Summary Of the Markets Today:

- The Dow closed down 110 points or 0.33%,

- Nasdaq closed down 0.80%,

- S&P 500 closed down 0.60%,

- Gold $2,015 up $7.40,

- WTI crude oil settled at $77 down $1.87,

- 10-year U.S. Treasury 3.539% down 0.063 points,

- USD $101.86 down $0.11,

- Bitcoin $28,144 down $1,110,

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our Economic Forecast for April 2023

Today’s Economic Releases:

The National Association of Realtors (NAR) reported that existing-home sales in the United States fell 2.4% in March from February to a seasonally adjusted annual rate of 4.44 million – sales declined 22.0% from one year ago (blue line on the graph below). This was the fourth consecutive month of declines in existing-home sales. The median price for an existing home sold in March was $375,700, up 10.7% from a year ago (red line on the graph below). The supply of homes for sale at the end of March was 980,000, which is equal to 2.6 months of inventory at the current sales pace. The decline in existing-home sales was driven by a number of factors, including rising interest rates, inflation, and a slowdown in the economy. Interest rates have been rising in recent months, which has made it more expensive to buy a home. Inflation is also at a 40-year high, which is putting a strain on household budgets. And the economy is showing signs of slowing down, which could lead to fewer people buying homes. Despite the decline in existing-home sales, the housing market is still strong overall. Home prices are rising, and there is still strong demand for homes. However, the rising interest rates and inflation are likely to put some pressure on the housing market in the coming months.

