Summary Of the Markets Today:

- The Dow closed down 150 points or 0.43%,

- Nasdaq closed down 0.36%,

- S&P 500 closed down 0.53%,

- Gold $1,977 up $7.70,

- WTI crude oil settled at $83 up $1.07,

- 10-year U.S. Treasury 4.050% down 0.139 points,

- USD Index $102.04 down $0.50,

- Bitcoin $28,984 down $308,

- Baker Hughes Rig Count: U.S. -5 to 659 Canada -5 to 188

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our Economic Forecast for August 2023

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

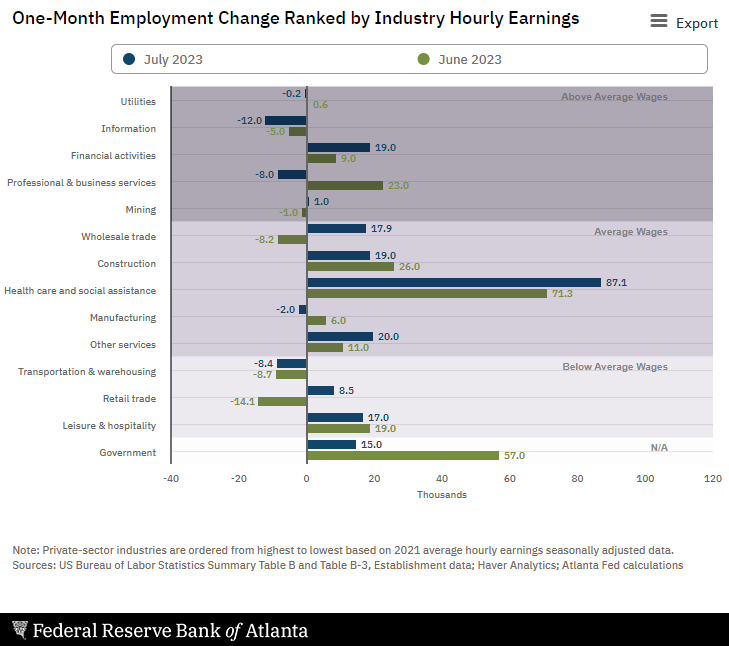

Total nonfarm payroll employment rose by 187,000 in July 2023, and the unemployment rate changed little at 3.5%. The employment gains show a continued cooling of the jobs sector – but still not bad. The household survey shows employment gains of 268,000 against the establishment survey’s 187,000. Health care growth accounted for nearly half of the gains. The leisure and hospitality sector has really cooled off and shows only 17,000 gains.

Here is a summary of headlines we are reading today:

- OPEC’s Production Drops More Than 1 Million Bpd In July: Argus

- Oil Products Accounted For 57% Of 2021 U.S. Energy Expenditure

- Oil Prices Continue To Climb As Pace Of Drilling Continues To Slow

- Amazon stock rallies after blowout quarter

- JPMorgan backs off recession call even with ‘very elevated’ risks

- S&P 500 and Nasdaq tumble for four straight days, both notch worst weeks since March: Live updates

- Here’s where the jobs are for July 2023 — in one chart

- US jobs market holds steady despite rate rises

- Inflation among top 10 factors affecting fixed income market

- Market Snapshot: Stocks turn lower, S&P 500 heads for fourth straight day of losses

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Ex-National Grid Chief: Community Payouts Could Speed Up UK’s Net-Zero GoalsHouseholds near new energy projects should be offered lump sum payments to boost community approval of needed infrastructure and ensure the rollout of new electricity lines, according to a new landmark report on grid connections. Electricity networks commissioner Nick Winser has delivered his report to energy security secretary Grant Shapps, which advocates “speeding up the delivery of strategic electricity transmission lines”, which he described as “challenging but vital and achievable”. The former National Grid chief executive… Read more at: https://oilprice.com/Energy/Energy-General/Ex-National-Grid-Chief-Community-Payouts-Could-Speed-Up-UKs-Net-Zero-Goals.html |

