Summary Of the Markets Today:

- The Dow closed up 71 points or 0.20%,

- Nasdaq closed down 0.43%,

- S&P 500 closed down 0.27%,

- Gold $1,982 down $26.90,

- WTI crude oil settled at $82 down $0.27,

- 10-year U.S. Treasury 4.037% up 0.078 points,

- USD Index $102.24 up $0.38,

- Bitcoin $29,269 up $86,

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our Economic Forecast for August 2023

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

The number of job openings was little changed at 9.6 million on the last business day of June 2023. As the number of job openings roughly correlates to employment gains, one would expect a continued modest slowing of employment gains in July 2023.

Construction spending during June 2023 increased 3.5% year-over-year (red line on the graph below) – down 6.2% year-over-year inflation-adjusted (blue line on the graph below). Construction is on an improving trend line.

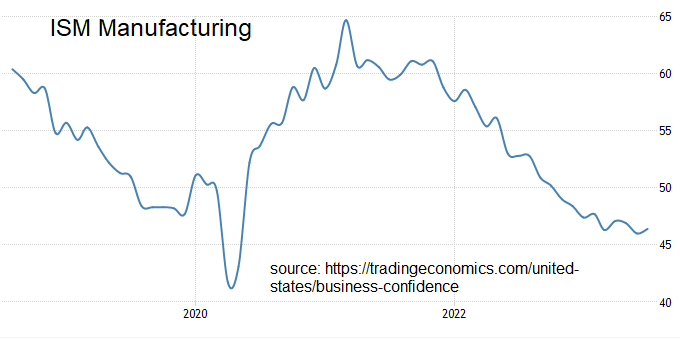

The July 2023 Manufacturing PMI® registered 46.4 percent, 0.4 percentage point higher than the 46 percent recorded in June. This figure indicates an eighth month of contraction after a 30-month period of expansion. Manufacturing remains in a recession.

Here is a summary of headlines we are reading today:

- Exxon Eyes Lithium Leadership: Enters Talks With Tesla, Ford, And Volkswagen

- OPEC’S Production Falls By Most In 3 Years: Survey

- Russian Crude Oil Exports Plunge To January Lows

- Automakers Push Back Against New 58 MPG Fuel Efficiency Proposal

- Russian Diesel Exports Rise As Refineries Return From Maintenance

- S&P 500 slips to kick off August, Dow notches small gain after touching highest level in over a year: Live updates

- Job openings, layoffs declined in June in a positive sign for the labor market

- CVS to slash 5,000 jobs as company deepens costly health-care push

- Short-Covering By Hedge Funds Lifted Oil Prices

- Yellow’s Collapse A Tailwind For Other Freight Carrier Names, Deutsche Bank Says

- Mid-sized private companies are more ‘cautiously optimistic’ but no one knows where the economy is headed, lender says

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Global Powers Are Vying For Influence In EurasiaVia the Jamestown Foundation On June 23, Kazakhstan, Azerbaijan and Georgia established a joint logistics company to improve cargo transportation between Central Asia and the South Caucasus in both directions (Bm.ge, June 23). More recently, on July 17, Uzbekistan Prime Minister Abdulla Aripov paid a visit to Georgia where he discussed the importance of developing trade and transit potential between the two countries (Civi.ge, July 17). These events follow other similar developments since early 2022 with Georgia, Azerbaijan and the Central Asian… Read more at: https://oilprice.com/Geopolitics/International/Global-Powers-Are-Vying-For-Influence-In-Eurasia.html |

|

Exxon Eyes Lithium Leadership: Enters Talks With Tesla, Ford, And VolkswagenExxon Mobil Corp. is planning to enter the minerals game by becoming a supplier of lithium to Tesla Inc., Ford Motor Co., Volkswagen AG, and other automakers, according to Bloomberg, citing people familiar with the matter. The sources said discussions are in the “early stages and also include battery giants Samsung and SK On Co.” If the report is correct, Exxon appears to be searching for buyers as it positions itself to capitalize on the electric-vehicle boom amid pressure by ESG funds and the Biden administration to shrink its core oil… Read more at: https://oilprice.com/Metals/Commodities/Exxon-Eyes-Lithium-Leadership-Enters-Talks-With-Tesla-Ford-And-Volkswagen.html |

