Summary Of the Markets Today:

- The Dow closed up 525 points or 1.57%,

- Nasdaq closed up 2.43%,

- S&P 500 closed up 1.96%,

- Gold $1,997 up $1.50,

- WTI crude oil settled at $75 up $0.46,

- 10-year U.S. Treasury 3.526% up 0.096 points,

- EUR/USD $1.102 down $0.002,

- Bitcoin $29,683 up $2,039,

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our Economic Forecast for April 2023

Today’s Economic Releases:

The U.S. Bureau of Economic Analysis reported that the advance estimate for 1Q2023 Real Gross Domestic Product (GDP) grew at an annual rate of 1.1%. This was slower than the 2.6% growth in the fourth quarter of 2022. However, when viewed year-over-year – the economy grew at 1.6% (up from 0.9% in 4Q2023 – blue line in the graph below). Inflation calculate by the BEA fell to 5.3% in 1Q2023 (down from the 6.4% in 4Q2023 – red line in the graph below). The slowdown in GDP growth was driven by a number of factors, including:

- A decline in consumer spending, which accounts for about 70% of GDP.

- A decrease in business investment, which accounts for about 17% of GDP.

- A slowdown in exports, which account for about 12% of GDP.

My takeaway is that economic growth is rather modest – and any black swan event would cause a recession.

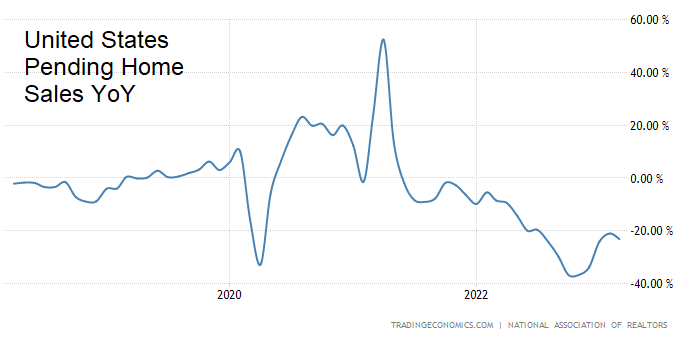

The National Association of Realtors (NAR) reported that pending home sales decreased 5.2% in March 2023 from February. This was the first month-over-month decline since November 2022. On an annual basis, pending home sales were down 23.2%. Pending home sales measures the number of homes that have gone under contract but have not yet closed. The decline in pending home sales is being caused to a significant degree by lower inventory of homes for sale

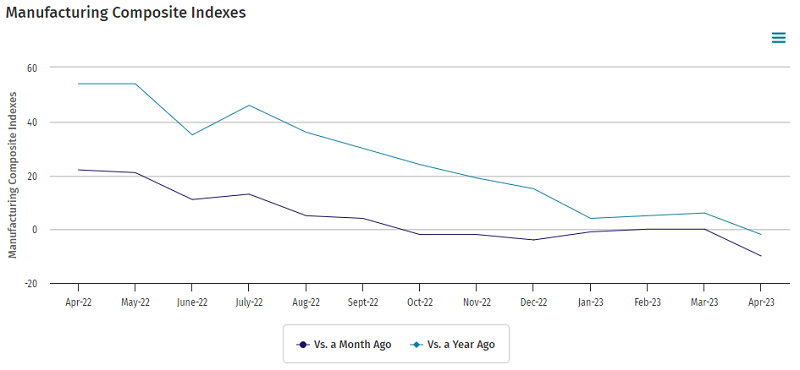

The Kansas City Fed’s Tenth District Manufacturing Activity composite index was -10 in April, down from 0 in March and February. The composite index is an average of the production, new orders, employment, supplier delivery time, and raw materials inventory indexes.

According to the U.S. Department of Labor, initial claims for state unemployment benefits four-week moving average decreased by 4,000 to 236,000. The decrease in claims was driven by a decline in layoffs in the leisure and hospitality sector. Claims in the sector decreased by 12,000, accounting for all of the decline in initial claims.

