Summary Of the Markets Today:

- The Dow closed down 109 points or 0.33%,

- Nasdaq closed down 0.24%,

- S&P 500 closed down 0.14%,

- Gold $1,977 up $17.30,

- WTI crude oil settled at $72 down $0.05,

- 10-year U.S. Treasury 3.669% up 0.051 points,

- USD Index $103.19 down $0.39,

- Bitcoin $26,839 up $88,

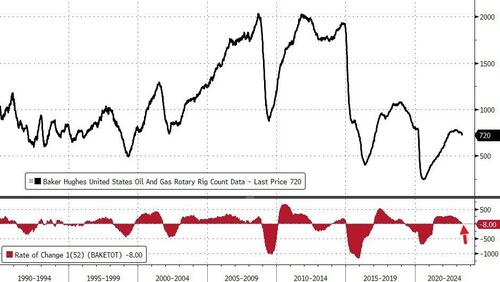

- Baker Hughes Rig Count: U.S. -11 to 720 Canada -9 to 85

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our Economic Forecast for May 2023

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

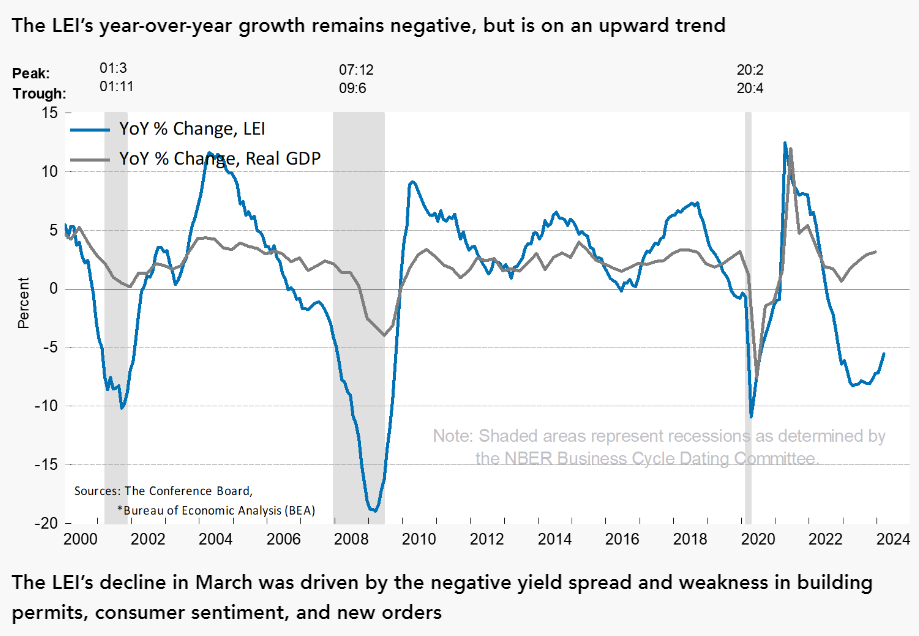

The Conference Board Leading Economic Index® (LEI) for the U.S. declined 0.6% in April 2023 to 107.5 (2016=100), following a decline of 1.2% in March. The LEI is down 4.4% over the six-month period between October 2022 and April 2023—a steeper rate of decline than its 3.8% contraction over the previous six months (April–October 2022). According to Justyna Zabinska-La Monica, Senior Manager, Business Cycle Indicators, at The Conference Board:

The LEI for the US declined for the thirteenth consecutive month in April, signaling a worsening economic outlook. Weaknesses among underlying components were widespread—but less so than in March’s reading, which resulted in a smaller decline. Only stock prices and manufacturers’ new orders for both capital and consumer goods improved in April. Importantly, the LEI continues to warn of an economic downturn this year. The Conference Board forecasts a contraction of economic activity starting in Q2 leading to a mild recession by mid-2023.

[Note that EconCurrents has yet to forecast a recession – and currently is forecasting a slightly improving economy. However, the overall economy remains weak (especially goods manufacturing) and it would not take much of an economic event to cause the economy to recess.]