|

OPEC’S Production Falls By Most In 3 Years: SurveyOPEC’s crude oil production fell in July by the largest amount in years, according to a new Bloomberg survey. According to the results of the survey, OPEC’s crude production fell 900,000 barrels per day (bpd) last month, to an average of 27.79 million bpd. It is the sharpest drop since 2020 when the group rushed to cut its output in the wake of Covid lockdowns and crashing demand. The survey showed that Saudi Arabia carried the heaviest load in cutting production in July, producing 9.15 million bpd. Nigeria and Libya also saw their… Read more at: https://oilprice.com/Latest-Energy-News/World-News/OPECS-Production-Falls-By-Most-In-3-Years-Survey.html |

|

What Really Caused The Inflation Crisis?International supply chains were stretched by a combination of ports suddenly closing at short notice due to virus outbreaks, workers being forced to stay at home and unusually high goods spending overwhelming suppliers. Once lockdowns ended and citizens gradually returned to normal spending habits, demand for essential items like energy came roaring back, colliding with strained supply. Judging these trends to be “transitory”, as the Federal Reserve, ECB and Bank of England did at the time, can be seen as justifiable. Staff would eventually… Read more at: https://oilprice.com/Finance/the-Economy/What-Really-Caused-The-Inflation-Crisis.html |

|

BMW Faces Headwinds After Tesla’s Weaponized EV Price CutsTesla’s weaponized price cuts of its electric vehicles have fueled a global price war to maintain market share appears to be working yet again. Just last week, Ford announced it would suffer billion-dollar losses on EVs this year. Now, BMW AG shares are sliding after it warned of soaring costs for developing electric vehicles and snarled supply chains. BMW now expects automotive free cash flow of above €6 billion ($6.6 billion) this year, from about €7 billion earlier. Additionally, free cash… Read more at: https://oilprice.com/Latest-Energy-News/World-News/BMW-Faces-Headwinds-After-Teslas-Weaponized-EV-Price-Cuts.html |

|

Biofuel Breakthrough: WSU Researchers Crack The Lignin PuzzleWashington State University researcher’s new and novel method to extract lignin could help spin wheat straw into cash. Lignin, a super tough biomaterial has been a problem in biofuel production. Lignin produced using the new method was color-neutral, odorless and homogenous, an advance that could make this carbon-neutral material a more viable candidate for development of high-value products. The researchers reporting in the Proceedings of the National Academy of Sciences they extracted up to 93% lignin with up to 98% purity from wheat straw,… Read more at: https://oilprice.com/Alternative-Energy/Biofuels/Biofuel-Breakthrough-WSU-Researchers-Crack-The-Lignin-Puzzle.html |

|

Sweden’s Nuclear Power Ambitions QuashedSweden’s hope to build out its nuclear power capacity was quashed this week, with German utility Uniper SE saying it had no intention of throwing more money on nuclear power. Uniper currently operates Sweden’s largest nuclear power reactor Oskarshamn-3, and has partial stakes in Ringhals and Forsmark. But Uniper isn’t interested in spending on additional nuclear power beyond its existing plants. It instead intends to focus on natural gas and renewables, according to Bloomberg, in line with its home country’s recent mothballing… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Swedens-Nuclear-Power-Ambitions-Quashed.html |

|

Oil Exploration Grows But Discovered Volumes Fall To New LowsSpending on conventional oil and gas exploration is rebounding and expected to top $50 billion this year, the highest since 2019, but operators are still waiting for the results they had hoped for. Rystad Energy research shows that despite the rising investments, discovered volumes are falling to new lows. Our estimates show that in the first half of 2023, explorers found 2.6 billion barrels of oil equivalent (boe), 42% lower than the first half of 2022 total of 4.5 billion boe. Fifty-five discoveries have been made, compared to 80 in the… Read more at: https://oilprice.com/Energy/Crude-Oil/Oil-Exploration-Grows-But-Discovered-Volumes-Fall-To-New-Lows.html |

