Summary Of the Markets Today:

- The Dow closed down 67 points or 0.19%,

- Nasdaq closed down 0.10%,

- S&P 500 closed down 0.25%,

- Gold $1,969 down $6.30,

- WTI crude oil settled at $82 up $2.19,

- 10-year U.S. Treasury 4.183% up 0.105 points,

- USD Index $102.51 down $0.08,

- Bitcoin $29,261 up $133,

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our Economic Forecast for August 2023

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

U.S.-based employers announced 23,697 job cuts in July 2023 a 42% decrease from the 40,709 cuts announced one month prior. It is 8% lower than the 25,810 cuts announced in the same month last year, and marks the first time this year cuts were lower than the corresponding month one year earlier.

Nonfarm business sector labor productivity increased 1.3% year-over-year in the second quarter of 2023 – an improvement from the previous quarter’s -0.6% year-over-year. Unit labor costs increased 2.4% in the same period which is a slowing from the previous period.

New orders for manufactured goods in June 2023 decreased 0.2% year-over-year (but UP 6.1% inflation-adjusted – red line on the graph below). The Federal Reserve’s industrial production manufacturing is down 0.3% year-over-year.

In the week ending July 29, the advance figure for seasonally adjusted initial unemployment claims 4-week moving average was 228,250, a decrease of 5,500 from the previous week’s unrevised average of 233,750.

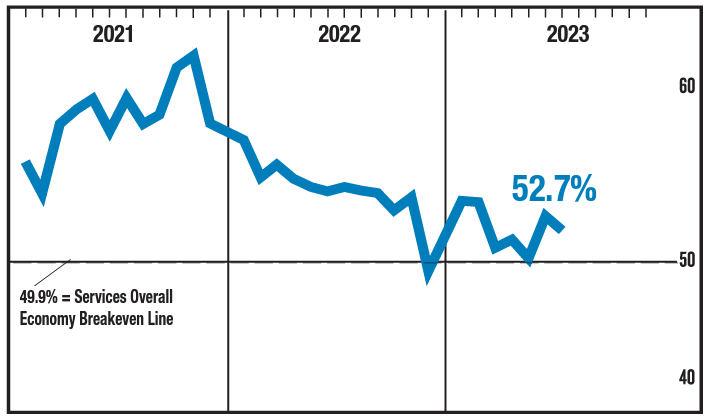

In July 2023, the ISM Services PMI® registered 52.7%, 1.2 percentage points lower than June’s reading of 53.9 percent. The Business Activity sub-index registered 57.1 percent, a 2.1 percentage point decrease compared to the reading of 59.2 percent in June. The New Orders sub-index was 55% and is 0.5 percentage points lower than the June reading of 55.5%. These numbers represent a weak growth service sector.

Forty-two percent of small business owners (seasonally adjusted) reported job openings they could not fill in the current period, according to NFIB’s monthly jobs report. The percent of small business owners reporting labor quality as their top small business operating problem remains elevated at 23%, down one point from June. Labor costs reported as the single most important problem to owners increased by two points to 10%. NFIB Chief Economist Bill Dunkelberg stated:

The small business economy continues to struggle with the current job market, with owners working hard to fill open positions. Hiring plans are trending down but are still historically strong in the face of a weakening economy.

Here is a summary of headlines we are reading today:

- Automakers Bank On Gigafactories For EV Expansion

- Colombia’s Economic Woes Worsen As Cocaine Prices Plunge

- What Does China’s Stimulus Plan Mean For Rare Earths?

- The Oil Price Rally Is Gaining Serious Momentum

- Oil Markets On Edge Ahead Of Saudi Arabia’s Next Production Cut Announcement

- S&P 500 closes lower for a third day as rising bond yields pressure stocks: Live updates

- Stocks making the biggest moves midday: Southwest Airlines, Qualcomm, Roku, Clorox and more

- Bond Bloodbath Builds, Yield Curve Steepens, Black Gold Bounces Ahead Of Payrolls

