Summary Of the Markets Today:

- The Dow closed up 92 points or 0.27%,

- Nasdaq closed down 1.29%,

- S&P 500 closed down 0.38%,

- Gold $1,958 down $23.90,

- WTI crude oil settled at $73 up $0.88,

- 10-year U.S. Treasury 3.791% up 0.093 points,

- USD Index $104.17 up $0.04,

- Bitcoin $26,490 down $642,

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our Economic Forecast for June 2023

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

April exports were $249.0 billion, $9.2 billion less than March exports. April imports were $323.6 billion, $4.8 billion more than March imports. Year-to-date, the goods and services deficit decreased 23.9% from the same period in 2022. Inflation-adjusted exports increased 4.4% year-over-year whilst inflation-adjusted imports increased only 0.3%. Imports are an indicator of the strength of the economy – and show the economy is insignificantly growing.

Here is a summary of headlines we are reading today:

- Russian Crude Prices Via Druzhba Pipeline To Jump 16% After Dam Collapse

- Saudi Growth Outlook Expected To Slow 2.1% On Oil Output Cuts

- Bitcoin Sinks As Crypto Companies Grapple With SEC Lawsuits

- U.S. Sanctions Iranian And Chinese Companies Over Ballistic Missiles

- The Single Most Important Factor For Oil Prices This Year

- S&P 500, Nasdaq end Wednesday lower as market rally pauses: Live updates

- Cybersecurity ETFs gain steam as investors look for A.I. plays

- Landlords Face A $1.5 Trillion Bill For Interest-Only Commercial Mortgages

- Market Snapshot: Nasdaq tumbles as Treasury yields rise on Fed rate hike expectations

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Europe’s Nuclear Power PuzzleSince the European Commission stated the need for an accelerated green transition that includes nuclear power and natural gas, it seems member states are having a hard time agreeing on nuclear development. While some countries, such as Germany, are closing their nuclear plants, others, including Finland and Hungary, are developing new facilities. So, after years of nuclear power fearmongering and avoidance, where will Europe land on new nuclear development? In 2022, the European Commission defined both nuclear power and natural gas as climate-friendly… Read more at: https://oilprice.com/Alternative-Energy/Nuclear-Power/Europes-Nuclear-Power-Puzzle.html |

|

Russian Crude Prices Via Druzhba Pipeline To Jump 16% After Dam CollapseJune prices for Russian flagship Urals crude via the Druzhba pipeline through Ukraine are set to jump by 16% over May’s prices due to European refiners’ concerns of transit disruptions following the collapse of a major Ukrainian dam and fears of more significant infrastructure damage, Reuters reports, citing two unnamed sources. While Russian seaborne oil is banned by sanctions, piped crude is not, with the Druzhba pipeline running through Ukraine and supplying Hungary, Slovak and the Czech Republic from the southern branch. Reuters… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Russian-Crude-Prices-Via-Druzhba-Pipeline-To-Jump-16-After-Dam-Collapse.html |

|

DRC Eyes Peru’s Position As Second-Largest Copper ProducerVia AG Metal Miner There’s a new kid on the block in copper production. Media reports say the Democratic Republic of Congo (DRC) continues to put up a tough fight against Peru, the world’s second-biggest copper producer. If the latter does not square up, expects feel the DRC may end up taking its #2 title. Of course, such competition could not only affect copper prices today, but also in the near future. Bloomberg recently reported on a prediction from consulting firm Wood Mackenzie. According to the article, Wood Mackenzie expects… Read more at: https://oilprice.com/Metals/Commodities/DRC-Eyes-Perus-Position-As-Second-Largest-Copper-Producer.html |

|

Saudi Growth Outlook Expected To Slow 2.1% On Oil Output CutsSaudi Arabia’s growth is expected to slow to 2.1% this year due to production cuts, according to the International Monetary Fund (IMF), though the Kingdom’s current account surprise is at a decade-high and inflation has been contained. The IMF’s new growth projection for Saudi Arabia this year is lower than its May forecast of 3.1% growth, and comes after Riyadh surprised the markets with another 1 million barrel-per-day voluntary oil output cut on June 4. “Non-oil growth momentum is expected to remain strong,” the… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Saudi-Growth-Outlook-Expected-To-Slow-21-On-Oil-Output-Cuts.html |