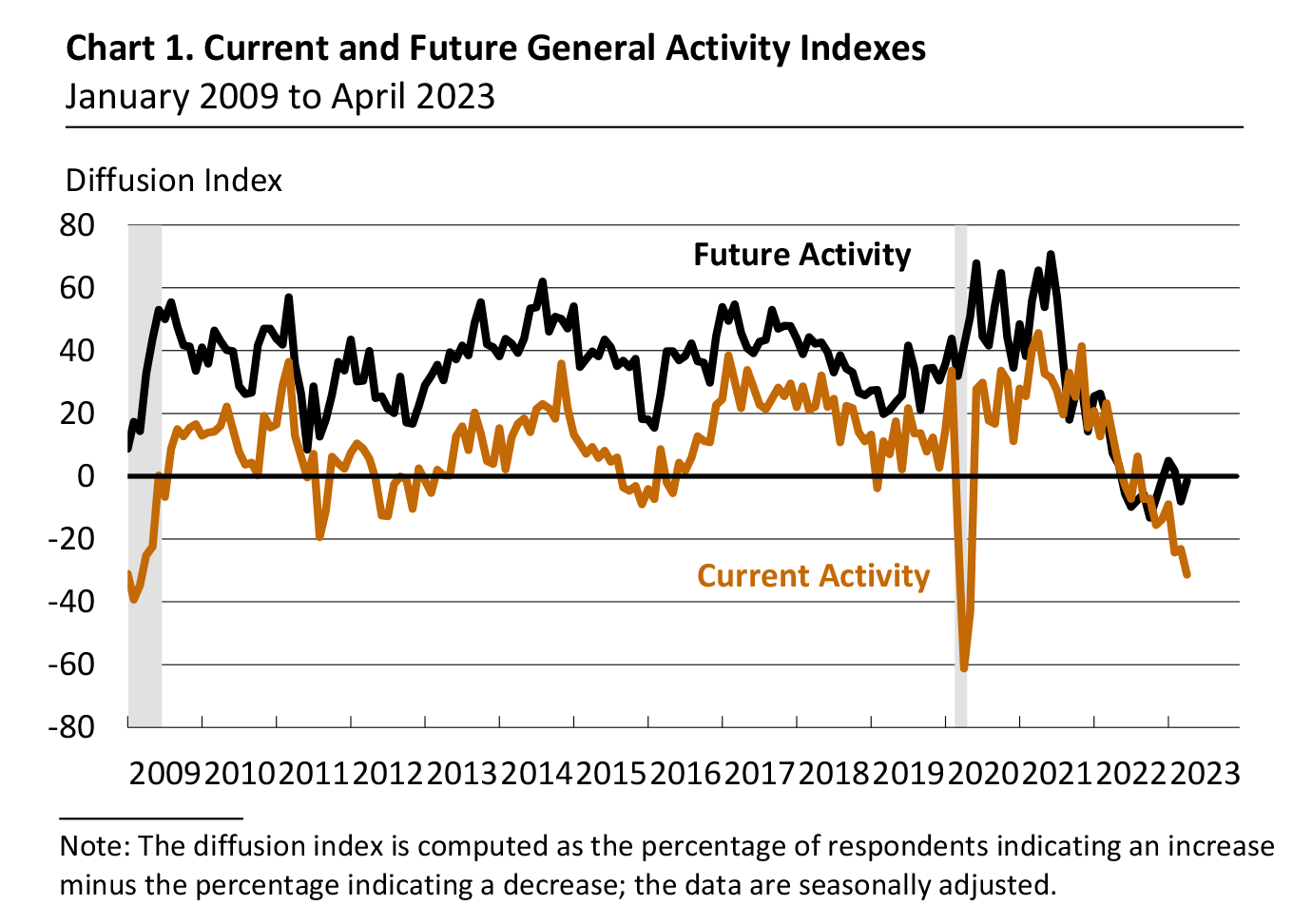

The Philadelphia Federal Reserve Bank’s April 2023 Manufacturing Business Outlook Survey (MBOS) showed that manufacturing activity in the Philadelphia Fed’s Third District contracted in April. The headline MBOSS index fell to -31.3 in April from 1.3 in March, its lowest level since May 2020. The index’s decline was driven by a sharp drop in new orders and a slowdown in production. The decline in the Philadelphia Fed’s MBOSS index in April suggests that manufacturing activity in the Third District contracted in April. The decline in new orders suggests that demand for manufactured goods is weakening. The slowdown in production suggests that manufacturers are producing less output. The decline in the Philadelphia Fed’s MBOSS index in April is consistent with other recent data that suggests that the U.S. economy is slowing.

The number of people filing for unemployment benefits in the United States rose by 27,457 to 234,577 in the week ending April 8, 2023, the U.S. Labor Department reported Thursday. The four-week moving average for new claims, which smooths out week-to-week volatility, rose by 7,500 to 215,000 (blue line on the graph below), the highest level since November 13, 2021.

