Summary Of the Markets Today:

- The Dow closed up 48 points or 0.14%,

- Nasdaq closed up 0.66%,

- S&P 500 closed up 0.30%,

- Gold $2,020 up $0.60,

- WTI crude oil settled at $71 up $1.21,

- 10-year U.S. Treasury 3.496% up 0.033 points,

- USD Index $102.42 down $0.26,

- Bitcoin $27,417 up $522,

Click here to read our Economic Forecast for May 2023

Today’s Economic Releases:

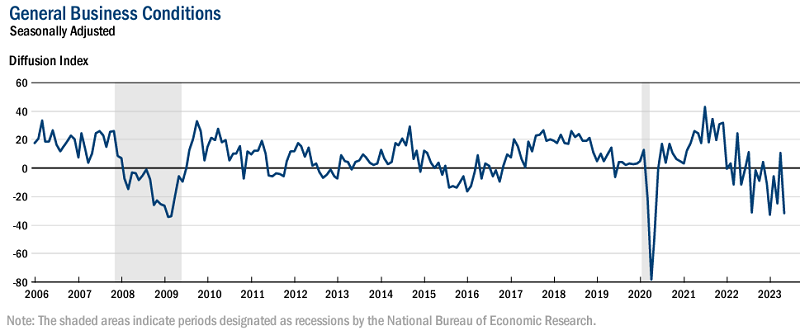

The Empire State Manufacturing Index for May 2023 came in at -31.8, down from 10.8 in April. This is the lowest reading since April 2020, and it suggests that manufacturing activity in New York State is contracting at a rapid pace. The decline was driven by a sharp drop in new orders, which fell to -28.0 from 25.1 in April. Shipments also declined, falling to -16.4 from 23.9 in April. One month is not a trend but this decline was so steep that it makes one wonder if the manufacturing sector just hit a brick wall.

A summary of headlines we are reading today:

- Iran Seizes Third Oil Tanker As U.S. Boosts Military Presence

- Global Platinum Shortage Set To Worsen

- U.S. Natural Gas Drilling Collapses At Fastest Fastest Pace Since 2016

- U.S. Gasoline Prices Are Set For A Significant Decline

- Consumer debt passes $17 trillion for the first time despite slide in mortgage demand

- S&P 500 closes higher as debt ceiling negotiations in Washington are set to resume: Live updates

- Microsoft releases update that allows iPhone users to text from Windows

- Dollar Weaponization Expands – FDIC Message To Foreign Depositors Is Don’t Trust The US

- US dollar falls from five-week high as data, debt ceiling weigh

- Bond Report: 2-year Treasury yield advances for third straight day amid hopes for debt-ceiling deal

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Will The EPA’s New Power Plant Emissions Rule Make An Impact?The Environmental Protection Agency (EPA) will try again to limit carbon dioxide emissions from power plants, having failed to do so during the Obama administration. Well, if at first you don’t succeed… Electric power generating plants account for about 31% of US carbon dioxide emissions, so this is not a minor event. This time around the EPA will not tell power generators affirmatively what to do (that is, install certain devices) but rather less aggressively what not to do (do not emit the carbon dioxide). The more corporate-friendly… Read more at: https://oilprice.com/Energy/Energy-General/Will-The-EPAs-New-Power-Plant-Emissions-Rule-Make-An-Impact.html |

|

Iran Seizes Third Oil Tanker As U.S. Boosts Military PresenceIran has seized yet another oil tanker bringing the tally to three tankers seized in the space of just 19 days as tensions in the Persian Gulf heat up. The tanker in question is said to be an Iranian oil tanker that had been seized by a foreign company five years ago, according to state-run IRNA news agency, which describes the seizure as the reclamation of that previously seized Iranian tanker. “The seized 10,000-ton oil tanker Purity had been illegally leased to a foreigner by falsifying documents since 2018 and its Iranian owners… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Iran-Seizes-Third-Oil-Tanker-As-US-Boosts-Military-Presence.html |

