Summary Of the Markets Today:

- The Dow closed down 9 points or 0.03%,

- Nasdaq closed down 0.35%,

- S&P 500 closed down 0.16%,

- Gold $2,017 down $4.20,

- WTI crude oil settled at $70 down $0.74,

- 10-year U.S. Treasury 3.464% up 0.067 points,

- USD Index $102.69 up $0.64,

- Bitcoin $26,476 down $366,

- Baker Hughes Rig Count: U.S. -17 to 731 Canada +1 to 94

Click here to read our Economic Forecast for May 2023

Today’s Economic Releases:

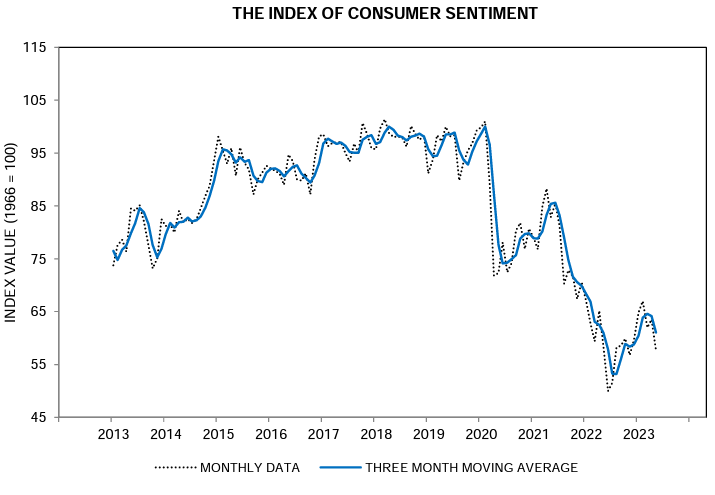

The University of Michigan’s Consumer sentiment tumbled 9% to 57.7 amid renewed concerns about the trajectory of the economy, erasing over half of the gains achieved after the all-time historic low from last June. While current incoming macroeconomic data show no sign of recession, consumers’ worries about the economy escalated in May alongside the proliferation of negative news about the economy, including the debt crisis standoff.

Well, there is no inflation in the export and import of goods and services. In April 2023, prices for U.S. imports declined 4.8% year-over-year. The price index for U.S. exports declined 5.9% year-over-year.

A summary of headlines we are reading today:

- Oil, Gas Drilling Activity In U.S. Sees Largest Single-Week Drop Since Mid-2020

- European Natural Gas Prices Are Set For A Sixth Consecutive Weekly Loss

- A Plethora Of Bearish Factors Push Oil Prices Down

- Shell Suspends Production At The World’s Largest Floating LNG Facility

- Tesla To Recall Over 1.1 Million EVs In China

- S&P 500 closes lower, notches a second week of losses, following disappointing consumer sentiment data: Live updates

- Bitcoin dips below $27,000 and PitchBook releases Q1 crypto report on VC investments: CNBC Crypto World

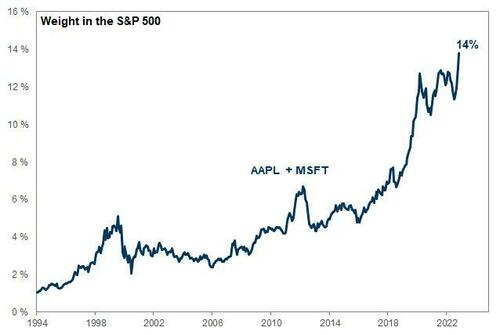

- The S&P Is Up 8% In 2023; Without AI It Would Be Down 2%, Below 3,800

- Market Snapshot: Dow on track to book 5th straight day of losses, as poor consumer sentiment report reignites recession fears

