Summary Of the Markets Today:

- The Dow closed up 116 points or 0.33%,

- Nasdaq closed down 0.02%,

- S&P 500 closed up 0.18%,

- Gold $1,967 up $1.10,

- WTI crude oil settled at $86 up $2.25,

- 10-year U.S. Treasury 4.179% up 0.088 points,

- USD Index $104.26 up $0.640,

- Bitcoin $25,618 down $482,

- Baker Hughes Rig Count: U.S. -1 to 631 Canada -3 to 187

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our Economic Forecast for September 2023

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

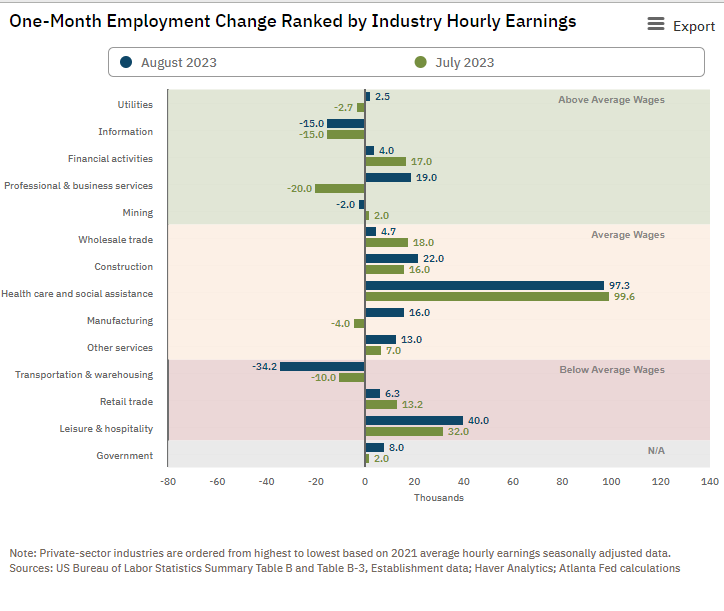

Total nonfarm payroll employment increased by 187,000 in August 2023 and the unemployment rate rose to 3.8 percent. Employment continued to trend up in health care, leisure and hospitality, social assistance, and construction. Employment in transportation and warehousing declined. There were a massive 736,000 people added to the workforce this month which fully explains the increase in the unemployment rate (this is from the household survey portion of the jobs report which extrapolates data from 50,000 households). Comparing the gains, the household survey increased employment by 222,000 whilst the establishment survey increased 187,000 which reasonably correlates. Average weekly earnings grew from $1,119 in August 2022 to $1,163 in August 2023. The bottom line is that employment gains have been growing for the last 2 months and remains relatively strong. The decline in transport jobs this month is an idiosyncrasy caused by several factors facing this sector.

Construction spending grew in July 2019 by 5.5% year-over-year (red line on the graph below). Inflation-adjusted, construction spending grew 1.7% year-over-year (blue line on the graph below).

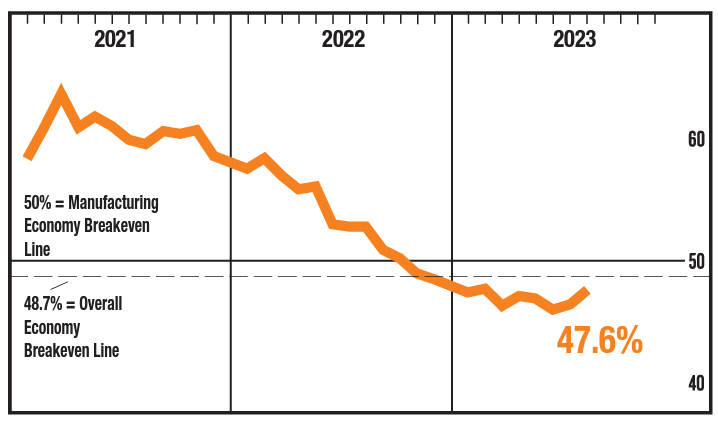

The August 2023 Manufacturing PMI registered 47.6 percent, 1.2 percentage points higher than the 46.4 percent recorded in July. This figure indicates a ninth month of contraction after a 30-month period of expansion. The New Orders Index remained in contraction territory at 46.8 percent, 0.5 percentage points lower than the figure of 47.3 percent recorded in July. No question that the manufacturing sector remains in a recession.