|

U.S. And Turkmenistan Join Forces To Tackle Methane LeaksFollowing months of embarrassing stories in the international press documenting the scale of its methane emissions, Turkmenistan has consented to accept foreign help in solving the crisis. Signs are, though, that Ashgabat is reluctant to spend too much of its own money in addressing the problem. On May 31, Bloomberg news agency reported that U.S. officials are in negotiations with Turkmenistan to provide it with funding and expertise to stem gas leakages from outdated infrastructure. The plan is to hatch an agreement in time… Read more at: https://oilprice.com/Energy/Energy-General/US-And-Turkmenistan-Join-Forces-To-Tackle-Methane-Leaks.html |

|

Indian Refiner Drops Expansion Plan To Focus On PetrochemicalsMangalore Refinery and Petrochemicals Limited (MRPL), a major Indian refiner, is shifting its focus on petrochemicals and has shelved plans to expand its refinery capacity to “de-risk” its future in the energy transition. MRPL, whose parent company is Indian state-held company Oil and Natural Gas Corporation Limited (ONGC), is looking to boost its petrochemicals capacity, MRPL’s managing director Sanjay Varma told Bloomberg in an interview published on Wednesday. Expanding the petrochemicals capacity could cost up to $5.7 billion,… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Indian-Refiner-Drops-Expansion-Plan-To-Focus-On-Petrochemicals.html |

|

Booming Solar Industry Has An Unresolved Waste ProblemSolar power installations are leading a surge in renewable energy capacity, and solar additions are set to account for two-thirds of the increase in global renewable power capacity this year, the International Energy Agency (IEA) said last week. Along with the solar boom, however, comes another surge—the end-of-life solar panels need to be disposed of, and solar panel waste will grow exponentially as installations boom. We are now seeing the beginning of a major waste problem or the big cleantech opportunity for the… Read more at: https://oilprice.com/Alternative-Energy/Solar-Energy/Booming-Solar-Industry-Has-An-Unresolved-Waste-Problem.html |

|

Bitcoin Sinks As Crypto Companies Grapple With SEC LawsuitsUS regulators are suing Coinbase, one of the world’s leading crypto brokers and exchanges, just a day after announcing action against fellow crypto giant Binance. The filing by the US Securities and Exchange Commission (SEC) in a Manhattan court accuses Coinbase of operating as an unlicensed broker since 2019. Per a Reuters report, the SEC claims Coinbase has ‘deprived investors of disclosures and protections that come from registration, exposing them to significant risk.’ The SEC also says Coinbase’s staking program… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Bitcoin-Sinks-As-Crypto-Companies-Grapple-With-SEC-Lawsuits.html |

|

R&D Spending Surges In GCC’s Chemical SectorRussia’s February 2022 invasion of Ukraine has reignited international debate about the pace of the global energy transition and the risks of relying on oil and gas imports from countries with opposing agendas. In the Gulf it is largely framed around how to extract maximum benefit from the remaining hydrocarbon wealth, while also playing a responsible role in global efforts to both mitigate climate change and maintain stability in international energy supply. In October 2022 Oman, along with the UAE, pledged to reach net-zero emissions by… Read more at: https://oilprice.com/Energy/Energy-General/RD-Spending-Surges-In-GCCs-Chemical-Sector.html |

|

U.S. Sanctions Iranian And Chinese Companies Over Ballistic MissilesThe United States has sanctioned seven individuals and six entities from Iran, China, and Hong Kong who the U.S. Treasury Department says have helped Tehran get key technology for ballistic missile development. In a statement on June 6, the department’s Office of Foreign Assets Control (OFAC), accused the individuals and entities of conducting financial transactions facilitating the network to procure parts needed for missile development. The statement said the six companies sold sensitive centrifuges, metals, and radar materials to key actors… Read more at: https://oilprice.com/Latest-Energy-News/World-News/US-Sanctions-Iranian-And-Chinese-Companies-Over-Ballistic-Missiles.html |

|

Oil Moves Up Despite Rising Product InventoriesCrude oil prices inched higher today after the Energy Information Administration reported an inventory decline of 500,000 barrels for the week to June 9. This compared with an inventory build of 4.5 million barrels for the previous week, which pushed prices lower. At 459.2 million barrels, U.S. crude oil inventories are around 2% below the five-year average for this time of the year, the EIA said. In fuels, the agency estimated inventory builds across the board. Gasoline stocks added 2.7 million barrels in the reporting period, which… Read more at: https://oilprice.com/Energy/Crude-Oil/Oil-Moves-Up-Despite-Rising-Product-Inventories.html |

