Summary Of the Markets Today:

- The Dow closed up 82 points or 0.23%,

- Nasdaq closed down 0.12%,

- S&P 500 closed down 0.02%,

- Gold $1,976 up $12.40,

- WTI crude oil settled at $79 down $0.71,

- 10-year U.S. Treasury 3.863% down 0.051 points,

- USD Index $100.96 down $0.39,

- Bitcoin $29,401 up $203,

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our Economic Forecast for July 2023

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

Sales of new single‐family houses in June 2023 is 23.8% above June 2022. The median sales price of new houses sold in June 2023 was $415,400. The average sales price was $494,700. The seasonally‐adjusted estimate of new houses for sale at the end of June was 432,000. This represents a supply of 7.4 months at the current sales rate. Funny how lower prices increase the volume of sales. The month’s supply of new houses is at levels associated with recessions.

The Federal Reserve’s FOMC meeting statement shows they decided to raise the target range for the federal funds rate to 5-1/4 to 5-1/2 percent. They see the economic situation as follows:

Recent indicators suggest that economic activity has been expanding at a moderate pace. Job gains have been robust in recent months, and the unemployment rate has remained low. Inflation remains elevated.

The U.S. banking system is sound and resilient. Tighter credit conditions for households and businesses are likely to weigh on economic activity, hiring, and inflation. The extent of these effects remains uncertain. The Committee remains highly attentive to inflation risks.

Here is a summary of headlines we are reading today:

- China’s Aluminum Imports Skyrocket Amid Domestic Supply Shortages

- Big Oil Profits To Take a Hit Amid Lower Oil And Gas Prices Big Oil companies

- Oil Prices Fall Slightly On Small Crude, Gasoline Draws

- Rolls-Royce Shares Skyrocket 20% On Long-Haul Travel Boom

- China Accelerates Crude Stockpiling To Highest Rate In Three Years

- Fed approves hike that takes interest rates to highest level in more than 22 years

- Dow rises for a 13th straight day, posting its best winning streak since 1987: Live updates

- Here’s what the Federal Reserve’s 25 basis point interest rate hike means for your money

- Bankruptcies Hit Healthcare Hard

- The Margin: Netflix criticized for posting AI jobs paying up to $900,000 while writers and actors are on strike

- Regional-bank stocks add to gains on Fed move and after PacWest deal suggests stabilization in sector

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

China’s Aluminum Imports Skyrocket Amid Domestic Supply ShortagesVia Metal Miner China has significantly increased its reliance on aluminum imports this year due to lower domestic aluminum supply. According to reports, the move is part of a strategic measure to partially offset the below-average output in domestic production. Indeed, new customs data reveals that China saw a notable 10.7% increase in aluminum imports during the first half of 2023 compared to the previous year. This surge in imports amounted to 1.2 million metric tons of unwrought aluminum and related products. Among the most notable were primary… Read more at: https://oilprice.com/Metals/Commodities/Chinas-Aluminum-Imports-Skyrocket-Amid-Domestic-Supply-Shortages.html |

|

Trans-Pacific Spot Rates Surge As Shipping Capacity DiminishesShipping lines finally seem to be making some headway in managing vessel capacity in the Asia-U.S. trades. Spot rates have been on the rise for three straight weeks, rebounding to levels last seen in early 2023 and late 2022, according to several index providers. U.S. import bookings remain above pre-COVID levels, and multiple analysts are now highlighting positive rate effects from reduced vessel capacity. Liners managing down trans-Pacific capacity “Typically, higher demand leads to higher capacity availability, but over the past month,… Read more at: https://oilprice.com/Finance/the-Economy/Trans-Pacific-Spot-Rates-Surge-As-Shipping-Capacity-Diminishes.html |