|

Russian Crude Oil Exports Plunge To January LowsRussian crude oil exports by sea continued to decline in July and averaged below 3 million barrels per day (bpd) in the four weeks to July 30, the lowest four-week average since the start of the EU embargo, tanker-tracking data monitored by Bloomberg showed on Tuesday. Russia is estimated to have shipped out of its ports 2.98 million bpd on average in the four-week period to July 30, according to the data reported by Bloomberg’s Julian Lee. This is the lowest four-week average of Russian crude shipments since the four weeks to January… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Russian-Crude-Oil-Exports-Plunge-To-January-Lows.html |

|

Automakers Push Back Against New 58 MPG Fuel Efficiency ProposalThe Biden administration on Friday announced a proposal to require raising fuel economy standards to 58 miles per gallon. The proposal, from the Department of Transportation’s National Highway Traffic Safety Administration (NHTSA), would aim for a respective 2% annual increase for passenger cars, and a 4% increase in light trucks’ Corporate Average Fuel Economy (CAFE) standards for 2027 – 2032 models, and would require 2030 – 2035 “heavy-duty pickup trucks and vans” to boost fuel economy by 10% per year. “If finalized as proposed, the updated… Read more at: https://oilprice.com/Energy/Gas-Prices/Automakers-Push-Back-Against-New-58-MPG-Fuel-Efficiency-Proposal.html |

|

Putin Signs Law To Narrow Russian Urals Crude Discount To BrentRussian President Vladimir Putin has signed into law amendments in the tax code in the energy sector which will narrow the discount of Russia’s flagship Urals crude to Brent to $20 per barrel from September from a $25 discount now. The amendments in the tax code will also halve the subsidies to Russian refineries as of September 2023 to the end of 2026. The halved subsidies to refiners will allow Russia’s budget to save $326 million (30 billion Russian rubles) in expenses per month, according to Finance Minister Anton Siluanov. The… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Putin-Signs-Law-To-Narrow-Russian-Urals-Crude-Discount-To-Brent.html |

|

China’s Economic Woes Weigh On Oil Prices Once AgainAfter climbing by 13% in July, oil prices were dragged lower on the first day of August by further disappointing economic data out of China. Chart of the Week- Boosting the effect of Saudi Arabia’s production cuts, oil production in Canada’s crude heartland Alberta fell to the lowest since June 2016 as producers doubled down on field maintenance.- According to AER data, Alberta’s oil output dropped 21% year-on-year to 2.71 million b/d as oil sands mines, usually undergoing field maintenance in the summer, posted the highest… Read more at: https://oilprice.com/Energy/Energy-General/Chinas-Economic-Woes-Weigh-On-Oil-Prices-Once-Again.html |

|

Russian Diesel Exports Rise As Refineries Return From MaintenanceRussia’s diesel and gasoil exports by sea increased by 5% in July compared to June as more refining capacity in Russia returned from seasonal maintenance, Reuters reported on Tuesday, citing data from trade sources and vessel tracking. Turkey, North Africa, Brazil, and the Middle East are now the key markets for Russia’s seaborne diesel exports after the EU imposed an embargo on those imports on February 5. Around 1 million barrels per day (bpd) of Russian diesel, naphtha, and other fuels are needed to find a home elsewhere… Read more at: https://oilprice.com/Energy/Energy-General/Russian-Diesel-Exports-Rise-As-Refineries-Return-From-Maintenance.html |

