Summary Of the Markets Today:

- The Dow closed down 46 points or 0.14%,

- Nasdaq closed down 0.11%,

- S&P 500 closed down 0.04%,

- Gold $1,989 down $10.30,

- WTI crude oil settled at $76 down $1.01,

- 10-year U.S. Treasury 3.589% up 0.135 points,

- EUR/USD $1.097 down $0.005,

- Bitcoin $27,821 down $1,506,

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our Economic Forecast for May 2023

Today’s Economic Releases:

Construction spending in the United States increased by 0.3% in March 2023 to a seasonally adjusted annual rate of $1,834.7 billion. This was the third consecutive month of growth. Unfortunately, inflation is high, and when subtracting the inflation rate from the construction growth rate – construction spending continues to slow (see graph below).

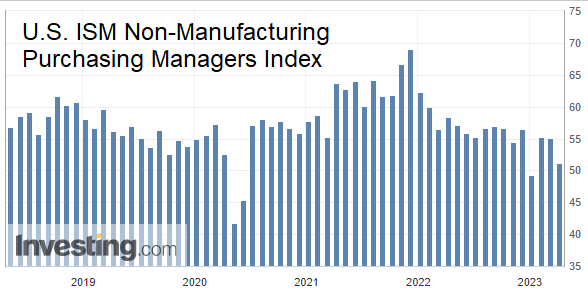

The Institute for Supply Management (ISM) Services Report On Business for March 2023 registered 51.2%, 3.9 percentage points lower than February’s reading of 55.1%. The Services PMI® Index is a composite indicator of the performance of the non-manufacturing sector, including service-providing industries such as retail, transportation, and warehousing, as well as finance and insurance. The index is based on a survey of purchasing managers in the United States. The decline in the Services PMI® Index in March was driven by a number of factors, including:

- Rising inflation

- Supply chain disruptions

- Labor shortages

A summary of headlines we are reading today:

- A summary of headlines we are reading today:

- U.S. April Oil Exports Beat Expectations

- Harvard Study: Divesting From Coal Is More Beneficial Than Previously Thought

- New Nuclear Technology Is Safer, More Efficient And More Sustainable

- Oil Prices Fall On Disappointing Manufacturing Data

- Jamie Dimon says ‘this part of the crisis is over’ after JPMorgan Chase buys First Republic

- Dow closes slightly lower following JPMorgan’s takeover of fallen First Republic: Live updates

- Bonds, Bitcoin, & Bullion Battered After Bank Bailout, Stagflation Scare

- The Economy Is A Powder Keg, Boiling Over And Ready To Blow

- Key Words: ‘It is hard to see how you can prevent the bad actors from using it for bad things’: Google’s former ‘Godfather of AI’ warns of misuse after quitting tech giant

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Iraq’s Giant Halfaya Gas Project May Be Finished Ahead Of TimeNews last week from Iraq Oil Ministry sources that the first stage of a gas processing facility at the Halfaya oil field is now expected to come online ahead by early 2024, ahead of schedule, is crucial for the country’s future in three respects. First, it will go some way to appeasing repeated U.S. calls for Iraq to end its energy dependence on neighbouring pariah state, Iran. Second, it bodes well for progress on the similar gas capture projects that are part of the four-part US$27 billion deal with France’s TotalEnergies. And third,… Read more at: https://oilprice.com/Energy/Natural-Gas/Iraqs-Giant-Halfaya-Gas-Project-May-Be-Finished-Ahead-Of-Time.html |

|

U.S. April Oil Exports Beat ExpectationsU.S. crude oil exports for the month of April have surpassed forecasts, hitting a record 4.5 million barrels per day in March thanks to rising fuel demand in China. U.S. crude exports grew 22% last year from 2021 after Russia’s invasion of Ukraine led the U.S., the EU, and Canada to ban imports of Russian oil and dramatically altered global flows. China is the world’s second-largest oil consumer and has recorded an economic resurgence ever since it rolled back its strict zero-covid policies. April exports to China surged to ~850,000… Read more at: https://oilprice.com/Latest-Energy-News/World-News/US-April-Oil-Exports-Beat-Expectations.html |

