Summary Of the Markets Today:

- The Dow closed up 101 points or 0.30%,

- Nasdaq closed up 0.28%,

- S&P 500 closed up 0.33%,

- Gold $2,009 down $7.30,

- WTI crude oil settled at $81 down $1.54,

- 10-year U.S. Treasury 3.598% up 0.076 points,

- USD $102.08 up $0.53,

- Bitcoin $29,501 down $788,

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our Economic Forecast for April 2023

Today’s Economic Releases:

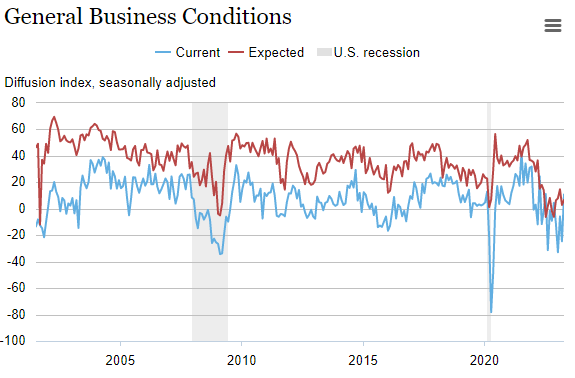

The Empire State Manufacturing Survey for April 2023 showed a significant increase in business activity, with the general business conditions index jumping 35.4 points to 10.8. This was the first month of expansion in five months, and the largest expansion in the last nine. The increase in activity was driven by a surge in new orders and shipments, as well as a pickup in delivery times and inventories. However, employment and hours worked declined for a third consecutive month. Despite the increase in activity, businesses continued to expect little improvement in conditions over the next six months. The index for future business conditions edged up to 6.6, suggesting that firms do not expect much improvement in activity over the next six months.

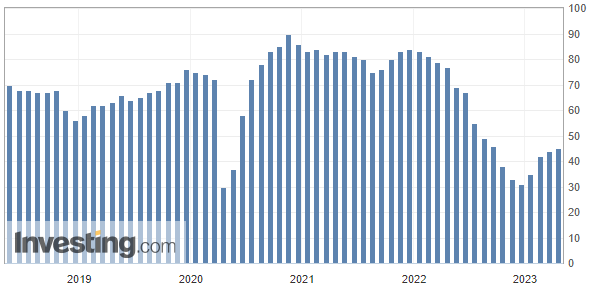

The housing market index for April 2023 rose for a fourth consecutive month, reaching 45. This was a fresh high since September 2022 and beat market expectations of 44. The gauge for current sales conditions rose to 51 from 49, sales expectations in the next six months increased to 50 from 47, and traffic of prospective buyers was unchanged at 31. Builders noted that additional declines in mortgage rates, to below 6%, will price-in further demand for housing. They also said that they are seeing more buyers coming back into the market, as affordability improves. The housing market is still facing some headwinds, such as rising inflation and interest rates. However, the overall trend is positive, and builders are optimistic about the outlook for the housing market in the coming months. Here are some additional details from the housing market index for April 2023:

- The index for current sales conditions rose to 51 from 49, indicating that more builders view sales conditions as good than poor.

- The index for sales expectations in the next six months increased to 50 from 47, indicating that builders are more optimistic about the outlook for the housing market over the next six months.

- The index for the traffic of prospective buyers was unchanged at 31, indicating that the level of buyer interest remains stable.

Overall, the housing market index for April 2023 suggests that the housing market is continuing to improve. Builders are more optimistic about the outlook for the housing market, and more buyers are coming back into the market. However, the housing market is still facing some headwinds, such as rising inflation and interest rates.

A summary of headlines we are reading today:

- Hedge Funds Dropping China Stocks For American Oil

- Exxon Faces Shareholder Scrutiny Over Unclear Decommissioning Plans

- Can Technology Really Solve Our Climate Problems?

