Summary Of the Markets Today:

- The Dow closed down 229 points or 0.68%,

- Nasdaq closed up 0.47%,

- S&P 500 closed down 0.38%,

- Gold $1,998 down $6.90,

- WTI crude oil settled at $74 down $2.81,

- 10-year U.S. Treasury 3.441% up 0.043 points,

- EUR/USD $1.104 up $0.006,

- Bitcoin $27,362 down $366

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our Economic Forecast for April 2023

Today’s Economic Releases:

New orders for manufactured durable goods in March increased to 4.6% year-over-year (5.6% inflation-adjusted). The increase is predominately due to civilian aircraft.

A summary of headlines we are reading today:

- Schiff: Gold Is A Buy In Every Single Currency

- IEA: EVs Will Account For 20% Of All Car Sales This Year

- Large Crude Inventory Draw Jolts Oil Prices

- Pipeline Failure Triggers Inspection Of Davis-Besse Nuclear Power Plant

- Oil Prices Slip As Banking Fears Return

- First Republic’s dramatic slide continues, stock falls 30% as bank looks for rescue deal

- Dow, S&P 500 close lower Wednesday as First Republic woes eclipse Big Tech earnings: Live updates

- Tyson Foods to eliminate 10% of corporate jobs, memo says

- Commodities Bellwether Flashes US Recession Warning

- Revolution Investing: Stock investors are right to be cautious now, and being bearish is even smarter

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Schiff: Gold Is A Buy In Every Single CurrencyAmericans continue to deal with rising prices even as the economy deteriorates. But the US isn’t the only country with an inflation problem. As Peter Schiff explained in a recent podcast, every country has let the inflation horses out of the barn. When you couple that with the de-dollarization trend, it’s bullish for gold. More and more economic indicators signal a looming recession. The Leading Economic Index is now lower than in the early stages of the 2008 recession. In a recent interview, Peter said we’d… Read more at: https://oilprice.com/Metals/Gold/Schiff-Gold-Is-A-Buy-In-Every-Single-Currency.html |

|

Hess Shares Gain On Earnings, New Guyana DiscoveryHess Corporation (NYSE:HES) beat Wall Street estimates in its first-quarter earnings report released on Wednesday and added another discovery in offshore Guyana to its production portfolio, though the good news failed to boost share prices in early morning trading. Despite first-quarter oil prices that were some 20% lower than in 2022, Hess reported Q1 earnings of $346 million, or $1.13 per share, soundly beating analyst estimates of around $1.06 per share, based on data from Refinitiv. However, these figures compare to Q1 2022 net… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Hess-Shares-Gain-On-Earnings-New-Guyana-Discovery.html |

|

Organic Electrodes: A Promising Development For The Energy TransitionA Chinese team has now introduced new Organic Electrode Materials (OEM) for aqueous organic high-capacity batteries that can be easily and cheaply recycled. Right now our modern rechargeable batteries, such as lithium-ion batteries, are anything but sustainable. The team has introduced their results in the journal Angewandte Chemie. Modern rechargeable batteries, such as lithium-ion batteries, are anything but sustainable. One alternative is organic batteries with OEMs, which can be synthesized from natural ‘green’ materials. Graphical… Read more at: https://oilprice.com/Energy/Energy-General/Organic-Electrodes-A-Promising-Development-For-The-Energy-Transition.html |

|

Mozambique President Greenlights $20 Billion TotalEnergies LNG ProjectIt is now safe for TotalEnergies to restart work on the $20-billion Mozambique LNG project, Mozambique’s President Filipe Nyusi said on Wednesday, but the French supermajor says the decision to resume construction is up to all shareholders in the venture. “The working environment and security in northern Mozambique makes it possible for Total to resume its activities any time,” Nyusi said today at an energy conference in Mozambique’s capital city of Maputo, as carried by Reuters. TotalEnergies holds a 26.5% stake in the LNG project,… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Mozambique-President-Greenlights-20-Billion-TotalEnergies-LNG-Project.html |

