Summary Of the Markets Today:

- The Dow closed up 293 points or 0.85%,

- Nasdaq closed up 1.74%,

- S&P 500 closed up 1.45%,

- Gold $1,966 up $19.00,

- WTI crude oil settled at $81 up $1.11,

- 10-year U.S. Treasury 4.114% down 0.098 points,

- USD Index $103.43 down $0.630,

- Bitcoin $27,853 up $1,880,

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our Economic Forecast for September 2023

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

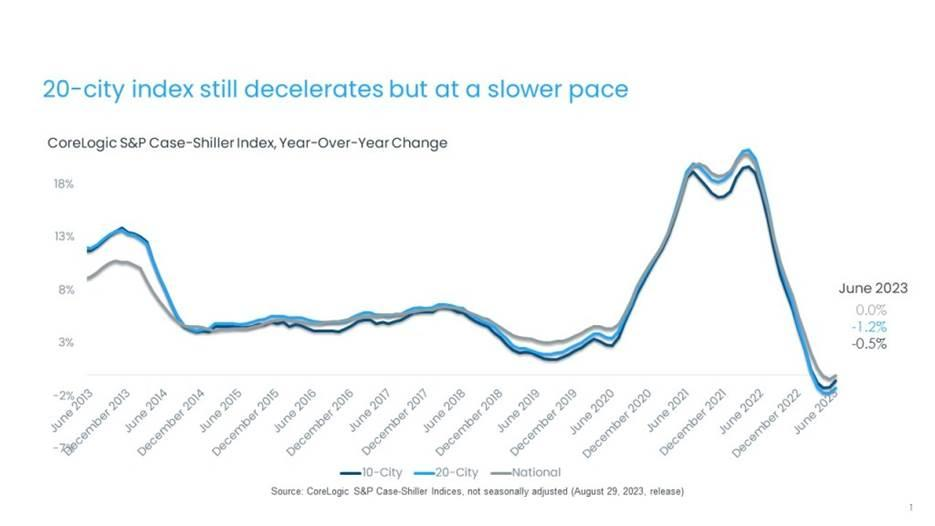

The S&P CoreLogic Case-Shiller U.S. National Home Price 20-City Composite posted a year-over-year loss of -1.2%, up from -1.7% in the previous month. According to Dr. Selma Hepp, chief economist at CoreLogic:

While home prices have shown a lot of strength so far in 2023, elevated mortgage rates are making it difficult for many potential buyers to purchase properties, which will likely keep a lid on additional gains for the rest of the year. Nevertheless, home prices are still expected to continue to reaccelerate and reach mid-single-digit growth rate by the year’s end. Across price tiers, the high tier continued to show relative weakness, -2.6% year over year, the fourth month of annual declines and similar to trends observed in CoreLogic’s Single-Family Rent Index. This trend may reflect the greater mobility of higher-income households during the pandemic, which has since slowed. In addition, the surge in demand for luxury and second homes seen in 2021 and 2022 also contracted relatively more since the increase in mortgage rates and stalling home sales

The number of job openings edged down to 8.8 million on the last business day of July, the U.S. Bureau of Labor Statistics reported today. Over the month, the number of hires and total separations changed little at 5.8 million and 5.5 million, respectively. Still, there remain many unfilled job openings which should continue to drive strong job growth in the months to come.

