Summary Of the Markets Today:

- The Dow closed down 38 points or 0.11%,

- Nasdaq closed down 0.85%,

- S&P 500 closed down 0.41%,

- Gold $2,028 up $9.30,

- WTI crude oil settled at $83 up $1.68,

- 10-year U.S. Treasury 3.402% down 0.032 points,

- USD $101.56 down $0.64,

- Bitcoin $29,845 down $300,

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our Economic Forecast for April 2023

Today’s Economic Releases:

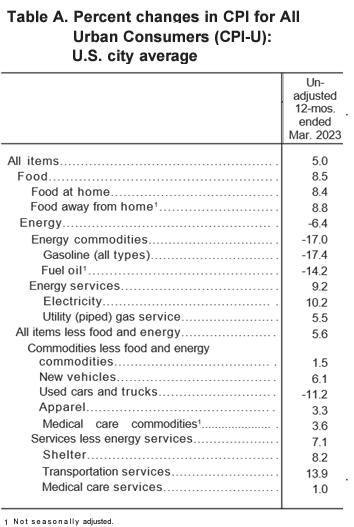

The Consumer Price Index for All Urban Consumers (CPI-U) rose 0.1% in March 2023 but over the last 12 months, the all items index increased by 5.0% (blue line on the graph below). The index for shelter was by far the largest contributor to the monthly all-items increase. This more than offset a decline in the energy index, which decreased 3.5% over the month as all major energy component indexes declined. The all items index less food and energy index rose 5.6% over the last 12 months (red line on the graph below). The Fed looks more at inflation excluding food and energy – so in their view, the rate of inflation has little changed since January 2022.

Today, the Federal Reserve released the minutes for their FOMC meeting ending on March 22, 2023. The minutes note that some members of the Committee were concerned that the war in Ukraine could lead to a further increase in inflation. However, the Committee ultimately decided that it was important to take action to combat inflation, even in the face of uncertainty about the war. The minutes also note that the Committee is closely monitoring the labor market. The minutes state that the labor market is “tight” and that there are “signs of wage pressures.” The Committee is concerned that wage pressures could lead to a further increase in inflation. Highlights:

… In assessing the economic outlook, participants noted that since they met in February, data on inflation, employment, and economic activity generally came in stronger than expected. They also noted, however, that the developments in the banking sector that had occurred late in the intermeeting period affected their views of the economic and policy outlook and the uncertainty surrounding that outlook. …

…Participants agreed that the actions taken so far by the Federal Reserve in coordination with other government agencies, as well as actions taken by foreign authorities to address banking and financial stresses outside the U.S., had helped calm conditions in the banking sector. Even with the actions, participants recognized that there was significant uncertainty as to how those conditions would evolve. Participants assessed that the developments so far would likely lead to some weakening of credit conditions, as some banks were likely to tighten lending standards amid rising funding costs and increased concerns about liquidity. Participants noted that it was too early to assess with confidence the magnitude of the effect of a credit tightening on economic activity and inflation, and that it was important to continue to closely monitor developments and update assessments of the actual and expected effects of credit tightening. …

… participants observed that wage growth appeared to be slowing gradually amid this apparent easing in labor demand and increase in labor supply. However, participants assessed that labor demand continued to substantially exceed labor supply, and several participants pointed out that wage growth was still well above the rates that would be consistent over the longer run with the 2 percent inflation objective, given current estimates of trend productivity growth. …

… Participants generally observed that the recent developments in the banking sector had further increased the already-high level of uncertainty associated with their outlooks for economic activity, the labor market, and inflation. Participants saw risks to economic activity as weighted to the downside. …

… In their consideration of appropriate monetary policy actions at this meeting, participants concurred that inflation remained well above the Committee’s longer-run goal of 2 percent and that the recent data on inflation provided few signs that inflation pressures were abating at a pace sufficient to return inflation to 2 percent over time. Participants also noted that recent developments in the banking sector would likely result in tighter credit conditions for households and businesses and weigh on economic activity, hiring, and inflation, though the extent of these effects was highly uncertain. …

… due to the potential for banking-sector developments to tighten financial conditions and to weigh on economic activity and inflation, they judged it prudent to increase the target range by a smaller increment at this meeting.

