Summary Of the Markets Today:

- The Dow closed up 27 points or 0.08%,

- Nasdaq closed up 0.61%,

- S&P 500 closed up 0.28%,

- Gold $1,966 up $3.80,

- WTI crude oil settled at $80 up $0.85,

- 10-year U.S. Treasury 3.896% up 0.037 points,

- USD Index $101.30 down $0.04,

- Bitcoin $29,216 up $107,

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our Economic Forecast for July 2023

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

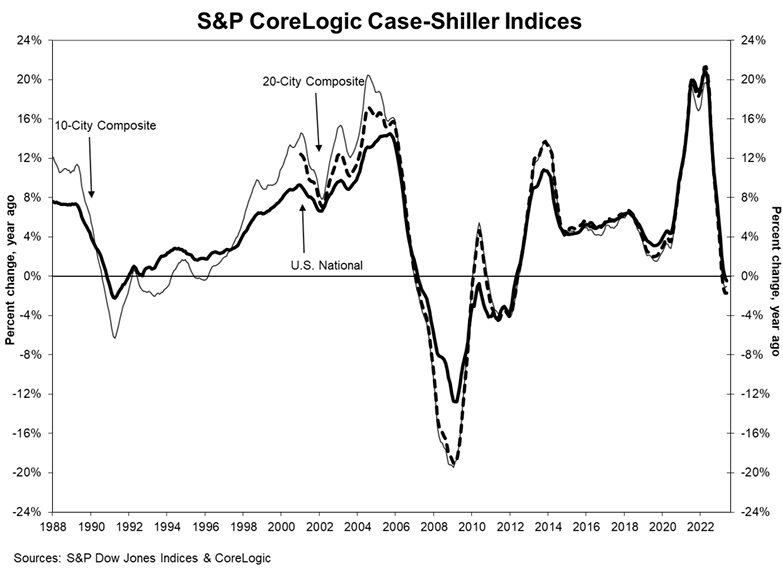

The S&P CoreLogic Case-Shiller 20-City Home Price Composite Index in May 2023 posted a -1.7% year-over-year loss, the same as in the previous month. Chief Economist Dr. Selma Hepp explained:

In May, the CoreLogic S&P Case-Shiller Index decline indicates the second month of year-over-year losses. However, while the annual decline reflects price drops that occurred in 2022, recent above-average price gains indicate an inflection ahead. And while home sales activity still continues to tell a tale of two markets: one of the West, which is constrained by a lack of existing inventory, and the other of the Southeast and South, where the availability of new homes for sale is creating sales opportunities; home prices are not necessarily following the trend anymore. Price gains have been strongest in Mid-West pandemic-laggers, Cleveland, Chicago, Detroit, which are now the hottest housing markets. In addition, 11 metros saw reacceleration in annual prices. Prices in many of the previously declining West Coast markets are rebounding and showing some renewed vigor, particularly as those are also most constrained with a lack of homes for sale. Heating of competition among buyers is also reflected in an increasing share of home selling over the asking price again, 39%, compared to an average of 25% pre-pandemic. As a result, median price premium (ratio of sale price to list price) is back to positive, at 1%, after declining since last September.

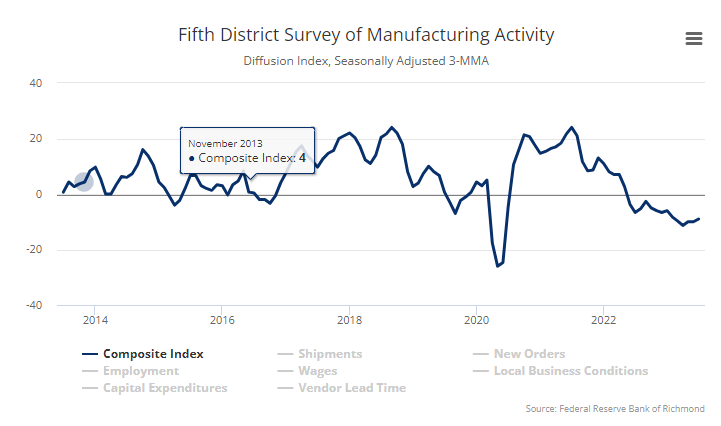

Richmond Fed manufacturing activity remained sluggish in July 2023. The composite manufacturing index edged down from −8 in June to −9 in July. Two of its three component indexes — shipments and new orders — also fell slightly. Manufacturing remains in a recession.

