Summary Of the Markets Today:

- The Dow closed down 345 points or 1.02%,

- Nasdaq closed down 1.98%,

- S&P 500 closed down 1.58%,

- Gold $2,009 up $8.20,

- WTI crude oil settled at $77 down $1.67,

- 10-year U.S. Treasury 3.392% down 0.123 points,

- USD $101.86 up $0.520,

- Bitcoin $27,634 up $248,

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our Economic Forecast for April 2023

Today’s Economic Releases:

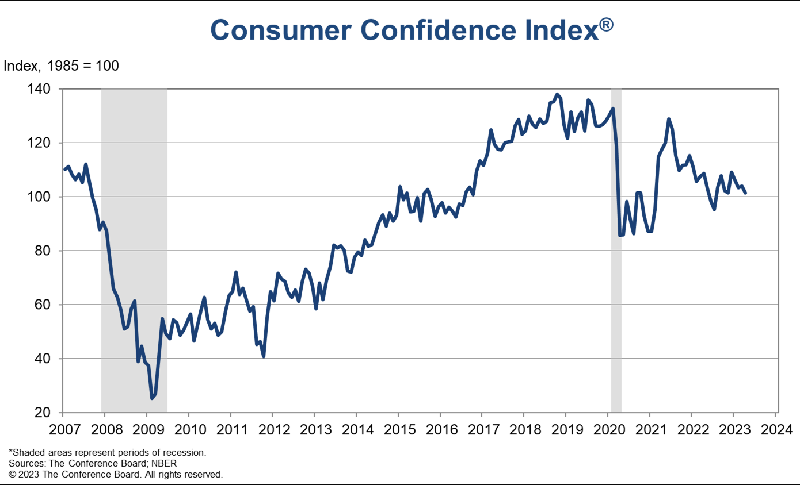

The Conference Board Consumer Confidence Index® fell in April to 101.3, down from 104.0 in March. This is the lowest reading since July 2022. The decline was driven by a darkening outlook that augers a recession beginning in the near future. The decline in consumer confidence was widespread, with all major demographic groups reporting lower readings in April. The biggest declines were among consumers under 55 years of age and for households earning $50,000 and over. The Federal Reserve is closely monitoring consumer confidence and other economic indicators. The decline was driven by a number of factors, including:

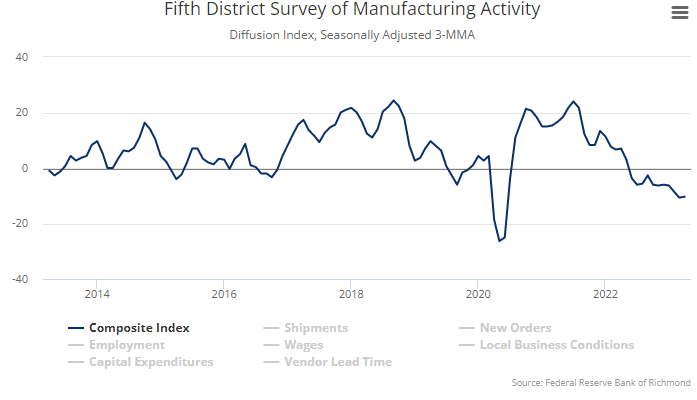

The Fifth District Manufacturing Report for April 2023 showed that manufacturing activity continued to contract in April. The headline index fell to -10 from -5 in March, and two of its three component indexes — shipments and new orders — declined.

The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, covering all nine U.S. census divisions, reported a 2.0% annual gain in February, down from 3.7% in the previous month. The 10-City Composite annual increase came in at 0.4%, down from 2.5% in the previous month. The 20-City Composite posted a 0.4% year-over-year gain, down from 2.6% in the previous month. Miami, Tampa, and Atlanta again reported the highest year-over-year gains among the 20 cities in February.

The U.S. Census Bureau reported that sales of new single-family houses in the United States increased 9.6% to a seasonally adjusted annual rate of 683,000 in March 2023. This is 3.4% below the March 2022 estimate of 707,000. The median sales price of new houses sold in March 2023 was $449,800. The average sales price was $562,400. The seasonally‐adjusted estimate of new houses for sale at the end of March 2023 was 432,000. This represents a supply of 7.6 months at the current sales rate.

