Summary Of the Markets Today:

- The Dow closed down 270 points or 0.80%,

- Nasdaq closed down 0.46%,

- S&P 500 closed down 0.70%,

- Gold $2,037 up $13.60,

- WTI crude oil settled at $68 down $3.49,

- 10-year U.S. Treasury 3.352% down 0.087 points,

- EUR/USD $1.105 up $0.005,

- Bitcoin $28,351 down $384,

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our Economic Forecast for May 2023

Today’s Economic Releases:

The ADP National Employment Report for April 2023 showed that private payrolls increased by 296,000 (blue line on the graph below), much higher than expected. This was the largest gain since July 2022. The services sector added 229,000 jobs, led by leisure/hospitality (154,000), education/health services (69,000), and trade/transportation/utilities (32,000). Meanwhile, the goods-producing industry added 67,000 jobs due to construction (53,000) and mining (52,000) while manufacturing shed 38,000 jobs. Medium establishments created 122,000 jobs, small-sized companies 121,000 jobs only large firms 47,000 jobs. Job changers in particular saw a dramatic decline in pay growth to 13.2%, the slowest pace of growth since November 2021, from 14.2%. For job stayers, pay growth eased to 6.7% from 6.9%. The report also showed that average hourly earnings for private employees rose 5.4% from a year ago, down from 5.5% in March. The deceleration in wage growth is a sign that labor market tightness is easing.

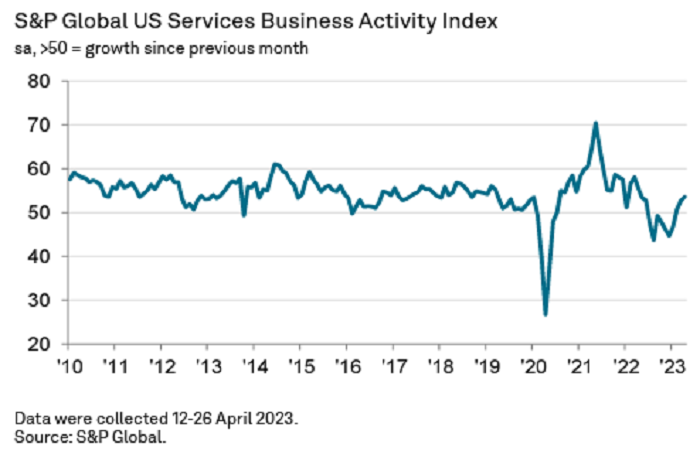

The S&P Global US Services PMI for April 2023 came in at 53.6, up from 52.6 in March. This was the fastest pace of expansion in the country’s service sector since April 2022. The increase in the S&P Global US Services PMI suggests that the services sector is growing at a faster pace.

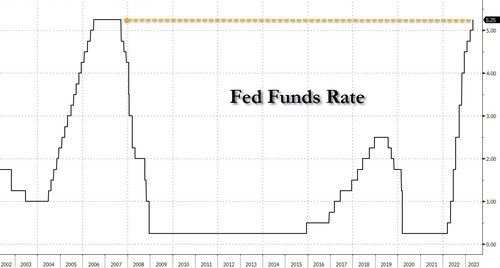

The Federal Open Market Committee (FOMC) met on May 3-4, 2023, and decided to raise the target range for the federal funds rate by 0.25 percentage points to a range of 5.00 to 5.25 percent. The FOMC’s decision to raise interest rates was in response to high inflation which is not moderating quickly. There were few word changes in the meeting statement so there are no clues on how many more rate increases are projected. For a commentary on Chair Powell’s market-moving comments after the latest rate hike – [click here].

A summary of headlines we are reading today:

- TotalEnergies To Launch $27 Billion Energy Project In Iraq This Month

- Rare Earth Metals See Prices Plunge

- Oil Prices Crash As Demand Fears Mount

- Iran Seizes Second Oil Tanker In Arabian Gulf

- Fed recap: Here are Chair Powell’s market-moving comments after the latest rate hike

- Dow closes more than 250 points lower Wednesday after Fed hikes rates for a 10th time: Live updates

- The market is looking for the next ‘domino’ to fall, keeping banks under pressure

- Private payrolls surged by 296,000 in April, much higher than expected, ADP says

- Watch Live: Fed Chair Powell Attempt To Explain If The Pause Is Hawkish Or Dovish

