Summary Of the Markets Today:

- The Dow closed up 415 points or 1.26%,

- Nasdaq closed up 1.74%,

- S&P 500 closed up 1.44%,

- Gold $1,987 down $10.50,

- WTI crude oil settled at $76 up $1.20,

- 10-year U.S. Treasury 3.481% down 0.07 points,

- USD $102.59 up $0.44,

- Bitcoin $28,417 up $450,

- Baker Hughes Rig Count: U.S. down 3 to to 755 rigs

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our Economic Forecast for April 2023

Today’s Economic Releases:

Personal income increased $72.9 billion (0.3%) in February 2023, according to estimates released today by the Bureau of Economic Analysis. Disposable personal income (DPI) increased $89.9 billion (0.5%) and personal consumption expenditures (PCE) increased by $27.9 billion (0.2%). The PCE price index increased 0.3%. Excluding food and energy, the PCE price index also increased 0.3%. But the real (inflation-adjusted) year-over-year growth is what is important – personal income is up 3.3% (blue line on the graph below), consumption expenditures up 2.5% (red line on the graph below), price index (inflation) is up 5.0% (green line on the graph below), and price index (excluding food and energy) up 4.6% (purple line on the graph below). At the current rate of moderation of inflation – it will be several years for inflation to fall near 2%. There is NO SIGN of a recession in this data.

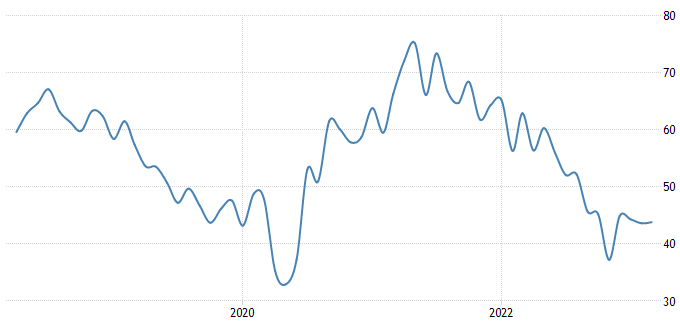

The Chicago Business Barometer, also known as the Chicago PMI, inched up 0.2 index points to 43.8 in March. It was the first increase since December. The increase was unexpected. Economists polled by the Wall Street Journal forecast a 43 reading. This is the seventh straight reading below the 50 threshold that indicates activity is contracting.

A summary of headlines we are reading today:

- Time To Buy The Oil Dip: Goldman Sachs

- Nickel Buyers On Edge As Another LME Scandal Unfolds

- Peter Schiff: We Are On The Cusp Of Another Financial Crisis

- U.S. Drilling Activity Slips Following Price Slump

- Supply Outage Fuels Oil Price Recovery

- Here’s what went wrong with Virgin Orbit

- Key Fed inflation gauge rose 0.3% in February, less than expected

- Trump campaign uses newly restored Facebook page to fundraise off of indictment

- Stocks could be shaky in the week ahead as sigh-of-relief rally runs its course

- Reasons To Be Cheerful (and Drear-full) About Stocks

- Simon Black: I Love How Everyone Pretends The Bank Crisis Is Over…

- In One Chart: Stocks are headed for gains in March. This chart shows why retirement should still be a worry for investors.

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

London Looks To Become First Net-Zero Financial HubThe government released its long-awaited Green Finance Strategy on Thursday, announcing a widespread review of policies and regulations as it seeks to channel investment toward the green economy. The delayed report sets out proposals to pursue the government’s ambition of making London the world’s first net zero-aligned financial center. It said the proposals would “ensure the necessary finance flows to our net zero, energy security and environmental industries”. A key part of the plan is the so-called… Read more at: https://oilprice.com/Energy/Energy-General/London-Looks-To-Become-First-Net-Zero-Financial-Hub.html |