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Petrobras Has High Hopes For Refining, Pre-Salt DiscoveriesBrazilian-controlled oil company Petrobras has high hopes for increasing its refining capacity and its Curacao pre-salt discovery, company officials said on Friday. In a Friday webcast for investors, Petrobras director of industrial processes and products William Franca said that the company has the potential to increase its refining capacity by as much as a half a million barrels daily without greenfield projects. According to Franca, there are multiple projects currently being reviewed that will increase Petrobras’ distillation capacity—and… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Petrobras-Has-High-Hopes-For-Refining-Pre-Salt-Discoveries.html |

|

How to Play A Potential Bounce In Natural GasOver the last year or so, probably the most spectacular move in any energy-related market has been the collapse of natural gas (NG). The price of front-end futures in the commodity peaked in August last year at just a shade over $10 before turning tail and dropping to a low of just below $1.95 a month or so ago. A big move like that requires a perfect storm, of course, not just one factor. An unusually mild winter in most of the US reduced demand for gas used for heating and electricity generation, for example, and the expected shortage as Russian… Read more at: https://oilprice.com/Energy/Natural-Gas/How-to-Play-A-Potential-Bounce-In-Natural-Gas.html |

|

Justice For NordStream Attack? Highly UnlikelyThe chances of finding and bringing the Nord Stream attack perpetrators to justice are negligible, according to Russian Security Council Deputy Chairman Dmitry Medvedev, who added that Russia would nevertheless continue to work towards holding them accountable. “Of course, we will continue to employ all available legal tools to hold those responsible to account, but the chances of doing this in international judicial institutions are negligible,” Medvedev said at the International Legal Forum today. At the same time, Medvedev blasted Europe for… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Justice-For-NordStream-Attack-Highly-Unlikely.html |

|

Oil, Gas Drilling Activity In U.S. Sees Largest Single-Week Drop Since Mid-2020The total number of total active drilling rigs in the United States fell by 17 this week, according to new data from Baker Hughes published Friday, after falling by 7 last week. It is the largest single-week drop in the number of oil and gas rigs in the United States since June 2020. The total rig count fell to 731 this week—just 17 rigs higher than the rig count this time in 2022—and 344 rigs lower than the rig count at the beginning of 2019, prior to the pandemic. Oil rigs in the United States fell by 2 this week to 586. Gas rigs… Read more at: https://oilprice.com/Energy/Energy-General/Oil-Gas-Drilling-Activity-In-US-Sees-Largest-Single-Week-Drop-Since-Mid-2020.html |

|

450,000 Bpd Flow Of Kurdish Crude Unlikely To Restart This WeekendWhile the Iraqi oil minister has said that 450,000 barrels per day of shut-in oil exports from Iraqi Kurdistan would restart exports on Saturday, Kurdish and Turkish officials both said on Friday that it is unlikely the pipeline would be turned back on in that timeframe. The pipeline was closed down on March 25 by Turkey, following an international arbitration ruling in favor of Iraq against Turkey. The pipeline shut-down removed Kurdish oil from the market that it was exporting unilaterally to Turkey, against the wishes of the Iraqi federal government. … Read more at: https://oilprice.com/Energy/Crude-Oil/450000-Bpd-Flow-Of-Kurdish-Crude-Unlikely-To-Restart-This-Weekend.html |

|

European Natural Gas Prices Are Set For A Sixth Consecutive Weekly LossLow demand for natural gas has sent Europe’s benchmark gas prices towards a sixth consecutive weekly loss—the longest run of weekly losses since 2020. The front-month futures at the TTF hub, the benchmark for Europe’s gas trading, fell by 3.7% to $36.80 (33.80 euros) per megawatt-hour (MWh) as of 12:27 p.m. GMT on Friday. Lower power demand amid mild spring weather in most of Europe is depressing gas prices, while comfortable inventories of gas have not yet led to any rush for filling storage sites ahead of… Read more at: https://oilprice.com/Energy/Energy-General/European-Natural-Gas-Prices-Are-Set-For-A-Sixth-Consecutive-Weekly-Loss.html |