- Fed’s Powell says U.S. banking system is ‘sound and resilient’ after First Republic failure

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

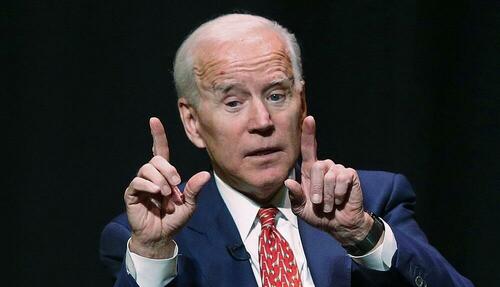

Biden Is Losing Young Climate-Conscious VotersAuthored by Rick Whitbeck via RealClear Wire, Now that President Biden has made his 2024 run official, he has plenty of work to do if he hopes to shore up his lagging support among key constituencies. According to a recent NBC News survey, a full 70 percent of Americans do not want the President to run again. One demographic to watch is younger voters, who backed Biden by a wide 61-36 margin in 2020. Younger Americans are exceptionally aggressive and vocal on climate policies. Nearly two-thirds (62%), support phasing out fossil fuels… Read more at: https://oilprice.com/Energy/Energy-General/Biden-Is-Losing-Young-Climate-Conscious-Voters.html |

|

TotalEnergies To Launch $27 Billion Energy Project In Iraq This MonthFrench oil and gas multinational TotalEnergies (NYSE:TTE) has finally reached an agreement with the government of Iraq to start a long-delayed $27 billion energy project in two weeks, Iraq’s oil minister Hayan Abdel-Ghani said on Wednesday. The two parties first struck the deal back in 2021 that would see Total build four oil, gas, and renewables projects in southern Iraq over 25 years with an initial investment of $10 billion. Unfortunately, the giant project was shelved amid disputes and squabbling between Iraqi politicians over the terms… Read more at: https://oilprice.com/Latest-Energy-News/World-News/TotalEnergies-To-Launch-27-Billion-Energy-Project-In-Iraq-This-Month.html |

|

Rare Earth Metals See Prices PlungeBy Jennifer Kary via AGMetalminer.com The Rare Earths MMI (Monthly Metals Index) suffered yet another significant drop month-over-month. Overall, the index fell 15.81%. These massive drops in prices are the result of several factors. One of the biggest culprits is rising supply and falling demand. Prices for rare earth metals have also decreased due to new mining initiatives cropping up globally. While some parts of the MetalMiner rare earths index traded sideways month-over-month, most components fell, pulling the overall index down sharply.China… Read more at: https://oilprice.com/Energy/Energy-General/Rare-Earth-Metals-See-Prices-Plunge.html |

|

European Oil Giants Beat Energy Traders At Their Own Game In 2022Europe’s oil giants saw their trading arms rake in some $37 billion in pre-tax earnings last year, overtaking the estimated $34 billion made by the world’s largest energy traders, with soaring profits attributed to the events since Russia invaded Ukraine. According to data from Bernstein Research cited by The Financial Times, Shell generated $16 billion in pre-tax earnings from its energy trading arm, while TotalEnergies took in $11.5 billion and BP earned $8.4 billion. These figures compare to Vitol’s record energy… Read more at: https://oilprice.com/Energy/Energy-General/European-Oil-Giants-Beat-Energy-Traders-At-Their-Own-Game-In-2022.html |

|

Oil Exporters In The Middle East To See Economic Growth SlowEconomic growth in the oil exporters in the Middle East and North Africa will shift from oil to the non-oil sectors due to lower crude production as part of the OPEC+ agreement, the International Monetary Fund (IMF) said in its latest regional outlook published on Wednesday. Economic growth is set to moderate in oil-exporting countries in the Middle East – which are some of the world’s biggest oil exporters, including top crude exporter Saudi Arabia – according to the IMF. That’s due to the OPEC+ cuts decided late last year,… Read more at: https://oilprice.com/Energy/Energy-General/Oil-Exporters-In-The-Middle-East-To-See-Economic-Growth-Slow.html |

|

Oil Prices Crash As Demand Fears MountOil prices crashed in Wednesday’s session, marking the second day of declines ahead of a likely 25-basis point rate hike by the Federal Reserve as well as growing anxiety over the prospect of a recession amid questions about the health of U.S regional banks. WTI June contract slipped 5.1% to $68.29 per barrel while Brent for June settlement was 4.7% lower to $71.80, the lowest level in more than a year. The current crash closely mirrors the March decline when the banking crisis first unfolded, suggesting the markets are getting concerned… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Oil-Prices-Crash-As-Demand-Fears-Mount.html |

