Summary Of the Markets Today:

- The Dow closed down 5 points or 0.01%,

- Nasdaq closed up 0.95%,

- S&P 500 closed up 0.37%,

- Gold $1,924 down $21.20,

- WTI crude oil settled at $69 down $3.11,

- 10-year U.S. Treasury 3.795% up 0.072 points,

- USD Index $102.41 up $0.34,

- Bitcoin $30,234 up $59,

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our Economic Forecast for June 2023

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

In the week ending June 17, the advance figure for seasonally adjusted initial unemployment claims 4-week moving average was 255,750, an increase of 8,500 from the previous week’s revised average. This is the highest level for this average since November 13, 2021 when it was 260,000. The previous week’s average was revised up by 500 from 246,750 to 247,250.

Existing-home sales rose insignificantly month-over-month in May 2023, with gains in the South and West and declined in the Northeast and Midwest regions of the U.S. Sales in all four regions combined fell 20.4% year-over-year. The median existing-home price declined by 3.1% from May 2022.

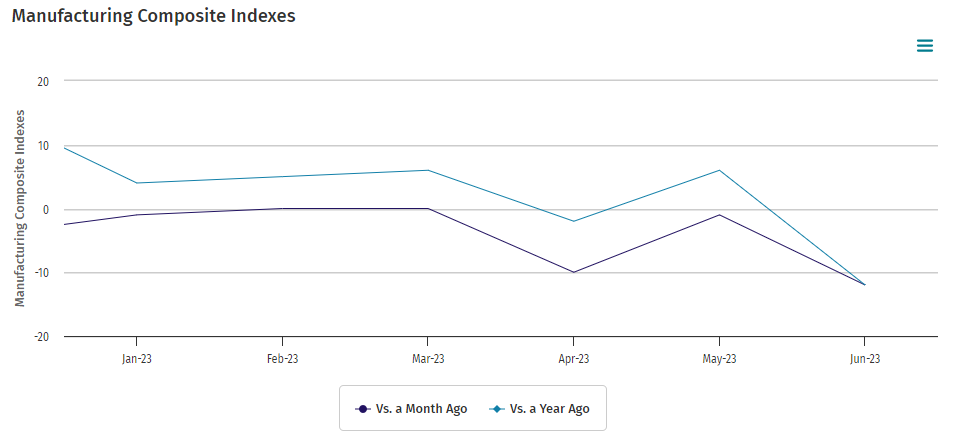

The Kansas City Fed manufacturing area declined further in June 2023. The month-over-month composite index was -12 in June, down from -1 in May and from -10 in April. This indicates a contraction in manufacturing activity.