A summary of headlines we are reading today:

- More Banking Trouble Pushes Oil Prices Down Another 2%

- Nigeria Completes Gas Pipeline Without Chinese Funds

- Credit Suisse Reports Alarming Magnitude Of Losses And Outflows

- Halliburton Earnings Beat Estimates In Tight Oilfield Services Market

- U.S. Net Debt To Exceed 110% By 2028 As Decarbonization Costs Mount

- First Republic falls nearly 50% to a record low after reporting a massive deposit drop

- Stocks close lower Tuesday as investors’ bank fears return, Dow sheds more than 300 points: Live updates

- Alphabet earnings are out — here are the numbers

- Japanese ispace moon landing attempt falls short at ‘very end,’ CEO says

- Market Extra: What’s next for the stock market as small-cap index suffers its first ‘death cross’ since January 2022

- Movers & Shakers: First Republic stock tanks, UPS shares weaken, Spotify shares advance, and more stocks on the move

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

How Azerbaijan Is Helping Europe Pivot Away From Russian GasOn April 13, Azerbaijani President Ilham Aliyev paid an official visit to Sarajevo, Bosnia-Herzegovina. While there, Aliyev met with his counterparts, the members of the Bosnian tripartite presidency, Željka Cvijanovi?, Denis Beirovi? and Željko Komši? (Azertac, April 13). Despite the shortness of the visit—Aliyev departed on the same day—it was considered quite successful as Azerbaijan gained “one more strategic partner in Europe” (Trend.az, April 13), with the leaders of the two countries signing a joint declaration… Read more at: https://oilprice.com/Energy/Natural-Gas/How-Azerbaijan-Is-Helping-Europe-Pivot-Away-From-Russian-Gas.html |

|

More Banking Trouble Pushes Oil Prices Down Another 2%West Texas Intermediate futures for June delivery closed out at $77.07 per barrel on NYMEX—the lowest front-month finish in nearly a month. WTI sank $1.69 per barrel, or just over 2%, on Tuesday afternoon as recession fears reinforced doubts about what that means for crude oil demand. The Brent front-month contract was also down by more than 2% (-$1.96 per barrel), ending the trading day at $80.77 per barrel. Prices had been trading up earlier in the week after a poor showing last week, but sank as yet another bank—First Republic—created… Read more at: https://oilprice.com/Latest-Energy-News/World-News/More-Banking-Trouble-Pushes-Oil-Prices-Down-Another-2.html |

|

Russian Deputy Prime Minister Novak To Discuss Energy Cooperation With IranRussian Deputy Prime Minister Alexander Novak and the country’s Central Bank Governor Elvira Nabiullina are set to visit Iran next month, Iran’s Deputy Oil Minister Ahmad Asadzadeh said, according to the Information Agency of the Islamic Republic, in a move that could result in a powerful collaboration that could shift global energy markets. Novak is set to attend the 27th International Exhibition of Oil, Gas, and Petrochemicals in Iran that is scheduled for mid-May, and is scheduled to sign cooperation documents at that time as well.… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Russian-Deputy-Prime-Minister-Novak-To-Discuss-Energy-Cooperation-With-Iran.html |

|

European Union Pushes Into North African Solar MarketsElectrifying Africa is going to be one of the biggest challenges (and opportunities) of the clean energy era. In order to build a carbon-free economy, Africa has to “leapfrog” over what is normally the next phase of development in a nation’s economic journey. At present, 600 million people across the African continent still lack access to energy. But instead of looking to cheap and abundant fossil fuel sources to kickstart economic development as other nations have historically done, African leaders are facing the necessary and… Read more at: https://oilprice.com/Energy/Energy-General/European-Union-Pushes-Into-North-African-Solar-Markets.html |

|

Nigeria Completes Gas Pipeline Without Chinese FundsThe Nigerian National Petroleum Corporation (NNPC) has used around $1.1 billion of its own funds so far and has completed work on 70% of a large natural gas pipeline in Nigeria even after a Chinese loan for the project failed to materialize. Nigeria’s federal government announced in July 2020 that the Bank of China and Sinosure had agreed to finance part of the costs for constructing the Ajaokuta-Kaduna-Kano (AKK) gas pipeline to the economic hub in the north, Kano. In the summer of 2021, reports started swirling that Chinese lenders were… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Nigeria-Completes-Gas-Pipeline-Without-Chinese-Funds.html |

|

Turkmenistan Is Facing A Water CrisisTurkmenistan is starting to think harder about water, and not before time. On April 22, the Foreign Ministry hosted a conference under the title of “Management of Water Resources Amid Climate Change Conditions.” The ministry’s account of the event offered a sparse summary about what was said. Namely, that regional transboundary water cooperation is essential to ensuring stability and prosperity, and that climate change is forcing the world to focus more urgently on how it uses water. At first glance, these pronouncements… Read more at: https://oilprice.com/The-Environment/Global-Warming/Turkmenistan-Is-Facing-A-Water-Crisis.html |

