Summary Of the Markets Today:

- The Dow closed up 11 points or 0.03%,

- Nasdaq closed up 0.21%,

- S&P 500 closed up 0.12%,

- Gold $1,929 down $0.10,

- WTI crude oil settled at $70 down $0.52,

- 10-year U.S. Treasury 3.858% up 0.039 points,

- USD Index $103.01 up $0.09,

- Bitcoin $31,263 up $704,

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our Economic Forecast for July 2023

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

Construction spending during May 2023 is up 7.3% year-over-year (but DOWN 3.2% year-over-year inflation adjusted. This sector remains in a recession.

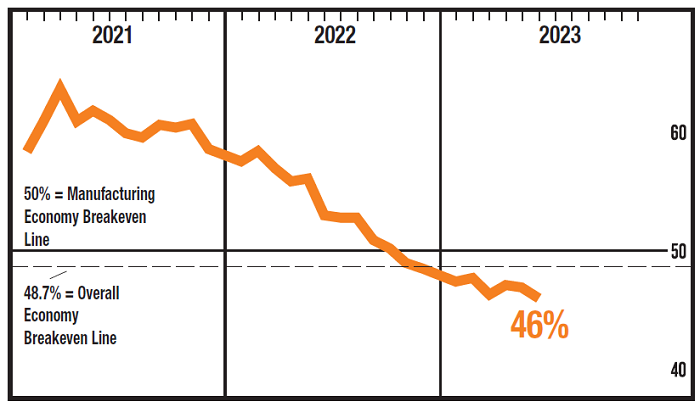

The June Manufacturing PMI® registered 46.0% down, 0.9 percentage points from May 2023. This number shows a seventh month of contraction. The New Orders Index remained in contraction at 45.6% which is 3 percentage points higher than May. Manufacturing remains in a recession.

Here is a summary of headlines we are reading today:

- What China’s Solar Dominance Means For Global Trade

- U.S. Lifts Tariffs On Indian Steel And Aluminum

- China Stockpiling Cobalt Reserves Amid Price Crash

- Tesla Stock Climbs 6% After Beating Analyst Delivery Estimates

- Code Language Limitations: The Achilles’ Heel Of Autonomous Vehicles

- Oil, EVs, And Big Tech Hit The Ground Running In The Second Half

- Oil Prices Climb As Saudi Arabia Extends Production Cut Into August

- Dodge Durango, Jeep SUVs push Stellantis second-quarter sales up 6.4%

- Bitcoin crosses $31,000, and Galaxy Digital’s CIO shares crypto outlook for Q3: CNBC Crypto World

- AOC Wants Supreme Court Justices Impeached In Retaliation For Doing Their Job

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

How To Spot Greenwashing In Renewables InvestmentBy now, we’ve all tired of sanctimonious, box -checking ESG (environmental-social-governance) investors who talk the talk but own clearly unsustainable (to use another favorite word) stocks. And of big fossil-fuel producers who profess their desire to decarbonize—but not for a while, and not if it will cost too much money, or decrease profits. The same folks who want to take “responsible” steps to decarbonize but not until 2050 when all present managers will have retired. So, with our long experience in banking, security… Read more at: https://oilprice.com/Energy/Energy-General/How-To-Spot-Greenwashing-In-Renewables-Investment.html |

|

UK Manufacturing Faces More Headwinds As Overseas Spending CoolsBritain’s factories have plunged further into recession territory, driven by domestic and foreign buyers reining in spending amid intense economic uncertainty, a closely watched survey out today shows. S&P Global and the Chartered Institute of Procurement and Supply’s (CIPS) purchasing managers’ index (PMI) for the UK’s manufacturing industry slipped to 46.5 in June from 47.1 in May. It means the sector has been in the sub 50 point negative growth territory for 11 months in a row, although the reading was upgraded from… Read more at: https://oilprice.com/Latest-Energy-News/World-News/UK-Manufacturing-Faces-More-Headwinds-As-Overseas-Spending-Cools.html |