- Russia’s Seaborne Crude Oil Exports Rebound To Above 3 Million Bpd

- Natural Gas Prices Jump 8% On Colder-Than-Expected Weather Forecast

- Electric Vehicle Market Share Continues To Grow

- Lithium Prices Could Start To Rebound Soon

- S&P 500 closes higher Monday to kick off a busy earnings week: Live updates

- Bitcoin dips below $30,000, and backlash brews as SEC moves toward DeFi oversight: CNBC Crypto World

- US Banks Lost Money On Mortgages For The First Time Since The MBA Began Keeping Records

- “Does Not Appear Sustainable”: The US Budget Deficit Is Unexpectedly Soaring Again And It’s About To Get Much Worse

- Market Snapshot: Dow turns positive in afternoon trade with earnings season set to pick up steam

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

How Big Oil Has Adapted To A New Energy RealityThe last decade or so has been tumultuous for the oil industry. It’s an industry underpinning every world economy, except perhaps isolated communities in the Amazon jungle, yet its existence has been called into question repeatedly and persistently. After enjoying many decades of government support because of the essential nature of the products it extracts from the ground, now the oil and gas industry is finding itself under fire from those same governments that used to support it. It’s the target of activist pressure the likes of which the world… Read more at: https://oilprice.com/Energy/Energy-General/How-Big-Oil-Has-Adapted-To-A-New-Energy-Reality.html |

|

Hedge Funds Dropping China Stocks For American OilAs tensions rise between China and the United States over Taiwan, Goldman Sachs says it is seeing big money managers around the world dumping Chinese equities and moving money into American energy instead, Reuters reports. Not only are Chinese equities being dropped in favor of American energy shares, but it’s being done at what Goldman calls a near-record pace. “As concerns heightened around geopolitics, Chinese equities were net sold for the first time in a month, driven by risk unwinds with long sales outpacing short covers,” Reuters cited… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Hedge-Funds-Dropping-China-Stocks-For-American-Oil.html |

|

Exxon Faces Shareholder Scrutiny Over Unclear Decommissioning PlansExxon Mobil is facing fresh scrutiny from investors over its climate ambitions at its upcoming AGM next month. Legal and General Investment Management (LGIM) and Christian Brothers Investment Services (CBIS) have co-filed a shareholder resolution, calling on the energy giant to provide more disclosures on potentially stranded assets post-energy transition. The two investment groups are requesting Exxon’s board reveals whether their asset retirement obligations (ARO) are in line with the International Energy Agency’s (IEA) net zero emissions… Read more at: https://oilprice.com/Energy/Energy-General/Exxon-Faces-Shareholder-Scrutiny-Over-Unclear-Decommissioning-Plans.html |

|

Sudan Clashes Could Threaten South Sudan Oil ExportsLandlocked South Sudan’s oil could be at risk as clashes between the army and a paramilitary group in Sudan continued for a third day Monday, with the risk growing that this could turn into a full-blown civil war. Sudan exclusively exports crude oil produced by landlocked South Sudan. No indications have yet emerged that oil exports have been affected; however, previous uprisings in Sudan have taken barrels off the market.The Rapid Support Forces (RSF), a paramilitary group, took up arms against the Sudanese army in the capital Khartoum over… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Sudan-Clashes-Could-Threaten-South-Sudan-Oil-Exports.html |

|

A Beginners Guide To Living Off The GridEnergy security and the energy transition has been catapulted into the limelight over the last year, and the idea of living off the grid has grown to become quite fashionable. People like to talk about it, but few actually go ahead and do it. Why? Because it’s a challenge. Actually, it’s a series of challenges, and while a challenge or two adds spice to life, not everyone is ready to tackle the multiple challenges of off-grid living. Be that as it may, off-grid living is a great way to put the principles of sustainable living into practice.… Read more at: https://oilprice.com/Energy/Energy-General/A-Beginners-Guide-To-Living-Off-The-Grid.html |

|

UK Government Acknowledges Challenges To Meeting Emissions TargetsThe British government has announced plans to expand its flagship renewable energy support scheme as part of its push toward a greener future. The scheme, known as Contracts for Difference (CfD), supports new low-carbon electricity generation projects, such as offshore wind and solar projects, by guaranteeing a fixed, pre-agreed price for the electricity generated over the term of the contract. The program has successfully supported 26.1 gigawatts of low-carbon projects, but the government has recognized that changes are needed… Read more at: https://oilprice.com/Latest-Energy-News/World-News/UK-Government-Acknowledges-Challenges-To-Meeting-Emissions-Targets.html |