|

Iraq And Turkey Yet To Reach Deal On Restarting Kurdistan Oil ExportsIraq and Turkey have not reached an agreement yet on the resumption of crude oil exports out of the semi-autonomous Iraqi region of Kurdistan from the Turkish port of Ceyhan, Iraq’s Oil Minister Ihsan Abdul Jabbar Ismaael was quoted as saying on Wednesday. Kurdistan’s exports of crude oil have been shut for more than a month now, weeks after the federal government of Iraq and the region of Kurdistan reached an agreement in early April to resume exports via an Iraq-Turkey pipeline and the port of Ceyhan on the Mediterranean.… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Iraq-And-Turkey-Yet-To-Reach-Deal-On-Restarting-Kurdistan-Oil-Exports.html |

|

Iran Seizes Second Oil Tanker In Arabian GulfA commercial oil tanker was seized by Iran in the Strait of Hormuz on Wednesday in the second such merchant vessel seizure by the Islamic Republic in waters in the Arabian Gulf in less than a week. Iran’s Islamic Revolutionary Guard Corps Navy (IRGCN) seized early on Wednesday local time the Panama-flagged oil tanker Niovi, the U.S. Navy said today. The tanker was seized while transiting the Strait of Hormuz, the world’s most important oil transit chokepoint between Oman and Iran that connects the Persian Gulf with… Read more at: https://oilprice.com/Geopolitics/Middle-East/Iran-Seizes-Second-Oil-Tanker-In-Arabian-Gulf.html |

|

EIA Inventory Report Fails To Arrest Oil Price SlideCrude oil prices continued lower after the Energy Information Administration reported yet another weekly inventory draw on crude oil inventories. The report came a day after the American Petroleum Institute estimated inventories had shrunk by almost 4 million barrels in the week to April 28. The EIA estimated inventories had shed 1.3 million barrels in the period, which compares with a draw of 5.1 million barrels for the previous week. Whatever the size of the draw, it was unlikely to move prices, however, as worry about the… Read more at: https://oilprice.com/Energy/Oil-Prices/EIA-Inventory-Report-Fails-To-Arrest-Oil-Price-Slide.html |

|

Phillips 66 Trumps Earnings Estimates As Refining Margins RiseOne of the top U.S. refiners, Phillips 66 (NYSE: PSX), reported higher-than-expected earnings for the first quarter amid solid demand and lower crude oil feedstock. Phillips 66 booked adjusted earnings of $2.0 billion, or $4.21 per share, in the first quarter, compared with fourth-quarter adjusted earnings of $1.9 billion. Adjusted EPS beat the Wall Street consensus of $3.56 compiled by the Wall Street Journal. “In Refining, we ran above industry-average crude utilization, successfully executed major turnarounds and increased market capture… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Phillips-66-Trumps-Earnings-Estimates-As-Refining-Margins-Rise.html |

|

IMF: Saudi Arabia Needs Oil Prices At $80.90 To Balance BudgetSaudi Arabia needs oil prices at $80.90 per barrel to balance its budget this year, the International Monetary Fund (IMF) said on Wednesday in its latest economic projections for the Middle East and Central Asia. The breakeven price for the world’s largest crude oil exporter for 2023 is estimated to be lower than the $83.60 and $85.80 a barrel levels of 2021 and 2022, respectively, but higher than the $80.40 breakeven average for the two decades to 2019. Economic growth in OPEC’s de facto leader is set to materially slow down from 8.7% last year… Read more at: https://oilprice.com/Energy/Energy-General/IMF-Saudi-Arabia-Needs-Oil-Prices-At-8090-To-Balance-Budget.html |

|

Norway Set To Accelerate Arctic Oil And Gas DrillingCompanies operating in the Norwegian Continental Shelf are planning for more drilling in the Arctic areas in the Barents Sea, encouraged by Norway’s government which wants more oil and gas discoveries to boost energy security and help European partners with energy supply. At a conference on the Barents Sea in Hammerfest last week, Norway’s Petroleum and Energy Minister Terje Aasland called on oil and gas companies to fulfill their “social responsibility” and “leave no stone unturned” to find more natural gas… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Norway-Set-To-Accelerate-Arctic-Oil-And-Gas-Drilling.html |