|

VW Hopes To Tap Chinese EV Market with $700M Xpeng InvestmentEurope’s largest automaker, Volkswagen AG, plans to invest $700 million in Chinese electric vehicle manufacturer, Xpeng Inc.(NYSE:XPEV), as it tries to stem a sales decline in its pivotal Chinese market, Bloomberg has reported. VW will eventually hold a nearly 5% stake in Xpeng through capital increases with the company’s Audi premium brand looking to deepen ties with Volksawgen’s long-term partner SAIC Motor Corp Ltd. “The objective of the strategic technical collaboration is to leverage each other’s complementary… Read more at: https://oilprice.com/Latest-Energy-News/World-News/VW-Hopes-To-Tap-Chinese-EV-Market-with-700M-Xpeng-Investment.html |

|

Will China Ever Be Able To Kick Coal?While China crushes the competition in terms of clean energy spending, the country is also almost single-handedly keeping the global coal industry alive and well. The story of China’s renewable revolution has always taken place against the backdrop of a severe and persevering reliance on coal. This is by design. China’s place at the helm of global renewable energy expansion has never been about decarbonization – it’s about energy security. Renewable energy in China is not poised to displace coal, but is being developed… Read more at: https://oilprice.com/Energy/Coal/Will-China-Ever-Be-Able-To-Kick-Coal.html |

|

Big Oil Profits To Take a Hit Amid Lower Oil And Gas Prices Big Oil companiesBig Oil companies Exxon Mobil Corp. (NYSE:XOM) and Chevron Corp. (NYSE:CVX) are both set to report a significant drop in second quarter profits when they return their quarterly scorecards on the 28th of July thanks to a sharp decline in oil and gas prices compared to a year ago. Analysts expect Exxon to post Q2 2023 earnings per share (EPS) of $2.04, a huge 50.4% drop from EPS of $4.14 in the second quarter of 2022. The company’s earnings dropped to about $7.8 billion from $17.85 in the year-ago quarter in large part due to lower natural… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Big-Oil-Profits-To-Take-a-Hit-Amid-Lower-Oil-And-Gas-Prices-Big-Oil-companies.html |

|

EPA’s New Rules May Short-Circuit The GridThe U.S. power grid is already straining under excess regulations, with blackouts possible, but now the U.S. Environmental Protection Agency (EPA) has proposed two more rules that promise to cause even more major problems. One is a tailpipe emissions standard that would require 60% of new cars sold in 2030 to be electric. The other is a rule that would force hundreds of power plants to shut down. The unintended consequences of these rules are obscured by the flawed assumptions the EPA uses in assessing the effects they’ll have on grid reliability… Read more at: https://oilprice.com/Energy/Energy-General/EPAs-New-Rules-May-Short-Circuit-The-Grid.html |

|

U.S. Boosts Ukraine’s Arsenal With $400 Million Military Aid PackageThe United States has announced an additional $400 million security package for Ukraine, including air defense munitions, armored vehicles, anti-armor weapons, and other “critical military assistance” from Defense Department stockpiles to help it retake territory and defend against Russian missile strikes. The Pentagon announced the package on July 25 after the European Union announced a 1.5 billion-euro ($1.66 billion) aid disbursement to help Ukraine repair infrastructure amid fresh air strikes by Russia on the port city of Odesa and the capital… Read more at: https://oilprice.com/Latest-Energy-News/World-News/US-Boosts-Ukraines-Arsenal-With-400-Million-Military-Aid-Package.html |

|

UK Regulator Introduces Strict Capital Rules For Energy SuppliersOfgem has announced toughened capital requirements for suppliers, as it looks to shore up the industry’s finances following the volatility of soaring gas prices last year and the domestic energy crisis which caused 30 firms to collapse. The watchdog has unveiled a new capital target for suppliers of £115 of net assets per customers, with a floor of zero pounds – to ensure suppliers are financially resilient in the face of future market shocks. The new rules will come in from March 2025 and will mean companies will be required… Read more at: https://oilprice.com/Energy/Energy-General/UK-Regulator-Introduces-Strict-Capital-Rules-For-Energy-Suppliers.html |