- ‘COVID-Karen’ Installed As Fauci’s Replacement At NIAID

- Morgan Stanley upgrades India to overweight, downgrades China

- Market Snapshot: U.S. stocks edge lower after biggest drop in 3 months

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Automakers Bank On Gigafactories For EV ExpansionElectric vehicle (EV) companies worldwide are constructing “gigafactories”, huge factories that produce very large numbers of batteries for electric vehicles. The construction of these types of factories is becoming more popular worldwide, as automakers look to manufacture batteries for their vehicles and ensure their supply chain is stable, particularly following the challenges of the Covid pandemic. Over the next decade, we can expect this model of battery production to become more commonplace, with lithium batteries being manufactured… Read more at: https://oilprice.com/Energy/Energy-General/Automakers-Bank-On-Gigafactories-For-EV-Expansion.html |

|

Nigerian Military Destroys 36 Illegal Refining Sites In Niger DeltaNigerian military forces have destroyed 36 illegal refining sites and arrested 22 suspected oil thieves in the Niger Delta in the country’s latest crackdowns on illegal oil trade, with a Defense Headquarters spokesperson telling local media that the operation recovered 310,700 liters of crude oil; 14,675 liters of Automotive Gas Oil, 49,000 liters of Dual Purpose kerosene and assorted weapons. “Troops on July 24, intercepted and destroyed one wooden boat loaded with 1000 litres of product suspected to be stolen crude oil at Wellhead… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Nigerian-Military-Destroys-36-Illegal-Refining-Sites-In-Niger-Delta.html |

|

Energy Emergency Spurs Kyrgyzstan’s Hydropower Collaboration With ChinaLong-reliant on hydropower to keep its power grid up and running, Kyrgyzstan is grappling with nationwide electricity shortages so severe that the government declared a three-year energy emergency that took effect on August 1. In seeking to build its power-generating capacity, Kyrgyz authorities also want to push forward with long-held plans for a series of new hydropower plants (HPP) along the Naryn River, with Bishkek signing a memorandum of understanding and an investment agreement with a consortium of Chinese companies on July 27. Few details… Read more at: https://oilprice.com/Alternative-Energy/Hydroelectric/Energy-Emergency-Spurs-Kyrgyzstans-Hydropower-Collaboration-With-China.html |

|

Russia To Cut Oil Exports By 300,000 bpd In SeptemberRussia will cut oil exports by 300,000 barrels per day in September, Deputy Prime Minister Alexander Novak has announced. Russia has already pledged to cut oil output by around 500,000 bpd from March until year-end. “Within the efforts to ensure the oil market remains balanced Russia will continue to voluntarily reduce its oil supply in the month of September, now by 300,000 barrels per day, by cutting its exports by that quantity to global markets,” Novak has said. The news comes shortly after Saudi Arabia said it would extend its unilateral voluntary… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Russia-To-Cut-Oil-Exports-By-300000-bpd-In-September.html |

|

Colombia’s Economic Woes Worsen As Cocaine Prices PlungeSurging cocaine production, which hit yet another annual record during 2021, makes Colombia the world’s top supplier of the illicit narcotic. The vast profits generated by cocaine are a primary driver of Colombia’s decades-long multiparty low-level asymmetric conflict, which has claimed at least 450,000 lives. Since 2018, as cocaine production soared, violence across the Andean country surged, deterring foreign investment and impacting the economy, including the beaten-down oil industry, which has operations located in key… Read more at: https://oilprice.com/Finance/the-Economy/Colombias-Economic-Woes-Worsen-As-Cocaine-Prices-Plunge.html |

|

ConocoPhillips Agrees To Long-Term LNG Deal With MexicoConocoPhillips has agreed to a long-term LNG deal from a $15 billion export terminal that is being built in Puerto Libertad, Sonora, Mexico, according to a press release. The free on-board basis deal with span 20 years, with Conoco committing to purchasing 2.2 million tons per year of LNG from Mexico Pacific Limited LLC. Mexico Pacific Limited LLC is building out the terminal and in Sonora, Mexico, which is expected to cost some $15 billion. It is also planning to build a 500-mile-long pipeline as part of the project. The annual capacity of the… Read more at: https://oilprice.com/Latest-Energy-News/World-News/ConocoPhillips-Agrees-To-Long-Term-LNG-Deal-With-Mexico.html |