A summary of headlines we are reading today:

- Tanker Carrying Oil For Chevron Seized By Iran

- The High Costs Of Electrifying The U.S. Auto Industry

- Wisconsin’s Only Oil Refinery Reopens 5 Years After Explosion

- Falling Crude Prices Drag Down Profits At China’s Oil Giants

- Pioneer CEO Retirement Could Reignite Exxon Takeover Talks

- Dow jumps 500 points on strong earnings, heads for best day since January: Live updates

- Amazon earnings are out — here are the numbers

- Here’s why the stock market is having such a massive rally today

- U.S. GDP rose at a 1.1% pace in the first quarter as signs build that the economy is slowing

- Market Snapshot: Dow jumps over 500 points as stocks rally after earnings from Meta and other big-tech names

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Who Can Challenge China’s EV Dominance?As Tesla announces a new Megapack battery factory in Shanghai, the question arises about which country or region will dominate electric vehicle (EV) production in the coming decades. Tesla also recently announced a major factory in Mexico, and other EV firms have been looking to diversify their manufacturing locations, finally signaling greater competition in a market overwhelmingly dominated by China. China has gradually been rising as an EV giant over the last decade, supporting government efforts to lead the green energy revolution.… Read more at: https://oilprice.com/Energy/Energy-General/Who-Can-Challenge-Chinas-EV-Dominance.html |

|

Tanker Carrying Oil For Chevron Seized By IranA tanker carrying crude oil destined for Chevron has been seized by the Iranian Navy, the United States Navy said on Thursday. The tanker had reportedly been involved in a collision with an Iranian vessel in the Gulf of Oman. Iran’s Navy seized a Marshall Islands-flagged oil tanker, Advantage Sweet, in the Gulf of Oman shortly after the tanker hit another Iranian vessel, Iran’s Navy said on Thursday. The oil tanker— had departed the Mina Saud Port in Kuwait and was destined for Houston, Texas, after being commissioned by U.S. oil giant Chevron.… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Tanker-Carrying-Oil-For-Chevron-Seized-By-Iran.html |

|

The Volatility Of Nickel And Stainless Steel MarketsVia AG Metal Miner Stainless steel is intriguing from a pricing perspective. After all, it has practical applications that are especially sensitive to even small shifts in the economic state of play. With the likelihood of ongoing volatility at a global level this year and in the near future, now is a good time to discuss what changes stainless steel prices might incur. By doing so, those “in the know” might potentially make the most of this period of protracted uncertainty. Supply and Demand Dynamics: What to Look for in the Years… Read more at: https://oilprice.com/Metals/Commodities/The-Volatility-Of-Nickel-And-Stainless-Steel-Markets.html |

|

Oil Ticks Up as Russia’s Novak Says No More OPEC+ Cuts NeededCrude oil prices ticked higher on Thursday, stabilizing after Wednesday’s drop due to sentiments that the OPEC+ late March production cut announcement had already been priced in for the next month, when they go into force. On Thursday at 1:41 p.m. EST, Brent crude was trading at $78.53, up 1.08% for an 84-cent gain on the day, but still well below the $80 resistance mark. West Texas Intermediate (WTI) was trading at $75.11 per barrel, up 1.09% for an 81-cent gain on the day. On Wednesday, oil prices shed nearly 4% despite a surprisingly… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Oil-Ticks-Up-as-Russias-Novak-Says-No-More-OPEC-Cuts-Needed.html |

|

The High Costs Of Electrifying The U.S. Auto IndustryNew proposed EPA emissions targets would require that at least two-thirds of vehicle sales will need to be EVs by just 2032 – less than a decade from now. Powering this massive increase in electrification will require an unprecedented expansion of existing infrastructure and supply chains, and it won’t be cheap. At the moment, the future of EVs looks bright in the United States thanks to the strict proposed emissions standards, state-level “Advanced Clean Truck” rules, and the major incentives offered by the Biden… Read more at: https://oilprice.com/Energy/Energy-General/The-High-Costs-Of-Electrifying-The-US-Auto-Industry.html |

|

Exxon Looks To Recoup Investment As Colombia Prepares To Ban FrackingExxonMobil is holding discussions with the Colombian government to potentially recover some of its investments in projects as Colombia prepares to ban fracking in the coming months, sources close to the talks have told Reuters. Colombia’s leftist president Gustavo Petro, who took office on August 7, 2022, campaigned on a platform of ending hydrocarbon exploration, hiking taxes and banning hydraulic fracturing, known as fracking. The Colombian Senate has already approved a ban on unconventional oil and gas exploration and projects, including… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Exxon-Looks-To-Recoup-Investment-As-Colombia-Prepares-To-Ban-Fracking.html |