|

India’s August Oil Imports From Russia Could Fall To Lowest Level Since JanuaryIndia’s crude oil imports from Russia dropped in July and could be headed to a more significant decline in August, to the lowest since January this year, according to Kpler, as Russia has pledged to reduce its oil exports this month. In July, crude imports from Russia into India, the world’s third-largest oil importer, dropped to 2.09 million barrels per day (bpd), down from 2.11 million bpd in the previous month, Viktor Katona, head of crude analysis at Kpler, has told Bloomberg. This month, India’s crude oil imports… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Indias-August-Oil-Imports-From-Russia-Could-Fall-To-Lowest-Level-Since-January.html |

|

Oil Buyers Brace For Saudi Arabia To Boost Prices Once AgainSaudi Arabia may raise the price of its crude for the third month in a row for September cargos, according to sources from the refining industry surveyed by Reuters. Per those sources, Asian buyers of Saudi crude could see September prices for Arab Light rise by $0.45 per barrel from August’s level, reaching a $3.65 premium over the Dubai/Oman benchmarks—the highest since the start of the year. “It’s always hard to make prediction on Saudi’s OSPs. But the rollover of the 1 million bpd cut is seen as a baseline in September price assessments,”… Read more at: https://oilprice.com/Energy/Energy-General/Oil-Buyers-Brace-For-Saudi-Arabia-To-Boost-Prices-Once-Again.html |

|

Amazon employees leak secret info that marketplace sellers can buy on TelegramThird-party merchants who have been suspended by Amazon can pay for confidential data to potentially help them get their accounts back up and running. Read more at: https://www.cnbc.com/2023/08/01/amazon-employees-leak-info-that-marketplace-sellers-buy-on-telegram.html |

|

S&P 500 slips to kick off August, Dow notches small gain after touching highest level in over a year: Live updatesThe major averages ended July’s trading on a positive note. Read more at: https://www.cnbc.com/2023/07/31/stock-market-today-live-updates.html |

|

Starbucks is about to report earnings. Here’s what to expectStarbucks stock has risen just 1.5% this year, giving the company a market value of $115 billion. Read more at: https://www.cnbc.com/2023/08/01/starbucks-sbux-q3-2023-earnings.html |

|

Apple expected to post third consecutive down quarter, but its forecast is more importantApple is expected to post its third consecutive quarterly revenue decline when it reports earnings after the bell on Thursday. Read more at: https://www.cnbc.com/2023/08/01/apple-earnings-preview-for-q3-2023.html |

|

Trump’s $100 million PAC has burned through nearly all of its cashHuge legal fees helped the Save America PAC burn through cash, raising questions about how Trump would fund a general election campaign. Read more at: https://www.cnbc.com/2023/08/01/donald-trumps-100-million-pac-has-just-3point6-million-in-cash.html |

|

Job openings, layoffs declined in June in a positive sign for the labor marketEmployment openings totaled 9.58 million for the month, edging lower from the downwardly revised 9.62 million in May. Read more at: https://www.cnbc.com/2023/08/01/jolts-june-2023-job-openings-layoffs-both-declined-in-a-positive-sign-for-the-labor-market.html |

|

Banks kicked off the last two weeks of July with higher rates on CDs. Where to find solid yieldsThe average 1-12 month CD rate increased by 11 basis points to 4.6%, according to Morgan Stanley. Read more at: https://www.cnbc.com/2023/08/01/banks-kicked-off-the-last-two-weeks-of-july-with-higher-rates-on-cds.html |

|

Federal judge rules some crypto assets are securities in Do Kwon, Terraform case: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, Oliver Linch, CEO and general counsel of Bittrex Global, weighs in on Worldcoin’s launch sparking privacy concerns in Europe. Read more at: https://www.cnbc.com/video/2023/08/01/manhattan-judge-rules-some-crypto-assets–securities-despite-ripple-decision-cnbc-crypto-world.html |

|

CVS to slash 5,000 jobs as company deepens costly health-care pushThe pharmacy chain had about 300,000 employees in the U.S. at the end of last year, according to a securities filing. Read more at: https://www.cnbc.com/2023/08/01/cvs-health-to-slash-5000-jobs-to-save-costs.html |

