Summary Of the Markets Today:

- The Dow closed down 366 points or 1.07%,

- Nasdaq closed down 0.82%,

- S&P 500 closed down 0.79%,

- Gold $1,917 down $10.40,

- WTI crude oil settled at $72 up $0.09,

- 10-year U.S. Treasury 4.043% up 0.098 points,

- USD Index $103.13 down $0.24,

- Bitcoin $30,312 down $123,

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our Economic Forecast for July 2023

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

ADP says private employers created 497,000 jobs in June 2023 and annual pay was up 6.4% year-over-year. Leisure/hospitality, construction, and trade/transportation made up the majority of the gains. Employment shows no signs of an approaching recession.

The U.S. monthly international trade deficit decreased in May 2023 as imports declined 0.9% year-over-year whilst exports rose 7.0% year-over-year. The import data suggests slowing economic growth as imports have been slowing for the last year.

The number of job openings decreased to 9.8 million on the last business day of May 2023. Job openings have been in a downtrend for over one year – but they remain historically high which suggests a strong employment market.

According to Challenger, U.S.-based employers announced 40,709 job cuts in June 2023, down 49% from the 80,089 cuts announced in May. It is up 25% from the 32,517 announced in the same month one year prior.

In the week ending July 1, the advance figure for seasonally adjusted initial unemployment claims 4-week moving average was 253,250, a decrease of 3,500 from the previous week’s revised average. The previous week’s average was revised down by 750 from 257,500 to 256,750.

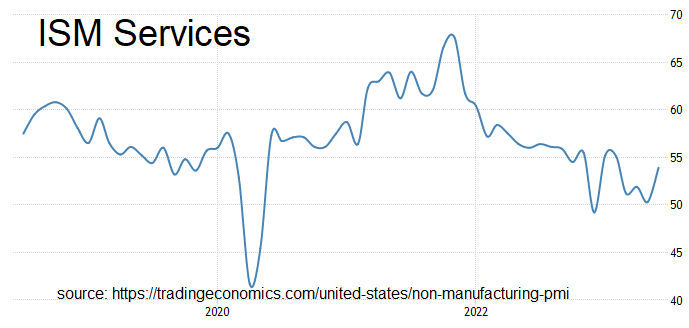

In June 2023, the ISM Services PMI® registered 53.9 percent, 3.6 percentage points higher than May’s reading of 50.3 percent. The Business Activity Index registered 59.2 percent, a 7.7-percentage point increase compared to the reading of 51.5 percent in May. Readings between 50 and 55 suggest a sluggish economy.

Seasonally adjusted, a net 36% of owners reported raising compensation in June, down five points from May and the lowest since May 2021. A net 22% of owners plan to raise compensation in the next three months, according to NFIB’s monthly jobs report. NFIB Chief Economist Bill Dunkelberg stated:

The labor force participation rate remains below pre-COVID levels, which is contributing to the tight labor market seen on Main Street. With labor demand remaining strong, owners will have to continue raising compensation to compete and fill their open positions, although that pressure is easing a bit.

Here is a summary of headlines we are reading today:

- Libya’s Oil Revenues Sink To $6.95 Billion In H1 2023

- EU Could Use Newly Launched Gas Cartel To Purchase Hydrogen

- MIT’s Groundbreaking Discovery In The Intriguing World Of Superconductivity

- Oil Prices Stabilize After Small Crude Draw

- Dow closes more than 300 points lower as hot jobs data raises fears of Fed rate hikes: Live updates

- Mark Zuckerberg’s Twitter rival passed 30 million signups overnight — here’s how to use Meta’s Threads app and what’s missing

- Mortgage rate soars to 7.22% after strong economic data

- Private sector companies added 497,000 jobs in June, more than double expectations, ADP says

- Job openings fall by half a million

- Bitcoin touches 13-month high, and Valkyrie refiles for spot bitcoin ETF: CNBC Crypto World

- Market Snapshot: Dow slides 350 points as jobs data triggers jump in bond yields