Here is a summary of headlines we are reading today:

- Drilling Continues To Disappoint As Oil Prices Climb

- Oil Reaches New 2023 High

- Massive Copper Theft Scandal Sends Shockwaves Through Metal Market

- The Largest Threat To The Solar Industry

- Oil Prices Climb As Traders Refocus On Fundamentals

- Hollywood sheds 17,000 jobs in August amid ongoing strikes

- Dow closes more than 100 points higher to kick off September, notches best week since July: Live updates

- Home prices may be on the verge of cooling off

- Dell has best day on stock market since its relisting in 2018 after earnings sail past estimates

- Russia Puts Its Longest Range Nuke-Capable Missile On Combat Duty, Nicknamed ‘Satan II’

- Market Snapshot: S&P 500 heads for weekly gain as U.S. stocks trade mixed after jobs report

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

LME’s Reputation On The Line After Nickel FiascoVia AG Metal Miner The Stainless MMI continues its decline this month. Moreover, nickel prices continue to show weakness without any apparent bullish anticipation from market participants. As the entire industrial metals market sloped downward, nickel prices followed suit. Moreover, volumes remain lower than pre-LME shutdown levels, which will continue to foster slow price movement. The Stainless Monthly Metals Index (MMI) dropped 9.55% from June to July. Tsingshan Tycoon Caps Losses at $1 Billion After Nickel Crisis According to a recent Bloomberg… Read more at: https://oilprice.com/Metals/Commodities/LMEs-Reputation-On-The-Line-After-Nickel-Fiasco.html |

|

OPEC’s Crude Oil Production Rose Slightly In August: SurveyCrude oil production from the OPEC alliance actually climbed in August by 40,000 bpd, according to a new survey published by Bloomberg on Friday. Saudi Arabia’s output may have fallen in August by 170,000 bpd, according to the survey, but Nigeria and Iran’s production increased, largely offsetting Saudi Arabia’s cuts. Overall, the group produced 27.82 million barrels per day in August, the survey said. Analysts largely expect Saudi Arabia to extend its 1 million bpd supply cut into October, even though crude oil prices rose to… Read more at: https://oilprice.com/Latest-Energy-News/World-News/OPECs-Crude-Oil-Production-Rose-Slightly-In-August-Survey.html |

|

Drilling Continues To Disappoint As Oil Prices ClimbThe total number of active drilling rigs in the United States fell by 1 this week, according to new data from Baker Hughes published Friday. The total rig count fell to 631 this week. So far this year, Baker Hughes has estimated a loss of 148 active drilling rigs. This week’s count is 444 fewer rigs than the rig count at the beginning of 2019 prior to the pandemic. The number of oil rigs stayed the same this week at 512, down by 109 so far in 2023. The number of gas rigs fell by 1 to 114, a loss of 42 active gas rigs from the start of the… Read more at: https://oilprice.com/Energy/Energy-General/Drilling-Continues-To-Disappoint-As-Oil-Prices-Climb.html |

|

Aramco Looks To Break Another Record With $50 Billion Share OfferingThe world’s largest oil company, Saudi Aramco, is considering the world’s largest offering, according to the Wall Street Journal. According to Saudi officials and “other people familiar with the plan,” Saudi Aramco is considering selling off as much as $50 billion in shares. If The Kingdom goes through with the share sale, it would be the largest share sale in history. The share sales will be hosted on the Riyadh exchange, Tadawul. That decision was reached after a series of advisor consultations that spanned months, in… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Aramco-Looks-To-Break-Another-Record-With-50-Billion-Share-Offering.html |

|

Oil Reaches New 2023 HighThe per barrel price for the WTI grade of crude oil reached $85 on Friday—the highest price point yet this year as falling inventory levels spook the market. WTI crude oil briefly reached $85 per barrel before sagging to $84.90 around 10:00 a.m. ET. The last time WTI traded at a level that high was November 2022. For the day, WTI was trading up $1.33 per barrel, or 1.59%. Brent crude oil was also trading up on the day, by $1.05 per barrel, or 1.21%, at $87.88—also a new 2023 record. A big factor in the rising price of crude oil are… Read more at: https://oilprice.com/Energy/Crude-Oil/Oil-Reaches-New-2023-High.html |