|

Albemarle Plans To Boost Lithium Capacity In AustraliaThe world’s largest lithium producer Albemarle has announced plans to expand a lithium processing facility in Australia, boosting its production capacity twofold to 100,000 tons of lithium hydroxide annually. “Our decision to expand was driven by our confidence in future demand and allows us to offer customers additional supply from Greenbushes, well known as one of the world’s best lithium mines,” chief executive Ken Masters said, as quoted by the Wall Street Journal. According to the company, annual production of 100,000 tons of lithium… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Albemarle-Plans-To-Boost-Lithium-Capacity-In-Australia.html |

|

Oil Price Rout Sends Ripples Across Related IndustriesOil prices are down despite OPEC+ production cuts and the war in Ukraine because of growing economic worries focused on the U.S. and China. But this is no longer affecting traders only. The rout is spreading to related industries, including tanker owners, who are witnessing their stocks dive. “We believe the market will more heavily discount energy exposed companies, including tanker owners, based on current downside demand risks and negative macroeconomic sentiment,” Deutsche Bank shipping analyst Chris Robertson said this week as… Read more at: https://oilprice.com/Energy/Energy-General/Oil-Price-Rout-Sends-Ripples-Across-Related-Industries.html |

|

Why Shale Frackers Should Be In A Strong Position In 2023Last December I published an article on Oilprice discussing why I thought land drilling contractors would start to rally after the first of the year. It turned out I was a bit early in my thesis and both of the companies I highlighted in the article, Patterson-UTI Energy, (NYSE:PTEN), and Helmerich & Payne, (NYSE:HP) have both fallen about 60% from where I thought they were attractively priced. At this point, I will quote Dr. Niels Bohr who once famously said, “Predicting is very difficult, especially when it is about the future.”… Read more at: https://oilprice.com/Energy/Energy-General/Why-Shale-Drillers-Should-Be-In-A-Strong-Position-In-2023.html |

|

Fed recap: Here are Chair Powell’s market-moving comments after the latest rate hikeThe Federal Reserve will announce its decision on interest rates Wednesday afternoon. Investors expect a 25 basis point rate hike. Read more at: https://www.cnbc.com/2023/05/03/live-updates-fed-decision-may-2023.html |

|

Dow closes more than 250 points lower Wednesday after Fed hikes rates for a 10th time: Live updatesThe central bank signaled it could pause rate hikes through a change in its statement. Read more at: https://www.cnbc.com/2023/05/02/stock-market-today-live-updates.html |

|

The market is looking for the next ‘domino’ to fall, keeping banks under pressureThe sharp selloff in regional banks sparked by the March failure of Silicon Valley Bank resumed Tuesday, catching Wall Street analysts and investors off guard. Read more at: https://www.cnbc.com/2023/05/03/regional-banks-market-looking-for-next-domino-to-fall.html |

|

Apple expected to announce $90 billion in buybacks and dividends when it reports earningsRegardless of its quarterly results, Apple will remind investors of how much cash it generates and its extreme profitability. Read more at: https://www.cnbc.com/2023/05/03/apple-q2-2023-earnings-preview-90-billion-in-buybacks-expected.html |

|

Apple’s profit report is the market’s next big test now. JPMorgan breaks down whether it can deliverWith the Federal Reserve’s rate decision now in the rear view mirror, the next major test for markets will come from Apple earnings. Read more at: https://www.cnbc.com/2023/05/03/apples-profit-report-may-be-the-markets-next-big-test-jpmorgan-says.html |

|

Private payrolls surged by 296,000 in April, much higher than expected, ADP saysPrivate payrolls growth was above the downwardly revised 142,000 the previous month and well ahead of the Dow Jones estimate for 133,000. Read more at: https://www.cnbc.com/2023/05/03/adp-jobs-report-april-2023.html |

|

UAW withholding Biden re-election endorsement until EV concerns are addressedUAW President Shawn Fain says the union wants a “just transition” for workers, as the government uses taxpayer money to subsidize the EV industry. Read more at: https://www.cnbc.com/2023/05/03/uaw-withholding-biden-re-election-endorsement-over-ev-transition.html |