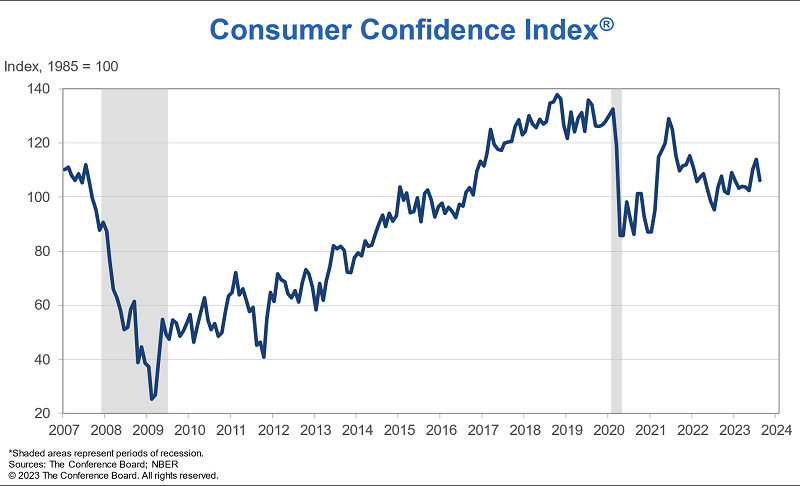

The Conference Board Consumer Confidence Index declined in August to 106.1 (1985=100), from a downwardly revised 114.0 in July. Expectations were a hair above 80—the level that historically signals a recession within the next year. Although consumer fears of an impending recession continued to recede, The Conference Board still anticipates one is likely before yearend. Dana Peterson, Chief Economist at The Conference Board stated:

Consumer confidence fell in August 2023, erasing back-to-back increases in June and July. August’s disappointing headline number reflected dips in both the current conditions and expectations indexes. Write-in responses showed that consumers were once again preoccupied with rising prices in general, and for groceries and gasoline in particular. The pullback in consumer confidence was evident across all age groups—and most notable among consumers with household incomes of $100,000 or more, as well as those earning less than $50,000. Confidence held relatively steady for consumers with incomes between $50,000 and $99,999.

Here is a summary of headlines we are reading today:

- Is The Shale Reinvestment Surge Just A Blip Or A Strategy Shift?

- U.S. Treasury Increases Flexibility For Energy Tax Credit Program

- Chevron Evacuates Gulf Of Mexico Oil Platforms As Hurricane Idalia Approaches

- Cartels Take Over As Ecuador’s New Power Brokers

- One-Third Of Toyota’s Global Production Frozen Due To Mysterious Glitch

- The U.S. Holds First-Ever Offshore Wind Lease Sale In Gulf Of Mexico

- Nasdaq pops more than 1% for third straight winning day as tech rebounds from August slump: Live updates

- Investors are ramping up short bets against these electric vehicle makers and small-cap health-care stocks

- 3M faces more legal headaches after $6 billion earplug settlement

- Buy the August dip in this travel stock with a deep moat and 30% upside, says Bernstein

- The 30-year mortgage rate has surpassed 7%, but some buyers are only paying 6%. Here’s how they do it.

- Bond Report: Treasury yields end at almost three-week lows after U.S. job-openings data

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Is The Shale Reinvestment Surge Just A Blip Or A Strategy Shift?The reinvestment rate of US shale oil producers hit its highest level in three years in the second quarter of 2023, but the recent trajectory will not last, according to Rystad Energy research. Our analysis focuses on a peer group of 18 public companies, excluding majors, that collectively accounted for about 40% of total US shale oil output in 2022. The group’s reinvestment rate was 72% in the second quarter of the year, up from 58% in the first quarter and the highest since the 150% seen in the second quarter of 2020. The reinvestment rate… Read more at: https://oilprice.com/Energy/Crude-Oil/Is-The-Shale-Reinvestment-Surge-Just-A-Blip-Or-A-Strategy-Shift.html |

|

Erdogan Looks To Restore Grain Deal In Upcoming Russia VisitThe head of the country which comprises NATO’s second largest military is planning a trip to Russia to meet with President Vladimir Putin. Turkey’s President Recep Tayyip Erdogan made the announcement Monday, and teased potential progress for reestablishing the critical Black Sea grain deal, despite ongoing international tensions over Russia bombing Ukraine ports, which has been strongly condemned by the West. “President Erdo?an has so far led an intense diplomacy in order to help prevent a global food crisis,” ruling Justice and Development… Read more at: https://oilprice.com/Geopolitics/International/Erdogan-Looks-To-Restore-Grain-Deal-In-Upcoming-Russia-Visit.html |