A summary of headlines we are reading today:

- U.S. To Refill SPR This Year If Advantageous

- World’s Largest Uranium Miner Ramps Up Output To Sell To New Customers

- Oil Prices Gain 2% As Inflation Data Remains Hot

- Clean Energy Sources Produced 39% Of Global Electricity In 2022

- Fed expects banking crisis to cause a recession this year, minutes show

- Stocks fall as fear of recession weighs on investors, Dow snaps four-day win streak: Live updates

- Warren Buffett says we’re not through with bank failures

- FOMC Minutes Show Staff Expect ‘Mild Recession’, All Members Backed Continued QT, 25bps Hike

- Market Snapshot: U.S. stocks erase gains in final hour of trade after minutes show Fed officials expect banking crisis to cause economic slowdown this year

- Bond Report: Two- and 10-year Treasury yields drop by most in a week after Fed minutes, March inflation report

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Iraq Must Diversify Despite Strong Oil RevenuesAfter a successful 2022, Iraq’s oil and gas industry has faced challenges this year following the closure of an export pipeline in the north of the country. Conflict over the semi-autonomous Kurdistan region has made it complicated to export the crude that provides most of the country’s income. An overreliance on oil revenues has led to economic instability and the dire need for economic diversification to bring about greater stability. However, with new energy projects in the works, with international partners, Iraq’s oil industry… Read more at: https://oilprice.com/Energy/Crude-Oil/Iraq-Must-Diversify-Despite-Strong-Oil-Revenues.html |

|

U.S. To Refill SPR This Year If AdvantageousAfter saying it would take years to refill the SPR, U.S. Energy Secretary Jennifer Granholm is now saying that the Biden Administration plans to refill the SPR soon. According to Secretary Granholm, the Biden Administration hopes to refill the SPR at lower oil prices yet this year—provided it is advantageous to taxpayers. WTI prices dipped to sub-$70 per barrel last month but have since surged back to more than $83 per barrel. Last October, the Administration said it would repurchase crude oil for the SPR when prices were at or below $67-$72… Read more at: https://oilprice.com/Latest-Energy-News/World-News/US-To-Refill-SPR-This-Year-If-Advantageous.html |

|

Will Occidental’s Billion-Dollar Carbon Capture Bet Pay Off?U.S. oil and gas company Occidental Petroleum Corporation (OXY) has big decarbonization plans to keep its oil production going as long as it can. As the U.S. undergoes a green transition, putting pressure on companies across all industries to reduce their greenhouse gas emissions, several companies are introducing new technologies aimed at helping them produce lower-carbon fossil fuels. The use of carbon capture and storage (CCS) technologies is helping energy firms to keep their operations running even as the government pushes for a shift away… Read more at: https://oilprice.com/Energy/Energy-General/Will-Occidentals-Billion-Dollar-Carbon-Capture-Bet-Pay-Off.html |

|

What’s Next For Venezuela After Another Major Oil Corruption Scandal?On March 20th, Tarek Al Aissami, Venezuela’s former Oil Minister, announced his resignation amidst a large corruption scandal at the state oil company PDVSA. The scandal involved the disappearance of 3 billion dollars, which was connected to the sale of oil cargoes and connected with the crypto system. This led to the detention of Joselit Ramirez, the top official of the official cryptocurrency mechanism called SUNACRIP, who was known to be close to Tarek Al Aissami. In a rare move, Al Aissami resigned to President Maduro, which gave way for an… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Whats-Next-For-Venezuela-After-Another-Major-Oil-Corruption-Scandal.html |

|

World’s Largest Uranium Miner Ramps Up Output To Sell To New CustomersEurope has been weaning itself off Russian crude, refined products, and natural gas in the wake of the war in Ukraine. But the dependency on Russia’s vast nuclear industry has been more complicated. Russia, through its state-owned nuclear power company, Rosatom, dominates the global nuclear supply chain. It’s one of the major suppliers of enriched uranium to Europe’s power plants. But there are emerging signs of a future shift in uranium sourcing from Russia to Kazakhstan. Bloomberg reported Kazakhstan’s state-owned uranium miner Kazatomprom… Read more at: https://oilprice.com/Alternative-Energy/Nuclear-Power/Worlds-Largest-Uranium-Miner-Ramps-Up-Output-To-Sell-To-New-Customers.html |

