Summary Of the Markets Today:

- The Dow closed down 109 points or 0.32%,

- Nasdaq closed down 0.68%,

- S&P 500 closed down 0.37%,

- Gold $1,968 down $2.60,

- WTI crude oil settled at $72 up $1.03,

- 10-year U.S. Treasury 3.769% up 0.039 points,

- USD Index $102.32 up $0.02,

- Bitcoin $26,355 up $894,

- Baker Hughes Rig Count: U.S. -8 to 687 Canada +23 to 159

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our Economic Forecast for June 2023

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

The 15 participants in the June Livingston Survey predict higher output growth for the first half of 2023 than they predicted in the December 2022 survey. The forecasters, who are surveyed by the Federal Reserve Bank of Philadelphia twice a year, now project that the economy’s output (real GDP) will grow at an annual rate of 1.1 percent during the first half of 2023. They expect weaker conditions in the second half of 2023, when growth is expected to be at an annual rate of -0.7 percent. Both projections represent upward revisions from those of the December 2022 survey. Growth is expected to average an annual rate of 1.0 percent in the first half of 2024. Additionally:

- On an annual-average over annual-average basis, CPI inflation is expected to be 4.1 percent in 2023 and 2.5 percent in 2024.

- The interest rate on three-month Treasury bills is now predicted to be 5.25 percent at the end of June 2023, an upward revision from 5.05 percent in the previous survey. The forecasters predict the three-month rate will fall to 4.80 percent at the end of December 2023 and 3.05 percent at the end of June 2024. The panelists see the rate at 2.95 percent at the end of December 2024.

- The panelists predict the S&P 500 index will finish the first half of 2023 at a level of 4200.0, marking an upward revision from their previous prediction of 3927.4. Stock prices are expected to rise to 4260.4 at the end of 2023 and continue to rise to 4350.9 at the end of June 2024. The index is predicted to reach 4411.0 by the end of 2024. All forecasts for stock prices mark upward revisions from those of the December 2022 survey.

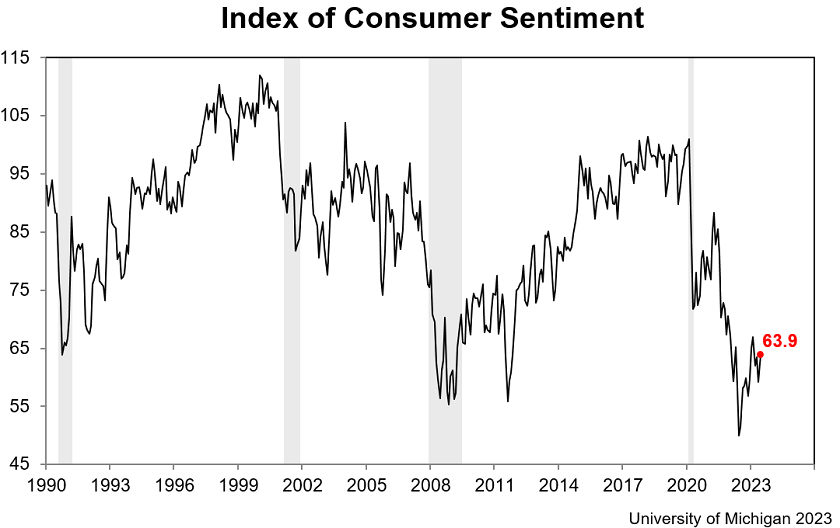

Consumer sentiment lifted 8% in June, reaching its highest level in four months, reflecting greater optimism as inflation eased and policymakers resolved the debt ceiling crisis. The outlook on the economy surged 28% over the short run and 14% over the long run. Sentiment is now 28% above the historic low from a year ago and may be resuming its upward trajectory since then. As it stands, though, sentiment remains low by historical standards as income expectations softened. A majority of consumers still expect difficult times in the economy over the next year.