|

Two Charts That Explain U.S. Energy IndependenceEvery time I address the topic of energy independence, it spurs a lot of interest. But people also get confused about the subject. In the previous article, I addressed a number of questions related to energy independence. In today’s article, I am going to make it very simple, using just two graphics. You can see all of the data yourself in the Energy Information Administration’s (EIA) Monthly Energy Review. There are two different ways to think about energy independence. One is that we produce more than enough energy for our needs.… Read more at: https://oilprice.com/Energy/Energy-General/Two-Charts-That-Explain-US-Energy-Independence.html |

|

Global Platinum Shortage Set To WorsenThe global shortage of platinum is set to worsen in the coming quarters, resulting in one of the most significant deficits in half a century, the World Platinum Investment Council (WPIC) said in a quarterly report on Monday. This should continue to support spot prices of the metal. Rolling power blackouts in South Africa, a country responsible for mining approximately 70% of the world’s supply, disrupt production. It comes as demand remains robust and will outstrip supply by 983,000 ounces in 2023. This means the shortfall will… Read more at: https://oilprice.com/Metals/Commodities/Global-Platinum-Shortage-Set-To-Worsen.html |

|

Oil Prices Rise As Canada Wildfires Rage OnCrude oil prices were on the rise on Monday as the market continued to fear a tightening of crude supplies on Canadian wildfires. Crude oil prices were trading up 1.5% on Monday afternoon, with WTI trading at $71.12 per barrel, up $1.08 per barrel (+1.54%) as the oil-producing province of Alberta sees more hot and dry weather, triggering an increase in wildfires, with no sign of abating. The number of wildfires labeled as out of control as of Saturday is 21, with more than 16,000 people displaced. There still were more than 300,000 boepd of Canadian… Read more at: https://oilprice.com/Energy/Oil-Prices/Oil-Prices-Rise-As-Canada-Wildfires-Rage-On.html |

|

European Commission President Says Fossil Fuel-Centric Growth Is DeadEconomic growth cannot be carried by a fossil fuel energy mix, according to European Commission President Ursula von der Leyen. “A growth model centered on fossil fuels is simply obsolete,” von der Leyen said on Monday at an event in Brussels designed to speak about coordinating economic development with environmental goals, according to Reuters. Von der Leyen added that the EU’s Green Deal transition had a goal of creating “a different growth model that is sustainable far into the future.” That EU Green Deal has a… Read more at: https://oilprice.com/Latest-Energy-News/World-News/European-Commission-President-Says-Fossil-Fuel-Centric-Growth-Is-Dead.html |

|

Is The Next Commodity Super-Cycle Right Around The Corner?In recent years, commodity prices have reached a 50-year low relative to overall equity markets (S&P 500). Historically, lows in the ratio of commodities to equities have corresponded with the beginning of new commodity supercycles. As Visual Capitalist’s Bruno Venditti shows in the infographic below, using data from Incrementum AG and Crescat Capital LLC, the relationship between commodities and U.S. equities has varied greatly over the last five decades. What is a Commodity Supercycle? A commodity supercycle occurs… Read more at: https://oilprice.com/Energy/Energy-General/Is-The-Next-Commodity-Super-Cycle-Right-Around-The-Corner.html |

|

EU Lawmakers Seek Revenue Cap On Power Firms If Energy Prices SoarThe European Parliament is proposing a cap on the revenues of electricity generators in case energy prices surge again, according to a draft proposal of the Parliament’s lead negotiator on the EU electricity market reform seen by Reuters. Nicolas Gonzalez Casares—the European Parliament’s lead negotiator on the reform proposed by the European Commission earlier this year – has drafted the Parliament’s position on the Commission’s proposals for market reforms. According to Gonzalez Casares and the Spanish Socialist Members of the European… Read more at: https://oilprice.com/Latest-Energy-News/World-News/EU-Lawmakers-Seek-Revenue-Cap-On-Power-Firms-If-Energy-Prices-Soar.html |