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Spain To Emerge As Europe’s Green Energy PowerhouseSpain is set to be Europe’s green energy poster child. “Rich in natural resources and with highly competitive renewable energy potential, Spain boasts a privileged geographical position and a technically qualified economy […] to become a European leader in sustainability and a clean-energy hub,” states a recent McKinsey report. In order to reach a net-zero scenario, the report finds that Spain will have to invest in three key areas: electrification, green hydrogen, and biofuels. The natural conditions in Spain give it uniquely… Read more at: https://oilprice.com/Alternative-Energy/Renewable-Energy/Spain-To-Emerge-As-Europes-Green-Energy-Powerhouse.html |

|

Central Banks Add Gold Amid Economic UncertaintyExcluding another big sale by Turkey, central banks were net buyers of gold in May, according to the latest data compiled by the World Gold Council. Eight central banks added gold to their reserves in May with net purchases totaling 50 tons. But with Turkey dumping another 63 tons of gold in May, global net central bank gold holding fell by 27 tons. Turkey has sold nearly 160 tons of gold since March. According to the World Gold Council, this is a response to local market dynamics and doesn’t likely reflect a change in the Turkish central… Read more at: https://oilprice.com/Metals/Gold/Central-Banks-Add-Gold-Amid-Economic-Uncertainty.html |

|

Libya’s Oil Revenues Sink To $6.95 Billion In H1 2023Libya’s revenues from crude oil in the first half of the year fell to $6.95 billion (33.4 billion Libyan dinars)—down from 37.3 billion dinars in H1 2022, according to a Thursday statement from Libya’s central bank. Libya’s crude oil production in the first part of this year is higher than it was during the same period last year. In Q1 2023, Libya’s crude oil production averaged 1.157 million bpd, according to OPEC’s secondary sources, rising only slightly to average 1.169 million bpd by May of this year.… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Libyas-Oil-Revenues-Sink-To-695-Billion-In-H1-2023.html |

|

Innovative Supply Chain Model Marks A New Era For HydrogenA University of Technology Sydney team of researchers has created a new supply chain model which could empower the international hydrogen renewable energy industry. Hydrogen has been touted as the clean fuel of the future; it can be extracted from water and produces zero carbon emissions. However, it is currently expensive to transport over long distances, and currently no infrastructure is in place to do so. The new supply chain model, created by researchers in Australia, Singapore, and Germany, successfully guides the development of international transport… Read more at: https://oilprice.com/Alternative-Energy/Fuel-Cells/Innovative-Supply-Chain-Model-Marks-A-New-Era-For-Hydrogen.html |

|

Xi Jinping’s Blueprint For A China-centric World OrderChinese President Xi Jinping has promulgated a new law on foreign affairs to legitimize tough measures that Beijing is taking against the “bullying” of the “hegemonic West.” The statute, “The Law on Foreign Relations of the People’s Republic of China (PRC),” which took effect on July 1, will also anchor the supreme leader’s long-standing aspiration to build a China-centric global order that will challenge the framework established by the US-led Western Alliance since the end of World War II. The law… Read more at: https://oilprice.com/Energy/Energy-General/Xi-Jinpings-Blueprint-For-A-China-centric-World-Order.html |

|

EU Could Use Newly Launched Gas Cartel To Purchase HydrogenThe European Union could use its newly launched gas cartel to purchase vast quantities of hydrogen and other critical materials, Bloomberg has reported. The bloc had set a goal of aggregating enough demand to fill 15% of its gas storage sites across the bloc, equivalent to around 13.5 billion cubic meters, and has managed to exceed expectations with its gas stores nearly 80% full. “We have to invest much more in critical raw materials to have the strategic supplies we need. We need to diversify the suppliers,” Commission Vice President… Read more at: https://oilprice.com/Latest-Energy-News/World-News/EU-Could-Use-Newly-Launched-Gas-Cartel-To-Purchase-Hydrogen.html |