|

What Does China’s Stimulus Plan Mean For Rare Earths?Via Metal Miner Month-over-month, the Rare Earths MMI (Monthly Metals Index) broke its short-term sideways trend and once again spiked down. Overall, the index witnessed a 10.03% decrease as reduced short-term demand continues to cause more and more supply to build up. This leaves rare earth prices struggling to find support. However, the prospect of China offering a stimulus plan could add support to rare earths prices, particularly rare earth magnets. That said, a stimulus plan would not provide long-term bullish sentiment. In order for… Read more at: https://oilprice.com/Metals/Commodities/What-Does-Chinas-Stimulus-Plan-Mean-For-Rare-Earths.html |

|

Oil Protestors Drape Home Of British PM In Black FabricFive Greenpeace protesters have been arrested after covering the home of British Prime Minister Rishi Sunak in black sheets of fabric on Thursday as the group seeks to challenge the UK’s oil drilling policies. The protests stood atop the home with a banner that read “Rishi Sunak- oil profits or our future?” The United Kingdom has drawn the wrath of environmentalists with its “proportionate approach” to climate change as it seeks to juggle energy security, the cost of energy to consumers, and environmental concerns… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Oil-Protestors-Drape-Home-Of-British-PM-In-Black-Fabric.html |

|

Hedge Funds Boost Bullish Bets On OilMoney managers have grown increasingly optimistic about a recovery in oil prices and have raced to close out bearish bets on petroleum futures over the past month. Shrinking supply due to the OPEC+ and Saudi Arabia’s cuts and resilient demand despite recession fears – with oil consumption estimated to have already set record highs in July – have made fundamentals look increasingly bullish for the rest of the year. Macroeconomic sentiment in the oil market has also improved, with Fed cues that the U.S. could manage… Read more at: https://oilprice.com/Energy/Crude-Oil/Hedge-Funds-Boost-Bullish-Bets-On-Oil.html |

|

Nigeria Looks To Attract Oil & Gas Investment At International RoadshowNigeria plans to hold an international roadshow to attract investments in its upstream sector, the petroleum regulator of OPEC’s biggest African oil producer said in a speech shared with Reuters. The Nigerian Upstream Petroleum Regulatory Commission (NUPRC) plans to organize in the coming weeks an international roadshow to pitch upstream investments in the country, which looks to boost its oil production and significantly raise its natural gas output. NUPRC plans to organize in the coming weeks its first Nigerian… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Nigeria-Looks-To-Attract-Oil-Gas-Investment-At-International-Roadshow.html |

|

UK Energy Giant Drax In Hot Water Over Alleged Misuse Of Profit CapThe chair of a leading Westminster panel has vowed to investigate reports Drax has been switching off one of its biomass units to reduce pay-outs to customers last winter. Angus MacNeil, SNP MP and chair of the energy security and net zero committee told City A.M. the latest accusations were “concerning” and could be included in its upcoming review of customer protections. He said: “These are concerning reports which merit further investigation, I will bring these facts to my wider committee for further deliberation. Further,… Read more at: https://oilprice.com/Energy/Energy-General/UK-Energy-Giant-Drax-In-Hot-Water-Over-Alleged-Misuse-Of-Profit-Cap.html |

|

Cheniere Q2 Revenue Halves As LNG Prices SlumpCheniere Energy (NYSEAMERICAN: LNG) reported higher-than-expected net income for the second quarter of 2023, but its revenues halved from last year amid lower international LNG prices. Cheniere’s net income jumped by 85% year-on-year to $1.369 billion, but revenue plunged by 49% to $4.1 billion in the second quarter, the biggest U.S. LNG exporter said on Thursday. Cheniere shipped 149 LNG cargoes in the second quarter of 2023, down from 156 cargoes for the same period last year, as LNG volumes fell by 5% year over year. During the three months… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Cheniere-Q2-Revenue-Halves-As-LNG-Prices-Slump.html |

|

The Oil Price Rally Is Gaining Serious MomentumThe oil markets were slow to react to obviously bullish catalysts such as supply cuts, falling inventories and growing demand when they first kicked in about three months ago. Indeed, it appeared that the bears were about to overrun the markets, with bearish positioning in the oil futures markets recently sinking to the extremes they last did during the 2009 financial crisis. However, just as Saudi Energy Minister Abdulaziz bin Salman had warned speculators of an impending short squeeze, the oil markets have turned around and the… Read more at: https://oilprice.com/Energy/Oil-Prices/The-Oil-Price-Rally-Is-Gaining-Serious-Momentum.html |

