Summary Of the Markets Today:

- The Dow closed up 3 points or 0.01%,

- Nasdaq closed down 0.22%,

- S&P 500 closed up 0.03%,

- Gold $1,965 down $6.10,

- WTI crude oil settled at $77 up $1.29,

- 10-year U.S. Treasury 3.837% down 0.017 points,

- USD Index $101.08 up $0.20,

- Bitcoin $29,892 up $154,

- Baker Hughes Rig Count: U.S. -6 to 669 Canada unchanged at 187

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our Economic Forecast for July 2023

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

None

Here is a summary of headlines we are reading today:

- Europe Backs Kazakhstan’s Efforts To Sidestep Russian Influence

- China And Russia Kick Off Joint Military Exercises In Sea Of Japan

- U.S. Oil Rig Count Continues To Drop

- A Nickel Glut Is Looming

- U.S. Natural Gas Prices Set For First Weekly Gain In Four Weeks

- Wall Street rides high into next week as traders brace for a major Fed decision and key earnings

- The gender wage gap is now the smallest it’s been since it started being tracked in 1979

- Regional bank yields have fallen but plenty are still paying more than 4%

- Wind And Solar Are Not Cheaper Than Coal And Oil

- Futures Movers: Oil prices score a 4th straight weekly gain

- Ron DeSantis threatens legal action against Budweiser for ‘radical’ advertising campaign

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Europe Backs Kazakhstan’s Efforts To Sidestep Russian InfluenceVia the Jamestown Foundation On June 20, after meeting with Kazakhstan President Kassym-Jomart Tokayev in Astana, German President Frank-Walter Steinmeier announced Germany’s recent endorsement of Kazakhstan’s efforts to create alternative trade routes and transport corridors to Europe while bypassing Russia. Steinmeier declared that such measures would further prevent the Kremlin’s ability to evade sanctions via Kazakhstan (Svoboda, June 20). However, Moscow’s moves to redirect trade through a new corridor… Read more at: https://oilprice.com/Geopolitics/International/Europe-Backs-Kazakhstans-Efforts-To-Sidestep-Russian-Influence.html |

|

India’s Reliance Posts Weak Profits On Underperforming Refining SegmentIndia’s largest energy company, Reliance Industries (NSE: RELIANCE), has posted lower-than-expected Q2 2023 profits after its petrochemicals and refining businesses underperformed. The oil-to-retail conglomerate owned by Asia’s richest man Mukesh Ambani saw net income fall 11% Y/Y to 160.1 billion rupees ($1.95 billion), well below the average 183.02 billion rupee profit estimated by a Bloomberg survey of analysts. Revenue was down 5.8% to 2.1 trillion rupees, in-line with Wall Street estimates, while costs dipped… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Indias-Reliance-Posts-Weak-Profits-On-Underperforming-Refining-Segment.html |

|

Vitol Urged UK Government To Boost Liquidity During Energy CrisisGiant commodity trader Vitol urged the UK government to pump in extra liquidity at the height of last year’s energy crisis, Bloomberg has reported. Vitol CEO Russell Hardy “raised the idea that government intervention could support liquidity in the market” by “effectively incentivising sellers to return to the market” to help stabilize prices, according to the minutes, obtained by Bloomberg News under the Freedom of Information Act. Hardy has said It is incorrect to state or imply that Vitol ‘lobbied’ for government action because such… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Vitol-Urged-UK-Government-To-Boost-Liquidity-During-Energy-Crisis.html |

|

China And Russia Kick Off Joint Military Exercises In Sea Of JapanChina and Russia have kicked off their anticipated joint military exercises in the Sea of Japan on Thursday. Chinese state television has described the purpose as ensuring security of “strategic passage at sea”. Bloomberg noted of regional reporting that China and Russia are “testing their joint combat capability via the exercise” – but there’s been no specification of how long the exercise is expected to last, which involves land, air, and sea military assets. In reality, China and Russia are ‘answering’ recent US-Japan drills with… Read more at: https://oilprice.com/Geopolitics/International/China-And-Russia-Kick-Off-Joint-Military-Exercises-In-Sea-Of-Japan.html |

|

UAE Says OPEC+ Cuts Are Enough To Support The Oil MarketThe current moves of OPEC+ to cut oil production are enough to support the market, Suhail al-Mazrouei, the energy minister of the United Arab Emirates (UAE), told Reuters on Friday. The actions the OPEC+ group has taken so far are sufficient, according to the OPEC heavyweight the UAE. “What we are doing is sufficient as we say today,” al-Mazrouei told Reuters. “But we are constantly meeting and if there is a requirement to do anything else then during those meetings, we will pick it up. We are always a phone call away… Read more at: https://oilprice.com/Latest-Energy-News/World-News/UAE-Says-OPEC-Cuts-Are-Enough-To-Support-The-Oil-Market.html |