|

MIT’s Groundbreaking Discovery In The Intriguing World Of SuperconductivityA Massachusetts Institute of Technology study sheds surprising light on how certain superconductors undergo a ‘nematic transition’ – unlocking new, superconducting behavior. The results could help identify unconventional superconducting materials. Under certain conditions – usually exceedingly cold ones – some materials shift their structure to unlock new, superconducting behavior. This structural shift is known as a “nematic transition,” and physicists suspect that it offers a new way to… Read more at: https://oilprice.com/Energy/Energy-General/MITs-Groundbreaking-Discovery-In-The-Intriguing-World-Of-Superconductivity.html |

|

OPEC Maintains Its Rosy Outlook For Oil Demand In 2024OPEC is expected to keep a bullish view on next year’s oil demand growth when it publishes its outlook on July 13, according to Reuters. Anonymous OPEC sources who spoke to Reuters said on Thursday that OPEC’s 2024 demand outlook will likely remain upbeat and above average, although lower than this year’s oil demand growth. For 2023, OPEC said in its June report that oil demand growth was expected to be 2.35 million bpd—a 2.4% increase over 2022, and a rather high rate that comes only after a couple of years of sluggish… Read more at: https://oilprice.com/Latest-Energy-News/World-News/OPEC-Maintains-Its-Rosy-Outlook-For-Oil-Demand-In-2024.html |

|

Oil Prices Stabilize After Small Crude DrawCrude oil prices remained down today after the U.S. Energy Information Administration reported an estimated inventory decline of 1.5 million barrels for the week to July 1. This compared to an estimated inventory draw of a substantial 9.6 million barrels for the previous week, which pushed prices temporarily higher. At 452.2 million barrels, the EIA said, U.S. crude oil inventories were about the five-year average for this time of the year. Demand concern, however, continues to weigh on prices, even if the EIA recently revised upwards its own fuel… Read more at: https://oilprice.com/Energy/Crude-Oil/Oil-Prices-Stabilize-After-Small-Crude-Draw.html |

|

Wind Lobbyists Push UK Government For More SubsidiesIn a move that gives the lie to years of propaganda claiming falling costs, the wind industry’s leading lobbyists have written to the Government threatening to abandon the U.K. unless subsidies for their companies are hugely increased… The industry lobbyists claim that unforeseen rising costs now require three actions: A revision to the auction rules so that the winners are not determined by lowest bids but by an administrative decision that weights bids according to their ‘value’ in contributing towards the Net… Read more at: https://oilprice.com/Alternative-Energy/Wind-Power/Wind-Lobbyists-Push-UK-Government-For-More-Subsidies.html |

|

Saudi And Iranian Oil Ministers Discuss Energy RelationsThe energy ministers of Saudi Arabia and Iran met on Thursday on the sidelines of an OPEC event in Vienna to discuss bilateral energy relations, Iranian media report. Iran’s Oil Minister Javad Owji met with Saudi Arabia’s Energy Minister, Prince Abdulaziz bin Salman, on the sidelines of the OPEC International Seminar, the news service of Iran’s oil ministry, Shana, reported. “The two ministers discussed the global oil markets’ status quo and future, and decisions needed for setting oil prices,” the news service… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Saudi-And-Iranian-Oil-Ministers-Discuss-Energy-Relations.html |

|

Saudi Arabia Hikes Oil Prices To AsiaDays after Saudi Arabia extended its voluntary production cuts, OPEC’s largest producer has hiked some oil prices to Asia, Bloomberg has reported. According to the report, Saudi Arabia has increased the premium of its flagship Arab Light crude to $3.20 a barrel for August, with Asia accounting for 60% of the country’s market. Price hikes by Saudi Arabia are good news for U.S. producers. Heavy trading in Dubai oil has lifted its premium to WTI crude to its highest since late March, a development that could make U.S. crude even more competitive in… Read more at: https://oilprice.com/Energy/Oil-Prices/Saudi-Arabia-Hikes-Oil-Prices-To-Asia.html |