|

India Leads In Russian Oil ‘Laundering’ To EuropeA new report by the Center for Research on Energy and Clean Air (CREA) has found that European countries that banned Russian oil imports are instead importing huge amounts of oil commodities from India, China, United Arab Emirates, Singapore, and Turkey, therefore qualifying them as laundromats. The report, titled Laundromat: How the price cap coalition whitewashes Russian oil in third countries, reveals that Western countries bought $42 billion worth of laundered Russian crude in the form of various oil products from nations that are friendly… Read more at: https://oilprice.com/Energy/Crude-Oil/India-Leads-In-Russian-Oil-Laundering-To-Europe.html |

|

TotalEnergies To Buy LNG From ADNOC In $1B DealADNOC Gas Plc, a listed subsidiary of Abu Dhabi National Oil Co, has reached an agreement with France’s TotalEnergies SE (NYSE:TTE) to supply the latter with liquefied natural gas (LNG) in a $1B deal, Bloomberg has reported. The deal is one of the latest by a European gas buyer as Europe once again scrambles to fill its gas stores ahead of the next winter season. Last year, Europe managed to fill its gas stores well ahead of winter and has seen storage levels remain above historical levels thanks to mild weather, with higher temperatures… Read more at: https://oilprice.com/Latest-Energy-News/World-News/TotalEnergies-To-Buy-LNG-From-ADNOC-In-1B-Deal.html |

|

Harvard Study: Divesting From Coal Is More Beneficial Than Previously ThoughtOver the last decade, banks have had a very hot and cold relationship with divesting from coal. As calls to defund the world’s dirtiest fossil fuel have ramped up, big banks have increasingly agreed to sever ties with coal enterprises – but they haven’t always kept those promises. Part of the reason that divesting from coal has been such a wishy-washy component of the global road to decarbonization is that there has been a lack of empirical studies proving the efficacy of this approach. But now, thanks to a new study by the Harvard… Read more at: https://oilprice.com/Energy/Coal/Harvard-Study-Divesting-From-Coal-Is-More-Beneficial-Than-Previously-Thought.html |

|

Libya’s Natural Gas Exports Set To Slump Due To MaintenanceExports of natural gas from Libya to Europe are expected to be significantly lower this month compared to normal levels, due to a three-week maintenance program at the Mellitah Industrial Complex in the North African oil and gas producer. The Mellitah Industrial Complex will begin a total shutdown to start renovation at the Mellitah complex, the Bahr Es Salam gas field, and the Wafa gas field, the National Oil Corporation (NOC) of Libya said this weekend. NOC chairman Farhat Bengdara issued instructions for the renovations and maintenance… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Libyas-Natural-Gas-Exports-Set-To-Slump-Due-To-Maintenance.html |

|

New Nuclear Technology Is Safer, More Efficient, And More SustainableIn 2019, the International Energy Agency (IEA) released Nuclear Power in a Clean Energy System, which highlights the importance of nuclear power in decarbonizing the world’s energy sector. The paper notes: “For advanced economies, nuclear has been the biggest low-carbon source of electricity for more than 30 years, and it has played an important role in the security of energy supplies in several countries. But it now faces an uncertain future as aging plants begin to shut down in advanced economies, partly because of policies to phase… Read more at: https://oilprice.com/Alternative-Energy/Nuclear-Power/New-Nuclear-Technology-Is-Safer-More-Efficient-And-More-Sustainable.html |

|

Oil Prices Fall On Disappointing Manufacturing DataOil prices were down sharply on Monday after the latest manufacturing data showed that the sector contracted for the 5th straight month in April, ending a 30-month period of expansion. Brent crude was down 1.8% to $79.15 per barrel at 11:30 ET, marking the first time it has slipped below $80 per barrel in nearly four weeks. Meanwhile, WTI crude lost 2.1% to trade at $75.20 per barrel after the manufacturing report showed that April Manufacturing Purchasing Managers Index (PMI) clocked in at 47.1 percent, 0.8… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Oil-Prices-Fall-On-Disappointing-Manufacturing-Data.html |