|

Time To Buy The Oil Dip: Goldman SachsCrude oil prices are on their way up, despite the market panic caused by the collapse of two U.S. banks, the global head of commodities for Goldman Sachs said on Friday in a Bloomberg Television interview. “We would argue you are buying the dip at this point,” Jeff Currie said, adding, “I have never seen a market sell off that sharply, but retain a bullish structure.” Goldman is still a believer that we will see a “solid recovery” from China toward the latter part of the year, as economic activity snaps back… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Time-To-Buy-The-Oil-Dip-Goldman-Sachs.html |

|

Nickel Buyers On Edge As Another LME Scandal UnfoldsVia AG Metal Miner The London Metal Exchange and its notorious nickel contract are back in the limelight again. This time, the news has to do with reports of potential fraud with a recent LME nickel shipment. The scrutiny comes following the discovery of nine warrants, some 54 tons of Nickel briquettes, that turned out to contain rocks. The discovery came following a delivery out of Access World’s Rotterdam warehouse. At the time the nickel arrived at the warehouse, Glencore had full ownership. However, a BVI firm called Global Capital… Read more at: https://oilprice.com/Metals/Commodities/Nickel-Buyers-On-Edge-As-Another-LME-Scandal-Unfolds.html |

|

Peter Schiff: We Are On The Cusp Of Another Financial CrisisPeter Schiff appeared on NTD News to talk about the bank bailout and the March Federal Reserve meeting. During the conversation, Peter explained that everybody is going to pay for these bailouts because they will ultimately devalue the dollar as inflation skyrockets. During his press conference after the March FOMC meeting, Jerome Powell said the banking system is “sound and resilient.” Peter said it’s not sound at all. “It’s a house of cards that is starting to collapse,” Peter explained how the… Read more at: https://oilprice.com/Finance/the-Economy/Peter-Schiff-We-Are-On-The-Cusp-Of-Another-Financial-Crisis.html |

|

U.S. Crude Oil Production Rebounds In January: EIACrude oil production in the United States rebounded in January to an average of 12.462 million barrels per day, according to new data released Friday by the Energy Information Administration. The 12.462 million bpd level was the highest production level the United States has seen since March of 2020, shortly after the pandemic took hold in the country. Production of crude oil in the United States reached a pandemic low of 9.713 million bpd in May of 2020. By 2022, production had somewhat recovered, starting the year at 11.369 million bpd and ending… Read more at: https://oilprice.com/Latest-Energy-News/World-News/US-Crude-Oil-Production-Rebounds-In-January-EIA.html |

|

U.S. Drilling Activity Slips Following Price SlumpThe total number of total active drilling rigs in the United States fell by 3 this week, according to new data from Baker Hughes published on Friday. The total rig count fell to 755 this week—82 rigs higher than the rig count this time in 2022 and 320 rigs lower than the rig count at the beginning of 2019, prior to the pandemic. Oil rigs in the United States decreased by 1 this week, to 592. Gas rigs slipped 2 to 160. Miscellaneous rigs stayed the same. The rig count in the Permian Basin fell by 1, partially offsetting last week’s 3-rig… Read more at: https://oilprice.com/Energy/Crude-Oil/US-Drilling-Activity-Slips-Following-Price-Slump.html |

|

Brazil’s Oil Exports Surge To Record-High Despite New TaxDespite a new export tax, Brazilian oil exports have jumped to a monthly record-high this month, Reuters reported on Friday, quoting government data and industry experts. Brazil’s oil exports soared by 75.4% year over year between March 1 and 24, per data from foreign trade agency Secex, as oil producers did not have time to relocate oil cargoes after a surprise export tax was announced in early March. The Brazilian government announced at the start of this month that it would collect taxes on crude oil exports for four months in a bid to… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Brazils-Oil-Exports-Surge-To-Record-High-Despite-New-Tax.html |