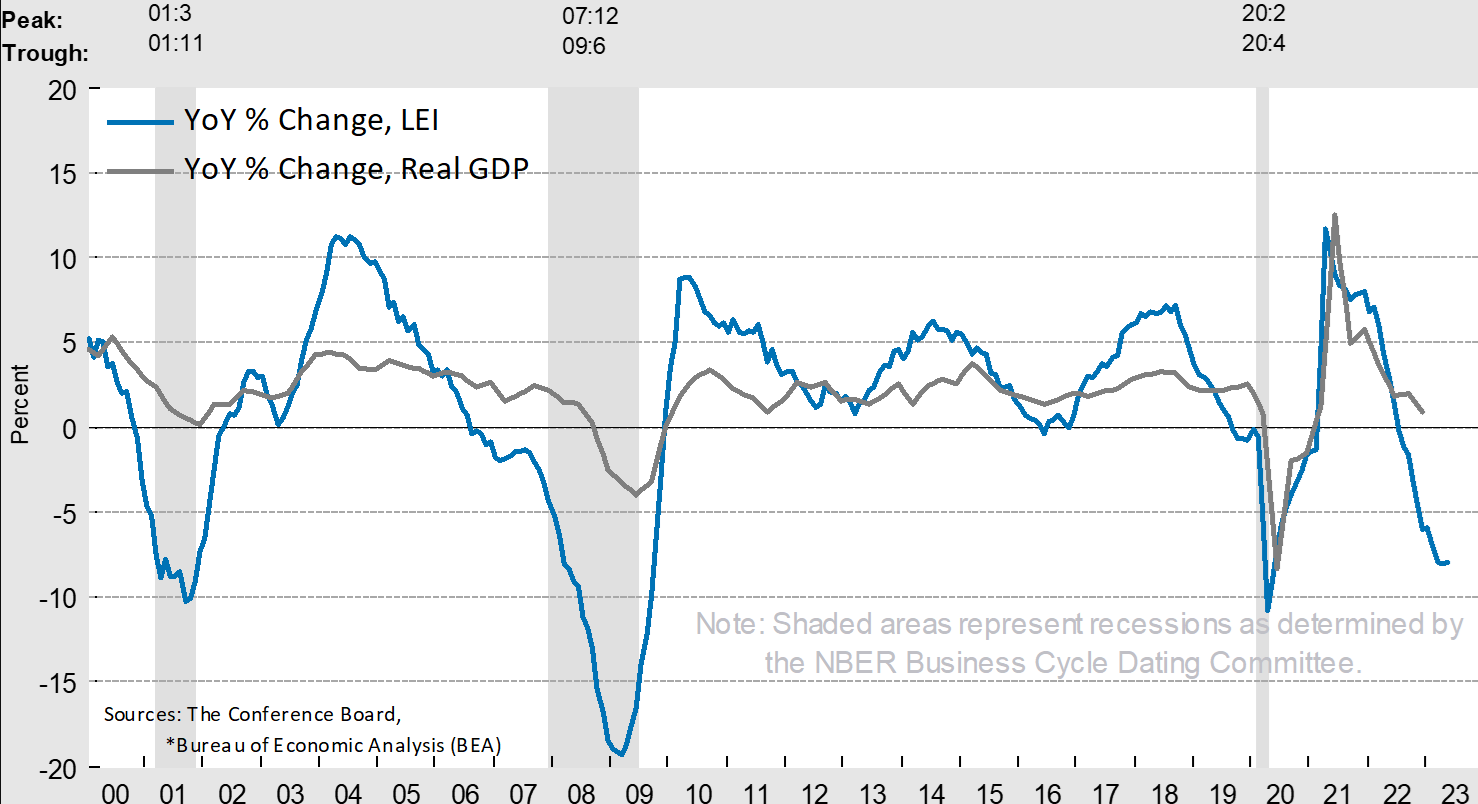

The Conference Board Leading Economic Index® (LEI) for the U.S. declined by 0.7 percent in May 2023 to 106.7, following a decline of 0.6 percent in April. The LEI is down 4.3 percent over the six-month period between November 2022 and May 2023—a steeper rate of decline than its 3.8 percent contraction over the previous six months from May to November 2022. Justyna Zabinska-La Monica, Senior Manager, Business Cycle Indicators, at The Conference Board said a recession is coming:

The US LEI continued to fall in May as a result of deterioration in the gauges of consumer expectations for business conditions, ISM® New Orders Index, a negative yield spread, and worsening credit conditions. The US Leading Index has declined in each of the last fourteen months and continues to point to weaker economic activity ahead. Rising interest rates paired with persistent inflation will continue to further dampen economic activity. While we revised our Q2 GDP forecast from negative to slight growth, we project that the US economy will contract over the Q3 2023 to Q1 2024 period. The recession likely will be due to continued tightness in monetary policy and lower government spending.

Here is a summary of headlines we are reading today:

- How Renewable Energy Prosumers Are Decentralizing The Power Grid

- U.S. Department Of Energy Splashes $9.2B On Ford EV Batteries

- Soaring Car Prices Put American Auto Loans Underwater

- Oil Falls Despite Moderate Draw In Crude Inventories

- Oil Prices Dip As Further Interest Rate Hikes Loom

- S&P 500, Nasdaq rise to end 3-day losing streak as investors snap up tech shares: Live updates

- Fed Chair Powell says smaller banks likely will be exempt from higher capital requirements

- New technologies hurt car quality as EV brands fare poorly, J.D. Power says

- Ghosts Of 2000 And 2007 Market Tops Are Absent Today

- Movers & Shakers: Tesla, Anheuser-Busch, Logitech stocks rise, AMC, iRobot, Virgin Galactic shares fall, and other stocks on the move

