Summary Of the Markets Today:

- The Dow closed down 144 points or 0.42%,

- Nasdaq closed down 0.35%,

- S&P 500 closed down 0.21%,

- Gold $2,020 down $36,

- WTI crude oil settled at $83 up $0.44,

- 10-year U.S. Treasury 3.517% up 0.066 points,

- USD $101.58 up $0.56,

- Bitcoin $30,347 down $5,

- Baker Hughes Rig Count: U.S. -3 to 748 Canada -16 to 111

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our Economic Forecast for April 2023

Today’s Economic Releases:

The Advance Estimates of U.S. Retail and Food Services Sales for March 2023 show that sales were down 1.0 percent from the previous month, but up 2.9 percent from March 2022 – after inflation adjustment retail sales is down 0.3% year-over-year. It appears the consumer continues to marginally slow its purchases.

Industrial production rose 0.5 percent year-over-year in March 2023 (blue line in the graph below). Components manufacturing declined 0.9% year-over-year (red line on the graph below), mining output improved 5.4% percent year-over-year (orange line on the graph below), and utilities jumped to 4.2% percent year-over-year (green line on the graph below). Capacity utilization moved up to 79.8 percent in March, a rate that is 0.1 percentage points above its long-run (1972–2022) average. There is little evidence of a manufacturing resurgence.

In a bit of good news for consumers, U.S. import prices decreased 4.6% year-over-year in March 2023 (blue line on the graph below). Lower March prices for nonfuel industrial supplies and materials; consumer goods; foods, feeds, and beverages; capital goods; and automotive vehicles all contributed to the overall decrease in nonfuel import prices. Nonfuel import prices declined 1.5 percent from March 2022 to March 2023, the first 12-month drop since June 2020. And export prices also declined to 4.8% year-over-year (red line on the graph below).

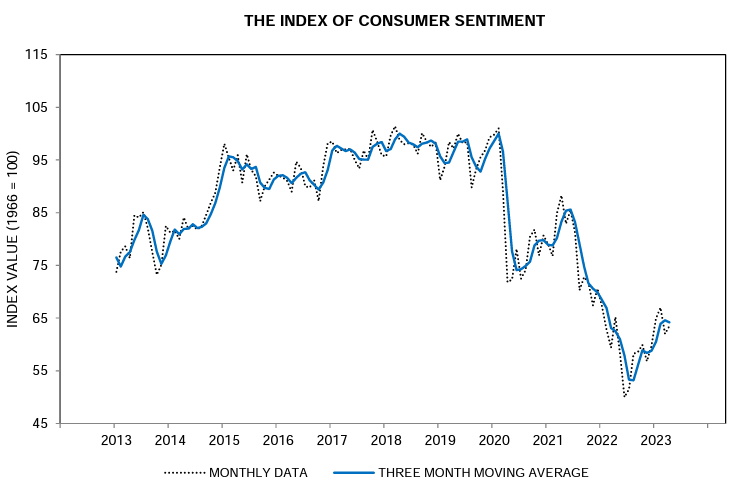

The University of Michigan’s Consumer Sentiment Index for April 2023 is 65.2, down from 67.2 in March. This is the lowest level since August 2011. The index’s decline was driven by a drop in all three of its components: current conditions, expectations, and buying plans.

The current conditions index fell to 70.7 from 73.2 in March. This suggests that consumers are feeling less optimistic about the current state of the economy. The expectations index fell to 64.7 from 68.1 in March. This suggests that consumers are less optimistic about the future of the economy. The buying plans index fell to 52.9 from 56.0 in March. This suggests that consumers are less likely to make major purchases in the near future.

A summary of headlines we are reading today:

- U.S. Sends Delegation To Saudi Arabia To Discuss Energy And Security

- U.S. Drilling Activity Slips Further

- Auto Manufacturers To Brace For Turmoil Amid Supply Chain Disruptions

- Oil Prices Rise As Traders Brush Off OPEC Demand Warnings

- Dow sheds more than 100 points Friday, but notches fourth straight positive week: Live updates

- Jamie Dimon issues warning on rates: ‘It will undress problems in the economy’

- Nvidia’s top A.I. chips are selling for more than $40,000 on eBay

- Recession Odds Jump As The Fed Crushes Consumers

- Market Extra: ‘Fed-is-going-to-stop-soon’ trade peters out in stocks, bonds amid prospect of at least one more rate hike