|

U.S. Natural Gas Drilling Collapses At Fastest Fastest Pace Since 2016According to a new report from Baker Hughes Co., the US natural gas sector is rapidly pulling drilling rigs from the field due to oversupply conditions that have led to a collapse in natural gas prices over a nine-month period. Baker Hughes reported Friday that exploration companies reduced rigs by 16 to 141 this week. This is the most significant weekly decline since February 2016. Nabors Industries Ltd., one of the top providers of rigs to shale drillers, warned last month about the fall in rig orders. The rig provider expects a 9%… Read more at: https://oilprice.com/Energy/Natural-Gas/US-Natural-Gas-Drilling-Collapses-At-Fastest-Fastest-Pace-Since-2016.html |

|

U.S. Gasoline Prices Are Set For A Significant DeclineGasoline prices in the U.S. ticked higher today, according to the AAA, though overall, national averages are down by around $1 from this time last year, according to GasBuddy. “Overall, gasoline prices continue to see significant relief from year-ago levels,” GasBuddy head petroleum analyst Patrick De Haan, said on Monday, noting that while some states have seen higher prices due to West Texas Intermediate (WTI) prices rebounding to over $70 from the mid-60s range earlier this month, “the natural average has seen little change… Read more at: https://oilprice.com/Latest-Energy-News/World-News/US-Gasoline-Prices-Are-Set-For-A-Significant-Decline.html |

|

Russia’s Crude Oil Exports By Sea Continue To ClimbRussia’s crude oil exports by sea rose in the four weeks to May 12 to a new record-high and are now estimated to have increased by 10% from early April, tanker-tracking data monitored by Bloomberg showed on Monday. Crude on vessels departed from Russia’s oil export terminals and en route to international markets hit another record at 3.61 million barrels per day (bpd) in the four-week period to May 12, according to the data reported by Bloomberg’s Julian Lee. That’s the highest volume of Russian seaborne crude oil exports… Read more at: https://oilprice.com/Energy/Energy-General/Russias-Crude-Oil-Exports-By-Sea-Continue-To-Climb.html |

|

Venezuela Plans To Issue LNG Export Licenses To European MajorsVenezuela is planning to issue in June export licenses to European majors Eni and Repsol to ship liquefied natural gas (LNG) from the country, Venezuela’s Oil Minister Pedro Tellechea has told Bloomberg in an interview. The LNG export licenses would allow Venezuela to start shipments of natural gas, having spent decades focusing only on its huge reserves of heavy crude oil. “Eni and Repsol are interested in growing in the area of ??gas in Venezuela. They had been waiting for seven years for the export permit for natural… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Venezuela-Plans-To-Issue-LNG-Export-Licenses-To-European-Majors.html |

|

Russia’s Natural Gas Exports To Europe Have Slumped This MonthRussia’s natural gas exports via pipeline to Europe have fallen by 11.4% so far this month compared to the average pipeline flows in April, estimates from Reuters showed on Monday. Russia still sends some gas via pipelines to Europe via one transit route through Ukraine and via TurkStream. Between May 1 and May 15, Russia’s gas giant Gazprom sent 67 million cubic meters per day of gas to Europe, down from 75.6 million cubic meters per day last month, as spot prices for gas in Europe fell to a 21-month low. Low demand for natural… Read more at: https://oilprice.com/Energy/Energy-General/Russias-Natural-Gas-Exports-To-Europe-Have-Slumped-This-Month.html |

|

Nationalized German Energy Firms Paid Big Bonuses To Their TradersUniper and Sefe, two energy firms Germany nationalized last year, paid some of their traders big bonuses for 2022, sources with knowledge of the matter told Reuters on Monday. Traders at the companies have received millions of U.S. dollars in bonuses for last year, even as the German government had to intervene and rescue Uniper and Sefe with multi-billion-dollar bailouts. As part of the nationalization, the companies have agreed to cap salaries for the management boards, but the bonus limits did not apply to the entire staff, Reuters’… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Nationalized-German-Energy-Firms-Paid-Big-Bonuses-To-Their-Traders.html |