|

Kurdistan Partially Honors Oil Supply Commitment To Federal Iraqi GovtThe semi-autonomous region of Kurdistan is partially honoring the recent deal with the federal government of Iraq to supply crude from the region to Iraqi, an unnamed source told Argus on Wednesday. The Kurdistan Regional Government (KRG) supplies 50,000 barrels per day (bpd) of crude oil to Iraq’s northern refineries, as part of the Iraq-Kurdistan deal under which the semi-autonomous region should deliver at least 400,000 bpd to the Iraqi storage tanks at the Ceyhan port in Turkey for sale to the international markets by… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Kurdistan-Partially-Honors-Oil-Supply-Commitment-To-Federal-Iraqi-Govt.html |

|

Oil Prices Fall Slightly On Small Crude, Gasoline DrawsCrude oil prices fell slightly after the Energy Information Administration reported an estimated draw of 600,000 barrels in U.S. oil inventories for the week to July 21. This compared with a modest inventory decline of 700,000 barrels for the previous week that kept inventories slightly above the five-year seasonal average. In fuels, the Energy Information Administration also reported small inventory draws. Gasoline stocks shed 800,000 barrels in the week to July 21, which compared with an inventory draw of 1.1 million barrels for… Read more at: https://oilprice.com/Energy/Crude-Oil/Oil-Jumps-On-Small-Crude-Gasoline-Draws.html |

|

Rolls-Royce Shares Skyrocket 20% On Long-Haul Travel BoomRolls-Royce shares skyrocketed more than 20 per cent this morning after it raised its full year profit guidance on the back of a boom in long-haul flying and increased defence spending. The aerospace giant said that half year profits are expected to be “materially above” expectations, with the company looking to make £680m, double the previous forecasts £328m. Full year underlying operating profits of between could reach as high as £1.2-1.4bn, Rolls said, up from a previous consensus of £934m. The improvement… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Rolls-Royce-Shares-Skyrocket-20-On-Long-Haul-Travel-Boom.html |

|

Europe’s Natural Gas Prices Fall As Heatwaves AbateEurope’s benchmark natural gas prices fell by nearly 6% mid-day in Amsterdam on Wednesday, erasing gains from earlier in the day, as the heatwave across southern Europe started to abate and gas inventories are high with storage sites on track to be full well in advance of EU targets. The front-month futures at the TTF hub, the benchmark for Europe’s gas trading, traded at $34 (30.75 euros) per megawatt-hour (MWh) as of 12:08 p.m. GMT on Wednesday, down by 5.8% on the day. Early on Wednesday, prices rallied by 5% after news broke that… Read more at: https://oilprice.com/Energy/Energy-General/Europes-Natural-Gas-Prices-Fall-As-Heatwaves-Abate.html |

|

Manchin Pushes For Faster Permitting Of High-Voltage Power LinesSenator Joe Manchin is calling for faster approval of high-voltage power lines as part of the permitting reform he has been seeking to pass for months. Manchin, Chairman of the Senate Energy and Natural Resources Committee, is calling for provisions in the reform for the federal government to intervene when electric transmission projects get “stuck at the state level,” the Senator is expected to say in prepared remarks at Wednesday’s hearing at the committee on the permitting reform. The committee is discussing today opportunities… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Manchin-Pushes-For-Faster-Permitting-Of-High-Voltage-Power-Lines.html |

|

Oil Prices Drop As Market Awaits Fed’s Interest Rate DecisionOil prices fell by 1% early on Wednesday ahead of the Fed meeting later today, which is expected to raise the key interest rate again in what could be the end of the aggressive money-tightening policies. As of 7:40 a.m. EDT on Wednesday, WTI Crude was down 1.04% to below $79 per barrel – at $78.79 – after hitting $79 and a three-month high earlier this week. The international benchmark, Brent Crude, was trading down by 1.03% at $82.77, off the three-month high of above $83 per barrel reached on Tuesday. At the July 26 meeting, the Fed… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Oil-Prices-Drop-As-Market-Awaits-Feds-Interest-Rate-Decision.html |