|

What China’s Solar Dominance Means For Global TradeChina’s rise as a global economic superpower has brought with it an ability for the nation to utilize its economic dominance for geopolitical purposes. As Visual Capitalist’s Marcus Lu shows in this infographic, sponsored by The Hinrich Foundation, China’s dominant position in the solar photovoltaic (PV) supply chain has used as leverage against countries that are dependent on it for clean energy. Dominance in the Solar Supply Chain Solar energy is playing a significant role in the green energy transition, and as… Read more at: https://oilprice.com/Energy/Energy-General/What-Chinas-Solar-Dominance-Means-For-Global-Trade.html |

|

U.S. Lifts Tariffs On Indian Steel And AluminumVia AG Metal Miner Indian Prime Minister Narendra Modi recently visited the United States. During his stay, the two nations agreed to resolve six long-standing disputes at the World Trade Organization (WTO). U.S. steel news outlets watched this exchange particularly closely. This is because one of the subjects of debate was India’s imposition of retaliatory tariffs on U.S. products, including steel. Many analysts expect this development to stimulate trade between the U.S. and India while offering crucial tax benefits to Indian exporters. … Read more at: https://oilprice.com/Metals/Commodities/US-Lifts-Tariffs-On-Indian-Steel-And-Aluminum.html |

|

Why The EU Is Hesitant To Implement Its New Sanctions FrameworkWhen EU member states finally approved the bloc’s latest sanctions package against Russia on June 23, perhaps the most interesting feature was a new anti-circumvention framework aimed at third countries. Although this framework for the moment very much remains an empty canvas, it has now given Brussels the legal tools to do two things: Draw up a list of products made in the bloc that it believes are being sent to Russia via third countries, and another register in which third countries can be named and hence will no longer be able to import things… Read more at: https://oilprice.com/Geopolitics/International/Why-The-EU-Is-Hesitant-To-Implement-Its-New-Sanctions-Framework.html |

|

China Stockpiling Cobalt Reserves Amid Price CrashChina is taking advantage of the cobalt price crash to boost its reserves, Bloomberg has reported. China’s National Food and Strategic Reserves Administration plans to buy ~2,000 tons of cobalt, according to people familiar with the matter. Chinese refiners rely heavily on DRC cobalt mines, although Indonesia is quickly emerging as a large producer. After hitting an all-time high of $81,790/metric ton in April 2022, cobalt prices have declined nearly 60% to $33,140/ metric ton amid lackluster global demand and surging supply from Indonesia,… Read more at: https://oilprice.com/Latest-Energy-News/World-News/China-Stockpiling-Cobalt-Reserves-Amid-Price-Crash.html |

|

Yellen’s Beijing Visit: A Chance to Calm U.S.-China Tensions?Treasury Secretary Janet Yellen will be the next top Biden admin official to try and calm spiraling relations with China, as the Treasury Department confirmed Sunday she’ll travel to Beijing this week, Thursday through Sunday, for meetings with senior officials, in what will mark the first trip of her tenure. “While in Beijing, Secretary Yellen will discuss with [People’s Republic of China] officials the importance for our countries — as the world’s two largest economies — to responsibly manage our relationship,… Read more at: https://oilprice.com/Geopolitics/Asia/Yellens-Beijing-Visit-A-Chance-to-Calm-US-China-Tensions.html |

|

Tesla Stock Climbs 6% After Beating Analyst Delivery EstimatesTesla reported its Q2 production and deliveries on Sunday, posting numbers that exceeded analyst estimates, despite doubts about demand throughout the quarter. At the end of Q2, Tesla once again proved that price cuts can help move metal, posting 466,140 deliveries for the quarter, ahead of Bloomberg’s consensus estimate of 448,351. The auto manufacturer produced 479,700 vehicles in the quarter, exceeding estimates of 456,617. Tesla delivered 19,225 Model S/X vehicles in the quarter, beating expectations of 14,606. The EV manufacturer also delivered… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Tesla-Stock-Climbs-6-After-Beating-Analyst-Delivery-Estimates.html |