|

UK Grid Puts Coal Plant On Standby While Ordering Wind Farm to Cut OutputThe UK’s electricity system operator, National Grid ESO, has paid a coal-fired power plant to be available for potential power production this weekend, while ordering an offshore wind farm to reduce output, Bloomberg reported on Thursday. Temperatures in the UK will rise into the weekend and temperatures overnight will also remain high, “which will make for an uncomfortably warm night for some,” Met Office Deputy Chief Meteorologist Dan Harris said in the latest weather forecast on Thursday. As demand for electricity… Read more at: https://oilprice.com/Latest-Energy-News/World-News/UK-Grid-Puts-Coal-Plant-On-Standby-While-Ordering-Wind-Farm-to-Cut-Output.html |

|

Shell CEO Says Slashing Oil Output Would Be ‘Dangerous and Irresponsible’Reducing global oil and gas production would be “dangerous and irresponsible” as the world still desperately needs those hydrocarbons, Shell’s chief executive Wael Sawan has told the BBC. Last month, Shell unveiled its new strategy to continue investing in oil and gas production and selectively pour capital into renewable energy solutions, angering climate activists and some institutional investors. Back in 2021, Shell said that its oil production peaked in 2019 and is set for a continual decline over the next three… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Shell-CEO-Says-Slashing-Oil-Output-Would-Be-Dangerous-and-Irresponsible.html |

|

Venezuela’s Oil Exports Jump To Over 700,000 BpdVenezuela exported more than 715,000 barrels per day (bpd) of crude and refined petroleum products in June, up by 8% from May, as state oil firm PDVSA renewed contracts and signed new deals and an extra heavy crude processing unit restarted operations after six months. Venezuela’s oil exports have been rising over the past three months after a government audit of oil contracts over unpaid oil purchase bills halted many cargoes early this year. The audits took place after Nicolas Maduro ordered them at the end of last year in a probe into… Read more at: https://oilprice.com/Energy/Energy-General/Venezuelas-Oil-Exports-Jump-To-Over-700000-Bpd.html |

|

Dow closes more than 300 points lower as hot jobs data raises fears of Fed rate hikes: Live updatesStocks fell as traders assessed the hotter-than-expected ADP payrolls report. Read more at: https://www.cnbc.com/2023/07/05/stock-market-today-live-updates.html |

|

Mark Zuckerberg’s Twitter rival passed 30 million signups overnight — here’s how to use Meta’s Threads app and what’s missingThreads looks very similar to Twitter and connects automatically to a user’s Instagram account. Read more at: https://www.cnbc.com/2023/07/06/how-to-use-metas-threads-app-and-whats-missing.html |

|

Mortgage rate soars to 7.22% after strong economic dataThe average rate on the popular 30-year fixed mortgage hit 7.22%, according to Mortgage News Daily. Read more at: https://www.cnbc.com/2023/07/06/mortgage-rate-soars-after-strong-economic-data.html |

|

Twitter accuses Meta of stealing trade secrets for its new Threads appElon Musk’s attorney, Alex Spiro, wrote a letter to Meta on Thursday accusing the company of “willful” misappropriation of trade secrets. Read more at: https://www.cnbc.com/2023/07/06/twitter-accuses-meta-of-stealing-trade-secrets-for-its-new-threads-app.html |

|

Bond yields and volatility are spiking. These ETFs should benefitFunds that bet on higher volatility and rising yields can help bolster portfolios during broad selloffs. Read more at: https://www.cnbc.com/2023/07/06/bond-yields-and-volatility-are-spiking-these-etfs-should-benefit.html |

|

Sens. Warren, Booker grill failed retailer Bed Bath & Beyond over allegedly denying severanceThe retailer filed for bankruptcy in April and began closing stores and laying off workers. Read more at: https://www.cnbc.com/2023/07/06/sens-warren-booker-grill-bed-bath-beyond-on-severance-pay-.html |

|

Private sector companies added 497,000 jobs in June, more than double expectations, ADP saysThe U.S. labor market showed no signs of letting up in June, as companies created far more jobs than expected. Read more at: https://www.cnbc.com/2023/07/06/adp-jobs-report-private-sector-added-497000-workers-in-june.html |

