Summary Of the Markets Today:

- The Dow closed up 164 points or 0.47%,

- Nasdaq closed down 2.05%,

- S&P 500 closed down 0.68%,

- Gold $1,973 down $7.90,

- WTI crude oil settled at $76 up $0.28,

- 10-year U.S. Treasury 3.848% up 0.106 points,

- USD Index $100.82 up $0.54,

- Bitcoin $29,745 down $310,

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our Economic Forecast for July 2023

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

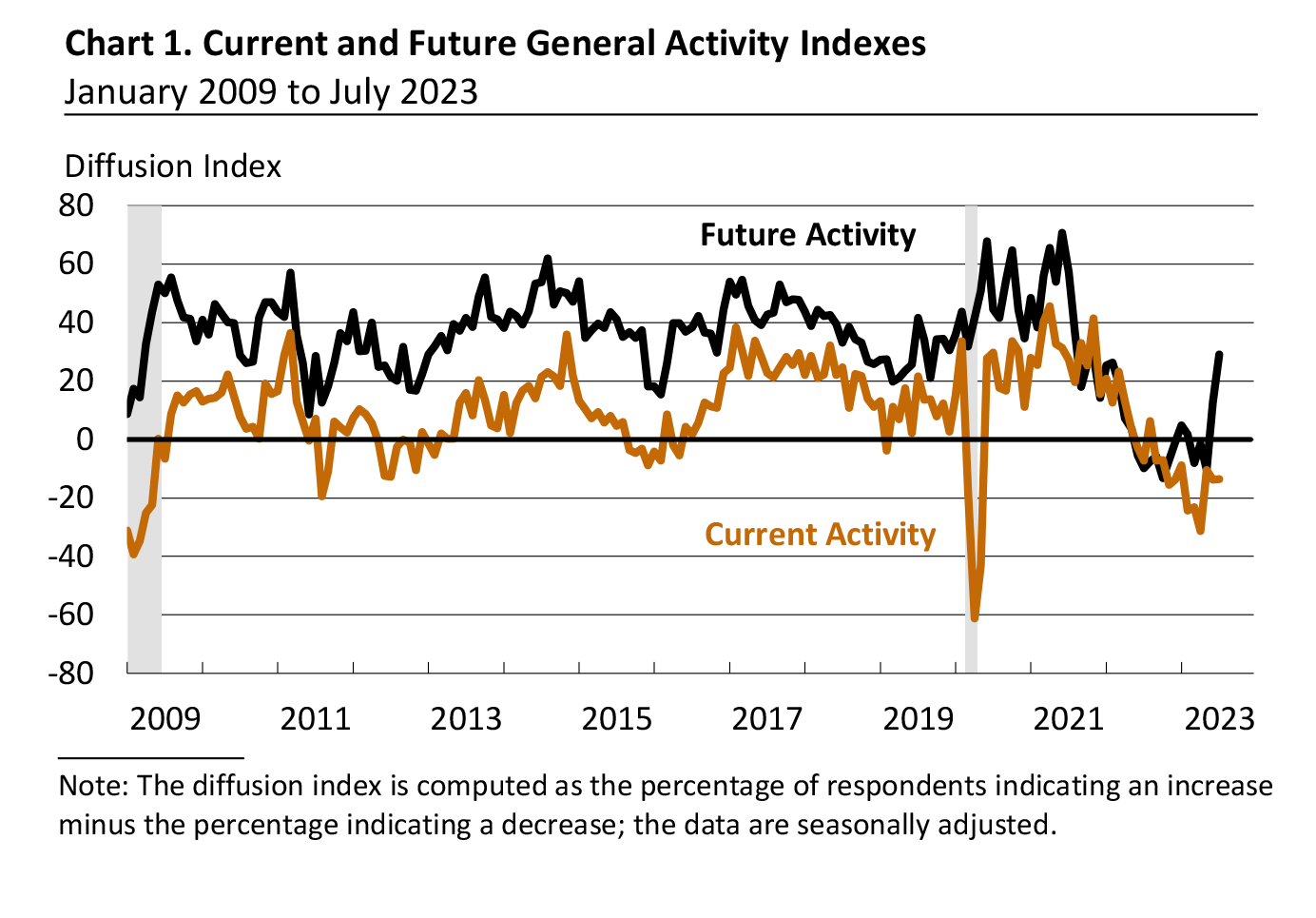

The Philly Fed July 2023 Manufacturing Business Outlook Survey was little changed at a reading of -13.5, its 11th consecutive negative reading. The survey’s indicators for general activity and new orders remained negative. Furthermore, the index for shipments declined and turned negative. The employment index suggests mostly steady employment overall. The prices paid index remained below its long-run average, while the prices received index rose. Most future indicators improved, suggesting more widespread expectations for overall growth over the next six months. The manufacturing sector remains in a recession.

Total existing-home sales fell 18.9% year-over-year. The median existing-home price3 for all housing types in June was $410,200, the second-highest price of all time and down 0.9% from the record-high of $413,800 in June 2022. NAR Chief Economist Lawrence Yun stated:

The first half of the year was a downer for sure with sales lower by 23%. Fewer Americans were on the move despite the usual life-changing circumstances. The pent-up demand will surely be realized soon, especially if mortgage rates and inventory move favorably.

In the week ending July 15, the advance figure for seasonally adjusted initial unemployment claims 4-week moving average was 237,500, a decrease of 9,250 from the previous week’s unrevised average of 246,750.