|

Ether rises after Fed raises rates, and the White House pushes crypto mining tax: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, Justin Chapman, global head of digital assets and financial markets at Northern Trust and Elliot Han, head of crypto, blockchain and digital assets investment banking at Cantor Fitzgerald, discuss the future of tokenization on Wall Street from Digital Assets Week in San Francisco. Read more at: https://www.cnbc.com/video/2023/05/03/ether-rises-fed-white-house-pushes-crypto-mining-tax-cnbc-crypto-world.html |

|

Trump lawyers will not offer witnesses at E. Jean Carroll rape defamation trialDonald Trump denies claims he raped the writer E. Jean Carroll in the dressing room of the New York City department store Bergdorf Goodman in the mid-1990s. Read more at: https://www.cnbc.com/2023/05/03/trump-no-witnesses-e-jean-carroll-rape-trial.html |

|

FDA approves GSK’s RSV vaccine for older adults, world’s first shot against virusThe FDA’s approval is a victory for GSK in a race against Pfizer and Moderna to bring a shot that targets respiratory syncytial virus to the market. Read more at: https://www.cnbc.com/2023/05/03/rsv-vaccine-fda-approves-gsk-shot-for-older-adults.html |

|

Olive Garden owner Darden Restaurants buys Ruth’s Chris Steak House for $715 millionRuth’s Chris Steak House has more than 150 locations worldwide and generated $505.9 million in revenue in 2022. Read more at: https://www.cnbc.com/2023/05/03/olive-garden-owner-darden-restaurants-buys-ruths-chris-steak-house.html |

|

Here’s how the Federal Reserve’s latest quarter-point interest rate hike impacts your moneyWhen the Federal Reserve boosts its benchmark rate, everything from credit cards to savings accounts can be affected. Read more at: https://www.cnbc.com/2023/05/03/how-a-federal-reserve-25-basis-point-interest-rate-hike-impacts-you.html |

|

Deposition of JPMorgan CEO Dimon in Jeffrey Epstein lawsuit set for late May, source saysJeffrey Epstein, a sex offender who had been friends with Donald Trump and Bill Clinton, was a customer of JPMorgan Chase for years. Read more at: https://www.cnbc.com/2023/05/03/deposition-of-jpmorgan-ceo-dimon-in-jeffrey-epstein-lawsuit-set-for-late-may-sources-say.html |

|

The Path To Full StagflationAuthored by Peter Earle via The American Institute for Economic Research, In an article last week, I referred to the combination of rapidly slowing US economic growth and persistently high inflation as “stagflation lite.” Despite receding from the highs of last summer, inflation remains near its highest levels in decades as disinflation (particularly in services) has recently slowed to a crawl. Meanwhile, US economic growth has been on a downward trajectory over the past few years, including a brief recession in the middle two quarters of 2022.

What’s currently missing from the full stagflationary scenario is elevated unemployment. The Bureau of Labor Statistics reported the U-3 US unemployment rate as … Read more at: https://www.zerohedge.com/economics/path-full-stagflation |

|

Joe Biden ‘Engaged In A Bribery Scheme With A Foreign National’: FBI Internal Document AllegesPresident Joe Biden allegedly participated in “a criminal scheme” to exchange money for policy decisions, according to Sen. Chuck Grassley (R-IA) and Rep. James Comer (R-KY), citing an internal FBI document they say contains evidence of the alleged bribery which took place when Biden was Vice President.

“We have received legally protected and highly credible unclassified whistleblower disclosures, ” reads a Wednesday letter addressed to Attorney General Merrick Garland and FBI Director Christopher Wray. “It has come to our attention that the Department of Justice (DOJ) and Federal Bureau of Investigation (FBI) possess an unclassified FD-1023 form that describes an alleged criminal scheme involving then-Vice President Biden and a foreign national relating to the exchange of money for policy decisions. It has been alleged that the document includes a precise description of how the alleged criminal scheme was employed as well as its purpose.” Read more at: https://www.zerohedge.com/political/joe-biden-engaged-bribery-scheme-foreign-national-fbi-internal-document-alleges |

|

Watch Live: Fed Chair Powell Attempt To Explain If The Pause Is Hawkish Or Dovish“One and done”? The Fed statement was a hawkish pause – signaling “some additional policy firming may be appropriate” as opposed to “some additional policy easing may be appropriate.”

