Summary Of the Markets Today:

- The Dow closed up 80 points or 0.24%,

- Nasdaq closed down 1.07%,

- S&P 500 closed down 0.25%,

- Gold $2037 down $0.60,

- WTI crude oil settled at $80 down $0.26,

- 10-year U.S. Treasury 3.302% down 0.034 points,

- USD index $101.92 up $0.34,

- Bitcoin $28,244 up $65

Click here to read our Economic Forecast for April 2023

Today’s Economic Releases:

Private employers added 145,000 jobs in March (blue line on the graph below) according to the ADP employment report. Over the last year, employment growth has been moderating. According to Nela Richardson, the chief economist at ADP:

Our March payroll data is one of several signals that the economy is slowing. Employers are pulling back from a year of strong hiring and pay growth, after a three-month plateau, is inching down

Both exports and imports of goods and services declined in February 2023 – but imports declined more than exports causing an increase in the trade deficit. Over the last 12 months, imports (which are an indicator of US economic growth) have been slowing.

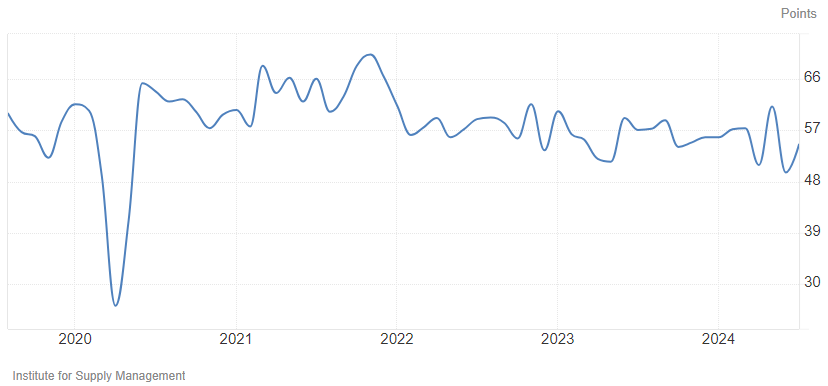

The ISM Services PMI fell to 51.2 in March of 2023 from 55.1 in February and well below forecasts of 54.5. The reading pointed to the slowest growth in the services sector in three months, as demand and employment cooled while capacity and logistics improved and price pressures eased to the lowest since September 2020. This decline is considered as this index is showing services are nearing the no-growth line – and the services PMI correlates well with past US recessions.

source: https://tradingeconomics.com/united-states/non-manufacturing-pmi

A summary of headlines we are reading today:

- China Considers Prohibiting Exports Of Rare Earth Magnet Technology To The U.S.

- Oil Markets Are Misinterpreting The OPEC+ Cut

- Small Modular Reactors Are Gaining Ground

- White House Will Work With All Oil Producers To Ensure Low Prices

- Russian Urals Breaks Past $60 Price Cap Thanks To OPEC+

- Fitch Raises Saudi Arabia’s Credit Rating Due To “Formidable” Foreign Reserves

- Inflation’s inventory gluts are here to stay and will hit the bottom line in weaker economy

- Nasdaq falls 1% for three-day losing streak after weak economic data: Live updates

- Google reveals its newest A.I. supercomputer, says it beats Nvidia

- U.S. Dollar “Fear Mongers” Only Need To Be Right Once

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Tech Tensions Heat Up Between China And The U.S.U.S.-China relations appear headed for further deterioration despite the People’s Republic of China’s (PRC) efforts to lure back American multinationals and Beijing’s relatively limited support for Russia in its war with Ukraine. Washington has characterized the “existential competition” with the Chinese Communist Party (CCP) as an entrenched struggle on all fronts, but the data and information sectors have recently become areas of particularly intense contention. The Xi Jinping leadership has sternly retaliated against… Read more at: https://oilprice.com/Geopolitics/International/Tech-Tensions-Heat-Up-Between-China-And-The-US.html |