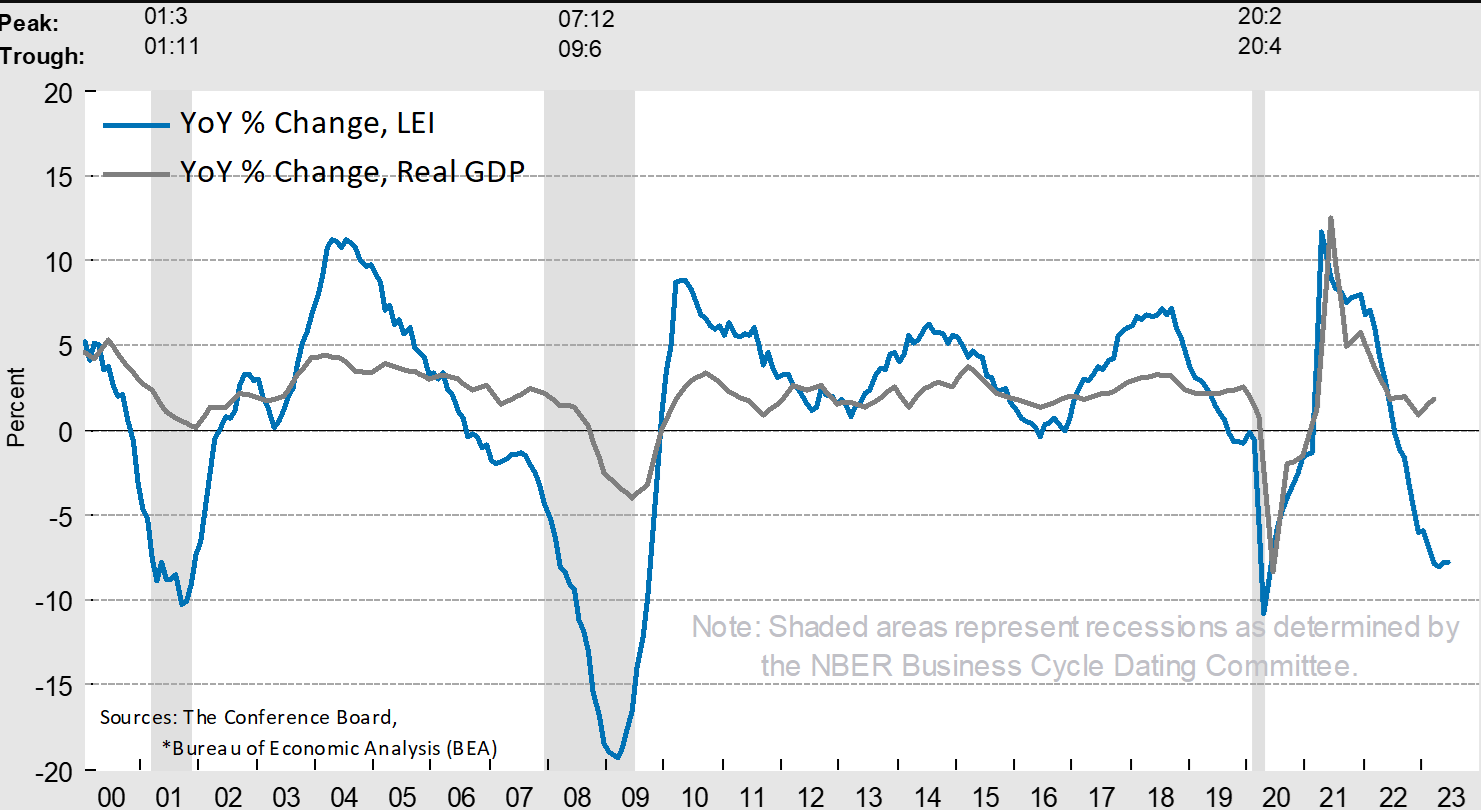

The Conference Board Leading Economic Index® (LEI) for the U.S. declined by 0.7 percent in June 2023 to 106.1 (2016=100), following a decline of 0.6 percent in May. The LEI is down 4.2 percent over the six-month period between December 2022 and June 2023—a steeper rate of decline than its 3.8 percent contraction over the previous six months (June to December 2022). Justyna Zabinska-La Monica, Senior Manager, Business Cycle Indicators, at The Conference Board added:

The US LEI fell again in June, fueled by gloomier consumer expectations, weaker new orders, an increased number of initial claims for unemployment, and a reduction in housing construction. The Leading Index has been in decline for fifteen months—the longest streak of consecutive decreases since 2007-08, during the runup to the Great Recession. Taken together, June’s data suggests economic activity will continue to decelerate in the months ahead. We forecast that the US economy is likely to be in recession from Q3 2023 to Q1 2024. Elevated prices, tighter monetary policy, harder-to-get credit, and reduced government spending are poised to dampen economic growth further.

Here is a summary of headlines we are reading today:

- Russia Recycling Used Cooking Oil To Make Marine Fuel

- New EV Innovations Put A Dent In Copper Demand

- European Warehouses Are Overflowing With Chinese Solar Panels

- California Consumes Nearly All Renewable Diesel In The U.S.

- Heatwave Shows That Biden’s Better Grid Initiative Is Woefully Underfunded

- Tesla shares down on slimming margins, Cybertruck concerns

- Netflix stock sinks as Wall Street looks for clarity on revenue growth

- AMC drops plan to charge more for better seats at the movies

- June home sales drop to the slowest pace in 14 years as short supply chokes the market