|

Credit Suisse Reports Alarming Magnitude Of Losses And OutflowsCredit Suisse reported Monday that clients had withdrawn 61.2 billion francs ($69 billion) in the first quarter and that outflows were continuing, highlighting the challenge faced by UBS in rescuing its rival in March. In the last financial statement as an independent company, Credit Suisse reported a loss of 1.3 billion Swiss francs ($1.46 billion) for the first three months of the year. It said “significant net asset outflows” were seen in March. Most asset outflows originated from its wealth management unit and occurred in all regions.… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Credit-Suisse-Reports-Alarming-Magnitude-Of-Losses-And-Outflows.html |

|

U.S. Banks Face Pressure To Cut Fossil Fuel FundingCitigroup, Bank of America, and Wells Fargo shareholders are voting on Tuesday on non-binding resolutions proposed by environmental groups and ESG investors to wind down or phase out financing for fossil fuels. At last year’s shareholders’ meetings of some of the biggest American banks, similar resolutions won no more than 13% of shareholder support, Reuters notes. Early this year, As You Sow, Harrington Investments, The Sierra Club Foundation (SCF), and Trillium Asset Management filed two shareholder proposals… Read more at: https://oilprice.com/Energy/Energy-General/US-Banks-Face-Pressure-To-Cut-Fossil-Fuel-Funding.html |

|

Eni Starts Work On Congo LNG Plant To Supply Gas To EuropeItalian energy major Eni on Tuesday launched the construction works for the first natural gas liquefaction project in the Republic of the Congo, which is expected to supply LNG to Europe. The President of the Republic of the Congo, Denis Sassou Nguesso, and Eni’s CEO Claudio Descalzi today laid the foundation stone of Congo LNG. The project is designed to exploit the huge gas resources of Marine XII, with which it would meet the country’s power generation needs and export LNG, supplying new volumes of gas to international… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Eni-Starts-Work-On-Congo-LNG-Plant-To-Supply-Gas-To-Europe.html |

|

Halliburton Earnings Beat Estimates In Tight Oilfield Services MarketHalliburton (NYSE: HAL) on Tuesday reported first-quarter earnings beating analyst expectations amid strong demand for oilfield services and tight service capacity. Halliburton, the leading fracking services provider among the industry’s top three firms, followed Baker Hughes and SLB (formerly Schlumberger) in reporting earnings above consensus forecasts for the first quarter of this year despite a decline in oil and gas prices. Halliburton’s net income for the first quarter rose to $651 million, or $0.72 per diluted share, up… Read more at: https://oilprice.com/Energy/Energy-General/Halliburton-Earnings-Beat-Estimates-In-Tight-Oilfield-Services-Market.html |

|

Iran Oil Workers Join Labor ProtestWorkers from several industries in Iran, including the oil sector, continue to strike in protest of inadequate wage increases and deteriorating living conditions amid spiraling inflation and a widening gap between household income and expenses. Strikes have been ongoing in several cities for months, with workers from petrochemical, mining, and steel industries demonstrating as well. In the oil industry, workers have called for a 79 percent wage increase for contract workers in both industrial and nonindustrial factories, almost three times the… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Iran-Oil-Workers-Join-Labor-Protest.html |

|

China’s Golden Week Demand Boost Gives Oil Bulls HopeIn this week’s newsletter, we will take a quick look at some of the critical figures and data in the energy markets this week. We will then look at some of the key market movers early this week before providing you with the latest analysis of the top news events taking place in the global energy complex over the past few days. We hope you enjoy. Chart of the Week The Era of Golden Oil Profits Is Over, For Now – After oil companies’ net income peaked… Read more at: https://oilprice.com/Energy/Energy-General/Chinas-Golden-Week-Demand-Boost-Gives-Oil-Bulls-Hope.html |

|

Germany’s Energy Transition Fund Is $13 Billion ShortGermany’s fund for climate action and energy security is some $13.2 billion (12 billion euros) short on resources from funds to be allocated by 2026, sources with knowledge of the matter told Bloomberg on Tuesday. Last year, the federal government of Germany moved to create a $195.5 billion (177.5 billion euros) fund to support climate action, energy security, and help households and businesses with energy costs between 2023 and 2026. Industry decarbonization, the implementation of a hydrogen strategy, funding for buildings… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Germanys-Energy-Transition-Fund-Is-13-Billion-Short.html |