|

U.S. Oil Rig Count Continues To DropThe total number of active drilling rigs in the United States fell by 6 this week, according to new data from Baker Hughes published Friday. The total rig count fell to 669 this week. So far this year, Baker Hughes has estimated a loss of more than 100 active drilling rigs. This week’s count is also 406 fewer rigs than the rig count at the beginning of 2019, prior to the pandemic. The number of oil rigs declined by 7 this week to 530, down by 91 so far in 2023. The number of gas rigs fell by 2, to 131, a loss of 25 active gas rigs from the… Read more at: https://oilprice.com/Energy/Energy-General/US-Oil-Rig-Count-Continues-To-Drop.html |

|

Asia Snapping Up U.S. Crude Oil In Near Record AmountsAsia has scheduled near-record volumes of U.S. crude oil to be shipped next month, according to trade sources who spoke to Reuters. Between 1.5 million and 1.9 million bpd of U.S. crude—most of which is WTI Midland—will make their way to Asia in August, just shy of the 2.2 million bpd record loadings of Asia-bound crude oil that the U.S. saw in April. WTI continues to be an attractive grade for Asia’s refiners, who see it as a bargain compared to the Middle East benchmark Dubai. The spread between the two grades stood at $5.40… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Asia-Snapping-Up-US-Crude-Oil-In-Near-Record-Amounts.html |

|

Mayfair And Morgan Stanley Raise Stake In UK Gas Supplier Despite Profit SlumpOvo Group (Ovo) shareholders have raised their stakes in the company in transactions worth £200m, which has been announced the same day the company revealed a hefty downturn in profits amid higher hedging costs for buying gas. Long-standing partners Mayfair Equity Partners and Morgan Stanley Investment Management have both increased their holdings in the owner of the UK’s fourth-largest energy supplier by an undisclosed amount – buying shares from existing investors. Both groups have backed Ovo Group since 2015, alongside a handful… Read more at: https://oilprice.com/Energy/Natural-Gas/Mayfair-And-Morgan-Stanley-Raise-Stake-In-UK-Gas-Supplier-Despite-Profit-Slump.html |

|

A Nickel Glut Is LoomingSupply of nickel deliverables to the London Metal Exchange could jump next year by 35% compared to 2022 levels as new plants for nickel processing in China and Indonesia could cause a glut and crash prices, analysts at Macquarie Group say. The new plants in Asia would process growing volumes of intermediate nickel products into LME-deliverable nickel metal, the strategists wrote in a note quoted by Bloomberg. The pure nickel metal accounts for only 20% of global production of nickel, the other forms of nickel are intermediate products used in the… Read more at: https://oilprice.com/Latest-Energy-News/World-News/A-Nickel-Glut-Is-Looming.html |

|

Glencore Trading Profits Spike Despite Decreased Copper, Zinc, And Lead ProductiGlencore saw its output in copper, zinc, lead and nickel dip this morning as it struggled with a downturn in production but said it expects to exceed its long-term annual guidance – with trading profits reaching as high $4B (£3.1bn). The commodity giant said the half-year results were in line with expectations, with its full year production guidance remaining unchanged. It expects earnings before interest and tax (EBIT) to hit the top end of its guidance, between $3.5-4.0 billion (£3.1bn). Chief Executive Officer Gary Nagle,… Read more at: https://oilprice.com/Energy/Energy-General/Glencore-Trading-Profits-Spike-Despite-Decreased-Copper-Zinc-And-Lead-Producti.html |

|

U.S. Natural Gas Prices Set For First Weekly Gain In Four WeeksThe U.S. benchmark natural gas prices fell early on Friday but were set for the first weekly gain in four weeks as summer temperatures soar and injections into gas storage sites were smaller than expected in the latest reporting week. As of 9:35 a.m. EDT, the front-month Henry Hub contract traded down by 1.49% at $2.715 per million British thermal units (MMBtu). Working gas in storage saw a net increase of 41 billion cubic feet (Bcf) in the week to July 14, the EIA’s Weekly Natural Gas Storage Report showed on Thursday. The net… Read more at: https://oilprice.com/Latest-Energy-News/World-News/US-Natural-Gas-Prices-Set-For-First-Weekly-Gain-In-Four-Weeks.html |