- Futures Movers: Oil prices finish higher with traders’ attention ‘shifting between demand and supply’

- The Tell: Why U.S. economy is heading to a soft landing, and its stocks may be a better bet than those in China and Europe, says Goldman Sachs

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Agrivoltaics: A Game Changer For Land Use In Renewable EnergyThe renewable revolution is facing a major land use issue that threatens to seriously impede the growth trajectory of the clean energy sector. Mass-scale renewable energy infrastructure like wind and solar farms take up much more land area than traditional fossil fuel production plants, and the sector is increasingly competing for land with other major industries including agriculture. Going forward, the renewables sector will have to get creative about using land more efficiently and in a more collaborative manner with other major land users.… Read more at: https://oilprice.com/Alternative-Energy/Renewable-Energy/Agrivoltaics-A-Game-Changer-For-Land-Use-In-Renewable-Energy.html |

|

Russia Recycling Used Cooking Oil To Make Marine FuelRussia’s state-owned oil and gas company Gazprom has teamed up with Russia’s successor to McDonald’s, Vkusno & tochka, to make marine biofuel produced using waste cooking oil, Reuters has reported. Gazpromneft-Marine Bunker, Gazprom’s bunkering business subsidiary,says it was the first company in Russia to feed a vessel with marine fuel blended with biofuel. Moscow says it remains committed to climate goals despite facing heavy sanctions following its war in Ukraine. Last year, Gazpromneft-Marine Bunker sold over 200,000 tonnes… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Russia-Recycling-Used-Cooking-Oil-To-Make-Marine-Fuel.html |