|

U.S. Net Debt To Exceed 110% By 2028 As Decarbonization Costs MountWhile the latest IMF forecasts were mostly lost in the din surrounding the start of earnings season, besides the now standard cuts to global growth forecasts, there was one standout item. As the National Bank of Canada points out, the IMF’s projections forecast U.S. net debt to rise from 95% of GDP in 2023 to 110% by 2028, which actually is a conservative estimate when comparing a similar, if even more concerning longer-term forecast from the Congressional Budget Office, which effectively projects hyperinflation. But while the fate of US… Read more at: https://oilprice.com/Energy/Energy-General/US-Net-Debt-To-Exceed-110-By-2028-As-Decarbonization-Costs-Mount.html |

|

EU Boosts Energy Infrastructure Security After Nord Stream SabotageThe European Union has stepped up security measures and protection of its critical energy infrastructure following the sabotage on the Nord Stream natural gas pipelines last autumn, European Commission President Ursula von der Leyen said at the North Sea Summit late on Monday. “We know that our critical infrastructures are under threat,” von der Leyen said. The EU has improved preparedness and coordinated responses at EU level to protect critical energy infrastructure, the EC president added. The EU is currently working on a… Read more at: https://oilprice.com/Latest-Energy-News/World-News/EU-Boosts-Energy-Infrastructure-Security-After-Nord-Stream-Sabotage.html |

|

First Republic falls nearly 50% to a record low after reporting a massive deposit dropThe decline comes after the bank’s first-quarter earnings report, which showed that First Republic’s deposits shrank by 40.8% during the quarter. Read more at: https://www.cnbc.com/2023/04/25/first-republic-falls-more-than-40percent-to-record-low-after-reporting-massive-deposit-drop.html |

|

Stocks close lower Tuesday as investors’ bank fears return, Dow sheds more than 300 points: Live updatesInvestors weighed earnings from consumer-facing brands while looking to tech giants Alphabet and Microsoft after the bell. Read more at: https://www.cnbc.com/2023/04/24/stock-market-today-live-updates.html |

|

Alphabet earnings are out — here are the numbersGoogle reported earnings after the bell. Here are the results. Read more at: https://www.cnbc.com/2023/04/25/alphabet-googl-q1-earnings-report-2023.html |

|

Microsoft set to report quarterly earnings after the bellMicrosoft’s results are likely to be weighed down by the continuing slump in the PC market, but the company stands to benefit from its partnership with OpenAI. Read more at: https://www.cnbc.com/2023/04/25/microsoft-msft-q3-earnings-report-2023.html |

|

How to trade Apple’s March quarter results based on historyUsing data going back 10 years, Morgan Stanley found how well the stock performs against the S&P 500 based on different outcomes from the March quarter report. Read more at: https://www.cnbc.com/2023/04/25/how-to-trade-apples-march-quarter-results-based-on-history.html |

|

Chipotle Mexican Grill is about to report earnings. Here’s what to expectChipotle hasn’t provided an outlook for 2023 same-store sales growth, noting the possibility of a recession. Read more at: https://www.cnbc.com/2023/04/25/chipotle-mexican-grill-cmg-earnings-q1-2023-.html |

|

U.S. regulators warn they already have the power to go after A.I. bias — and they’re ready to use itFour federal U.S. agencies issued a warning on Tuesday that they already have the authority to tackle harms caused by AI bias. Read more at: https://www.cnbc.com/2023/04/25/us-regulators-warn-they-already-have-the-power-to-go-after-ai-bias.html |

|

ChatGPT users can now turn off their chat history, OpenAI announcesOpenAI announces new controls that allow ChatGPT users to turn off chat history Read more at: https://www.cnbc.com/2023/04/25/chatgpt-users-can-now-turn-off-their-chat-history-openai-announces.html |

|

Ukraine war live updates: Two killed, 10 wounded in Russian attack on museum; Russian diplomats expelled by Sweden, MoldovaUkraine’s President Volodymyr Zelenskyy said Russian forces struck a museum in Kupyansk in the east of the country, killing two people and wounding 10 others. Read more at: https://www.cnbc.com/2023/04/25/ukraine-war-live-updates-latest-news-on-russia-and-the-war-in-ukraine.html |