Can Fed Chair Powell walk the high-wire again – justifying a ‘pause’ with inflation so high and unemployment so low without spreading fear about the banking system crisis being worse than we know (remember they have seen the latest SLOOS data). Bear in mind that the market is now massively (and dovishly) divergent from The Fed’s dot-plots for the end of this year and next year… How will Powell explain that ‘higher for longer’ compared to the market’s belief that cuts are coming fast and many… Read more at: https://www.zerohedge.com/markets/watch-live-fed-chair-powell-attempt-pitch-dovish-hike |

|

Fed Hikes 25bps As Expected, Signals ‘Hawkish Pause’; Warns Of ‘Tighter Credit Standards’Fed raises rates by 25 bps as expected. Policy statement softens the rate guidance in a way consistent with past pauses and The Fed deletes reference to “some additional policy firming may be appropriate.” A clear hat-tip to the banking crisis:

The decision was unanimous. As WSJ Fed Whisperer Nick Timiraos notes: “The FOMC statement used language broadly similar to how officials concluded their interest-rate increases in 2006, with no explicit promise of a pause by retaining a bias to tighten.”

This is clearly more of a hawkish pause since it doesn’t suggest whether ‘policy easing’ may be appropriate… Read more at: https://www.zerohedge.com/markets/fomc-7 |

|

Fed raises US interest rates to highest in 16 yearsThe US central bank announces its tenth rate rise, while signaling it may be the last increase for now. Read more at: https://www.bbc.co.uk/news/business-65474456?at_medium=RSS&at_campaign=KARANGA |

|

UK to ban all cold calls selling financial productsIt comes as part of a wider crackdown on scams that affect millions of people each year. Read more at: https://www.bbc.co.uk/news/business-65466653?at_medium=RSS&at_campaign=KARANGA |

|

Bank closures prompt calls for High Street hubsSpaces shared by several different lenders could help communities that have seen all their branches close. Read more at: https://www.bbc.co.uk/news/business-65457428?at_medium=RSS&at_campaign=KARANGA |

|

Fall from grace! Tesla loses most in April among top 20 global companiesAmong the top 20 global companies by market cap, Tesla Inc was the biggest loser in April Read more at: https://economictimes.indiatimes.com/markets/web-stories/fall-from-grace-tesla-loses-most-in-april-among-top-20-global-companies/articleshow/99959656.cms |

|

Tech View: Nifty forms red-bodied candle. What should traders do on Thursday expiryPresent minor weakness or consolidation movement could end up with the formation of another higher bottom at the lows. Hence, the present weakness with range movement could be a buy-on-dips opportunity, said Nagaraj Shetti, Technical Research Analyst, HDFC Securitie Read more at: https://economictimes.indiatimes.com/markets/stocks/news/tech-view-nifty-forms-red-bodied-candle-what-should-traders-do-on-thursday-expiry/articleshow/99963061.cms |

|

Nexus Select Trust REIT IPO: 10 things to know about the first retail asset offering in IndiaIndia’s first retail asset offering, Nexus Select Trust, will launch its IPO on May 9, closing on May 11, with a price band for its initial shares of between INR 95-100 ($1.28-$1.35). The company, which has 17 high-quality mall assets in 14 cities across India with a total leasable area of 9.2 million sq ft, is the country’s largest mall platform. The IPO comprises a fresh issue of shares worth INR 1,400 crore and a sale of existing shares of up to INR 1,800 crore. Read more at: https://economictimes.indiatimes.com/markets/ipos/fpos/nexus-select-trust-reit-ipo-10-things-to-know-about-the-first-retail-asset-offering-in-india/articleshow/99959537.cms |

|

Fed’s Powell says U.S. banking system is ‘sound and resilient’ after First Republic failureFederal Chairman Jerome Powell attempted to reassure Americans that the U.S. banking system remains stable following the failure of First Republic Bank Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-71E9-D227C43AA1C7%7D&siteid=rss&rss=1 |

|

Earnings Outlook: Apple is about to rain billions more on investors as cash position shrinksIt’s time once again for Apple Inc.’s annual cash bonanza. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-71E8-1EFEDBEA4FF3%7D&siteid=rss&rss=1 |

|

Crypto: LeBron James pictured wearing $791 Nike sneakers that are only available via an NFT. Here’s how that works.LeBron James, who plays for the Lakers, was wearing Nike sneakers that are only available through an NFT. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-71E9-ED29F9C3B54C%7D&siteid=rss&rss=1 |