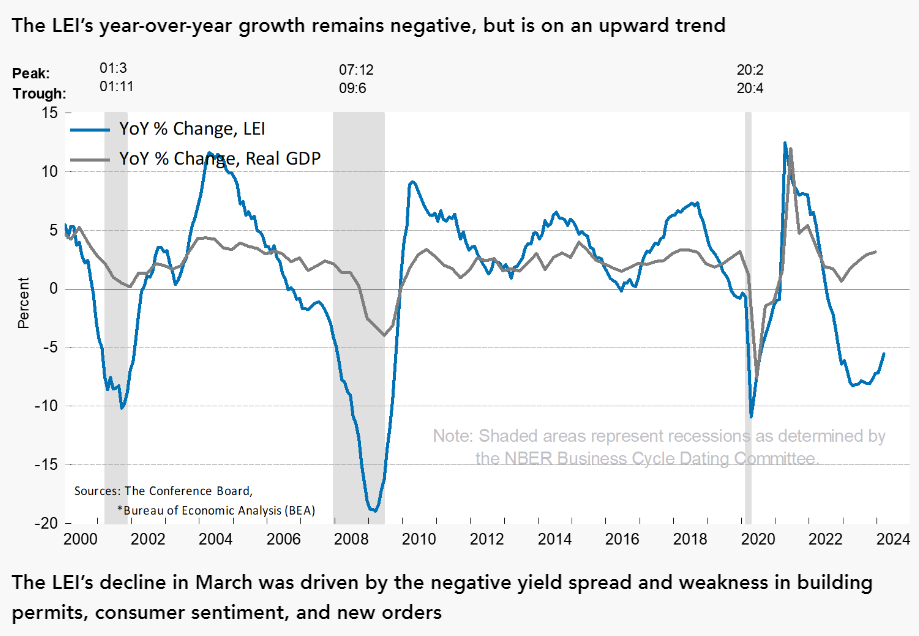

The Conference Board Leading Economic Index® (LEI) for the United States decreased by 0.7% in March 2023 to 110.2 (2016=100), after also falling 0.3% in February. The LEI is now down 0.8% over the six-month period between September 2022 and March 2023—slightly lower than the 1.0% growth it recorded over the previous six months. The LEI is a composite index of 10 economic indicators that are believed to forecast economic activity. The index is designed to anticipate turning points in the economy, typically three to six months in advance. The decline in the LEI in March was led by a decline in stock prices and a slowdown in consumer expectations. Stock prices fell sharply in March, as investors became more concerned about inflation and the potential for a recession. Consumer expectations also fell in March, as consumers became more concerned about the rising cost of living. The decline in the LEI in March suggests that the U.S. economy is slowing.

A summary of headlines we are reading today:

- Marco Rubio Under Fire For Florida Gasoline Shortage

- Oil Sheds 2% Amid Indications Of Fragile Demand

- Ukraine’s Grain Flows Shift To Europe

- China’s Coal Use Set To Rise With Growing EV Demand

- SpaceX Starship rocket launches in historic test but explodes mid-flight

- Nasdaq closes lower Thursday, dragged by Tesla shares: Live updates

- Nuclear fusion will not be regulated the same way nuclear fission is — a big win for the fusion industry

- Futures Movers: U.S. oil benchmark settles at nearly a 3-week low, below $80 on recession fears

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Nickel Surplus Weighs On Stainless Steel PricesVia AG Metal Miner The Stainless Monthly Metals Index (MMI) fell 7.53% from March to April. Downside momentum continued to pressure the nickel market, sending prices down into support zones. Meanwhile, no bullish reversal patterns have formed, leaving the global stainless steel price at high risk of further decline. Nickel Market Shifted into Surplus, While Inventories Declined According to the International Nickel Study Group (INSG), the nickel market shifted from deficit to surplus in 2022, and thus the stainless steel price index… Read more at: https://oilprice.com/Metals/Gold/Nickel-Surplus-Weighs-On-Stainless-Steel-Prices.html |

|

ViPER Group Announces Breakthrough In Battery TechPurdue University’s research shows promise for developing high-energy-density rechargeable lithium-metal batteries and addressing the electrochemical oxidation instability of ether-based electrolytes. The research was conducted by Purdue University’s Vilas Pol Energy Research (ViPER) Group. The research report has been published in Nature Communications, a peer-reviewed, open access, scientific journal published by Nature Portfolio. Zheng Li, a graduate research assistant in the Davidson School of Chemical Engineering, is… Read more at: https://oilprice.com/Energy/Energy-General/ViPER-Group-Announces-Breakthrough-In-Battery-Tech.html |

|

Marco Rubio Under Fire For Florida Gasoline ShortageThings are heating up in Florida over the widespread gasoline shortages plaguing the state, with Republicans calling out other Republicans for not finding a resolution to the problem already. In a video clip that Marco Rubio shared on Twitter on Sunday, the Senator lashed out at the people that had failed to resolve the gasoline shortages. “FOUR DAYS and they still can’t figure out how to get gasoline to South #Florida #GasShortage” Rubio tweeted, leaving most readers to assume the “they” in that sentence was referring to Florida Governor Ron DeSantis.… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Marco-Rubio-Under-Fire-For-Florida-Gasoline-Shortage.html |