|

Oil Prices Jump As Saudi Arabia Extends Oil Production CutOil prices jumped on Thursday after Saudi Arabia said it would extend its unilateral voluntary cut of 1 million barrels per day (bpd) into September, adding that the cut could be extended or extended and deepened. Minutes after the Saudi announcement via the official Saudi Press Agency, oil prices – which were flat until then – rose by 1%. The Saudi extension was largely expected by the market and traders. The announcement comes a day ahead of a regular meeting of the Joint Ministerial Monitoring Committee (JMMC) of the OPEC+ group,… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Oil-Prices-Jump-As-Saudi-Arabia-Extends-Oil-Production-Cut.html |

|

Oil Markets On Edge Ahead Of Saudi Arabia’s Next Production Cut AnnouncementAs the OPEC+ panel prepares to meet virtually on Friday, the oil market is more closely watching the next move from Saudi Arabia, OPEC’s top producer and de facto leader. The Joint Ministerial Monitoring Committee (JMMC) of the OPEC+ group, which regularly discusses the situation on the market and the need for OPEC+ intervention, is meeting in the early afternoon Vienna time on August 4 to take stock of the most recent market developments. While the panel is not expected to make recommendations to the OPEC+ ministers to change current supply,… Read more at: https://oilprice.com/Energy/Energy-General/Oil-Markets-On-Edge-Ahead-Of-Saudi-Arabias-Next-Production-Cut-Announcement.html |

|

Apple earnings live updates: What analysts are looking forThe June period is typically Apple’s slowest quarter of the year. Read more at: https://www.cnbc.com/2023/08/03/apple-earnings-live-updates.html |

|

Amazon earnings are out – here are the numbersAmazon investors will be focused on cloud revenue growth, retail margins and commentary around artificial intelligence in the company’s earnings report. Read more at: https://www.cnbc.com/2023/08/03/amazon-amzn-q2-earnings-report-2023.html |

|

S&P 500 closes lower for a third day as rising bond yields pressure stocks: Live updatesThe S&P 500 ticked lower Thursday, after notching its worst day since April, as Wall Street struggled to shake off a rise in bond yields. Read more at: https://www.cnbc.com/2023/08/02/stock-market-today-live-updates.html |

|

Microsoft is touting the size and growth rate of its Salesforce rival DynamicsDynamics grew faster than almost all other parts of Microsoft in the latest fiscal year, and the company is now giving investors more clarity on its size. Read more at: https://www.cnbc.com/2023/08/03/microsoft-discloses-scale-of-dynamics-software-in-annual-report.html |

|

Americans are going abroad in droves — at the expense of domestic travelThe shift overseas is driving up international airfares and room rates, while domestic growth lags. Read more at: https://www.cnbc.com/2023/08/03/international-travel-surges-domestic-airfares-hotel-rates-lag.html |

|

Buy these high-quality stocks as the macro backdrop remains uncertain, Bernstein saysHigh-quality stocks trading at a reasonable valuation outperform during periods of macro uncertainty, according to Bernstein. Read more at: https://www.cnbc.com/2023/08/03/buy-these-high-quality-stocks-as-macro-backdrop-remains-uncertain-bernstein-says.html |

|

Trump arraignment live updates: Ex-president enters courtroom to face election interference chargesThe hearing before a federal magistrate judge will take place at 4 p.m. ET, according to the Department of Justice. Read more at: https://www.cnbc.com/2023/08/03/-donald-trump-arraignment-live-updates.html |

|

Infant RSV shot wins backing of CDC advisors, paving way for fall availabilitySanofi has said the companies are prepared to roll the shot out before RSV season this fall and do not foresee any challenges meeting demand. Read more at: https://www.cnbc.com/2023/08/03/infant-rsv-shot-faces-final-hurdle-at-cdc-could-be-available-by-fall.html |

|

Stocks making the biggest moves midday: Southwest Airlines, Qualcomm, Roku, Clorox and moreThese are the stocks posting the largest moves in midday trading. Read more at: https://www.cnbc.com/2023/08/03/stocks-making-the-biggest-moves-midday-luv-qcom-roku-clx.html |