Here is a summary of headlines we are reading today:

- U.S. Drilling Rigs Swing To Annual Loss For First Time In Years

- Warren Buffett Buys Up Even More Occidental Petroleum

- Oil Prices Climb As Bullish Sentiment Builds

- Bank Of America Sees Oil Prices Heading Toward $90 This Year

- Why The Market Didn’t React To The Latest SPR News

- New Mexico Accounted For 50% Of U.S. Oil Production Growth In 2022

- Republicans walk out of debt ceiling talks, say White House isn’t being ‘reasonable’

- Fed Chair Powell says rates may not have to rise as much as expected to curb inflation

- Foot Locker’s 28% plunge, guidance cut may signal trouble ahead for other retailers

- Powell signals a June pause, says Fed can afford to watch data

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Alberta Wildfires Still Sapping Crude Oil ProductionRaging wildfires in Canada could shave off 0.1%-0.3% of the country’s real gross domestic production this month, according to an estimate from ATB Financial. The number of wildfires grew on Friday, to 93 distinct fires, with out-of-control blazes falling by 1 to 25, according to provincial data. The current hit to the country’s crude oil production is estimated at between 240,000 and 300,000 barrels per day, according to Rystad estimates. Rystad Energy warned previously that nearly 2.7 million barrels per day of Alberta oil sands production… Read more at: https://oilprice.com/Energy/Energy-General/Alberta-Wildfires-Still-Sapping-Crude-Oil-Production.html |

|

U.S. Drilling Rigs Swing To Annual Loss For First Time In YearsThe total number of total active drilling rigs in the United States fell by 11 this week, according to new data from Baker Hughes published Friday, after falling by 17 last week. The total rig count fell to 720 this week—8 rigs below this time last year. It is the first year-over-year loss in the number of active drilling rigs in the United States since April 2021. The current count is 355 fewer rigs than the rig count at the beginning of 2019, prior to the pandemic. The decline in the number of rigs was entirely attributed to oil rigs, which… Read more at: https://oilprice.com/Energy/Crude-Oil/US-Drilling-Rigs-Swing-To-Annual-Loss-For-First-Time-In-Years.html |

|

Trans Mountain Pipeline Needs More FundsCanada’s Trans Mountain Expansion crude oil pipeline needs more funds as construction costs have skyrocketed, Canada’s federal government said on Friday. “Given the significant expenditures expected … [Trans Mountain Corporation] will require the continued availability of future financing in order to proceed with the project,” the Canada Development Investment Corporation (CDEV) said in its 2022 annual report. The Trans Mountain Pipeline was due for an expansion years ago, but the former owner, Kinder Morgan, was planning on killing in the project… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Trans-Mountain-Pipeline-Needs-More-Funds.html |

|

The Death Of Fracking In ColombiaColombia’s beleaguered oil industry is facing a series of volatile headwinds as it struggles to return to a pre-pandemic tempo of operations. Petroleum output despite rising during March 2023 to 771,332 barrels per day remains well below 2019 pre-pandemic production of nearly 900,000 barrels daily. Meagre proven oil reserves of just over 2 billion barrels with a production life of eight years are also weighing on the crucially important hydrocarbon sector. The Andean country’s first leftist President Gustavo Petro, a former socialist… Read more at: https://oilprice.com/Energy/Crude-Oil/The-Death-Of-Fracking-In-Colombia.html |

|

G7 Urged To Take The Lead In Phasing Out Fossil FuelsSeveral countries, including the Netherlands, Chile, and New Zealand, are calling on the G7 to lead by example and take the lead in phasing out fossil fuels, according to a letter sent to the group of the world’s most industrialized nations, which Reuters has seen. “We must bring the fossil fuel era to an end and phase out fossil fuels,” the Netherlands, Chile, New Zealand, the Marshall Islands, Palau, Saint Lucia, and Vanuatu wrote in the letter. The small island nations of the Marshall Islands, Palau, Saint Lucia,… Read more at: https://oilprice.com/Alternative-Energy/Renewable-Energy/G7-Urged-To-Take-The-Lead-In-Phasing-Out-Fossil-Fuels.html |