|

Oil Sheds 2% Amid Indications Of Fragile DemandCrude oil prices hit a three-week low on Thursday, trading down over 2.5% amid a significant uptick in gasoline inventories and continued fears of recession countering demand growth. At 1:15 p.m. EST on Thursday, Brent crude had shed 1.99%, trading at $81.47 per barrel, just above the resistance mark of $80. West Texas Intermediate (WTI) was trading down 1.92%, at $77.64 per barrel. Oil price gains from a rally in the first week of March, when OPEC+ announced surprise oil output cuts, have now been erased. Last week’s U.S. labor data has… Read more at: https://oilprice.com/Energy/Oil-Prices/Oil-Sheds-2-Amid-Indications-Of-Fragile-Demand.html |

|

US, Allies Weigh Export Bans On Everything To RussiaOfficials from the G7 group of the world’s most industrialized nations are discussing the idea of an outright ban on nearly all exports to Russia in another move aimed at hurting the Russian economy over Putin’s invasion of Ukraine, sources with knowledge of the matter told Bloomberg on Thursday. The G7 officials are discussing the idea ahead of a summit of the leaders in Japan next month, with the goal of bringing the EU into the fold of countries banning nearly all exports to Russia, according to Bloomberg’s sources.… Read more at: https://oilprice.com/Latest-Energy-News/World-News/US-Allies-Weigh-Export-Bans-On-Everything-To-Russia.html |

|

Can South Africa Replace Coal With Natural Gas And Green Hydrogen?South Africa’s energy sector is in a state of disarray. Once one of the most reliable utilities in Africa, Eskom – the country’s state-owned power utility – now exists in a state of constant emergency which is currently threatening to push the country into civil disarray and economic catastrophe. Eskom has allowed its power plants to fall into disrepair to the disastrous extent that the company has been running at about 50% capacity. As a result, South Africans are living with consistent and continuous rolling… Read more at: https://oilprice.com/Energy/Energy-General/Can-South-Africa-Replace-Coal-With-Natural-Gas-And-Green-Hydrogen.html |

|

Stoltenberg Invites Zelensky To Join NATO SummitNATO Secretary-General Jens Stoltenberg has visited Kyiv for the first time since Russia’s invasion last year, telling Ukrainians their country’s future belongs in the alliance as President Volodymyr Zelenskiy proclaimed that “it is time” an invitation was extended to join the group. Stoltenberg arrived in the Ukrainian capital early on April 20 on an unannounced visit as fighting raged in the east and Moscow continued to launch attacks with dozens of drones on civilian infrastructure in several regions. Stoltenberg reaffirmed the alliance’s position… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Stoltenberg-Invites-Zelensky-To-Join-NATO-Summit.html |

|

Ukraine’s Grain Flows Shift To EuropeRussia’s invasion of Ukraine and the temporary blockage of its Black Sea ports have redirected the flow of grain from Ukraine. One of the world’s leading producers of wheat, corn and vegetable oils, Ukraine shipped much of its grain internationally prior to the war, with seven of the 10 most important destination markets for Ukrainian grain exports in 2021 located in Asia and North Africa (eight when including Turkey). That changed drastically in 2022, as the following chart illustrates. You will find more infographics at Statista… Read more at: https://oilprice.com/Energy/Energy-General/Ukraines-Grain-Flows-Shift-To-Europe.html |

|

Lego And Novo Nordisk To Use Renewable Methanol For PlasticsThe world’s largest toy maker, Lego, and pharmaceutical giant Novo Nordisk have reached a deal with renewable firm European Energy to procure methanol produced from renewable energy to replace part of their fossil fuel-derived plastics production. Denmark-based European Energy will produce methanol from renewable energy and biogenic CO2, commonly referred to as e-methanol, which will, in turn, be used for plastic production, Lego said on Thursday. The e-methanol will be produced at European Energy’s e-methanol facilities… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Lego-And-Novo-Nordisk-To-Use-Renewable-Methanol-For-Plastics.html |