|

Will Demand Concerns Force Middle East Producers To Cut Oil PricesLess than a month following the announcement of OPEC+ production cuts, oil prices have gone back to where they were before. As difficult as it is to fathom the real-time concerns of the oil group, in case the output target curtailments were a deliberate measure to maintain a pricing range of 70-80 per barrel in the midst of severe macroeconomic headwinds, it worked. In case the expectation was that prices would stay high for longer, then the overall effect has dissipated relatively quickly. For Middle Eastern pricing in May 2023 the OPEC+ production… Read more at: https://oilprice.com/Energy/Oil-Prices/Will-Demand-Concerns-Force-Middle-East-Producers-To-Cut-Oil-Prices.html |

|

U.S. Administration Set To Delay Decision On Biofuel Credits For EVsThe Biden Administration, which last year proposed to include electric vehicle charging from renewable electricity in the renewable fuel standard, could delay a decision on giving the so-called eRIN tradable credits to EVs over concerns about expected legal challenges, sources with knowledge of the plans told Reuters on Monday. Last year, the U.S. Environmental Protection Agency (EPA) proposed to significantly expand the current Renewable Fuel Standard (RFS) to include the so-called eRIN proposal which would allow automakers… Read more at: https://oilprice.com/Latest-Energy-News/World-News/US-Administration-Set-To-Delay-Decision-On-Biofuel-Credits-For-EVs.html |

|

In A World First, California Bans New Diesel Truck Sales From 2036California’s regulators have unanimously voted to move with a plan to ban the sales of new diesel trucks as of 2036 as part of the state’s push to clean up its transportation sector emissions. Late last week, the California Air Resources Board (CARB) approved a first-of-its-kind rule that requires a phased-in transition toward zero-emission medium-and-heavy duty vehicles. Under the new rule, named Advanced Clean Fleets, all truck sales need to shift to zero emissions by 2036, and is especially focused on… Read more at: https://oilprice.com/Energy/Energy-General/In-A-World-First-California-Bans-New-Diesel-Truck-Sales-From-2036.html |

|

World’s Largest LNG Buyer Concerned About Another Price SpikeThe northern hemisphere experienced higher-than-average temperatures this past winter, which helped alleviate energy crunches and sent liquefied natural gas prices tumbling from record-high levels. Now the world’s largest gas buyer expects another price spike this year. In an interview with Bloomberg, Yukio Kani, the chairman and CEO of Jera Co., expressed his concerns about another potential surge in LNG prices, attributing this to the increasing import capacity in Europe and China, along with potential severe weather risks. Here’s… Read more at: https://oilprice.com/Energy/Natural-Gas/Worlds-Largest-LNG-Buyer-Concerned-About-Another-Price-Spike.html |

|

Fuel Smuggling Out Of Iran Is ThrivingDiesel and gasoline are being smuggled out of Iran to neighboring countries where fuel prices are much higher than in the Islamic Republic, according to analysts and officials. Some 58,000 barrels per day (bpd) of domestic diesel supply is not going for local consumption, Jalil Salari, managing director of the National Iranian Oil Refining and Distribution Company (NIORDC), tells Argus. Due to the cheap Iranian fuel, nearly 10 million liters of diesel are smuggled out of the Islamic Republic every day, Salari told the local IRNA news… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Fuel-Smuggling-Out-Of-Iran-Is-Thriving.html |

|

Total’s CEO Blames Stock Discount On European ListingThe primary listing on a stock market in Europe is the main reason for the discount at which TotalEnergies’ stock trades relative to the market value fundamentals of its U.S. competitors, TotalEnergies’ chief executive Patrick Pouyanné has said at meetings with investors in recent months. However, TotalEnergies does not consider moving its primary listing to the United States, Pouyanné has said during recent meetings with investors, the Financial Times reports, citing sources familiar with the discussions. “Culturally… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Totals-CEO-Blames-Stock-Discount-On-European-Listing.html |