|

U.S. Envoy Warns Of The Dangers Of Russian DisinformationWestern Balkan countries are vulnerable to Russian and Chinese disinformation, “a big chunk” of which comes out of Serbia, a U.S. diplomat whose job involves exposing and countering foreign propaganda said on April 11 in an interview with RFE/RL. James Rubin, coordinator for the U.S. State Department’s Global Engagement Center, said the distribution of the disinformation and propaganda out of Serbia is a major problem that needs to be dealt with.Asked about RT Balkan, an online Serbian-language project launched in November by the Russian… Read more at: https://oilprice.com/Latest-Energy-News/World-News/US-Envoy-Warns-Of-The-Dangers-Of-Russian-Disinformation.html |

|

Oil Prices Gain 2% As Inflation Data Remains HotOil prices gained over 2% on Wednesday amid the release of U.S. consumer price data for March showing consistent inflation pressure that has analysts predicting the Federal Reserve will raise interest rates in May. The U.S. Consumer Price Index (CPI) rose a slight 0.1%, compared to its 0.4% increase in February, according to Department of Labor data released Wednesday. Year-to-date, the CPI is up 5%, compared to 6% year-to-date in February. The Dow edged up slightly on the CPI data, which suggests slowing inflation, but not enough to inject a great… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Oil-Prices-Gain-2-As-Inflation-Data-Remains-Hot.html |

|

Lithium Exports Projected To Be As Lucrative As Coal In AustraliaCompared to most developed countries, Australia is lagging far behind in the race for decarbonization. Per capita, Australians are the world’s worst coal power polluters. By this metric, they are the top polluters in both the G20 and OECD. According to an analysis from energy think Ember, the average Australian emits four times more carbon dioxide than the average person around the world. Coal is a pillar of the Australian economy, and the government there has been reluctant to move away from it. But the science is increasingly indicating… Read more at: https://oilprice.com/Metals/Commodities/Lithium-Exports-Projected-To-Be-As-Lucrative-As-Coal-In-Australia.html |

|

Clean Energy Sources Produced 39% Of Global Electricity In 2022The world is on course for the first annual drop in the use of coal, oil and gas to generate electricity outside of a global recession or pandemic, according to a new climate change report. Renewables are now due to meet all growth in demand this year, a new study titled the Global Electricity Review 2023, claimed today. The report says “2022 will be remembered as a turning point in the world’s transition to clean power”, with non-fossil fuel-based energy sources now accounting for almost 40 percent. “Russia’s… Read more at: https://oilprice.com/Alternative-Energy/Renewable-Energy/Clean-Energy-Sources-Produced-39-Of-Global-Electricity-In-2022.html |

|

U.S. To Take Action Against Hungary For Sanctions-BustingA day after the Hungarian foreign minister visited Moscow to talk about energy supplies with Gazprom, sources have told Reuters that Washington is preparing to make a move against certain Hungarian individuals for sanctions-busting. Hungarian Foreign Minister Peter Szijjarto met with Russian Deputy PM Alexander Novak on Tuesday to discuss additional natural gas supplies for 2023, Reuters reported. Agreements signed between the two parties on Tuesday pledge a consistent supply of Russian oil and gas to Hungary, in addition to an amended deal for the… Read more at: https://oilprice.com/Latest-Energy-News/World-News/US-To-Take-Action-Against-Hungary-For-Sanctions-Busting.html |

|

Small Declines In Fuel Inventories Bolster Oil PricesCrude oil prices changed little today after the Energy Information Administration estimated a modest inventory increase of 600,000 barrels for the week to April 7. This compared with an inventory draw of 3.7 million barrels for the previous week and put the total at 470.5 million barrels. This was about 3 percent higher than the five-year seasonal average, the EIA said. In fuels, the authority estimated inventory declines. Gasoline stocks last week shed 300,000 barrels, which compared with a draw of 4.1 million barrels for the previous week. Gasoline… Read more at: https://oilprice.com/Energy/Crude-Oil/Small-Declines-In-Fuel-Inventories-Bolster-Oil-Prices.html |