|

Warren Buffett Buys Up Even More Occidental PetroleumWarren Buffett’s Berkshire Hathaway bought additional shares in Occidental Petroleum this week, raising its stake in the U.S. oil firm to 24.4%, a regulatory filing shows. Berkshire Hathaway acquired 3,457,222 Oxy common stock this week, at around $58 per share for some $201 million. As a result of the latest transactions, Berkshire Hathaway now owns 217,330,133 common shares of Occidental, which are worth around $12.7 billion. Earlier this month, Warren Buffett said that Berkshire Hathaway would not be seeking full control of Occidental… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Warren-Buffett-Buys-Up-Even-More-Occidental-Petroleum.html |

|

Oil Prices Climb As Bullish Sentiment BuildsWhile it may still be too early to say if sentiment in oil markets has completely shifted, signs that the U.S. will avoid a default and that oil markets are beginning to tighten have put oil prices on course for their first weekly gain in a month.Oilprice Alert: Whether you are new to the oil and gas industry or an energy market veteran, you will regret not signing up for Global Energy Alert. Oilprice.com’s premium newsletter provides everything from geopolitical analysis to trading analysis, and all for less than a cup of coffee per… Read more at: https://oilprice.com/Energy/Energy-General/Oil-Prices-Climb-As-Bullish-Sentiment-Builds.html |

|

Canada’s Gasoline Prices Set To Rise As Driving Season StartsAlberta’s wildfires could shut in more oil production, adding to rising gasoline demand at the start of Canada’s driving season this weekend and pushing gasoline prices in Canada higher, analysts told The Canadian Press ahead of long May 20-22 long weekend. “It’s not unusual to see gas prices go up and down around weekends, and especially long weekends,” Colin Cieszynski, chief market strategist at SIA Wealth Management, told The Canadian Press. Wildfires in Alberta could put upward pressure on oil and gasoline prices, the analysts say. Following… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Canadas-Gasoline-Prices-Set-To-Rise-As-Driving-Season-Starts.html |

|

Bank Of America Sees Oil Prices Heading Toward $90 This YearOil prices will return to above $80 per barrel in the second half of this year and could continue rising toward $90 due to a deepening supply deficit, Francisco Blanch, head of commodities research at Bank of America, told Bloomberg Television on Friday. This quarter will be a little weaker, with oil prices averaging in the mid-$70s, Blanch said. “We’ll get back up over $80 in the second half of the year, toward $90, because the deficit is going to get deeper over the course of the next six to nine months,” BofA’s head of commodities research… Read more at: https://oilprice.com/Energy/Energy-General/Bank-Of-America-Sees-Oil-Prices-Heading-Toward-90-This-Year.html |

|

Bearish Sentiment Keeps Traders From Going Long On CrudeThe June WTI crude oil futures contract witnessed fluctuations throughout the week, responding to various factors. Despite solid U.S. economic data that fueled a stronger dollar and raised expectations of an interest rate hike by the U.S. Federal Reserve in June, prices managed to climb approximately 2.68% for the week. This increase is significant considering that a stronger dollar can potentially dampen oil demand by increasing the cost of fuel for holders of other currencies. Supply Dynamics One of the significant factors impacting the market… Read more at: https://oilprice.com/Energy/Energy-General/Bearish-Sentiment-Keeps-Traders-From-Going-Long-On-Crude.html |

|

Oil Majors Face Tough Choices Ahead Of Shareholder Meetings1. OPEC Lambasts Anti-Oil Sentiment, Warns of Underinvestment- OPEC+ compliance with its collective targets keeps on worsening with the 19 members underperforming by 2.6 million b/d, just as the oil alliance prepares for its June 3-4 meeting. – Meanwhile, OPEC+ production has edged lower to 42 million b/d as production shut-ins in Iraqi Kurdistan, industrial action at Nigerian loading terminals, and slightly lower Russian output weighed on supply. – Simultaneously, OPEC has voiced its dissatisfaction with the IEA’s discouraging investment… Read more at: https://oilprice.com/Energy/Energy-General/Oil-Majors-Face-Tough-Choices-Ahead-Of-Shareholder-Meetings.html |

|

Russia And Iran Plan To Challenge The Suez Canal With New Trade CorridorPolitics, Geopolitics & Conflict While the battle rages on in Sudan between the military and a paramilitary group called the Rapid Support Forces (RSF), the big question for oil market observers is whether the fighting will negatively impact land-locked South Sudan’s oil exports. For now, this remains secure because the two fighting sides need it to be so, and they have largely divided up these spoils indirectly, with the RSF said to control one of the country’s two refineries (Al Jaili), while the Sudanese military controls the… Read more at: https://oilprice.com/Energy/Energy-General/Russia-And-Iran-Plan-To-Challenge-The-Suez-Canal-With-New-Trade-Corridor.html |