|

China Accelerates Crude Stockpiling To Highest Rate In Three YearsCheap Russian oil helped China accelerate the pace of stockpiling crude in June to the largest monthly additions to inventories in three years, according to estimates by Reuters columnist Clyde Russell based on official Chinese data. In June, China is estimated to have added 2.1 million barrels per day (bpd) of crude oil to either its commercial or strategic reserves, up from 1.77 million bpd added to inventories in May, per Russell’s calculations. China does not report commercial or strategic inventories, so analysts are trying to… Read more at: https://oilprice.com/Energy/Energy-General/China-Accelerates-Crude-Stockpiling-To-Highest-Rate-In-Three-Years.html |

|

Fed approves hike that takes interest rates to highest level in more than 22 yearsThe quarter percentage point move takes the federal funds rate to a target range of 5.25%-5.5%. Read more at: https://www.cnbc.com/2023/07/26/fed-meeting-july-2023-.html |

|

Meta to report second-quarter earnings after the bellIn Meta’s quarterly earnings report, analysts will be looking to see whether the company’s online ad business continues to show improvement. Read more at: https://www.cnbc.com/2023/07/26/meta-to-report-second-quarter-earnings-after-the-bell.html |

|

Dow rises for a 13th straight day, posting its best winning streak since 1987: Live updatesInvestors digested the latest interest rate decision. Read more at: https://www.cnbc.com/2023/07/25/stock-market-today-live-updates.html |

|

Tesla under investigation by California attorney general over Autopilot safety, marketingThe California attorney general is investigating Tesla over the electric car company’s driver assistance technology, CNBC has learned. Read more at: https://www.cnbc.com/2023/07/26/tesla-under-investigation-by-california-attorney-general.html |

|

The Fed needs the economy to slow from here. These funds could outperformFed Chair Jerome Powell said that the economy will need to have a period of below-trend growth for inflation to come down. Read more at: https://www.cnbc.com/2023/07/26/the-fed-needs-to-economy-to-slow-from-here-these-funds-could-outperform.html |

|

Chipotle Mexican Grill is about to report earnings. Here’s what to expectChipotle’s stock has climbed 50% year to date. Read more at: https://www.cnbc.com/2023/07/26/chipotle-mexican-grill-cmg-q2-2023-earnings.html |

|

AWS announces generative A.I. tool to save doctors time on paperworkAmazon Web Services on Wednesday announced a new service for health care software providers called AWS HealthScribe. Read more at: https://www.cnbc.com/2023/07/26/aws-announces-generative-ai-tool-to-save-doctors-time-on-paperwork.html |

|

Senators spar over whether CFPB has the power to root out junk feesDemocrats accused big banks of funding GOP efforts to undermine the CFPB during a Senate subcommittee hearing. Read more at: https://www.cnbc.com/2023/07/26/cfpb-junk-fee-proposals-weighed-by-senate-banking-committee.html |

|

Mitch McConnell freezes at Senate press conference, is briefly unable to speakPeople standing near Sen. Mitch McConnell quickly realized what was happening, and escorted the Kentucky Republican, who turned 81 this year, off to the side. Read more at: https://www.cnbc.com/2023/07/26/mcconnell-freezes-at-senate-press-conference.html |

|

Ukraine war live updates: Russia raises conscription age limit; Zelenskyy gives fresh corruption warningRussia’s lower house voted to expand the upper age limit of its military conscription base, potentially adding over 2 million men to the country’s forces. Read more at: https://www.cnbc.com/2023/07/26/ukraine-war-live-updates-latest-news-on-russia-and-the-war-in-ukraine.html |

|

Here’s what the Federal Reserve’s 25 basis point interest rate hike means for your moneyEverything from mortgages and credit cards to student and car loans has been affected by the Federal Reserve’s rate hike cycle. Read more at: https://www.cnbc.com/2023/07/26/how-the-federal-reserves-quarter-point-interest-rate-hike-impacts-you.html |