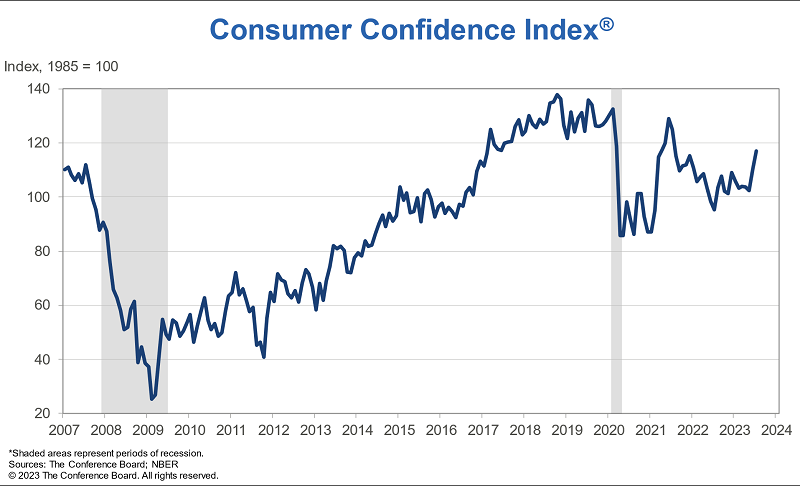

The Conference Board Consumer Confidence Index® rose again in July to 117.0 (1985=100), up from 110.1 in June. Expectations climbed well above 80—the level that historically signals a recession within the next year. Despite rising interest rates, consumers are more upbeat, likely reflecting lower inflation and a tight labor market. Although consumers are less convinced of a recession ahead, we still anticipate one likely before yearend. Dana Peterson, Chief Economist at The Conference Board stated:

Consumer confidence rose in July 2023 to its highest level since July 2021, reflecting pops in both current conditions and expectations. Headline confidence appears to have broken out of the sideways trend that prevailed for much of the last year. Greater confidence was evident across all age groups, and among both consumers earning incomes less than $50,000 and those making more than $100,000.

Here is a summary of headlines we are reading today:

- Is China’s Economic Miracle Fading? A Look At The Hurdles Ahead

- Low Gasoline Inventories Push Up Prices For U.S. Consumers

- Oil Prices Tick Higher On Optimistic Economic Forecasts

- Russian Crude Oil Exports Continue To Plunge

- GM Raises Earnings Guidance For Second Time This Year

- Oil Bulls Are Cautiously Optimistic As Brent Holds Above $82

- Dow closes higher for 12th straight day, registers longest rally since February 2017: Live updates

- Home prices continue to climb with ‘striking’ regional differences, says S&P Case-Shiller

- Musk explains why he’s rebranding Twitter to X: It’s not just a name change

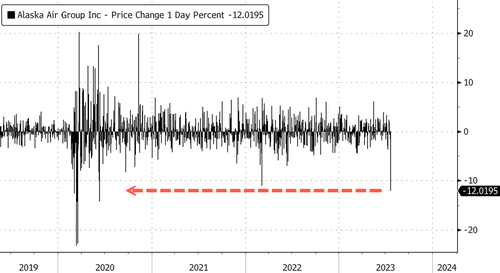

- Airline Stocks Hit Turbulence After Alaska Air Signals Slowing Demand

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Is China’s Economic Miracle Fading? A Look At The Hurdles AheadBy the Jamestown Foundation In December of last year, China’s central government lifted its stringent “zero-COVID” restrictions, signaling to the public it shifted its principal policy objective from pandemic prevention measures to jump-starting China’s flagging economy (Japan Times, April 16). In the first quarter of 2023, the country seemed to be recovering as growth accelerated to 4.5 percent—compared to only 2.9 percent in the final quarter of last year (Xinhua, April 13). Looking beyond GDP growth figures, however,… Read more at: https://oilprice.com/Geopolitics/International/Is-Chinas-Economic-Miracle-Fading-A-Look-At-The-Hurdles-Ahead.html |