|

Woodside Sees 100,000 Bpd Peak Production At Mexico’s Giant Trion FieldPerth-based Woodside Energy Group has quantified the peak production it expects from its ultra-deepwater Trion oilfield in Mexico that it is developing jointly with Pemex at 100,000 bpd. Woodside Energy (ASX:WDS) expects Trion to reach peak production by 2028, Mexico’s oil regulator said on Tuesday, while estimating the total cost for the project at nearly US$7.5 billion. Woodside gave the green light for the project in June. Woodside owns 60% of the Trion field, with the remaining 40% held by Mexico’s state-run oil firm, Pemex,… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Woodside-Sees-100000-Bpd-Peak-Production-At-Mexicos-Giant-Trion-Field.html |

|

What’s Wrong With Rystad Energy’s Global Oil Reserve Estimate?Rystad Energy in a June 29th press release reported that its most recent assessment of the true size of the world’s proved oil reserves stands at 285 billion barrels, a value only one-sixth of the widely accepted value of around 1700 billion barrels. Insiders have long known of this extraordinary discrepancy, but it may come as a surprise to many. The widely accepted global proved oil reserves are those published by organisations such as the US EIA, OPEC, Oil and Gas Journal, World Oil and BP’s Statistical Review… Read more at: https://oilprice.com/Energy/Crude-Oil/Whats-Wrong-With-Rystad-Energys-Global-Oil-Reserve-Estimate.html |

|

U.S. Treasury Increases Flexibility For Energy Tax Credit ProgramThe U.S. Department of Treasury has outlined new guidelines for wage and apprenticeship requirements for projects that hope to take advantage of clean energy tax credits, the agency said in a release on Tuesday. The newly proposed IRS rules detail additional for constructing clean energy production and manufacturing facilities and build on rules already laid out by the IRA of last year. Under the new rules, paying the prevailing wage called for by Labor Department rules and utilizing qualified apprentices will allow companies working to build IRA-qualified… Read more at: https://oilprice.com/Latest-Energy-News/World-News/US-Treasury-Increases-Flexibility-For-Energy-Tax-Credit-Program.html |

|

Water Woes Cloud Green Hydrogen’s Future In The Middle EastA host of energy companies and governments around the globe are backing green hydrogen as the next big renewable energy source. The fuel is highly popular as it can be used to decarbonise the transportation sector, which is notoriously hard to make clean. It could also be used in highly polluting industries. As 1kg of hydrogen contains around three times as much energy as 1kg of petrol, it is viewed by many as a super-fuel for the green transition. But despite much optimism around the energy source, some are now accusing companies of exaggerating… Read more at: https://oilprice.com/Energy/Energy-General/Water-Woes-Cloud-Green-Hydrogens-Future-In-The-Middle-East.html |

|

Chevron Evacuates Gulf Of Mexico Oil Platforms As Hurricane Idalia ApproachesChevron has evacuated three oil and gas platforms in the Gulf of Mexico ahead of tropical storm Idalia which is strengthening to a hurricane and expected to make landfall in Florida on Wednesday. The U.S. supermajor said on Tuesday that it had evacuated non-essential personnel from its Blind Faith and Petronius platforms, and all staff had been removed from its Genesis platform in the Gulf of Mexico. Oil and gas production continued on Tuesday at Chevron’s operated platforms and other facilities in the Gulf of Mexico, a spokesperson… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Chevron-Evacuates-Gulf-Of-Mexico-Oil-Platforms-As-Hurricane-Idalia-Approaches.html |

|

U.S. LNG Exports to Take Center Stage At G7 MeetingU.S. House Speaker Kevin McCarthy has revealed he plans to promote U.S. natural gas exports at an upcoming G7 meeting. McCarthy will frame his agenda in the context of Europe buying more U.S. gas as a way for the continent to wean itself off Russian gas following its war in Ukraine. “If we just replace Russian natural gas with American in Europe alone for one year, we would lower 218 billion tons of CO2 emissions because our natural gas is cleaner. America would be economically stronger, our prices would be lower and the world would… Read more at: https://oilprice.com/Energy/Natural-Gas/US-LNG-Exports-to-Take-Center-Stage-At-G7-Meeting.html |

