |

|

Tech View: Nifty gives signs of pullback but clear breakout awaited. What traders should do on ThursdayFor the traders now, 19630 would act as a key support level. Above which, the market could continue the positive momentum till 19800-19825. On the flip side, below 19630 uptrend would be vulnerable, said Shrikant Chouhan of Kotak Securities Read more at: https://economictimes.indiatimes.com/markets/stocks/news/tech-view-nifty-gives-signs-of-pullback-but-clear-breakout-awaited-what-traders-should-do-on-thursday/articleshow/103992110.cms |

|

Google’s 25th birthday: Stock would be worth $5,100 without splitsGoogle is celebrating its 25th birthday, but its initial public offering was only 19 years ago, and it became Alphabet eight years ago. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-726F-129733E801A6%7D&siteid=rss&rss=1 |

|

Futures Movers: Oil extends march toward $100 a barrel after U.S. crude drawdownU.S. oil futures end at a nearly 13-month high Wednesday after official data showed a drop in U.S. crude supplies last week. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-726E-A9C2A3E04C82%7D&siteid=rss&rss=1 |

|

Outside the Box: Climate change meets political change: Key 2024 election issues for ESG investorsESG investors must factor in anti-ESG backlash, the investment impact of climate events and pending SEC climate regulation. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7266-E9C27F9C23E3%7D&siteid=rss&rss=1 |