|

UK Energy Regulator Hits SSE Generation With Hefty FineOfgem has imposed a hefty £9.78m penalty on SSE Generation for securing excessive payments from the UK’s electricity system operator, which was in breach of its licence and raised costs for customers. SSE Generation are expected to pay the sum in full by Tuesday 5 September. The watchdog confirmed the penalty will be paid into its voluntary redress fund, a support kitty for vulnerable households, after first proposing the fine last month. It determined that the company gained excessive payments from the ESO during periods of what is… Read more at: https://oilprice.com/Latest-Energy-News/World-News/UK-Energy-Regulator-Hits-SSE-Generation-With-Hefty-Fine.html |

|

The Caspian Conundrum: Receding Waters Spell Trouble For KazakhstanAzamat Sarsenbaev, an activist from the Kazakh Caspian Sea city of Aqtau, is trying to bring attention to a problem that is closing in on residents of his city at the same time as their only water source recedes further into the distance.“Ten years ago we would swim around 200 meters in order to get to these rocks,” Sarsenbaev told RFE/RL’s Kazakh Service, recalling his childhood. “Now we are standing on them.”There is no doubt that the Caspian Sea — the world’s largest enclosed body of water that is shared… Read more at: https://oilprice.com/Energy/Energy-General/The-Caspian-Conundrum-Receding-Waters-Spell-Trouble-For-Kazakhstan.html |

|

Low Gasoline Inventories Push Up Prices For U.S. ConsumersPrices at the pump are climbing for U.S. consumers, with the current average for a gallon of gasoline reaching $3.636 per gallon on Tuesday, according to AAA data. That is a 4 cent increase in a single day—the largest one-day increase in a year—and a more than 7 cent hike per gallon over the last week as the nation enters peak driving season. According to the latest Weekly Petroleum Status from the EIA published last Wednesday, total motor gasoline inventories fell by another 1.1 million barrels in the week to a level that is 7% below… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Low-Gasoline-Inventories-Push-Up-Prices-For-US-Consumers.html |

|

China’s Soft Power Strategy In Central AsiaChina is making a soft-power push in Central Asia, launching initiatives to strengthen cooperation with expert institutions in Uzbekistan and boost cultural exchanges and tourism with Kyrgyzstan. An Uzbek expert delegation led by Doniyor Kurbanov, head of the Foreign Ministry’s Information and Analytical Center for International Relations, recently toured China, holding talks with representatives of leading Chinese research institutions, including the Academy of International Affairs, Peking University and the Academy of Social Sciences.… Read more at: https://oilprice.com/Geopolitics/International/Chinas-Soft-Power-Strategy-In-Central-Asia.html |

|

G20 Meeting Sets The Stage For Heated COP28The outcome of the recent G20 meeting held in India has left some participants disappointed, while others had anticipated a fiery discussion on hydrocarbons and energy policies. Amid growing concerns about the future of the planet, the debate surrounding the future of hydrocarbons has intensified, with the Global South aligning its objections with powerful oil and gas-producing nations. The G20 Ministerial energy meeting, hosted by India in Goa, included influential countries such as China, the US, Russia, Saudi Arabia, Brazil, Japan, Mexico,… Read more at: https://oilprice.com/Energy/Energy-General/G20-Meeting-Sets-The-Stage-For-Heated-COP28.html |

|

How Phoenix’s Heatwave Is Challenging Energy SystemsFor the past decade, I have lived in Phoenix, Arizona. People sometimes ask what it’s like to live here. I tell them that it’s great from about mid-October to mid-April. We have very pleasant weather then. But it’s an entirely different story in the summer. From May through September, it’s really hot. Right now, we are in the midst of a 20-day streak of 110 degree plus weather. I went outside at midnight a couple of nights ago. The temperature was still 100 degrees. I think the low temperature that night was 97 degrees.… Read more at: https://oilprice.com/Energy/Energy-General/How-Phoenixs-Heatwave-Is-Challenging-Energy-Systems.html |