Here is a summary of headlines we are reading today:

- A Deep Dive Into The World’s Leading Lithium Producers

- U.S. Shale Patch Sees Rig Count Decline By 8 This Week

- How To Protect Your Wealth If The Fed Is Lying About More Interest Rate Hikes

- S&P 500 breaks six-day win streak on Friday, but still notches best week since March: Live updates

- Elon Musk says Tesla’s market cap is directly tied to whether it solves autonomous driving

- An ETF focused on the ‘moats’ strategy of Warren Buffett is beating the market once again

- Ukraine war live updates: Putin says nuclear weapons transferred to Belarus; Ukraine ‘will be equal to NATO allies’

- Cryptocurrencies climb to end the week as investors digest BlackRock’s bitcoin ETF plans

- Converting gas-powered cars to EVs is a booming business

- “Broke Generation”: 64% Of Gen Xers Have Stopped Saving For Retirement

- Average two-year mortgage rate close to 6%

- Bond Report: Two-year Treasury yield rises for a second straight week after Fed officials repeat need for more rate hikes

- Market Snapshot: U.S. stocks trade lower, but S&P 500 on pace for longest weekly win streak since 2021 after Fed pause

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Norsk Hydro ASA Leads In Green Hydrogen Aluminum ProductionGreen hydrogen is heating up. Across the world, rapid advances in technology related to the green hydrogen sector are being accompanied by increasing investor attention and political support. The potential benefits of scaling up green hydrogen production and broadening its applications across and along manufacturing supply chains are hard to overstate. Hydrogen can be combusted like fossil fuels, but leaves behind nothing but water vapor. What’s more, it burns at such high temperatures that it could replace emissions-heavy fuel sources like… Read more at: https://oilprice.com/Energy/Energy-General/Norsk-Hydro-ASA-Leads-In-Green-Hydrogen-Aluminum-Production.html |

|

A Deep Dive Into The World’s Leading Lithium ProducersLithium has become essential in recent years, primarily due to the boom in electric vehicles and other clean technologies that rely on lithium batteries. The global lithium-ion battery market was valued at $52 billion in 2022 and is expected to reach $194 billion in 2030. In the infographic below, using data from the United States Geological Survey Visual Capitalist’s Bruno Venditti explores the world’s largest lithium-producing countries. Australia and Chile: Dominating Global Lithium Supply Australia and Chile stand… Read more at: https://oilprice.com/Energy/Energy-General/A-Deep-Dive-Into-The-Worlds-Leading-Lithium-Producers.html |

|

Tbilisi’s Economic Aspirations Spark Security ConcernsOn June 5, Georgia announced plans to build a second civilian airport near Tbilisi. During a recent government meeting, Prime Minister Irakli Garibashvili reiterated this decision and justified it with the government’s intentions to turn the country into an international air transport hub (Facebook.com/GaribashviliOfficial, June 5). In 2005, management of Tbilisi International Airport, on the initiative of former President Mikheil Saakashvili, was transferred to Turkish company TAV Georgia (TAV) (Tbilisiairport.com, accessed June 12). At… Read more at: https://oilprice.com/Geopolitics/International/Tbilisis-Economic-Aspirations-Spark-Security-Concerns.html |

|

U.S. Shale Patch Sees Rig Count Decline By 8 This WeekThe total number of total active drilling rigs in the United States fell by 8 this week, according to new data from Baker Hughes published Friday, falling by 57 from in the last six weeks. The total rig count fell to 687 this week—53 rigs below this time last year. The current count is 388 fewer rigs than the rig count at the beginning of 2019, prior to the pandemic. The number of oil rigs declined by 4 this week to 552. Gas rigs slipped 5, reaching 130. Gas rigs are now 24 below where they were a year ago, while oil rigs are 32 below. Miscellaneous… Read more at: https://oilprice.com/Energy/Energy-General/US-Shale-Patch-Sees-Rig-Count-Decline-By-8-This-Week.html |

|

Iran Oil Exports Hit A 5-Year HighIranian crude exports exceeded 1.5 mb/d in May, the highest level since 2018 despite the country still being under U.S. sanctions. Last month Tehran said it has boosted crude output to above 3 million bpd, again the highest since 2018. Last week, oil prices tanked after reports emerged that the U.S. and Iran are making progress after resuming talks on a nuclear deal, a move that could ease sanctions on Iran’s oil exports. Israel’s Haaretz newspaper reported that the talks are moving forward more rapidly than expected,… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Iran-Oil-Exports-Hit-A-5-Year-High.html |

|

China Steps Up Game With 1st ‘Floating Oil Factory’China has delivered its first smart floating production storage and offloading (FPSO) with land-sea integrated operation system, marking a breakthrough in the country’s application of the digital twin technology. The offshore oil and gas FPSO with a storage capacity of 100,000 tons is the first of its kind in China and employs diverse cutting-edge technologies including artificial intelligence (AI), edge computing, cloud computing, big data and the internet of things (IoT). The ship can process oil and gas on the sea thus eliminating… Read more at: https://oilprice.com/Latest-Energy-News/World-News/China-Steps-Up-Game-With-1st-Floating-Oil-Factory.html |