|

Azerbaijani-Israeli Relations Spark Renewed Tensions With IranOn March 30, Azerbaijan officially inaugurated its first embassy in Tel Aviv, Israel, after avoiding the move for three decades. Although the decision highlighted the importance of Azerbaijani-Israeli relations, it quickly became a catalyst behind the renewed war of words between Iran and Azerbaijan (Themedialine.org, March 30). Since 2021, diplomatic relations between Tehran and Baku have steadily become embittered. Iran is primarily concerned with the decline of its influence in the South Caucasus, which has suffered since the end of the Second… Read more at: https://oilprice.com/Geopolitics/International/Azerbaijani-Israeli-Relations-Spark-Renewed-Tensions-With-Iran.html |

|

China’s Coal Use Set To Rise With Growing EV DemandConcerns about power shortages could force China to rely more on coal to keep grids stable amid the growing demand for electricity, including from the rising electric vehicles (EV) fleet, analysts at ANZ Group say. The rise in EV sales in the world’s largest EV market, China, is set to increase pressure on the grids, which have struggled recently amid low hydropower output and rising power demand from industry and households. In these circumstances, the “only real option in the short term” for China to boost its electricity… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Chinas-Coal-Use-Set-To-Rise-With-Growing-EV-Demand.html |

|

Pakistan Has Bought Its First Russian Oil Cargo. Now What?Pakistan has placed its first order for discounted Russian crude oil, a move that could potentially reduce the country’s reliance on Middle Eastern oil producers. The order amounts to around 100,000 barrels per day (bpd) of Russian crude oil, which does not include related products. In 2022, Pakistan imported 154,000 bpd of oil, with most of it coming from Saudi Arabia and the UAE. The introduction of Russian crude could have a significant impact on the supplies from Middle Eastern producers, which may not be welcomed and could lead to future issues.… Read more at: https://oilprice.com/Energy/Energy-General/Pakistan-Has-Bought-Its-First-Russian-Oil-Cargo-Now-What.html |

|

Pakistan To Receive Its First Cargo Of Cheap Russian CrudePakistan expects to receive in May its first cargo loaded with discounted Russian crude after placing its first order for oil from Moscow under a new bilateral deal, Pakistan’s Petroleum Minister Musadik Malik told Reuters. For several months, Pakistan has been negotiating for the purchase of Russian crude at discounts. Pakistan hasn’t been a major importer of Russian oil and gas so far. Last month, reports emerged that Pakistan is looking to buy Russian oil at $50 per barrel, as the South Asian country is grappling with an economic… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Pakistan-To-Receive-Its-First-Cargo-Of-Cheap-Russian-Crude.html |

|

Southeast Asian Gasoline Demand Disappoints During Peak SeasonGasoline demand in major economies in Southeast Asia is showing signs of weakness just as the peak fuel demand for travel has begun, traders have told Bloomberg, which could be a concern about global oil demand. Indonesia, a large market for gasoline, hasn’t seen a surge in demand ahead of the Eid festivities this weekend, according to the traders. Stocks of fuels, including gasoline at the hub in Singapore, are at their highest for this time of the year since 1995, according to Singaporean government data cited by Bloomberg. There is also… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Southeast-Asian-Gasoline-Demand-Disappoints-During-Peak-Season.html |

|

China Set To Slash Fuel Export QuotasChinese authorities are expected to give much lower fuel export allowances to refiners in the second batch of quotas in the coming weeks amid rising domestic demand, a Reuters survey of state refiners and consultancies showed on Thursday. Following a rather generous first batch of export quotas early this year, when a total of 18.99 million tons in allowances were issued, China is now set to limit quotas in the second batch to between 8 million tons and 12 million tons, according to the survey. In the first batch, China increased its fuel… Read more at: https://oilprice.com/Energy/Energy-General/China-Set-To-Slash-Fuel-Export-Quotas.html |