|

Oil Prices Tick Higher On Optimistic Economic ForecastsOil prices saw another rise on Tuesday morning on optimistic forecasts published by the International Monetary Fund (IMF). On Tuesday, the IMF raised its 2023 global growth estimates based on promising economic activity in Q1. For 2023, the IMF is now estimating a 3% GDP growth—up 0.2 percentage points from its forecast published in April. Its 2024 remains unchanged at 3.0%. Oil prices rose on the news, with WTI surpassing the $79 mark. WTI was trading at $79.05 as of 10:52 am ET, up $0.31 (0.39%) on the day. Brent crude rose above $83, up… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Oil-Prices-Tick-Higher-On-Optimistic-Economic-Forecasts.html |

|

Russian Crude Oil Exports Continue To PlungeRussia’s crude oil exports by sea continued to slump last week and are now well below the February levels and nearly 1.5 million barrels per day (bpd) lower than the recent peak at the end of April, tanker-tracking data monitored by Bloomberg showed on Tuesday. Russia’s crude shipments plunged by 311,000 bpd to 2.73 million bpd in the week to July 23, as exports out of the Western ports on the Baltic Sea and the Black Sea crashed to 1.17 million bpd, down by 625,000 bpd from the previous week, according to the data… Read more at: https://oilprice.com/Energy/Crude-Oil/Russian-Crude-Oil-Exports-Continue-To-Plunge.html |

|

GM Raises Earnings Guidance For Second Time This YearGM raised its earnings and cash flow guidance for 2023, for a second time this year, after reporting on Tuesday strong second-quarter profits beating analyst expectations on the back of strong demand for many of its models. GM’s revenue of $44.7 billion for the second quarter exceeded analyst estimates of $42.6 billon, and net income jumped to $2.6 billion from $1.666 billion for the second quarter of 2022. Profits would have been even higher were it not for a $792-million charge for new commercial agreements GM has with LG Electronics… Read more at: https://oilprice.com/Latest-Energy-News/World-News/GM-Raises-Earnings-Guidance-For-Second-Time-This-Year.html |

|

Ukraine’s Metinvest Eyes Italy For New Steel PlantVia Metal Miner Ukraine’s Metinvest plans to build a new steel manufacturing facility in Italy. Indeed, an official for the group recently confirmed reports of plans to build a plant in either that country or Bulgaria. “Many people talked about the fact that we are considering the possibility of building a new plant in Italy. Indeed, this is the case,” Metinvest CEO Yuriy Ryzhenkov said in an interview on the group’s website. Ryzhenkov provided no technical details on the plant or what products it would produce. However,… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Ukraines-Metinvest-Eyes-Italy-For-New-Steel-Plant.html |

|

Oil Bulls Are Cautiously Optimistic As Brent Holds Above $82Oil prices have been slowly but surely edging higher in July as rising optimism around Chinese demand combines with supply concerns to boost bullish sentiment.Chart of the Week- Chinese authorities have reformed natural gas pricing in the country, linking retail residential gas prices to distributors’ purchasing costs to avoid squeezing the margin of power-generating companies too much.- The deregulation of natural gas prices in China has almost immediately engendered a wave of retail price increases, mostly between 10%-15%, with China Gas… Read more at: https://oilprice.com/Energy/Energy-General/Oil-Bulls-Are-Cautiously-Optimistic-As-Brent-Holds-Above-82.html |

|

UN Fails To Reach Agreement On Deep Sea Mining RegulationWeek-long discussions at the Council of the International Seabed Authority (ISA), a UN-backed regulator, have failed to reach a consensus on immediate permission for deep sea mining or draft regulations on seabed mineral exploitation. Some countries have been exploring the potential of seabed mining for the minerals that are key to the energy transition. However, the ISA authority said that it would “continue the work on the exploitation regulations with a view to adopting them during the 30th session in 2025.” The Council of the International… Read more at: https://oilprice.com/Latest-Energy-News/World-News/UN-Fails-To-Reach-Agreement-On-Deep-Sea-Mining-Regulation.html |