|

Code Language Limitations: The Achilles’ Heel Of Autonomous VehiclesSelf-driving vehicles are stopping in traffic for no apparent reason and blocking emergency vehicles reports the Los Angeles Times. The writer alludes to a famous high-tech shibboleth: “Move fast and break things.” But in this case the things that are being broken are the health and lives of California residents who are having to endure the growing presence of so-called autonomous vehicles on the state’s streets and highways. I have repeatedly warned that autonomous vehicles could only be truly safely operated on closed courses where the possible… Read more at: https://oilprice.com/Energy/Energy-General/Code-Language-Limitations-The-Achilles-Heel-Of-Autonomous-Vehicles.html |

|

Water Scarcity Could Derail Biden’s Green Hydrogen PlansProposed green hydrogen hubs along the U.S. Gulf Coast would require a lot of fresh water in drought-prone areas, so clean hydrogen production may need costly and environmentally-damaging desalination plants, activist groups have told Reuters. As part of the Bipartisan Infrastructure Law, the Biden Administration last year opened applications for a $7 billion program to create regional clean hydrogen hubs (H2Hubs) across the United States. “These H2Hubs are a once-in-a-generation opportunity to lay the foundation for the clean… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Water-Scarcity-Could-Derail-Bidens-Green-Hydrogen-Plans.html |

|

Oil, EVs, And Big Tech Hit The Ground Running In The Second HalfGlobal markets have kicked off the new quarter with solid gains from Asia to Europe (as previewed last week in “The Technical Overhang Is Done, July Starts With A Bullish Eruption”) while US equity futures were in the green, with sentiment getting a boost thanks to Tesla and BYD climbing on record quarterly sales. Oil rallied as Saudi Arabia and Russia extended oil supply cuts. At 7:45am ET, S&P emini futures were flat, reversing an earlier rally, with trading activity subdued by today’s half-day schedule ahead of the upcoming July 4… Read more at: https://oilprice.com/Finance/the-Markets/Oil-EVs-And-Big-Tech-Hit-The-Ground-Running-In-The-Second-Half.html |

|

India Has Started Paying In Yuan For Some Russian Oil ImportsSome Indian refiners have paid in Chinese yuan for part of the crude oil cargoes they have bought from Russia, sources have told Reuters, as Moscow seeks alternatives to the U.S. dollar amid the sanctions while India looks to buy crude at discounts. India has become a top customer of Russia’s crude, alongside China, after the Western sanctions and the price cap on Russian oil. India’s crude oil imports from Russia are estimated to have hit a new record high of 2.2 million barrels per day (bpd) in June, having risen in 10… Read more at: https://oilprice.com/Latest-Energy-News/World-News/India-Has-Started-Paying-In-Yuan-For-Some-Russian-Oil-Imports.html |

|

Russia Says It Will Reduce Oil Exports By 500,000 Bpd In AugustRussia will cut its crude oil exports by 500,000 barrels per day (bpd) in August in a bid to ensure a balanced market, Russia’s Deputy Prime Minister Alexander Novak said on Monday. “As part of the efforts to ensure a balanced market, Russia will voluntarily reduce its oil supply in August by 500,000 barrels per day by cutting its exports to global markets by that quantity,” Novak said in a brief statement. The top oil official in Russia didn’t give any figures as to the volume of the Russian production and exports for August,… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Russia-Says-It-Will-Reduce-Oil-Exports-By-500000-Bpd-In-August.html |

|

Saudi Arabia Expected To Cut Oil Prices To AsiaSaudi Arabia is expected to reduce the price of its crude oil going to Asia in August to reflect market movements, a Reuters survey of six Asian refining sources showed on Monday. Saudi Aramco, the world’s top crude oil exporter, is set to reduce the official selling price (OSP) for the flagship Saudi grade, Arab Light, by around $0.50 per barrel compared to the loadings for July, according to the Reuters poll. Saudi Arabia typically announces on the fifth of each month the OSPs for the following month and its pricing… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Saudi-Arabia-Expected-To-Cut-Oil-Prices-To-Asia.html |

|

Oil Prices Climb As Saudi Arabia Extends Production Cut Into AugustSaudi Arabia is extending its unilateral 1 million bpd production cut into August, the world’s top crude exporter said on Monday, sending oil prices rising by 1%. “An official source from the Ministry of Energy announced that the Kingdom of Saudi Arabia will extend the voluntary cut of one million barrels per day, which has gone into implementation in July, for another month to include the month of August that can be extended, and in effect, the Kingdom’s production for the month of August 2023 will be approximately… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Oil-Prices-Climb-As-Saudi-Arabia-Extends-Production-Cut-Into-August.html |