|

Bitcoin launderer pleads guilty, admits to massive Bitfinex hackPlea hearings for the Crypo Couple were moved up due to the arraignment of former President Donald Trump in the same Washington, D.C., courthouse. Read more at: https://www.cnbc.com/2023/08/03/new-york-man-admits-being-original-bitfinex-hacker-during-guilty-plea-in-dc-to-bitcoin-money-laundering.html |

|

Unprecedented Canada wildfires obliterate previous annual pollution record in just seven monthsAstonished climate scientists have warned that the unprecedented nature of what’s happening in Canada is a harbinger of what’s still to come. Read more at: https://www.cnbc.com/2023/08/03/canada-wildfires-emissions-more-than-double-previous-annual-record.html |

|

Secondhand luxury watch prices slump to near two-year low after a pandemic runExperts had warned that a bubble could burst along with cryptocurrency and other trendy pandemic booms. But the recent declines appear to mark a stabilization. Read more at: https://www.cnbc.com/2023/08/03/secondhand-luxury-watch-prices-slump.html |

|

Qualcomm stock drops 10% as phone chip sales diveThe chipmaker beat on the top line but reported weaker-than-expected revenue and upcoming guidance, following a sharp downturn in income. Read more at: https://www.cnbc.com/2023/08/03/qualcomm-stock-down-q3-earnings-on-falling-phone-chip-sales.html |

|

Bond Bloodbath Builds, Yield Curve Steepens, Black Gold Bounces Ahead Of PayrollsAnother day, another clubbing of bond bulls (and oil bears)…

Services surveys signaled ‘stickier’ inflation, jobless claims (and falling challenger job cuts YoY) confirmed labor market remains strong, and factory orders jumping all helped send Treasury yields to new cycle highs (and initially weighed on stocks before the ubiquitous wave of buying came back in). Futures were slammed around the Asia-close-Europe-open and then again at the US cash open before bouncing back aggressively after the ISM data at 10ET. Once Europe closed, stocks faded to end in the red… Read more at: https://www.zerohedge.com/markets/bond-bloodbath-builds-yield-curve-steepens-black-gold-bounces-ahead-payrolls |

|

Retailers Strike Back! 7-Eleven Workers Beat Brazen Mega-Shoplifter With A StickIn what we hope will be looked back on as the pivotal stick-whooping heard ’round the world, two 7-11 workers in California lashed out at a mega-shoplifter who’d defiantly thrown hundreds of cigarette packs into a rolling, 55-gallon trash can. It’s easily the year’s most heartwarming video so far. As the action begins, we see a black man, with most of his head covered, brazenly rolling a large, trash bin along a wall full of individual cigarette packs and other nicotine products.

As two Indian-accented store employees verbally confront him, the thief aggressively moves his right hand toward the 5-o’clock position on his waistband, which is covered by a baggy t-shirt. As he does, he exclaims, “Shut your ass up” and threatens to “put my strap on your bitch ass.” Strap is urban slang for a pistol. With the audience temporarily left to wonder if … Read more at: https://www.zerohedge.com/political/retailers-strike-back-7-eleven-workers-beat-brazen-mega-shoplifter-stick |

|

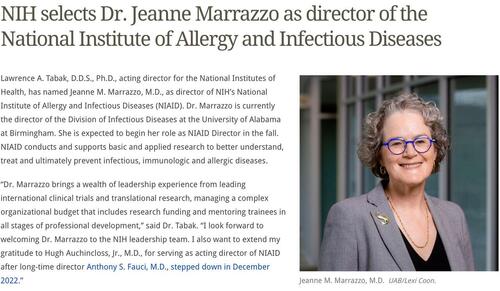

‘COVID-Karen’ Installed As Fauci’s Replacement At NIAIDAuthored by Jordan Schachtel via ‘The Dossier’ Substack, There will soon be a new boss in town over at the Government Health insane asylum and off the books pharmaceutical lobbying outfit that is the National Institute of Allergy and Infectious Diseases (NIAID). Her name is Dr Jeanne Marrazzo, and she has been named to replace Fauci as the new NIAID chief.