|

EV Slump Forces China’s Top Lithium Producers To Set Price FloorChina’s top lithium producers, including Tianqi Lithium and Ganfeng Lithium, have reportedly agreed to establish a minimum price of 250,000 yuan or $36,380 per tonne of lithium carbonate to slow down the plummeting price of the crucial raw material for batteries. The agreement was met at a gathering of roughly ten firms in Nanchang, southern China, on Tuesday this week amid the backdrop of slowing demand for electric vehicles, particularly in China, which has weighed on lithium prices. Since November, lithium prices have shed more… Read more at: https://oilprice.com/Metals/Commodities/EV-Slump-Forces-Chinas-Top-Lithium-Producers-To-Set-Price-Floor.html |

|

U.S. Unveils Supply Chain Requirements For EV Tax CreditsThe U.S. government has unveiled tighter rules on electric vehicle (EV) tax credits to curb the nation’s reliance on China’s EV battery supply chains. As part of President Joe Biden’s push to make 50% of U.S. new vehicle sales EVs or plug-in hybrids by 2030, the new sourcing requirements will reduce or eliminate credits on some zero-emission models. The new guidance, issued by the U.S. Treasury Department, includes requirements for the procurement of critical minerals and battery components and aims to increase domestic supply… Read more at: https://oilprice.com/Latest-Energy-News/World-News/US-Unveils-Supply-Chain-Requirements-For-EV-Tax-Credits.html |

|

Move Over ESG, Fund Managers Have A New Favorite BuzzwordOver the last few weeks, we have reported about billions being pulled from ESG funds, hedge funds losing ESG ratings, and companies and banks scrambling to cover up their ESG appeal in pitch decks, all after “woke” ESG name Silicon Valley Bank went under, forcing the market to focus a bit more on things that matter (i.e. solvency, cash generation) instead of the unicorn and rainbow ESG fairy tale it has been obsessed with over the last 5 years. But, the more things change, the more they stay the same. Bloomberg reported this… Read more at: https://oilprice.com/Finance/the-Economy/Move-Over-ESG-Fund-Managers-Have-A-New-Favorite-Buzzword.html |

|

U.S. South Central Natural Gas Withdrawals Set A Record-Low This WinterThe South Central natural gas storage in the United States saw record-low cumulative gas withdrawals from underground storage this winter season, the U.S. Energy Information Administration (EIA) said in its natural gas weekly update this week. Natural gas withdrawals from the South Central region—which includes Texas, Oklahoma, Louisiana, Alabama, Arkansas, Kansas, and Mississippi – stood at 233 billion cubic feet (Bcf) between early November 2022 and the week ending March 2023, the EIA said. That’s a record low for a winter heating… Read more at: https://oilprice.com/Latest-Energy-News/World-News/US-South-Central-Natural-Gas-Withdrawals-Set-A-Record-Low-This-Winter.html |

|

Supply Outage Fuels Oil Price RecoveryUS benchmark June West Texas Intermediate crude oil futures increased by more than 1% on Thursday. This price rise was due to a reduction in U.S. crude reserves and a suspension of exports from the Kurdistan region in Iraq. These factors counteracted the effect of a smaller-than-anticipated decrease in Russian oil supplies, which would have otherwise put downward pressure on the price of oil. To prop up the prices, producers in the semi-autonomous Kurdistan region of northern Iraq have closed down or decreased production at various oilfields, as… Read more at: https://oilprice.com/Energy/Energy-General/Supply-Outage-Fuels-Oil-Price-Recovery.html |

|

A New Hotbed For Oil Mergers And Acquisitions1. Iraq’s Oil Ambitions Face Harsh Reality of Low Investment- Iraq’s oil production capacity is set for a decline in the long term as political infighting and worsening upstream terms disappointed Western majors, leading to years of insufficient investment. – Having enjoyed steady output growth in the early 2010s, Iraqi oil production has been stagnating at around 4.5 million b/d, despite repeated government calls for a 7-8 million b/c production capacity. – Low recovery factors, high natural decline rates and lacking government funding… Read more at: https://oilprice.com/Energy/Energy-General/A-New-Hotbed-For-Oil-Mergers-And-Acquisitions.html |