|

A Plethora Of Bearish Factors Push Oil Prices DownOn Thursday, US benchmark West Texas Intermediate crude oil prices experienced a 2% decline, reaching a one-week low. The drop then continued on Friday morning. This drop can be attributed to several interconnected factors that impact supply and demand including inflation, Federal Reserve policy, the US debt ceiling, OPEC+ projections, and inventories. US Debt Ceiling Standoff Raises Concerns of a Potential Recession One significant factor contributing to the decline in oil prices is the political standoff over the US debt ceiling. This standoff… Read more at: https://oilprice.com/Energy/Energy-General/A-Plethora-Of-Bearish-Factors-Push-Oil-Prices-Down.html |

|

EU Considers Formally Banning Russian Oil Flows To Germany And PolandThe European Union is considering formally banning Russian crude flows via the Druzhba pipeline to Germany and Poland, which have already stopped importing Russia’s crude, Bloomberg reported on Friday, citing documents it has seen. The Druzhba pipeline is a key artery of oil supply from Russia to Europe. It has two branches – a northern one via Belarus to deliver oil to Belarus, Poland, Germany, Latvia, and Lithuania, and a southern one passing through Ukraine and sending oil to the Czech Republic, Slovakia, Hungary, and Croatia. Flows… Read more at: https://oilprice.com/Latest-Energy-News/World-News/EU-Considers-Formally-Banning-Russian-Oil-Flows-To-Germany-And-Poland.html |

|

Global Investment In Oil And Gas Soars1. Canada Wildfires Curb Gas Output- Canada’s ongoing state of emergency that was triggered by rampant wildfires across the province of Alberta is taking a heavy toll on gas production in the country, shedding some 15% from production levels in April. – Seven oil and gas producers announced production curtailments totaling 319,000 barrels of oil equivalent per day, followed by shut-ins of gas processing plants. – The decline in natural gas production has pushed Canadian gas prices higher in both Alberta and British Columbia, both up 60-70… Read more at: https://oilprice.com/Energy/Energy-General/Global-Investment-In-Oil-And-Gas-Soars.html |

|

Russian Forces Fall Back In BakhmutPolitics, Geopolitics & Conflict Kyiv said mid-week that Russian forces had withdrawn from parts of the key battlefield of Bakhmut as a result of Ukrainian counterattacks. The fallback is not a rout but indicates Russia has retreated in some areas by up to a mile. The battle in Bakhmut has been a litmus test for Putin’s patience with his much-needed but dangerous reliance on Wagner mercenaries. Indications continue to surface that this relationship is becoming highly fractured. Just prior to Kyiv’s announcement that Russia had withdrawn… Read more at: https://oilprice.com/Energy/Energy-General/Russian-Forces-Fall-Back-In-Bakhmut.html |

|

Syria Rejoins The Arab League After A 12-Year AbsenceThe Arab world has welcomed Syria back into the fold; specifically, by readmitting the Assad regime into the Arab League, from which it was evicted 12 years ago. A lot is being read into this move, and from the Western perspective, the bulk of analysis hinges on the perception that the U.S. is losing ground in the Middle East. It is, of course, rather more complicated than that. The Arab League’s decision to readmit Assad after 12 years of war is not an expression of loyalty or commitment. Instead, it’s an acknowledgment that Assad… Read more at: https://oilprice.com/Energy/Energy-General/Syria-Rejoins-The-Arab-League-After-A-12-Year-Absence.html |

|

Oil Markets Struggle To Overcome Bearish SentimentBearish sentiment has continued to build in oil markets this week despite OPEC boosting its outlook for Chinese demand and the Biden administration hinting that they may soon refill the SPR.Friday, May 12th, 2023The oil price slide has continued this week as recessionary fears have been aggravated by a reversal in crude inventory draws, even the carefully worded DOE announcement that they might start refilling SPRs failed to spark a sustainable price recovery. OPEC tried to intervene with its monthly report, hiking Chinese demand growth this… Read more at: https://oilprice.com/Energy/Energy-General/Oil-Markets-Struggle-To-Overcome-Bearish-Sentiment.html |