She shares many similarities with her predecessor. Both come from the HIV/AIDS world, neither saw a patient ever again after completing their respective residencies, and neither has ever achieved anything scientifically significant. Unsurprisingly, Dr Fauci, who is worshipped as a deity in the Government Health world, gave his blessing to Marrazzo. Marrazzo is “very well-liked, very respected” and experienced, Fauci told STAT News on Wednesday. Read more at: https://www.zerohedge.com/political/covid-karen-installed-faucis-replacement-niaid |

|

$4 Trillion In 2 Companies: Apple, Amazon Earnings PreviewToday is the busiest day of Q2 earnings season, and the highlight of today’s earnings releases will be reports by tech gigacaps Amazon ($1.4TN) and Apple ($3.02TN mkt cap, world’s largest), which collectively have over $4 trillion in market cap, and while they may not give a strong read-through on the broader economy, certainly every investor will be watching results. Here is a preview of what to expect, courtesy of JPM TMT trader Jack Atherton and Goldman TMT trader Peter Callahan: AMZN reports post close on 8/3 (conf call @ 530pm ET): From AI loser to AI winner in a matter of weeks. Not only is there a sense AI creates a rising tide for all Cloud Infrastructure players, but investors are increasingly confident that OpenAI/GPT won’t be the only LLM in town with AWS well placed as an LLMagnostic platform.

What to focus on:

|

|

Interest rates: No cut until ‘solid evidence’ price rises slowing – Bank bossBank of England boss Andrew Bailey comments come as it raises interest rates to 5.25% from 5%. Read more at: https://www.bbc.co.uk/news/business-66384289?at_medium=RSS&at_campaign=KARANGA |

|

Bud Light boycott over trans influencer Dylan Mulvaney hits beer giant’s salesBut performance by parent company AB/Inbev holds up better than expected. Read more at: https://www.bbc.co.uk/news/business-66398296?at_medium=RSS&at_campaign=KARANGA |

|

Wilko homeware chain on brink of collapseThe retailer, which employs 12,000 people, blames mounting cost pressures at its 400 UK stores. Read more at: https://www.bbc.co.uk/news/business-66395824?at_medium=RSS&at_campaign=KARANGA |

|

Ahead of Market: 10 things that will decide D-Street action on FridayOn the higher side, the market could move up till 19450-19500. On the flip side, below 19350, the selling pressure is likely to accelerate. Below which, the market could slip till 19300-19250 Read more at: https://economictimes.indiatimes.com/markets/stocks/news/ahead-of-market-10-things-that-will-decide-d-street-action-on-friday/articleshow/102400169.cms |

|

Morgan Stanley upgrades India to overweight, downgrades ChinaGlobal brokerage firm Morgan Stanley (MS) upgraded India’s status to overweight, observing a ‘long wave boom’ in its economy. Here’s how the brokerage has reshuffled other countries in its list Read more at: https://economictimes.indiatimes.com/markets/stocks/news/up-the-ladder-morgan-stanley-upgrades-india-to-overweight-downgrades-china/global-rejig/articleshow/102399493.cms |

|

Tech View: 19,200-19,600 new trading range for Nifty. What traders should do on FridayOption data suggests a broader trading range between 19,000 and 20,000 zones while an immediate trading range between 19,200 and 19,600 zones Read more at: https://economictimes.indiatimes.com/markets/stocks/news/tech-view-19200-19600-new-trading-range-for-nifty-what-traders-should-do-on-friday/articleshow/102395147.cms |

|

AMC second-quarter results on deck amid strong box office, Hollywood strikes and stock-conversion battleAMC reports second-quarter results after market close on Aug. 8. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7240-BEA106DC4CDA%7D&siteid=rss&rss=1 |

|

Bond Report: 10-, 30-year Treasury yields end at new 2023 highs ahead of Friday’s jobs reportLong-term Treasury yields reach fresh year-to-date highs amid worries about persistent U.S. inflation ahead of July’s official jobs report. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-723F-D2A8A2238B29%7D&siteid=rss&rss=1 |

|

Market Snapshot: U.S. stocks edge lower after biggest drop in 3 monthsU.S. stocks edge lower, moving between small gains and losses. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-723F-CEDEC81AD31C%7D&siteid=rss&rss=1 |