|

ONEOK And Magellan Merger To Create $60-Billion Pipeline GiantONEOK will buy Magellan Midstream Partners in a cash-and-stock deal valued at $18.8 billion, creating a combined U.S. oil and gas pipeline giant with a total enterprise value of $60 billion, the two major pipeline operators said on Sunday. Under a merger agreement, primarily gas-focused ONEOK will buy all outstanding units of Magellan for $25.00 in cash and 0.6670 shares of ONEOK common stock for each outstanding Magellan common unit. This would represent a current implied value to each Magellan unitholder of $67.50 per unit, for a 22% premium,… Read more at: https://oilprice.com/Latest-Energy-News/World-News/ONEOK-And-Magellan-Merger-To-Create-60-Billion-Pipeline-Giant.html |

|

Consumer debt passes $17 trillion for the first time despite slide in mortgage demandThe total for borrowing across all categories hit $17.05 trillion, an increase of nearly $150 billion, or 0.9% during the January-to-March period. Read more at: https://www.cnbc.com/2023/05/15/consumer-debt-passes-17-trillion-for-the-first-time-despite-slide-in-mortgage-demand.html |

|

Biden optimistic about a debt limit deal, but McCarthy says White House isn’t being seriousPresident Joe Biden sounds optimistic about the odds of reaching a deal with Republicans to raise or suspend the debt limit. Read more at: https://www.cnbc.com/2023/05/15/debt-limit-deal-biden-optimistic-ahead-of-g-7-this-week-.html |

|

S&P 500 closes higher as debt ceiling negotiations in Washington are set to resume: Live updates“It’s kind of a waiting game,” said Globalt Investments’ Keith Buchanan. Read more at: https://www.cnbc.com/2023/05/14/stock-market-today-live-updates.html |

|

EU approves Microsoft’s $69 billion acquisition of Activision Blizzard, clearing huge hurdleMicrosoft offered remedies in cloud gaming to earn the approval of European Union regulators for the $69 billion Activision Blizzard acquisition. Read more at: https://www.cnbc.com/2023/05/15/microsoft-activision-deal-eu-approves-takeover-of-call-of-duty-maker.html |

|

Paul Tudor Jones says the Fed is done raising rates, stocks to finish the year higher from herePaul Tudor Jones believes the Fed has finished raising interest rates in its fight against inflation, and the stock market could grind higher this year. Read more at: https://www.cnbc.com/2023/05/15/paul-tudor-jones-says-the-fed-is-done-raising-rates-stocks-to-finish-the-year-higher-from-here.html |

|

‘Big Short’ Michael Burry bought shares in a slew of regional banks last quarter amid banking crisisMichael Burry, known for calling the subprime mortgage crisis, bought a number of regional banks last quarter, betting the industry could weather the crisis. Read more at: https://www.cnbc.com/2023/05/15/big-short-michael-burry-bought-a-slew-of-regional-banks-last-quarter-amid-banking-crisis.html |

|

Florida Gov. Ron DeSantis looks nearly ready to launch his White House bidThe DeSantis political operation is moving offices, potentially triggering a 15-day window for him to file paperwork declaring his intent to run for president. Read more at: https://www.cnbc.com/2023/05/15/florida-gov-ron-desantis-prepares-2024-presidential-campaign.html |

|

Binance pulls out of Canada, and Florida Gov. DeSantis signs CBDC legislation: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, EMURGO’s Vineeth Bhuvanagiri discusses how experimental new tokens on bitcoin’s blockchain are affecting the network. Read more at: https://www.cnbc.com/video/2023/05/15/binance-pulls-out-canada-florida-desantis-cbdc-legislation-cnbc-crypto-world.html |