- Market Snapshot: U.S. stocks retreat from mid-February high as traders digest bank earnings, retail sales and Fed comments

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Possible Cuts In Government Funding Could Affect RenewablesVia AG Metal Miner The Renewables MMI (Monthly Metals Index) dropped by 3.65% between March and April. This represents the index’s most significant drop since November 2022. Despite this, the index still has yet to break out of its sideways trend. However, the falling economy continues to keep both renewable energy companies and investors on edge. The Inflation Reduction Act currently supports the index, particularly electric vehicles. However, renewable resources could start feeling the strain with the economy slowing down… Read more at: https://oilprice.com/Energy/Energy-General/Possible-Cuts-In-Government-Funding-Could-Affect-Renewables.html |

|

U.S. Sends Delegation To Saudi Arabia To Discuss Energy And SecurityWhite House Coordinator for the Middle East and North Africa and the U.S. Special Presidential Coordinator for Global Infrastructure and Energy Security visited Saudi Arabia officials on Friday to discuss regional security and energy matters. It is the senior-most U.S. delegation to visit Saudi Arabia since the latter announced a large crude oil production cut in the Fall of last year. White House Coordinator Brett McGurk and Coordinator for Global Infrastructure and Energy Security Amos Hochstein visited with Saudi Arabia’s Foreign Minister… Read more at: https://oilprice.com/Latest-Energy-News/World-News/US-Sends-Delegation-To-Saudi-Arabia-To-Discuss-Energy-And-Security.html |

|

Putin’s Digital Disconnect: A Leader Without A SmartphoneDecision-making in the Kremlin had been so erratic—even before the re-invasion of Ukraine on February 24, 2022—that the proposition of President Vladimir Putin inhabiting a bubble of servile courtiers and carefully doctored information appeared perfectly plausible. Early April 2023 has brought even more evidence supporting this assumption of detachment from reality typical for mature autocratic regimes but aggravated by an unhealthy ambition for determining the course of global affairs. Gleb Karakulov, who had held the rank of captain… Read more at: https://oilprice.com/Geopolitics/International/Putins-Digital-Disconnect-A-Leader-Without-A-Smartphone.html |

|

U.S. Drilling Activity Slips FurtherThe total number of total active drilling rigs in the United States fell by 3 this week, according to new data from Baker Hughes published Friday, after falling 4 last week. The total rig count fell to 748 this week—55 rigs higher than the rig count this time in 2022—still 327 rigs lower than the rig count at the beginning of 2019, prior to the pandemic. Oil rigs in the United States decreased by 2 this week, for the secnd week in a row, landing at 588. Gas rigs fell by 1 to 157. Miscellaneous rigs stayed the same. The rig count in… Read more at: https://oilprice.com/Energy/Energy-General/US-Drilling-Activity-Slips-Further.html |

|

Lula Seeks To Revive Brazilian Foreign Policy Through Peace DiplomacyBrazilian President Luiz Inacio Lula da Silva kicked off a state visit to China in the country’s financial hub of Shanghai as he seeks to position himself as a peace broker in the ongoing war in Ukraine while attempting to elevate Brazil’s global status and boost economic ties with Beijing. The left-wing Brazilian president arrived late on April 11 and will also meet Chinese leader Xi Jinping in Beijing on April 14 before departing China a day later.In Shanghai, Lula attended the official swearing-in of close adviser and former Brazilian President… Read more at: https://oilprice.com/Geopolitics/International/Lula-Seeks-To-Revive-Brazilian-Foreign-Policy-Through-Peace-Diplomacy.html |

|

Iraq’s Oil Exports Still Seeing 450,000 bpd HiccupTurkey still hasn’t resumed the flow of crude oil from Iraq, with 450,000 bpd in Iraqi oil exports still offline, anonymous sources told Reuters on Friday. The International Chamber of Commerce (ICC) ruled three weeks ago that Turkey must pay Iraq $1.5 billion in damages for receiving oil from the semi-autonomous Kurdistan region in Iraq without Baghdad’s permission from 2014 to 2018. Turkey responded by halting the flow of crude oil overseen by the Kurdistan Regional Government. The flows have not resumed despite a temporary agreement… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Iraqs-Oil-Exports-Still-Seeing-450000-bpd-Hiccup.html |