|

Foreign Policy Problems Mount For The U.S.Politics, Geopolitics & Conflict In a major loss for U.S. foreign policy, the Saudis have agreed to join the Shanghai Cooperation Organization (SCO) as a “dialogue partner” as it moves to further cement ties with China. The SCO includes India, Pakistan, Russia, Iran, and Central Asian countries. Egypt and Qatar also have “dialogue partner” status. What we’re seeing now is a bit of a payout for Beijing after it brokered a restoration of diplomatic ties between Saudi Arabia and Iran earlier this month. It also comes… Read more at: https://oilprice.com/Energy/Energy-General/Foreign-Policy-Problems-Mount-For-The-US.html |

|

The Easiest Way To Bet On Hydrogen?As I have said many times before, I have made a living from markets on and off for around forty years. I have often looked back and analyzed what it is that has made that longevity possible, and one of the things that keep coming up in that context is that I am inherently skeptical of consensus. I guess that makes me what Americans call “ornery” and we British would simply refer to it as an argumentative pain in the backside, but it has always made me look for a counterargument when everyone seems to agree on something, and that has served… Read more at: https://oilprice.com/Energy/Energy-General/The-Easiest-Way-To-Bet-On-Hydrogen.html |

|

Here’s what went wrong with Virgin OrbitVirgin Orbit is on the brink of bankruptcy after last-ditch efforts to secure funding failed. Read more at: https://www.cnbc.com/2023/03/31/virgin-orbit-what-went-wrong.html |

|

Stocks close higher Friday, Nasdaq notches best quarter since 2020: Live updatesStocks mounted a comeback in the latter part of March after the month started with the failure of two regional banks. The Dow surged about 400 points on Friday. Read more at: https://www.cnbc.com/2023/03/30/stock-market-today-live-updates.html |

|

Trump indictment live updates: Facing about 30 counts, Trump lashes out at NY officialsPresident Donald Trump was indicted by a New York grand jury in a hush-money case, and is expected to be arraigned on Tuesday. Read more at: https://www.cnbc.com/2023/03/31/trump-indicted-ny-grand-jury.html |

|

Key Fed inflation gauge rose 0.3% in February, less than expectedThe personal consumption expenditures price index excluding food and energy was expected to rise 0.4% in February. Read more at: https://www.cnbc.com/2023/03/31/fed-inflation-gauge-february-2023-.html |

|

CNBC Special Pro Talks: How top women in finance are putting money to workCNBC Pro is rounding out Women’s History Month with three of the best female investors around. CNBC “Halftime Report” Supervising Producer, Patricia Martell, sits down with Requisite Capital Management’s Bryn Talkington, Gilman Hill Asset Management’s Jenny Harrington, and SoFi’s Liz Young to discuss their impact on the industry, how they are investing in today’s market, and to answer your questions. Read more at: https://www.cnbc.com/video/2023/03/31/cnbc-special-pro-talks-how-top-women-in-finance-are-putting-money-to-work.html |

|

Millions will start losing Medicaid coverage as Covid safety net is dismantledAs many as 15 million people stand to lose Medicaid coverage as safety net expansions implemented during the Covid pandemic are dismantled. Read more at: https://www.cnbc.com/2023/03/31/medicaid-millions-to-lose-coverage-as-covid-safety-net-dismantled.html |

|

Social Security trust funds depletion date moves one year earlier to 2034, Treasury saysNew estimates for the depletion dates for Social Security and Medicare benefits released on Friday prompted retirement experts to urge Congress to take action. Read more at: https://www.cnbc.com/2023/03/31/social-security-trust-funds-depletion-date-moves-up-to-2034.html |

|

California to require half of all heavy trucks sales to be electric by 2035The Biden administration’s waiver comes after California last year banned the sale of new gasoline-powered vehicles starting in the same target year of 2035. Read more at: https://www.cnbc.com/2023/03/31/california-requires-half-of-heavy-trucks-sales-to-be-electric-by-2035.html |