|

Biden to nominate cancer surgeon Monica Bertagnolli to lead National Institutes of HealthThe NIH, which funds medical research, played a key role in developing the messenger RNA technology that underlies the Covid vaccine made by Moderna. Read more at: https://www.cnbc.com/2023/05/15/biden-nominates-cancer-surgeon-for-naitonal-institutes-of-health.html |

|

‘Guardians of the Galaxy: Vol. 3’ had best second weekend box office hold for MCU in 5 yearsGuardians’ second weekend box office drop was the smallest one for the Marvel Cinematic Universe since the original “Black Panther” in 2018. Read more at: https://www.cnbc.com/2023/05/15/guardians-of-the-galaxy-box-office-second-week.html |

|

A new company wants to give you a free TV, in exchange for always showing you adsTelly is offering 500,000 free 55-inch TVs to consumers willing to have a steady stream of advertisements in their homes. Read more at: https://www.cnbc.com/2023/05/15/telly-offering-a-free-tv-but-it-will-constantly-display-ads.html |

|

Microsoft releases update that allows iPhone users to text from WindowsPC users want the ability to text from their laptops at work or at school. Read more at: https://www.cnbc.com/2023/05/15/microsoft-windows-update-allows-iphone-users-to-text.html |

|

The Energy Transition Has A Metals ProblemAuthored by Irina Slav via OilPrice.com,

Copper prices this week fell to the lowest since last November on weak economic data from China. Yet the International Copper Study Group, a group of copper exporters and importers, just said it expected a deficit of the metal this year.

< … Read more at: https://www.zerohedge.com/commodities/energy-transition-has-metals-problem |

|

Turkey Confirms Election Runoff, But With Erdogan In Driver’s SeatOn Monday Turkey’s High Election Board confirmed that the country’s two leading candidates from Sunday’s election will hold a runoff vote in two weeks, after neither incumbent Recep Tayyip Erdogan nor top opposition candidate Kemal Kilicdaroglu broke past the 50% threshold needed to win outright in the first round. Erdogan and his AK party’s allies are expected to retain a parliamentary majority as a result of the Sunday elections, which saw some of the highest voter turnout in the nation’s history. Turnout was 89% of eligible voters. With 100 percent counted, Erdogan captured 49.5% of the vote – which is significantly better than even pre-election polls predicted – compared to Kilicdaroglu’s 44.9%.

Read more at: https://www.zerohedge.com/political/turkey-confirms-election-runoff-erdogan-drivers-seat |

|

Dollar Weaponization Expands – FDIC Message To Foreign Depositors Is Don’t Trust The USAuthored by Mike Shedlock via MishTalk.com, The weaponization of the US dollar by US agencies continues with a ruling by the FDIC…

In March, the FDIC seized nearly $14 billion in foreign deposits at Silicon Valley Bank, most of of the deposits were from Asia. Foreign depositors have been waiting access to their money. The FDIC now affirms, sorry, too bad. Poof. The Pain of Silicon Valley Bank’s Collapse Is Being Felt by These DepositorsThe Wall Street Journal reports The Pain of Silicon Valley Bank’s Collapse Is Being Felt by These Depositors

|

|

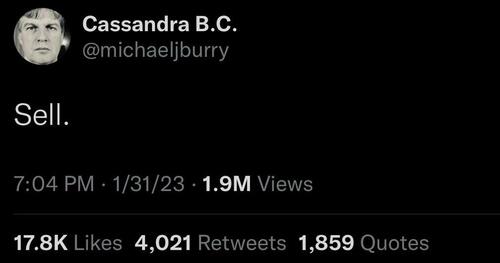

Michael Burry Didn’t Sell, Instead He Loaded Up On Regional Banks: Here Are All The “Big Short’s” Latest Stock HoldingsOn Jan 31, just one day before a dovish Powell presser sent stocks surging higher in what to this date remains the biggest short squeeze in a decade, boosted by a historic 0DTE buying frenzy, the “Big Short” Michael Burry tweeted one word: “sell.”