|

Oil Markets Are Misinterpreting The OPEC+ CutThe surprise announcement by OPEC+ of another production cut totaling 1.16 million barrels per day caused oil prices to rally 8%. I previously wrote about this in my weekly research for Primary Vision Network, stating that the likelihood of a cut remained low and that the cartel was aware of the oversupply in the markets and the lack of imminent demand resurgence. However, when viewed from a different perspective, the cut makes sense precisely for the same reason. For at least the past year, the prevailing narrative in oil markets has been a tug-of-war… Read more at: https://oilprice.com/Energy/Crude-Oil/Oil-Markets-Are-Misinterpreting-The-OPEC-Cut.html |

|

China Considers Prohibiting Exports Of Rare Earth Magnet Technology To The U.S.If China thought the trade war with Trump was bad, little did they know how much worse it would get under Joe “Big Guy” Biden. As Rabobank’s Michael Every wrote this morning, “don’t forget President Biden is already running a US trade policy far more protectionist than his predecessor’s” and the latest example of that came this morning when Japan decided to join United States and the Netherlands in restricting exports of chipmaking gear to China, as the cold chip war between China and the west enters an… Read more at: https://oilprice.com/Latest-Energy-News/World-News/China-Considers-Prohibiting-Exports-Of-Rare-Earth-Magnet-Technology-To-The-US.html |

|

Small Modular Reactors Are Gaining GroundIn terms of technology, the first fifty years of the commercial nuclear power industry in the US was similar to early ice cream choices when there was only chocolate and vanilla. In nuclear power terms that means boiling water and pressurized water reactors (PWRs). Because of their better efficiency and flexibility, producing electricity and steam, PWR technology dominates the market for gigawatt scale reactors. Worldwide of the 470 or so operating reactors about 300 are PWRs. But this limited choice in nuclear power plant technologies is rapidly… Read more at: https://oilprice.com/Alternative-Energy/Nuclear-Power/Small-Modular-Reactors-Are-Gaining-Ground.html |

|

White House Will Work With All Oil Producers To Ensure Low PricesThe White House on Tuesday promised to work with all crude oil producers and others to ensure lower prices for the American people as the OPEC+ group surprised markets with a 1.6 million barrel-per-day production cut. “We’ll continue to work with all producers and consumers to ensure energy markets, support economic growth and lower prices for the American producers,” Jean-Pierre said in a reiteration of the Administration’s stance. The price of WTI has shot up to $80 per barrel, a more than $7 per barrel increase over last… Read more at: https://oilprice.com/Latest-Energy-News/World-News/White-House-Will-Work-With-All-Oil-Producers-To-Ensure-Low-Prices.html |

|

Steel Buyers Brace For A Bumpy 2023Via AG Metal Miner The irony is not lost on steel buyers when they hear the phrase “the cold, hard truth.” After a massive spike at the beginning of March, HRC, CRC, and HDG steel prices are finally losing momentum. However, as any savvy procurement professional knows, they are not out of the woods yet. Recession indicators continue to rear their ugly heads, leaving many bracing themselves for the worst market demand since 2008. Experts continues to provide mixed predictions regarding upcoming steel prices and demand. Some sources… Read more at: https://oilprice.com/Metals/Commodities/Steel-Buyers-Brace-For-A-Bumpy-2023.html |

|

Saudi Aramco Hikes Crude Prices To AsiaJust days after the unexpected OPEC+ oil production cut, Saudi Aramco, the Saudi state-owned oil company, has raised prices of crude to Asia by 30 cents per barrel. The price hike in Aramco’s flagship Arab Light crude to Asia for May delivery represents the monthly increase in a row, Bloomberg reports. The move to increase the May OSP was not unexpected, though prior to the surprise OPEC+ announcement traders surveyed by Bloomberg had expected Arab Light prices to fall by 43 cents per barrel. Earlier this week, analysts speculated… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Saudi-Aramco-Hikes-Crude-Prices-To-Asia.html |