|

Can Technology Really Solve Our Climate Problems?My expectations are never disappointed when I read the news each day and find out that the solutions to the problems created by our modern technology are to be found in more technology. We do not need to restructure our society, reduce our consumption, moderate our desires or change our habits. Technology will solve our problems without us having to make any substantial change in our way of life. The breathless coverage of a university-based startup company that will draw carbon dioxide out of the ocean—thereby making room for more… Read more at: https://oilprice.com/Energy/Energy-General/Can-Technology-Really-Solve-Our-Climate-Problems.html |

|

Gazprombank Strengthens Partnership With Indian Banks To Expedite TradeTrade between India and Russia has experienced a significant boost since the West imposed sanctions on Russia last year for its invasion of Ukraine. This has led to a change in the flow of oil and other goods, making Russia the largest supplier of crude to India this year. The growing relationship has been expedited with Russia’s Gazprombank playing a pivotal role by expanding their links with banks in India to facilitate trade between the two countries in national currencies. Gazprombank is Russia’s third-largest lender… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Gazprombank-Strengthens-Partnership-With-Indian-Banks-To-Expedite-Trade.html |

|

Russia’s Seaborne Crude Oil Exports Rebound To Above 3 Million BpdRussian weekly crude oil exports by sea returned to above 3 million barrels per day (bpd) in the week to April 14, bouncing back from an eight-week low in the previous week, data from vessel-tracking services compiled by Bloomberg showed on Monday. Last week’s jump in observed Russian crude oil shipments is not reflective of the ongoing production cut of 500,000 bpd and Moscow’s claims that it had cut its output in March by 700,000 bpd. The latest data showed that the fall in exports in early April may have been short-lived, Bloomberg’s Julian… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Russias-Seaborne-Crude-Oil-Exports-Rebound-To-Above-3-Million-Bpd.html |

|

Natural Gas Prices Jump 8% On Colder-Than-Expected Weather ForecastNatural gas futures jumped by 8% Monday morning as weather models suggested cooler temperatures in the U.S. Natural gas rose to $2.29/MMBtu in early trading. Colder weather is projected to impact the central part of the country before moving eastwards toward the Great Lakes and Northeast. Weekend weather forecasts suggested a second consecutive period of strong demand for natural gas. LNG feed gas demand is also estimated to hit record highs, providing additional support to the market. The forecasts have been labeled… Read more at: https://oilprice.com/Energy/Natural-Gas/Natural-Gas-Jumps-8-On-Colder-Than-Expected-Weather-Forecast.html |

|

Top Oil EFTs See Longest Weekly Run Of Withdrawals In Eight MonthsSome of the leading oil exchange-traded funds saw funds withdrawn in the past four weeks for the longest streak of withdrawals in eight months, according to data compiled by Bloomberg. The funds WisdomTree Brent Crude Oil, United States Oil Fund, WisdomTree WTI Crude Oil, and ProShares Ultra Bloomberg Crude Oil – which collectively account for a quarter of the biggest oil ETFs – saw withdrawals of $211 million last week alone. This was the fourth consecutive week of withdrawals from those funds, making it the longest run of withdrawals… Read more at: https://oilprice.com/Energy/Energy-General/Top-Oil-EFTs-See-Longest-Weekly-Run-Of-Withdrawals-In-Eight-Months.html |

|

Strong Commodity Prices Push Rio Tinto And Anglo American HigherLondon’s FTSE 100 kicked off a fresh week in decent style this morning, lifted higher by investors snapping up shares in mining giants Rio Tinto and Anglo American off the back of a bump in commodity prices. The capital’s premier index added 0.5 percent to reach 7,911.02 points, while the domestically-focused mid-cap FTSE 250 index, which is more responsive to sentiment toward the UK economy, climbed 0.76 percent to 19,389.25 points. Strong advances for big industrial companies pushed the FTSE 100 higher in the City today, with appetite… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Strong-Commodity-Prices-Push-Rio-Tinto-And-Anglo-American-Higher.html |

|

Electric Vehicle Market Share Continues To GrowElectric vehicle (EV) sales have grown rapidly over the past few years, but have they managed to make a dent in the global market? To find out, Visual Capitalist’s Marcus Lu visualized data from BloombergNEF that breaks down annual vehicle sales by three categories: Internal combustion (including traditional hybrids) Plug-in hybrids Battery electric From this, we can see that EVs are definitely building up market share. In fact, combustion vehicle sales appear to have peaked in 2017. Growth in EV Market Share The following table… Read more at: https://oilprice.com/Energy/Energy-General/Electric-Vehicle-Market-Share-Continues-To-Grow.html |