|

The EV Charging Challenge: U.S. Needs A Million More Stations By 2030Via AG Metal Miner The Renewables MMI (Monthly Metals Index) continued to edge sideways, this time rising by just 2.64%. Cobalt and neodymium rising in price contributed the most to the index’s upward movement. This occurred despite massive oversupplies of cobalt, which is crucial to utilizing renewable energy sources like EV batteries. Meanwhile, grain-oriented electrical steel dropped month-over-month, with the steel plate components of the index either moving sideways or dropping slightly. U.S. Infrastructure Racing to Get… Read more at: https://oilprice.com/Energy/Energy-General/The-EV-Charging-Challenge-US-Needs-A-Million-More-Stations-By-2030.html |

|

Maintenance On Norway’s Giant Gas Processing Plant Extended Till JulyA maintenance outage at Norway’s Nyhamna gas processing plant will take at least a month longer than anticipated due to problems with the plant’s cooling system, plant operator Shell Plc. (NYSE:SHEL) has said. Shell has stopped all non-essential work after discovering a gas formation with hydrogen, terming the situation ‘‘complex’’. Located in North-western Norway, the Nyhamna gas processing plant processes gas from the Ormen Lange and Aasta Hansteen fields. With 79.8 million cubic meters (mcm)… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Maintenance-On-Norways-Giant-Gas-Processing-Plant-Extended-Till-July.html |

|

Russia Downplays Possibility Of Curbing Gasoline ExportsRussia has enough gasoline to meet its domestic demand, Energy Minister Nikolai Shulginov said on Friday, downplaying the possibility that Moscow could limit gasoline exports. Last month, Russia was considering restricting some gasoline exports after a sharp rise in wholesale gasoline prices. “We discussed export restrictions in relation to rising prices on the wholesale market,” Shulginov was quoted as telling Russia-24 television channel in an interview on Friday. “Otherwise, our market is provided with production,… Read more at: https://oilprice.com/Energy/Energy-General/Russia-Downplays-Possibility-Of-Curbing-Gasoline-Exports.html |

|

UK Battery Maker Sees Shares Crash As It Needs To Raise Funds Within WeeksLithium-ion and battery producer AMTE Power’s shares crashed more than 70 per cent today, following an announcement that the company needed to raise new funds within the next few weeks. AMTE Power – who are currently set to build a £200m gigafactory in Dundee – said in the announcement that it needed to raise more cash in “no less than four weeks,” and that discussions with investors were ongoing. It warned that without further funding the “recovery of value” by shareholders “would be… Read more at: https://oilprice.com/Latest-Energy-News/World-News/UK-Battery-Maker-Sees-Shares-Crash-As-It-Needs-To-Raise-Funds-Within-Weeks.html |

|

Russia Sees $80 Oil Price As Realistic This YearIt is realistic to believe that oil prices could reach $80 per barrel this year, it is an achievable price point, Russian Energy Minister Nikolai Shulginov said on Friday in comments likely referring to Brent prices. “It is important that oil prices suit the consumers who buy these products,” Russian media quoted Shulginov as saying. The OPEC+ agreement, to which Russia is a party, is taking all steps to rebalance the oil market, the minister added. Three weeks ago, Russian Deputy Prime Minister Alexander Novak said that Brent… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Russia-Sees-80-Oil-Price-As-Realistic-This-Year.html |

|

Bullish Refinery Data From China Lifts Oil PricesSeptember West Texas Intermediate (WTI) crude oil futures experienced another volatile week, culminating in a 3% increase to reach a one-week high on Thursday. Several factors contributed to this rise, including a weaker U.S. dollar and a significant surge in refinery runs in China, the world’s top crude oil importer. This positive performance helped the market recover from earlier losses, which puts it in a position to end the week on an upward trajectory. Supply and Demand Factors The bullish sentiment in the oil market was supported by multiple… Read more at: https://oilprice.com/Energy/Energy-General/Bullish-Refinery-Data-From-China-Lifts-Oil-Prices.html |

|

European Natural Gas Prices Are On The Rise1. European Natural Gas Prices Start to Climb- Bottoming out in early June, European spot natural gas prices have been on the rise ever since and are currently flirting with the €40 per MWh threshold amid Norwegian supply disruptions. – Even though Norway’s Hammerfest LNG export terminal has solved its leakage issues and is set to resume loadings this weekend, maintenance at gas processing plants in Nyhamna and Kollsnes is keeping gas flows capped. – Above-normal temperatures are expected in most of Northwest Europe through the upcoming… Read more at: https://oilprice.com/Energy/Energy-General/European-Natural-Gas-Prices-Are-On-The-Rise.html |

