Summary Of the Markets Today:

- The Dow closed down 16 points or 0.05%,

- Nasdaq closed down 1.04%,

- S&P 500 closed down 0.57%,

- Gold $1,936 down $11.5,

- WTI crude oil settled at $89 up $1.71,

- 10-year U.S. Treasury 4.266% down 0.022 points,

- USD Index $104.73 up $0.160,

- Bitcoin $26,097 up $1,092,

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our Economic Forecast for September 2023

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

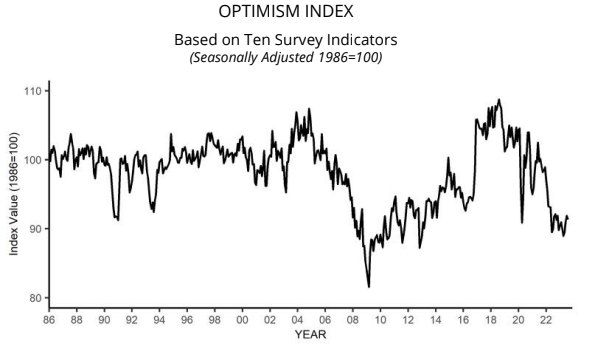

NFIB’s Small Business Optimism Index decreased 0.6 of a point in August to 91.3, the 20th consecutive month below the 49-year average of 98. 23% of small business owners reported that inflation was their single most important business problem, up two points from last month. I believe that Main Street is in a recession, and the index value for small businesses supports this opinion. NFIB Chief Economist Bill Dunkelberg stated:

With small business owners’ views about future sales growth and business conditions discouraging, owners want to hire and make money now from strong consumer spending. Inflation and the worker shortage continue to be the biggest obstacles for Main Street.

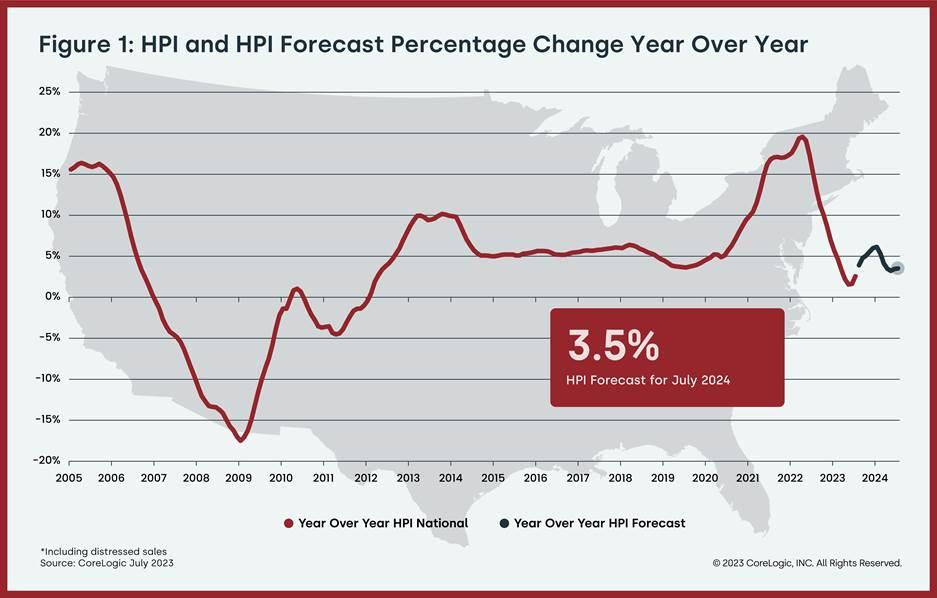

The CoreLogic Home Price Index (HPI) and HPI Forecast for July 2023 show U.S. home prices rebounded year over year in July, increasing to 2.5% and following two months of 1.6% annual gains. The annual reacceleration reflects six consecutive monthly gains, which drove prices about 5% higher compared to the February bottom. The 11 states that saw home price declines were all in the West, but since many of those markets continue to struggle with inventory shortages, that trend may be short-lived, and recent buyer competition will causes prices to heat up again. CoreLogic projects that all states that saw year-over-year losses in July will begin posting gains by October of this year. Selma Hepp, chief economist for CoreLogic stated:

Annual home price growth regained momentum in July, which mostly reflects strong appreciation from earlier this year. That said, high mortgage rates have slowed additional price surges, with monthly increases returning to regular seasonal averages. In other words, home prices are still growing but are in line with historic seasonal expectations. Nevertheless, the projection of prolonged higher mortgage rates has dampened price forecasts over the next year, particularly in less-affordable markets. But as there is still an extreme inventory shortage in the Western U.S., home prices in some of those markets should see relatively more upward pressure.