|

Sweet Success: Sugar Additive Boosts Flow Battery PerformancePacific Northwest National Laboratory’s new flow battery design achieves long life and capacity for grid energy storage from renewable sources. A common food and medicine additive has shown it can boost the capacity and longevity of a next-generation flow battery design in a record-setting experiment. A research team from the Department of Energy’s Pacific Northwest National Laboratory reports that the flow battery, a design optimized for electrical grid energy storage, maintained its capacity to store and release energy for more than… Read more at: https://oilprice.com/Energy/Energy-General/Sweet-Success-Sugar-Additive-Boosts-Flow-Battery-Performance.html |

|

Russian Oil And Gas Revenues May Jump By 60% In JulyRussia’s revenue from oil and gas sales may increase by around 60% in July from May receipts to 844 billion roubles ($9.3 billion), Reuters has reported. The rise in income from oil and gas will, however, be merely a reflection of cyclical patterns. The increase will also help alleviate Moscow’s budget deficit, which stood at 2.6 trillion roubles ($28.7B) in the first half of the year. Previously, Russia’s Finance Minister Anton Siluanov said that the country’s budget deficit in the coming year might exceed the expected… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Russian-Oil-And-Gas-Revenues-May-Jump-By-60-In-July.html |

|

New EV Innovations Put A Dent In Copper DemandVia AG Metal Miner Two firms, Goldman Sachs & Consultancy CRU Group, recently revised their forecasts for copper usage in electric vehicles (EVs). Indeed CRU Group now predicts that the average EV will use between 51-56 kilograms of copper from this year to 2030. This is a significant decrease from their previous estimate of 65-66 kilograms. Similarly, Goldman Sachs predicts that the amount of copper in an average EV will decrease to 65 kilograms per vehicle by 2030, compared to their previous estimate of 73 kilograms last year. These… Read more at: https://oilprice.com/Metals/Commodities/New-EV-Innovations-Put-A-Dent-In-Copper-Demand.html |

|

Azerbaijan Shuts Down Gold Mine Over Environmental ConcernsThe Azerbaijani government has suspended the operation of a gold mine near the village of Soyudlu, where locals protested a month ago claiming that the mine was poisoning them and their crops. On July 13, Azerbaijani Prime Minister Ali Asadov chaired a meeting of the commission studying the ecological situation in the village, which is situated in the western Gadabay district. The commission was created on June 21, a day after a huge protest took place in the village against the environmental and public health hazards posed by the work of… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Azerbaijan-Shuts-Down-Gold-Mine-Over-Environmental-Concerns.html |

|

U.S. and Qatar At The Forefront Of Global LNG Supply GrowthThe United States and Qatar are frontrunners – by a mile – as the LNG exporters best positioned to capture the global demand for additional supply capacity over the next two decades. That’s the estimate by Wood Mackenzie, which sees the abundant, low-cost natural gas resources in the world’s current top two LNG exporters as the key factor for their export capacity growth. In addition, the U.S. and Qatar also have competitive pricing and “astute commercial partnering,” which… Read more at: https://oilprice.com/Energy/Natural-Gas/US-and-Qatar-At-The-Forefront-Of-Global-LNG-Supply-Growth.html |

|

New UK Offshore Wind Projects Threatened By Soaring CostsVattenfall is halting the development of a major offshore wind power project in the UK due to surging costs and challenging market conditions pressuring new developments, the Swedish utility said on Thursday. Vattenfall will not proceed with the development of the 1.4-gigawatt (GW) Norfolk Boreas offshore wind project as the offshore wind industry has seen cost increases up to 40%, the company said in its Q2 results release today. The soaring costs, coupled with increased cost of capital, put significant pressure on all… Read more at: https://oilprice.com/Latest-Energy-News/World-News/New-UK-Offshore-Wind-Projects-Threatened-By-Soaring-Costs.html |