|

Europe’s Largest Nuclear Reactor Comes Online 14 Years Later Than PlannedThe biggest nuclear reactor in Europe by capacity, Olkiluoto 3 in Finland, started regular electricity production on Sunday, entering into service 14 years later than initially planned. Olkiluoto 3, which had completed test production and is now regularly producing electricity, is expected to account for 30% of Finland’s power generation, the operator of the plant, TVO, said in a statement. The reactor with around 1,600 megawatts (MW) of capacity has been plagued by operational issues for years and is the first one to start production in… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Europes-Largest-Nuclear-Reactor-Comes-Online-14-Years-Later-Than-Planned.html |

|

Lithium Prices Could Start To Rebound SoonThe freefall in lithium prices could be about to start reversing soon as demand for EVs and energy storage is expected to pick up from this quarter onwards, analysts say. The price of lithium in China has crashed since the end of last year amid sluggish demand in the world’s largest EV market. But signs have recently started to emerge that the price decline could end soon. “Inventory in the supply chain is already at a low level, and with the recovery of downstream demand in the second quarter, lithium prices could stop falling… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Lithium-Prices-Could-Start-To-Rebound-Soon.html |

|

Apple launches its savings account with 4.15% interest rateApple on Monday said its Apple Card savings account is now available to users with a 4.15% annual percentage yield. Read more at: https://www.cnbc.com/2023/04/17/apple-savings-account-announced-with-4point15percent-interest.html |

|

Alphabet shares dip on report Samsung phones may switch to Microsoft Bing searchThe move could cost Google billions in advertising revenue and reportedly shocked employees, given Samsung’s longtime relationship with Google. Read more at: https://www.cnbc.com/2023/04/17/alphabet-stock-dips-on-report-samsung-phones-may-use-microsoft-bing-search.html |

|

S&P 500 closes higher Monday to kick off a busy earnings week: Live updatesThe S&P 500 rose slightly Monday as traders pored over the latest batch of corporate earnings results, looking for clues on the health of corporate America. Read more at: https://www.cnbc.com/2023/04/16/stock-futures-climb-as-wall-street-awaits-more-bank-earnings-live-updates.html |

|

Nikki Haley gets early support from wealthy donors while some remain on the sidelinesBillionaires and corporate leaders flocked toward Nikki Haley’s campaign in the first quarter, as many megadonors remain on the 2024 sidelines. Read more at: https://www.cnbc.com/2023/04/17/nikki-haley-enjoys-early-billionaire-support-in-2024-race.html |

|

Howard Marks says commercial real estate defaults could add to market stress in the months aheadMarket veteran Howard Marks is sounding the alarm on commercial real estate, with a wave of mortgage defaults set to add stress to the financial system. Read more at: https://www.cnbc.com/2023/04/17/howard-marks-says-commercial-real-estate-defaults-could-add-to-stress.html |

|

Rep. George Santos, who admitted lying about his resume, announces 2024 reelection bidSantos’ brief tenure in Congress has been marked by a cavalcade of scandals, including admitting he lied about key details of his resume. Read more at: https://www.cnbc.com/2023/04/17/george-santos-announces-2024-reelection-bid.html |

|

Bitcoin dips below $30,000, and backlash brews as SEC moves toward DeFi oversight: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, as the tax deadline looms, Patrick White, the co-founder and CEO of Bitwave, explains the need for businesses to account for crypto. Read more at: https://www.cnbc.com/video/2023/04/17/bitcoin-dips-backlash-brews-sec-defi-oversight-cnbc-crypto-world.html |

|

NJ deli stock fraud defendant denied bail as judge calls him a serious flight riskA federal judge ruled Peter Coker Jr. is a serious flight risk and should be held behind bars pending trial because he didn’t try to turn himself in. Read more at: https://www.cnbc.com/2023/04/17/new-jersey-deli-defendant-peter-coker-jr-held-without-bail.html |

|

Ukraine war live updates: Kremlin critic’s 25-year jail sentence condemned by the West; Russia and China build defense tiesRussian President Vladimir Putin met with China’s defense minister on Sunday, marking the latest high-profile meeting between Russian and Chinese officials. Read more at: https://www.cnbc.com/2023/04/17/ukraine-war-live-updates-latest-news-on-russia-and-the-war-in-ukraine.html |