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

How Renewable Energy Prosumers Are Decentralizing The Power GridThe spread of renewable energy has changed the way that our grids operate. Variable energy sources such as wind and solar require major upgrades to the existing power grid that would allow for increased efficiency and flexibility. And it’s not just mass-scale solar and wind farms that are complicating the functionality of the grid. Energy generation is becoming increasingly decentralized and localized as people install residential solar panels, batteries, and other grid-connected residential infrastructure, creating challenges as… Read more at: https://oilprice.com/Energy/Crude-Oil/How-Renewable-Energy-Prosumers-Are-Decentralizing-The-Power-Grid.html |

|

Nuclear Fusion Project Sees Cost Overruns, More DelaysThe old joke that nuclear fusion is perpetually a decade away may seem unfair, but the world’s largest fusion project is once again facing more delays and billions in cost overruns. The International Thermonuclear Experimental Reactor, or ITER, has suffered at the hands of disrupted supply chains and faulty parts. And now, the project’s hopes of achieving fusion by next year is in serious jeopardy. The project has seen a number of setbacks—including Covid-19. When all its ducks were finally in a row again post-Covid, the project… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Nuclear-Fusion-Project-Sees-Cost-Overruns-More-Delays.html |

|

Hot Weather Sends Ripples Through Natural Gas MarketsA year ago, Europe was in the midst of an energy crisis as the continent struggled to adapt to a new post-Russian gas reality. TTF prices, the European benchmark for natural gas, spiraled higher throughout the summer and peaked in late August, with all energy users affected, from major industries to individual households. So far in 2023, natural gas in Europe has stolen fewer headlines, with prices predominantly drifting downwards since December and returning to levels last seen in 2021. Last week, however, was marked with volatile trading on TTF… Read more at: https://oilprice.com/Energy/Gas-Prices/Hot-Weather-Sends-Ripples-Through-Natural-Gas-Markets.html |

|

U.S. Department Of Energy Splashes $9.2B On Ford EV BatteriesThe U.S. Department of Energy is gearing up to divvy out a $9.2 billion loan to a Ford Motor JV to finance EV battery plants. The loan comes courtesy of the Inflation Reduction Act—a massive spending bill designed to earmark monies in part that will be used to help spur clean energy projects. The $11.4 billion JV known as BlueOval SK was finalized last year, and is set to construct three battery plants: two in Kentucky and one in Tennessee. Ford is set to contribute $7 billion to the BlueOval project, and South Korean battery maker SK will… Read more at: https://oilprice.com/Latest-Energy-News/World-News/US-Department-Of-Energy-Splashes-92B-On-Ford-EV-Batteries.html |

|

How Sunlight Is Transforming Waste Into EnergyUniversity of Cambridge researchers have demonstrated how carbon dioxide can be captured from industrial processes – or even directly from the air – and transformed into clean, sustainable fuels using just the energy from the Sun. The report describing the research has been published in the journal Joule. The research team developed a solar-powered reactor that converts captured CO2 and plastic waste into sustainable fuels and other valuable chemical products. In tests, CO2 was converted into syngas, a key building block for sustainable… Read more at: https://oilprice.com/Energy/Energy-General/How-Sunlight-Is-Transforming-Waste-Into-Energy.html |

|

Soaring Car Prices Put American Auto Loans UnderwaterMillions of Americans who took out loans to purchase overpriced used vehicles during the pandemic are at risk of going underwater. Financing costs are soaring, and used car values are sliding, culminating into a perfect storm as only the tip of the negative equity iceberg appears. On Tuesday, credit reporting firm TransUnion and market researcher J.D. Power published a new report warning in recent quarters that used car loan-to-value ratios (LTVs) at origination have “trended in the wrong direction for consumers.” Originating… Read more at: https://oilprice.com/Finance/the-Economy/Soaring-Car-Prices-Put-American-Auto-Loans-Underwater.html |

|

Indian Solar Giant To Invest $1.5B In New U.S. FactoriesA venture group backed by India’s second-largest solar energy company, Vikram Solar, will invest up to $1.5 billion in the U.S. solar energy supply chain, with the first investments going to a factory in Colorado next year, according to an exclusive Reuters report. The $250 million Colorado facility will be capable of producing 2 gigawatts (GW) of modules a year initially and double the capacity over time and will also create more than 900 jobs. Newly formed VSK Energy LLC will leverage India’s extensive solar manufacturing know-how… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Indian-Solar-Giant-To-Invest-15B-In-New-US-Factories.html |