|

European Warehouses Are Overflowing With Chinese Solar PanelsChinese-manufactured solar photovoltaic (PV) panels are piling up in European warehouses, with approximately 40 gigawatts-direct current* (GWdc) of capacity currently in storage – the same amount installed across the continent in 2022. These solar panels in storage are worth about €7 billion and could generate enough electricity to power 20 million homes per year. The build-up is only set to grow this year, with Rystad Energy forecasting 100 GWdc of solar capacity in storage by the end of 2023. Europe’s spending on solar imports… Read more at: https://oilprice.com/Alternative-Energy/Solar-Energy/European-Warehouses-Are-Overflowing-With-Chinese-Solar-Panels.html |

|

California Consumes Nearly All Renewable Diesel In The U.S.California consumes almost all renewable diesel in the United States as demand has jumped since the state’s Low Carbon Fuel Standard went into effect in 2011, the U.S. Energy Information Administration (EIA) said on Thursday. California was only one of two states where renewable diesel was consumed in 2021, but the other renewable diesel-consuming state, Oregon, accounted for less than 1% of total U.S. renewable diesel consumption. Oregon requires petroleum diesel fuel sold in the state to be blended with either biodiesel or renewable diesel.… Read more at: https://oilprice.com/Latest-Energy-News/World-News/California-Consumes-Nearly-All-Renewable-Diesel-In-The-US.html |

|

European Natural Gas Prices Rise Amid Lower Wind Power OutputEurope’s benchmark natural gas prices rose in the early afternoon in Amsterdam as lower wind speeds across Europe are set to reduce wind power generation amid a massive heatwave in many parts of the continent. The front-month futures at the TTF hub, the benchmark for Europe’s gas trading, traded at $30.73 (27.48 euros) per megawatt-hour (MWh) as of 1:30 p.m. GMT on Thursday, rising by 1.9% on the day. As demand for gas from power plants increased and wind speeds slowed, demand for gas-fired power generation has grown over the past day.… Read more at: https://oilprice.com/Energy/Energy-General/European-Natural-Gas-Prices-Rise-Amid-Lower-Wind-Power-Output.html |

|

Putin To Skip BRICS Summit Due To UN Arrest WarrantSouth Africa has announced that Russian President Vladimir Putin, who has an outstanding arrest warrant issued in his name by the UN’s International Criminal Court (ICC), will not travel to a BRICS summit to be held in Johannesburg next month. “By mutual agreement, President Vladimir Putin of the Russian Federation will not attend the Summit, but the Russian Federation will be represented by Foreign Minister Sergei Lavrov,” the office of President Cyril Ramaphosa said in a statement on July 19. The leaders of Brazil, India, China, and South Africa… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Putin-To-Skip-BRICS-Summit-Due-To-UN-Arrest-Warrant.html |

|

Heatwave Shows That Biden’s Better Grid Initiative Is Woefully UnderfundedThe United States is experiencing a blistering heat wave that’s putting major strain on the country’s electrical grids. As temperatures soar in the Western U.S., air conditioning units are working overtime, drawing far more energy from the grid than usual. This is a serious concern, as the nation’s power grids are antiquated and often underperforming on the best of days. And in heat above 100 degrees, a blackout could be extremely dangerous, if not deadly. In Las Vegas, Nevada, temperatures have hovered around 110… Read more at: https://oilprice.com/Energy/Energy-General/Heatwave-Shows-That-Bidens-Better-Grid-Initiative-Is-Woefully-Underfunded.html |

|

Exxon Looks To Double Its LNG Portfolio By 2030ExxonMobil aims to nearly double the volumes of liquefied natural gas it is handling to more than 40 million tons per year by 2030, a top executive at the U.S. supermajor has told Nikkei in an interview. “We’re very bullish about the growth opportunities in natural gas and LNG. When you think about that in the portfolio with a corporation, investing in more LNG is certainly part of the strategy,” Andrew Barry, vice president in charge of LNG marketing at Exxon, told the publication. Currently, Exxon is estimated to handle around 22… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Exxon-Looks-To-Double-Its-LNG-Portfolio-By-2030.html |