|

Hunter Biden pleads not guilty to charges after judge questions revised plea dealJudge Maryellen Noreika, an appointee of former President Donald Trump, put the proceedings on hold as she asked the parties to work out their dispute. Read more at: https://www.cnbc.com/2023/07/26/hunter-biden-guilty-plea-criminal-tax-charges.html |

|

Singer Sinead O’Connor dies aged 56, Irish media reportsIrish singer Sinead O’Connor has died at 56, Irish media reported. Read more at: https://www.cnbc.com/2023/07/26/singer-sinead-oconnor-dies-aged-56-irish-media-reports.html |

|

Take It From A Coach: The GOP Can Win By Hitting SinglesAuthored by Guy Ciarrocchi via RealClear Wire,

After the Republican bloodbath that was the 2022 midterm election, there was no shortage of reactions. “We have to ballot-harvest, too.” “We have to stop the stealing.” “Only Trump can save us.” “We have to move away from Trump.” “We have to reposition on abortion.” “We have to kick out the RINOs.” “We have to win-back the never-Trumpers.” And so on. Too often, we hear that there’s only one path forward. But my experience as a candidate, working to rebuild the party after setbacks going back to 1986 and spending much of the last few years listening, leads me to believe that it’s a mix of things. There is no “home run” idea; but there are a lot of singles that we can hit. And if we bunch the singles together – and avoid errors – we can win. (Forgive me; I’ve been c … Read more at: https://www.zerohedge.com/political/take-it-coach-gop-can-win-hitting-singles |