|

Biden vows to ‘finish the job’ on the economy in first speech since launching 2024 campaignBiden launched his reelection campaign with a video Tuesday morning, four years to the day after he announced he was running for president in the 2020 cycle. Read more at: https://www.cnbc.com/2023/04/25/joe-biden-2024-reelection-president-to-speak-on-economy.html |

|

Warner Bros. Discovery previews a stacked film slate, centered around this summer’s ‘Barbie’CEO David Zaslav told attendees at CinemaCon that the studio will release 16 films in 2023 and hopes to do more than 20 releases annually going forward. Read more at: https://www.cnbc.com/2023/04/25/cinemacon-2023-warner-bros-teases-barbie-dune-part-two.html |

|

Japanese ispace moon landing attempt falls short at ‘very end,’ CEO saysJapanese company ispace aimed to be the first private enterprise to land on the moon, but lost communication and is investigating the attempt’s result. Read more at: https://www.cnbc.com/2023/04/25/ispace-moon-landing-watch-live.html |

|

Cruise robotaxis now run all day in San Francisco, with public access after 10 p.m.GM-owned Cruise’s announcement is one more step towards broader commercial deployment of an autonomous alternative to ride-hailing services like Uber or Lyft Read more at: https://www.cnbc.com/2023/04/25/cruise-robotaxis-now-run-24-7-in-san-francisco-public-access-at-night.html |

|

Shaky Start To US-Brokered Sudan Truce, Hundreds Of Thousands Flee Across Borders“They feel it will become a war zone. But many simply don’t have the means to leave Khartoum,” Al Jazeera’s Khartoum-based war correspondent Mohamed el-Tayeb observed Tuesday of ongoing efforts to evacuate foreigners, but which has still left no escape options for local Sudanese. The United Nations High Commissioner for Refugees (UNHCR) is meanwhile preparing for hundreds of thousands of people to spill over borders into neighboring countries in the coming days and weeks, with a UNHCR briefing indicating that 270,000 people will likely go into South Sudan and Chad.

Read more at: https://www.zerohedge.com/markets/shaky-start-us-brokered-truce-sudan-hundreds-thousands-fleeing |

|

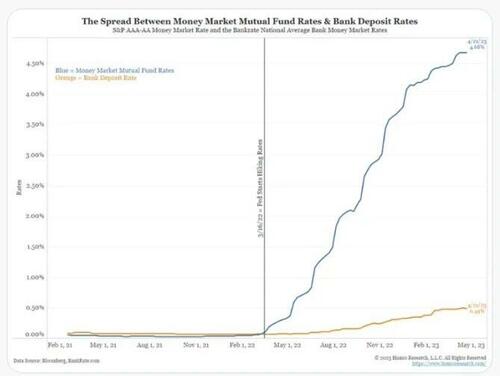

A Tidal Wave Of Money Leaving Banks Will Kill Profits And LendingAuthored by Mike Shedlock via MishTalk.com, Let’s tune into a mass exodus of deposits at banks for money market mutual funds and what it means…

Spread between bank deposit rates and money market funds from Tweet below. Jim Bianco has a 21-Tweet Thread on what’s going on with bank deposits. I chimed in on a couple of the Tweets. Here are some of the most important ideas.

|

|

Inflated Big Tech Values Spell Trouble For S&PBy Jeran Wittenstein and Ryan Vlastelica, Bloomberg Markets live reporters and analysts The stock market faces a major test this week when the big technology companies that have powered the S&P 500 Index’s rally this year are expected to report dismal quarterly earnings. Profits for information technology companies in the benchmark are projected to fall 15% in the first quarter, which would be the biggest contraction year-over-year since 2009, according to data compiled by Bloomberg Intelligence. The largest tech-related companies have been the biggest contributors to the S&P 500’s 7% advance this year, by virtue of their size and outperformance. Apple Inc., Microsoft Corp., and Nvidia Corp. alone account for nearly half of the index’s gains, according to data compiled by Bloomberg. “The valuation premium for US mega-cap stocks could remain problematic for S&P 500 performance, as these long-duration equities appear glaringly mispriced with interest rates at current levels,” Bloomberg Intelligence strategists Gina Martin Adams and Michael Casper wrote in a research note on April 18. Read more at: https://www.zerohedge.com/markets/inflated-big-tech-values-spell-trouble-sp |

|

OAN Founder Says He’d Pay Tucker Carlson $25 Million To Join NetworkSan Diego-based One America News CEO and founder Robert Herring Sr. has an offer for Tucker Carlson: $25 million to join the network.