|

SpaceX Starship rocket launches in historic test but explodes mid-flightElon Musk’s SpaceX launched its towering Starship rocket to space but suffered a mid-flight explosion. Read more at: https://www.cnbc.com/2023/04/20/spacex-starship-orbital-launch-attempt-live-updates.html |

|

Nasdaq closes lower Thursday, dragged by Tesla shares: Live updatesInvestors pored through results from Tesla, American Express and more, for hints related to the health of corporate profits. Read more at: https://www.cnbc.com/2023/04/19/stock-market-today-live-updates.html |

|

Disney tells its lobbyists to step up fight against DeSantis and his allies in FloridaDisney’s lobbyists are trying to influence DeSantis and Florida’s state legislature on issues including land-use bills that could hurt the company. Read more at: https://www.cnbc.com/2023/04/20/disney-desantis-fight-new-phase.html |

|

DOJ charges 18 people — including doctors — in massive Covid healthcare fraud takedownsThe alleged healthcare fraud schemes involved false billing and theft from federal programs, fake Covid vaccine cards, and Covid test kits. Read more at: https://www.cnbc.com/2023/04/20/doj-charges-doctors-others-with-covid-health-care-fraud.html |

|

Small caps will be large this year, says Jefferies. Here are 10 buy ideasThe firm listed 10 buy-rated stocks that do well across rating factors and are down in 2023. Read more at: https://www.cnbc.com/2023/04/20/small-caps-will-be-large-this-year-says-jefferies-here-are-10-buy-ideas.html |

|

MyPillow CEO Mike Lindell ordered to pay $5 million to 2020 election fraud data debunkerMyPillow CEO Mike Lindell claims that ex-President Donald Trump was defrauded out of reelection in 2020 by voting machine manipulation. Read more at: https://www.cnbc.com/2023/04/20/mypillow-ceo-lindell-election-fraud-debunked.html |

|

Read the internal memo Alphabet sent in merging A.I.-focused groups DeepMind and Google BrainGoogle is merging two previously separate teams as it races to advance artificial intelligence. Read more at: https://www.cnbc.com/2023/04/20/alphabet-merges-ai-focused-groups-deepmind-and-google-research.html |

|

Nuclear fusion will not be regulated the same way nuclear fission is — a big win for the fusion industryThe Nuclear Regulatory Commission, the nation’s top nuclear watchdog, has decided nuclear fusion will not be regulated the way nuclear fission reactors are. Read more at: https://www.cnbc.com/2023/04/20/nuclear-fusion-will-not-be-regulated-the-same-way-nuclear-fission-is.html |

|

Ukraine war live updates: Kyiv says it’s time for NATO to invite Ukraine into the alliance — not just to a summitUkraine’s President Volodymyr Zelenskyy said Thursday that it was time for NATO to invite Ukraine to join the Western military alliance. Read more at: https://www.cnbc.com/2023/04/20/ukraine-war-live-updates-latest-news-on-russia-and-the-war-in-ukraine.html |

|

Alec Baldwin lawyers say manslaughter charges to be dropped in ‘Rust’ movie set shootingThe “Rust” movie set shooting case was set to go to trial early next month. Read more at: https://www.cnbc.com/2023/04/20/alec-baldwin-lawyers-say-manslaughter-charges-to-be-dropped-in-rust-movie-set-shooting.html |

|

BuzzFeed will lay off 15% of staff, shutter its news unitBuzzFeed will lay off 15% of staff and will shut down its news unit, BuzzFeed CEO Jonah Peretti wrote in an email to staff Thursday. Read more at: https://www.cnbc.com/2023/04/20/buzzfeed-will-lay-off-15percent-of-staff-shutter-its-news-unit.html |

|

Taylor Swift sidestepped FTX lawsuit by asking a simple question—investors can use the same strategy to avoid potential scamsTaylor Swift’s apparent due diligence may have helped her avoid getting caught in the legal fallout following the collapse of failed crypto exchange FTX. Read more at: https://www.cnbc.com/2023/04/20/taylor-swift-avoided-ftx-lawsuit-by-asking-a-simple-question.html |