|

Navigating Georgia’s Potential Ascent To The EUThis week, the European Commission will give an “oral update” on how Georgia, Ukraine, and Moldova are faring on their respective EU membership paths. This update will first be given to ambassadors of the 27 EU member states in Brussels on June 21, and then in Stockholm when the European affairs ministers from all the bloc’s capitals meet for an informal EU general affairs council. Don’t expect this update to be very detailed; it is essentially a midterm review of the proper EU enlargement package that the European Commission will present in the… Read more at: https://oilprice.com/Geopolitics/International/Navigating-Georgias-Potential-Ascent-To-The-EU.html |

|

EU Targets Russia’s Trading Partners With Latest Sanctions PackageEuropean Union governments have agreed to an 11th package of sanctions against Russia over its invasion of Ukraine aimed largely at stopping other countries and companies from circumventing previously imposed sanctions. European Commission President Ursula von der Leyen said the new package will “deal a further blow to [Russian President Vladimir] Putin’s war machine with tightened export restrictions, targeting entities supporting the Kremlin,” she said on June 21 after the Swedish Presidency of the EU Council announced that… Read more at: https://oilprice.com/Latest-Energy-News/World-News/EU-Targets-Russias-Trading-Partners-With-Latest-Sanctions-Package.html |

|

Oil Falls Despite Moderate Draw In Crude InventoriesCrude oil prices were little changed today after the U.S. Energy Information Administration reported an inventory decline of 3.8 million barrels for the week to June 16. At 463.3 million barrels, the EIA said, inventories were around the five-year average for this time of the year. Last week’s inventory level change compared with a substantial build of almost 8 million barrels estimated for the previous week. In fuels, the authority estimated modest inventory builds. Gasoline stocks added 500,000 barrels in the week to… Read more at: https://oilprice.com/Energy/Crude-Oil/Oil-Falls-Despite-Moderate-Draw-In-Crude-Inventories.html |

|

Mysterious Saudi Oil Tanker Cluster Off Suez Starts To ClearA cluster of mostly Saudi supertankers loaded with oil that has been idling off Egypt’s Red Sea coast for weeks has shown signs of starting to clear as two of the 11 tankers are no longer anchored near the Ain Sukhna oil terminal, according to tanker tracking data compiled by Bloomberg. As of last Friday, 10 very large crude carriers (VLCCs) carrying around 20 million barrels of oil were floating off Ain Sukhna and another two supertankers were heading to the same location, Vortexa data showed on June 16. All 10 floating supertankers… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Mysterious-Saudi-Oil-Tanker-Cluster-Off-Suez-Starts-To-Clear.html |

|

UAE’s ADNOC Eyes Expansion Of Downstream Activity In EuropeAbu Dhabi’s ADNOC has made a preliminary takeover proposal for German chemical group Covestro, a German chemical group, as part of its strategic plans to leverage market developments. While no official offer has been made yet, the proposal is estimated to be around €10 billion ($10.9 billion), valuing Covestro at nearly €11 billion. ADNOC’s interest in Covestro aligns with its goal to become more sustainable, although any potential deal would likely involve keeping Covestro’s operations separate from ADNOC. Although a full… Read more at: https://oilprice.com/Energy/Energy-General/UAEs-ADNOC-Eyes-Expansion-Of-Downstream-Activity-In-Europe.html |

|

Oil Prices Dip As Further Interest Rate Hikes LoomOil prices slumped by 2% early on Thursday after Fed Chair Jerome Powell told Congress that further interest rate hikes are coming in the second half of the year after a pause last week. As of 8:11 a.m. EDT on Thursday, ahead of EIA’s weekly inventory report, the U.S. benchmark, WTI Crude, was trading at $71.12, down by 1.92% on the day. The international benchmark, Brent Crude, was falling by 1.84% and traded at $75.67. On Wednesday, Brent settled at above $77, the highest settlement since May 24, as the U.S. dollar fell. But prices resumed… Read more at: https://oilprice.com/Energy/Energy-General/Oil-Prices-Dip-As-Further-Interest-Rate-Hikes-Loom.html |

|

Church Of England Ditches Big Oil Stocks Over Climate Goals FailureThe Church of England is dumping all remaining oil and gas majors from its portfolio for failing to align with the 1.5 degrees Celsius pathway, the Church Commissioners for England said on Thursday. The Church of England will now exclude from its portfolio BP, Shell, ExxonMobil, TotalEnergies, Eni, Equinor, Ecopetrol, Occidental Petroleum, Pemex, Repsol, and Sasol, “after concluding that none are aligned with the goals of the Paris Climate Agreement, as assessed by the Transition Pathway Initiative (TPI).” Back in 2021, the Church of… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Church-Of-England-Ditches-Big-Oil-Stocks-Over-Climate-Goals-Failure.html |