|

Ukraine war live updates: Biden tells Russia to release WSJ reporter; Wimbledon reverses ban on Russians and BelarusiansThe step for Finland marks a historic foreign policy shift and a significant setback for Russia. Read more at: https://www.cnbc.com/2023/03/31/russia-ukraine-live-updates.html |

|

Tesla issues recall on Semi over defective brake module, rollaway riskTesla has issued a voluntary recall on the Semi, a first since the company began deliveries of the heavy-duty electric trucks to customers in December 2022. Read more at: https://www.cnbc.com/2023/03/31/tesla-issues-recall-on-semi-over-defective-brake-module-rollaway-risk.html |

|

Trump campaign uses newly restored Facebook page to fundraise off of indictmentDonald Trump’s campaign turned to Facebook to raise money off of his indictment in New York as he rages against Manhattan District Attorney Alvin Bragg. Read more at: https://www.cnbc.com/2023/03/31/trump-indictment-campaign-uses-facebook-to-fundraise.html |

|

Trump faces about 30 criminal counts for document fraud in New York indictmentFormer President Donald Trump is expected to be arraigned next week in New York on a grand jury indictment charging him with document fraud. Read more at: https://www.cnbc.com/2023/03/31/trump-faces-about-30-criminal-counts-in-new-york-indictment.html |

|

Stocks could be shaky in the week ahead as sigh-of-relief rally runs its courseVolatility could persist in the week ahead with fading momentum and a big jobs report. Read more at: https://www.cnbc.com/2023/03/31/stocks-could-be-shaky-in-the-week-ahead-as-sigh-of-relief-rally-runs-its-course.html |

|

Wimbledon Lifts Ban On Russian & Belarusian Tennis PlayersWimbledon on Friday announced it has lifted its ban on Russian and Belarusian tennis players, reversing the decision put in place one year ago as a punitive measure in the wake of the Russian invasion of Ukraine. Russians and Belarusians didn’t compete in the 2022 tournament, the most visible tennis tournament and championship in the world, but they will for 2023. The All England Club and the Lawn Tennis Association has now explained that keeping the ban in place would have “damaging and far reaching” impact on tennis in England.

“There was a strong and very disappointing reaction from some governing bodies in tennis to the position taken by the All England Club and the LTA last year with consequences which, if continued, would be damaging to the interests of players, fans, The Championships and British tennis,” the club said in Read more at: https://www.zerohedge.com/geopolitical/wimbledon-lifts-ban-russian-belarusian-tennis-players |

|

Reasons To Be Cheerful (and Drear-full) About StocksAuthored by Simon White, Bloomberg macro strategist, While the bearish case for stocks holds sway, there is a valid reason to hold the opposite view. And in the spirit of understanding, we will offer both below.

First, the bear case: It’s easy to find reasons why stocks are vulnerable. Below are three. 1) The S&P 500 is being driven by a very narrow band of stocks. The three biggest (Apple, Microsoft and Amazon) are up an average of ~20% while the rest of the market is flat on the year. That the high-duration tech sector is leading the charge implicitly assumes that inflation is yesterday’s problem. That that is overly-optimistic. Read more at: https://www.zerohedge.com/markets/reasons-be-cheerful-and-drear-full-about-stocks |

|

Bearded Male Powerlifter Self-Identifies As Woman In Protest, Destroys Women’s RecordSometimes, you just need to fight lunacy with more lunacy. That’s what a male powerlifting coach by the name of Avi Silverberg must have thought when he decided to protest new “trans policies” in the sport by “self-identifying” as a woman and then destroying a women’s record during a recent event. Prior to Silverberg taking action, “the women’s bench press title holder in the 84+ kilogram category [was] Anne Andres, who is a biological male”, Fox News reported this week. There used to be a name for this…the men’s division. Andres had to sit and watch at the Heroes Classic Powerlifting Meet while a fully bearded Silverberg, obviously a biological male, destroyed his bench press record.