|

Ukraine’s Counteroffensive Has BegunPolitics, Geopolitics & Conflict In what is perhaps Ukraine’s most significant counteroffensive since the war began, Ukrainian forces began a series of attacks on the Russian frontline last week, claiming earlier this week to have retaken some half a dozen villages. Russia denies these claims, with pro-Russian military bloggers posting pictures of what they say are Ukraine’s destroyed Leopard-2 tanks. Neither Russian nor Ukrainian reporting from the front line is reliable, and the battlefield situation remains extremely dynamic.… Read more at: https://oilprice.com/Energy/Energy-General/Ukraines-Counteroffensive-Has-Begun.html |

|

How To Protect Your Wealth If The Fed Is Lying About More Interest Rate HikesShortly after Fed Chair Jay Powell started talking in the press conference that followed the FOMC meeting and interest rate statement on Wednesday, it was clear what he wanted to emphasize. No, the Fed was not raising rates this quarter, but he really wanted us all to know that that doesn’t mean that hikes are over and that there is absolutely no intention of cutting the Fed Funds rate any time soon. I’m sorry Mr. Powell, but I don’t believe you and neither, it seems, does the market. Stocks are still showing strong Year to Date… Read more at: https://oilprice.com/Energy/Energy-General/How-To-Protect-Your-Wealth-If-The-Fed-Is-Lying-About-More-Interest-Rate-Hikes.html |

|

S&P 500 breaks six-day win streak on Friday, but still notches best week since March: Live updatesInvestors have considered whether the current strength in the market is here to stay. Read more at: https://www.cnbc.com/2023/06/15/stock-market-today-live-updates.html |

|

Elon Musk says Tesla’s market cap is directly tied to whether it solves autonomous drivingTesla CEO Elon Musk thinks the automaker’s market capitalization is directly tied to whether the automaker is able to solve autonomous driving. Read more at: https://www.cnbc.com/2023/06/16/elon-musk-teslas-market-cap-is-tied-to-solving-autonomous-driving.html |

|

Binance France chief brushed off concerns days before police visitBinance France’s president David Prinçay dismissed U.S. regulatory action just days before French prosecutors accused the exchange of money laundering. Read more at: https://www.cnbc.com/2023/06/16/binance-france-chief-brushed-off-concerns-days-before-police-visit.html |

|

Trump lawyer who quit classified documents case withdraws from $475 million CNN defamation suitJim Trusty, who just quit Trump’s team in the Mar-a-Lago classified documents case, cited “irreconcilable differences” with the ex-president in the CNN suit. Read more at: https://www.cnbc.com/2023/06/16/trump-lawyer-who-quit-docs-case-quits-cnn-defamation-suit.html |

|

An ETF focused on the ‘moats’ strategy of Warren Buffett is beating the market once againThe VanEck Morningstar Wide Moat ETF (MOAT) has a total return of more than 23% year to date. Read more at: https://www.cnbc.com/2023/06/16/an-etf-focused-on-the-moats-strategy-of-warren-buffett-is-beating-the-market-once-again.html |

|

Michael Jordan is selling his majority stake in the Charlotte Hornets for $3 billionJordan will sell his majority stake in the NBA’s struggling Charlotte Hornets, and Gabe Plotkin and Rick Schnall are poised to become majority owners. Read more at: https://www.cnbc.com/2023/06/16/michael-jordan-is-selling-his-stake-in-the-charlotte-hornets-.html |

|

Ukraine war live updates: Putin says nuclear weapons transferred to Belarus; Ukraine ‘will be equal to NATO allies’Kyiv says nearly 20,000 Ukrainian children have been abducted by Russia, something that international organizations say constitutes a war crime. Read more at: https://www.cnbc.com/2023/06/16/russia-ukraine-live-updates.html |

|

BlackRock files to launch spot bitcoin ETF, and Binance to exit the Netherlands: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, Gustavo Schwenkler of Santa Clara University’s Leavey School of Business discusses BlackRock’s proposal for a spot bitcoin ETF. Read more at: https://www.cnbc.com/video/2023/06/16/blackrock-spot-bitcoin-etf-binance-exit-the-netherlands-crypto-world.html |