|

Why The Market Didn’t React To The Latest SPR NewsOn Monday, the US Department of Energy announced that it will begin buying crude oil to restock the Strategic Petroleum Reserve (SPR), the level of which hit a multi-decade low last year following the release of stocks from the reserve when crude prices jumped to over $120. The announcement was not really a surprise as Energy Secretary Jennifer Granholm had effectively told lawmakers last week that it was coming, but even so, the market reaction, basically a big yawn and shrug of the shoulders, was interesting, and it set me thinking about the… Read more at: https://oilprice.com/Energy/Energy-General/Why-The-Market-Didnt-React-To-The-Latest-SPR-News.html |

|

Why Erdogan Is Expected To Win Turkey’s Presidential RunoffWith Turkey’s presidential and parliamentary elections heading into a run-off vote on May 28th, Erdogan has the new god of selective censorship (Elon Musk on his Twitter throne) on his side, and he could end up winning the second-round vote with a stability argument. Financial markets seem to be fairly confident that Erdogan will win. This is clear with a weakening of Turkish financial assets as the market prepares for another five-year term for the near-autocrat and his extremely unorthodox economic policies. While Erdogan won 49.51% in… Read more at: https://oilprice.com/Energy/Energy-General/Why-Erdogan-Is-Expected-To-Win-Turkeys-Presidential-Runoff.html |

|

New Mexico Accounted For 50% Of U.S. Oil Production Growth In 2022New Mexico, home to part of the Permian basin, saw the highest crude oil production growth of any U.S. state last year, with output gains of 300,000 barrels per day (bpd) accounting for half of America’s oil production increase, the Energy Information Administration (EIA) said in a report on Thursday. Total U.S. crude oil production increased by 600,000 bpd in 2022 compared with 2021, averaging 11.9 million bpd, per EIA’s Monthly Crude Oil and Natural Gas Production report. For the third year in a row, New Mexico’s oil production… Read more at: https://oilprice.com/Latest-Energy-News/World-News/New-Mexico-Accounted-For-50-Of-US-Oil-Production-Growth-In-2022.html |

|

Republicans walk out of debt ceiling talks, say White House isn’t being ‘reasonable’Financial markets dipped on news of the debt ceiling talks stalling, after a week of purported progress. Read more at: https://www.cnbc.com/2023/05/19/debt-ceiling-republicans-pause-negotiations-with-white-house.html |

|

Fed Chair Powell says rates may not have to rise as much as expected to curb inflationPowell spoke Friday at a “Perspectives on Monetary Policy” panel in Washington, D.C. Read more at: https://www.cnbc.com/2023/05/19/fed-chair-powell-says-rates-may-not-have-to-rise-as-much-as-expected-to-curb-inflation.html |

|

Five takeaways about the consumer from Walmart, other retailers after a big week of earningsWalmart, Home Depot and Target offered up the latest clues about the health of the American consumer and previewed what could be ahead for the economy. Read more at: https://www.cnbc.com/2023/05/19/us-economy-consumer-takeaways-from-wmt-tgt-hd-retail-earnings.html |

|

China-Taiwan tensions could grip 2024 election as Musk, Buffett, and Dalio sound alarmsElon Musk, Warren Buffett, Ray Dalio and others have weighed in on the fraying U.S.-China relations and rising tensions over a possible invasion of Taiwan. Read more at: https://www.cnbc.com/2023/05/19/musk-buffett-china-taiwan-2024-election.html |

|

Crypto’s biggest headwinds this year are hurting stablecoins. Here’s what investors need to knowStablecoins are designed to be less volatile and perceived to be more useful than cryptocurrencies, but even they aren’t immune from this year’s headwinds. Read more at: https://www.cnbc.com/2023/05/19/cryptos-biggest-headwinds-this-year-are-hurting-stablecoins.html |