|

Biden Announces First Gulf Of Mexico Offshore Wind Lease SaleThe Biden Administration will announce on Thursday the first-ever offshore wind lease sale in the U.S. Gulf of Mexico which will be held in late August as part of the efforts to build 30 gigawatts (GW) of offshore wind by 2030, the White House said. Today, the Department of the Interior (DOI) is issuing the final sale notice for the first-ever offshore wind lease sale in the Gulf of Mexico, which will take place on August 29, the White House added. The sale will include one lease area of 102,480 acres offshore Lake Charles, Louisiana,… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Biden-Announces-First-Gulf-Of-Mexico-Offshore-Wind-Lease-Sale.html |

|

Tesla shares down on slimming margins, Cybertruck concernsTesla CEO Elon Musk and other execs on the earnings call warned production would slow down during Q3 due to shutdowns for factory improvements. Read more at: https://www.cnbc.com/2023/07/20/tesla-stock-falls-on-slim-margins-cybertruck-concerns.html |

|

Netflix stock sinks as Wall Street looks for clarity on revenue growthThe sell-off in Netflix shares follows a 60% year-to-date rally, spurred by the rollout of its cheaper, ad-supported plan and a crackdown on password sharing. Read more at: https://www.cnbc.com/2023/07/20/netflix-stock-revenue-growth-clarity.html |

|

Airline cargo revenue is cratering. Here’s why that’s actually good newsAirlines’ cargo businesses were lifelines during the pandemic when travel demand dried up. Read more at: https://www.cnbc.com/2023/07/20/airline-shrinking-cargo-revenue-good-news.html |

|

Victims want Morgan Stanley to answer for ex-financial advisor’s Ponzi schemeVictims filed arbitration claims against Morgan Stanley, alleging that it failed to reasonably supervise its employee. Read more at: https://www.cnbc.com/2023/07/20/morgan-stanley-financial-advisor-ponzi-scheme.html |

|

Analysts are getting bullish on these stocks slated to report next week, including MetaRoughly 150 S&P 500 companies are slated to report next week, including Microsoft, Coca-Cola and Boeing. Read more at: https://www.cnbc.com/2023/07/20/analysts-are-getting-bullish-on-these-stocks-slated-to-report-next-week-including-meta.html |

|

Johnson & Johnson investors can soon swap their shares for Kenvue stock — here’s what you need to knowJ&J owns nearly 90% of Kenvue shares and plans to reduce its stake in the company through an exchange offer that could launch “as early as the coming days.” Read more at: https://www.cnbc.com/2023/07/20/jj-investors-can-soon-swap-shares-for-kenvue-stock.html |

|

SEC Chair Gensler cites ‘Wild West’ of crypto in case to boost agency’s budget: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, Caitlin Long, the founder and CEO of Custodia Bank, a Wyoming-chartered special purpose depository institution, weighs in on the implications of Ripple’s partial win in the firm’s fight with the SEC. She also reacts to the Fed launching its instant payments service as Custodia Bank is in a legal battle with the regulator. Read more at: https://www.cnbc.com/video/2023/07/20/sec-chair-gensler-cites-wild-west-crypto-boost-budget-cnbc-crypto-world.html |

|

AMC drops plan to charge more for better seats at the moviesAMC Entertainment is dropping its new tiered pricing system that provided moviegoers multiple seating options. Read more at: https://www.cnbc.com/2023/07/20/amc-drops-plan-to-charge-more-for-better-seats.html |

|

Ukraine war live updates: Russia continues to attack Ukraine ports, wheat prices soar as concerns for global food supplies riseRussian strikes on Ukrainian ports continued for the third day, Ukraine’s air force said. Multiple injuries were reported in Odesa and Mykolaiv. Read more at: https://www.cnbc.com/2023/07/20/russia-ukraine-live-updates.html |

|

Broadway union reaches tentative deal with management, averting strikeThe strike would have added to the intense labor strife roiling the entertainment industry. Hollywood screenwriters and actors are on strike from coast to coast. Read more at: https://www.cnbc.com/2023/07/20/broadway-union-reaches-tentative-deal-with-management-averting-strike.html |

|

Midyear check-in: Take these 3 actions now to start cleaning your financial houseThe middle of the year is a good time to do a financial checkup, reviewing budgets, tax withholding and retirement plans. Read more at: https://www.cnbc.com/2023/07/20/midyear-check-in-3-steps-for-cleaning-your-financial-house.html |