|

U.S. Could Mandate Water Cuts To Preserve Colorado River HydropowerThe U.S. Department of the Interior’s Bureau of Reclamation is proposing changed guidelines in the water use along the Colorado River to address drought conditions and preserve Glen Canyon and Hoover Dams’ hydropower generation and protect the dams from damage. The changes could mean mandatory water use cuts in the worst-case scenario, according to Bloomberg. The Bureau of Reclamation published this week a draft environmental review outlining possible actions to cut water use and protect the dams. “The need for the modified operating… Read more at: https://oilprice.com/Latest-Energy-News/World-News/US-Could-Mandate-Water-Cuts-To-Preserve-Colorado-River-Hydropower.html |

|

China Prepares For Another Summer Of Power ShortagesAs China’s electricity demand is set to increase, some areas of the country could face renewed power shortages at peak demand times this summer, Chinese officials said on Wednesday. The maximum power load could hit 1,360 gigawatts (GW) in the summer, which could lead to shortages in some regions, Liang Changxin, a spokesman for the National Energy Administration (NEA), said at a news conference today, as carried by Bloomberg. The expected maximum power load would be higher than the 1,290 GW seen last year. In 2022, a heatwave… Read more at: https://oilprice.com/Energy/Energy-General/China-Prepares-For-Another-Summer-Of-Power-Shortages.html |

|

China’s Sinopec To Take 5% Stake In Qatar’s Giant LNG ProjectQatarEnergy will transfer to China’s Sinopec a 5% stake in the development of the huge North Field East (NFE) expansion project, the largest project in the history of the LNG industry, the Qatari state-owned firm said on Wednesday. QatarEnergy has signed a definitive partnership agreement with China Petrochemical Corporation (Sinopec) for the NFE expansion project, which marks the entry of Sinopec as a shareholder in one of the NFE joint venture companies that own the NFE project. Pursuant to the terms of the agreement,… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Chinas-Sinopec-To-Take-5-Stake-In-Qatars-Giant-LNG-Project.html |

|

OPEC+ Cuts Sent Bullish Bets On Brent SoaringMoney managers boosted their net bullish bets on Brent Crude by the second-largest amount on record following the surprise announcement from major OPEC+ producers that they would remove more than 1 million barrels per day (bpd) from the market between May and December. Speculators and traders added as many as 73,000 contracts to the net long position – the difference between bullish and bearish bets – in Brent Crude, the second-highest increase in such bets, per data from ICE Futures Europe cited by Bloomberg. The biggest-ever jump… Read more at: https://oilprice.com/Latest-Energy-News/World-News/OPEC-Cuts-Send-Bullish-Bets-On-Brent-Soaring.html |

|

Fed expects banking crisis to cause a recession this year, minutes showThe Federal Reserve on Wednesday released minutes from its March 21-22 policy meeting. Read more at: https://www.cnbc.com/2023/04/12/fed-expects-banking-crisis-to-cause-a-recession-this-year-minutes-show.html |

|

Stocks fall as fear of recession weighs on investors, Dow snaps four-day win streak: Live updatesInvestors absorbed a key inflation reading showing that consumer prices rose less than expected in March. Read more at: https://www.cnbc.com/2023/04/11/stock-market-today-live-updates.html |

|

Here’s the inflation breakdown for March 2023 — in one chartAnnual inflation eased to 5% in March, down from 6% in February. While still high, there are encouraging signs that inflation will continue to trend downward. Read more at: https://www.cnbc.com/2023/04/12/heres-the-inflation-breakdown-for-march-2023-in-one-chart.html |

|

Warren Buffett says we’re not through with bank failuresInvesting legend Warren Buffett believes there will be more bank failures down the road even as the current banking crisis gets resolved. Read more at: https://www.cnbc.com/2023/04/12/warren-buffett-says-were-not-through-with-bank-failures.html |

|

Earnings playbook: Your guide to trading the start of a big reporting season this weekJPMorgan Chase, Wells Fargo and Citigroup are all slated to report Friday, along with health insurance giant UnitedHealth. Read more at: https://www.cnbc.com/2023/04/12/earnings-playbook-your-guide-to-trading-the-start-of-a-big-reporting-season-this-week.html |