|

Canada Becomes Global Leader In Green Tax CreditsCanada’s new renewable energy investment tax credit (ITC), unveiled in the 2023 federal budget, will make the country a global leader in favorable financial conditions for green energy projects. Rystad Energy’s renewable economic modeling shows that these new tax breaks will raise the value of some projects by more than 50% over their lifetime, positioning Canada as the second most attractive place for renewable developers, behind only the US. The ‘made in Canada’ strategy is part of a growing global trend of policies prioritizing… Read more at: https://oilprice.com/Energy/Energy-General/Canada-Becomes-Global-Leader-In-Green-Tax-Credits.html |

|

IEA: EVs Will Account For 20% Of All Car Sales This YearThe surge in electric vehicle sales will continue this year after a record 2022, with EVs accounting for nearly one-fifth of global car sales in 2023, the International Energy Agency (IEA) said on Wednesday. The momentum of EVs taking a growing share of the global car market is set to continue in the coming years to the point of displacing 5 million barrels per day of oil, the IEA said in its annual report Global EV Outlook 2023. Last year, EV sales accounted for 14% of all new cars sold globally, up from around 9% in 2021… Read more at: https://oilprice.com/Latest-Energy-News/World-News/IEA-EVs-Will-Account-For-20-Of-All-Car-Sales-This-Year.html |

|

Drax Ditches Coal, Shifts Focus To Biomass GenerationDrax has closed the curtain on its coal operations, putting the government under more pressure to secure supplies ahead of next winter. The power group announced the official end of coal-fired operations at its flagship power station in North Yorkshire today after nearly five decades of generation. Downing Street relied on the power plant as two of five coal standby units last winter in the case of supply pressure, extending the lifespan of both of Drax’s coal units beyond its original closure date. National Grid, which oversaw the standby… Read more at: https://oilprice.com/Alternative-Energy/Biofuels/Drax-Ditches-Coal-Shifts-Focus-To-Biomass-Generation.html |

|

South Africa Seeks Renewable Energy Procurement ProposalsSouth Africa has issued the first request inviting proposals for renewable energy procurement for 3,740 megawatts (MW) in the biggest such program in Africa. “The release of this Phase One RFP comes at an opportune moment, with government remaining steadfast in eradicating the electricity and water supply challenges, and the rampant landfill shortages our country continues to face,” South Africa’s Public Works Minister Sihle Zikalala said in a statement carried by Bloomberg. Currently, coal is the major energy… Read more at: https://oilprice.com/Latest-Energy-News/World-News/South-Africa-Seeks-Renewable-Energy-Procurement-Proposals.html |

|

China’s Steel Exports Reach Highest Monthly Total Since April 2021Via AG Metal Miner For the 1st quarter of this year, China’s iron ore imports hit a Q1 record. Altogether, prices climbed nearly 10% from January to March, reaching 29.3 million tons (MT). Indeed, March alone saw imports grow 1.8% to 100.23 MT. Helping these numbers were expectations of stronger steel demand as the Chinese economy continues to emerge our of the country’s zero-COVID-19 policies. Ultimately, a recovery in China’s steel sector seems to be in motion, and iron ore production continues to react accordingly. Newly… Read more at: https://oilprice.com/Metals/Commodities/Chinas-Steel-Exports-Reach-Highest-Monthly-Total-Since-April-2021.html |

|

GM Pulls The Plug On Bolt EVGeneral Motors Chair and CEO Mary Barra announced that production of the Chevrolet Bolt EV and Bolt EUV would be halted by the end of 2023. This aligns with the GM’s plan to transition the Bolt production line in Orion, Michigan, into manufacturing electric trucks. During a Tuesday morning earnings call with investors, Barra confirmed the seven-year run of the Bolt would come to an end and be retooled for electric truck production: “We’ve progressed so far that it’s now time to plan the end of Chevrolet Bolt EV and EUV production, which… Read more at: https://oilprice.com/Latest-Energy-News/World-News/GM-Pulls-The-Plug-On-Bolt-EV.html |