|

How to invest in the massive and urgent demand for infrastructure, according to the manager of a $40 billion firm that does just thatUrbanization and climate change are driving massive and urgent need for more and different infrastructure. Sadek Wahba shares how to invest in that trend. Read more at: https://www.cnbc.com/2023/07/20/sadek-wahba-i-squared-capital-how-to-invest-in-infrastructure.html |

|

June home sales drop to the slowest pace in 14 years as short supply chokes the marketJune home sales declined 18.9% compared with last year. That’s the slowest sales pace for June since 2009. Read more at: https://www.cnbc.com/2023/07/20/june-home-sales-drop-to-the-slowest-pace-in-14-years.html |

|

Friendly Fire: Dan Goldman Accidentally Demolishes Biden Defense In Whistleblower HearingAuthored by Jonathan Turley via jonathanturley.org, One of the most basic lessons that we teach law students is that you should “never ask a question you don’t know the answer to.”

The peril of the poorly crafted question was on display in Wednesday’s hearing with two whistleblowers on political interference in the Hunter Biden investigation. Most Democrats avoided any questions on the substance of the allegations, focusing instead on everything from systemic racism to the use of the term “two-tiered system of justice” and, of course, Donald Trump. Rep. Dan Goldman (D-N.Y.) often goes where wiser members fear to tread. On this occasion, Goldman may have delivered one of the most damaging moments for the Democrats. In the course of just a few minutes, the freshman New York congressman seemed to … Read more at: https://www.zerohedge.com/political/friendly-fire-dan-goldman-accidentally-demolishes-biden-defense-whistleblower-hearing |

|

As FedNow Launches, Fed Reassures Public That ‘Service Has No Relation With CBDCs’As Bruce WIlds noted earlier in the week, The Fed has stated that FedNow is not intended to kill or replace other money transfer options like Venmo, Cash App, PayPal, or Zelle. Instead, it is designed to work alongside the current systems built by the private sector. Still. FedNow could rapidly become a game changer. Money.com notes this FedNow is launching soon. FedNow was scheduled to begin formal certification of participants of the program in April 2023, with a formal launch planned for July 2023. It will operate on a 24-hour, 365-days-a-year basis, This new system differs from consumer-facing apps which allow instant peer-to-peer payments, FedNow won’t be an app per se. It’s more designed to allow banks to move money instantly. More than 50 financial institutions are “early adopters” of FedNow, some of the notable banks that will use FedNow include JPMorgan Chase, Wells Fargo, and Peoples Bank. FedNow will only be available to customers of the banks that choose to implement FedNow. The Fed says all 10,000 or so banks that are regulated by the Fed can join but will not be required to do so. The claim is that, for everyday people, FedNow could make managing money much easier and faster. It would allow you to pay your mortgage bill on Christmas Day without worrying about it being delayed or late because of the holiday. This also means that transferring money between, say, your Read more at: https://www.zerohedge.com/personal-finance/fednow-launches-fed-reassures-public-service-has-no-relation-cbdcs |

|

Lawmaker Questions Top Official Over Proposed Gas Stove BanAuthored by Tom Ozimek via The Epoch Times (emphasis ours), A top Biden administration official behind the Department of Energy’s (DOE) proposed regulatory crackdown on gas stoves while encouraging the adoption of their electric counterparts admitted in Congressional testimony Tuesday that she doesn’t know basic facts about installing electric stoves in homes.

Read more at: https://www.zerohedge.com/political/lawmaker-questions-top-official-over-proposed-gas-stove-ban |

|

“I Warned You Guys In 1984… And You Didn’t Listen” – Director James Cameron Highlights Fears Of AI TakeoverDirector James Cameron claims he tried to warn people about the dangers posed by artificial intelligence (AI) in his 1984 movie “The Terminator” but that his concerns fell on deaf ears.

In a CTV News interview, the “Titanic” and “Avatar” director said he saw this problem coming a long time ago and is surprised that people are just now beginning to notice the dangers lurking ahead.