|

Shell Suspends Production At The World’s Largest Floating LNG FacilityShell has halted production at Prelude LNG – the world’s largest floating liquefied natural gas facility offshore Australia – due to a trip, a spokesperson for the supermajor said on Friday without giving details when production could resume. “Production on the Shell-operated Prelude FLNG facility has been temporarily suspended due to a trip,” a spokeswoman for Shell told Reuters on Friday. “We are working methodically through the stages in the restart process with safety and stability foremost in mind,”… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Shell-Suspends-Production-At-The-Worlds-Largest-Floating-LNG-Facility.html |

|

Houston Is Attracting Oil Flows Again Amid Record-High U.S. Crude ExportsHouston is attracting crude flows via pipelines again as record-high U.S. oil exports have resulted in a surge in pipeline utilization to the top-exporting hub of Corpus Christi, analysts told Reuters. Crude oil production in the top shale field in Texas, the Permian, is set to hit a record high of 5.694 million barrels per day (bpd) in May, up from an estimated 5.681 million bpd in April, according to drilling productivity data from the U.S. Energy Information Administration (EIA). Since 2020, when Corpus Christi overtook Houston as the main export… Read more at: https://oilprice.com/Energy/Energy-General/Houston-Is-Attracting-Oil-Flows-Again-Amid-Record-High-US-Crude-Exports.html |

|

Tesla To Recall Over 1.1 Million EVs In ChinaTesla will recall more than 1.1 million of its electric vehicles sold in China, both domestically produced and imported into China, due to potential safety risks, the Chinese State Administration for Market Regulation said on Friday. The recall of 1,104,622 Teslas, which will begin on May 29, affects imported Model S, Model X, and Model 3, and China-made Model 3 and Model Y, the Chinese administration said about the recall plan Tesla’s local units had submitted with the regulator. The vehicles subject to the recall have issues… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Tesla-To-Recall-Over-11-Million-EVs-In-China.html |

|

Elon Musk hires ex-NBCUniversal ad chief Linda Yaccarino to be Twitter’s CEOTwitter has suffered a rapid decline in advertising revenue since Elon Musk took over the social media platform last year. Read more at: https://www.cnbc.com/2023/05/12/nbcuniversal-ad-chief-yaccarino-resigns-as-sources-say-shes-in-talks-to-be-twitter-ceo.html |

|

S&P 500 closes lower, notches a second week of losses, following disappointing consumer sentiment data: Live updatesThe broad-market index slid on Friday and ended the week with losses. Read more at: https://www.cnbc.com/2023/05/11/stock-market-today-live-updates.html |

|

U.S. can avoid default in July if Treasury can make it through June cash crunch, Congressional Budget Office saysTax revenues and emergency measures after June 15 will let Treasury “continue financing operations through at least the end of July,” said the CBO. Read more at: https://www.cnbc.com/2023/05/12/us-can-avoid-default-in-july-if-it-gets-cash-in-june-cbo.html |

|

DeSantis allies could shift $86 million to help him run for president as watchdogs cry foulRon DeSantis, widely considered former President Donald Trump’s top potential GOP primary rival, is expected to launch his White House bid in the coming weeks. Read more at: https://www.cnbc.com/2023/05/12/desantis-allies-could-shift-millions-for-presidential-bid.html |

|

These buyback champions are shrinking their share count and analysts love themWith earnings season winding down, the buyback window is opening for certain stocks. Read more at: https://www.cnbc.com/2023/05/12/these-buyback-champions-are-shrinking-their-share-count-and-analysts-love-them.html |

|

Alzheimer’s treatment Leqembi could cost Medicare up to $5 billion per year, study estimatesThe authors said the estimated costs of Leqembi to Medicare are conservative and spending on the Alzheimer’s treatment may increase more than anticipated. Read more at: https://www.cnbc.com/2023/05/12/alzheimers-disease-leqembi-could-cost-medicare-5-billion-per-year.html |

|

U.S. aims to turn middle-American cities into new tech hubs with $500 million investmentThe hope is to create more well-paying jobs across the nation and ensure the U.S. maintains dominance in key areas of tech innovation. Read more at: https://www.cnbc.com/2023/05/12/us-to-make-tech-hubs-in-middle-america-with-500-million-investment.html |