|

OPEC’s Production Drops More Than 1 Million Bpd In July: ArgusA third survey has come in showing that OPEC’s production dipped even more than earlier estimates, according to Argus, which showed that production fell in July by more than 1 million bpd as Russia and Saudi Arabia stepped up their efforts to curtail production. Argus’ survey is just one of many, with each survey looking increasingly more bullish. On July 31, a Reuters survey showed that OPEC output fell 840,000 bpd from June levels, carried mainly by Saudi Arabia, which the survey showed had cut 860,000 bpd from June levels.… Read more at: https://oilprice.com/Latest-Energy-News/World-News/OPECs-Production-Drops-More-Than-1-Million-Bpd-In-July-Argus.html |

|

Pioneering Tech Turns Sunlight And CO2 Into Renewable FuelUniversity of Cambridge researchers have developed a solar-powered technology that converts carbon dioxide and water into liquid fuels that can be added directly to a car’s engine as drop-in fuel. The researchers report on the new technology in Nature Energy. The researchers harnessed the power of photosynthesis to convert CO2, water and sunlight into multicarbon fuels – ethanol and propanol – in a single step. These fuels have a high energy density and can be easily stored or transported. Unlike fossil fuels, these solar fuels… Read more at: https://oilprice.com/Energy/Energy-General/Pioneering-Tech-Turns-Sunlight-And-CO2-Into-Renewable-Fuel.html |

|

Oil Products Accounted For 57% Of 2021 U.S. Energy ExpenditurePetroleum products accounted for the largest share, 57%, of the amount U.S. consumers spent on energy in 2021, as overall energy spending jumped by inflation-adjusted 25% from 2020, due to higher consumption and prices, the Energy Information Administration (EIA) said this week. In 2021, the amount U.S. consumers spent on energy grew to over $1.3 trillion when adjusted for inflation, according to EIA’s SEDS. Petroleum products including motor gasoline, diesel, and jet fuel accounted for $757 billion of end-use energy expenditures… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Oil-Products-Accounted-For-57-Of-2021-US-Energy-Expenditure.html |

|

Supply Chain Snarls Ease As Shipping Rates JumpSpot rates for shipping containers have been rising for four weeks. The latest data from the Drewry World Container Index composite shows the most significant weekly gain in the index in more than two years. The 23-month slump in ocean-freight costs appears to be ending. The Drewry World Container Index jumped 11.79% to $1,761 for a 40-foot container, the largest weekly gain since June 24, 2021 — or the period when shipping costs worldwide were sky-high because of snarled supply chains. All major shipping lines have experienced a multi-year… Read more at: https://oilprice.com/Energy/Energy-General/Supply-Chain-Snarls-Ease-As-Shipping-Rates-Jump.html |

|

Oil Prices Continue To Climb As Pace Of Drilling Continues To SlowThe total number of active drilling rigs in the United States fell by 5 again this week, according to new data from Baker Hughes published Friday. The total rig count fell to 659 this week. So far this year, Baker Hughes has estimated a loss of 120 active drilling rigs. This week’s count is 416 fewer rigs than the rig count at the beginning of 2019 prior to the pandemic. The number of oil rigs declined by 4 this week to 525, down by 96 so far in 2023. The number of gas rigs stayed the same at 128, a loss of 28 active gas rigs from the start… Read more at: https://oilprice.com/Energy/Energy-General/Oil-Prices-Continue-To-Climb-As-Pace-Of-Drilling-Continues-To-Slow.html |

|

Blinken: World Must Stand Against Russia’s Weaponization Of GrainU.S. Secretary of State Antony Blinken on August 3 took aim at Russia in a speech to the UN Security Council in New York, accusing Moscow of “blackmail” over its recent withdrawal from the Black Sea Grain Initiative. Blinken told the 15-member council that “hunger must not be weaponized” and urged all UN countries to tell Russia they have had “enough” of Moscow’s actions. “Enough using the Black Sea as blackmail. Enough treating the world’s most vulnerable people as leverage. Enough of this unjustified unconscionable war,” he said. Blinken… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Blinken-World-Must-Stand-Against-Russias-Weaponization-Of-Grain.html |