|

Large Crude Inventory Draw Jolts Oil PricesCrude oil prices moved higher today after the Energy Information Administration reported an inventory draw of 5.1 million barrels for the week to April 21. This compared with another draw, of 4.6 million barrels, for the previous week, and an estimated 6-million-barrel inventory decline for the week to April 21, as reported by the American Petroleum Institute. The EIA also reported a decline in gasoline inventories and a smaller draw in middle distillate inventories for the week to April 21. Gasoline inventories shed 2.4 million barrels last week,… Read more at: https://oilprice.com/Energy/Crude-Oil/Large-Crude-Inventory-Draw-Jolts-Oil-Prices.html |

|

Pipeline Failure Triggers Inspection Of Davis-Besse Nuclear Power PlantThe U.S. Nuclear Regulatory Commission has launched an inspection into ground settling at the Davis-Besse nuclear power plant in Ohio. The reason for the inspection is information that suggests a 2022 pipeline failure was likely the result of stress from ground settling, Reuters has reported. The pipeline failure occurred in October last year, the report noted, and there were also later reports of pipeline failures on the site of the nuclear power facility and “multiple occurrences of ground settling.” “A certain extent of… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Pipeline-Failure-Triggers-Inspection-Of-Davis-Besse-Nuclear-Power-Plant.html |

|

Private Investment Boosts Mexico’s Oil And Gas SectorMexico still has a strong potential for oil and gas despite faltering due to nationalization policies and a poor health and safety record in recent years. Despite a poor track record from Mexico’s state-owned oil company Pemex and the introduction of policies that have pushed away foreign investors, recent developments show that Mexico’s oil and gas industry may have a long way to go before the green transition curbs demand. In 2022, Pemex reported profits of $1.2 billion, boosted by high oil prices throughout the year. This marks… Read more at: https://oilprice.com/Energy/Crude-Oil/Private-Investment-Boosts-Mexicos-Oil-And-Gas-Sector.html |

|

Oil Prices Slip As Banking Fears ReturnOil prices dropped early on Wednesday after another banking sector scare and after U.S. consumer confidence fell for the third time in four months. As of 8:00 a.m. EDT on Wednesday, ahead of the EIA’s weekly inventory report, the U.S. benchmark WTI Crude was trading down by 0.47% at $76.71. The international benchmark, Brent Crude, was barely hanging onto the $80 a barrel level – Brent was down by 0.85% on the day at $80.09. Oil continued the slide from Tuesday when prices fell by 2% to the lowest… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Oil-Prices-Slip-As-Banking-Fears-Return.html |

|

Wind-Powered North Sea Natural Gas Project Halted Over Emissions UncertaintyA court in the Netherlands has suspended a project for natural gas drilling and extraction in the North Sea due to potential environmental damage. The offshore gas project, proposed by Netherlands-based company ONE-Dyas, was approved by the Dutch Ministry of Economic Affairs and Climate in June last year. The Dutch government issued the final permit for the proposed gas field, thus allowing the production of natural gas from the N05-A field and surrounding fields in the North Sea. The N05-A platform is located in the North… Read more at: https://oilprice.com/Energy/Natural-Gas/Wind-Powered-North-Sea-Natural-Gas-Project-Halted-Over-Emissions-Uncertainty.html |

|

Disney sues Florida Gov. Ron DeSantis, alleges political effort to hurt its businessThe lawsuit escalates the feud between DeSantis, expected to be a top Republican contender for president in 2024, and Disney. Read more at: https://www.cnbc.com/2023/04/26/disney-sues-florida-gov-ron-desantis-alleges-political-effort-to-hurt-its-business.html |

|

First Republic’s dramatic slide continues, stock falls 30% as bank looks for rescue dealThis week’s drop for First Republic comes after the San Francisco-based lender said it lost roughly 40% of its deposits in the first quarter. Read more at: https://www.cnbc.com/2023/04/26/first-republic-continues-dramatic-slide-as-it-searches-for-rescue-deal.html |