|

Trump grand jury members depart courthouse as potential indictment loomsTrump’s receipt of a target letter signaled that charges were likely in the special counsel Jack Smith’s probe. Read more at: https://www.cnbc.com/2023/08/01/trump-grand-jury-in-special-counsel-election-probe-arrives-at-court.html |

|

Trump-endorsed ‘Sound of Freedom’ has outgrossed ‘Mission: Impossible,’ ‘The Flash’Angel Studios’ “Sound of Freedom” has generated nearly $150 million at the domestic box office since its early July debut, topping some Hollywood heavyweights. Read more at: https://www.cnbc.com/2023/08/01/sound-of-freedom-outgrosses-mission-impossible-the-flash.html |

|

Ford restarts F-150 Lightning production, says demand jumped sixfold after July price cutsFord’s Rouge Electric Vehicle Center will be able to produce Lightnings at an annual rate of 150,000 vehicles, three times its previous output. Read more at: https://www.cnbc.com/2023/08/01/ford-restarts-f-150-lightning-production-amid-heightened-demand.html |

|

The 5 U.S. metro areas with the highest single-family rents — 3 are in CaliforniaAmericans are still feeling the pinch from the high costs of single-family rentals. But experts say there may be hidden costs of moving. Read more at: https://www.cnbc.com/2023/08/01/these-5-us-metro-areas-have-the-highest-single-family-rents.html |

|

Rickards: Here’s What The Fed Does NextAuthored by James Rickards via DailyReckoning.com, The Fed raised interest rates again last week. But that’s the past. What does the future look like? Today, you’ll receive a full recap of what happened with last week’s Fed meeting. I’ll explain what happened in terms of policy moves, what Fed Chair Jay Powell believes will happen next, and what will actually happen. Importantly, the difference between Powell’s expectations and market expectations creates opportunities for investors to profit from those competing forecasts.

So, without further ado, let’s break it all down… Last Week’s Fed Meeting, ExplainedLast Tuesday, I offered the following forecast of what would happen at the FOMC meeting the following day:

|

|

House GOP Launch Probe Into Hunter Biden’s Absurd Plea DealHouse Republicans have launched an investigation into Hunter Biden’s sweetheart plea deal from his father’s Justice Department, which was so egregious that a judge sent it back to the drawing board.

According to the Washington Times, the House committees conducting a probe into the agreement say parts of it were “atypical” to the point where the lead federal prosecutor was forced to admit under questioning that there was no precedent for this type of arrangement. ‘Odd’ features of the deal include a provision which gave Hunter immunity from future prosecutions on crimes beyond the scope of the current case. Another provision limits the government’s ability to prosecute Hunter, should he violate the terms of the deal. Last week US District Judge Maryellen Noreika said she was not ready to accept … Read more at: https://www.zerohedge.com/political/house-gop-launch-probe-hunter-bidens-absurd-plea-deal |

|

Short-Covering By Hedge Funds Lifted Oil PricesBy John Jemp, Senior Energy Analyst Benchmark crude oil prices have risen to the highest level for three months after the extension of production cuts by Saudi Arabia and its allies in OPEC+ sparked a rush to cover bearish short positions by investors. Hedge funds and other money managers purchased the equivalent of 52 million barrels in the six most important petroleum futures and options contracts over the seven days ending on July 25.

Fund managers had purchased a total of 229 million b … Read more at: https://www.zerohedge.com/markets/short-covering-hedge-funds-lifted-oil-prices |