“Maybe Fox News’ loss could be @OANN’s gain, Founder and CEO @RobHerring would like to extend an invitation to Carlson to meet for negotiation,” the network tweeted on Monday, hours after we learned that Lachlan Murcoch had fired the #1 cable news host from Fox News.

|

|

Bank of England economist says people need to accept they are poorerHuw Pill, chief economist for the Bank of England, says asking for pay rises contributes to inflation. Read more at: https://www.bbc.co.uk/news/business-65308769?at_medium=RSS&at_campaign=KARANGA |

|

Anger as fans say Coronation Concert ballot ‘misleading’Fans who applied to attend thought they had won, only to find out the tickets had already gone. Read more at: https://www.bbc.co.uk/news/business-65387085?at_medium=RSS&at_campaign=KARANGA |

|

Barbie with Down’s syndrome on sale after ‘real women’ criticismMattel says it wants children to see themselves in Barbie and also play with dolls who do not look like them. Read more at: https://www.bbc.co.uk/news/business-65388131?at_medium=RSS&at_campaign=KARANGA |

|

Top 5 ELSS funds of last year delivered over 25% return in 3 yearsETMarkets used ET Mutual Screeners to analyze the top five equity-linked savings plans (ELSS) over the past year and found that all five have produced good CAGR returns of over 25% over the past three years. Tax-saving mutual funds, which invest at least 80% of assets in equities, are essentially ELSS that offer tax benefits to investors under Section 80C of the Income Tax Act, 1961. The lock-in period instills a good habit among investors to aim for long-term investing. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/top-5-elss-funds-of-last-year-delivered-over-25-return-in-3-years/top-bets/articleshow/99766751.cms |

|

Zerodha’s Nithin Kamath on the hard lessons for startups this funding winterStartups rushing to raise more funds at higher valuations risk a difficult situation amid the current liquidity crunch as it narrows equity upside, said Zerodha CEO and co-founder Nithin Kamath. Liquidation preferences, which allow investors to recover their investment before anyone else in a business, need to be fine-tuned to match underlying fundamentals to succeed, he added. Kamath pointed out the discrepancy between uneven valuations and the market’s fundamentals, which may prompt founders and leaders at late-stage startups to exit, potentially putting their firms’ survival at risk. Kamath’s comments come as fundraising for Indian startups falls to its lowest in four years. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/zerodhas-nithin-kamath-on-the-hard-lessons-for-startups-this-funding-winter/articleshow/99763281.cms |

|

Tech View: Nifty forms Doji candle. What should traders do on WednesdayThe Nifty needs to hold above 17,717 zones to witness an upward move towards 17,850 and 17,950 zones, according to Chandan Taparia of Motilal Oswal. On the downside, support is placed at 17,620 and 17,550 marks. Volatility has sunk to hover at its lower band, with options data suggesting a shift in the trading range between 17,500 to 18,000 zones. The PCR Ratio for Nifty settled at 1.01, indicating a mildly bullish trend. However, immediate support is around 17,650-17,600 levels, warned Nagaraj Shetti of HDFC Securities. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/tech-view-nifty-forms-doji-candle-what-should-traders-do-on-wednesday/articleshow/99763865.cms |

|

Market Extra: What’s next for stock market as small-cap index suffers its first ‘death cross’ since January 2022The Russell 2000 index of small-cap stocks has produced a bearish “death cross” chart pattern for the first time in over a year, flashing a widely followed technical sell signal as small-caps are struggling with tightening financial conditions in the wake of bank failures and potential economic slowdown. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-71E0-0EC977B7AAAB%7D&siteid=rss&rss=1 |

|

Key Words: Social Security can be saved by investing it in the stock market, says Sen. Bill CassidyHis ‘big idea’ would invest money in the stock market over 75 years to make Social Security solvent. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-71DF-9ED60B922125%7D&siteid=rss&rss=1 |

|

Movers & Shakers: First Republic stock tanks, UPS shares weaken, Spotify shares advance, and more stocks on the moveThese stocks were making some of the most notable moves Tuesday amid a wave of earnings reports. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-71DF-300623C59737%7D&siteid=rss&rss=1 |

Jordanians flown from Sudan arrive in Amman, via AP.More refugees are also expected to flood into Eritrea, Ethiopia, Egypt, Libya, and Central African Republic, after fighting has raged between the nation’s two top gener …

Jordanians flown from Sudan arrive in Amman, via AP.More refugees are also expected to flood into Eritrea, Ethiopia, Egypt, Libya, and Central African Republic, after fighting has raged between the nation’s two top gener …