|

Carney: New Oil & Gas Investment Is Still Needed In The Energy TransitionInvestment in new oil and gas production will still be needed in the energy transition as demand will still be there over the next few decades, Mark Carney, former governor of the Bank of Canada and the Bank of England, said in an interview with CTV on Sunday. The world is raising investments in clean energy, but oil and gas will still be necessary and will need investment to keep up with demand, said Carney, who is currently head of transition investing at Brookfield Asset Management. The energy crisis and policy actions sent global investment… Read more at: https://oilprice.com/Energy/Energy-General/Carney-New-Oil-Gas-Investment-Is-Still-Needed-In-The-Energy-Transition.html |

|

The First Republic deal has come at a crucial point for the markets and economyWith financial services covering such a wide swath of activities in the $26.5 trillion U.S. economy, the bank failures will reverberate. Read more at: https://www.cnbc.com/2023/05/01/the-first-republic-deal-has-come-at-a-crucial-point-for-the-markets-and-economy.html |

|

Jamie Dimon says ‘this part of the crisis is over’ after JPMorgan Chase buys First RepublicJPMorgan Chase, which acquired banking assets in the 2008 financial crisis, just won an auction to gain even more size with the takeover of First Republic. Read more at: https://www.cnbc.com/2023/05/01/jamie-dimon-jpmorgan-first-republic.html |

|

DeSantis Disney oversight board votes to sue company over tax-district fightDeSantis is battling Disney as he is considered a leading potential contender against ex-President Donald Trump for the 2024 Republican presidential nomination. Read more at: https://www.cnbc.com/2023/05/01/desantis-disney-tax-lawsuit-oversight-board-votes-to-sue.html |

|

‘Godfather of A.I.’ leaves Google after a decade to warn society of technology he’s toutedGeoffrey Hinton, known as the “godfather of A.I.” is leaving his role at Google, and plans to warn about the risks of the technology he’s promoted. Read more at: https://www.cnbc.com/2023/05/01/godfather-of-ai-leaves-google-after-a-decade-to-warn-of-dangers.html |

|

Dow closes slightly lower following JPMorgan’s takeover of fallen First Republic: Live updatesStocks are coming off a winning week and month. Read more at: https://www.cnbc.com/2023/04/30/stock-futures-are-flat-after-dow-notches-best-month-since-january.html |

|

A.I. mentions in earnings calls skyrocket this season. What executives are sayingData analyzed by CNBC showed there were more mentions of AI in earnings calls for S&P 500 companies this season than any earnings season since at least 2016. Read more at: https://www.cnbc.com/2023/05/01/ai-mentions-in-earnings-calls-skyrocket-this-season-what-executives-are-saying.html |

|

FAA sued over SpaceX Starship launch program following April explosionThe FAA is sued by environmental groups over SpaceX Starship Super Heavy launch. Read more at: https://www.cnbc.com/2023/05/01/faa-faces-suit-over-spacex-starship-launch-following-april-explosion.html |

|

Scientists develop A.I. system focused on turning peoples’ thoughts into textScientists have developed a noninvasive AI system focused on translating a person’s brain activity into a stream of text. Read more at: https://www.cnbc.com/2023/05/01/scientists-develop-ai-system-focused-on-turning-thoughts-into-text.html |

|

Robinhood Crypto reveals new wallet feature, and Google announces web3 tools: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, Robinhood Crypto GM Johann Kerbrat explains the new feature to help fund digital asset wallets and Richard Widmann, global head of strategy for web3 at Google Cloud, reveals the new tools for web3 developers. Read more at: https://www.cnbc.com/video/2023/05/01/robinhood-crypto-wallet-feature-google-web3-tools-cnbc-crypto-world.html |

|

Facebook was the main donor to a group that fought antitrust reforms in 2020 and 2021Facebook donated $34 million to pro-tech industry group American Edge Project as the nonprofit took on antitrust legislation. Read more at: https://www.cnbc.com/2023/05/01/facebook-primary-donor-group-antitrust-fight.html |