|

Dow, S&P 500 close lower Wednesday as First Republic woes eclipse Big Tech earnings: Live updatesFirst Republic lost more than 30%. Read more at: https://www.cnbc.com/2023/04/25/stock-market-today-live-updates.html |

|

Meta set to report first-quarter earnings after the bellMeta will report its first-quarter earnings on Wednesday as the company is in the midst of a wave of cost-cutting efforts. Read more at: https://www.cnbc.com/2023/04/26/facebook-meta-q1-earnings-report.html |

|

Economic growth likely was solid to start the year, but that could end the good news for a whileFirst-quarter GDP is projected to show an annualized gain of 2% when the Commerce Department releases the number Thursday. Read more at: https://www.cnbc.com/2023/04/26/q1-gdp-economic-growth-likely-was-solid-to-start-the-year.html |

|

Amazon starts layoffs in HR and cloud units: Read the memos announcing the cutsAmazon on Wednesday began laying off some employees in its cloud computing and human resources divisions. Read more at: https://www.cnbc.com/2023/04/26/amazon-starts-layoffs-impacting-hr-and-aws-cloud-unit.html |

|

Amazon axes Halo fitness wearable in a latest cost-cutting moveAmazon unveiled the health-tracking bracelet in 2020, marking its first foray into wearable devices and a deeper move into the health care space. Read more at: https://www.cnbc.com/2023/04/26/amazon-halo-fitness-wearable-dead-in-latest-cost-cutting-move.html |

|

Illumina CEO touts Grail’s 100% revenue growth amid proxy fight with IcahnCEO Francis deSouza said San Diego-based Illumina can significantly expand the market for Grail’s early cancer screening test. Read more at: https://www.cnbc.com/2023/04/26/illumina-ceo-touts-grail-revenue-amid-proxy-fight-with-icahn-.html |

|

Ukraine war live updates: China will send representatives to Ukraine for talks; Kyiv praises ‘long and meaningful’ call with XiChina said Wednesday that it will send special representatives to Ukraine and hold talks with all parties on resolving the war. Read more at: https://www.cnbc.com/2023/04/26/ukraine-war-live-updates-latest-news-on-russia-and-the-war-in-ukraine.html |

|

Hunter Biden lawyers meet with DOJ prosecutors about the pending criminal probeHunter Biden has been under criminal investigation since 2018 by the U.S. Attorney in Delaware, who was appointed to that post by former President Donald Trump. Read more at: https://www.cnbc.com/2023/04/26/hunter-biden-lawyers-meet-with-doj-prosecutors-about-criminal-probe.html |

|

California’s reappearing phantom lake could remain for two years in the Central ValleyTulare Lake could trigger billions of dollars in economic losses and displace thousands of farmers. Read more at: https://www.cnbc.com/2023/04/26/californias-reappearing-tulare-lake-could-remain-for-two-years.html |

|

Ed Sheeran is being sued for allegedly copying Marvin Gaye — here’s where the trial standsMusician Ed Sheeran is in court this week to deny claims that his 2014 song “Thinking Out Loud” is a copy of Marvin Gaye’s 1973 classic “Let’s Get it On.” Read more at: https://www.cnbc.com/2023/04/26/ed-sheeran-copyright-trial-heres-what-you-need-to-know.html |

|

Tyson Foods to eliminate 10% of corporate jobs, memo saysTyson Foods will eliminate about 10% of corporate jobs and 15% of senior leadership roles, Chief Executive Donnie King told employees on Wednesday. Read more at: https://www.cnbc.com/2023/04/26/tyson-foods-to-eliminate-10percent-of-corporate-jobs-memo-says.html |

|

US Warns China It Will Ramp Up Military Drills In The RegionThe Biden administration has forewarned China that it plans to bolster military drills and the US presence in the region, particularly off the Korean peninsula where it’s decided to send nuclear-armed submarines as extra deterrence against North Korean threats aimed at Seoul. “We are briefing the Chinese in advance and laying out very clearly our rationale for why we are taking these steps,” a Biden administration official said. “We believe that non-proliferation efforts in the Indo-Pacific are in the best interest of not just the United States and other leading states, but China as well.”