|

Foot Locker’s 28% plunge, guidance cut may signal trouble ahead for other retailersFoot Locker shares plunged nearly 28% on Friday after a slowdown in consumer spending led to a drop in sales and weak guidance. Read more at: https://www.cnbc.com/2023/05/19/foot-locker-shares-drop-25percent-after-big-earning-miss-lower-guidance.html |

|

Michael Saylor gives crypto outlook from Bitcoin 2023, and XRP jumps 10% for week: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, Crypto World explores why some Bitcoin 2023 conference attendees decided to shell out thousands of dollars for a VIP ticket amid the current downturn. Crypto World also spoke with MicroStrategy executive chairman Michael Saylor about his outlook for bitcoin. Read more at: https://www.cnbc.com/video/2023/05/19/michael-saylor-crypto-outlook-bitcoin-2023-xrp-jumps-cnbc-crypto-world.html |

|

Mediterranean restaurant chain Cava files for IPO as revenue climbsThe Mediterranean restaurant chain Cava plans to trade on the New York Stock Exchange using the ticker “CAVA.” Read more at: https://www.cnbc.com/2023/05/19/cava-files-for-ipo-as-revenue-climbs-.html |

|

Elon Musk and Twitter face San Francisco city probe over headquartersThe probe follows a lawsuit from six former Twitter employees who allege management ordered them to make unsafe modifications to the company’s office space. Read more at: https://www.cnbc.com/2023/05/19/elon-musk-and-twitter-face-san-francisco-city-probe-over-headquarters-.html |

|

Ukraine war live updates: Russia hit with more sanctions from UK and U.S.; G-7 leaders meet in HiroshimaThe U.K. has formally introduced a wave of new sanctions against Russia, as officials of the G-7 bloc gather for their annual summit in Hiroshima, Japan. Read more at: https://www.cnbc.com/2023/05/19/ukraine-war-live-updates-latest-news-on-russia-and-the-war-in-ukraine.html |

|

Bentley car review: The $384,000 Continental GTC Speed offers a smooth and powerful rideBentley’s new supercar, the Continental GTC Speed, is a swan song for 12-cylinder luxury vehicles as we enter the age of EVs. Read more at: https://www.cnbc.com/2023/05/19/bentley-continental-gtc-speed-car-review.html |

|

Toyota redesigns bestselling Tacoma pickup amid increased midsize competitionToyota has commanded a roughly 40% share of the American midsize pickup truck segment since 2019 when Ford Motor and Jeep re-entered the market. Read more at: https://www.cnbc.com/2023/05/19/toyota-tacoma-pickup-redesign.html |

|

US Rig Count Tumbles To Annual Decline; Jobs & Production Next?Baker Hughes just reported that the total number of active drilling rigs in the US tumbled by 11 last week to 720 – down 8 rigs on a YoY basis…

Source: Bloomberg This is the first annual decline since April 2021. The first question we have is simple – with rigs now down almost 10% from the February highs – will Oil & Gas Extraction Industry jobs start to decline?

Source: Bloomberg … Read more at: https://www.zerohedge.com/energy/us-rig-count-tumbles-annual-decline-jobs-production-next |

|

US Preparing For Ukraine War To Become A ‘Frozen Conflict’Authored by Dave DeCamp via AntiWar.com, The Biden administration is preparing for the war in Ukraine to turn into a frozen conflict for years or possibly even decades, similar to the situation on the Korean peninsula, POLITICO reported on Thursday. US officials have been discussing the possibility, including potential options for where to draw the lines for a frozen conflict that either side would agree not to cross. The report said the idea of freezing the fighting could be a “politically palatable long-term result.”

The administration is considering the possibility because they don’t expect Ukraine to regain much territory in its long-awaited counteroffensive. According to POLITICO, the US is expecting that the assault “won’t deal a mortal blow to Russia. … Read more at: https://www.zerohedge.com/geopolitical/us-preparing-ukraine-war-become-frozen-conflict |