|

Superconductor Mania Sends Korean Tech Stocks Sky-HighLate Wednesday, the Korean Exchange warned investors about speculative trading in superconductor-related stocks following claims of a technological breakthrough that could revolutionize the energy industry. On Thursday, small-cap stocks such as Duksung Co. and Sunam Co. surged as much as their 30% daily limits for their third consecutive session. Sunam has jumped 220% in the last eight sessions, while Duksung has increased 165%. Mobiis Co. and Shinsung Delta Tech Co. have risen by 125% and 107%, respectively. Because of the volatility, the… Read more at: https://oilprice.com/Energy/Energy-General/Superconductor-Mania-Sends-Korean-Tech-Stocks-Sky-High.html |

|

Bullish Momentum Is Building For CrudeCrude oil prices are set to post a sixth straight week of gains on the back of a tighter market and easing recession fears. Friday, August 04, 2023The coordinated supply-side management of Saudi Arabia and Russia has set oil prices for a sixth weekly gain, with the two OPEC+ heavyweights extending their production and export cuts into September. Brent has moved above $85 per barrel, the highest level since March, and one could argue there is still further upside coming from Friday’s attack on Russia’s Black Sea oil terminals and… Read more at: https://oilprice.com/Energy/Energy-General/Bullish-Momentum-Is-Building-For-Crude.html |

|

Ukrainian Drones Target Russian Ship At Major Oil Export TerminalUkrainian security services and navy hit with drones a Russian Navy ship outside the Russian oil export port of Novorossiysk on the Black Sea. The Russian Navy landing ship, Olenegorsky Gornyak, was damaged in the attack, Ukraine says, while Russia said it had repelled the attack. Videos of the purported attack started circulating in social media. Sources have told Ukrainian media outlet “Ukrainska Pravda” that Ukraine’s security service, SBU, and the Ukrainian Navy carried out the operation with a drone… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Ukrainian-Drones-Target-Russian-Ship-At-Major-Oil-Export-Terminal.html |

|

Oil Prices Are On A Six-Week Winning StreakCrude oil prices were set for yet another weekly gain after Saudi Arabia said it would extend its voluntary production cuts of 1 million bpd into September. The Kingdom added fuel to the rally by suggesting it could extend them beyond September, too, or deepen the cuts, or combined both an extension and deeper cuts. Prices got an additional boost this week from the American Petroleum Institute and the Energy Information Administration, which both estimated the most significant drawdown in U.S. oil inventories in years for the last week… Read more at: https://oilprice.com/Energy/Oil-Prices/Oil-Prices-Are-On-A-Six-Week-Winning-Streak.html |

|

Canadian Oil Producers Eye Big Boost With Trans Mountain ExtensionCanadian oil sands producers are in a rush to boost production as the Trans Mountain expansion comes online, providing an additional 590,000 bpd in capacity. Bloomberg reports that Canadian Natural Resources and Cenovus are among the producers planning on output boosts in the coming months. Canadian Natural Resources plans to increase production by some 40,000 bpd in the current quarter, while Cenovus will take longer, starting a new production site in 2025. “This industry has a great habit of expanding to fill pipeline capacity,”… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Canadian-Oil-Producers-Eye-Big-Boost-With-Trans-Mountain-Extension.html |

|

Supermajors Return To Libya As Political Climate StabilizesBP and Eni, as well as Algeria’s Sonatrach have returned to Libya after a force majeure forced them out of the North African country. In a statement, Libya’s National Oil Corporation said that BP and Eni had notified it about lifting the force majeure and returning to fulfill their contractual obligations in several onshore and offshore blocks the Libyan government had previously awarded to them. Foreign oil and gas companies declared forcer majeure on their operations in Libya amid the troubled political situation in the country that… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Supermajors-Return-To-Libya-As-Political-Climate-Stabilizes.html |

|

OPEC+ Leaves Oil Output Levels UnchangedThe Joint Ministerial Monitoring Committee (JMMC) of OPEC+ affirmed on Friday the current levels of oil production of the group and didn’t make any recommendation to change the output at this time. In a very short meeting, as expected, the JMMC panel, which regularly discusses the situation on the market and the need for OPEC+ intervention, rubberstamped the OPEC+ decisions from June 4, when the current cuts – initially set for May through December 2023 – were extended to the end of 2024. … Read more at: https://oilprice.com/Energy/Crude-Oil/OPEC-Leaves-Oil-Output-Levels-Unchanged.html |

