Summary Of the Markets Today:

- The Dow closed up 38 points or 0.11%,

- Nasdaq closed up 0.54%,

- S&P 500 closed up 0.38%,

- Gold $1,972 up $6.60,

- WTI crude oil settled at $82 up $0.44,

- 10-year U.S. Treasury 4.118% down 0.004 points,

- USD Index $103.02 down $0.330,

- Bitcoin $27,255 down $606,

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our Economic Forecast for September 2023

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

Private sector employment increased by 177,000 jobs in August and annual pay was up 5.9 percent year-over-year, according to the August ADP National Employment Report. 177,000 job growth is higher than normal new workers entering the workforce – but continues to slow. Nela Richardson, ADP chief economist stated:

This month’s numbers are consistent with the pace of job creation before the pandemic, After two years of exceptional gains tied to the recovery, we’re moving toward more sustainable growth in pay and employment as the economic effects of the pandemic recede.

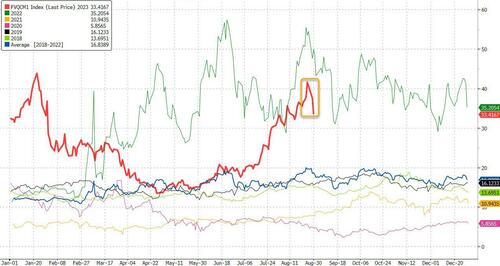

The second estimate of real gross domestic product (GDP) in 2Q2023 increased at an annual rate of 2.1 percent – down from 2.4% in the advance estimate. This is little changed In the first quarter, real GDP increased 2.0 percent. I prefer to analyze year-over-year growth as the primary metric for GDP which increased to 2.5% (blue line in the graph below). The good news is that inflation continues to abate as the implicit price deflator moderated to 3.5% year-over-year (red line on the graph below).

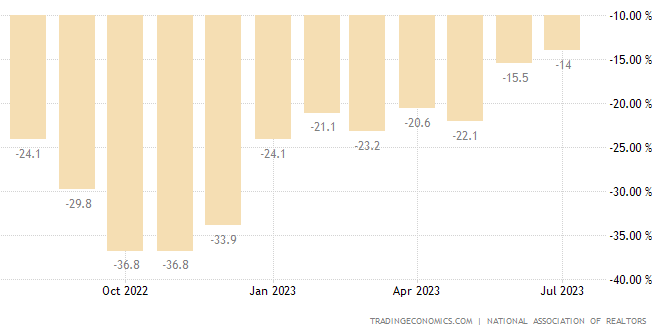

The National Association of REALTORS Pending home sales fell by 14.0% year-over-year in July 2023 – but is a significant improvement over the declines seen over the past year. You should expect continued improvement as the data is being compared to the terrible data over the past year. Pending Home Sales is a forward-looking indicator of home sales based on contract signings. NAR Chief Economist Lawrence Yun stated:

The small gain in contract signings shows the potential for further increases in light of the fact that many people have lost out on multiple home buying offers. Jobs are being added and, thereby, enlarging the pool of prospective home buyers. However, rising mortgage rates and limited inventory have temporarily hindered the possibility of buying for many.

Here is a summary of headlines we are reading today:

- Energy Storage Sector Gears Up For Explosive Growth

- Saudis Pour Money Into American Lithium

- Shipping Woes Ease As Rates Drop To Pre-Pandemic Levels

- Oil Rises After EIA Confirms Major Crude Draw

- S&P 500 rises for a fourth straight day, major averages curtail monthly losses in late August hot streak

- How China became the king of new nuclear power, and how the U.S. is trying to stage a comeback

- HHS calls for easing restrictions on marijuana, sending cannabis stocks higher

- Grayscale CEO lays out next steps after ‘huge victory’ against SEC: CNBC Crypto World

- Mitch McConnell appears to freeze again, in another health scare for Senate’s top Republican