|

Ether dips slightly ahead of Shanghai upgrade, and Montenegro taps Ripple for CBDC: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, Diogo Monica, co-founder and president of Anchorage Digital, explains what Ethereum’s Shanghai hard fork means for institutions. Read more at: https://www.cnbc.com/video/2023/04/12/ether-dips-shanghai-upgrade-montenegro-ripple-cbdc-crypto-world.html |

|

Warner Bros. Discovery unveils new flagship streaming service, ‘Max’Max will launch on May 23 and combine scripted dramas like HBO’s “Succession,” “White Lotus” and “House of the Dragon” with Discovery’s unscripted staples Read more at: https://www.cnbc.com/2023/04/12/warner-bros-discovery-unveils-new-flagship-streaming-service-max.html |

|

Trump sues former lawyer Michael Cohen, key witness in Manhattan DA probe, for $500 millionCohen has become a key witness against Trump in a criminal case in Manhattan, where Trump faces 34 criminal counts. Read more at: https://www.cnbc.com/2023/04/12/trump-sues-michael-cohen-for-500-million.html |

|

Ukraine war live updates: Zelenskyy slams ‘beasts’ in gruesome beheading video; Kremlin calls footage ‘terrible’Ukrainian President Volodymyr Zelenskyy delivered searing remarks in response to a video that appears to show the beheading of a captured Ukrainian serviceman. Read more at: https://www.cnbc.com/2023/04/12/russia-ukraine-live-updates.html |

|

Coalition of media companies sue for Jan. 6 tapes given to Fox News’ Tucker CarlsonSpeaker Kevin McCarthy, R-Calif., exclusively released security video from the Capitol riot to Carlson earlier this year. Other media companies have so far tried and failed to get copies. Read more at: https://www.cnbc.com/2023/04/12/coalition-of-media-companies-sue-for-jan-6-tapes-given-to-fox-news-tucker-carlson.html |

|

NPR quits Twitter, becoming first major U.S. news outlet to do soNPR is leaving Twitter following its temporary “state-affiliated media” designation. It’s the first major U.S. news outlet to leave since Elon Musk took over. Read more at: https://www.cnbc.com/2023/04/12/npr-is-first-major-us-news-outlet-to-stop-using-twitter.html |

|

Warren Buffett: I’d give up a year of my life to eat what I likeHappiness is key “in terms of longevity,” the Berkshire Hathaway leader said. “I’m happier when I’m eating hot fudge sundaes or drinking Coke.” Read more at: https://www.cnbc.com/2023/04/12/warren-buffett-id-give-up-a-year-of-my-life-to-eat-what-i-like.html |

|

Juul to pay $462 million to settle youth vaping claims from six states, D.C.The attorneys general accused Juul of marketing addictive vaping products to underage teenagers. Read more at: https://www.cnbc.com/2023/04/12/juul-to-pay-462-million-settlement-to-six-states.html |

|

Kirby Addresses Pentagon Leak Showing US Special Forces On Ground In UkraineIn our previous reporting on the leaked Pentagon documents which US authorities are scrambling to undercover the source of, we noted that one Department of Defense slide confirms that the United States and its allies have roughly 100 special forces troops on the ground in Ukraine. Many observers believe it could be much more. But the leaked intel showed that as many as 50 British have been operating inside Ukraine at the time the March 23 briefing was put together. Among the US, France and Latvia are also a dozen special forces personnel each, according to the document.

However, the documents don’t identify the location of the Western special forces operatives inside Ukraine or what their mission or purpose inside the war-ravaged country is. Typically, US Green Berets train and advise local forces on the ground, as well as assist or directly conduct unconventional warfare operations. On Wednesday White House National Security Council spokesman John Kirby belatedly admitted to the accuracy of basic content the slide (namely that there are indeed US Special Forces on the ground), but he downplayed it as a “small U … Read more at: https://www.zerohedge.com/markets/kirby-addresses-pentagon-leak-showing-us-special-forces-ground-ukraine |

|

Trump: “There’s Something Wrong” With BidenAuthored by Paul Joseph Watson via Summit News, During an interview with Tucker Carlson, Donald Trump said “there’s something wrong” with Joe Biden, with the former president suggesting Biden won’t be able to run in 2024.