|

FTC Chair Lina Khan refused to sit out agency’s case against Meta despite ethics concerns, report saysMeta, which owns Facebook, accused Khan of bias over her prior statements on banning the company’s future acquisitions. Read more at: https://www.cnbc.com/2023/06/16/ftc-chair-lina-khan-refused-to-sit-out-meta-case.html |

|

Cryptocurrencies climb to end the week as investors digest BlackRock’s bitcoin ETF plansCrypto prices climbed to end the week, a day after the largest asset manager in the world jumped into the race to launch the first spot bitcoin ETF in the U.S. Read more at: https://www.cnbc.com/2023/06/16/cryptocurrencies-climb-to-end-the-week-as-investors-digest-blackrocks-bitcoin-etf-plans.html |

|

Here are 5 key trends shaping the liquor industry as spirits overtake beer for the first timeThe spirits industry is overcoming economic headwinds to keep up with changing consumer preferences and demands. Read more at: https://www.cnbc.com/2023/06/16/liquor-industry-trends-as-spirits-take-market-share-from-beer.html |

|

You can rent the iconic mansion where Walt Disney created ‘Bambi’ and ‘Snow White’ for $40,000 a monthDisney created classics like ‘Dumbo’ and ‘Snow White’ while living at the Storybook Mansion. Read more at: https://www.cnbc.com/2023/06/16/you-can-rent-walt-disneys-iconic-mansion-for-40000-per-month.html |

|

Converting gas-powered cars to EVs is a booming businessConverting gas cars to electric is growing in popularity. CNBC explores what it takes to convert an ICE car and whether it could go mainstream. Read more at: https://www.cnbc.com/2023/06/16/converting-gas-powered-cars-to-evs-is-a-booming-business.html |

|

“Broke Generation”: 64% Of Gen Xers Have Stopped Saving For RetirementBy Kathie Rothman of WRAL Tech Wire

While their parents belonged to the “Greatest Generation,” Gen X may soon be carving out a reputation as the “Broke Generation.” A recent survey conducted by Clever Real Estate polled 1,000 Gen Xers born between 1965 and 1980 to find out how they fare when it comes to personal finances and the road to retirement. A staggering 56% of Gen Xers said they have less than $100,000 saved for retirement, and 22% said they have yet to save a single cent. While the desire to retire may be there, the money just isn’t. A whopping 64% of respondents said they stopped saving for retirement not because they don’t want to but because they simply can’t afford to. The reasons for the lagging savings varied, with many citing poor economic conditions and backbreaking student debt as retirement roadblocks. With the eldest members well into their 50s, the re … Read more at: https://www.zerohedge.com/economics/broke-generation-64-gen-xers-have-stopped-saving-retirement |

|

Micron To Invest $600MM In Chinese Factory Despite Beijing Chip Ban, Warns Half Of China HQ Customer Data Revenue At RiskA little more than three weeks after China’s cyberspace regulator announced that Micron Technology, America’s biggest maker of memory chips, possesses “serious network security risks” and will be banned from critical infrastructure projects in the world’s second-largest economy, the chipmaker said on Friday it was committed to investing hundreds of millions of dollars in its high-tech manufacturing facility in the Chinese city of Xian. Micron made the announcement on the WeChat social media app earlier this morning. It said it would invest 4.3 billion yuan ($603 million) over the next few years in upgrading its chip packaging and testing equipment at the Xi’an factory.

|

|

Is The ESG Investing Boom Already Over?Authored by Alex Kimani via OilPrice.com,

Over the past decade, green and socially-responsible investments, aka ESG (Environmental, Social, and Governance) investing, have emerged as one of the biggest investment megatrends in modern times. For years, trillions of dollars in new global funds flowed into the market each year, with UBS predicting that carbon-reducing tech would hit $60 trillion of investment by 2040 in the U.S.

Unfortunately, the ESG boom now appears to be languishi … Read more at: https://www.zerohedge.com/markets/esg-investing-boom-already-over |

|

Notorious Grifting Marxist Bill de Blasio Hit With Record Fine For Abusing NYC ResourcesFormer New York Mayor, notorious socialist Bill de Blasio, was ordered to pay almost a half-million dollars by the city Conflicts of Interest Board for using taxpayer money for his security detail during his short-lived run for president in 2019, Bloomberg first reported. De Blasio, who served two catastrophic terms through 2021 and like any good socialist, left NYC in a state of disrepeair and soaring crime, campaigned briefly as part of a presidential bid that saw him reach 1% in some polls before ultimately dropping out. During his travels, he used city funds to pay expenses for members of the New York Police Department who served as the security detail for his family, clearly enjoying the role of wannabe socialist dictator, and with just the right amount of popular support.