|

The Battle For Energy Influence In Central AsiaIn February 2023, Uzbekistani President Shavkat Mirziyoyev announced an energy package valued at over $1 billion to ease the country’s heating and electricity needs (Tashkent Times, February 8). In this, while Russia is considered a key player in providing Tashkent with much-needed oil and natural gas products, Uzbekistan also hopes to improve energy ties with its neighbors to avoid becoming overly dependent on Moscow. In truth, situated in the heart of Central Asia, neighboring Afghanistan and with close proximity to Russia, Uzbekistan holds… Read more at: https://oilprice.com/Geopolitics/International/The-Battle-For-Energy-Influence-In-Central-Asia.html |

|

Russian Urals Breaks Past $60 Price Cap Thanks To OPEC+Following the weekend’s surprise OPEC+ 1.6 million bpd output cut, the price of Urals, Russia’s flagship crude oil, has reached beyond the $60 per barrel price cap level set by the G7 in December, Reuters reports, citing sources involved in Russian oil trading. Based on the G7 price cap, Urals can only be traded in US dollars if sold below $60 per barrel. Oil traders told Reuters that because there is a period of time during which cargoes are priced, it is still possible to close below $60, depending on deal timing. Also on Wednesday,… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Russian-Urals-Breaks-Past-60-Price-Cap-Thanks-To-OPEC.html |

|

Inventory Draws Across The Board Push Oil Prices HigherOil prices climbed higher today, after the Energy Information Administration reported a crude oil inventory draw of 3.7 million barrels for the week to March 31. At 470 million barrels, inventories are about 4 percent above the five-year average for this time of the year, the authority said. Last week’s draw compares with a draw of 7.5 million barrels estimated for the previous week, which helped push oil prices higher. Of course, this week’s breaking news about OPEC+ deciding to reduce oil production by another million barrels daily… Read more at: https://oilprice.com/Energy/Crude-Oil/Inventory-Draws-Across-The-Board-Push-Oil-Prices-Higher.html |

|

Another Russian Energy Oligarch Dies Under Mysterious CircumstancesIt’s a bad time to be an energy-related Russian oligarch with yet another mysterious death. The body of Igor Shkurko, age 49, was found in his cell yesterday in a Yakutsk detention center. Shkurko was the First Deputy General Director/Chief Engineer of the Russian energy company Yakutskenergo and had been accused of taking a £5,000 bribe—an allegation that Shkurko denied. Russian authorities have so far proffered no explanation for his death, although they stated that there were no signs of “criminal death.” Shkurko… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Another-Russian-Energy-Oligarch-Dies-Under-Mysterious-Circumstances.html |

|

India’s Refinery Throughput Rises After Fuel Demand Hits 24-Year HighRecord-high fuel demand raised refinery throughput in India by 2% in February from January, according to provisional government data cited by Reuters. In February, when fuel demand in the world’s third-largest crude oil importer hit the highest in at least 24 years, Indian refiners processed 20.85 million tons of crude. In barrel-per-day terms, the throughput was at 5.46 million bpd, the highest in bpd terms in Reuters records dating back to 2009. India’s fuel demand jumped by 5% to 4.82 million bpd in February, per oil ministry data quoted… Read more at: https://oilprice.com/Energy/Energy-General/Indias-Refinery-Throughput-Rises-After-Fuel-Demand-Hits-24-Year-High.html |

|

Kurdistan Oilfield Back To Full Capacity Following Export AgreementAfter more than a week of pumping crude at reduced rates, one of Kurdistan’s oilfields has resumed production to full capacity following the agreement between Kurdistan and Iraq on the resumption of oil exports. The Hassira oilfield has returned to full production, an industry insider told Shafaq News on Wednesday. The oilfield resumed output at 14,000 barrels per day (bpd), up from 4,000 bpd to 5,000 bpd in the previous days. The federal government of Iraq and the semi-autonomous region of Kurdistan reached an agreement earlier this… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Kurdistan-Oilfield-Back-To-Full-Capacity-Following-Export-Agreement.html |