|

IAEA Still Doesn’t Have Full Access To Zaporizhzhya Nuclear PlantRussia has still not provided UN nuclear experts at the Zaporizhzhya nuclear power plant in Ukraine access to the rooftops of the occupied facilitie’s reactors, the agency said on July 20. The International Atomic Energy Agency (IAEA) said in a statement that its team has carried out inspections at the power plant over the past week and has not observed any heavy military equipment or “visible indication of explosives or mines.” But the statement added that the experts “are still awaiting access to the rooftops of the reactor buildings.”The… Read more at: https://oilprice.com/Geopolitics/International/IAEA-Still-Doesnt-Have-Full-Access-To-Zaporizhzhya-Nuclear-Plant.html |

|

Bullish Sentiment Slowly Builds In Oil MarketsOil prices are on track for a slight weekly gain as traders grow cautiously bullish despite a strengthening U.S. dollar and speculation on another rate hike from the Fed. Friday, July 21st, 2023This week has seen the first replenishment of US SPR stocks in more than two weeks and another week-on-week decline in oil inventories (albeit a meager 0.7 MMbbls), prices have been trending sideways as bullish indicators were capped by a stronger US dollar and resurgent speculation about the upcoming OMC meeting of the Federal Reserve next week. With… Read more at: https://oilprice.com/Energy/Energy-General/Bullish-Sentiment-Slowly-Builds-In-Oil-Markets.html |

|

Saudi Aramco Buys $3.4 Billion Stake In Chinese Petrochemical FirmSaudi Aramco said on Friday it had completed the purchase of a 10% stake in a Chinese petrochemical firm for the equivalent of $3.4 billion as the Saudi oil giant continues to expand its downstream footprint in one of its key export markets. Aramco successfully closed the acquisition of a 10% interest in Rongsheng Petrochemical Co Ltd, which followed the signing of definitive strategic agreements in March this year. “Our strategic partnership with Rongsheng advances Aramco’s liquids to chemicals strategy while growing our presence… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Saudi-Aramco-Buys-34-Billion-Stake-In-Chinese-Petrochemical-Firm.html |

|

Turkey’s Fuel Hike Undermines Erdogan’s Natural Gas GiftPolitics, Geopolitics & Conflict Erdogan had campaigned on free natural gas for homes shortly after production began of first gas in mid-April (just a few weeks before elections that he would win in a run-off) from the Sakarya field. In its first phase, Turkish officials said the field would supply 10 MMcm per day, peaking at 40 MMcm by 2027-28. Turkey’s current natural gas consumption is at about 53 Bcm per year, and the country is energy starved, spending some $97 billion annually on imports. Erdogan appears to have made good on this… Read more at: https://oilprice.com/Energy/Energy-General/Turkeys-Fuel-Hike-Undermines-Erdogans-Natural-Gas-Gift.html |

|

ESPN held talks with NBA, NFL, and MLB in search for strategic partner, sources sayESPN has held early talks with the NBA, NFL, and MLB as potential strategic partners, sources said. Read more at: https://www.cnbc.com/2023/07/21/espn-had-talks-with-nba-nfl-in-search-for-strategic-partner.html |

|

‘Barbenheimer’ gets off to hot start with $32.8 million in combined Thursday sales“Barbenheimer” weekend begins with a bang as “Barbie” snared $22.3 million in Thursday night preview tickets, the most of any film released so far in 2023. Read more at: https://www.cnbc.com/2023/07/21/barbenheimer-box-office-thursday-ticket-sales.html |

|

Cathie Wood says her flagship innovation fund has completely exited ChinaArk Invest’s Cathie Wood said her flagship innovation fund has reduced its China exposure to zero as the developing market faces an economic slowdown. Read more at: https://www.cnbc.com/2023/07/21/cathie-wood-says-her-flagship-innovation-fund-has-completely-exited-china.html |

|

DeSantis orders probe into Bud Light’s deal with transgender influencer Dylan MulvaneySales of Bud Light have plummeted in the wake of conservative uproar and a boycott over the partnership with transgender influencer Dylan Mulvaney. Read more at: https://www.cnbc.com/2023/07/21/desantis-orders-probe-into-bud-light-dylan-mulvaney-deal.html |

|

Wall Street rides high into next week as traders brace for a major Fed decision and key earningsThe Dow Jones Industrial Average is set to close out a 10-day winning streak on Friday. Read more at: https://www.cnbc.com/2023/07/21/wall-street-rides-into-next-week-as-traders-brace-for-a-big-fed-decision.html |