|

Saudi Arabia’s Oil Revenues Slump To The Lowest Level Since 2021Saudi Arabia’s oil revenues plunged in May to the lowest level since September 2021, official data showed on Tuesday as the world’s top crude oil exporter lowered shipments while oil prices were significantly lower than in the spring of last year. The value of Saudi Arabia’s total exports slumped in May, mostly due to the decline in oil exports, the Kingdom’s General Authority for Statistics said on Tuesday. Oil revenues slumped by 37.7% year over year to $19.2 billion (72 billion Saudi riyals) in May 2023. This compares… Read more at: https://oilprice.com/Energy/Energy-General/Saudi-Arabias-Oil-Revenues-Slump-To-The-Lowest-Level-Since-2021.html |

|

Buffett Bets On Fossil Fuels Amid Cheap Market ValuationsWarren Buffett and his investment conglomerate Berkshire Hathaway have been increasing stakes in oil and gas industry operators this year as cheap valuations and attractive returns make fossil fuels good investments amid the ongoing ESG considerations from many other investors. “I love ESG” because oil and gas stocks are cheap now partly due to this, Cole Smead, CEO at Smead Capital Management, has told Bloomberg. “I’m sure Buffett and Munger love ESG as well,” Smead, whose firm manages $5.4 billion worth of assets,… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Buffett-Bets-On-Fossil-Fuels-Amid-Cheap-Market-Valuations.html |

|

RTX tumbles after disclosing jet engine problem will require accelerated inspectionsRTX said some 200 engines will have to be removed from airline fleets for accelerated inspections. Read more at: https://www.cnbc.com/2023/07/25/rtx-tumbles-after-disclosing-engine-manufacturing-issue-on-some-a320-planes.html |

|

Alphabet to report second-quarter results after the bellAlphabet’s earnings report follows a period of deep cost cuts and a renewed focus on artificial intelligence Read more at: https://www.cnbc.com/2023/07/25/alphabet-googl-q2-earnings-report-2023.html |

|

Dow closes higher for 12th straight day, registers longest rally since February 2017: Live updatesThe Dow tried to build on its longest winning streak in more than six years, while traders weighed the latest earnings reports. Read more at: https://www.cnbc.com/2023/07/24/stock-market-today-live-updates.html |

|

Microsoft set to report earnings after the closeMicrosoft is trying to capitalize on demand for artificial intelligence services while also cutting costs Read more at: https://www.cnbc.com/2023/07/25/microsoft-msft-q4-earnings-report-2023.html |

|

Big investors sold tech stocks ahead of key earnings reports, Bank of America saysBank of America clients sold a record amount of single stock positions last week. Read more at: https://www.cnbc.com/2023/07/25/big-investors-sold-tech-stocks-ahead-of-key-earnings-reports-bank-of-america-says.html |

|

House Judiciary Committee to vote on citing Zuckerberg in contempt of CongressA criminal contempt case could be referred to the Justice Department, which could decide whether to take up the case. Read more at: https://www.cnbc.com/2023/07/25/house-judiciary-committee-to-vote-on-citing-zuckerberg-in-contempt.html |

|

Home prices continue to climb with ‘striking’ regional differences, says S&P Case-ShillerHome prices continue to heat but regional differences are widening, and the mid-west is leading the way. Read more at: https://www.cnbc.com/2023/07/25/sp-case-shiller-may-2023-home-prices-continue-to-climb.html |

|

Game Plan 2023 live updates: Coverage from CNBC and Boardroom’s inaugural sports business summitFollow live updates from CNBC and Boardroom’s inaugural Game Plan sports business conference in Los Angeles. Read more at: https://www.cnbc.com/2023/07/25/game-plan-sports-business-conference-live-updates.html |

|

UPS, Teamsters reach labor deal to avoid strikeThe deal includes wage increases for both full- and part-time workers. Read more at: https://www.cnbc.com/2023/07/25/ups-teamsters-reach-contract-to-avoid-strike-union-says.html |

|

Ukraine war live updates: Kyiv faces sixth attack this month; Zelenskyy says Ukraine grain export ban ‘unacceptable’Kyiv faced its sixth air attack this month early Tuesday, city officials said, while grain export issues continue to be controversial within and outside Europe. Read more at: https://www.cnbc.com/2023/07/25/ukraine-war-live-updates-latest-news-on-russia-and-the-war-in-ukraine.html |