|

Fitch Raises Saudi Arabia’s Credit Rating Due To “Formidable” Foreign ReservesFitch Ratings on Wednesday upgraded Saudi Arabia’s long-term foreign-currency issuer default rating (IDR) to ‘A+’ from ‘A,’ citing the Kingdom’s strong fiscal position and “formidable” foreign reserves. The outlook on the rating is “stable,” said Fitch, which noted that the world’s top crude oil exporter has a much stronger debt-to-GDP ratio than many other sovereigns, as well as significant fiscal buffers in the form of deposits and other public sector assets. “Saudi Arabia has one of the highest reserve coverage ratios among Fitch-rated… Read more at: https://oilprice.com/Energy/Energy-General/Fitch-Raises-Saudi-Arabias-Credit-Rating-Due-To-Formidable-Foreign-Reserves.html |

|

Exxon Ends Major Drilling Campaign In Brazil After Failing To Find OilAfter years of failing to make a major oil discovery offshore Brazil, ExxonMobil has ended a major drilling campaign there, but hasn’t ruled out further exploration in the country, The Wall Street Journal reported on Wednesday, citing sources with knowledge of the plans. Exxon, the first oil and gas company to set up operations in Brazil in 1912 under the name of Standard Oil Company of Brazil, bought deepwater acreage back in 2017, hoping to find oil in the prolific offshore basins where other majors and Brazilian state oil firm Petrobras have… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Exxon-Ends-Major-Drilling-Campaign-In-Brazil-After-Failing-To-Find-Oil.html |

|

Inflation’s inventory gluts are here to stay and will hit the bottom line in weaker economy: CNBC Supply Chain SurveyThe inventory gluts caused by inflationary conditions aren’t going to be worked off quickly, according to an exclusive CNBC Supply Chain Survey. Read more at: https://www.cnbc.com/2023/04/05/as-economy-weakens-inflations-inventory-gluts-are-here-to-stay.html |

|

Judge says he can compel Fox’s Rupert and Lachlan Murdoch to testify live in Dominion trialDominion Voting Systems is urging a Delaware judge to compel Fox execs Rupert Murdoch and Lachlan Murdoch to testify live in court. Read more at: https://www.cnbc.com/2023/04/05/dominion-fox-murdoch-witness-list.html |

|

Private payrolls rose by 145,000 in March, well below expectations, ADP saysCompany payrolls rose by 145,000, down from 261,000 in February and below the Dow Jones estimate for 210,000. Read more at: https://www.cnbc.com/2023/04/05/adp-march-2023.html |

|

Nasdaq falls 1% for three-day losing streak after weak economic data: Live updatesThe S&P 500 dipped Wednesday on the heels of weak economic data. Read more at: https://www.cnbc.com/2023/04/04/stock-market-today-live-updates.html |

|

CNBC Pro Talks: Here’s how top trader Joe Terranova is playing gold as prices soarVirtus Investment Partners Senior Managing Director Joe Terranova shares how he is positioning for the rest of the year and answers your questions from the New York Stock Exchange with CNBC Senior Markets Correspondent Bob Pisani. Read more at: https://www.cnbc.com/video/2023/04/05/cnbc-pro-talks-top-trader-joe-terranovaas-best-ideas-for-the-rest-of-2023.html |

|

Jeep unveils 2024 Wrangler SUV in next stage of off-road sales battle with Ford BroncoThe 2024 Jeep Wrangler features an evolutionary exterior design and a redesigned interior that includes additional safety, convenience and tech options. Read more at: https://www.cnbc.com/2023/04/05/jeep-2024-wrangler-suv.html |

|

Trump faces more legal threats beyond a hush money case. Here’s the status of those probesTrump, the first former U.S. president to be arrested, faces probes involving the 2020 election, the Jan. 6 Capitol riot and classified documents at Mar-a-Lago. Read more at: https://www.cnbc.com/2023/04/05/trump-criminal-probes-stormy-daniels-mar-a-lago-election.html |

|

Google reveals its newest A.I. supercomputer, says it beats NvidiaGoogle’s TPU-based supercomputer, called TPU v4, is “1.2x–1.7x faster and uses 1.3x–1.9x less power than the Nvidia A100,” Google researchers wrote. Read more at: https://www.cnbc.com/2023/04/05/google-reveals-its-newest-ai-supercomputer-claims-it-beats-nvidia-.html |