|

‘Very Sad’: Trump Slams Democrats Over Partisan Attacks On FBI WhistleblowersFormer President Donald Trump slammed Democrats on the House Judiciary Select Subcommittee on Weaponization of the Federal Government, who attacked FBI whistleblowers throughout a Thursday hearing. “Very sad watching what took place today in Congress regarding Whistleblowers and the FBI,” Trump wrote on Truth Social late Thursday night. “There has never been a time like this in our Country, the complete weaponization of Justice.” “I am a victim also, but the real victim is the United States of America,” Trump continued. “Congress must use its purse strings to straighten it out, before it is too late! MAGA 2024.” During the 3.5-hour hearing, Republican members on the panel repeatedly pushed back against Democrats’ complaints that they didn’t have transcripts of prior remarks from suspended FBI agent Marcus Allen. The Republicans argued that the FBI whistleblowers didn’t feel s … Read more at: https://www.zerohedge.com/political/very-sad-trump-slams-democrats-over-partisan-attacks-fbi-whistleblowers |

|

Echoing Scarface, “First We Get The Money” Say Chicago Mayor Johnson’s Allies With $12 Billion Financial PlanBy Mark Glennon of Wirepoints Two Chicago interest groups that are major allies of Mayor Brandon Johnson published Wednesday what they want Johnson to pursue for new taxes: a city income tax, a wealth tax, a “head tax” assessed per worker on employers, a digital ad tax, a jump in the tax on jet fuel used at Chicago’s airports, a progressive increase on real estate transaction fees on sales over $1 million. The new taxes would total $6.8 billion according to the plan, and would be coupled with supposed savings of $5.1 billion that would be redirected to other spending, totaling nearly $12 billion

For a lit … Read more at: https://www.zerohedge.com/markets/echoing-scarface-first-we-get-money-say-chicago-mayor-johnsons-allies-12-billion-financial |

|

Tesco chairman John Allan to quit after claims over behaviorThe supermarket says John Allan is leaving as allegations over his conduct “risk becoming a distraction”. Read more at: https://www.bbc.co.uk/news/business-65649851?at_medium=RSS&at_campaign=KARANGA |

|

Network Rail says infrastructure will get less reliableExtreme weather and rising costs are stretching the budget for maintaining rail infrastructure. Read more at: https://www.bbc.co.uk/news/business-65648927?at_medium=RSS&at_campaign=KARANGA |

|

Will a Russian diamond ban be effective?Countries in the G7 bloc want to be able to trace the gemstones to block Russian exports. Read more at: https://www.bbc.co.uk/news/business-65644348?at_medium=RSS&at_campaign=KARANGA |

|

JSW Steel board approves plans to raise up to Rs 17,000 cr; $1 bn from international marketsIn addition to the issuance of convertible securities and non-convertible debentures, the board also approved raising Rs 3,000 crore through private placement and/or public issuance. The funds will be used to replace short-maturity loans, meet working capital requirements, reimburse capex, and for general corporate purposes. A fresh approval is being sought from shareholders for its previous plan to raise Rs 14,000 crore through the issuance of non-convertible debentures and convertible securities. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/jsw-steel-board-approves-plans-to-raise-up-to-rs-17000-cr-1-bn-from-international-markets/articleshow/100363341.cms |

|

Powell signals a June pause, says Fed can afford to watch dataFederal Reserve Chair Jerome Powell suggested he might pause interest rate increases at next month’s policy meeting. Powell said that after a series of hikes, he was keen to assess the data before making a decision. His comments reinforced earlier guidance this week from other members of his leadership team. The US central bank has increased interest rates 5 percentage points in little more than a year, aiming to contain inflation. Many investors reduced their expectations of a June rate rise after Powell’s remarks. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/federal-reserve-chairman-powell-says-tighter-credit-conditions-ease-rate-hike-pressure/articleshow/100362486.cms |

|

Help My Career: Pay ranges on job listings are widening. One economist calls it a ‘double-edged sword’ for job seekers.Pay transparency laws provide insight into remuneration, but some jobs are seeing wider disparities in listed salaries. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-71FB-66679AB4B062%7D&siteid=rss&rss=1 |

|

What is the G-7? Which countries are in it? Here’s what you should know about this year’s summit.This year’s G-7 summit begins on Friday, May 19, and is being held in Hiroshima, Japan. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-71FA-52E3F5E7DB91%7D&siteid=rss&rss=1 |

|

Brett Arends’s ROI: Small-caps suck. Is it time to buy small-caps?Small-caps are on track for yet another dismal year, but there are some solid reasons why they might be a good investment—especially now Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-71F9-DC2879449DB7%7D&siteid=rss&rss=1 |