|

One Sector To Watch Oil As Oil Prices RallyAfter remaining range-bound for much of the second quarter, oil prices have mounted a significant rally, with analysts saying oil markets are finally waking up to the fact that fundamentals have tightened significantly. After remaining in surplus for months, many experts have predicted that demand will begin to surpass supply thus improving oil prices and margins for oil refiners. For instance, StanChart’s demand model projects a supply deficit of 2.81 million barrels per day in August; 2.43 mb/d in September and more than 2mb/d in November… Read more at: https://oilprice.com/Energy/Crude-Oil/One-Sector-To-Watch-Oil-As-Oil-Prices-Rally.html |

|

Google is offering an on-campus hotel ‘special’ to help lure workers back to the officeThe offer is part of the search giant’s efforts to bring remote employees back to offices. Read more at: https://www.cnbc.com/2023/08/04/google-offers-on-campus-hotel-special-to-lure-workers-back-in.html |

|

Amazon stock rallies after blowout quarterAnalysts cheered stabilizing AWS growth, improving retail margins and progress on cutting costs. Read more at: https://www.cnbc.com/2023/08/04/amazon-stock-on-pace-for-best-day-since-november-after-blowout-quarter.html |

|

JPMorgan backs off recession call even with ‘very elevated’ risksEconomists at the country’s largest bank bailed on their recession call, joining a growing chorus that now thinks a contraction is no longer inevitable. Read more at: https://www.cnbc.com/2023/08/04/jpmorgan-backs-off-recession-call-even-with-very-elevated-risks.html |

|

‘Barbie’ is less than $100 million away from a billion-dollar box office heading into third weekend“Barbie” is expected to hit a billion-dollar benchmark before Monday, making Greta Gerwig the first solo female director to have a film cross the mark. Read more at: https://www.cnbc.com/2023/08/04/barbie-box-office-nears-1-billion-heading-into-third-weekend.html |

|

Apple shares slide after it reports decreased revenue for iPhone and other hardwareShares of Apple were down Friday morning after the company reported lower year-over-year revenue for its flagship products in its third quarter. Read more at: https://www.cnbc.com/2023/08/04/apple-shares-slide-after-it-reports-decreased-hardware-revenue.html |

|

These stocks reporting earnings next week have historically exceeded expectations and rallied as a resultCNBC Pro screened for stocks that have historically beat analysts’ expectations at a high rate and rallied more than 1%. Read more at: https://www.cnbc.com/2023/08/04/these-stocks-reporting-earnings-next-week-usually-beat-expectations-and-rally.html |

|

S&P 500 and Nasdaq tumble for four straight days, both notch worst weeks since March: Live updatesThe three major indexes are on pace for week-to-date losses. Read more at: https://www.cnbc.com/2023/08/03/stock-market-today-live-updates.html |

|

Facing lawsuit from Musk, nonprofit head says he won’t stop exposing Twitter’s problemsThe head of the Center for Countering Digital Hate said his nonprofit will continue researching alleged hate speech on Twitter despite a lawsuit from Musk. Read more at: https://www.cnbc.com/2023/08/04/ccdh-head-says-he-wont-stop-exposing-twitter-problems-after-musk-suit.html |

|

Here’s where the jobs are for July 2023 — in one chartThe health care and social assistance category grew by 87,100 jobs last month, continuing a hot streak. Read more at: https://www.cnbc.com/2023/08/04/heres-where-the-jobs-are-for-july-2023-in-one-chart.html |

|

Trump pleads not guilty to new classified documents charges, waives arraignment appearanceDonald Trump is charged in two federal criminal cases and has pleaded not guilty in both. One relates to the 2020 election, the other to classified records. Read more at: https://www.cnbc.com/2023/08/04/trump-pleads-not-guilty-to-new-classified-documents-charges.html |