|

Tesla shares rise nearly 7% after delivery and production numbers beat expectationsTesla shares closed 6.9% higher Monday, driven in part by stronger-than-expected second-quarter deliveries and production numbers. Read more at: https://www.cnbc.com/2023/07/03/tesla-shares-rise-over-7percent-after-deliveries-report-production-numbers.html |

|

Bluesky experiences ‘record-high traffic’ after Elon Musk imposes rate limits on TwitterBluesky said it experienced “record-high traffic” after Elon Musk said Twitter will temporarily limit the number of posts users can read per day. Read more at: https://www.cnbc.com/2023/07/03/users-flock-to-twitter-competitor-bluesky-after-elon-musk-imposes-rate-limits.html |

|

Rivian shares surge as second-quarter EV deliveries top estimatesRivian on Monday reported deliveries of 12,640 vehicles during the second quarter, topping analyst expectations of 11,000 vehicles. Read more at: https://www.cnbc.com/2023/07/03/rivian-shares-surge-as-second-quarter-ev-deliveries-top-estimates.html |

|

Dodge Durango, Jeep SUVs push Stellantis second-quarter sales up 6.4%Stellantis’ sales uptick is expected to be among the lowest of the quarter, according to auto analysts who project industry sales to have increased 16% to 18%. Read more at: https://www.cnbc.com/2023/07/03/stellantis-new-vehicle-sales-second-quarter.html |

|

Most patriotic stocks: These names can benefit the most from a strong U.S. economyCNBC Pro set out to find the stocks that can capitalize the most from a strong U.S. economy. Read more at: https://www.cnbc.com/2023/07/03/most-patriotic-stocks-these-names-can-benefit-the-most-from-a-strong-us-economy.html |

|

Wind turbine troubles have sent one stock tumbling. There are fears it could be a much wider issue“We have to acknowledge that … the pace of change in that machinery has put us into slightly uncharted territory,” one analyst said. Read more at: https://www.cnbc.com/2023/07/03/siemens-energy-wind-turbine-problems-could-be-an-industry-wide-issue.html |

|

Bitcoin crosses $31,000, and Galaxy Digital’s CIO shares crypto outlook for Q3: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, Christopher Ferraro, president and CIO of Galaxy Digital, joins “CNBC Crypto World” to discuss the U.S. regulatory environment and investor sentiment that will shape crypto prices in the second half of 2023. Read more at: https://www.cnbc.com/video/2023/07/03/bitcoin-31000-galaxy-digital-cio-outlook-q3-crypto-world.html |

|

Ukraine war live updates: Russia’s Medvedev cites risks of nuclear war; Moscow calls loss of Wagner forces ‘no threat’ to combat abilitiesThe failed insurgency of Russian paramilitary group Wagner against the Kremlin has driven militia leader Yevgeny Prigozhin into exile in Belarus. Read more at: https://www.cnbc.com/2023/07/03/ukraine-war-live-updates-latest-news-on-russia-and-the-war-in-ukraine.html |

|

Here are steps student loan borrowers should take now, after Supreme Court strikes down debt cancellationTo prepare for the resumption of federal student loan payments in October, here are five steps borrowers should take starting now. Read more at: https://www.cnbc.com/2023/07/03/some-steps-student-loan-borrowers-can-take-following-supreme-court-ruling.html |

|

United CEO says flight cuts needed as thunderstorms roil July Fourth holiday travelUnited’s CEO, Scott Kirby, apologized late Friday for taking a private jet out of New Jersey during the flight disruptions. Read more at: https://www.cnbc.com/2023/07/01/united-flight-disruptions-30000-frequent-flyer-miles-.html |

|

The rise and fall of SkypeMicrosoft says Skype “remains a great option.” But it has lost daily users in the past three years, while other services, including Microsoft Teams, have grown. Read more at: https://www.cnbc.com/2023/07/02/the-rise-and-fall-of-skype.html |