|

Cartels Take Over As Ecuador’s New Power BrokersEcuador, once an island of peace in the strife-torn Northern Andean region of South America, is caught in the midst of drug-fueled violence, which is exacerbating a long-running political crisis. In an unprecedented event, presidential candidate Fernando Villavicencio was shot down by a Colombian gunman when leaving an August 2023 campaign rally. That occurred after government officials and local politicians were attacked and even murdered over the last year by gangs battling to control Ecuador’s booming cocaine trade. A confluence of events,… Read more at: https://oilprice.com/Geopolitics/International/Cartels-Take-Over-As-Ecuadors-New-Power-Brokers.html |

|

European Majors Look To Expand Venezuela Oil DealsItaly’s Eni and Spain’s Repsol, two major European oil and gas firms, are looking to expand their oil deals with Venezuela with U.S. consent, Reuters reported on Tuesday, quoting sources familiar with the matter. A potential further U.S. exemption for Eni and Repsol could give the companies access to oil swap deals, which could increase fuel deliveries to Venezuela’s state oil firm PDVSA in exchange for Venezuelan crude to be shipped to Europe. Under the current sanctions regime, direct payments to PDVSA are not… Read more at: https://oilprice.com/Latest-Energy-News/World-News/European-Majors-Look-To-Expand-Venezuela-Oil-Deals.html |

|

Is Beijing Losing Control Of Its Economy?Via Metal Miner Many speculate that China’s slowdown will not only undermine metal prices but also put China at risk of experiencing a Japan-style decade of deflation. A recent Financial Times article suggests that China has tried various measures to stimulate economic growth. Examples include cutting lending rates, mortgage rates, business taxes, stock-trading fees, and admission costs at tourist sites. That said, these efforts, including extended EV subsidies, relaxed regulations, Forex market interventions, and extended stock trading hours,… Read more at: https://oilprice.com/Finance/the-Economy/Is-Beijing-Losing-Control-Of-Its-Economy.html |

|

One-third of Toyota’s Global Production Frozen Due To Mysterious GlitchThe world’s biggest-selling automaker has frozen output at all factories across Japan “due to a system malfunction,” according to Bloomberg. A Toyota spokesperson said a ‘glitch’ in ordering parts forced the company to shutter operations at all 14 assembly plants. This is a big problem for the company because it utilizes a just-in-time inventory strategy, which keeps only a limited amount of parts on hand to minimize costs — might lead to supply chain snarls if downtime is long enough. Bloomberg said, “28 assembly lines churning out… Read more at: https://oilprice.com/Latest-Energy-News/World-News/One-Third-Of-Toyotas-Global-Production-Frozen-Due-To-Mysterious-Glitch.html |

|

Oil Prices Remain Flat As Supply Shocks Counter Macroeconomic ConcernsOil prices continue to trade sideways this week, with supply shocks being counteracted by continued macroeconomic pessimism. Chart of the Week- China has at last issued product export quotas that would enable Chinese refiners to ship their surplus barrels overseas, with state-owned Sinopec getting the highest quota share of all.- According to market sources, China will export around 3.5 million tonnes of oil products in September, with almost half of it coming from jet fuel, a 10% month-on-month increase compared to August allocations.- Just as… Read more at: https://oilprice.com/Energy/Energy-General/Oil-Prices-Remain-Flat-As-Supply-Shocks-Counter-Macroeconomic-Concerns.html |

|

Soaring Oil & Gas Prices Made Renewables Cheaper Than Fossil Fuels In 2022The surge in fossil fuel prices last year made renewable energy sources more competitive, with 86% of all new installed renewable capacity exhibiting lower costs in 2022 compared to electricity powered by fossil fuels, the International Renewable Energy Agency (IRENA) said in a new report on Tuesday. In 2022, 187 gigawatts (GW), or 86% of all the newly commissioned renewable capacity, had lower costs than fossil fuel-fired electricity, the agency said. Renewable energy capacity added over the past two decades helped to reduce the electricity… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Soaring-Oil-Gas-Prices-Made-Renewables-Cheaper-Than-Fossil-Fuels-In-2022.html |