|

Ukraine war live updates: Putin blames U.S. for Ukraine crisis; Zelenskyy makes another rare visit abroadUkraine yearns for NATO membership, having long aspired to benefit from the collective defense that membership demands of — and confers on — its members. Read more at: https://www.cnbc.com/2023/04/05/ukraine-war-live-updates-latest-news-on-russia-and-the-war-in-ukraine.html |

|

Cash App founder Bob Lee reportedly killed in San Francisco stabbing, sources sayPolice did not identify the man, but sources identified Lee, who was serving as the chief chief product officer of MobileCoin, as the victim to NBC Bay Area. Read more at: https://www.cnbc.com/2023/04/05/cash-app-founder-bob-lee-reportedly-killed-in-san-francisco-stabbing-sources-say.html |

|

With layoffs looming, you could be offered a voluntary buyout—4 things to know before taking oneBuyouts are a way to incentivize employees to leave a company in order to reduce wage expenses and bring down costs. Read more at: https://www.cnbc.com/2023/04/05/what-to-know-before-taking-an-employee-buyout.html |

|

Insolvency is on the horizon for Social Security, Medicare funds, expert says. These changes may helpSocial Security and Medicare face an uncertain future, according to the latest projections from the programs’ trustees. Experts suggest what changes may help. Read more at: https://www.cnbc.com/2023/04/05/insolvency-on-horizon-for-social-security-medicare-soon-expert-says.html |

|

MicroStrategy buys 1,045 bitcoin, and Invest Diva explains her crypto confidence: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, Invest Diva CEO Kiana Danial discusses her bullishness on bitcoin. Read more at: https://www.cnbc.com/video/2023/04/05/microstrategy-buys-bitcoin-invest-diva-confidence-crypto-world.html |

|

Swiss Authorities Eliminate, Cut Credit Suisse Executives’ BonusesPrior to the $3.25 billion emergency takeover of Credit Suisse by UBS, mandated by Swiss authorities more than two weeks ago to avert a global financial crisis, the struggling Swiss bank had been contemplating for several months about slashing bonuses for its bankers. On Wednesday afternoon, the Swiss government, not Credit Suisse bank executives, moved forward with a plan to cancel or reduce bonuses. The Swiss Federal Council directed the Federal Department of Finance to eliminate or decrease top Credit Suisse bankers’ bonuses by 25% to 50%. According to the SFC statement, this action would affect bankers in the top three tiers of management. For the bonuses already paid out, Credit Suisse has to examine whether some of those payments to employees can be recovered. The lender would have to report to FDF and the Swiss Financial Market Supervisory Authority on the matter. Bloomberg noted UBS is required that its “remuneration system continues to give appropriate consideration to risk awareness and includes as a criterion the successful, i.e., most profitable possible, realization of the Credit Suisse assets covered by the state loss guarantee.” Read more at: https://www.zerohedge.com/markets/swiss-authorities-eliminate-cut-credit-suisse-executives-bonuses |

|

U.S. Dollar “Fear Mongers” Only Need To Be Right OnceSubmitted by QTR’s Fringe Finance Optimists about the U.S. economy and the dollar’s global reserve status have had the wind at their back for half of a century, so why should anyone expect them to consider an alternative viewpoint? Therein lies the folly that our country faces. There’s a reason that every financial disclosure, brochure, hedge fund letter or commercial always says “past performance is not indicative of future results” on it: because it isn’t. But that boilerplate-sounding warning is printed in size zero font and, as a result, also rests in the equivalent of size zero font in the brains of U.S. dollar bulls. The fact is that warnings about the precarious nature of the U.S. dollar – whether bombastic or not – are probably more important today than they have ever been. But these warnings can’t compete with 50 years of the “trend being the United States’ friend”, a hurricane force tailwind that includes politicians on both sides of the aisle, the nation’s central bank, the treasury secretary and the roaring concert of all financial news media. Those who believe the dollar is always destined to be the backbone of the global economy are like players at a roulette table who have a system of betting all of the inside numbers, except for the number 13. Given a small house edge and the fact that you have to lay 35 to win 36 (excluding the 0 and 00) means that, in order to start cashing in on your system in a big way, you have to get hot and tear off a ton of wins in a row. But when the odds are in your … Read more at: https://www.zerohedge.com/markets/us-dollar-fear-mongers-only-need-be-right-once |