|

With a record number of travelers expected to drive this July 4, here’s how to save on gasPent-up travel demand will prompt more people to hit the road this holiday weekend. These tips can help drivers save on gas. Read more at: https://www.cnbc.com/2023/07/03/heres-how-travelers-can-save-on-gas-this-july-4-holiday.html |

|

This is where to find hot yields in July, according to UBSInvestors should be focused on fixed income over equities right now, according to UBS. Read more at: https://www.cnbc.com/2023/07/03/this-is-where-to-find-hot-yields-in-july-according-to-ubs.html |

|

ESG Investing Isn’t Doing Much For The Environment; Yale Study ConfirmsWhen companies with poor environmental credentials are starved of capital thanks to investors obsessed with ESG, they become dirtier to avoid bankruptcy, writes City AM’s Matthew Lesh

ESG or environmental, social and governance investing is facing troubles. Higher bond yields drove an astonishing £304m out of the sector in May. This largely reflects a natural market dynamic – investors are chasing higher returns by moving from shares to bonds. Yet perhaps there should be some deeper angst at play. Is ESG investing really everything it is cracked up to be? Read more at: https://www.zerohedge.com/markets/esg-investing-isnt-doing-much-environment-yale-study-confirms |

|

AOC Wants Supreme Court Justices Impeached In Retaliation For Doing Their JobInterpreting the laws as close to the original intent of the constitution as possible is the focus of the US Supreme Court. Sometimes they do this job well, sometimes they get it completely wrong and it takes years for their mistakes to be corrected. Generally speaking, the mandate of Supreme Court justices is to make decisions based on the logic of the law as it was designed by the Founding Fathers and not allow politics or personal bias to interfere. But what happens when the country becomes so utterly divided that one side of the aisle views the constitution itself as an illegitimate document? What happens when the goal of that group is the deconstruction of the law in an effort to engineer double standards that work in their favor? How would the Supreme Court be viewed in a world where any deviation from the party line is seen as treason? Well, we are witnessing the results of this powder keg atmosphere right now. This week has brought a flood of outrage from Democrats and leftist activist groups who have been, for the most part, getting exactly what they want from the government and the legal system for years. So much so that they have now come to expect that every policy and every law will be adjudicated according to their manifesto. One notable meltdown was that of Democrat Rep. Jaamal Bowman, who accused the Supreme Court of being ‘illegitimate’ and in the service of ‘white patriarchy.’ Another revealing leftist commentary was that of Alex … Read more at: https://www.zerohedge.com/political/aoc-wants-supreme-court-justices-impeached-retaliation-doing-their-job |

|

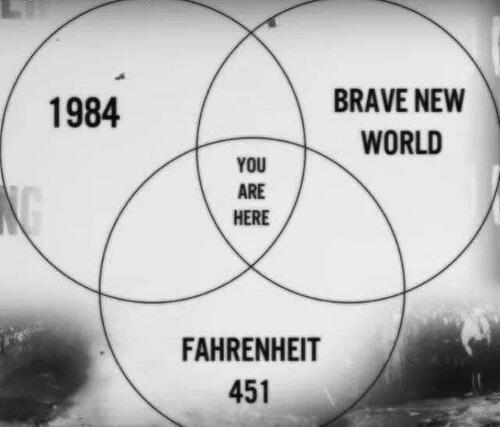

Burning Books In A Brave New 1984 WorldAuthored by Jim Quinn via The Burning Platform blog, “Those who don’t build must burn.” ― Ray Bradbury, Fahrenheit 451

“One believes things because one has been conditioned to believe them.” ― Aldous Huxley, Brave New World “Being in a minority, even in a minority of one, did not make you mad. There was truth and there was untruth, and if you clung to the truth even against the whole world, you were not mad.” ― George Orwell, 1984 The Venn diagram above perfectly captures the zeitgeist of our current dystopian world better than any academic drivel disguised as a scientific study or any regime media produced propaganda disguised as journalism. In fact, these three novels capture everything that has gone te … Read more at: https://www.zerohedge.com/political/burning-books-brave-new-1984-world |

|

Bitcoin, Banks, & Bullion Bid To Start H2; Bonds & Stocks ChopMore ugly ‘soft’ survey data with both ISM and PMI showing serious contraction the US Manufacturing sector (and don’t forget, this does not cycle independently of Services, there is a lead-lag relationship).