|

The U.S. Holds First-Ever Offshore Wind Lease Sale In Gulf Of MexicoThe U.S. Department of the Interior is holding on Tuesday the first-ever offshore wind lease sale in the Gulf of Mexico, the key federal oil and gas production hub. The Bureau of Ocean Energy Management (BOEM) is holding the offshore wind energy lease sale for three areas on the Outer Continental Shelf (OCS) off Louisiana and Texas. The online auction will be held in a series of rounds and will allow qualified offshore wind developers to bid on three lease areas, the first-ever offered in the Gulf of Mexico. The provisional winners… Read more at: https://oilprice.com/Latest-Energy-News/World-News/The-US-Holds-First-Ever-Offshore-Wind-Lease-Sale-In-Gulf-Of-Mexico.html |

|

First bitcoin ETF could be coming soon as court rules in favor of Grayscale over SECFirst bitcoin ETF could be coming soon as court rules in favor of Grayscale over SEC. Read more at: https://www.cnbc.com/2023/08/29/first-bitcoin-etf-could-be-coming-soon-as-court-rules-in-favor-of-grayscale-over-sec.html |

|

Nasdaq pops more than 1% for third straight winning day as tech rebounds from August slump: Live updatesInvestors were keen on tech stocks with Nvidia helping lead the charge for the sector on Tuesday. Read more at: https://www.cnbc.com/2023/08/28/stock-market-today-live-updates.html |

|

Medicare pricing deal set to play a key role in Biden’s 2024 campaign pitchPresident Joe Biden is placing a priority on reducing individual health-care costs as he seeks reelection. Read more at: https://www.cnbc.com/2023/08/29/medicare-pricing-deal-set-to-play-a-key-role-in-bidens-2024-campaign-pitch.html |

|

Regional banks face another hit as regulators force them to raise debt levelsAll American banks with at least $100 billion in assets would be subject to the new requirement. Read more at: https://www.cnbc.com/2023/08/29/regional-banks-to-be-forced-to-raise-debt-in-case-of-failure.html |

|

Investors are ramping up short bets against these electric vehicle makers and small-cap health-care stocksSome on Wall Street are betting that these troubled stocks will keep falling. Read more at: https://www.cnbc.com/2023/08/29/investors-are-ramping-up-short-bets-against-these-electric-vehicle-makers-and-a-big-crypto-play.html |

|

Here are the 3 most-used drugs on the Medicare price negotiation listThe Biden administration unveiled the much-awaited list Tuesday, officially kicking off a process that aims to control rising drug costs in the U.S. Read more at: https://www.cnbc.com/2023/08/29/most-used-drugs-on-medicare-price-negotiation-list-see-the-top-three.html |

|

Hurricane Idalia chases Florida residents from the Gulf Coast as forecasters warn of storm surgeHurricane Idalia is expected to barrel into Florida with the threat of flooding that could swamp the Gulf Coast. Read more at: https://www.cnbc.com/2023/08/29/idalia-strengthens-to-a-hurricane-dangerous-storm-forecast-for-floridas-gulf-coast.html |

|

Apple sends invites for Sept. 12 launch event, new iPhone 15 expectedApple is expected to announce the iPhone 15 and new Apple Watches at its September event. Read more at: https://www.cnbc.com/2023/08/29/apple-event-2023-invites-sent-for-september-12-iphone-15-expected-.html |

|

3M faces more legal headaches after $6 billion earplug settlement3M is also awaiting approval of its $10.3 billion settlement over so-called forever chemicals. Read more at: https://www.cnbc.com/2023/08/29/3m-faces-more-legal-headaches-after-earplug-settlement.html |