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Energy Storage Sector Gears Up For Explosive GrowthThe renewable energy revolution is here. Global wind and solar energy capacity additions are set to shatter previous records by the end of 2023, with an expected 440 gigawatts to be added by the end of the year, according to figures from the International Energy Agency (IEA). With the unprecedented catalyzation of the global clean energy transition, plus the skyrocketing rate of adoption for electric vehicles (EVs), the world could be on track to hit peak fossil fuel emissions by 2025. While the rapid rise of renewables is inarguably… Read more at: https://oilprice.com/Energy/Energy-General/Energy-Storage-Sector-Gears-Up-For-Explosive-Growth.html |

|

China’s Involvement In Mega UK Wind Farm Sparks ControversyConservative MPs have criticised the role of a Chinese private investment group in a new mega offshore wind farm that could power over one million homes. The Moray West offshore wind farm project, located off the coast of Scotland, is an upcoming 882MW development, consisting of 60 turbines, with the potential to serve 1.33m homes. The development, which has been fully approved, is run as a joint venture between EDP Renewables and Engie, and is expected to generate power as soon as next year. While the turbines have been supplied by Siemens Gamesa,… Read more at: https://oilprice.com/Energy/Energy-General/Chinas-Involvement-In-Mega-UK-Wind-Farm-Sparks-Controversy.html |

|

Saudis Pour Money Into American LithiumSaudi Arabia-based investment company Energy Capital Group (ECG) has invested in U.S.-based Pure Lithium, a company that specializes in lithium metal batteries, for an undisclosed sum. Pure Lithium is looking to establish a fully integrated supply chain in Saudi Arabia, using its proprietary technology that extracts lithium from oil field brines. “We are thrilled with Energy Capital Group’s investment in Pure Lithium. They recognise the value and impact we can have in the kingdom by unlocking oilfield brines to create… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Saudis-Pour-Money-Into-American-Lithium.html |

|

Is It Time To Include Afghanistan In Global Climate Talks?A top UN official expressed concerns that Afghanistan has been excluded from global discussions on climate change, despite being among the top 10 countries worldwide facing climate-related issues. Afghanistan has been excluded from the UN’s global climate summit talks since the Taliban takeover in 2021. Roza Otunbaeva, head of the UN Assistance Mission in Afghanistan (UNAMA), highlighted the impact of climate change and drought conditions on the poverty level of the country and pointed to the importance of Taliban-driven initiatives, such… Read more at: https://oilprice.com/The-Environment/Global-Warming/Is-It-Time-To-Include-Afghanistan-In-Global-Climate-Talks.html |

|

Brazil’s Oil & Gas Production Hits Record HighsBrazil’s oil and gas production hit the highest level ever for a single month in July, with production totaling 4.48 million barrels of oil equivalent per day in the period, data from oil regulator ANP has revealed. According to ANP, oil output increased 18.6%Y/Y to 3.51 million barrels per day while natural gas production grew 13.6%Y/Y to 154.08 million cubic meters per day. Previously, global research and consultancy group Wood Mackenzie predicted that Brazil’s private oil companies will increase oil production by 75% from 1.221Mb/d to… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Brazils-Oil-Gas-Production-Hits-Record-Highs.html |

|

The Science Behind A Cleaner, Greener Pipeline SystemLos Alamos National Laboratory researchers are reporting that mathematical modeling can show how to safely blend hydrogen with natural gas for transport in existing pipeline systems. A secure and reliable transition to hydrogen is one of the proposed solutions for the shift to a net-zero-carbon economy. Anatoly Zlotnik, a co-author of a new paper on the modeling in the journal PRX Energy. Zlotnik, a mathematician at Los Alamos National Laboratory, has expertise in modeling, designing and controlling energy-transmission systems briefly explained,… Read more at: https://oilprice.com/Energy/Natural-Gas/The-Science-Behind-A-Cleaner-Greener-Pipeline-System.html |

|

Russia’s Diesel, Fuel Exports See August SlumpRussia’s diesel and fuel exports are thought to have slumped in August—reaching 10-month lows—as oil refiners gear up for routine seasonal maintenance that typically saps demand, according to data from Vortexa Ltd. According to Vortexa data compiled by Bloomberg, oil products exports from Russia sank to 2.3 million barrels per day from August 1 to August 26. That 2.3 million bpd is 250,000 bpd less than the previous month, and also below August 2022 levels. Official data from Russia is unavailable since the country classified… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Russias-Diesel-Fuel-Exports-See-August-Slump.html |