Source: Bloomberg Equities were volatile early on (especially Small Caps) but by the close, The Dow, S&P, and Nasdaq all hugged the unch-line while Russell 2000 outperformed…

Banks outperformed today alomg with … Read more at: https://www.zerohedge.com/markets/bitcoin-bullion-bid-start-h2-bonds-stocks-chop |

|

Supermarkets forced to publish live fuel prices to cut costsRetailers will be “held to account”, ministers say, after drivers paid an extra 6p per litre for fuel in 2022. Read more at: https://www.bbc.co.uk/news/business-66085232?at_medium=RSS&at_campaign=KARANGA |

|

Nigel Farage: Banks warned against closing accountsCulture Secretary Lucy Frazer says she is concerned banks are shutting accounts for the wrong reasons. Read more at: https://www.bbc.co.uk/news/business-66090522?at_medium=RSS&at_campaign=KARANGA |

|

July train disruption: New Aslef overtime ban to hit servicesAslef drivers will refuse to work overtime for another six days, in addition to the current industrial action. Read more at: https://www.bbc.co.uk/news/business-66084766?at_medium=RSS&at_campaign=KARANGA |

|

FPI Deluge: Foreign investors buy big in India.FPI investment in June was Rs 47,148 cr ($5.7 billion), the most in 10 months. Here’s a look at the FPI rush into India. Read more at: https://economictimes.indiatimes.com/markets/web-stories/fpi-deluge-foreign-investors-buy-big-in-india-/articleshow/101465260.cms |

|

Breakout Stocks: How Suzlon, L&T Finance and HPCL are looking on charts for TuesdayThe oil & gas, energy, public sector, and metals sectors performed well, while healthcare, capital goods, auto, and IT sectors experienced some selling pressure. Stocks like Suzlon, L&T Finance, and HPCL were in focus. Analyst Kumar Saurabh highlights that Suzlon and L&T Finance have potential for gains, but caution is needed due to their distance from key support levels. HPCL’s good Q4 results and a rounding bottom base indicate swing trading opportunities. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/breakout-stocks-how-suzlon-lt-finance-and-hpcl-are-looking-on-charts-for-tuesday/articleshow/101463806.cms |

|

TCS, HCL Tech to kick-off Q1 earnings season on July 12; Infosys results on July 20Indian IT companies, including TCS, HCL Technologies, and Infosys, are set to release their earnings for the first quarter of 2023. Despite an uncertain global environment and muted demand, Jefferies expects a small decline in aggregate revenue and a contraction in margins. They anticipate Infosys may lower its guidance, while TCS could announce a buyback. Motilal Oswal predicts a modest year-on-year revenue growth but a drop in profit. Analysts also speculate that Infosys and HCL Technologies may revise their sales growth outlook for FY24 due to weak earnings. Read more at: https://economictimes.indiatimes.com/markets/stocks/earnings/tcs-hcl-tech-to-kick-off-q1-earnings-season-on-july-12-infosys-results-on-july-20/articleshow/101464668.cms |

|

Futures Movers: Oil fails to hold gains scored after Saudi, Russia announced supply cutsOil futures end lower, erasing gains scored Monday after Saudi Arabia extends voluntary production cut through August and Russia announces export curbs. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7222-FBBE3F0AFE74%7D&siteid=rss&rss=1 |

|

Personal Finance Daily: These fully remote jobs pay over $100,000 a year, but there are a couple of caveats and what NOT to buy on Amazon Prime Day — and why discounts may be even bigger this yearMonday’s top personal finance stories. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7223-9DEA7B7C3137%7D&siteid=rss&rss=1 |

|

Washington Watch: Yellen’s China trip: 3 key issues to watchTreasury Secretary Yellen will travel to China this week in an attempt to repair a partnership that has frayed after years of political conflict and trade wars. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7223-488239715B8E%7D&siteid=rss&rss=1 |