|

Trans Mountain Oil Pipeline Risks Delays If Route Change Isn’t ApprovedTrans Mountain Corporation (TMC) warned this week in a filing to the Canada Energy Regulator that the oil pipeline expansion project could be delayed by several months and incur additional costs if the regulator doesn’t approve a last-minute change in a small section of the route. The company has asked the regulator to approve a change from its approved route on a 1.3-kilometer (0.8 mile) section south of Kamloops, British Columbia, Reuters reports. The current construction method of micro-tunneling through the section is not technically… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Trans-Mountain-Oil-Pipeline-Risks-Delays-If-Route-Change-Isnt-Approved.html |

|

Massive Copper Theft Scandal Sends Shockwaves Through Metal MarketShares of Europe’s top copper producer in Frankfurt trading plummeted following an announcement that it might have fallen victim to a massive theft, potentially leading to losses of several hundred million euros –adding to the series of turbulence to rock the global metals sector in recent years. Bloomberg reported that Hamburg-based Aurubis ‘found discrepancies’ in its metal inventories. It said suppliers had manipulated details about the scrap metal shipments, with even its employees in the sampling department covering up the scam. … Read more at: https://oilprice.com/Metals/Commodities/Massive-Copper-Theft-Scandal-Sends-Shockwaves-Through-Metal-Market.html |

|

Russia’s Urals Crude Rises Well Above The $60 Price CapThe price of Russia’s flagship crude grade, Urals, averaged $74 per barrel in August, slightly down from August 2022, but way above the G7 price cap of $60 and higher than the July average of $64.37 a barrel, according to data released by the Russian Finance Ministry on Friday. To compare, the average price of North Sea Dated Brent was $86.20 per barrel in August. Between January and August 2023, the average price of Urals was $56.58 per barrel, compared to an average of $82.13 a barrel for the same period of 2022, the ministry’s data… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Russias-Urals-Crude-Rises-Well-Above-The-60-Price-Cap.html |

|

The Largest Threat To The Solar Industry1. Gabon Coup Roils West African Markets, Avoiding Disruptions So Far- The second coup in Africa in a month, the military takeover in Gabon that ended the Bongo family’s 56-year rule in the country, has for the first time impacted an OPEC producer. – According to sources on the ground, the new leadership under Gen Brice Oligui Nguema is not touching Gabonese production and does not want to disrupt exports, yet stocks of producers such as Maurel & Prom (EPA:MAU) or BW Energy (OSL:BWE) all fell this week. – Oil exports from Gabon have soared… Read more at: https://oilprice.com/Energy/Energy-General/The-Largest-Threat-To-The-Solar-Industry.html |

|

Will We See $90 WTI Soon?U.S. Crude Trends Upward U.S. benchmark October West Texas Intermediate (WTI) crude oil prices marked a significant uptick, with U.S. crude oil seeing an increase of over $2 a barrel on Thursday. This jump is attributed to expectations that the OPEC+ consortium, dominated by Saudi Arabia, will maintain their production cuts till 2023’s end. This would mark an extended period of OPEC-led reductions, further consolidating the market’s bullish stance. Additionally, West Texas Intermediate (WTI) registered a 2.2% gain, marking its third consecutive… Read more at: https://oilprice.com/Energy/Energy-General/Will-We-See-90-WTI-Soon.html |

|

Has The Oil Rally Run Out Of Fuel?Crude oil futures have been on a bit of a tear for the last week or so, posting only one down day in the last six days of trading, and gaining over six percent in the process. That has largely been about two things. The approach of Hurricane Idalia has been raising fears about disruptions in supply, and there was a drop in inventories here in the States last week that signals that there is already a slight imbalance in supply and demand, even before the storm’s impact. That is a bullish scenario, for sure, but it is very US-centric, and may… Read more at: https://oilprice.com/Energy/Energy-General/Has-The-Oil-Rally-Run-Out-Of-Fuel.html |

|

What The Gabon Coup Means For Oil MarketsThe coup in Niger has now spread to Gabon, with military leaders on Wednesday overthrowing the long-time president (the Bongo family, which has ruled since the 60s) and placing him under house arrest. Gabon is a mineral-rich country and a member of OPEC (though the smallest), producing around 200,000 bpd. The country’s oil production is not likely to be negatively impacted unless external forces attempt to intervene or unless the coup loses strength and the situation descends into civil war. For the time being, the oil is safe. The opposition… Read more at: https://oilprice.com/Energy/Energy-General/What-The-Gabon-Coup-Means-For-Oil-Markets.html |