Here is a summary of headlines we are reading today:

- U.S. Discovers Lithium Deposit Bigger Than Bolivia’s Salt Flats

- Chevron To Be Majority Owner Of World’s Largest Hydrogen Production Facility

- Oil Prices Soar To 10-Month High

- Renewables Are Gaining Ground, But Coal Is Still King

- Here’s everything Apple just announced at its 2023 event: iPhone 15 models, new Apple Watch, new AirPods

- Nasdaq closes lower by 1% Tuesday as Apple slides and tech suffers, Oracle sheds 13%: Live updates

- Sen. Blumenthal plans action against telemarketing scams masquerading as political, charitable causes

- Oracle stock is poised for its steepest drop since 2002 on weak revenue guidance

- US Real Household Incomes Slide For 3rd Year In A Row As White Incomes Tumble; Blacks, Hispanics Gain

- 10Y Treasury Auction Prices On The Screws At Highest Yield Since Nov 2007

- 8 commodities stocks touched their 52-week high, gaining up to 40% in a month

- Market Snapshot: Stocks fall after Apple unveils iPhone 15, with U.S. inflation data looming

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

European Court Upholds Sanctions Against Key Russian FiguresLast week, the European Union’s sanctions regime against Russia — and, to a lesser extent, its more minor measures targeting Belarus — cleared one of the greatest hurdles: the question of their own legality. Since the full scale-invasion of Ukraine in February 2022, the bloc has imposed asset freezes and visa bans on 1,800 individuals and entities for what the EU calls “actions undermining or threatening the territorial integrity, sovereignty, and independence of Ukraine.” The Belarus sanctions, which are a response to several incidents in recent… Read more at: https://oilprice.com/Geopolitics/International/European-Court-Upholds-Sanctions-Against-Key-Russian-Figures.html |

|

U.S. Discovers Lithium Deposit Bigger Than Bolivia’s Salt FlatsOver the past few years, the lithium boom went into overdrive as EV makers like Tesla Inc. (NASDAQ:TSLA) scrambled to secure supplies amid rapid EV growth and tight supplies. The lithium bonanza sent lithium carbonate prices up more than six-fold and spodumene up nearly tenfold in the space of just two years. Unfortunately for the bulls, the lithium bubble finally burst in late 2022 and sent prices crashing thanks to slowing EV demand as well as an influx of fresh supply mainly from China, Australia and Chile. Lithium… Read more at: https://oilprice.com/Energy/Energy-General/US-Discovers-Lithium-Deposit-Bigger-Than-Bolivias-Salt-Flats.html |

|

BP CEO Looney To Step DownBP’s Chief Executive Officer, Bernard Looney, is poised to step down after serving in the role for over three years, as reported by the Financial Times. Since starting his career at BP as an engineer in 1991, he has occupied various operational and managerial positions across locations such as Alaska, the Gulf of Mexico, Vietnam, and the UK North Sea. In 2020, Bernard Looney assumed the position of CEO at BP after previously leading the company’s Upstream group. Despite his background in Upstream oil and gas, Bernard Looney has emerged as a prominent… Read more at: https://oilprice.com/Latest-Energy-News/World-News/BP-CEO-Looney-To-Step-Down.html |

|

Turkmenistan Walks Tightrope Between Russia And The WestTurkmenistan’s ambassador to Belgium last week presented his credentials to NATO Secretary-General Jens Stoltenberg and exchanged some pleasantries on the state of relations between Ashgabat and the Brussels-based alliance. According to the Turkmen Foreign Ministry, Stoltenberg “noted the importance of Turkmenistan’s role as a key partner in Central Asia, in particular on matters of regional stability and security.” Sapar Palvanov, meanwhile, talked during the September 7 ceremony about ongoing plans to cooperate on addressing… Read more at: https://oilprice.com/Geopolitics/International/Turkmenistan-Walks-Tightrope-Between-Russia-And-The-West.html |