|

Suncor In $4.1B Deal To Buy TotalEnergies’ Oilsands OperationsCalgary-based Suncor Energy will acquire French TotalEnergies’ Canadian operations in a US$4.1-billion deal for the oilsands patch. For US$4.1 billion in cash and another potential $450 million under a conditional arrangement, Suncor will acquire TotalEnergies EP Canada’s 31.23% interest in Canada’s Fort Hills oilsands project and a 50% working interest in Surmont, which is operated by ConocoPhillips. Fort Hills is an open-pit mine containing raw oil sands bitumen. Suncor says the deal will boost its per day production capacity… Read more at: https://oilprice.com/Energy/Crude-Oil/Suncor-In-41B-Deal-To-Buy-TotalEnergies-Oilsands-Operations.html |

|

Tesla Model Y Now Cheaper Than Average New Car In U.S.Tesla’s latest round of price cuts on its Model Y – putting the base model of the crossover vehicle at $46,990 – has made the vehicle cheaper than the average new vehicle in the U.S. In fact, it’s now about $759 cheaper than the average price tag on any given car or truck, according to Bloomberg. The Model Y was the best-selling EV in the U.S. last year, the report notes, stating about Tesla’s price cuts: “No carmaker has made such a dramatic a reduction to a high-volume vehicle in the modern age of the automobile.” Tesla is continuing what seems… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Tesla-Model-Y-Now-Cheaper-Than-Average-New-Car-In-US.html |

|

Wisconsin’s Only Oil Refinery Reopens 5 Years After ExplosionThe Superior refinery is restarting five years after a massive explosion wounded dozens at Wisconsin’s only such facility, with product sales expected to begin this quarter. The restart will accomplish a rare task—increasing refinery capacity in the United States. An explosion occurred at the Superior refinery at the end of April 2018, injuring dozens of workers and forcing people to evacuate. An explosion and a fire occurred at the refinery while preparations were underway for major maintenance work, and the refinery has been shut… Read more at: https://oilprice.com/Energy/Energy-General/Wisconsins-Only-Oil-Refinery-Reopens-5-Years-After-Explosion.html |

|

U.S. Ethanol Producers Seek Sustainable Aviation Fuel CreditsThe U.S. ethanol industry, some top U.S. airlines, and sustainable aviation fuel (SAF) producers are lobbying the Biden Administration to have ethanol-sourced SAF receive credits under the Inflation Reduction Act. Currently, the IRA says that the SAF credit applies to certain fuel mixtures that contain SAF. To qualify for the credit of $1.25 for each gallon of SAF, the fuel must have a minimum reduction of 50% in lifecycle greenhouse gas emissions. There is also a supplemental credit of one cent for each percent that the reduction exceeds 50%.… Read more at: https://oilprice.com/Latest-Energy-News/World-News/US-Ethanol-Producers-Seek-Sustainable-Aviation-Fuel-Credits.html |

|

Falling Crude Prices Drag Down Profits At China’s Oil GiantsChina’s giant state-owned oil corporations saw their first-quarter profits fall from the same period a year ago as a decline in international oil prices squeezed profit margins. China Petroleum & Chemical Corporation, or Sinopec, the largest refiner in Asia, reported on Thursday an 11.8% drop in first-quarter net profit to $2.9 billion (20.1 billion Chinese yuan). As international crude oil prices fluctuated in a wide range and the spot price of Brent for the first quarter averaged $81.27 per barrel, down by 19.7% year on… Read more at: https://oilprice.com/Energy/Energy-General/Falling-Crude-Prices-Drag-Down-Profits-At-Chinas-Oil-Giants.html |

|

Think Tank Says Coal Use In EU Dropped This WinterCoal power plants produced less electricity this winter despite the energy crunch in Europe, a climate think tank has reported. According to Ember, quoted by the FT, coal power plants in Europe produced 27 fewer terawatt-hours between October 2022 and March 2023 than the same period of 2021/22. Gas generation also declined, the think tank said, adding that the reason for the decline was lower electricity consumption overall in response to higher prices. “For a lot of people this winter was really hard with prices that were extraordinarily… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Think-Tank-Says-Coal-Use-In-EU-Dropped-This-Winter.html |