Since the meet was held under the rules of the Canadian Powerlifting Union (CPU), their policy on gender self-identification, which they introduced earlier this … Read more at: https://www.zerohedge.com/markets/bearded-male-powerlifter-self-identifies-woman-protest-destroys-womens-powerlifting-record |

|

Simon Black: I Love How Everyone Pretends The Bank Crisis Is Over…Authored by Simon Black via SovereignMan.com, Practically on cue, politicians began their public hearings yesterday about the recent banking crisis. This was so predictable; every time there was a major crisis, Congressmen book a committee meeting to express their shock and outrage. They pass new laws to prevent a future crisis. Then their new laws fail to work properly, so they hold another public hearing to express more outrage. This is the cycle of political problem-solving, and yesterday was no exception. The Senate Banking Committee summoned key officials from the Federal Reserve, FDIC, and US Treasury Department. And the tone was quite angry. Senators were flummoxed that their thousands of pages of banking legislation had once again failed to provide adequate protection to the US financial system. And they were looking for someone to blame. Read more at: https://www.zerohedge.com/markets/simon-black-i-love-how-everyone-pretends-bank-crisis-over |

|

House prices see biggest annual fall since 2009Property prices dropped by 3.1% in the year to March, the Nationwide says. Read more at: https://www.bbc.co.uk/news/business-65135405?at_medium=RSS&at_campaign=KARANGA |

|

Rival energy firms lose court case over Bulb saleHigh Court judges dismiss a case against Octopus Energy’s purchase of failed supplier Bulb. Read more at: https://www.bbc.co.uk/news/business-65140179?at_medium=RSS&at_campaign=KARANGA |

|

Large ethnicity gap in real living wage, report findsAlmost a third of Pakistani or Bangladeshi workers in London are on low pay, a new report finds. Read more at: https://www.bbc.co.uk/news/uk-england-london-65138075?at_medium=RSS&at_campaign=KARANGA |

|

Tech View: Nifty forms morning star pattern on weekly scale. What should traders do next weekNifty as per weekly chart formed a long bull candle, which indicates a sharp reversal in the market on upside. After declining continuously for the last three months a doji type candle pattern was formed as per monthly time frame chart. This is a positive signal as per long term charts. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/tech-view-nifty-forms-morning-star-pattern-on-weekly-scale-what-should-traders-do-next-week/articleshow/99146259.cms |

|

These 5 Hybrid Funds gave high returns to investors over 3-5 yearsThe aim of Hybrid funds is to balance the risk-reward ratio, thereby, optimising the return on investments. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/these-5-hybrid-funds-given-high-returns-to-investors-over-3-5-years/articleshow/99145907.cms |

|

Expect RBI to deliver final rate hike of 25 bps next week: Kotak Mahindra BankIncremental rate hikes from these two key central banks will depend on how incoming macro data and financial markets conditions evolve over the next few weeks and months, said Lakshmi Iyer, CEO-Investment & Strategy, Kotak Investment Advisors. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/expect-rbi-to-deliver-final-rate-hike-of-25-bps-next-week-kotak-mahindra-bank/articleshow/99139308.cms |

|

: Biden declines to comment on Trump indictment as he heads to Mississippi town hit by tornadoPresident Joe Biden, traveling Friday to Rolling Fork, Miss., which was devastated by a tornado last week, did not weigh in on his predecessor’s indictment. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-71C7-F6BDC720581A%7D&siteid=rss&rss=1 |

|

In One Chart: Stocks are headed for gains in March. This chart shows why retirement should still be a worry for investors.Investors in stocks are seeing gains in March by looking past stress in the U.S. banking system. This chart shows another reason for worry. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-71C8-6786DB5BD5CB%7D&siteid=rss&rss=1 |

|

Tesla price cuts are in the spotlight with deliveries update dueRegardless of what Tesla Inc.’s first-quarter deliveries show in the coming days, analysts say the electric-vehicle maker is seeing strong demand. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-71C8-5978C3794CF9%7D&siteid=rss&rss=1 |