|

FTX sues former execs to recoup millions, and banks push to tokenize Wall Street: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, Crypto World explores why big banks are charging ahead with plans to tokenize real-world assets and put Wall Street on chain. Read more at: https://www.cnbc.com/video/2023/07/21/ftx-sues-sbf-others-recoup-millions-wall-street-pushes-tokenize-assets-cnbc-crypto-world.html |

|

FTX lobbyist tried to buy Pacific island of Nauru to create a new superspecies, lawsuit saysGabe Bankman-Fried, the younger brother of FTX’s founder, tried to buy the island nation of Nauru to build a shelter to create a superhuman species in a lab. Read more at: https://www.cnbc.com/2023/07/21/ftx-lobbyist-tried-to-buy-island-nauru-create-superspecies-lawsuit.html |

|

Ukraine war live updates: Zelenskyy sacks UK ambassador after media comments; U.S. says Ukraine now using cluster bombsRussian missiles and drones landed on Ukrainian port cities for a fourth straight night, authorities said, amid mounting global food security concerns. Read more at: https://www.cnbc.com/2023/07/21/live-updates-latest-news-on-russia-and-the-war-in-ukraine.html |

|

Former Trump lawyer Michael Cohen settles legal fees suit with Trump OrganizationMichael Cohen sued Donald Trump’s company for legal fees related to congressional testimony. He is a key witness against Trump in his New York criminal case. Read more at: https://www.cnbc.com/2023/07/21/former-trump-lawyer-michael-cohen-settles-legal-fees-suit-.html |

|

Lawmakers seek review of Ford partnership with Chinese battery supplierU.S. lawmakers are seeking to review a licensing deal between Ford and China-based CATL involving a planned $3.5 billion battery cell plant in Michigan. Read more at: https://www.cnbc.com/2023/07/21/lawmakers-probe-ford-partnership-with-chinese-battery-supplier-catl.html |

|

The gender wage gap is now the smallest it’s been since it started being tracked in 1979A persistently tight labor market has afforded more women the opportunity to switch jobs and negotiate for better pay. Read more at: https://www.cnbc.com/2023/07/21/the-gender-wage-gap-is-now-the-smallest-its-been-on-record.html |

|

Why ‘tipflation’ might ruin your chances for a second dateEarly dating has a new challenge: The ubiquity of gratuity screens and changing expectations of when to tip and how much. Etiquette experts share advice. Read more at: https://www.cnbc.com/2023/07/21/why-tipflation-might-ruin-your-chances-for-a-second-date.html |

|

Regional bank yields have fallen but plenty are still paying more than 4%Dividend yields on banks have come down as shares have recovered, but these names are still generating enough income to cover their payouts. Read more at: https://www.cnbc.com/2023/07/21/regional-bank-yields-are-down-but-lots-still-pay-more-than-10-year-note.html |

|

White House Changes Course On MTGAuthored by Philip Wegmann via RealClear Wire, Maybe President Biden and his aides didn’t want to elevate an opponent, or maybe they were saving their criticism for later, but either way, the White House has found a pitch-perfect foil in Rep. Marjorie Taylor Greene. Biden wants the country to hear what the Georgia Republican has to say. The Biden campaign posted a clip of Greene Tuesday from a recent conservative conference where the congresswoman blasted the president for his infrastructure and environmental spending, arguing that he “is actually finishing what FDR started, that LBJ expanded on.” Greene replied by posting a video of her more complete remarks, which included the exact quotes that Biden enjoyed but also less flattering condemnation about the state of the country. The zealous conservative, whose office did … Read more at: https://www.zerohedge.com/political/white-house-changes-course-mtg |

|

Russian Navy Rehearses Blowing Up Ukrainian Ships After Grain Deal CollapseIn the most significant threat and escalation thus far following the Monday expiration and collapse of the UN-backed Black Sea Grain Initiative, which allowed Ukrainian food exports to reach global markets, Russia announced Friday its forces are conducting live-fire exercises in the region of Black Sea shipping routes. “Russia’s Defense Ministry [MoD] said on Friday that its Black Sea Fleet had practiced firing rockets at surface targets in a live fire exercise, two days after it warned that ships heading to Ukraine’s Black Sea ports could be considered military targets,” Reuters reports based on the fresh MoD statements.

“In accordance with the combat training plan of the Black Sea Fleet forces, the crew of the Ivanovets missile boat carried out live … Read more at: https://www.zerohedge.com/geopolitical/russian-navy-fires-black-sea-targets-warning-ukraine-over-grain-shipments |

|

Wind And Solar Are Not Cheaper Than Coal And OilAuthored by Connor Mortell via The Mises Institute, In his recent address, President Joe Biden claimed that “wind and solar are already significantly cheaper than coal and oil.” This is flat-out wrong. There are many arguments that can be made for Biden’s claim. However, not only can they all be refuted, but they have all already been refuted.