|

Oil Prices Climb As Traders Refocus On FundamentalsBullish sentiment is building in oil markets as U.S. inventory levels continue to drop while OPEC+ production and export cuts are expected to be extended.Friday, September 1st, 2023Continuous US stock draws equivalent to a 1 million b/d decline over the past five weeks have led to an unusually tight oil market in the United States, adding upward pressure to oil prices despite economic woes. Widespread expectations of OPEC+ extending production and export cuts as well as recovering Chinese manufacturing activity have added to the bullish sentiment,… Read more at: https://oilprice.com/Energy/Energy-General/Oil-Prices-Climb-As-Traders-Refocus-On-Fundamentals.html |

|

Another Twist In Kurdistan’s Oil Export SagaPolitics, Geopolitics & Conflict In the wake of the death of the Russian head of the Wagner mercenary group in a plane crash, the focus is now on who will take over the leadership of Wagner, and there are still Wagner forces that could cause problems for Putin. An interesting development between Libya and Israel unfolded over the past weekend, with Libya’s foreign minister meeting with the Israeli foreign minister in Rome. News of the meeting – unilaterally released by Israel – sparked violent protests in Libya, and Dbeibah, head of the… Read more at: https://oilprice.com/Energy/Energy-General/Another-Twist-In-Kurdistans-Oil-Export-Saga.html |

|

Shell Sells Retail Energy Businesses In The UK And GermanyShell has agreed to sell its retail home energy businesses in the UK and Germany to Octopus Energy Group, the UK-based supermajor said on Friday. Shell will be selling Shell Energy Retail Limited (SERL) in the UK and Shell Energy Retail GmbH (SERG) in Germany, under a broader agreement with Octopus Energy to explore a potential international partnership in EV charging. The sale has an effective date of September 1, 2023, and is expected to complete in the fourth quarter of 2023, subject to regulatory approval. Financial details were not disclosed,… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Shell-Sells-Retail-Energy-Businesses-In-The-UK-And-Germany.html |

|

Hollywood sheds 17,000 jobs in August amid ongoing strikesThe ongoing Writers Guild of America and SAG-AFTRA strikes have resulted in a monthly decrease of 17,000 jobs in Hollywood. Read more at: https://www.cnbc.com/2023/09/01/jobs-report-hollywood-sheds-17000-jobs-in-august-amid-strikes-.html |

|

Amazon loses One Medical CEO a year after acquiring primary care providerAmazon announced in July 2022 that it would acquire One Medical for roughly $3.9 billion, the third-largest deal in its history. Read more at: https://www.cnbc.com/2023/09/01/amazon-loses-one-medical-ceo-one-year-after-acquisition.html |

|

Dow closes more than 100 points higher to kick off September, notches best week since July: Live updatesThe 30-stock Dow ended Friday higher as traders bet an increase in the U.S. unemployment rate could keep the Federal Reserve from tightening policy. Read more at: https://www.cnbc.com/2023/08/31/stock-market-today-live-updates.html |

|

Home prices may be on the verge of cooling offHome prices in July were 2.3% higher than the same month last year, but the monthly gain was lower than historical averages. Read more at: https://www.cnbc.com/2023/09/01/home-prices-rise-in-july-but-may-be-on-the-verge-of-cooling-off.html |

|

Stocks will try to keep momentum, but September seasonality and other headwinds awaitWall Street will contend with a seasonally weak period for markets ahead of the Federal Reserve’s September rate decision. Read more at: https://www.cnbc.com/2023/09/01/stocks-will-try-to-keep-momentum-but-september-seasonality-and-other-headwinds-await.html |

|

Dell has best day on stock market since its relisting in 2018 after earnings sail past estimatesDell shares surged more than 20% on Friday after the company reported better-than-expected earnings and revenue. Read more at: https://www.cnbc.com/2023/09/01/dells-stock-has-best-day-since-its-relisting-in-2016-on-earnings-beat.html |

|

Charter puts media companies on notice in bid to save pay-TV bundleCharter Communications CEO Chris Winfrey wants to find a way for the pay-TV bundle to live, but content companies have to get on board. Read more at: https://www.cnbc.com/2023/09/01/charter-puts-media-companies-on-notice-in-bid-to-save-pay-tv-bundle.html |

|

When to wear masks as Covid cases rise, new variants emerge in the U.S.The decision to mask depends on a few things: your personal risk level, Covid rates in your region and who you might make contact with, experts say. Read more at: https://www.cnbc.com/2023/09/01/covid-when-to-wear-masks-as-cases-rise-new-variants-emerge-in-us-.html |