|

Iran’s Booming Oil Industry Adds Urgency To Nuclear NegotiationsOver the last few years, Iran has increasingly ignored sanctions imposed on its oil and gas industry by the U.S. by choosing to develop new energy partnerships and increase its oil exports. The U.S. has largely overlooked these actions in the hope that Iran will eventually sign a new nuclear deal, a hope that is yet to come to fruition. And now Iran’s oil exports are reaching new highs. So, will the U.S. start imposing stronger sanctions on Iranian oil and gas if no progress is seen in nuclear talks or will it continue to look the other way?… Read more at: https://oilprice.com/Geopolitics/Middle-East/Irans-Booming-Oil-Industry-Adds-Urgency-To-Nuclear-Negotiations.html |

|

S&P 500, Nasdaq rise to end 3-day losing streak as investors snap up tech shares: Live updatesInvestors resumed buying of some major tech names. Read more at: https://www.cnbc.com/2023/06/21/stock-market-today-live-updates.html |

|

Boycotts rarely work — but anti-LGBTQ+ backlash is forcing companies into tough choicesThe boycott of Bud Light is having a major effect on its sales, while the wave of anti-LGBTQ+ backlash is also affecting Target and Starbucks. Read more at: https://www.cnbc.com/2023/06/22/the-business-of-boycotts-what-can-corporate-america-do.html |

|

Fed Chair Powell says smaller banks likely will be exempt from higher capital requirementsPowell said Thursday that banks below $100 billion in assets won’t be impacted by any new capital requirements. Read more at: https://www.cnbc.com/2023/06/22/fed-chair-powell-says-smaller-banks-likely-will-be-exempt-from-higher-capital-requirements.html |

|

Pilot and 4 passengers of the Titan submersible are dead, U.S. Coast Guard saysCoast Guard officials said during a news conference Thursday that they’ve notified the families of the crew of the Titan, which has been missing for several days. Read more at: https://www.cnbc.com/2023/06/22/missing-titanic-submersible-rescuers-make-last-push.html |

|

Bank of America sees these 3 names benefiting from the A.I. networking chip warNvidia may reign as the dominant artificial intelligence play, but Bank of America says investors may want to also keep an eye on these networking chip stocks. Read more at: https://www.cnbc.com/2023/06/22/three-chip-stocks-could-win-ai-networking-war-bank-of-america-says.html |

|

Warren Buffett’s charitable giving exceeds $50 billion, more than his entire net worth in 2006Warren Buffett has boosted his total charitable giving to more than $50 billion — greater than his entire net worth in 2006 when he first scheduled the grants. Read more at: https://www.cnbc.com/2023/06/22/warren-buffetts-charitable-giving-exceeds-50-billion-more-than-his-entire-net-worth-in-2006.html |

|

Flavored e-cigarette sales are booming despite federal crackdownDisposable e-cigarettes, which have circumvented FDA restrictions, now comprise more than half of the vaping market. Read more at: https://www.cnbc.com/2023/06/22/flavored-e-cigarette-sales-usage-up-among-youths-.html |

|

New technologies hurt car quality as EV brands fare poorly, J.D. Power saysThree Stellantis brands — Dodge, Ram and Alfa Romeo — topped this year’s quality rankings. Read more at: https://www.cnbc.com/2023/06/22/jd-power-initial-quality-study-2023-dodge-ram-top-tesla-volvo.html |

|

Ukraine war live updates: UN report says Russia has killed 136 children, used kids as human shieldsUkrainian President Volodymyr Zelenskyy said “tough fights” are continuing in the counteroffensive, having acknowledged that progress is slower than expected. Read more at: https://www.cnbc.com/2023/06/22/ukraine-war-live-updates-latest-news-on-russia-and-the-war-in-ukraine.html |

|

AWS is investing $100 million in generative A.I. center in race to keep up with Microsoft and GoogleAmazon’s cloud unit wants to show investors that it’s committed to generative artificial intelligence after blockbuster announcements from rivals. Read more at: https://www.cnbc.com/2023/06/22/aws-invests-100-million-in-generative-ai-as-it-sees-a-long-race-ahead.html |