|

Glencore’s Latest Takeover Bid Rebuffed By Teck ResourcesCopper miner Teck Resources has rejected a sweetened bid from Glencore and made changes to a proposed restructuring plan to allow for an earlier full separation of its metals and coal divisions. Glencore has offered Teck’s shareholders 24 percent of the combined metals group and up to $8.2bn in cash for those who may not want exposure to thermal coal, which is the most polluting fossil fuel. It had initially not offered a cash option. Glencore’s play for the Vancouver-based miner comes amid a rising wave of buyout offers for mines and… Read more at: https://oilprice.com/Energy/Energy-General/Glencores-Latest-Takeover-Bid-Rebuffed-By-Teck-Resources.html |

|

Auto Manufacturers To Brace For Turmoil Amid Supply Chain DisruptionsWSJ cited data from multiple auto data providers that show the market shift and what appears to be an emerging discount wave on new vehicles, granted lending standards remain tight. The number one reason auto manufacturers experienced a profit boom during Covid was due to supply chain disruptions that led to inventory declines, and cheap credit allowed consumers to panic buy anything on the dealer lot, driving prices through the roof. Now inventory lots are filling up. According to data provider Cox Automotive, the weekly… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Auto-Manufacturers-To-Brace-For-Turmoil-Amid-Supply-Chain-Disruptions.html |

|

Corruption In Ukraine Remains A Major ProblemWar is a dirty business. The war profiteers descend on these battlefields like vultures. There are no exceptions. Ask Bosnians. Ask Iraqis. Ask Syrians. Take your pick. Everything is for sale on the battlefield. That this type of war profiteering is happening in Ukraine should come as no surprise to anyone. By 1999 already, corrupt forces in Bosnia had plundered $1 billion in foreign aid money. Of course, that doesn’t compare to the magnitude of the corruption that went down in Iraq in the early 2000s. The Oil-for-Food scandal… Read more at: https://oilprice.com/Energy/Energy-General/Corruption-In-Ukraine-Remains-A-Major-Problem.html |

|

Leaked Intelligence Shows Waning U.S. Influence In The Middle EastPolitics, Geopolitics & Conflict The purported U.S. intelligence leaks that were mysteriously been floating around social media for a month (possibly longer) before being detected speak volumes in one particular area: Relations between Moscow and the power centers of the MENA region. Keeping in mind that the alleged intel may or may not be real, though the Pentagon is conducting an investigation into the leaks and the FBI has arrested a subject, the MENA-related “classified” intelligence paints a picture of the U.S. losing major… Read more at: https://oilprice.com/Energy/Energy-General/Leaked-Intelligence-Shows-Waning-US-Influence-In-The-Middle-East.html |

|

Chinese Oil Imports Spike1. Chinese Oil Imports Soar to New Highs- Chinese crude imports have reached their highest level since June 2020, with the country’s General Administration of Customs showing 52.3 million tons of oil imported, up 22% year-on-year. – Despite GDP growth slowing down to 5% this year, China’s oil demand has been greatly boosted by the removal of stringent travel curbs and re-emerging flight activity. – According to Kpler data, exports of Chinese products plunged last month to a third of December 2022 readings (when they hit an all-time… Read more at: https://oilprice.com/Energy/Energy-General/Chinese-Oil-Imports-Spike.html |

|

Oil Prices Rise As Traders Brush Off OPEC Demand WarningsCrude oil closed lower on Thursday after an OPEC report raised concerns about summer demand, encouraging traders to book profits after the market failed to follow through to the upside following Wednesday’s big gain. US benchmark West Texas Intermediate futures gained 2% on Wednesday while testing its highest level in more than a month. This move was fueled by cooling US inflation that raised hopes that the US Federal Reserve will stop raising interest rates. The upside momentum came to an abrupt halt, however, when OPEC flagged downside… Read more at: https://oilprice.com/Energy/Energy-General/Oil-Prices-Rise-As-Traders-Brush-Off-OPEC-Demand-Warnings.html |