|

This last-second move is ‘one of the only’ things that can still reduce your 2022 taxes, says CPAContributing to certain investing accounts by tomorrow can reduce your 2022 tax bill. Last-second filers should also aim to avoid costly mistakes. Read more at: https://www.cnbc.com/2023/04/17/cpa-last-minute-move-to-reduce-your-2022-taxes.html |

|

Some travel is ‘off the charts’ expensive, experts say. Here are 3 ways to cut some costsThe travel boom in 2023 is fueling higher prices, especially for hotels and international flights. But there’s hope for a good deal, experts said. Read more at: https://www.cnbc.com/2023/04/17/travel-costs-are-off-the-charts-experts-say-heres-how-to-save.html |

|

Bitcoin’s chart has some eerie parallels to gold in the 1970s. What that means for it nextInvestors have dismissed Bitcoin’s digital gold narrative because it’s been trading like a speculative risk asset. But in the 1970s, gold did the same thing. Read more at: https://www.cnbc.com/2023/04/17/bitcoins-chart-has-some-eerie-parallels-to-gold-in-the-1970s.html |

|

US Banks Lost Money On Mortgages For The First Time Since The MBA Began Keeping RecordsUS banks lost money on mortgages in 2022, according to a report from the Mortgage Bankers Association (MBA), which noted that the average loss was $301 on each loan originated that year, vs. an average profit of $2,339 per loan in 2021.

“The rapid rise in mortgage rates over a relatively short period of time, combined with extremely low housing inventory and affordability challenges, meant that both purchase and refinance volume plummeted,” said Marina Walsh, MBA’s vice president of industry analysis, as reported by USA Today. “The stellar profits of the previous two years dissipated because of the confluence of declining volume, lower revenues and higher costs per loan.” The MBA has been trackin … Read more at: https://www.zerohedge.com/economics/us-banks-lost-money-mortgages-first-time-mba-began-keeping-records |

|

The Military-Industrial Stock-Buyback ComplexAuthored by Matt Stoller via ‘BIG by Matt Stoller’ Substack, Why is the US military ceding ground to China? As a new DOD report shows, big defense contractors are middlemen whose main purpose is stock buybacks and dividends.

Today I’m writing about an astonishing report that came from the Pentagon this week on how Wall Street has wrecked the defense industrial base. This chart, which shows stock buybacks are up while research and development is down, is the key finding. Read more at: https://www.zerohedge.com/geopolitical/military-industrial-stock-buyback-complex |

|

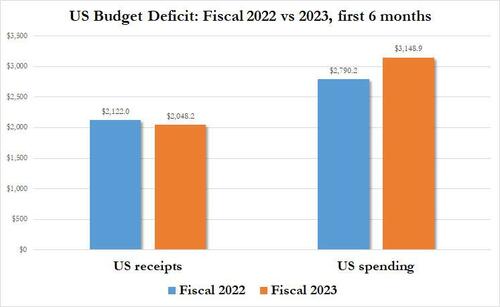

“Does Not Appear Sustainable”: The US Budget Deficit Is Unexpectedly Soaring Again And It’s About To Get Much WorseIt was supposed to be a year when the normalization of the record US budget deficit blowout from the covid collapse continued; it has ended up being anything but. As the US Treasury revealed in its latest Monthly Treasury Statement, in the first six months of the fiscal year ended March 31, the US fiscal picture is once again deteriorating rapidly, on both revenue and spending. As shown in the chart below, gross revenues declined by 4% to $2.048 trillion from $2.121 trillion in the same period a year earlier, while spending over the same period soared by $358 billion to $3.149 trillion from $2.790 trillion.