|

OPEC Bites Back At IEA Over Production Cut WarningIn response to the IEA’s warning made on Wednesday that OPEC should be careful not to cut too much production lest they jack up prices too high, the Organization of the Petroleum Exporting Countries (OPEC) issued a warning of its own to the IEA: your calls to stop investing in oil and gas is what could lead to future price volatility, OPEC said in a Thursday statement. The IEA’s warning was simple: OPEC should be careful not to cut production too much, lest crude oil prices rise to the point where it stifles economic growth and pressures… Read more at: https://oilprice.com/Energy/Energy-General/OPEC-Bites-Back-At-IEA-Over-Production-Cut-Warning.html |

|

India To Boost Wind, Solar Tenders Ahead Of 2030 TargetIndia will triple the number of wind and solar power auctions in a bid to reach a capacity target for 2030, which stands at 500 GW in low-carbon generation capacity, including hydro and nuclear. According to a Bloomberg report, this means that India needs to close deals for the construction of some 50 GW in new wind and solar capacity in the year until March 2024. For context, BloombergNEF says India auctioned 15 GW in wind and solar capacity annually in the last five years. Earlier this month, Reuters reported that India was planning to issue… Read more at: https://oilprice.com/Latest-Energy-News/World-News/India-To-Boost-Wind-Solar-Tenders-Ahead-Of-2030-Target.html |

|

Pioneer CEO Retirement Could Reignite Exxon Takeover TalksScott Sheffield, chief executive of Pioneer Natural Resources, is set to retire at the end of the year. Pioneer recently made the news with a report from Wall Street Journal that said Exxon was considering a takeover bid for the company. Reuters now notes that the news about Sheffield could reignite such talk, which appears to be a regular occurrence on Wall Street. The news outlet reported earlier this month Exxon was in informal talks with Pioneer to acquire it in order to boost its position in the U.S. shale patch. It has said for years that… Read more at: https://oilprice.com/Energy/Energy-General/Pioneer-CEO-Retirement-Could-Reignite-Exxon-Takeover-Talks.html |

|

Dow jumps 500 points on strong earnings, heads for best day since January: Live updatesStocks rose Thursday, as strong results from Meta Platforms boosted tech-related names, and investors weighed the latest data on the U.S. economy. Read more at: https://www.cnbc.com/2023/04/26/stock-market-today-live-updates.html |

|

Coinbase offers a fiery response to the SEC’s threat of enforcement actionThe crypto exchange unleashed the latest salvo against the regulator in an arguably existential battle over Coinbase’s business model. Read more at: https://www.cnbc.com/2023/04/27/coinbase-offers-fiery-response-to-sec-wells-notice-.html |

|

Amazon earnings are out — here are the numbersAmazon reported earnings after the bell. Here are the results. Read more at: https://www.cnbc.com/2023/04/27/amazon-amzn-q1-earnings-report-2023.html |

|

Here’s why the stock market is having such a massive rally todayInvestors looked past what appeared to be a weak first-quarter GDP report on Thursday. Read more at: https://www.cnbc.com/2023/04/27/heres-why-the-stock-market-is-having-such-a-massive-rally-today.html |

|

The most heavily shorted stocks on Wall Street include three electric vehicle-related namesThese increases in short interest come as all three stocks have taken a beating this year. Read more at: https://www.cnbc.com/2023/04/27/most-heavily-shorted-stocks-fisker-workhorse-and-blink.html |

|

U.S. GDP rose at a 1.1% pace in the first quarter as signs build that the economy is slowingGross domestic product was expected to increase at an annualized pace of 2% in the first quarter, according to Dow Jones. Read more at: https://www.cnbc.com/2023/04/27/gdp-q1-2023-.html |

|

Hasbro, Mattel shares rise as toymakers announce multiyear licensing agreement, increased IP focusHasbro, Mattel and other toy stocks rallied on Thursday after mixed earnings reports from the two rival toymakers. Read more at: https://www.cnbc.com/2023/04/27/hasbro-mattel-shares-rise-after-earnings.html |