|

Musk picks Vegas for Zuckerberg ‘cage match’ challengeTwitter owner and Tesla CEO Elon Musk seemingly picked Vegas for the location of a “cage match” after being challenged by Facebook co-founder Mark Zuckerberg. Read more at: https://www.cnbc.com/2023/06/22/musk-picks-vegas-for-zuckerberg-cage-match-challenge.html |

|

Why GM is sunsetting the classic Chevrolet CamaroThe Chevrolet Camaro was General Motors’ answer to the Ford Mustang. But the classic American sports car is tough to sell and is on its way out. Read more at: https://www.cnbc.com/2023/06/21/why-gm-is-sunsetting-the-classic-chevrolet-camaro.html |

|

Retailers Shein and Temu violate U.S. tariff law and evade human rights reviews on imports, House report saysThe violations enable the companies to avoid tariffs and human rights reviews on some shipments, lawmakers say. Read more at: https://www.cnbc.com/2023/06/22/shein-temu-evade-us-tariff-and-human-rights-law-on-imports-house-report.html |

|

Ghosts Of 2000 And 2007 Market Tops Are Absent TodayAuthored by Simon White, Bloomberg macro strategist, Today’s stock market is exhibiting few of the warning signs that were present at the market tops in 2000 and 2007. There is a growing cottage industry in comparing today’s equity market to the bursting of the tech bubble in 2000 and the financial crisis beginning in 2007. But it is the differences that are more notable than the similarities. If today’s market does go on to make new lows, it’s unlikely to be for the same set of reasons as in those two prior episodes. Cautious bullishness is therefore advised. It’s obviously handy if you can gauge when a market top is close. Each one is different, but they often tend to share several features. Signs of corporate exuberance; valuations at extreme levels; weak leading economic data that is worsening; and sentiment and positioning that are very stretched are all common signs a peak is near. The 2000 and 2007 market tops are canonical in many respects, but several key features of today’s market are sufficiently different to render any comparisons inadequate:

Both 2000 and 2007 were marked by extremes in corporate behavior that are not as marked today. Rapid rises in M&A, IPOs, leveraged buyouts, share buybacks and … Read more at: https://www.zerohedge.com/markets/ghosts-2000-and-2007-market-tops-are-absent-today |

|

Missing Titanic Sub Crew Presumed Dead: OceanGateUpdate (1453ET): In a somber statement Thursday afternoon, submersible company OceanGate announced that it believes all passengers on the Titanic-bound submersible have “sadly been lost.”

From left, Hamish Harding, Shahzada Dawood, Suleman Dawood, Paul-Henri Nargeolet and Stockton Rush Obtained by CNN”We now believe that our CEO Stockton Rush, Shahzada Dawood and his son Suleman Dawood, Hamish Harding, and Paul-Henri Nargeolet, have sadly been lost,” the company said in a statement relayed by CNN. “These men were true explorers who shared a distinct spirit of adventure, and a deep passion for exploring and protecting the world’s oceans,” the statement continues. “Our hearts are with these five souls and every member of their families during this … Read more at: https://www.zerohedge.com/markets/coast-guard-finds-debris-field-near-titanic-search-missing-tourist-sub |

|

Mania Hits Used Farm Equipment Market As Combine Prices Hit RecordThe cost of farm equipment continues to soar. And it’s not just fancy new tractors and combines with all bells and whistles, like GPS, automation, remote operation, sensors, diagnostics, screens, cameras, and air conditioners, but also ones that are one or two decades old with fewer microchips. One reason the second-hand market for large and small tractors and combines is hot could be due to supply chain issues of procuring a new tractor. However, we have shown most snarls in global supply chains have normalized in recent quarters. The second and most likely reason is that farmers are ditching new high-tech tractors with higher capital and maintenance costs. It’s widely known in the farming community that older tractors have less technology which makes it easier to work on and repair faster. Consider, for instance, how John Deere equipped its newest tractors with sophisticated technology but didn’t give farmers the tools to fix their own equipment, setting off the right-to-repair debate. Deere finally caved earlier this year by giving farmers the tools they needed. A proprietary used farm equipment price tracker published by Jefferies showed clients this week that “used farm equipment shows continued strong pricing as we move through 2023.” Jefferies scraped used equipment website MachineFinder. Its analysts found large farm equipment was up 13% year-over-year in June, while small farm equipment was up 11.4%. The most significant price move was a 42.% jump in combines. Read more at: https://www.zerohedge.com/markets/mania-hits-used-farm-equipment-market-combine-prices-hit-record |

|

Energy Regulator Claims Canadian Oil Production Will Plunge 76% By 2050By Alex Kimani of OilPrice.com, The Canada Energy Regulator has issued a grim outlook that the country’s oil production will plunge 76% by 2050 thanks to the world moving to the clean energy transition, marking the first time the regulator has provided a long-term forecast for Canada’s crude output. The energy regulator has also predicted that global fossil fuel usage will decline by 65% between now and 2050.