|

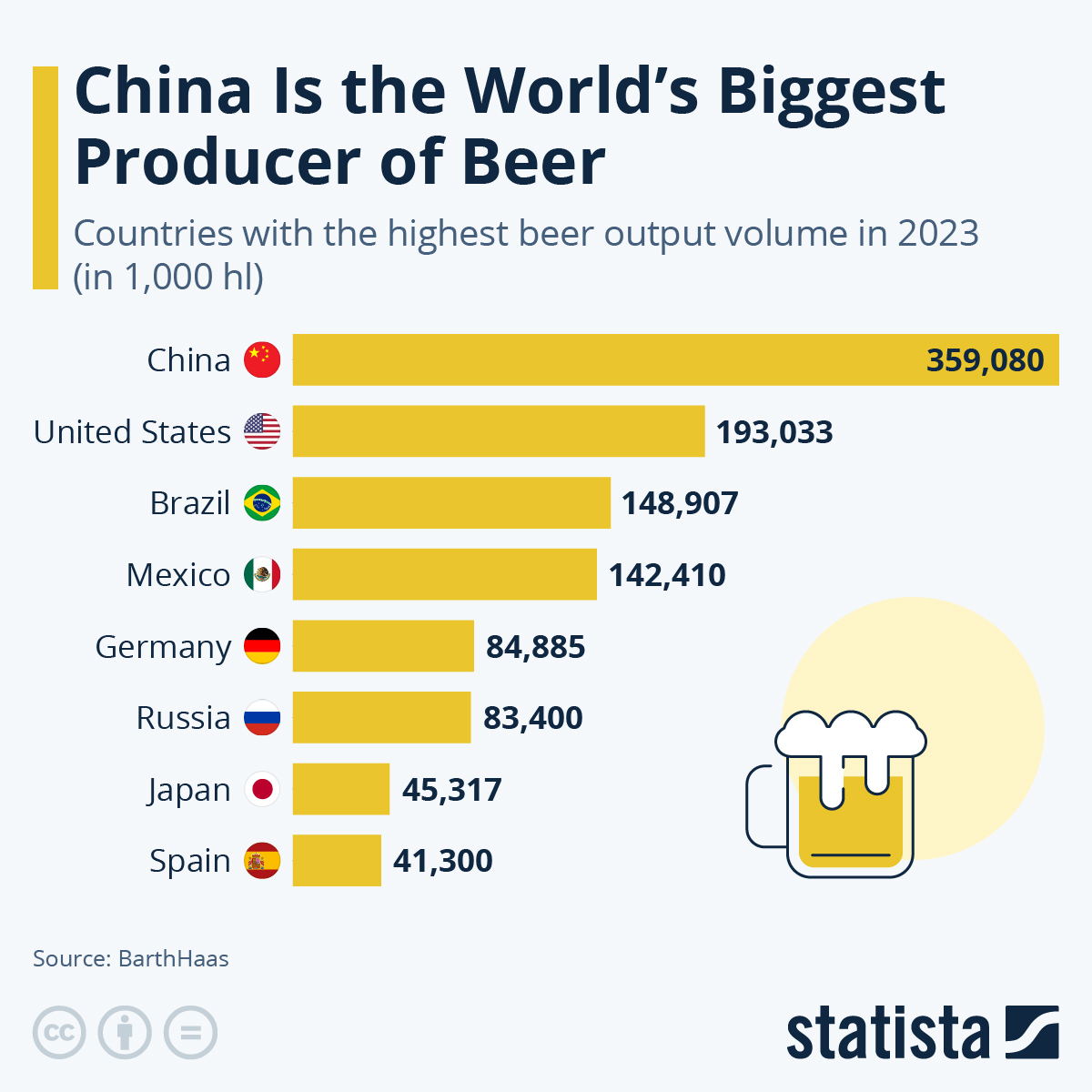

Who Is The World’s Largest Beer Producer?China is the world’s leading producer of beer, according to the BarthHaas Report released this week. As Statista’s Anna Fleck reports, in 2022, the country’s output stood at 360 million hectoliters of beer. A hectoliter is equivalent to one hundred liters. As the following chart shows, the United States is the second biggest producer of beer with an output of 194 million hl in 2022.

You will find more infographics at Statista Rounding off the top ten countries are Vietnam in ninth place with 39 million hl and Poland in tenth position with an estimated 38 million hl. Across Europe, beer production increased by a total of 3 million hl. In the EU, Spain (+3m hl) and Germany (+2.4m hl) saw particular gains, while Ukraine saw a strong decline (-4.8m hl). In the Americas, output rose b … Read more at: https://www.zerohedge.com/economics/who-worlds-largest-beer-producer |

|

Bankruptcies Hit Healthcare HardBy Alan Condon of Becker Hospital Reviews Healthcare bankruptcies have spiked this year as staffing shortages and climbing interest rates continue to challenge hospitals, health systems, physician staffing groups and other healthcare companies, according to Bloomberg. The healthcare sector was propped up largely by demands stemming from the pandemic. The federal government distributed more than $700 billion in health spending related to the pandemic, according to the Committee for a Responsible Federal Budget. That includes $160 billion in grants to hospitals, assisted living facilities and other providers. The end of the government money brought a “day of reckoning” for many struggling companies, Dragelin said. SiO2 Medical Products, which filed for Chapter 11 in March, said in its filings that its “liquidity crisis can be traced, at least in part, to government contracts the Company was awarded in the wake of the COVID-19 pandemic, and the rapid ensuing change in government and customer demand.” “Once the government money ran out, once all the stimulus dollars around healthcare ran out, there was essentially going to be this backwash,” Timothy Dragelin, a healthcare director at FTI Consulting said. “The fact that labor costs increased substantially—you also had the issues with supply chain and supply c … Read more at: https://www.zerohedge.com/medical/bankruptcies-hit-healthcare-hard |

|

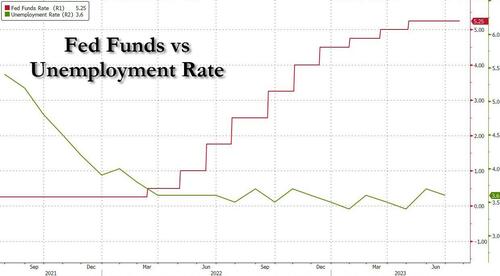

Watch Live: Powell Tries To Convince Market To Please Stop Fighting The Fed, Which May Hike One More TimeAs we noted earlier, Powell has a problem on his hands: the unemployment rate is exactly where it was when the Fed started hiking last March…