|

Oil Prices Bolstered By IEA WarningsOil prices dropped on Thursday as OPEC adjusted its demand forecast, but the IEA’s warning of a significant supply deficit later this year helped to bolster prices on Friday morning.Oilprice Alert: Whether you are new to the oil and gas industry or an energy market veteran, you will regret not signing up for Global Energy Alert. Oilprice.com’s premium newsletter provides everything from geopolitical analysis to trading analysis, and all for less than a cup of coffee per week.Friday, March 14th, 2023The optimism that nudged Brent above $87 per… Read more at: https://oilprice.com/Energy/Energy-General/Oil-Prices-Bolstered-By-IEA-Warnings.html |

|

Russia’s Oil Revenues Rebound As Exports Surge To Three-Year HighRussia’s crude oil and refined product exports surged in March to the highest level since April 2020, as fuel exports jumped, bringing $1 billion more to Putin’s oil revenues last month compared to February, the International Energy Agency (IEA) said on Friday. Russian crude and product exports increased in March by 600,000 barrels per day (bpd), reaching 8.1 million bpd, the highest oil export levels from Russia in three years, the IEA said in its closely-watched Oil Market Report today. A jump in product shipments accounted for most of… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Russias-Oil-Revenues-Rebound-As-Exports-Surge-To-Three-Year-High.html |

|

IEA Sees Global Oil Demand Hitting Record High In 2023Despite concerns about economic growth with the ongoing interest rate hikes, global oil demand is still set for a record high 101.9 million barrels per day (bpd) this year, driven by a resurgent Chinese consumption, the International Energy Agency (IEA) said on Friday. Buoyed by a resurgent China, world oil demand is set for growth of 2 million bpd this year, to hit a record 101.9 million bpd, the IEA said in its Oil Market Report for April today. The estimate remains unchanged from last month’s report. Yet, there will be a widening… Read more at: https://oilprice.com/Energy/Energy-General/IEA-Sees-Global-Oil-Demand-Hitting-Record-High-In-2023.html |

|

Dow sheds more than 100 points Friday, but notches fourth straight positive week: Live updatesInvestors assessed a weak retail sales report, as well as stronger-than-expected corporate earnings. Read more at: https://www.cnbc.com/2023/04/13/stock-market-today-live-updates.html |

|

Today’s homebuyers have their mortgage rate tipping point, and it’s artificially lowThe majority of potential homebuyers say they won’t accept a 30-year fixed mortgage rate over 5.5%, according to a new survey. The current rate is around 6.4%. Read more at: https://www.cnbc.com/2023/04/14/homebuyers-mortgage-rate-tipping-point-is-artificially-low.html |

|

Supreme Court lifts abortion pill restrictions for nowA U.S. appeals court blocked an earlier decision suspending the FDA’s approval of mifepristone but imposed restrictions on its use. Read more at: https://www.cnbc.com/2023/04/14/supreme-court-temporarily-blocks-abortion-pill-restrictions.html |

|

Jamie Dimon issues warning on rates: ‘It will undress problems in the economy’Higher rates jammed up swaths of the economy this year, from bankers who bet on low rates to consumers who can no longer afford mortgages or credit card debt. Read more at: https://www.cnbc.com/2023/04/14/jamie-dimon-warning-on-rates-it-will-undress-problems-in-the-economy.html |

|

Cash App founder Bob Lee was stabbed to death after argument about the suspect’s sister, court documents showThe suspect, 38-year-old IT consultant Nima Momeni, stabbed Lee three times with a 4-inch kitchen knife, according to documents obtained by NBC News. Read more at: https://www.cnbc.com/2023/04/14/bob-lee-stabbed-after-argument-about-suspects-sister-court-docs.html |

|

Boeing’s 737 Max problem is the latest headache for airlines hungry for new planesSouthwest and American are among the airlines expecting new Max aircraft this year. Read more at: https://www.cnbc.com/2023/04/14/boeings-737-max-problem-latest-headache-for-airlines.html |

|

Ukraine war live updates: Pentagon leak suspect, 21, appears in court; Ukraine making some withdrawals in Bakhmut, UK saysThe U.S. government and its allies are reeling from the discovery that the suspected source of a major intelligence breach is a 21-year-old National Guardsman. Read more at: https://www.cnbc.com/2023/04/14/russia-ukraine-live-updates.html |