|

Chevron To Be Majority Owner Of World’s Largest Hydrogen Production FacilityU.S.-based Chevron Corp. will soon be the majority owner of what will be the world’s largest hydrogen production and storage facility as it branches out past fossil fuels. Chevron New Energies—a division of Chevron that has a goal of “helping customers meet their lower carbon ambitions and reduce the carbon intensity of our operations”–purchased a 78% stake in a hydrogen production and storage project in Utah from a private equity firm, Chevron said on Tuesday in a press release. Chevron completed a deal with Haddington… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Chevron-To-Be-Majority-Owner-Of-Worlds-Largest-Hydrogen-Production-Facility.html |

|

Euro Steelmakers Defy Sluggish Market With Bold Price HikeVia Metal Miner Steelmakers in Northwestern Europe are seeking an increase of €20 ($20) per metric ton on hot rolled coil. Market sources told MetalMiner that the hike in steel prices comes despite subdued demand for the flat rolled product going into September. “I think that they are trying to push up prices against input prices,” one source said. Mills are reportedly seeking €650-670 ($695-720) per metric ton EXW for HRC for November rolling and December delivery. This is up significantly from the €630-650 ($675-695)… Read more at: https://oilprice.com/Metals/Commodities/Euro-Steelmakers-Defy-Sluggish-Market-With-Bold-Price-Hike.html |

|

Oil Prices Soar To 10-Month HighCrude oil is trading at levels not seen since last November, with Brent crude prices reaching $92 per barrel on Tuesday. Brent crude was trading at $92.30 (+1.83%) on Tuesday at 01:25 pm ET. The last time oil traded that high was in late November 2022. WTI crude—the U.S. benchmark—was trading at $89.26 at that time, trading up 2.26% on the day. The price increases come as OPEC+ heavyweights Saudi Arabia and Russia extended their voluntary production cuts in an effort to balance the markets—and to make good on Mohammed bin Salman’s… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Oil-Prices-Soar-To-10-Month-High.html |

|

Panama’s Water Crisis Is Reshaping Global TradeYou’ve almost certainly read about the backup of ships waiting to transit the Panama Canal, which carries 6 percent of all commercial ships worldwide. While the worry among faraway readers may be concerns about supply chain disruptions that could lead to holiday shopping shortages, the problem in Panama is more immediate. The proximate cause of the backup is severe drought. That makes sense on its face because the canal is full of water and that water has to come from somewhere. In a tropical country with copious rainfall—260 cm (102 inches)… Read more at: https://oilprice.com/The-Environment/Global-Warming/Panamas-Water-Crisis-Is-Reshaping-Global-Trade.html |

|

Iran: Revived LNG Project Is Almost 50% CompleteConstruction works at Iran’s revived LNG project is almost 50% complete, the Islamic Republic claims. “Progress at this project now stands at almost 50pc,” Abdolhossein Bayat, chairman of oil industry pension fund investment company Opic, said, as quoted by Argus. Works on the project in Iran’s southern province of Bushehr were restarted in March this year. The Iran LNG project is planned to have a capacity of 10.8 million tons per year. The Islamic Republic aims to have the project operational… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Iran-Revived-LNG-Project-Is-Almost-50-Complete.html |

|

OPEC’s Production Rises In AugustOPEC’s crude oil production was 27.45 million barrels per day in August, according to the group’s latest Monthly Oil Market Report (MOMR) published on Tuesday. A gain of an average of 113,000 bpd was recorded for OPEC’s August output, led primarily by Iran and Nigeria—both exempt from the production quotas. Saudi Arabia’s production declined as expected, by 88,000 bpd to 8.967 million bpd. Production declines were also seen from Algeria, Angola, Congo, and Venezuela. Venezuela’s production fell by 42,000 bpd,… Read more at: https://oilprice.com/Energy/Crude-Oil/OPECs-Production-Rises-In-August.html |