… while financial conditions are now far easier than where they were last September… Read more at: https://www.zerohedge.com/markets/watch-live-powell-tries-convince-market-please-stop-fighting-fed-which-may-hike-one-more |

|

Fed raises interest rates to highest in 22 yearsThe US central bank offered few firm clues as to what it might do next. Read more at: https://www.bbc.co.uk/news/business-66316710?at_medium=RSS&at_campaign=KARANGA |

|

Nigel Farage says more NatWest bosses must go in Coutts rowThe ex-UKIP leader says the whole board should go as the row over his account closure escalates. Read more at: https://www.bbc.co.uk/news/business-66309899?at_medium=RSS&at_campaign=KARANGA |

|

Alison Rose: The bank boss brought down by the Nigel Farage rowThe NatWest chief executive’s resignation brings an end to more than 30 years at the bank. Read more at: https://www.bbc.co.uk/news/business-66256912?at_medium=RSS&at_campaign=KARANGA |

|

Ahead of Market: 10 things that will decide DStreet action on ThursdayIndian equities finished Wednesday positively, with Nifty up 0.5% to over 19,750 levels, ahead of the release of the Fed meeting outcome. Sectoral indices for Nifty PSU Bank, FMCG, and Realty had the highest gains, while Nifty Consumer Durable and Auto Index went down. Analysts propose that there will potentially Read more at: https://economictimes.indiatimes.com/markets/stocks/news/ahead-of-market-10-things-that-will-decide-dstreet-action-on-thursday/articleshow/102147147.cms |

|

Will Netweb Technologies deliver strong listing gains on Thursday? Here’s what GMP signalsThe qualified institutional buyer portion was the most subscribed with a subscription of 228.91 times, followed by non-institutional investors with 81.81 times. Retail category was subscribed 19.15 times. The IPO comprised fresh equity of Rs 206 crore and an offer for sale (OFS) of 8.5 million equity shares. Ahead of the offer, the company has raised Rs 189 crore from anchor investors. Read more at: https://economictimes.indiatimes.com/markets/ipos/fpos/will-netweb-technologies-deliver-strong-listing-gains-on-thursday-heres-what-gmp-signals/articleshow/102145982.cms |

|

Numbers of days Nifty hit all-time highs in each of last 5 years since 1991Nifty hit all-time high 58 times between April 1, 1995 and March 31, 1996 Read more at: https://economictimes.indiatimes.com/markets/stocks/news/numbers-of-days-nifty-hit-all-time-highs-in-each-of-last-5-years-since-1991/articleshow/102145752.cms |

|

The Margin: Netflix criticized for posting AI jobs paying up to $900,000 while writers and actors are on strikeNetflix NFLX is catching some heat for posting several AI-related positions paying six-figure salaries, even as the Writers Guild of America strike enters its fourth month. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7238-1D8FF844F8BE%7D&siteid=rss&rss=1 |

|

Regional-bank stocks add to gains on Fed move and after PacWest deal suggests stabilization in sectorThe SPDR S&P Regional Banking ETF moved up after PacWest agreed to be acquired by Banc of California and added to gains on news of the Fed’s interest-rate hike. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7237-C763D3103289%7D&siteid=rss&rss=1 |

|

Next Avenue: How America deals with elder abuse—and how it doesn’tOlder Americans are facing a lot of unnecessary suffering, conflict and harm, according to the attorney who drafted the Elder Justice Act 21 years ago. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7234-282D5B7C14DF%7D&siteid=rss&rss=1 |