|

OpenAI CEO Sam Altman addresses letter from Musk and other tech leaders calling for A.I. pauseMusk, Wozniak and other tech leaders said that AI companies should halt the development of anything more powerful than GPT-4 in an open letter last month. Read more at: https://www.cnbc.com/2023/04/14/openai-ceo-altman-addresses-letter-from-musk-wozniak-calling-for-ai-pause.html |

|

Elon Musk is reportedly planning an A.I. startup to compete with OpenAI, which he cofoundedMusk’s entry would be the latest in an increasingly crowded artificial intelligence space, even as the CEO questions whether AI development is moving safely. Read more at: https://www.cnbc.com/2023/04/14/elon-musk-is-reportedly-planning-an-ai-startup-to-compete-with-openai.html |

|

Nvidia’s top A.I. chips are selling for more than $40,000 on eBayThe H100, Nvidia’s latest flagship AI chip, was announced last year and is currently being shipped to data centers. Read more at: https://www.cnbc.com/2023/04/14/nvidias-h100-ai-chips-selling-for-more-than-40000-on-ebay.html |

|

This is the ‘best defense’ against inflation, says financial advisorInflation has been easing but remains high. There are two basic ways for budget-strapped consumers to manage rising prices, one advisor said. Read more at: https://www.cnbc.com/2023/04/14/the-best-defense-against-inflation.html |

|

Photos show scenes of South Florida flooding after historic stormGov. Ron DeSantis on Thursday declared a state of emergency for Broward County after a historic storm hit Fort Lauderdale and other parts of South Florida. Read more at: https://www.cnbc.com/2023/04/14/photos-show-flooding-in-fort-lauderdale-other-parts-of-south-florida.html |

|

Burger King is selling more Whoppers than ever before in early days of its U.S. turnaroundEarly steps to improve operations and jazz up Burger King marketing are already boosting sales and customer satisfaction. Read more at: https://www.cnbc.com/2023/04/14/burger-kings-turnaround-plan-boosts-sales-customer-satisfaction.html |

|

Tesla Shares Dip After Company Slashes Prices Yet Again, This Time In Europe, Israel And SingaporeTesla is once again slashing prices to help spur demand, and Wall Street isn’t necessarily taking it as a good sign. Shares dipped about 2% in the pre-market session on Friday (before rebounding and then selling off back to the lows) after it was reported that the company would be slashing the price of its vehicles in Europe, Israel and Singapore. Tesla said it “cut prices in numerous European markets including Germany and France because of a scaling up and improvement in its production capacity,” according to a Reuters report out Friday morning.

Prices in Germany for the Model 3 and Model Y were cut between 4.5% and 9.8%, marking the second price cut for the country this year, the report says. Singapore saw price cuts of between 4.3% and 5% and Israel saw price cuts of an astounding 25% for the base rear-wheel drive Model 3. Just days ago … Read more at: https://www.zerohedge.com/markets/tesla-shares-dip-after-company-slashes-prices-yet-again-time-europe-israel-and-singapore |

|

Recession Odds Jump As The Fed Crushes ConsumersAuthored by Lance Roberts via RealInvestmentAdvice.com, Recession odds have climbed considerably since Jerome Powell’s testimony before Congress and the latest FOMC meeting. However, the recent failures of Silicon Valley Bank (SVB) and Credit Suisse (CS), as higher rates impact regional bank liquidity, also added to the risks. This isn’t the first time we have warned the aggressive rate hiking campaign would either cause a recession or “break something.”

You get the idea. We have been warning of the risk for quite some time. However, the financial markets continue to ignore the w … Read more at: https://www.zerohedge.com/markets/recession-odds-jump-fed-crushes-consumers |

|

Alleged Pentagon Leaker Charged Under Espionage Act In Boston CourtThe alleged leaker of hundreds of classified Pentagon and US intelligence documents, 21-year-old Jack Teixeira, was charged Friday with violating the Espionage Act. An additional statute was also cited which prohibits the unauthorized removal of classified documents. Both violations could bring 15 or 20 years in prison if convicted after the Pentagon deemed his actions as posing a “very serious” national security risk. The documents were a mix of classifications: everything from sensitive but unclassified, to Secret, to ‘Top Secret/NOFORN’ – meaning foreign allies were not allowed access to these. Espionage Act charges typically carry up to 10 years in prison each.