|

Shipping Woes Ease As Rates Drop To Pre-Pandemic LevelsVia Metal Miner Buyers who depend on imports for semi-finished materials or finished components will undoubtedly cheer the recent fall in freight rates. Indeed, global logistics costs peaked in late 2022. Now, buyers will soon see relief from the historic highs of the COVID-induced ocean freight-feeding frenzy. Indeed, few will shed a tear to learn that many shipping lines continue to contend with container spot rates that are below cost. They may even view them as “payback” for the massive profits made in the preceding three years.… Read more at: https://oilprice.com/Finance/the-Economy/Shipping-Woes-Ease-As-Rates-Drop-To-Pre-Pandemic-Levels.html |

|

Military Seizes Power In Mineral-Rich GabonElections in Gabon have ended in a coup, with the country’s military leaders seizing power following an announcement that President Ali Bongo–a member of a family that has controlled the Central African nation for over 50 years–had won a third term in office. As of Wednesday morning, all state institutions had been dissolved, with General Brice Oligui Nguema appearing to have been installed as the leader of the junta. The coup in Gabon follows a coup in Niger in July. Ali Bongo assumed power in Gabon in 2009,… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Military-Seizes-Power-In-Mineral-Rich-Gabon.html |

|

Oil Rises After EIA Confirms Major Crude DrawCrude oil prices moved higher today after the U.S. Energy Information Administration reported an inventory decline of 10.6 million barrels for the week to August 25. The estimate compared with a draw of 6.1 million barrels for the previous week. A day earlier, the American Petroleum had estimated inventories had shed a massive 11.5 million barrels in the week to August 25, which prompted a spike in oil prices. In fuels, the Energy Information Administration reported a modest gasoline draw and a middle distillate increase. In gasoline, stocks shed… Read more at: https://oilprice.com/Energy/Crude-Oil/Oil-Rises-After-EIA-Confirms-Major-Crude-Draw.html |

|

Barclays Sees $97 Brent Oil Price In 2024 As Market TightensSlower U.S. shale growth and persistent underproduction from several OPEC+ producers are set to tighten the oil market further in 2024, Barclays said on Wednesday, hiking its Brent price forecast for next year by $8 to $97 a barrel. “Slowing non-OPEC+ supply growth, driven primarily by the US, and persistent underproduction from several OPEC+ producers due to structural constraints bolsters our core thesis behind a constructive view on oil prices,” the bank said in a note carried by Reuters. But Barclays revised down its Brent forecast… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Barclays-Sees-97-Brent-Oil-Price-In-2024-As-Market-Tightens.html |

|

Bloomberg Predicts Peak Oil Demand In 2027A couple of weeks ago, the International Energy Agency reported that global oil demand reached an all-time high of 103mn barrels a day in June. According to the global energy watchdog, robust demand was driven by better-than-expected economic growth in OECD countries, surging oil consumption in China, particularly for petrochemical production and strong summer air travel. The IEA has predicted that demand could hit another peak in August and remains on track to average 102.2mn b/d for the whole year, the highest ever annual level. Well,… Read more at: https://oilprice.com/Energy/Crude-Oil/Bloomberg-Predicts-Peak-Oil-Demand-In-2027.html |

|

PetroChina Books Record H1 Profit Amid Refining RecoveryChinese oil and gas giant PetroChina reported on Wednesday a record-high profit for the first half of 2023, as its refining business recovered after the reopening and oil and gas production increased. Profit attributable to the shareholders of PetroChina rose by 4.5% year-over-year to $11.7 billion (85.27 billion Chinese yuan), the company said in a stock exchange filing. Total revenues fell by 8.3% in the first half of 2023 compared to the same period of 2022, primarily due to the decline in sales prices of oil and gas. PetroChina’s average… Read more at: https://oilprice.com/Latest-Energy-News/World-News/PetroChina-Books-Record-H1-Profit-Amid-Refining-Recovery.html |