|

Bitcoin dips below $27,000 and PitchBook releases Q1 crypto report on VC investments: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, Robert Le, crypto analyst at PitchBook, breaks down the research firm’s Q1 report on venture capital investments in the space and emerging opportunities as well as his analyst note on Consensus 2023 released this week. Read more at: https://www.cnbc.com/video/2023/05/12/bitcoin-dips-pitchbook-crypto-report-vc-investment-cnbc-crypto-world.html |

|

Ukraine war live updates: Russia denies reports of Ukrainian breakthrough in front lineRussia has denied reports that Ukraine has made a breakthrough in the front line, amid expectations of a Kyiv counteroffensive. Read more at: https://www.cnbc.com/2023/05/12/ukraine-war-live-updates-latest-news-on-russia-and-the-war-in-ukraine.html |

|

Former Trump probe prosecutor refuses to answer House Judiciary Committee questionsMark Pomerantz once played a key role in the Manhattan DA’s criminal probe of Donald Trump. The former president is charged with falsifying business records. Read more at: https://www.cnbc.com/2023/05/12/former-trump-prosecutor-pomerantz-refuses-to-answer-house-questions.html |

|

Why the U.S. government, the country’s largest employer, wants to ban the salary history questionResearch shows women earn more when they don’t have to disclose their previous pay in job interviews. Read more at: https://www.cnbc.com/2023/05/12/largest-us-employer-wants-to-ban-the-salary-history-question.html |

|

As shoppers look for savings, Nordstrom hopes Rack stores can fuel its revivalThe department store operator is opening 20 Nordstrom Rack stores and zeroing in on best-selling brands. Read more at: https://www.cnbc.com/2023/05/12/nordstrom-jwn-looks-to-nordstrom-rack-for-growth.html |

|

Fed Governor Philip Jefferson named as new vice chair to succeed Lael BrainardFederal Reserve Governor Philip Jefferson will be nominated by President Joe Biden to be vice chairman of the central bank’s board Read more at: https://www.cnbc.com/2023/05/12/fed-governor-philip-jefferson-named-as-new-vice-chair-to-succeed-lael-brainard.html |

|

EU Considers Formally Banning Russian Oil Flows To Germany And PolandAuthored by Charles Kennedy via OilPrice.com, The European Union is considering formally banning Russian crude flows via the Druzhba pipeline to Germany and Poland, which have already stopped importing Russia’s crude, Bloomberg reported on Friday, citing documents it has seen.

The Druzhba pipeline is a key artery of oil supply from Russia to Europe. It has two branches – a northern one via Belarus to deliver oil to Belarus, Poland, Germany, Latvia, and Lithuania, and a southern one passing through Ukraine and sending oil to the Czech Republic, Slovakia, Hungary, and Croatia. Flows through the Druzhba pipeline are currently exempted from the EU embargo on imports of Russian crude oil … Read more at: https://www.zerohedge.com/geopolitical/eu-considers-formally-banning-russian-oil-flows-germany-and-poland |

|

The S&P Is Up 8% In 2023; Without AI It Would Be Down 2%, Below 3,800In the past month we have discussed on multiple occasions the unprecedented collapse in market breadth, driven by a record outperformance of a handful of tech names…

… which has seen the Nasdaq’s advance/decline line plunge to all time lows even as the Nasdaq is up more than 21% YTD…

Read more at: https://www.zerohedge.com/markets/sp-8-2023-without-ai-it-would-be-down-2-below-3800 |

|

The Great Left-Wing Disinformation Operation Against The Supreme CourtAuthored by Josh Hammer via The Epoch Times, The past five weeks has seen a flurry of media activity, clearly coordinated, against the right-of-center U.S. Supreme Court.

Each and every one of these collusive “gotcha” pieces is left-wing disinformation at worst, and grossly misleading at best. Read more at: https://www.zerohedge.com/political/great-left-wing-disinformation-operation-against-supreme-court |

|

First Cyclone Of 2023 Hit In January, Months Before Hurricane Season Begins, NHC FindsThe National Hurricane Center tweeted Thursday that the first storm of the 2023 Atlantic hurricane season occurred well before the season even started. Forecasters said a reanalysis of a major winter storm moving up the US East Coast in January qualified as the first tropical cyclone of the year.