|

Job openings fall by half a millionThe closely watched JOLTS report showed that listings fell to 9.82 million, down 496,000 from April. Read more at: https://www.cnbc.com/2023/07/06/job-openings-fall-by-half-a-million.html |

|

Bitcoin touches 13-month high, and Valkyrie refiles for spot bitcoin ETF: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, Brian Mosoff, CEO of Ether Capital, discusses the rush by institutions to list spot bitcoin ETFs. Ether Capital helped launch the world’s first spot bitcoin and Ethereum ETFs in 2021. Read more at: https://www.cnbc.com/video/2023/07/06/bitcoin-13-month-high-valkyrie-refiles-spot-bitcoin-etf-crypto-world.html |

|

Ukraine war live updates: Wagner leader Prigozhin in St. Petersburg, Belarus leader says; Russian missile kills five in LvivA Russian missile struck an apartment block in the western city of Lviv, around 40 miles from the Polish border, killing at least five. Read more at: https://www.cnbc.com/2023/07/06/ukraine-war-live-updates-latest-news-on-russia-and-the-war-in-ukraine.html |

|

Taylor Swift agreed to FTX partnership, but the crypto exchange bailed, source tells CNBCThe nature of the agreement contradicts prior public statements from a high-profile attorney that suggested that Swift pulled out of the contract. Read more at: https://www.cnbc.com/2023/07/06/taylor-swift-agreed-to-ftx-partnership-despite-contrary-public-claims-source.html |

|

You don’t need to tip when you buy coffee, Shake Shack founder Danny Meyer saysShake Shack, the chain that Danny Meyer founded, added tipping at its restaurants last year. Read more at: https://www.cnbc.com/2023/07/06/tipping-danny-meyer-says-dont-add-gratuity-on-coffee-takeout-orders.html |

|

EU regulators open antitrust probe into Amazon’s $1.7 billion iRobot dealThe announced probe of Amazon’s purchase of iRobot marks the latest regulatory hurdle for large tech companies as they seek to expand. Read more at: https://www.cnbc.com/2023/07/06/eu-opens-in-depth-antitrust-probe-into-amazons-irobot-deal.html |

|

If You Hate Ordinals, You Might Undervalue The Bitcoin NetworkAuthored by Mark Maraia via BitcoinMagazine.com, For years, Bitcoiners have been telling almost everyone who would listen that bitcoin is undervalued. Any Bitcoiner who’s done the research knows that bitcoin the asset is radically undervalued. And I wholeheartedly agree!

But even though bitcoin, the asset, is undervalued, it pales in comparison to how much the Bitcoin network is undervalued. I have long held that Bitcoiners, as a group, are undervaluing the Bitcoin network as much or more than no coiners are undervaluing bitcoin the asset. So, it is with some amusement that I observe the fierce debate between the Bitcoin purists who believe that the use of the Bitcoin network (i.e., the immutable digital ledger) is only for sending value (bitcoin), and the inscriptions, Ordinals and BRC token crowd which says and does otherwise. … Read more at: https://www.zerohedge.com/crypto/if-you-hate-ordinals-you-might-undervalue-bitcoin-network |

|

Watch: Biden Laughs As Reporters Ask Him About Cocaine Found At White HouseAuthored by Steve Watson via Summit News, The biggest story in America yesterday was the discovery of cocaine at the White House, along with images and video of Hunter Biden at the White House on July 4th looking completely wired and allegedly taking a bump.

According to reports, the cocaine was found stashed in a cubby hole in the West Wing. Yet Joe Biden seemed to think it’s all funny, laughing at reporters trying to ask him about the incident.

|

|

China’s Military Says US Turning Taiwain Into A “Powder Keg” As Yellen Arrives In BeijingJust hours before the arrival of US Treasury Secretary Janet Yellen in Beijing, China’s defense ministry issued a stern warning aimed at Washington and its support for Taiwan. Col. Tan Kefei warned that the US is turning Taiwan into a “powder keg”. This was specifically in response to the Biden White House’s latest approval of new arms deals for the self-ruled island, in sales worth $440 million. “China is firmly opposed to US arms sales to Taiwan and has lodged stern representations with the US,” the Chinese military statement began. Certainly the timing of the statement is also aimed at reminding the newly arrived US delegation led by Yellen of Beijing’s highest priorities and ‘red lines’.