|

The story of inflation, as told through your child’s backpackAmericans are expected to spend a record amount on school supplies this year. They’re feeling sticker shock as inflation continues to push up prices. Read more at: https://www.cnbc.com/2023/08/04/back-to-school-shopping-prices-rise-for-backpacks-notepads-pens.html |

|

How Brightline is changing passenger rail in the U.S.Brightline is looking to connect the U.S. with passenger rail, starting with its Florida project, and moving on to create a high-speed line on the west coast. Read more at: https://www.cnbc.com/2023/08/04/how-brightline-is-changing-passenger-rail-in-the-us.html |

|

Chris Christie meets Zelenskyy in Ukraine as he tries to build momentum in GOP primary raceChristie reiterated his support for increasing U.S. aid to Ukraine, contrasting himself with his GOP primary rivals including former President Donald Trump. Read more at: https://www.cnbc.com/2023/08/04/gop-hopeful-christie-makes-surprise-trip-to-ukraine-visits-zelenskyy.html |

|

How Wall Street Is Killing The American DreamAuthored by James Gorrie via The Epoch Times, Single-family home ownership is under assault by ultra-wealthy investment firms…

The biggest single aspect of the American Dream is owning a home. Not only is a single-family residence (SFR) the single biggest investment most Americans will make in their lifetimes, but home ownership also is a way for people to move within the American economy. Lower-priced starter homes help people get on the real estate ladder, and move up into larger homes, if they desire, as their incomes, wealth, and savings increase. In short, homeownership has been the key to people entering the middle class But that’s proving more difficult these days. There are the usual suspects for skyrocketing home prices, such as inflation and rising interest rates. Of course, there’s often buyers that are competing for the same house. But for one in four b … Read more at: https://www.zerohedge.com/personal-finance/how-wall-street-killing-american-dream |

|

Meta Hit With Trifecta Of Fails: Metaverse, Smart Glasses, ThreadsUnder Mark Zuckerberg, Meta, previously known as Facebook, has faced a trifecta of recent failed product launches. The latest is the ‘Twitter-killer’ app “Threads,” which has already lost 80% of its daily active users. Meta’s ambitious venture into the world of creepy smart glasses has also ended in a flop, as well as its massive bet on the “metaverse.” Let’s begin with Threads. Similarweb, a digital intelligence platform, shared new data with Gizmodo, showing active Threads users were around 49 million two days after the July 5 launch. As of Tuesday, that number stands at only 9.6 million.

Similarweb data also showed user time spent on what some have called a ‘Twitter clone’ app peaked on July 6 at about 14 minutes and has since collapsed to just 2.3 minutes. We have observed Thr … Read more at: https://www.zerohedge.com/markets/meta-hit-trifecta-fails-metaverse-smart-glasses-threads |

|

Ramaswamy Wins Lawsuit Against World Economic Forum After Being Labeled A ‘Young Global Leader’Authored by Steve Watson via Summit News, Republican Vivek Ramaswamy has recorded a victory against the World Economic Forum in court, after the globalist organisation named him one of their ‘Young Global Leaders’ against his will.

Ramaswamy, who is running a presidential campaign, explained that he “explicitly rejected their ridiculous award,” two years ago and that Klaus Schwabb’s outfit “repeatedly failed to remove my name despite escalating demands. So I sued them. And we just succeeded.” He claimed that “I’ve been the leading opponent in America of the World Economic Forum’s agenda.”