|

4 strategies for avoiding taking on too much student debt in collegeOn College Decision Day, one key consideration should be picking a school that doesn’t require acquiring too much student debt, experts say. Read more at: https://www.cnbc.com/2023/05/01/4-strategies-for-avoiding-taking-on-too-much-student-debt-in-college-.html |

|

Mastering this skill is the ‘hardest part’ of personal finance, advisors sayBeing a “master of cash flow” is an important foundational step households should consider addressing before they invest. Read more at: https://www.cnbc.com/2023/05/01/cash-flow-is-the-hardest-part-of-personal-finance-advisors-say.html |

|

JPMorgan Chase takes over First Republic after biggest U.S. bank failure since 2008JPMorgan acquired all of First Republic’s deposits and a “substantial majority of assets.” Its shares rose 2.6% in premarket trading on the news. Read more at: https://www.cnbc.com/2023/05/01/first-republic-bank-failure.html |

|

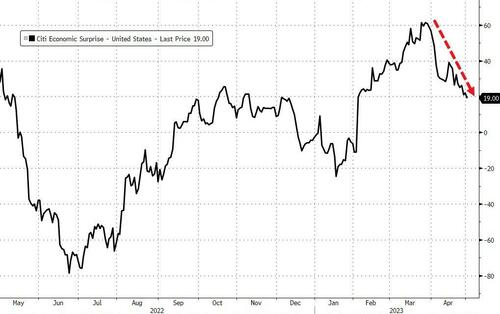

Bonds, Bitcoin, & Bullion Battered After Bank Bailout, Stagflation ScareWeak macro data, re-accelerating inflation (prices paid), no progress on the debt-ceiling, and a bank bailout that literally does nothing to calm fears of more bank runs (or superwalks). Macro data disappointment continues…

Source: Bloomberg ISM Manufacturing signaled stagflation with prices paid rising but activity and new orders still in contraction…

Source: Bloomberg “Sta … Read more at: https://www.zerohedge.com/markets/bonds-bitcoin-bullion-battered-after-bank-bailout-stagflation-scare |

|

Wagner Chief Threatens To Quit Bakhmut Unless His Men Get More MunitionsThe head of Wagner Group and Russia’s defense ministry have continued their public spat over war strategy and the mercenary firm’s role in Ukraine operations. On Sunday Wagner’s outspoken chief Yevgeny Prigozhin threatened to withdraw his fighters from the strategic eastern city of Bakhmut, where fighting has raged for several months, at a time Russian forces control something like eighty to ninety percent of the city.

“I am appealing to Sergei Shoigu with a request to issue ammunition immediately,” he said in reference to Russia’s defense minister. “Now if this is refused … I deem it necessary to inform the commander-in-chief about the existing problems and to make a decision regarding the feasibility of continuing to station units in the settlement of Bakhmut, given the current shortage of ammunition,” Prigozhin warned. By many accounts, Wagner has spearheaded successful operat … Read more at: https://www.zerohedge.com/military/wagner-chief-threatens-quit-bakhmut-unless-his-men-get-more-munitions |

|

The Economy Is A Powder Keg, Boiling Over And Ready ToSubmitted by QTR’s Fringe Finance A long time ago, in a different lifetime, I used to work at an industrial plant that operated several 20-ton chemical processes. Our processes operated using a closed-loop system, in the absence of oxygen, and were not pressurized. We monitored each aspect of our processes using an array of gauges, pressure sensors, thermocouples, and other devices to make sure things were running smoothly at any given point. Near the midpoint of each process, we had a blowoff valve — a long piece of piping that led to the outside of the building, fitted with a seal that was set to blow out when it reached a certain pounds per square inch (PSI) threshold. The valve was meant to be a safety mechanism so that if, inadvertently, pressure started to build up inside of the process, it would “blow off” outside the building, instead of turning our process into a 20-ton pressure bomb waiting to explode. It’s the same principle that causes a kettle to scream when the steam reaches a certain pressure inside: the whistle only goes off once the water gets hot enough to create enough steam. Read more at: https://www.zerohedge.com/markets/economy-powder-keg-boiling-over-and-ready-blow |