|

Gazprom’s H1 Profit Plunges As Natural Gas Deliveries To Europe SlumpRussia’s gas giant Gazprom has reported a massive drop in its first-half net profit as deliveries to Europe have slumped compared to 2022 when Russia was still supplying pipeline gas to its European customers for most of the first half of last year. Gazprom’s net profit plunged by 8.5 times to stand at just $3.1 billion (296 billion Russian rubles) for the first half of 2023, down from $26 billion (2.5 trillion rubles) for the same period of 2022. The collapse in Gazprom’s net profit was also due to the weak ruble, which fell… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Gazproms-H1-Profit-Plunges-As-Natural-Gas-Deliveries-To-Europe-Slump.html |

|

CEO Claims Russia’s Production Cuts Are Limiting Rosneft’s PotentialThe oil output cuts in Russia have been holding back its top producer Rosneft from fully realizing its potential, the chief executive of the state-controlled oil giant, Igor Sechin, said on Wednesday. “I should note that Rosneft has been limiting crude oil production in one way or another since 2017, which prevents the Company from fully unleashing its potential,” Sechin said in a statement discussing Rosneft’s first-half performance. This year alone, Russia has pledged to cut its oil production by 500,000 bpd. On top of this,… Read more at: https://oilprice.com/Latest-Energy-News/World-News/CEO-Claims-Russias-Production-Cuts-Are-Limiting-Rosnefts-Potential.html |

|

S&P 500 rises for a fourth straight day, major averages curtail monthly losses in late August hot streakStocks climbed Wednesday, as Wall Street tried to build on a three-day winning streak. Read more at: https://www.cnbc.com/2023/08/29/stock-market-today-live-updates.html |

|

How to stop Meta from using some of your personal data to train generative AI modelsFacebook users can now delete their personal information found in the third-party sources that Meta uses to train generative artificial intelligence models. Read more at: https://www.cnbc.com/2023/08/30/how-to-stop-meta-from-using-personal-data-to-train-generative-ai-.html |

|

How China became the king of new nuclear power, and how the U.S. is trying to stage a comebackChina is the current king of new nuclear power construction. The US is attempting to launch a comeback, but its still unknown whether that will be successful. Read more at: https://www.cnbc.com/2023/08/30/how-china-became-king-of-new-nuclear-power-how-us-could-catch-up.html |

|

Mitch McConnell freezes, struggles to speak in second incident this summerMcConnell, 81, initially seemed to struggle to hear when asked at an event in Covington, Kentucky, about his views on running for reelection. Read more at: https://www.cnbc.com/2023/08/30/mitch-mcconnell-freezes-struggles-to-speak-in-second-incident-this-summer.html |

|

Hurricane Idalia barrels into Georgia after hitting Florida coast, leaving at least two deadHurricane Idalia slammed Florida’s Big Bend with maximum sustained winds of more than 100 miles per hour and catastrophic flooding. Read more at: https://www.cnbc.com/2023/08/30/hurricane-idalia-slams-florida-with-life-threatening-storm-surge.html |

|

HHS calls for easing restrictions on marijuana, sending cannabis stocks higherThat move could potentially expand the market for cannabis, sending shares of Canopy Growth, Tilray Brands and Cronos Group higher. Read more at: https://www.cnbc.com/2023/08/30/hhs-calls-for-easing-marijuana-restrictions.html |

|

Trump fraud case: New York attorney general says ‘mountain’ of evidence justifies summary judgmentDonald Trump and the Trump Organization are due to go on civil trial in October in a massive fraud lawsuit filed by New York Attorney General Letitia James. Read more at: https://www.cnbc.com/2023/08/30/trump-fraud-case-new-york-attorney-general-seeks-summary-judgment.html |

|

State officials want Shein to prove it doesn’t use forced labor before it goes publicFast-fashion retailer Shein is facing more scrutiny from elected officials who want the company to independently prove it doesn’t use forced labor. Read more at: https://www.cnbc.com/2023/08/30/shein-faces-scrutiny-over-forced-labor-before-ipo.html |