Alex Epstein, in his book Fossil Future: Why Global Human Flourishing Requires More Oil, Coal, and Natural Gas—Not Less, explains that two facts are ignored when pretending that wind and solar are cheaper. The first is that

|

|

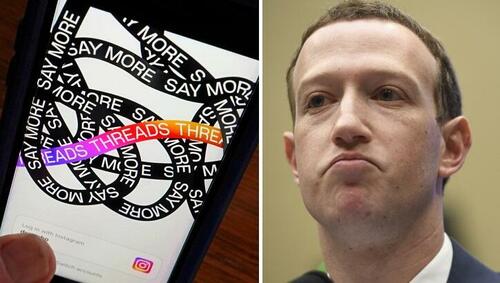

‘Threads’ Implosion Worsens As User Engagement Drops 70%The absolute train wreck known as Meta’s “Threads” has gone even further off the rails, with the Wall Street Journal reporting on Friday that following an initial surge in sign-ups, the number of daily active users fell to 13 million, a drop of around 70% from its July 7 peak, according to data from market intelligence firm Sensor Tower.

What’s more, the average time spent on the iOS and Android apps has also plummeted to just four minutes from 19 minutes, with the average Android user dropping to five minutes from a peak of 21 minutes on launch day, according to data from SimilarWeb. Meanwhile, Twitter’s got around 200 million active daily users, and average time spent on the site is 30 minutes per day according to Sensor Tower.

|

|

McDonald’s abuse claims personally shocking, says UK bossThe fast-food chain sets up an investigation unit after the BBC found dozens of workers were harassed. Read more at: https://www.bbc.co.uk/news/business-66265453?at_medium=RSS&at_campaign=KARANGA |

|

Nigel Farage row sparks hundreds of NatWest personal data requestsThe BBC understands the bank has seen an increase in the number of requests for personal data. Read more at: https://www.bbc.co.uk/news/business-66272594?at_medium=RSS&at_campaign=KARANGA |

|

Government borrows less than expected in JunePublic finances are boosted by tax receipts and lower interest payments but figures remain high. Read more at: https://www.bbc.co.uk/news/business-66265452?at_medium=RSS&at_campaign=KARANGA |

|

Paytm Q1 Results: Net loss narrows to Rs 357 cr; revenue jumps 39%At the operating level, EBITDA before ESOP improves to Rs 84 crore, with margins at 4%, driven by increase in contribution margin and operating leverage. Revenue from payments business is up 31% YoY to Rs 1,414 crore in the quarter Read more at: https://economictimes.indiatimes.com/markets/stocks/earnings/paytm-q1-results-loss-narrows-to-rs-357-cr-revenue-jumps-39/articleshow/102022734.cms |

|

Kotak Mahindra Bank Q1 Preview: PAT may surge 65% YoY, but NIMs to cool offNet interest income may zoom 35% YoY to Rs 6,337 crore, observe analysts. The private sector lender is set to report its first quarter earnings on Saturday Read more at: https://economictimes.indiatimes.com/markets/stocks/earnings/kotak-mahindra-bank-q1-preview-pat-may-surge-65-yoy-but-nims-to-cool-off/articleshow/102016562.cms |

|

YES Bank Q1 Preview: Soft quarter expected on weak underlying business; PAT may fall up to 9%YES Bank is set to release softer numbers for the first quarter ended June, with weakened underlying business growth. Analysts predict mid single-digit YoY growth in the lender’s net interest income, but decline sequentially given weak loan expansion. Kotak Institutional Equities estimates a 6% rise Read more at: https://economictimes.indiatimes.com/markets/stocks/earnings/yes-bank-q1-preview-soft-quarter-expected-on-weak-underlying-business-pat-may-fall-up-to-9/articleshow/102019759.cms |

|

Futures Movers: Oil prices score a 4th straight weekly gainOil futures rise Friday, to tally a fourth straight weekly gain. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7232-D5E92E977977%7D&siteid=rss&rss=1 |

|

Ron DeSantis threatens legal action against Budweiser for ‘radical’ advertising campaignThe Florida governor and presidential candidate said Bud Light’s fall from the top beer seller in the U.S. is “staggering.” Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7233-7E0320D08C5B%7D&siteid=rss&rss=1 |

|

Retirement Weekly: Pets may be an answer to our loneliness problem; when to ignore the big money on Wall Street; and what to do with your 401(k) when you retireThe week in retirement Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7233-63782BF15D14%7D&siteid=rss&rss= |