|

Blackstone’s BREIT Suffers Sixth Consecutive Month Of Withdraws As CRE DeterioratesBlackstone has limited investor redemption requests from its $70 billion real estate trust for high-net wealth investors for six consecutive months while storm clouds gather over commercial real estate markets. According to an investor letter published Monday, the CRE giant and the world’s largest commercial landlord said investors asked to pull out more than $4.5 billion in April from Blackstone Real Estate Income Trust (BREIT). Out of the request, the firm only allowed $1.3 billion to be withdrawn, or approximately 29% of the amount requested. The firm restricts withdrawals to about 5% a quarter, or about 2% monthly caps, leaving investors with a narrower path out of the non-trade REIT.

However, if this were the case, why do BREIT investors continue to panic exit? Recall last December, Blackstone sent a letter to financial advisors to keep their clients calm. Read the bizarre letter here. The continued high level of withdrawal requests is an ominous sign that investors are limiting their exposure to the CRE space, as higher borrowing costs risk sending some commercial property values into a tailspin. We’ve pointed out (” Read more at: https://www.zerohedge.com/markets/blackstones-breit-hit-six-consecutive-month-withdraws-cre-deteriorates |

|

First Republic: JP Morgan snaps up major US bankFirst Republic was seized by regulators, making it the third major US bank to fail in recent months. Read more at: https://www.bbc.co.uk/news/business-65445427?at_medium=RSS&at_campaign=KARANGA |

|

UK chip giant Arm files for blockbuster US share listingIn a blow to the London stock market, the firm said in March that it would not list shares in the UK. Read more at: https://www.bbc.co.uk/news/business-65445428?at_medium=RSS&at_campaign=KARANGA |

|

Capita: Watchdog warns pension funds over data after hackThe Pensions Regulator has told hundreds of funds to check details of customers after a data leak. Read more at: https://www.bbc.co.uk/news/business-65443841?at_medium=RSS&at_campaign=KARANGA |

|

6 zero-debt penny stocks under Rs 25 that have rallied up to 900% in just one yearHere are 7 such penny stocks under Rs 25 with zero debt levels. These stocks have also given multibagger returns to investors in the last one-year period. Read more at: https://economictimes.indiatimes.com/markets/web-stories/6-zero-debt-penny-stocks-under-rs-25-that-have-rallied-up-to-900-in-just-one-year/articleshow/99910824.cms |

|

First Republic collapse sparks sector-wide regional bank shares sell-offThe collapse of First Republic Bank, the third major casualty of the US banking sector since 2008, has led to the fall of shares of regional lenders. The KBW Regional Banking Index was down nearly 1%. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/first-republic-collapse-sparks-sector-wide-regional-bank-shares-sell-off/articleshow/99914216.cms |

|

Looking to ‘Sell in May & go away’? 10-year history shows you may lose out on gainsICICIDirect Research has closely examined the performance of NSE Nifty index over the past 20 years to verify if this adage holds true in the Indian context Read more at: https://economictimes.indiatimes.com/markets/web-stories/looking-to-sell-in-may-amp-go-away-10-year-history-shows-you-may-lose-out-on-gains/articleshow/99908571.cms |

|

Bond Report: 2-year Treasury yield jumps to highest in a week ahead of Fed meetingTreasury yields finish higher on Monday as investors prepare for another quarter-point rate increase by the Federal Reserve in two days. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-71E5-D4D0796B49B0%7D&siteid=rss&rss=1 |

|

Key Words: ‘It is hard to see how you can prevent the bad actors from using it for bad things’: Google’s former ‘Godfather of AI’ warns of misuse after quitting tech giantAI researcher paraphrases atom bomb developer Oppenheimer in one way, but sounds like he is also paraphrasing him in another, more dire way Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-71E6-600B4ABC9E35%7D&siteid=rss&rss=1 |

|

Key Words: After TOP Financial’s surge, influential meme-stock trader looks for next big opportunityIs Mullen Automotive about to get the meme-stock treatment? Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-71E6-488007796E0A%7D&siteid=rss&rss=1 |