|

|

Coinbase Seeks To Dismiss SEC Lawsuit, Argues It Doesn’t Trade SecuritiesCoinbase has asked a judge to end the Securities and Exchange Commission’s frivolous lawsuit accusing the world’s largest publicly traded cryptocurrency exchange of violating federal securities laws. In a filing in federal court in Manhattan, Coinbase said the SEC had “violated due process, abused its discretion, and abandoned its own earlier interpretations of the securities laws” in asserting certain regulatory authority over the crypto exchange, and that it had no authority to pursue its lawsuit because the digital assets and services it objected to did not qualify as securities, accusing the agency of overreach. Coinbase’s filing disputed that transactions of the 12 tokens at issue in the SEC case met the definition of “investment contracts” under the Howey test and the exchange was operating as an unregistered broker, and argued the commission’s challenges to its staking program “fail as a matter of law.” The crypto firm has requested the court dismiss the case, arguing the SEC’s enforcement action was “punitive” and represented an overreach in its authority granted by Congress. Coinbase also leaned on a recent Ripple ruling, in which a Manhattan judge ruled that the SEC regulator overstepped its authority by trying to regulate the sector; Coinbase said the SEC’s lawsuit hinges on the type of transactions that the judge deemed outside of the regulator’s jurisdiction. “Our core argument is si … Read more at: https://www.zerohedge.com/markets/coinbase-seeks-dismiss-sec-lawsuit-argues-it-doesnt-trade-securities |

|

British Airways workers to get 13% pay riseAround 24,000 staff will get a pay increase and one-off payment of £1,000, the Unite union says. Read more at: https://www.bbc.co.uk/news/business-66404999?at_medium=RSS&at_campaign=KARANGA |

|

US jobs market holds steady despite rate risesEmployers added 187,000 jobs in July raising hopes that the economy will avoid a painful downturn. Read more at: https://www.bbc.co.uk/news/business-66408284?at_medium=RSS&at_campaign=KARANGA |

|

What has gone wrong at Wilko?The discount retailer was founded in 1930 but has faced a raft of problems in recent years. Read more at: https://www.bbc.co.uk/news/business-66394238?at_medium=RSS&at_campaign=KARANGA |

|

Inflation among top 10 factors affecting fixed income marketAccording to Dr. Poonam Tandon, Chief Investment Officer of IndiaFirst Life Insurance Company, fixed income instruments are a series of cash flows. They carry a fixed rate of return and maturity period. Fixed-income securities are issued by both government and private companies. They can be short or long-term. Those maturing before 365 days are known as money market securities. Long-term fixed-income securities have more than one-year maturity. Take a look at the top 10 factors affecting fixed income market: Read more at: https://economictimes.indiatimes.com/markets/stocks/news/inflation-us-fed-actions-among-top-10-factors-affecting-fixed-income-market/pro-take/articleshow/102432948.cms |

|

Fortis board gives nod for diagnostic arm IPO, net profit drops 9% in Q1FY24Agilus was earlier called SRL Diagnostics, which was rebranded in May this year. Fortis Healthcare on Friday reported a 9% year-on-year (YoY) drop in net profit to Rs 122.5 crore in Q1FY24 Read more at: https://economictimes.indiatimes.com/markets/ipos/fpos/fortis-board-gives-nod-for-diagnostic-arm-ipo-net-profit-drops-9-in-q1fy24/articleshow/102433692.cms |

|

Tech View: Sell-on-rally mode till 19,660 gets taken out decisively. What traders should do next weekThe hourly momentum indicator has also reached the equilibrium line indicating that the pullback has matured and can begin a new cycle on the downside, said Nagaraj Shetti of HDFC Securities. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/tech-view-sell-on-rally-mode-till-19660-gets-taken-out-decisively-what-traders-should-do-next-week/articleshow/102429670.cms |

|

Futures Movers: Oil scores 6th straight weekly rise after supply cutsOil futures notch a sixth straight weekly gain after Saudi Arabia and Russia said they would extend supply cuts. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7241-672BC4C1C6E0%7D&siteid=rss&rss=1 |

|

Market Snapshot: Stocks turn lower, S&P 500 heads for fourth straight day of lossesU.S. stocks give up gains Friday afternoon, with the S&P 500 on track for a fourth straight day of losses, as investors parsed the July jobs report from the Department of Labor along with Big Tech earnings from Amazon and Apple. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7241-5906E04B9F10%7D&siteid=rss&rss=1 |

|

The Moneyist: My sibling ‘borrows’ hundreds of thousands of dollars from our parents. Should I take my inheritance now before it’s too late?‘I’m fearful that one day when I need help, our family funds will have all been spent helping this sibling.’ Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7241-4AF4D5DB6AFA%7D&siteid=rss&rss=1 |