|

China’s Oil Import Surge May Not Mean Economic ReboundChina imported in August record volumes of coal and the third-highest monthly amount of crude oil ever. But the recent surge in the imports of major commodities could be masking one-off temporary factors instead of a rebound in China’s economic growth in the second half of the year. Analysts have been closely tracking the growth pace of the world’s second-biggest economy in search of clues about oil and other commodity demand. In a disappointing first six months after the reopening from the Covid-related lockdowns, China failed to convince… Read more at: https://oilprice.com/Energy/Crude-Oil/Chinas-Oil-Import-Surge-May-Not-Mean-Economic-Rebound.html |

|

Russia’s Sakhalin-2 Back To Full Production After MaintenanceRussia’s Sakhalin-2 project producing LNG and oil has returned to full operations after planned maintenance, Gazprom’s Deputy CEO Vitaly Markelov has told Russian news agency Interfax. The maintenance, which began in July, involved all natural gas production facilities, according to the executive. The operator of Sakhalin-2 is now a Russian entity, Sakhalin Energy, following a decree by Vladimir Putin from last year that stipulated that a newly set-up state Russian company would take over the rights and obligations of Sakhalin… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Russias-Sakhalin-2-Back-To-Full-Production-After-Maintenance.html |

|

Renewables Are Gaining Ground, But Coal Is Still KingIn 2022, 29,165.2 terawatt hours (TWh) of electricity was generated around the world, an increase of 2.3% from the previous year. In this visualization, Visual Capitalist’s Chris Dickert and Sam Parker look at data from the latest Statistical Review of World Energy, and ask what powered the world in 2022. Coal is Still King Coal still leads the charge when it comes to electricity, representing 35.4% of global power generation in 2022, followed by natural gas at 22.7%, and hydroelectric at 14.9%. Source: Energy Institute Over three-quarters of the… Read more at: https://oilprice.com/Energy/Energy-General/Renewables-Are-Gaining-Ground-But-Coal-Is-Still-King.html |

|

OPEC’s Production Rises In AugustOPEC’s crude oil production climbed to 27.45 million barrels per day in August, according to the group’s latest Monthly Oil Market Report (MOMR) published on Tuesday. A gain of an average of 113,000 bpd was recorded for OPEC’s August output, led primarily by Iran and Nigeria—both exempt from the production quotas. Saudi Arabia’s production declined as expected, by 88,000 bpd to 8.967 million bpd. Production declines were also seen from Algeria, Angola, Congo, and Venezuela. Venezuela’s production fell by 42,000… Read more at: https://oilprice.com/Latest-Energy-News/World-News/OPECs-Production-Rises-In-August.html |

|

Oil Prices Continue To Climb Toward $100Oil prices are continuing to climb toward the $100 mark this week thanks to supply disruptions in Libya and expectations of a further U.S. inventory draw.Chart of the Week- Chevron’s (NYSE:CVX) Gorgon and Wheatstone liquefied natural gas facilities started short strikes last Friday after the last round of negotiations between the company and workers’ unions broke down without a deal.- Loadings are still ongoing at the two LNG terminals, with 3 laden tankers departing since the short strikes began, however from Thursday onwards unions… Read more at: https://oilprice.com/Energy/Energy-General/Oil-Prices-Continue-To-Climb-Toward-100.html |

|

Here’s everything Apple just announced at its 2023 event: iPhone 15 models, new Apple Watch, new AirPodsApple announced the iPhone 15 with USB-C charging, as well as the newest Apple Watch and AirPods. Read more at: https://www.cnbc.com/2023/09/12/apple-event-2023-live-updates-iphone-15-new-apple-watch-9-expected.html |

|

Nasdaq closes lower by 1% Tuesday as Apple slides and tech suffers, Oracle sheds 13%: Live updatesThe three major indexes finished Monday’s session higher. Read more at: https://www.cnbc.com/2023/09/11/stock-market-today-live-updates.html |