|

China’s Monthly Crude Oil Imports Surge To Third-Highest On RecordAs Chinese refiners returned from maintenance and built stockpiles, China’s crude oil imports jumped in May to the third-highest level on record, according to official data. China’s crude oil imports averaged 12.11 million barrels per day (bpd) in May, per data from the General Administration of Customs cited by Reuters. The imports in May surged by 17.4% compared to April when China imported just 10.32 million bpd of crude oil. The May crude arrivals were also 12.2% higher than in May of 2022 when imports averaged 10.79 million bpd.… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Chinas-Monthly-Crude-Oil-Imports-Surge-To-Third-Highest-On-Record.html |

|

Spain On Track To Generate 50% Of Its Power From Renewables In 2023Spain is on track to generate more than half of its power from renewable sources this year, the first of the top five European countries by power demand to accomplish this feat, according to Rystad Energy forecasts. Spain will reach this significant decarbonization milestone this year, with renewable-sourced generation surpassing the 50% average in 2023, beating France, Germany, Italy and the UK to this record. Spain has been one of the long-time leaders in the European renewables sector, making substantial investments in solar and wind capacity… Read more at: https://oilprice.com/Energy/Energy-General/Spain-On-Track-To-Generate-50-Of-Its-Power-From-Renewables-In-2023.html |

|

Iran Plans To Create A Regional Natural Gas HubIran is looking to set up a natural gas hub in the Persian Gulf and is cooperating with Russia, Qatar, and Turkmenistan to that end, Iranian Oil Minister Javad Owji said on Wednesday. “With the cooperation of Russia, Turkmenistan, and Qatar, we are trying to have a gas hub in the Asaluyeh region, and its preparations are being planned,” Iranian media quoted Owji as saying today. Asaluyeh is a port and energy hub in the southern Bushehr province in the Gulf. Iran will also continue its natural gas swap deals with neighboring countries,… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Iran-Plans-To-Create-A-Regional-Natural-Gas-Hub.html |

|

The Single Most Important Factor For Oil Prices This YearChina’s economy and oil demand will be the single most important driver of oil prices this year, even if OPEC+ manages to push prices upwards, according to Fatih Birol, the Executive Director of the International Energy Agency (IEA). “There are many uncertainties, as usual, when it comes to the oil market, and if I have to pick the most important one, it’s China,” Birol told Bloomberg TV in an interview on Wednesday. “If the Chinese economy weakens, or growth is much lower than many international economic institutions… Read more at: https://oilprice.com/Energy/Energy-General/The-Single-Most-Important-Factor-For-Oil-Prices-This-Year.html |

|

S&P 500, Nasdaq end Wednesday lower as market rally pauses: Live updatesThe broad market index was down slightly Wednesday. Read more at: https://www.cnbc.com/2023/06/06/stock-market-today-live-updates.html |

|

New York City tops world’s worst air pollution list from Canada wildfire smokeAs of Wednesday afternoon, New York City reached an AQI of 342, a level considered “hazardous” for all residents. Read more at: https://www.cnbc.com/2023/06/07/canadian-wildfire-smoke-nyc-residents-urged-to-stay-inside.html |

|

Amazon is pursuing ‘too many ideas’ and needs to focus on best opportunities, analyst says in letter to JassyBernstein analysts published a report on Wednesday that they called an “open letter” to CEO Andy Jassy and the board, laying out the company’s challenges. Read more at: https://www.cnbc.com/2023/06/07/amazon-is-pursuing-too-many-ideas-bernstein-says-in-open-letter.html |

|

Pence hits Trump harder than ever as he kicks off his 2024 campaignPence directly addressed his falling out with Trump after their losing campaign to President Joe Biden and Vice President Kamala Harris. Read more at: https://www.cnbc.com/2023/06/07/pence-hits-trump-2024-campaign.html |

|

Boeing sued over alleged theft of IP, counterfeiting of tools used on NASA projectsWilson Aerospace, a family-run tools company based in Colorado, is suing Boeing for a wide range of claims concerning allegedly stolen intellectual property. Read more at: https://www.cnbc.com/2023/06/07/wilson-aerospace-sues-boeing-over-allegedly-stole-ip-for-nasa-projects.html |

|

Cybersecurity ETFs gain steam as investors look for A.I. playsCyber funds have rallied since early May. Read more at: https://www.cnbc.com/2023/06/07/cybersecurity-etfs-gain-steam-as-investors-look-for-ai-plays.html |