Added across, in March the US deficit soared by $378 billion – the biggest monthly deficit since September 22, the last month of the previous fiscal year, and for the first six months of 2023 the total US deficit jumped to $1.10 trillion, up a massive 65% compa … Read more at: https://www.zerohedge.com/economics/us-budget-deficit-quietly-soaring-again-and-its-about-get-much-worse-heres-why |

|

The Fed Cannot Fix Today’s Energy Inflation ProblemAuthored by Gail Tverberg via Our Finite World blog, There is a reason for raising interest rates to try to fight inflation. This approach tends to squeeze out the most marginal players in the economy. Such businesses and governments tend to collapse, as interest rates rise, leaving less “demand” for oil and other energy products. The institutions that are squeezed out range from small businesses to financial institutions to governmental organizations. The lower demand tends to reduce inflationary pressure. The amount of goods and services that the world’s economy can produce is largely determined by fossil fuel supplies, plus our ability to use “complexity” in many forms to produce the items that the world’s growing population requires. Adding debt helps add complexity of various types, such as more international trade, more advanced education, and more specialized tools. For a while, the combination of growing energy supplies and growing complexity have helped pull economies along. Unfortunately, the world’s oil supply is no longer growing. Without an adequate oil supply, it becomes difficult to maintain complexity because complex solutions, such as international trade, require adequate oil supplies. Inasmuch as we seem to be reaching energy and complexity limits, nothing the regulators try to do to change the debt and money supplies–even reeling them back in–can fix the underlying oil (and total energy) problem. I expect that the rich parts of the world, including the US, Europe, and Japan … Read more at: https://www.zerohedge.com/energy/fed-cannot-fix-todays-energy-inflation-problem |

|

Forced prepay meter installations to be banned in homes of over-85sEnergy suppliers will also have to give struggling customers more chances to clear their debts. Read more at: https://www.bbc.co.uk/news/business-65305959?at_medium=RSS&at_campaign=KARANGA |

|

EY cuts 3,000 jobs in US blaming ‘overcapacity’The decision comes days after the firm called off a radical restructuring. Read more at: https://www.bbc.co.uk/news/business-65305165?at_medium=RSS&at_campaign=KARANGA |

|

Retiring landlords risk fuelling rental shortageInvestors with buy-to-let mortgages are retiring but new landlords are not replacing them. Read more at: https://www.bbc.co.uk/news/business-65298662?at_medium=RSS&at_campaign=KARANGA |

|

Decoding Blinkit delivery executive strike: Should Zomato investors worry?Blinkit delivery executives servicing ~50% of the dark stores in the NCR area are on strike since April 12 Read more at: https://economictimes.indiatimes.com/markets/web-stories/decoding-blinkit-delivery-executive-strike-should-zomato-investors-worry/articleshow/99556385.cms |

|

Tech View: Nifty charts indicate more pain ahead. What should traders do on TuesdayNifty has to hold above 17,717 zones to extend the move towards 17,850 and 18,000 zones, while on the downside, supports are placed at 17,620 and 17,500 marks, said Chandan Taparia of Motilal Oswal. Options data suggests a shift in the trading range between 17,400 to 18,000 zones, while a shift in the immediate trading range between 17,500 to 17,850 zones Read more at: https://economictimes.indiatimes.com/markets/stocks/news/tech-view-nifty-charts-indicate-more-pain-ahead-what-should-traders-do-on-tuesday/articleshow/99559841.cms |

|

Infosys shares tank 15%, hit 52-week low on weak Q4 earnings. Should you buy or sell?Despite calling Infosys’ January-March 2023 quarter results “shocking”, Jefferies maintained a ‘Buy’ on the second-largest IT services company for a price target of Rs 1,770 based on 24X 12m forward EPS. Key risks include weaker revenue growth, lower margin, unfavorable currency, and corporate action, the brokerage said. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/should-you-buy-sell-or-hold-infosys-after-disappointing-q4-earnings/articleshow/99546359.cms |

|

Market Snapshot: Dow turns positive in afternoon trade with earnings season set to pick up steamS&P 500 hovers near the top of the 3,800 to 4,200 range within which it has vacillated for about five months. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-71D6-974A58D42BD9%7D&siteid=rss&rss=1 |

|

Is it safe to live near recycling centers? Questions surge after Indiana plastics site burns.Recycling centers are challenging to regulate because they range from small community-led efforts to major industrial facilities. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-71D4-9C1FB6A6611D%7D&siteid=rss&rss=1 |

|

Metals Stocks: Gold ends lower after brief dip below $2,000 an ounceGold prices decline on Monday, briefly slipping below the key $2,000 mark after a Friday selloff that saw the most-active gold futures contract snap a streak of weekly gains. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-71D6-B6B3BA34424F%7D&siteid=rss&rss=1 |