|

South Florida records ocean temperature of over 101 degrees Fahrenheit, potentially a recordA data collecting buoy in Florida recorded an ocean temperature of over 101 degrees Fahrenheit on Monday. Read more at: https://www.cnbc.com/2023/07/25/florida-ocean-temp-tops-over-101-degrees-fahrenheit-possible-record.html |

|

Musk explains why he’s rebranding Twitter to X: It’s not just a name changeMusk plans for X to expand to “add comprehensive communications and the ability to conduct your entire financial world.” Read more at: https://www.cnbc.com/2023/07/25/musk-explains-why-hes-rebranding-twitter-to-x.html |

|

Don’t chase the Coinbase rally as regulatory risks still linger, analysts warnDespite the ways Coinbase and the crypto industry can benefit from the XRP ruling, the dark cloud of regulatory uncertainty hasn’t gone away yet. Read more at: https://www.cnbc.com/2023/07/25/dont-chase-the-coinbase-rally-as-regulatory-risks-still-linger-analysts-warn.html |

|

Making You Poorer To Control You. Honest Money Is The Key To FreedomAuthored by Daniel Lacalle, The middle class in all developed economies is disappearing through a constant process of erosion of its capacity to climb the social ladder. This is happening in the middle of massive so-called stimulus plans, large entitlement programs, endless deficit spending, and “social” programs.

The reality is that those who blame capitalism and free markets for the constant erosion of the middle class should think better. Massive money printing and constant financing of larger government size in the economy with new currency have nothing to do with capitalism or the free market; it is the imposition of a radical form of statism disguised as an open economy. Citizens who hail the latest government stimulus plan fail to understand that the government cannot give you anything that it has not taken from you before. You get a $1,000 check, … Read more at: https://www.zerohedge.com/personal-finance/making-you-poorer-control-you-honest-money-key-freedom |

|

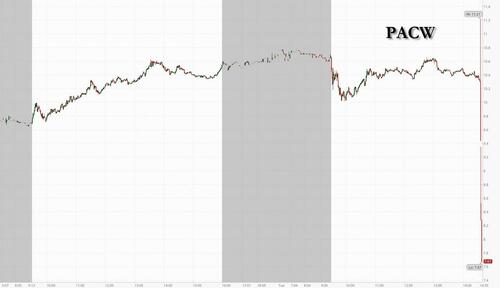

PacWest Plunges On WSJ Report It Will Be Bought By Far Smaller Peer Banc of CaliforniaTroubled regional bank PacWest Bancorp saw its stock move wildly moments ago, first spiking then tumbling, after the WSJ reported that the far smaller Banc of California (market cap of $770MM vs PACW’s $1.2BN) was in advanced talks to buy PacWest Bancorp PAC, in what appears to be the first aggressive post-crisis bank “take-under” as the lenders seek “to further shore themselves up following a regional-banking crisis earlier this year.”

Citing “people familiar”, the Journal notes that a deal could be announced as soon as today, when both banks are scheduled to report results, assuming there isn’t a last-minute snag. PacWest has been at the center of recent fears about the regional-banking system since the failure of three California lenders this spring, with the Beverly Hills, Calif., bank beset by deposit outflows and a sinking stock price. Shares of Banc of California dropped significantly too, but … Read more at: https://www.zerohedge.com/markets/pacwest-plunges-wsj-report-it-will-be-bought-far-smaller-peer-bank-california |

|

McCarthy Hints At Biden Impeachment Over Crimes Trump Was Impeached For Asking AboutHouse Speaker Kevin McCarthy suggested on Monday that the House may launch an impeachment inquiry over wide-ranging corruption allegations that former President Trump was impeached for asking about (while Adam Schiff ran cover).