|

Co-founder of $4 billion crypto ponzi scheme gets 20 years in prison, ‘Cryptoqueen’ partner remains at largeKarl Greenwood’s co-founder Ruja Ignatova, known as the “Cryptoqueen” on the FBI’s Top 10 Most Wanted list, remains at large, the DOJ said. Read more at: https://www.cnbc.com/2023/09/12/cryptoqueen-partner-gets-20-years-prison-in-4-billion-ponzi-fraud.html |

|

Decongestant found in many cold, allergy medicines doesn’t actually work, FDA advisors sayIn a unanimous vote, advisors said oral versions of phenylephrine – a nasal decongestant found in versions of drugs like Nyquil and Benadryl – isn’t effective. Read more at: https://www.cnbc.com/2023/09/12/decongestant-phenylephrine-ineffective.html |

|

UBS lays out the best names to play the $2 trillion clean energy transitionThe firm updated its list after second-quarter earnings season. Read more at: https://www.cnbc.com/2023/09/12/ubs-lays-out-the-best-names-to-play-the-2-trillion-clean-energy-transition.html |

|

Sen. Blumenthal plans action against telemarketing scams masquerading as political, charitable causesSen. Richard Blumenthal plans legislative action against telemarketing scams that raise millions of dollars for fake political and charitable causes. Read more at: https://www.cnbc.com/2023/09/12/blumenthal-plans-action-on-political-charitable-telemarketing-scams.html |

|

BP CEO Bernard Looney will resign, report saysThe Financial Times reported the move Tuesday, citing two people with knowledge of the decision. Read more at: https://www.cnbc.com/2023/09/12/bp-ceo-bernard-looney-will-resign-report-says.html |

|

Elizabeth Warren calls for an investigation into Musk and Starlink in Ukraine after biography claimIn his book titled “Elon Musk,” released Tuesday, Walter Isaacson details Musk’s policy of geofencing Starlink’s satellite network over Crimea last year. Read more at: https://www.cnbc.com/2023/09/12/warren-calls-for-investigation-into-elon-musk-and-starlink-in-ukraine.html |

|

Oracle stock is poised for its steepest drop since 2002 on weak revenue guidanceOracle shares plunged on Tuesday after the software maker missed analysts’ estimates on revenue and issued weak guidance. Read more at: https://www.cnbc.com/2023/09/12/oracle-stock-poised-for-steepest-drop-since-2002-on-weak-forecast-.html |

|

Ukraine war live updates: North Korea’s Kim Jong Un arrives in Russia; Moscow says it doesn’t care about U.S. warnings over meetingThe Kremlin confirmed that North Korea’s leader Kim Jong Un arrived in Russia Tuesday, and dismissed U.S. warnings about Putin’s forthcoming meeting with Kim. Read more at: https://www.cnbc.com/2023/09/12/ukraine-war-live-updates-latest-news-on-russia-and-the-war-in-ukraine.html |

|

Walter Isaacson’s book ‘Elon Musk’ hits shelves, details explosive encounter with Bill GatesWalter Isaacson’s book ‘Elon Musk’ is out. It details an explosive encounter with Bill Gates Read more at: https://www.cnbc.com/2023/09/12/walter-isaacsons-book-elon-musk-hits-shelves-details-explosive-encounter-with-bill-gates.html |

|

FA 100: CNBC ranks the top-rated financial advisory firms of 2023For the fifth year, CNBC unveils its ranking of top financial advisors. The CNBC FA 100 recognizes firms that best help clients navigate their financial lives. Read more at: https://www.cnbc.com/2023/09/12/fa-100-cnbc-ranks-the-top-rated-financial-advisory-firms-of-2023.html |

|

Biden impeachment inquiry gives White House a fight it’s ready forHouse Speaker Kevin McCarthy’s decision to open an impeachment inquiry into President Joe Biden did not come as a surprise to the White House. Read more at: https://www.cnbc.com/2023/09/12/house-impeachment-inquiry-gives-white-house-a-fight-its-ready-for-.html |