Read more at: https://www.zerohedge.com/geopolitical/us-warns-china-it-will-ramp-military-drills-regional-waters-near-korea |

|

META Earnings Preview: “The Least Controversial Name Of Mega-Tech”Unlike yesterday, where opinions what MSFT and GOOGL would report was split down the middle between outspoken bulls and just as fervent bears (the bulls ended up getting the upper hand), today’s results by META after the close should be a more subdued affair, because as JPM trader Jack Atherton writes in his preview, META is “probably the least controversial name of the tech group into earnings” and positioning reflects that: “top line accelerating, cost driven upgrade story, valuation support, etc.” As Atheron adds, investors are starting to discuss the growth sustainability story into 2024 as the next leg of upside – many hope to get more clarity on that (Reels monetization, AI ad tools, click to message, etc). Buyside looking for Q1 revenue ~2.5% FXN (guide -5% to +4%) and Q2 guide ~3.5% FXN (midpoint). Investors are mixed on whether mgmt update the cost outlook again but there is definitely a cohort expecting another small trim to the guide (especially on $30-33b capex outlook). Below is a snapshot of what consensus expects today courtesy of Bloomberg: Read more at: https://www.zerohedge.com/markets/meta-earnings-preview-least-controversial-name-mega-tech |

|

Biden, Yoon Agree: Response To North Korean Nuclear Attack Would Include US NukesUpdate(1450ET): As expected, Presidents Biden and Yoon unveiled the “Washington Declaration” during an afternoon joint press conference, boosting military cooperation which will include US nuclear deterrents being parked on the peninsula (previewed below). “The alliance formed in war and has flourished in peace,” Biden to reporters gathered in the Rose Garden. “Our mutual defense treaty is iron clad and that includes our commitment to extend a deterrence – and that includes the nuclear threat, the nuclear deterrent.” He added: “They’re particularly important in the face of DPRK’s increased threats and the blatant violation of US sanctions.” Biden further called the US-South Korea alliance “the linchpin of regional security and prosperity” in the Indo-Pacific. South Korea’s Yoon for his part took a tough stance in response to Pyongyang’s recent frequent missile drills and nuclear rhetoric, saying “peace with North comes through superior force, not ‘goodwill'” – according to AFP. Yoon also said that the response to a possible North Korean nuclear attack would include US nukes. Biden af … Read more at: https://www.zerohedge.com/geopolitical/us-sending-nuclear-submarines-south-korea-1st-time-40-years |

|

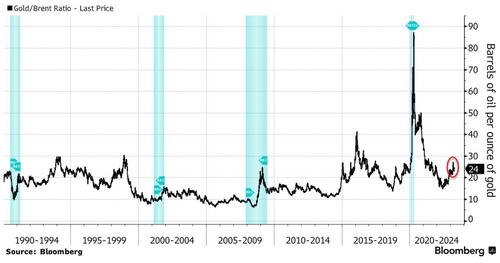

Commodities Bellwether Flashes US Recession WarningAuthored by Bloomberg’s Nour Al Ali, The commodities market’s bellwether for recessions is flashing a warning sign. As uncertainty circles the markets on whether the Fed is approaching the end of its tightening cycle, the gold-to-oil ratio suggests commodities traders are hedging against the risk of a US recession.