|

Yellow’s Collapse A Tailwind For Other Freight Carrier Names, Deutsche Bank SaysWith major trucking firm Yellow slated for bankruptcy and a wind-down of its operations, the key question is where its billions of dollars in business is going to wind up being siphoned off to. The firm was responsible for roughly 15% of major corporations’ less than truckload (LTL) shipments, according to Bloomberg. It has struggled with a sizeable debt load and changing consumer habits coming out of Covid. Yellow has $1 billion in debt due in 2024 alone and has struggled to find common ground with its union. The company’s labor force of 30,000 employees, 22,000 of which are union employees, were notified of the company’s bankruptcy plans this week. The company has about 300 cargo terminals, about half of which it owns. It had already started to liquidate some of these properties and its remaining ones are on small parcels of land. And now Yellow’s loss looks like it will be a marked positive for the rest of the industry. Old Dominion and XPO are expected to be two of the main beneficiaries, according to Lee Klaskow, a transportation and logistics analyst with Bloomberg Intelligence. Amit Mehrotra with Deutsche Bank weighed in this week, stating: “This development is clearly very positive for the companies that remain open for business.” He listed Old Dominion, Saia, CSX and FedEx among other top picks in the industry. “To put this in context, Yellow is more than double the size of TFII on a shipments basis, almost double SAIA’s le … Read more at: https://www.zerohedge.com/markets/yellows-collapse-tailwind-other-freight-carrier-names-deutsche-bank-says |

|

UK house prices fall at sharpest rate for 14 years, says NationwideThe building society says annual prices dropped by 3.8% and affordability “remains stretched”. Read more at: https://www.bbc.co.uk/news/business-66369695?at_medium=RSS&at_campaign=KARANGA |

|

Rishi Sunak heckled by angry publican over alcohol taxThe prime minister was challenged about changes that will see alcohol duty rise overall. Read more at: https://www.bbc.co.uk/news/uk-politics-66370651?at_medium=RSS&at_campaign=KARANGA |

|

Uber aims to be wider travel app as it turns first profitThe company has expanded its UK app to include planes, as it reports its first-ever operating profit. Read more at: https://www.bbc.co.uk/news/business-66375733?at_medium=RSS&at_campaign=KARANGA |

|

InterGlobe Aviation Q1 Preview: Airline to post profit vs loss a year ago on higher traffic, airfaresThe operator of IndiGo airlines is seen reporting a consolidated net profit of Rs 1,769 crore compared to a loss of Rs 1,064 crore a year ago. Sequentially, the net profit is seen rising 23%. Consolidated revenue is likely to grow 22% year-on-year (YoY) and 11% sequentially to Rs 15,895 crore, according to the average of estimates given by four brokerages. Read more at: https://economictimes.indiatimes.com/markets/stocks/earnings/interglobe-aviation-q1-preview-airline-to-post-profit-vs-loss-a-year-ago-on-higher-traffic-airfares/articleshow/102303727.cms |

|

Ahead of the Market: 10 things that will determine D-Street action on WednesdayA small negative candle was formed with a minor lower shadow. Technically, this pattern signifies a lackluster movement in the market at the hurdle of the down-sloping trend line around 19800 levels Read more at: https://economictimes.indiatimes.com/markets/stocks/news/ahead-of-the-market-10-things-that-will-determine-d-street-action-on-wednesday/articleshow/102324264.cms |

|

Sebi floats consultation paper to improve safeguards within Account Aggregator frameworkSecurities and Exchange Board of India (Sebi) has released a proposal aimed at improving the safeguards within the account aggregator (AA) framework in securities markets to counter scams and mis-selling. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/sebi-floats-consultation-paper-to-improve-safeguards-within-account-aggregator-framework/articleshow/102318178.cms |

|

The Margin: Think tipflation is out of control? Here’s what’s driving tip creep — and when it’s really OK to skip the tip.2 in 3 Americans have a negative view of tipping these days. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-723D-EE227C060CF4%7D&siteid=rss&rss=1 |

|

‘It’s a win-win’: Federal program helps ‘the most vulnerable’ seniors find jobs — and helps employers facing labor shortages.The Senior Community Service Employment Program, a community-service and work-based job-training program for older Americans, helps low-income seniors find work. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-723D-D58BD57A1ECB%7D&siteid=rss&rss=1 |

|

Mid-sized private companies are more ‘cautiously optimistic’ but no one knows where the economy is headed, lender saysRunway Growth Capital founder sees an uptick in deal flow as mid-sized companies stay private longer while preparing for a variety of market scenarios Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-723D-BF8530DE74D0%7D&siteid=rss&rss=1 |