|

Wells Fargo says this regional bank stock that got caught up in crisis should rebound by 60%Western Alliance still has room to run after Wednesday’s rally for the stock, according to Wells Fargo. Read more at: https://www.cnbc.com/2023/04/20/wells-fargo-says-this-regional-bank-stock-should-rebound-by-60percent.html |

|

Watch: RFK Jr. Tells Deep State “Nice Try” As Fire-Alarm Interrupts His Presidential AnnouncementAuthored by Steve Watson via Summit News, As Robert F. Kennedy Jr. officially announced he is running for the Democratic nomination for President in 2024, the fire alarm at the packed-out Plaza Hotel in Boston interrupted his speech as he waxed lyrical on failures of the deep state.

Kennedy had turned to talk about how China is mastering infrastructure, building roads and bridges while the U.S. military industrial complex has been bombing them into rubble. Then the fire alarm sounded. “Nice try” Kennedy quipped after the alarm continued, prompting the crowd to roar with approval. Watch:

|

|

Stoltenberg Visits Kiev In 1st Since War’s Start, Stresses Ukraine Belongs In NATONATO Secretary-General Jens Stoltenberg has visited Ukraine for the first time since Russia invaded over a year ago, confirming in a tweet that he met with President Volodymyr Zelensky. Stoltenberg further said that Ukraine should be in NATO. “Ukraine’s rightful place is in NATO, and over time our support will help to make this possible. We stand by you today and for the long haul,” the NATO chief said.

A NATO press release quoted Stoltenberg as reminding his Ukrainian audience and the world that nations in the Western military alliance have provided the war-ravaged country with more than 150 billion euros of support since the war began. “Your determination to fight the aggressor, liberate your land, and work for a brighter future says very clearly to me: Ukraine will prevail,” Stoltenberg said. He visited Bucha, site of alleged Russian atrocities, and visited a memorial remembering fallen Ukrainian soldiers in St. Michael’s Square in Kyiv. < … Read more at: https://www.zerohedge.com/geopolitical/stoltenberg-visits-kiev-1st-wars-start-stressing-ukraine-belongs-nato |

|

A Hair’s Breath From A Damp SquibBy Michael Every of Rabobank The title of today’s Global Daily fuses two mangled English metaphors I hear into one message for markets – a narrative can be nearly right, but one wrong letter gives it a different meaning. Yet again, UK deflationists were proved painfully wrong in expecting a damp squib. Headline CPI remained over 10% in March, core CPI was unchanged at 6.2% y-o-y, and food inflation was nearly 20%. That’s with a weak economy, ‘healed’ supply chains – as far as Brexit will allow, higher BOE interest rates, and negative real wage growth. As a result, BOE rates are going to go even higher, with chatter of 5%. UK inflation goes down from here, but how quickly it gets back to 2% is not clear: not when ‘The UK warns of cyber-attacks from new ‘Wagner-like’ Russian cyber hackers aimed at businesses and infrastructure, i.e., structural geopolitical supply-side shocks. The Fed’s Beige Book was either a hair’s breadth from a need for more rate hikes or for rate cuts. Overall economic activity was little changed, with consumer spending, manufacturing, freight volumes, residential real estate sales, construction, and CRE leasing all flat to down; auto sales steady; but travel, tourism, and nonfinancial services up. Bank lending volumes and loan demand generally declined, with tightened lending standards amid increased uncertainty and concerns about liquidity. Employment growth moderated somewhat, with the labor market becoming less tight on increased supply; wages showed some moderation but remained elevated. Consumer prices generally increased due to still-elevated demand as well as higher inventory and labor costs … Read more at: https://www.zerohedge.com/markets/hairs-breath-damp-squid |

|

Peter Schiff: A Death Blow Is Coming For The Dollar And People Will Run To GoldVia SchiffGold.com, There has been a lot of talk lately about de-dollarization. As just one example, the BRICS nations recently announced they are developing a new currency. Peter Schiff recently appeared on Commodity Culture with Jessie Day to talk about the trajectory of the dollar. He said that the death blow for the dollar is coming. And when it does, people will run to gold. There has been plenty of speculation about de-dollarization recently, but is it a real threat, or is all of the talk just hyperbole? Peter said, “None of it is hyperbole, and all of it will come to pass.”