|

Biden administration cancels $72 million in student debt for more than 2,300 borrowersThe Biden administration announced on Wednesday it would forgive $72 million in student debt for more than 2,300 borrowers who attended Ashford University. Read more at: https://www.cnbc.com/2023/08/30/biden-administration-cancels-72-million-in-student-debt-.html |

|

Grayscale CEO lays out next steps after ‘huge victory’ against SEC: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, Bobby Zagotta, U.S. CEO and Chief Commercial Officer at Bitstamp, explains what prompted the platform to halt ether staking in the United States. Read more at: https://www.cnbc.com/video/2023/08/30/grayscale-ceo-next-steps-huge-victory-sec-crypto-world.html |

|

Warren Buffett, who turns 93, is at the top of his game as he pushes Berkshire Hathaway to new heightsBerkshire shares have roared back to an all-time high on record operating profit, making it the biggest nontech company by market capitalization. Read more at: https://www.cnbc.com/2023/08/30/warren-buffett-is-at-the-top-of-his-game-as-berkshire-hits-new-heights.html |

|

Rudy Giuliani liable for defaming Georgia election workers, hit with sanctions by judgeRudy Giuliani, Donald Trump, and others are charged in Georgia with crimes related to trying to overturn Trump’s 2020 loss in the state to President Joe Biden. Read more at: https://www.cnbc.com/2023/08/30/judge-orders-default-judgment-sanctions-against-rudy-giuliani-in-election-workers-lawsuit.html |

|

This outperforming fund offers a socially responsibility way to invest in growthThe firm’s U.S. Large Cap Growth Responsibility Index (CGJAX) is up 27% this year, rallying in near harmony with growth stocks. Read more at: https://www.cnbc.com/2023/08/30/this-outperforming-fund-offers-a-socially-responsibility-way-to-invest-in-growth.html |

|

Hedge Fund MFN Partners Trying To Protect Equity Investment In Bankrupt YellowBy Todd Maiden of FreightWaves, A hedge fund with an integral role in Yellow Corp.’s bankruptcy proceedings is pushing for shareholders to have a bigger say in the company’s upcoming liquidation.

MFN Partners, which amassed a more than 40% stake in the now-defunct less-than-truckload carrier during July, sent a letter to the company urging several changes.

|

|

“We Have Turned Away Inventory”: US EV Market Struggles As Cars Pile Up On Dealer LotsThe rising mismatch between electric vehicle supply and demand is showing up at car dealerships as unsold EVs stack up. Dealerships tell Bussiness Insider that EV supply from automakers has been turned away as demand cools. Rising EV inventories and a Tesla-fueled price war could signal the beginnings of a pause in growth for the EV market. Scott Kunes, the chief operating officer of Kunes Auto and RV Group, which sells Detroit brands and Nissan and Mitsubishi in the Midwest, said: “We have turned away EV inventory.” Big Detroit brands are “asking us to make a large investment” in these EVs, Kunes added, “and we just want to see some return on that investment.” A recent report from Cox Automotive shows automakers such as General Motors, Ford, Hyundai, and Toyota have more than 90 days’ worth of unsold EVs at dealerships in July. That’s about 92,000 EVs sitting at lots, more than three times the number compared with a year ago. New vehicle inventories are up about 74% from a year ago. Read more at: https://www.zerohedge.com/markets/we-have-turned-away-inventory-us-ev-market-struggles-cars-pile-dealer-lots |

|

Navajo Leaders Challenge Chaco Canyon Drilling Ban — Climate Advocates Should ListenAuthored by Ethan Brown via RealClear Wire, On June 2, the U.S. Department of the Interior blocked oil and gas leasing for the next twenty years within a ten-mile radius of Chaco Canyon — the site of a Puebloan civilization in now-northern New Mexico dating back over a millennium. Despite some support from people within the Pueblo tribes and Navajo Nation which surround the land, the vast majority of Navajo leaders have opposed these drilling restrictions. It’s essential that climate advocates hear them out. Read more at: https://www.zerohedge.com/energy/navajo-leaders-challenge-chaco-canyon-drilling-ban-climate-advocates-should-listen |