Then, when stocks spiked higher, Burry promptly deleted not just the tweet but his entire account, only to reactivate it one week later for yet another sarcastic tweet, suggesting that this time was no different than the dot com crisis (the tweet has also since been deleted). Read more at: https://www.zerohedge.com/markets/michael-burry-didnt-sell-instead-he-loaded-regional-banks-here-are-all-big-shorts-latest |

|

Supermarkets investigated over food and fuel pricesThe competition watchdog will look at whether a failure in competition means customers are overpaying. Read more at: https://www.bbc.co.uk/news/business-65601292?at_medium=RSS&at_campaign=KARANGA |

|

Royal Mail to be investigated for missed delivery targetsThe postal service faces another fine by the industry watchdog for falling short on first class mail. Read more at: https://www.bbc.co.uk/news/business-65601117?at_medium=RSS&at_campaign=KARANGA |

|

Ex US bank bosses call collapse ‘unprecedented’The former chiefs of Silicon Valley Bank and Signature Bank are due to testify before Congress. Read more at: https://www.bbc.co.uk/news/business-65605251?at_medium=RSS&at_campaign=KARANGA |

|

Q4 Results Roundup: How Kalyan Jewellers, Tube Investments, Pfizer India, Karur Vysya Bank faredTube Investments reported a rise of 84% in net profit, reaching Rs 251 crore. Pfizer India saw a marginal increase in net profit to Rs 130 crore. Kalyan Jewellers’ consolidated revenue for the quarter stood at Rs 3,382 crore, an 18% YoY growth. Karur Vysya Bank reported a 64% YoY increase in net profit to Rs 1,106 crore. Read more at: https://economictimes.indiatimes.com/markets/stocks/earnings/q4-results-roundup-how-kalyan-jewellers-tube-investments-pfizer-india-karur-vysya-bank-fared/articleshow/100258518.cms |

|

US dollar falls from five-week high as data, debt ceiling weighThe dollar retreated from its five-week high due to the poor manufacturing index in New York and consolidation of gains from last week, but rises in US bond yields provided some support. Read more at: https://economictimes.indiatimes.com/markets/forex/us-dollar-falls-from-five-week-high-as-data-debt-ceiling-weigh/articleshow/100258090.cms |

|

NSE Q4 Results: Net profit rises 19% YoY to Rs 1,810 crore; co to pay Rs 80/share dividendThe National Stock Exchange of India (NSE) has reported strong financial results for the March quarter with a 32% YoY growth in operating income to Rs 3295 crore. The NSE reported total operating income of Rs 11,181 crore for the year-ended March, a 44% growth compared to the previous year. Read more at: https://economictimes.indiatimes.com/markets/stocks/earnings/nse-q4-results-net-profit-rises-19-yoy-to-rs-1810-crore-co-to-pay-rs-80/share-dividend/articleshow/100256853.cms |

|

TaxWatch: Do you want the IRS doing your taxes? It all depends on who you ask.The IRS is examining if it can pull off a free, online tax-preparation service. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-71F5-BF4A56828F0E%7D&siteid=rss&rss=1 |

|

C3.ai’s stock soars as company expects to beat revenue targetShares of C3.ai were surging in Monday afternoon trading after the software company said it expects that it exceeded its revenue target for last quarter. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-71F5-57F15C5C7801%7D&siteid=rss&rss=1 |

|

Bond Report: 2-year Treasury yield advances for third straight day amid hopes for debt-ceiling dealHopes for a U.S. debt-ceiling resolution damps demand for the perceived safety of government bonds, nudging yields higher. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-71F5-3B1AC67387C5%7D&siteid=rss&rss=1 |

Getty Images: Supporters of the Turkish president, Recep Tayyip Erdoğan, in IstanbulAs we noted

Getty Images: Supporters of the Turkish president, Recep Tayyip Erdoğan, in IstanbulAs we noted