|

Russia’s Putin says he will soon meet with China President Xi as war in Ukraine drags onThe upcoming meeting comes amid steady gains by Ukrainian forces on the battlefield. Read more at: https://www.cnbc.com/2023/09/01/-russias-putin-to-meet-with-china-president-xi-as-ukraine-war-drags-on.html |

|

USVI says JPMorgan notified Treasury of more than $1 billion in suspicious Jeffrey Epstein transactions after he died: ReportJeffrey Epstein, a former friend of Donald Trump and Bill Clinton, killed himself in 2019 after being arrested on child sex trafficking charges. Read more at: https://www.cnbc.com/2023/09/01/report-jpmorgan-flagged-over-1b-in-epstein-transactions-to-treasury.html |

|

Taylor Swift Eras Tour concert film is already a blockbuster with historic first-day ticket salesIn less than 24 hours on the market, ticket sales for Taylor Swift’s Eras Tour concert film have broken records. Read more at: https://www.cnbc.com/2023/09/01/taylor-swift-eras-tour-concert-film-record-first-day-ticket-sales.html |

|

Horror movies will dominate movie theaters from now until HalloweenStarting this weekend, movie theaters will have a steady stream of jump scares, creepy monsters and gore — and that’s great news for the box office. Read more at: https://www.cnbc.com/2023/09/01/horror-movies-dominate-movie-theaters-halloween.html |

|

Altcoin trading volume is off its first-half highs. Here’s what it will take to get it backAltcoin trading is limping along with bitcoin through the summer despite the July ruling in the SEC’s lawsuit against Ripple. Read more at: https://www.cnbc.com/2023/09/01/altcoin-trading-volume-is-off-its-first-half-highs-heres-what-it-will-take-to-get-it-back.html |

|

Rickards: History’s Starting To Rhyme…Authored by James Rickards via DailyReckoning.com, Has World War III already begun?

That’s not a facetious question meant to grab attention. It’s a legitimate question. It’s often the case that momentous events begin in small ways and expand out of control. In retrospect, it seems obvious that war was inevitable. But at the time, it’s not obvious at all. Events might seem disconnected and it’s far from obvious that war is inevitable. Historical hindsight is 20/20. World War I was not called that at the time. It was called the Great War. It was only when World War II arrived that the name World War I was applied. And how should we think about the beginning of World War II? Most historians date it from the German invasion of Poland on Sept. 1, 1939. Still, many Americans date the war from Dec. 7, 1941, when Japan bombed Pearl Harbor and the U.S. declared war on Japan. But … Read more at: https://www.zerohedge.com/geopolitical/rickards-historys-starting-rhyme |

|

Oil Surges To 2023 High As Saudi Exports Plunge To Lowest In Two Years Ahead Of Aramco $50BN Share OfferingYesterday we reported that the price of oil jumped to the second highest level of 2023 amid plunging US inventories…

… and news that Russia had agreed to further oil export cuts. Today, West Texas Intermediate extended its gain, surging another $2 to $85.55 and hitting the highest level of 2023 – just in time for headline inflation to surge again – amid a barrage of favorable news including the latest drip-drop of Chinese micro stimuli, all of which are useless in isolation yet which guarantee that Beijing will have to pull out a bazooka, but more importantly, that observed crude shipments from Saudi Arabia plunged in August, with flows to most major destinations slumping to multiyear lows as the kingdom l … Read more at: https://www.zerohedge.com/commodities/oil-surges-2023-high-saudi-exports-plunge-lowest-two-years-ahead-aramco-50bn-share |

|

Russia Puts Its Longest Range Nuke-Capable Missile On Combat Duty, Nicknamed ‘Satan II’Russia has on Friday announced its Sarmat ICBMs are on “combat duty”. RIA has quoted the head of the country’s space agency Roscosmos, Yuri Borisov, to confirm: “the Sarmat strategic complex has been put on combat duty.” The nuclear-capable Sarmat intercontinental ballistic missile system was previously touted by President Putin as being capable hitting “any target on Earth” – and is widely believed to be by far the longest-range missile in Russia’s arsenal (or in the world for that matter). It’s been nicknamed by NATO the “Satan II”.