|

Refiners Are Printing Money As Diesel Crack SoarsDiesel prices have been supercharged this summer, but as Bloomberg’s Jack Wittels warns, the moves seem out of kilter with the relatively mundane fundamental drivers, creating the risk of a correction. Then again, it could just be a repeat of last year when diesel prices went suborbital due to lack of refining capacity, and led to a cash bonanza for refiners. Benchmark diesel futures in northwest Europe are currently worth about $35 more than ICE Brent, more than double the seasonal norm. This price difference — known as the diesel crack, or margin — has been on an almost solid bull-run since late May.

As Wittels notes, such a dramatic price move, up or down, is extremely rare; not even Covid triggered this kind of swing in Northwest Europe’s diesel margins. Excluding last year — when Russia began its invasion of Ukraine — there hasn’t been anything like it in at least a decade. The forces behind this upward surge come more from the supply than the demand side. However, key factors, su … Read more at: https://www.zerohedge.com/markets/refiners-are-printing-money-diesel-crack-soars |

|

Families worried about expenses after flights axedPassengers are having to fork out for food, travel and accommodation, but are worried about costs. Read more at: https://www.bbc.co.uk/news/business-66657176?at_medium=RSS&at_campaign=KARANGA |

|

M&S returns to FTSE 100 on food and clothes boostThe retailer returned to the FTSE 100 index of Britain’s biggest listed companies on Wednesday. Read more at: https://www.bbc.co.uk/news/business-66659081?at_medium=RSS&at_campaign=KARANGA |

|

Wilko: Warning warehouse staff face redundancyJob cuts may resume on Thursday if the current bidder does not submit the necessary paperwork in time. Read more at: https://www.bbc.co.uk/news/business-66660679?at_medium=RSS&at_campaign=KARANGA |

|

How India’s most valuable firm Reliance earns the big bucksHere’s a look at the revenue mix of the oil-to-retail conglomerate Reliance Industries (RIL), according to the June quarter report card. (Source: Prabhudas Lilladher | @PLIndiaOnline) Read more at: https://economictimes.indiatimes.com/markets/stocks/news/how-does-indias-most-valuable-firm-ril-make-money-heres-the-breakdown/revenue-mix/slideshow/103202855.cms |

|

How BSE, Mahindra Lifespace and SPARC are looking on charts for ThursdayThe S&P BSE Sensex and Nifty50 closed flat but with a positive bias. Sectorally, buying was seen in telecom, realty, metal, and IT stocks while selling in banks, utilities, oil & gas, and power Read more at: https://economictimes.indiatimes.com/markets/stocks/news/breakout-stocks-how-bse-mahindra-lifespace-and-sparc-are-looking-on-charts-for-thursdays-trade/articleshow/103215355.cms |

|

Nifty poised to end August expiry below 19,500. What traders should doAmidst this downturn, the addition of substantial open interest in the 19500CE options signifies that the index is poised to expire below the 19,500 mark on Thursday’s expiry. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/tech-view-nifty-poised-to-end-august-expiry-below-19500-what-traders-should-do/articleshow/103214799.cms |

|

The Moneyist: I want to give over $600,000 to my adult children. How do I ensure they don’t lose that money in the event they divorce?“I have a good pension and my own property, so I would like to set my children on the property ladder.” Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7257-DD0A0B44C926%7D&siteid=rss&rss=1 |

|

Futures Movers: Oil prices end at a more than 2-week high as U.S. crude supplies post a nearly 11 million-barrel weekly dropOil futures settle Wednesday at their highest in over two weeks after the U.S. government reported a weekly drop in U.S. crude inventories of nearly 11 million barrels. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7256-C948FB871B2C%7D&siteid=rss&rss=1 |

|

Mitch McConnell appears to freeze again, in another health scare for Senate’s top RepublicanSenate Minority Leader Mitch McConnell freezes Wednesday during an event in Kentucky, with the incident coming a month after a similar freeze-up. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7257-C2B5F49EB304%7D&siteid=rss&rss=1 |