|

Bernie Sanders says price of Alzheimer’s treatment is unconscionable, calls on HHS to take actionSen. Bernie Sanders said the $26,500 annual price for Alzheimer’s treatment Leqembi would financially burden on Medicare and increase premiums for seniors. Read more at: https://www.cnbc.com/2023/06/07/sanders-condemns-alzheimers-treatment-price-calls-for-hhs-action.html |

|

Millionaires are hoarding cash, betting on higher rates, CNBC survey saysWealthy investors are still cautious on the stock market, but not as bearish as they were at the start of the year. Read more at: https://www.cnbc.com/2023/06/07/millionaires-hoarding-cash-betting-on-higher-rates-cnbc-survey-says.html |

|

Supreme Court Justice Clarence Thomas postpones annual financial disclosure amid donor controversyTexas billionaire Harlan Crow, a Republican donor, for decades treated Supreme Court Justice Clarence Thomas to expensive vacations. Read more at: https://www.cnbc.com/2023/06/07/supreme-court-justice-clarence-thomas-postpones-financial-disclosure.html |

|

Ukraine war live updates: Kakhovka dam flooding set to peak; Kyiv says it’s on offensive in BahmutUkraine is dealing with a humanitarian and ecological disaster as flooding engulfs much of Kherson after major damage to the Kakhovka dam. Read more at: https://www.cnbc.com/2023/06/07/ukraine-war-live-updates-latest-news-on-russia-and-the-war-in-ukraine.html |

|

Google tells employees in New York and along the East Coast to work from home as smoke fills the airAs smoke from wildfires in Canada engulfed East Coast cities, Google advised employees in those areas to stay home. Read more at: https://www.cnbc.com/2023/06/07/google-tells-east-coast-employees-to-work-from-home-due-to-smoke.html |

|

Northeast flights delayed as Canada wildfire smoke cuts visibilityThe FAA briefly halted flights bound for New York’s LaGuardia Airport, and flights to Newark Liberty International Airport were slowed. Read more at: https://www.cnbc.com/2023/06/07/flights-new-york-smoke-wildfires.html |

|

BNB token dips 7%, and SEC pushes for an emergency order to freeze Binance US assets: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, Kavita Gupta, the founder of Delta Blockchain Fund, weighs in on the push from digital asset companies to move overseas amid the SEC’s continued crackdown on crypto exchanges. Read more at: https://www.cnbc.com/video/2023/06/07/bnb-token-dips-sec-emergency-order-freeze-binance-us-assets-cnbc-crypto-world.html |

|

Cheese Pizza? Meta’s Instagram Facilitated Massive Pedophile NetworkA comprehensive investigation by the Wall Street Journal and the Stanford Internet Observatory reveals that Meta-owned Instagram has been home to an organized and massive network of pedophiles.

Meta CEO Mark ZuckerbergBut what separates this case from most is that Instagram’s own algorithms were promoting pedophile content to other pedophiles, while the pedos themselves used coded emojis, such as a picture of a map, or a slice of cheese pizza.

|

|

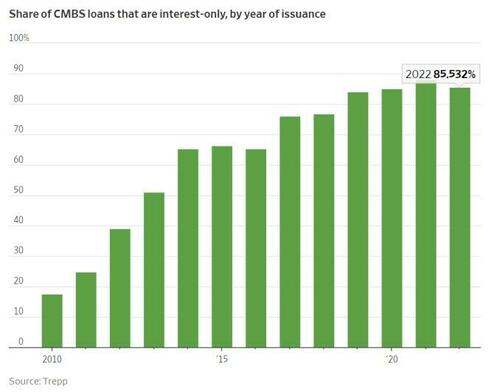

Landlords Face A $1.5 Trillion Bill For Interest-Only Commercial MortgagesAuthored by Mike Shedlock via MishTalk.com, Interest-only loans as a share of new commercial mortgage-backed securities issuance increased to 88% in 2021, up from 51% in 2013, according to Trepp…

Share of Interest Only Commercial Mortgage Backed Securities Commercial Real Estate BustA trend to walking away from commercial mortgages is just beginning. The Wall Street Journal reports Interest-Only Loans Helped Commercial Property Boom. Now They’re Coming Due.