“When Biden was running for office, he told the public he has never talked about business. He said his family has never received a dollar from China, which we prove is not true,” McCarthy told Fox News’ Sean Hannity on Monday night, referring to Biden’s previous statements that he didn’t speak with his son Hunter about his foreign business dealings. McCarthy also noted two IRS whistleblowers who say that Biden administration prosecutors slow-walked an investigation into Hunter Biden’s tax crimes, while House GOP investigators have found millions in foreign funds t … Read more at: https://www.zerohedge.com/political/mccarthy-hints-biden-impeachment-over-thing-trump-impeached-asking-about |

|

Airline Stocks Hit Turbulence After Alaska Air Signals Slowing DemandAirline shares hit a rough patch of turbulence on Tuesday after Alaska Air Group Inc. reported sliding fares would dent third-quarter results and warned domestic air travel is beginning to soften. “There is a very discernible shift in traffic into international markets and we are really a domestic-oriented carrier, so that’s having an impact in the third quarter on us,” Alaska Air Finance Chief Shane Tackett said in an interview who Bloomberg quoted. Tackett said that fares that were “really strong” through June have declined from record levels in 2022 but remain above 2019 prices. Alaska expects domestic air travel to recover during winter when consumers “have taken their trips to Europe” and resume shorter flights over the holidays. Shares of the budget airline carrier plunged 12%, the most since June 2020, or around the time many flights around the world were canceled because health authorities said it would stop the spread of Covid-19.

Other airlines tumbled on this news, with the S&P Supercomposite Airl … Read more at: https://www.zerohedge.com/markets/airline-stocks-hit-turbulence-after-alaska-air-signals-softer-demand |

|

Nigel Farage: NatWest boss admits ‘serious error’ in bank closure rowDame Alison Rose said she was “wrong” to respond to BBC questions about his bank account being closed. Read more at: https://www.bbc.co.uk/news/business-66307353?at_medium=RSS&at_campaign=KARANGA |

|

Magnum-maker Unilever’s profits higher after it raises pricesThe consumer goods giant sees profits rise by a fifth based almost entirely on increasing its prices. Read more at: https://www.bbc.co.uk/news/business-66299138?at_medium=RSS&at_campaign=KARANGA |

|

UPS reaches deal with Teamsters union to avert strikeThe agreement raises starting pay for part-time staff to $21 (£16.31) an hour. Read more at: https://www.bbc.co.uk/news/business-66306882?at_medium=RSS&at_campaign=KARANGA |

|

Ahead of Market: 10 things that will decide D-Street action on WednesdayForeign fund outflows and elevated levels of crude oil prices also weighed on investor sentiment, traders said Read more at: https://economictimes.indiatimes.com/markets/stocks/news/ahead-of-market-10-things-that-will-decide-d-street-action-on-wednesday/articleshow/102114655.cms |

|

Bajaj Finance Q1 Preview: PAT likely to rise up to 34% YoY on robust new loan bookingsThe company’s new loans booked during Q1 grew by 34% to 9.94 million as compared to 7.42 million in the corresponding quarter of the previous year. Read more at: https://economictimes.indiatimes.com/markets/stocks/earnings/bajaj-finance-q1-preview-pat-likely-to-rise-up-to-34-yoy-on-robust-new-loan-bookings/articleshow/102114510.cms |

|

Zomato, BoB among 10 largecaps that saw maximum upgrades in the last 1 yearThese stocks belong to domestic cyclical sectors such as financials, consumer discretionary, auto, industrials, and internet stocks. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/zomato-bob-among-10-largecaps-that-saw-maximum-upgrades-in-the-last-1-year/articleshow/102108871.cms |

|

AT&T says recent tests at two sites with lead-clad cables did not find health risksAT&T said Tuesday that recent tests at a pair of sites where there are lead-clad cables didn’t deem the cables to be a public-health risk. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7236-C547129640CE%7D&siteid=rss&rss=1 |

|

Futures Movers: Oil prices settle at highest since mid-AprilU.S. and global benchmark crude futures end Tuesday at their highest since mid-April, lifted by signs of tightening supply as traders await central bank meetings this week that may provide clues on the energy demand outlook. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7235-A8E00717CD44%7D&siteid=rss&rss=1 |

|

Next Avenue: How opioid abuse is afflicting older generationsAbuse of addictive painkillers is not just a problem among young people — the scourge increasingly is harming older adults. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7233-2C51FC57CD4B%7D&siteid=rss&rss=1 |