|

‘Oppenheimer’ shows Christopher Nolan is the prestige box office hero Hollywood needs“Oppenheimer” continues to explode at the box office. It’s Christopher Nolan’s third-highest grossing domestic release ever. Read more at: https://www.cnbc.com/2023/08/29/oppenheimer-shows-christopher-nolans-box-office-dominance.html |

|

Eminem tells GOP presidential hopeful Vivek Ramaswamy to stop rapping his musicEminem has sent a cease-and-desist order to Republican presidential candidate Vivek Ramaswamy over a performance of “Lose Yourself” at a campaign stop in Iowa. Read more at: https://www.cnbc.com/2023/08/29/eminem-demands-vivek-ramaswamy-stop-rapping-lose-yourself.html |

|

Trump legal challenges: Where the former president’s 7 cases stand right nowDonald Trump is facing trials involving claims of election interference and fraud, a porn star, a writer accusing him of rape, and classified documents. Read more at: https://www.cnbc.com/2023/08/29/trump-legal-challenges-where-the-former-presidents-7-big-cases-stand.html |

|

Buy the August dip in this travel stock with a deep moat and 30% upside, says BernsteinThe recent pullback in this travel stock creates an attractive entry point for investors looking to buy a quality growth company, according to Bernstein. Read more at: https://www.cnbc.com/2023/08/29/buy-the-august-dip-in-this-travel-stock-with-30percent-upside-says-bernstein.html |

|

Americans Abandon Home Insurance: An Ominous Sign In Era Of ‘Bidenomics’In yet another ominous sign, consumers are being pushed to the financial brink, leading some to abandon homeowner insurance due to soaring premiums. Without this coverage, homeowners are left vulnerable to fires, burst pipes, theft, vandalism, and windstorms. “Some skipping insurance say they are doing so because they can no longer afford the rising premiums,” said The Wall Street Journal. New Bankrate data shows insurance on a $250,000 home jumped to $1,428 annually, up 20% from 2022. That’s about a $119 monthly payment.

Amy Bach, executive director at United Policyholders, a national nonprofit insurance consumer-advocacy group, said an increasing number of homeowners in the past several years who have no mortgage or inherited a home are abandoning insurance because they can’t afford it. “It is a risky proposition to go without home insurance, and you need to fully understand the financial consequences if you lose your hom … Read more at: https://www.zerohedge.com/personal-finance/americans-abandon-home-insurance-ominous-sign-era-bidenomics |

|

Almost 70% Of Democrats Say Biden Too Old To Run Again; New AP Poll FindsAuthored by Steve Watson via Summit News, A new Associated Press/NORC poll has found that an overwhelming majority of Americans believe Joe Biden to be too old to run for a second term as president, with a huge amount of Democrats concurring.

In total 77 percent of Americans say Biden is too old to carry out a second term. Unsurprisingly, 89 percent of Republicans feel this way, yet the poll also found that 69 percent of Democrats agree.

|

|

NYC’s Crumbling Infrastructure On Full Display As Century-Old Water Line Floods Times SquareNew York City Mayor Eric Adams is dealing with yet another problem: A century-old water pipe broke early Tuesday, flooding midtown streets and the city’s busiest subway station.

Rohit Aggarwala, commissioner of NYC’s Department of Environmental Protection, told AP News the 20-inch water line erupted around 0300 ET under 40th Street and Seventh Avenue. The pipe was installed 127 years ago. Videos uploaded on X, formerly known as Twitter, show water flooding into the Times Square subway station.

|

|

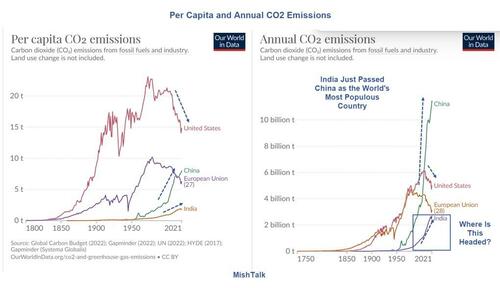

Two Elephants In The ‘Climate Change CO2 Production’ RoomAuthored by Mike Shedlock via MishTalk.com, Noah Smith has a question: What about per capita emissions? I have answers.