This racked up $319,794.20 in travel costs, including airfare, car rentals, hotel stays and meals, said the COIB, which ordered him to repay the costs. The board also fined the former mayor $155,000 for th … Read more at: https://www.zerohedge.com/political/notorious-grifting-marxist-bill-de-blasio-hit-record-fine-abusing-nyc-resources |

|

Average two-year mortgage rate close to 6%Lenders have been increasing the cost of new fixed-rate deals rapidly during a tumultuous week. Read more at: https://www.bbc.co.uk/news/business-65928188?at_medium=RSS&at_campaign=KARANGA |

|

Tesco sees early signs inflation is starting to easeThe UK’s largest supermarket says there are “encouraging” indications that price rises are slowing. Read more at: https://www.bbc.co.uk/news/business-65925217?at_medium=RSS&at_campaign=KARANGA |

|

Binance exits Netherlands and faces France probeThe world’s largest cryptocurrency exchange faces setbacks in Europe. Read more at: https://www.bbc.co.uk/news/business-65935263?at_medium=RSS&at_campaign=KARANGA |

|

MF Tracker: LIC, Damani’s Avenue Supermarts among top largecap stocks sold in MayFranklin Templeton Asset Management sold 0.1% of its stake in LIC, while Union Mutual Fund divested its entire holding?in May. Mutual funds were sellers in PSU stocks of Indian Oil Corporation and Hindustan Aeronautics, while stocks of Avenue Supermarts gave negative returns of over 1%. Leading mutual funds such as Axis Mutual Fund, Aditya Birla Sun Life Mutual Fund, and Kotak Mahindra Mutual Fund sold largecap, midcap and smallcap stocks in May. Recommendations, suggestions, views and opinions given by the experts are their own. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/mf-tracker-lic-damanis-avenue-supermarts-among-top-largecap-stocks-sold-in-may/articleshow/101042143.cms |

|

Mkts near fresh high, but why isn’t retail activity picking up? Here’s what Kamath saysIndian retail investors are turning away from equities and towards fixed deposit rates due to the high-interest rate environment, according to the co-founder and CEO of online brokerage Zerodha, Nithin Kamath. Despite markets hitting all-time highs, Kamath said the optimism wasn’t leading to increased retail interest. “Most retail investors question whether taking the added equity risk is worthwhile when govt bonds and FDs yield 7% plus”, Kamath added. The comments come after six consecutive rate hikes last year by the Central Bank. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/markets-near-all-time-high-but-why-isnt-retail-activity-picking-up-heres-what-nithin-kamath-says/articleshow/101042897.cms |

|

Warburg Pincus sells 6.2% stake in Kalyan Jewellers for Rs 724 cr; Franklin Templeton, Nomura emerge buyersThe move sees it lower its holdings in the firm from 23.82% in March to 17.60% now. Domestic investors BNP Paribas Arbitrage and Franklin Templeton MF have ended up with a 1.63% and 0.84% stake respectively, while foreign investor Nomura has bought an 0.83% stake. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/warburg-pincus-sells-6-2-stake-in-kalyan-jewellers-for-rs-724-cr-franklin-templeton-nomura-emerge-buyers/articleshow/101049870.cms |

|

Bond Report: Two-year Treasury yield rises for second straight week after Fed officials repeat need for more rate hikesThe policy-sensitive 2-year Treasury yield jumped on Friday, finishing with its second week of advances, after two Federal Reserve policy makers reinforced the central bank’s message that more rate hikes are needed to bring down inflation. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7215-504ABAA99D17%7D&siteid=rss&rss=1 |

|

Market Snapshot: U.S. stocks trade lower, but S&P 500 on pace for longest weekly win streak since 2021 after Fed pauseU.S. stocks are trading lower Friday afternoon in a choppy trading session, but with major benchmarks on track for weekly gains. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7215-4A04801BADFE%7D&siteid=rss&rss=1 |

|

The Moneyist: ‘It feels like a heavy burden’: My husband asked me to sell my $14,000 engagement ring to pay off our debt. Is he asking too much?“My husband had a good job with a six-figure salary at a well-known software company, but he was let go in late 2022.” Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7214-57A58B143BF2%7D& |