Peter said he thinks the current … Read more at: https://www.zerohedge.com/markets/peter-schiff-death-blow-coming-dollar-and-people-will-run-gold |

|

Buzzfeed News to close as media firm cuts jobsBuzzfeed is reducing its workforce by 15% and shutting its news site. Read more at: https://www.bbc.co.uk/news/65341450?at_medium=RSS&at_campaign=KARANGA |

|

What counts as workplace bullying?Unfortunately bullying in the workplace is quite common, so what can you do about it? Read more at: https://www.bbc.co.uk/news/business-65334727?at_medium=RSS&at_campaign=KARANGA |

|

Business group CBI reports new ‘criminal offense’ to policeThe lobby group says it has recently received additional information about “a serious criminal offense”. Read more at: https://www.bbc.co.uk/news/business-65336715?at_medium=RSS&at_campaign=KARANGA |

|

Tech View: Nifty charts signal fatigue among bulls, consolidation likely to continueThe Indian benchmark Nifty 50 traded within a narrow range amid bouts of profit booking, with support at 17,550 and 17,442 points on the downside, and resistance at 17,717-17,777 levels. Analysts suggest the market is witnessing a non-directional activity near the 200-day SMA, and while the daily momentum indicator has triggered a fresh negative crossover, we should assign less weightage to the signal until the Nifty 50 breaks below 17,550-17,500. The range of consolidation is set to be between 17,500-17,800 for the next few sessions. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/tech-view-nifty-charts-signal-fatigue-among-bulls-consolidation-likely-to-continue/articleshow/99642905.cms |

|

NRIs fret over Indian investments post Adani-Hindenburg saga: SurveyThe freefall was arrested to an extent after US-based FII GQG Partners had signed a Rs 15,000 crore deal with Adani Group promoter entity SB Adani Family Trust to buy stakes in Adani Ports, Adani Green Energy, Adani Transmission, and Adani Enterprises. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/nris-fret-over-indian-investments-post-adani-hindenburg-saga-survey/articleshow/99635987.cms |

|

Rs 83,000 crore in 3 months! DII faith in Dalal Street unaffected by global volatilityThe volatility in global markets notwithstanding, DIIs have been relentlessly buying equities, and in the first three months of 2023, they have pumped in Rs 832 billion, data shared by NSE showed. This is almost equal to the total inflows seen in 2021. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/rs-83000-crore-in-3-months-dii-faith-in-dalal-street-unaffected-by-global-volatility/articleshow/99630028.cms |

|

The Margin: Americans are expecting a 6.7% wage hike this year: ADP reportWorkers may be worried about layoffs, but they also can put stock in the fact they received an average 6.5% salary increase in 2022, according to ADP. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-71DB-9DAE98EE1170%7D&siteid=rss&rss=1 |

|

Futures Movers: U.S. oil benchmark settles at nearly a 3-week low, below $80 on recession fearsOil futures on Thursday extend a retreat that’s seen the U.S. benchmark slip back below $80 a barrel. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-71DA-F565258FFD52%7D&siteid=rss&rss=1 |

|

Key Words: Former Rep. Patrick Kennedy takes swipe at presidential longshot RFK Jr. — and at Democrats on 4/20 for supporting the marijuana industryFormer Rep. Patrick Kennedy throws cold water on his cousin’s longshot presidential bid, as he speaks before a group that opposes cannabis legalization. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-71DB-6F0316229648%7D&siteid=rss&rss=1 |