|

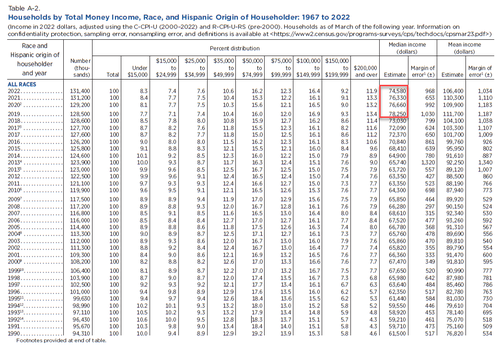

US Real Household Incomes Slide For 3rd Year In A Row As White Incomes Tumble; Blacks, Hispanics GainUS Real Household Incomes Slide For 3rd Year In A Row As White Incomes Tumble; Blacks, Hispanics GainRegular readers are aware that life for middle-class Americans under the Biden administration has been a constant – and consistent – descent into economic hell, courtesy of real incomes declining every single month since the end of the Trump administration, when inflation exploded wiping out all nominal wage gains since 2020. Today, the Census Bureau made sure that everyone else knows as well, when it reported that inflation-adjusted household incomes in the US decreased 2.3% in 2022 from a year earlier, the third year in a row of declining real incomes, highlighting the toll of higher cost of living for American families. The median income last year was $74,580 compared with $76,330 in 2021, $76,660 in 2020 and $78,250 in 2019, according to the Census Bureau’s annual report on income, poverty and health insurance coverage.

Tuesday’s data cements the devastating legacy of the economic farce known as “Bidenomics”, wh … Read more at: https://www.zerohedge.com/markets/us-real-household-incomes-slide-3rd-year-row-white-incomes-slide-black-hispanics-rise |

|

“Don’t Think The American People Will Buy It” – RFK Jr. Campaign Blasts ‘Undemocratic’ DNC“Don’t Think The American People Will Buy It” – RFK Jr. Campaign Blasts ‘Undemocratic’ DNCAuthored by Jack Phillips via The Epoch Times, The presidential campaign of Robert F. Kennedy Jr. alleged that the Democratic National Committee is trying to prevent it from challenging President Joe Biden and will allow the incumbent to handily win the 2024 nomination.

In a news release issued this week, former Ohio congressman and Democrat presidential candidate Dennis Kucinich stated that he believes the Democratic National Committee (DNC) “has created a class of pledged delegates, called Party Leaders and Elected Officials, who are essentially the same as superdelegates, due to the amount of control the party exercises over elected officials.”

|

|

CIA Bribed Analysts To Change Lab-Leak Conclusions: ‘Senior-Level’ WhistleblowerCIA Bribed Analysts To Change Lab-Leak Conclusions: ‘Senior-Level’ WhistleblowerA ‘senior-level’ CIA whistleblower has come forward to allege that the agency bribed analysts to change their opinion that Covid-19 most likely originated in a lab in Wuhan, China, according to the NY Post. The whistleblower told House committee leaders that his agency ‘ tried to pay off six analysts who found SARS-CoV-2 likely originated in a Wuhan lab if they changed their position and said the virus jumped from animals to humans,’ according to a Tuesday letter from the chairmen of two House subcommittees investigating the pandemic response and US intelligence, Brad Wenstrup (R-OH) and Mike Turner (R-OH). The pair have requested all documents, communications and pay info from the CIA’s Covid-19 Discovery Team by Sept. 26. “According to the whistleblower, at the end of its review, six of the seven members of the Team believed the intelligence and sc … Read more at: https://www.zerohedge.com/covid-19/cia-bribed-analysts-change-lab-leak-conclusions-senior-level-whistleblower |

|

10Y Treasury Auction Prices On The Screws At Highest Yield Since Nov 200710Y Treasury Auction Prices On The Screws At Highest Yield Since Nov 2007Following yesterday’s subpar 3Y auction, moments ago the US Treasury sold $35BN in 10Y paper in a stronger auction that saw solid, if not spectacular, metrics. After last month’s 10Y auction priced just shy of 4% (3.999% to be precise), this time it was no longer possible to contain the tidal wave of rising rates, and today’s auction priced at a high yield of 4.289%, up 29bps in the past month, and the highest level since Nov 2007. It also priced on the screws to the When Issued, which was also trading at 4.289% at 1pm. This was the first on the screws auction since Oct 2020. The bid to cover was 2.52, down from 2.56 last month, but above the six-auction average of 2.43. The internals were in line with averages, as foreign buyers were awarded 66.3%, also below last month’s 72.2% (and the lowest since June), but just above the recent average of 65.8. And with Directs taking down 19.9% or right on top of the recent auction average, Dealers were left holding 13.8%, higher from last month’s 9.5% but below the six auction average of 13.8%. Overall, this was a solid, if hardly spectacular, auction and not surprisingly it had zero impact on the secondary bond market with 10Y yields at 4.28% and unchanged for much of the day. Read more at: https://www.zerohedge.com/markets/10y-treasury-auction-prices-screws-highest-yield-nov-2007 |