Teixeira appeared in a federal court on Friday in Boston, after a somewhat dramatic FBI raid and arrest outside a residence in North Dighton, Massachusetts the day prior. One question which has been commonly asked is how such a young, relatively low ranking national guardsman was able to access so many classified and even Top S … Read more at: https://www.zerohedge.com/political/alleged-pentagon-leaker-charged-under-espionage-act-boston-court |

|

Indian Banks Fear Mess If Urals Passes $60 Price CapBy Charles Kennedy of OilPrice.com

Indian banks fear an end to the country’s major intake of discounted Russian oil in the wake of OPEC+ surprise production cuts, which have helped push Urals crude close to overrunning the G7’s $60 per barrel price cap. According to The Millennium Post, citing an unnamed refinery executive, both the State Bank of India and Bank of Baroda have informed refiners they will not handle payments for oil bought above the limit. In the meantime, Indian banks are very closely monitoring crude prices at ports, where costs of logistics are intermingled, making for a more co … Read more at: https://www.zerohedge.com/markets/indian-banks-fear-mess-if-urals-passes-60-price-cap |

|

Aldi, Lidl and Asda follow rivals in cutting milk pricesSeveral supermarkets are reducing the cost of milk in a sign that inflation could be easing. Read more at: https://www.bbc.co.uk/news/business-65267367?at_medium=RSS&at_campaign=KARANGA |

|

Ford launches hands-free driving on UK motorwaysGovernment approves Ford’s BlueCruise system to allow hands-off, eyes-on driving. Read more at: https://www.bbc.co.uk/news/business-65272929?at_medium=RSS&at_campaign=KARANGA |

|

CBI is no longer relevant in its current form, says ex-Barclays directorBaroness Wheatcroft says the embattled lobby group faces challenges in representing all businesses. Read more at: https://www.bbc.co.uk/news/business-65272827?at_medium=RSS&at_campaign=KARANGA |

|

9 IT stocks showing bearish trend>> For more such web stories click on the ET icon below Read more at: https://economictimes.indiatimes.com/markets/web-stories/9-it-stocks-showing-bearish-trend/articleshow/99499490.cms |

|

Gold holds near one-year high as Fed seen pausing ratesThe Fed, meanwhile, considered a rate-hike pause in March in the face of the sudden collapse of two U.S. regional lenders, yet inflationary pressures were seen as more important. The collapse pushed bullion over $2,000.Gold is considered a hedge against inflation and economic uncertainties, but higher interest rates dim non-yielding bullion’s appeal Read more at: https://economictimes.indiatimes.com/markets/commodities/news/gold-holds-near-one-year-high-as-fed-seen-pausing-rates/articleshow/99494335.cms |

|

Rich using PMS & AIF for alpha generation, MF for beta allocation: Mrinal SinghWe are long-term bottom-up investors and don’t try to take a broad-based market call in the near term. In the words of Benjamin Graham “… in the short run the market is a voting machine, but in the long run it is a weighing machine”. Read more at: https://economictimes.indiatimes.com/markets/expert-view/rich-using-pms-aif-for-alpha-generation-mf-for-beta-allocation-mrinal-singh/articleshow/99489467.cms |

|

Market Extra: ‘Fed-is-going-to-stop-soon’ trade peters out in stocks, bonds amid prospect of at least one more rate hikeHawkish remarks from the Fed, solid bank earnings reports, and consumer-sentiment data contribute to an abrupt adjustment in the financial market’s thinking. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-71D5-75380C3CC174%7D&siteid=rss&rss=1 |

|

Market Snapshot: U.S. stocks retreat from mid-February high as traders digest bank earnings, retail sales and Fed commentsU.S. stocks on Friday retreated from their highest levels since mid-February as investors digest strong big bank earnings, weak retail sales, and hawkish comments from a Federal Reserve official. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-71D4-F584BD789DA0%7D&siteid=rss&rss=1 |

|

The Tell: ‘Dangerous times’: These aerospace and defense, cybersecurity ETFs are on ‘verge of breakouts’Heightened geopolitical tensions and cybersecurity concerns may be propelling ETFs in those those areas toward potential ‘breakouts.” Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-71D5-DAC4DC9071E2%7D&siteid=rss&rss=1 |