During a prior test, via Russian media.The Sarmat, which is in a “superheavy” class of missiles, has a short initial boost phase which gives it better ability to elude all conventional anti-missile defense systems, given this results in a much smaller window of time to track it. By design, its super long-range gives it the ability to … Read more at: https://www.zerohedge.com/geopolitical/russia-puts-its-longest-range-nuke-capable-missile-combat-duty-nicknamed-satan-ii |

|

Wild Mobs Of Young People Totally Out Of ControlAuthored by Michael Snyder via The End of The American Dream blog, If young people are the future of this country, we are in really big trouble. We are supposed to be a civilized society, but now we are facing an entire generation of young Americans that is completely out of control. Violent crime is surging all over the nation, theft will cost U.S. retailers more than 100 billion dollars this year alone, and at this moment we are dealing with the worst drug crisis in the entire history of the United States. Needless to say, all of these problems are primarily being fueled by Americans under the age of 30. These young people have been raised in a society that has largely rejected traditional values, and now we are reaping the consequences.

At this point, things are so bad that even the news crews that are reporting on the rising crime in our major cities are getting robbed themselves. … Read more at: https://www.zerohedge.com/political/wild-mobs-young-people-totally-out-control |

|

UK economy made stronger recovery during CovidRevised official figures reveal that the UK grew at the end of 2021 rather than shrinking. Read more at: https://www.bbc.co.uk/news/business-66680188?at_medium=RSS&at_campaign=KARANGA |

|

Octopus to buy Shell’s household energy firmAbout 1.4 million households will see their accounts switched to a new provider. Read more at: https://www.bbc.co.uk/news/business-66684386?at_medium=RSS&at_campaign=KARANGA |

|

House prices see biggest yearly decline since 2009Nationwide says higher borrowing costs have led to a slowdown in activity in the housing market. Read more at: https://www.bbc.co.uk/news/business-66680166?at_medium=RSS&at_campaign=KARANGA |

|

BEML among 7 defence stocks that surged 50-178% in FY24Defence stocks have been in the spotlight in FY24 as the top performers from the pack have surged as much as 179% so far. (Source: Ace Equity). Despite this stellar rally, many can experience a decline in the near term, according to Trendlyne data. Take a look: Read more at: https://economictimes.indiatimes.com/markets/stocks/news/mazagon-beml-among-7-defence-stocks-that-surged-50-178-in-fy24/stellar-show/slideshow/103289908.cms |

|

Tech View: Nifty ends in green after 5 weekly losses. What traders should do on MondayAfter showing a false downside breakout of 19250 levels on Thursday, the market seems to have reversed sharply on the upside, says Nagaraj Shetti, Technical Research Analyst at HDFC Securities Read more at: https://economictimes.indiatimes.com/markets/stocks/news/tech-view-nifty-ends-in-green-after-5-weekly-losses-what-traders-should-do-on-monday/articleshow/103286421.cms |

|

Main drivers of growth in Q2 and Q3 likely to be domestic: Saugata Bhattacharya“The future growth in Q2, Q3 etc. will be balanced between consumption and investment and if consumption remains robust and if capacity utilization as the RBI surveys suggest, it’s moving towards that 78% threshold. Some amount of private investment will also happen, although nothing very spectacular before the general elections are likely to come in. Growth drivers are likely to be relatively balanced, but within the domestic sphere. ” Read more at: https://economictimes.indiatimes.com/markets/expert-view/main-drivers-of-growth-in-q2-and-q3-likely-to-be-domestic-saugata-bhattacharya/articleshow/103252634.cms |

|

Private equity, hedge funds sue SEC over new disclosure rulesIndustry groups are suing to block rules that would require private equity and hedge funds to disclose quarterly performance, fees and expenses. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-725A-3C262626A271%7D&siteid=rss&rss=1 |

|

Bond Report: 2- through 30-year Treasury yields end higher after remarks by Fed’s MesterTreasury yields finish mostly higher, but were down for the week, after the Cleveland Fed’s Loretta Mester comments on inflation. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7259-8E9249F077D6%7D&siteid=rss&rss=1 |

|

Market Snapshot: S&P 500 heads for weekly gain as U.S. stocks trade mixed after jobs reportU.S. stocks were mostly posting modest gains afternoon Friday, as Treasury yields rose in the wake of a fresh report on the jobs market in August. The data comes ahead of a three-day weekend, with U.S. markets closed Monday for Labor Day. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7259-8B52A59876E0%7D&siteid=rss&rss=1 |