“Do you think Biden will stay in the race,” Carlson asked President Trump. “Look. Uh, I watch him just like you do. And I think it’s almost inappropriate for me to say it. I don’t see how it’s possible. There’s something wrong,” Trump responded.

|

|

FOMC Minutes Show Staff Expect ‘Mild Recession’, All Members Backed Continued QT, 25bps HikeSummary (via Newsquawk): March Meeting

Fed Staff

Banking

|

|

S Korea Will Lend 500,000 Artillery Shells To Shore Up Drained US Arsenal, Help UkraineS Korea Will Lend 500,000 Artillery Shells To Shore Up Drained US Arsenal, Help UkraineIn a move that could help the US government supply Ukraine with ammunition, South Korea has agreed to lend the Pentagon 500,000 155mm artillery shells, Reuters reports, citing a South Korean newspaper. As the Pentagon relentlessly pours weapons and ammunition into its Ukraine proxy war against Russia, the American arsenal has been rapidly depleted, to the point that the Biden administration is going around begging to buy or “borrow” ammo from other countries. The United States has given Ukraine more than a million 155mm shells. The Korean deal will provide some relief to US stockpiles and thus the Ukrainian supply chain, but apparently came after significant hand-wringing in Seoul. Read more at: https://www.zerohedge.com/geopolitical/s-korea-will-lend-500000-artillery-shells-shore-drained-us-arsenal-help-ukraine |

|

Ex-CBI boss not shown report that led to dismissalTony Danker was dismissed immediately following a report into allegations of misconduct. Read more at: https://www.bbc.co.uk/news/business-65251668?at_medium=RSS&at_campaign=KARANGA |

|

Tesco cuts milk prices after wholesale costs fallThe supermarket says it is passing on savings to customers after seeing its own costs fall for milk. Read more at: https://www.bbc.co.uk/news/business-65255643?at_medium=RSS&at_campaign=KARANGA |

|

Six things we learned from Elon Musk interviewThe world’s second richest man spoke for nearly an hour on a wide range of subjects. Read more at: https://www.bbc.co.uk/news/world-us-canada-65251160?at_medium=RSS&at_campaign=KARANGA |

|

Ahead of Q4 results, Infosys, RIL, HDFC were top additions by mutual fundsKey additions to the portfolio included Gujarat Fluorochemicals, GAIL (India) and State Bank of India. Their major reductions were HDFCBank, Navin Fluoro International and Container Corporation. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/ahead-of-q4-results-infosys-ril-hdfc-were-top-additions-by-mutual-funds/articleshow/99432050.cms |

|

Vedanta, ITC among top 10 stocks that saw highest selling by MFs in MarchKey additions by MFs in March were Infosys, Reliance Industries and HDFC. Read more at: https://economictimes.indiatimes.com/markets/web-stories/vedanta-itc-among-top-10-stocks-that-saw-highest-selling-by-mfs-in-march/articleshow/99432544.cms |

|

US inflation slows in March but remains above Fed targetAlthough greeted by President Joe Biden as a sign of progress, several commentators noted that the inflation rate remains far above the Fed’s two percent target, adding that inflation remained elevated when food and energy costs are stripped out Read more at: https://economictimes.indiatimes.com/markets/stocks/news/us-inflation-slows-in-march-but-remains-above-fed-target/articleshow/99443457.cms |

|

Amazon workers’ serious-injury rates still double those of other warehouse workers, study showsA new report, which found slight improvement in Amazon injury rates, coincides with a shareholder resolution calling for an independent health-and-safety audit. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-71D1-D0CBE02EF1DD%7D&siteid=rss&rss=1 |

|

Market Snapshot: U.S. stocks erase gains in final hour of trade after minutes show Fed officials expect banking crisis to cause economic slowdown this yearU.S. stock indexes trimmed earlier gains on Wednesday afternoon after minutes from the Federal Reserve’s March policy meeting show policymakers agreed that the stress in the banking sector would slow U.S. economic growth. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-71D2-4E2EA1B5ED00%7D&siteid=rss&rss=1 |

|

Bond Report: Two- and 10-year Treasury yields drop by most in a week after Fed minutes, March inflation reportTreasury yields finish mostly lower after minutes of the Federal Reserve’s last meeting mentions the possibility of a mild recession later this year. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-71D2-4F1243A4EEAC%7D&siteid=rss&rss=1 |