The short-term investment outlook for Canada’s Oil Patch is just as bearish, with analysts predicting that earnings for the industry will decline 19% in 2023, in large part due to falling gas prices. A week ag … Read more at: https://www.zerohedge.com/markets/energy-regulator-claims-canadian-oil-production-will-plunge-76-2050 |

|

Interest rates: Bank of England boss denies wanting recession as rates rise“If we don’t raise rates now, it could be worse later,” Bank of England boss warns as it raises rates again. Read more at: https://www.bbc.co.uk/news/business-65982981?at_medium=RSS&at_campaign=KARANGA |

|

Train strikes: RMT union announces three days of walkouts in JulyThe RMT says 20,000 members will walk out on 20, 22 and 29 July as part of a long-running dispute. Read more at: https://www.bbc.co.uk/news/business-65986714?at_medium=RSS&at_campaign=KARANGA |

|

‘I saved thousands living abroad but still can’t afford a mortgage’Four people explain how rising interest rates are affecting their lives. Read more at: https://www.bbc.co.uk/news/business-65951697?at_medium=RSS&at_campaign=KARANGA |

|

Ahead of Market: 10 things that will decide D-Street action on FridayIndian equities ended lower on Thursday as heightened volatility caused small-cap and mid-cap stocks to decline following the US Federal Reserve Chair’s hawkish commentary. The Nifty settled below 18,800 levels, losing 0.45%. L&T, Divis Laboratories, HDFC twins and Bharti Airtel were the top gainers, while Tata Consumer Products, Asian Paints, Tata Motors, Bajaj Finance, and Tata Steel were the top losers in the Nifty pack. The overall market breadth favoured bears with 2,294 stocks ending in the red. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/ahead-of-market-10-things-that-will-decide-d-street-action-on-friday/articleshow/101197972.cms |

|

7 new-age stocks recover from 52-week lows, surge up to 98%India’s tech unicorns are back on track and have been rallying for the past few weeks Read more at: https://economictimes.indiatimes.com/markets/web-stories/7-new-age-stocks-recover-from-52-week-lows-surge-up-to-98/articleshow/101190674.cms |

|

Debt or equity mutual fund: Which one should investors choose?Debt mutual fund schemes have outperformed equity mutual funds in recent months, benefiting from inflows totalling INR 1.5 lakh crore ($22bn) during April and May, compared to just over INR 7,200 crores across all equity mutual fund categories. Adil Shetty, the CEO of BankBazaar.com, suggested that equity underperformance strayed from a variety of reasons: investor liquidity needs, profit-taking as markets edge towards new highs, and higher bond yields making debt funds more attractive. Nonetheless, experts have cautioned against an investment exclusively in debt funds and urge rebalancing portfolios to reduce risk and boost wealth. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/debt-or-equity-mutual-fund-which-one-should-investors-choose/articleshow/101190641.cms |

|

Jet engine, drone deals unveiled as Biden meets India’s ModiU.S.-India deals in the defense and tech sectors were announced as the two countries’ leaders met on Thursday. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7219-BBE90C938F74%7D&siteid=rss&rss=1 |

|

Movers & Shakers: Tesla, Anheuser-Busch, Logitech stocks rise, AMC, iRobot, Virgin Galactic shares fall, and other stocks on the moveAnheuser-Busch and Tesla shares were among the more active stocks on Thursday. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7218-BC679366B3F1%7D&siteid=rss&rss=1 |

|

MarketWatch: Why top pick Victor Wembanyama could be worth over $80 million a year to the SpursThe NBA Draft hype around the 7-foot-5 Wembanyama could give the San Antonio Spurs a financial windfall on and off the court, experts say Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7218-8E32E04D20B7%7D&siteid=rss&rss=1 |