|

Slowing, Slowing, Gone…By Peter Tchir of Academy Securities Slowing, Slowing, Gone?With baseball season coming, I couldn’t think of a better way to start this quick economic update. Since we highlighted Excess Inventory, Increasing Delinquencies Falling Shipping last week, April has provided us with largely weak economic data.

|

|

Well-Known Crypto Tech Exec Murdered In San Francisco StabbingWell-known crypto tech executive Bob Lee was stabbed to death early Tuesday morning near downtown San Francisco.

The 43-year-old Lee was perhaps best known for starting Cash App, and as former CTO of Square. He was the chief product officer of San Francisco-based crypto startup MobileCoin. “Our dear friend and colleague, Bob Lee passed away yesterday at the age of 43, survived by a loving family and collection of close friends and collaborators,” reads a statement from MobileCoin, which described him as “a dynamo, a force of nature … the genuine article.”

San Francisco police responded at around 2:35 a.m. to a report of a stabbing in t … Read more at: https://www.zerohedge.com/political/crypto-tech-exec-murdered-san-francisco-stabbing |

|

Government shuns CBI lobby giant after rape claimThe BBC understands the chancellor and business and trade ministers have “paused engagement” with the CBI. Read more at: https://www.bbc.co.uk/news/business-65186175?at_medium=RSS&at_campaign=KARANGA |

|

Dover to stagger coaches to avoid Easter delaysTravel will be spread across three days and temporary border controls will be installed. Read more at: https://www.bbc.co.uk/news/business-65187441?at_medium=RSS&at_campaign=KARANGA |

|

P&O Ferries plans to cut 60 jobs in the UKIt comes after the company sacked nearly 800 staff without notice last year. Read more at: https://www.bbc.co.uk/news/business-65196330?at_medium=RSS&at_campaign=KARANGA |

|

Tata Steel Q4 Update: Output grows 3%; sales fall 3.43%Its total sales were 7.59 MT, down 3.43 per cent over 7.86 MT in the same quarter of 2021-22 Read more at: https://economictimes.indiatimes.com/markets/stocks/news/tata-steel-q4-update-output-grows-3-sales-fall-3-43/articleshow/99277518.cms |

|

RBI’s interest rate decision on Thursday: Here’s what brokerages are expecting>> For more such web stories click on the ET icon below Read more at: https://economictimes.indiatimes.com/markets/web-stories/rbis-interest-rate-decision-on-thursday-heres-what-brokerages-are-expecting/articleshow/99275557.cms |

|

Trump is getting a political lift from the Manhattan D.A.’s case against him, but analysts say it won’t lastFormer President Donald Trump gets arraigned Tuesday. What do the legal proceedings in Manhattan mean for his 2024 presidential campaign? Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-71CA-E3A51D5F71DE%7D&siteid=rss&rss=1 |

|

The Tell: Active funds caught ‘off guard,’ missing out on stock market’s big rally in first quarterActively-managed mutual funds in the U.S. weren’t ready for the stock-market’s “big rally” in the first quarter, according to BofA Global Research. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-71CC-795DD5C09FC0%7D&siteid=rss&rss=1 |

|

McCarthy meets Taiwan’s leader, while key House panel talks with Disney’s Iger and Apple’s Cook about China’s growing influenceHouse speaker Kevin McCarthy’s Wednesday meeting with Taiwan’s leader angers Beijing, and a key panel’s talks with U.S. companies about China’s influence also may ruffle feathers. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-71CB-DB17557BDDA2%7D&siteid=rss&rss=1 |