In the statement released Thursday, NHC researchers said that the storm on Jan. 16, about 300 miles north of Bermuda, was designated a subtropical storm.

|

|

Elon Musk names Linda Yaccarino new Twitter CEONBCUniversal’s former head of advertising is revealed as the new boss of the social network. Read more at: https://www.bbc.co.uk/news/business-65574826?at_medium=RSS&at_campaign=KARANGA |

|

Royal Mail boss to step down after tumultuous two yearsSimon Thompson was under pressure after a long industrial dispute and accusations he had misled MPs. Read more at: https://www.bbc.co.uk/news/business-65572229?at_medium=RSS&at_campaign=KARANGA |

|

Mike Lynch: Autonomy founder extradited to US in criminal caseMike Lynch is accused of overinflating the value of his firm Autonomy when he sold it to Hewlett-Packard. Read more at: https://www.bbc.co.uk/news/business-65568967?at_medium=RSS&at_campaign=KARANGA |

|

Infosys, HUL among top April additions by MFs; Mankind Pharma steals the show as preferred pickMutual funds in India have sold shares worth INR 5,100 crore ($687m) in April, Nuvama Institutional Equities reported, while FIIs bought INR 12,400 crore worth of the stocks in the secondary market. Meanwhile, domestic investors’ equity inflows into mutual funds moderated to INR 6,500 crore, a five-month low. On a positive note, small- and mid-cap funds continued to see inflows, with a total of INR 4,000 crore in April. The retail category garnered 61% of the total inflows received into equity schemes in India, continuing the trend seen in recent months. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/infosys-hul-among-top-april-additions-by-mfs-mankind-pharma-steals-the-show-as-preferred-pick/articleshow/100189578.cms |

|

Nifty forms long bull candle on weekly charts. What should traders do next weekNifty formed a green candle with a long lower shadow, indicating buying in lower zones as bulls take comfort in falling India VIX. Analysts suggest that Nifty should continue holding above 18250 zones to witness upward momentum towards 18400 and 18442 zones, with downside supports in place at 18181 and 18081 marks. Technical charts suggest a broader trading range between 17900 and 18500 zones, with an immediate range between 18150 and 18450 zones. As long as the index remains above 18200, the overall trend is expected to remain positive, but traders should keep an eye on resistance at 18400. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/tech-view-nifty-forms-long-bull-candle-on-weekly-charts-what-should-traders-do-next-week/articleshow/100188920.cms |

|

Adani-Hindenburg probe: SC grants SEBI a 3-month extensionThe apex court had on March 2 asked the Securities and Exchange Board of India (SEBI)to probe within two months these allegations and had also set up a panel to look at providing protection to Indian investors after a damning report by US short-seller Hindenburg wiped out more than $140 billion of the Indian conglomerate’s market value. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/adani-hindenburg-probe-sc-grants-sebi-a-3-month-extension/articleshow/100184921.cms |

|

The Moneyist: ‘Poor people are not stupid’: I grew up in poverty, earned $14 an hour, and inherited $150,000. Here’s what I have learned from my windfall.‘When I open my accounts and see how they are growing it really fills me with a sense of pride and determination.’ Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-71E8-195A13618EA7%7D&siteid=rss&rss=1 |

|

Market Snapshot: Dow on track to book 5th straight day of losses, as poor consumer sentiment report reignites recession fearsU.S. stocks surrendered early gains on Friday after a report from the University of Michigan showed consumer sentiment soured in May, helping to revive recession fears. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-71F3-B3C86AE92F43%7D&siteid=rss&rss=1 |

|

The Moneyist: ‘I feel used’: My partner stays with me 5 nights a week, even though he owns his own home. Should he pay for utilities and food?‘He accused me of being materialistic.’ Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-71EF-A4E868D2104C%7D&siteid=rss&rss=1 |