Read more at: https://www.zerohedge.com/geopolitical/chinas-military-says-us-turning-taiwain-powder-keg-yellen-arrives-beijing |

|

America’s Oil And Gas Capital Leads The Transition To RenewablesBy Haley Zaremba of Oilprice.com

Peak energy demand has reached an all-time high in Texas, where temperatures have been hotter than 99% of the world over the last few weeks. The prolonged heat wave is shattering records now but is likely just the beginning of what scientists predict will be a pattern of increasing and increasingly extreme weather events associated with climate change. Read more at: https://www.zerohedge.com/markets/americas-oil-and-gas-capital-leads-transition-renewables |

|

Week of strikes to disrupt Tube services, RMT saysWeek of strikes to hit Tube services from 23 July in row over pensions and job cuts, RMT union says. Read more at: https://www.bbc.co.uk/news/business-66127959?at_medium=RSS&at_campaign=KARANGA |

|

Mothers could have missed out on £1bn in state pensionWomen will receive letters from the the UK’s tax authority aimed at correcting state pension underpayments. Read more at: https://www.bbc.co.uk/news/business-66124840?at_medium=RSS&at_campaign=KARANGA |

|

NatWest, Lloyds, Barclays and HSBC among banks quizzed over savings ratesThe regulator says it had a constructive meeting with major UK banks over worries rates on savings are too low. Read more at: https://www.bbc.co.uk/news/business-66111098?at_medium=RSS&at_campaign=KARANGA |

|

Is Bajaj Auto stock a buy after recent product launch? Here’s what top brokerages thinkWith the entry of Bajaj and Hero in the premium space, analysts see stiff competition, loss of market share, and growth concerns for Eicher. Read more at: https://economictimes.indiatimes.com/markets/web-stories/is-bajaj-auto-stock-a-buy-after-recent-product-launch-heres-what-top-brokerages-think/articleshow/101551978.cms |

|

Gainers & Losers: Eicher among top 6 stocks in news ThursdayThe 30-share Sensex climbed 339 to settle at 65,785, while the broader Nifty jumped nearly 100 points to end at a fresh high of 19,497. Read more at: https://economictimes.indiatimes.com/markets/web-stories/gainers-and-losers-hind-zinc-eicher-motors-among-top-6-stocks-in-limelight-today/articleshow/101545392.cms |

|

NCLT approves demerger of financial services unit of Reliance“The company and Reliance Strategic Investments Limited will take necessary steps including fixing the record date for allotment and listing of equity shares of Reliance Strategic Investments Limited,” it said without giving timelines for the same. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/nclt-approves-demerger-of-financial-services-unit-of-reliance/articleshow/101551024.cms |

|

Market Extra: Left behind by 2023 stock-market rally? Use this kind of ETF to play catchup, says BofAInvestors may be better off owning the equal-weighted version of the S&P 500 in the second half of 2023, after the popular stock-market gauge soared on narrow breadth during the first six months of the year, according to BofA Global Research. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7225-906B948279CF%7D&siteid=rss&rss=1 |

|

Market Snapshot: Dow slides 350 points as jobs data triggers jump in bond yieldsU.S. stocks slide Thursday after a report from ADP showed the private sector created nearly half a million new jobs in June. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7224-E2EE731B7623%7D&siteid=rss&rss=1 |

|

Market Extra: Mullen Automotive’s stock more than doubles in 2 days. Here’s why.Mullen Automotive’s stock rocketed on massive volume for a 2nd-straight day, after the electric-vehicle maker announced plans to buy back a chunk of shares. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7225-3BF5EC1E03C5%7D&siteid=rss&rss=1 |

Arrival in Beijing on Thursday, AFP/Getty Images”We urge the US side to abide …

Arrival in Beijing on Thursday, AFP/Getty Images”We urge the US side to abide …