Our World in Data, Per Capita and Annual CO2 Emissions bUT wHAT aBOut per cApITA

Per capita emissions in the US are the worlds highest, but they are also crashing. China per capita emissions are rising fast. And check out India. It has passed China as the world’s most populous count … Read more at: https://www.zerohedge.com/geopolitical/two-elephants-climate-change-co2-production-room |

|

Ryanair says air traffic failure is not acceptableAirline boss Michael O’Leary asks why there was no back-up system after glitch causes travel chaos. Read more at: https://www.bbc.co.uk/news/business-66644454?at_medium=RSS&at_campaign=KARANGA |

|

What are my rights if my flight is cancelled or delayed?Technical glitches have caused disruption at airports but passengers do have rights. Read more at: https://www.bbc.co.uk/news/business-61646214?at_medium=RSS&at_campaign=KARANGA |

|

Wilko: Redundancies suspended while rescue bids consideredThe GMB union says the retailer and its 12,500 workforce ‘are not out of the woods yet’. Read more at: https://www.bbc.co.uk/news/business-66645089?at_medium=RSS&at_campaign=KARANGA |

|

Here’s how Prez of India’s top 10 holdings fared in 2023 so farAs per the latest corporate shareholdings filed, the President of India publicly holds 78 stocks with a net worth of over Rs 2,520,595 crore. Talking about the portfolio changes in June 2023, BEML, The Fertilisers and Chemicals Travancore were added to the government’s portfolio, while it increased its stake in IFCI from 66.4% in the March quarter to 70.3% at the end of the previous quarter. A 4.5% stake reduction was seen in Bank of Maharastra, whereas the government sold around a 3% stake in Coal India. Now, let’s have a look at the top 10 holdings of the Government of India and how they fared so far this year. (Source: Trendlyne) Read more at: https://economictimes.indiatimes.com/markets/stocks/news/portfolio-tracker-heres-how-president-of-indias-top-10-holdings-fared-in-2023-so-far/in-spotlight/slideshow/103172050.cms |

|

How Finolex Industries & BEML are looking on charts for Wednesday’s tradeBuying was seen in realty, utilities, metal, power and capital goods on Tuesday while selling was seen in telecom, FMCG and healthcare. Stocks that were in focus on Tuesday include names like Finolex Industries that gained over 7%; BEML that rose over 13% and Gujarat Pipavav Port that closed with gains of over 7%. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/breakout-stocks-how-finolex-industries-beml-and-gujarat-pipavav-are-looking-on-charts-for-wednesdays-trade/articleshow/103179125.cms |

|

Nifty consolidating near 50-DMA. What traders should do on WednesdayThe lower tops and bottoms continued on the daily chart and the present up move of the last two sessions is expected to form a new lower top of the sequence, said Nagaraj Shetti, Technical Research Analyst, HDFC Securities. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/tech-view-nifty-consolidating-near-50-dma-what-traders-should-do-on-wednesday/articleshow/103177969.cms |

|

The 30-year mortgage rate has surpassed 7%, but some buyers are only paying 6%. Here’s how they do it.Mortgage rates have surged to 20-year highs, and are poised to rise even further. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7255-FF4586C53215%7D&siteid=rss&rss=1 |

|

Bond Report: Treasury yields end at almost three-week lows after U.S. job-openings dataTreasury yields fall, with the policy-sensitive 2-year rate below 5%, after U.S. data showing fewer job openings and declining consumer confidence. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7256-244298A2C612%7D&siteid=rss&rss=1 |

|

Eliquis, Jardiance among first 10 drugs selected for Medicare price negotiationsMerck, Johnson & Johnson and Amgen are among the first drugmakers to have products chosen for a contentious initiative to rein in prescription-drug costs. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7256-43A5BE32BF35%7D&siteid=rss&rss=1 |