|

|

Putin Slams Kiev’s “Barbaric Act” In 1st Public Comments On Dam CatastropheRussian President Vladimir Putin has addressed the Nova Kakhovka dam blast in public comments on Wednesday for the first time, charging that it was a “barbaric act” of the Ukrainian government and its military forces. Russia’s defense and foreign ministries had already laid blame on Kiev for the “catastrophic” attack. Putin’s comments came during a phone call to Turkish leader Recep Tayyip Erdogan – the first since his reelection. Putin offered Erdogan congratulations, but the two also discussed in-depth the dam disaster which has deeply impacted both Crimea and southern Ukraine as people are flooded out of their homes and towns. Evacuations and rescue efforts continue. Putin told Erdogan in the phone call that the breach was “a barbaric act which has led to a large-scale environmental and humanitarian catastrophe.”

Read more at: https://www.zerohedge.com/geopolitical/putin-slams-kievs-barbaric-act-1st-public-comments-dam-catastrophe |

|

14 Days To ‘Midnight’ – Greta’s Climate-Change Doomsday Clock Ticks OnAuthored by Beege Welborn via HotAir.com, We’re all done for. Bet you forgot.

I’m trying to decide how to handle it if it goes badly for Greta’s side – you know. Like, we’re all still here? I’d use “The Great Disappointment,” but The Millerites already stole that one. At least I have a couple weeks to think of something snappy. In the meantime, how we lookin’? Contrary to the hyperbole on the evening broadcast and the Weather Channel’s penchant for naming every breeze that goes by, we are not in bad shape at all. Read more at: https://www.zerohedge.com/weather/14-days-midnight-gretas-climate-change-doomsday-clock-ticks |

|

Telegraph Media Group set to be put up for saleLloyds is looking to recover debts owed by the network of companies controlled by the Barclay family. Read more at: https://www.bbc.co.uk/news/business-65835312?at_medium=RSS&at_campaign=KARANGA |

|

Marks & Spencer scraps milk use-by dates to cut wasteSupermarket becomes the latest to remove the dates, urging customers to use their judgement instead. Read more at: https://www.bbc.co.uk/news/business-65704475?at_medium=RSS&at_campaign=KARANGA |

|

Heathrow security officers announce summer strikesAbout 2,000 security officers will walk out for 31 days in June, July and August. Read more at: https://www.bbc.co.uk/news/business-65831998?at_medium=RSS&at_campaign=KARANGA |

|

Ahead of Market: 10 things that will decide D-Street action on ThursdayEquity markets in India ended the day strong anticipating dovish policy action by the RBI governor, extending gains to the fourth consecutive session to more-than-six-month highs. Consumer goods, metals and realty stocks contributed to the rise of the blue-chip Nifty 50 and Sensex, which rose 0.68% to 18,726 and 0.56% to 63,143 respectively. The participation of FIIs as net buyers and anticipation of a positive revision in the RBI’s inflation forecast during ongoing MPC meeting also led to today’s market rally. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/ahead-of-market-10-things-that-will-decide-d-street-action-on-thursday/articleshow/100829238.cms |

|

More than half of Indian equity investors come from non-metro cities: StudyOver half of equity investors in India are from non-metro areas, according to a study by equity investment advisory firm Research and Ranking. Of the 2,000 respondents, around 50% of investors had not experienced a complete business cycle, suggesting potential limited exposure to market fluctuations, but around 60% adopted a long-term investing approach. The survey also found that 57% of investors yearned to invest a lump sum in equity, while 43% preferred a more measured approach via investing through systematic investment plans. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/more-than-half-of-indian-equity-investors-come-from-non-metro-cities-study/articleshow/100826042.cms |

|

Brett Arends’s ROI: You may be betting one-sixth of your retirement portfolio on TV’s Jim CramerCramer is bullish on these seven stocks. Should you be? Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-720C-B6F330D84184%7D&siteid=rss&rss=1 |

|

NerdWallet: Ozempic: Will Medicare cover this TikTok-trending weight loss and diabetes drug?Ozempic, a medication used to treat Type 2 diabetes, has gone viral as a weight loss drug. Does Medicare pay for it? Here’s when it does and doesn’t. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7209-491AE8C2FD9E%7D&siteid=rss&rss=1 |

|

Market Snapshot: Nasdaq tumbles as Treasury yields rise on Fed rate hike expectationsU.S. stocks traded mostly lower Wednesday, as Treasury yields rose and undermined the rally in technology stocks. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-720C-1F61CE445263%7D&siteid=rss&rss=1 |