|

BP boss resigns amid review of ‘personal relationships’The oil giant said Bernard Looney had not been “fully transparent” in disclosures about past relationships with colleagues. Read more at: https://www.bbc.co.uk/news/business-66790609?at_medium=RSS&at_campaign=KARANGA |

|

Apple forced to ditch lightning charger in new iPhoneApple confirms new iPhone 15 will have a common USB-C charging port after EU forces it into the change. Read more at: https://www.bbc.co.uk/news/technology-66778528?at_medium=RSS&at_campaign=KARANGA |

|

Poundland owner to take on up to 71 Wilko storesPepco Group confirmed that existing Wilko staff will have priority in applying for new jobs at Poundland. Read more at: https://www.bbc.co.uk/news/business-66789546?at_medium=RSS&at_campaign=KARANGA |

|

Tech View: Nifty forms bearish candle with long wick. What traders should do on WednesdayThe short-term outlook is positive and this consolidation is likely to be used as a buying opportunity. In terms of levels, 19865 – 19810 is the crucial support zone, while 20200 – 20250 shall act as an immediate hurdle zone. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/tech-view-nifty-forms-bearish-candle-with-long-wick-what-traders-should-do-on-wednesday/articleshow/103609579.cms |

|

These 11 stocks have been in index since inceptionThe Nifty50 index achieved a significant milestone by reaching the 20,000 mark on September 11. This broad-based index comprises 50 prominent, liquid blue-chip stocks listed on the National Stock Exchange of India. Since its inception in November 1995, Nifty50 has been instrumental in helping investors understand the Indian capital market.Collectively, the index represents about 52% of the total market capitalization and 63% of the free float market capitalization of NSE-listed stocks as of June 30, 2023. Remarkably, despite semi-annual reviews that may remove or add stocks, 12 companies have remained in the index since its inception in 1995. One notable change was HDFC, which was part of Nifty50 until its merger with HDFC Bank in July 2023 (Source: NSEIndia). Out of these 11 stocks, 7 have achieved returns exceeding 100% over the past five years, while the remaining have delivered at least a 50% price return during the same period. Explore the details. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/ogs-of-nifty-these-11-stocks-have-been-in-index-since-inception/d-street-legends/slideshow/103605940.cms |

|

8 commodities stocks touched their 52-week high, gaining up to 40% in a monthDuring Tuesday’s trading session, the Sensex rose about 94 points, closing at 67,221. Within this upward trend, eight stocks from the BSE commodities index reached their highest prices in the last 52 weeks. The 52-week high holds significant value for specific traders and investors, serving as a vital technical indicator to evaluate a stock’s current value and anticipate potential price changes. This metric represents the highest price at which a stock was traded in the preceding year. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/8-commodities-stocks-touched-their-52-week-high-gaining-up-to-40-in-a-month/new-highs/slideshow/103611061.cms |

|

Market Snapshot: Stocks fall after Apple unveils iPhone 15, with U.S. inflation data loomingU.S. stocks were mostly lower early afternoon Tuesday, as Apple unveiled iPhone 15 at its annual marketing event. Investors were also looking ahead to the widely anticipated reading on August inflation from the consumer-price index on Wednesday. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7260-78216BBB34B7%7D&siteid=rss&rss=1 |

|

: Apple unveils iPhone 15 lineup, increases base price on highest-end model for first timeApple dropped the cheapest configuration of its Pro Max version in an effective price hike on that model. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7261-02784EE50129%7D&siteid=rss&rss=1 |