With oil prices down this year while gold is up, the ratio has surged to almost 24, compared with an average of less than 17 since 2000. Anything significantly above that average is considered as a warning sign by some market participants. The performance of gold and oil relative to each other is a measure of investor sentiment on the economy, as both assets are cyclical and priced in dollars. Historically, gold tends to outperform oil during the onset of a recession or great economic uncertainty. We’ve seen this trend during the global financial crisis, the recession of the early 1990s, and even … Read more at: https://www.zerohedge.com/markets/commodities-bellwether-flashes-us-recession-warning |

|

Pernod Ricard resumes Beefeater and Jameson exports to RussiaFrench drinks giant says the move is to keep its Russia operations viable but campaigners are ‘disgusted’. Read more at: https://www.bbc.co.uk/news/business-65403954?at_medium=RSS&at_campaign=KARANGA |

|

Disney sues Florida Governor Ron DeSantisIn a lawsuit filed on Wednesday, Disney alleges it has been the target of “government retaliation”. Read more at: https://www.bbc.co.uk/news/world-us-canada-65405312?at_medium=RSS&at_campaign=KARANGA |

|

Bank of England: ‘Accept’ you are poorer remark sparks backlashUnions and small businesses react with outrage to comments that people need to accept they are poorer. Read more at: https://www.bbc.co.uk/news/business-65397276?at_medium=RSS&at_campaign=KARANGA |

|

Axis Bank Q4 preview: Citi integration costs may drag bottomline, margin outlook eyedAxis Bank’s Q4 earnings are expected to be impacted by the one-off costs due to the integration of Citibank India’s business, leading to net losses, according to some analysts. The estimated net loss ranges from INR 54.12bn to INR 55.26bn, while others have excluded the integration costs from their calculations. The bank’s strong core performance is projected despite one-off costs, led by high double-digit growth in net interest income, lower bad loans, and net interest margin. Key items to watch from the management include business plans, near-term growth trends, and margin trajectory. Read more at: https://economictimes.indiatimes.com/markets/stocks/earnings/axis-bank-q4-preview-citi-integration-costs-may-drag-bottomline-margin-outlook-eyed/articleshow/99781154.cms |

|

SBI Life Q4 profit rises 15% YoY to Rs 777 cr, misses estimatesNet premium income for the reporting quarter jumped 14% to Rs 19,897 crore as against Rs 17,434 in the year-ago period Read more at: https://economictimes.indiatimes.com/markets/stocks/earnings/sbi-life-q4-results-profit-rises-15-yoy-to-rs-777-crore-misses-estimates/articleshow/99792415.cms |

|

Tech View: Nifty reaching towards key resistance of 17,863. What should traders do on Thursday expiryThe Nifty is moving towards the key resistance level of 17,863, a break of which could lead to significant gains, according to Nagaraj Shetti of HDFC Securities. Kunal Shah of LKP Securities advised traders to keep a buy stance and expect targets of 18,000/18,200 in the short term. Sharekhan by BNP Paribas’s Jatin Gedia said support levels to watch are 17700-17680, and a break above 17860-17880 could boost the Nifty towards the psychological 18,000 mark. Kotak Securities’ Shrikant Chouhan said the index could move up to 17900-17950, but could slip to 17650-17625 if support levels fail. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/tech-view-nifty-reaching-towards-key-resistance-of-17863-what-should-traders-do-on-thursday-expiry/articleshow/99790947.cms |

|

Revolution Investing: Stock investors are right to be cautious now, and being bearish is even smarterValuations are high and economic turmoil and losses are in the U.S. market’s future, writes Cody Willard. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-71D9-5399D827D8B3%7D&siteid=rss&rss=1 |

|

Futures Movers: Oil prices turn lower for the month on recession fearsOil futures fall Wednesday to turn lower for the month, as recession worries continued to shadow the market. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-71E0-B65F7481A93A%7D&siteid=rss&rss=1 |

|

Front Office Sports: The NBA’s media future could be decided by a bitter CEO rivalryWhen its next cycle of long-term media rights begins with the 2025-26 season, the NBA will seek a combined $50 billion to $75 billion. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-71E1-90C59C653C11%7D&siteid=rss&rss=1 |

USS Ronald Reagan leads a formation of Carrier Strike Group. DoD image”We’ll announce that we intend to take steps to make our deterrence more visible through the regular deployment of strategic assets, including …

USS Ronald Reagan leads a formation of Carrier Strike Group. DoD image”We’ll announce that we intend to take steps to make our deterrence more visible through the regular deployment of strategic assets, including …