|

Meta shares are up 170% in five months despite virtually no revenue growthRevenue at Facebook’s parent shrank for three straight quarters before increasing slightly in the latest period, but the stock is soaring. Read more at: https://www.cnbc.com/2023/04/27/meta-shares-are-up-170percent-in-five-months-on-virtually-no-growth.html |

|

SEC’s Gensler says ‘the law is clear’ for crypto exchanges and that they must comply with regulatorsSEC Chairman Gary Gensler wrote in a post on Thursday that crypto exchanges “must come into compliance, register with us, and deal with conflicts of interest.” Read more at: https://www.cnbc.com/2023/04/27/sec-chairman-gary-gensler-says-the-law-is-clear-for-crypto-exchanges.html |

|

Ukraine war live updates: Moscow ‘welcomes’ China contacting Ukraine; Kyiv says Russia ‘won’t get away with’ Mykolaiv strikesUkraine’s President Volodymyr Zelenskyy said Russia “won’t get away with this crime” after the southern Ukrainian city of Mykolaiv was hit by missiles. Read more at: https://www.cnbc.com/2023/04/27/ukraine-war-live-updates-latest-news-on-russia-and-the-war-in-ukraine.html |

|

Paramount wants to get moviegoers back to theaters. Here’s what it has on deckParamount Pictures’ president of domestic distribution spoke Thursday about focusing on the long-term health of the movie business. Read more at: https://www.cnbc.com/2023/04/27/paramount-film-slate-studio-hopes-to-draw-back-moviegoers.html |

|

Americans are saving far less than normal in 2023. Here’s whyThe U.S. personal savings rate fell in 2022 after excess savings from pandemic stimulus bolstered deposits. The slowdown could introduce economic headwinds. Read more at: https://www.cnbc.com/2023/04/27/us-personal-savings-rate-falls-near-record-low-as-consumers-spend.html |

|

This style of dividend ‘aristocrat’ ETF could outperform going into a recessionDividend aristocrats could be a winning trade as the U.S. economy slows, according to Wolfe Research. Read more at: https://www.cnbc.com/2023/04/27/this-style-of-dividend-etf-could-outperform-entering-a-recession.html |

|

Another Lockdown Authoritarian Tries To Weasel Out Of Responsibility For Role During PandemicAnother lockdown fanatic is attempting to rewrite history. Randi Weingarten, president of the American Federation of Teachers (which coordinated with the DOJ to label concerned parents domestic terrorists), claimed this week in front of the House Select Subcommittee on the Coronavirus Pandemic, that her organization “spent every day from February on trying to get schools open,” adding “We knew that remote education was not a substitute for opening schools.”

Except, as Twitter users quickly noted, Weingarten is misrepresenting her prior positions – having called attempts to reopen schools in the fall of 2020 “reckless, callous and cruel.” What’s more, her union Read more at: https://www.zerohedge.com/political/another-lockdown-authoritarian-tries-weasel-out-responsibility-role-during-pandemic |

|

So This Is What The Bottom Of The Freight Market Feels LikeBy Joe Antoshak of Freight Waves Freight pundits have spent plenty of time over the last few months wondering when conditions would improve. In the first quarter, despite that initial glimmer of hope in the beginning, capacity remained too high for demand. That pushed rates further downward and contributing to big-ticket acquisition and bankruptcy news within trucking. It did not help to boost freight sentiment.

Read more at: https://www.zerohedge.com/economics/so-what-bottom-freight-market-feels |

|

AMZN Earnings Preview: Here Are The Main Things To Look ForUnlike yesterday’s Facebook earnings, which were viewed by many including JPM, as the “least controversial” mega tech name of all, with most expecting stellar results – and judging by the move today they were not wrong – today’s tech giant on deck after the close on this busiest day of Q1 earnings season is Amazon, which JPM’s Jack Atheron writes is “number 2 to GOOGL on the list of most controversial mega-cap tech names.” Here is what the JPM trader expects from the online retail giant:

Taking a step back, here is what Wall Street’s median sellside consensus expects AMZN to report: EPS of $0.21, Revenue of $124.7BN (around the mid-line of the company’s $121-126BN guidance) and operating income of $3BN (guidance of $0-$4BN), translating into 2.38% operating margin. Read more at: https://www.zerohedge.com/markets/amzn-earnings-preview-here-are-main-things-look |

|

“It’s Fairy Dust”: The Proud Boys Case Goes To JuryAuthored by Julie Kelly via American Greatness, A marathon January 6 trial besieged by scandal, controversy, and acrimony is now in the hands of a Washington, D.C. jury. After nearly four months of back and forth, the government and defense attorneys made their final pitch during closing arguments this week in the multi-count case against five members of the Proud Boys. The drama surrounding the trial, both inside and outside the courtroom, is worthy of a Netflix series: shocking revelations of numerous FBI informants, deleted government evidence, outbursts from the bench, colorful defense attorneys, last-minute accusations of an assault on police, a mysterious “attack plan” sourced to a former intelligence operative, and concerns over a Read more at: https://www.zerohedge.com/political/its-fairy-dust-proud-boys-case-goes-jury |

|

Rail strike on 13 May, day of Eurovision finalThe RMT is to strike after talks in long-running pay dispute break down again. Read more at: https://www.bbc.co.uk/news/uk-65407844?at_medium=RSS&at_campaign=KARANGA |

|

Sainsbury’s and Unilever deny prices are too highThe supermarket and Marmite-maker reject suggestions they are not protecting customers from inflation. Read more at: https://www.bbc.co.uk/news/business-65414994?at_medium=RSS&at_campaign=KARANGA |

|

Federal Reserve chair Jerome Powell pranked by RussiansFederal Reserve chairman Jerome Powell is the latest personality to be pranked by comedians. Read more at: https://www.bbc.co.uk/news/business-65414175?at_medium=RSS&at_campaign=KARANGA |

|

Tech View: Nifty forms a long bull candle on F&O expiry day. What should traders do on FridayOptions data suggests a broader trading range between 17500 to 18500 zones, while an immediate trading range between 17700 to 18200 zones. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/tech-view-nifty-forms-a-long-bull-candle-on-fo-expiry-day-what-should-traders-do-on-friday/articleshow/99818390.cms |

|

Paytm likely to clock sustained growth in Q4 operating profitability, says Citi; raises target priceCitibank has raised its target price for Indian fintech Paytm to INR1,103 ($14.60), signalling a potential upside of 71%. After breaking even last year, Citibank expects Paytm’s growth to continue, partly thanks to recognition of annual UPI payouts from the Indian government, along with decent Q4 figures. Citibank believes Paytm’s lending and monetisation focus help it to achieve ongoing growth, and has raised the estimates for FY24 and FY25 by 6% and 5% respectively, while revised the adjusted EBITDA upwards by 31% for FY24 and 7% for FY25. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/paytm-likely-to-clock-sustained-growth-in-q4-operating-profitability-says-citi-raises-target-price/articleshow/99821019.cms |

|

Up 20% in a day, here’s how to trade this Gujarat-based smallcap companyThe Gujarat Mineral Development Corporation (GMDC) soared by 20% with high volumes, opening up the possibility of hitting Rs 200 in the next six months, according to experts. Traders and investors should keep an eye on the stock and consider buying on dips to Rs 135-140. The stock is part of the S&P BSE Smallcap index and has been trading above short and long-term moving averages. The technical indicator MACD is also in a buy mode providing support for bulls, while a clear break above Rs 160 levels will open up fresh investment opportunities. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/chart-check-up-20-in-a-day-heres-how-to-trade-this-gujarat-based-smallcap-company/articleshow/99804945.cms |

|

Brett Arends’s ROI: The debt ceiling nightmare could be a bond and gold buyer’s dreamThis toxic political standoff could easily go down to the wire, threatening the U.S. with its first-ever technical default, writes Brett Arends. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-71E2-116839FCDA93%7D&siteid=rss&rss=1 |

|

Market Snapshot: Dow jumps over 500 points as stocks rally after earnings from Meta and other big-tech namesU.S. stocks rise sharply on Thursday as investors cheer tech earnings. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-71E2-2C6CAF3E2264%7D&siteid=rss&rss=1 |

|

Futures Movers: Oil ends higher after erasing rally scored after OPEC+ rate cutsOil futures ends higher on Thursday, a day after erasing the rally scored earlier this month after OPEC+ announced an unexpected round of production cuts. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-71E2-4E41B5322D5D%7D&siteid=rss&rss=1 |

…

…