Cameron added that he “absolutely” shares the general consensus among various AI experts that rapidly advancing technology needs to be regulated to ensure it does not pose a threat to humanity. As Katabella Roberts reports at The Epoch Times, Mr. Cameron also said he bel … Read more at: https://www.zerohedge.com/technology/i-warned-you-guys-1984-and-you-didnt-listen-director-james-cameron-highlights-fears-ai |

|

Nigel Farage gets apology from banking boss in Coutts rowThe move comes as plans are announced to make it more difficult for banks to close banking accounts. Read more at: https://www.bbc.co.uk/news/business-66258137?at_medium=RSS&at_campaign=KARANGA |

|

Virgin Money to shut a third of its UK bank branchesThe firm says 255 workers will be at risk of redundancy at the 39 stores due for closure. Read more at: https://www.bbc.co.uk/news/business-66259277?at_medium=RSS&at_campaign=KARANGA |

|

Supermarkets told to make pricing clearer to help shoppersUK competition watchdog says unclear pricing could be hampering shoppers’ ability to spot deals. Read more at: https://www.bbc.co.uk/news/uk-66256240?at_medium=RSS&at_campaign=KARANGA |

|

Ahead of Market: 10 things that will decide D-Street action on FridayIndian equities rallied to a record high on the back of positive Q1 earnings from some counters and strong global cues. However, on Friday, the market may be influenced by Infosys. Market analysts believe if the index fails to surpass the 20,000 level, investors may engage in profit-taking. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/ahead-of-market-10-things-that-will-decide-d-street-action-on-friday/articleshow/101994162.cms |

|

Breakout Stocks: How Suzlon, PNC Infratech and Polycab India are looking on charts for Friday’s tradeSectorally, buying was seen in FMCG, banks, healthcare, and energy stocks while some profit-taking was seen in IT, power, and capital goods stocks. Stocks that were in focus include names like Suzlon Energy, which rose 5%, PNC Infratech closed nearly 2% higher and Polycab India closed with gains of over 9% on Thursday. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/breakout-stocks-how-suzlon-pnc-infratech-and-polycab-india-are-looking-on-charts-for-fridays-trade/articleshow/101990187.cms |

|

Ultratech Cement Q1 preview: Double-digit volume growth to boost revenue up to 18%The revenue is seen growing up to 18% year-on-year, while the estimates are mixed on the profit front. While some analysts are expecting a profit growth up to 18% YoY, others see a decline up to 7%. Read more at: https://economictimes.indiatimes.com/markets/stocks/earnings/ultratech-cement-q1-preview-double-digit-volume-growth-to-boost-revenue-up-to-18/articleshow/101974569.cms |

|

Students were charged $10,000 to take the Caltech cybersecurity bootcamp. But the top-ranked school did not run the course, suit claimsCaltech’s program is one of many online partnerships between non-profit universities and for-profit companies that have come under scrutiny. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7232-51CC7CD4D382%7D&siteid=rss&rss=1 |

|

Futures Movers: Oil prices finish higher with traders’ attention ‘shifting between demand and supply’Crude-oil futures gain on Thursday, with traders focused on prospects for supply and demand, while hot weather forecasts pull natural-gas prices sharply higher. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7231-9E2994BA0AC2%7D&siteid=rss&rss=1 |

|

The Tell: Why U.S. economy is heading to a soft landing, and its stocks may be a better bet than those in China and Europe, says Goldman SachsMost economists are expecting a recession to hit the U.S. in the next 12 months and company earnings growth to become stagnant in 2023, but Goldman Sachs is much more optimistic. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7232-511F9F5A4EA5%7D&siteid=rss&rss=1 |

Flames burn on a natural gas-burning stove in Chicago on Jan. 12, 2023. (Scott Olson/Getty Images)Geraldine Richmond, the Department of Energy Under Secretary for Science and Innovation, on Tuesday testified before the Subcommittee on Economic Growth, Energy Polic …

Flames burn on a natural gas-burning stove in Chicago on Jan. 12, 2023. (Scott Olson/Getty Images)Geraldine Richmond, the Department of Energy Under Secretary for Science and Innovation, on Tuesday testified before the Subcommittee on Economic Growth, Energy Polic …