Summary Of the Markets Today:

- The Dow closed up 141 points or 0.43%,

- Nasdaq closed up 0.73%,

- S&P 500 closed up 0.57%,

- Gold $2,000 up $15.50,

- WTI crude oil settled at $74 up $1.23,

- 10-year U.S. Treasury 3.554% down 0.012 points,

- USD $102.16 down $0.48,

- Bitcoin $27,956 down $412,

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our Economic Forecast for April 2023

Today’s Economic Releases:

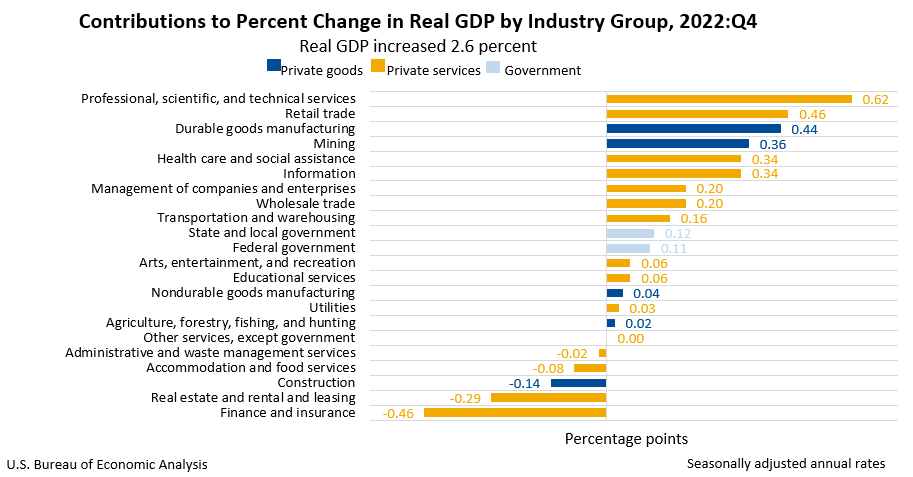

The third estimate of real gross domestic product (GDP) increased at an annual rate of 2.6% (relative to 3Q2022) in the fourth quarter of 2022. In the third quarter, real GDP increased by 3.2% which implies the economy slowed. My preferred method of analyzing GDP shows real GDP only improved by 0.9% from the quarter one year ago. In the second estimate, the increase in real GDP was 2.7%. This third estimate primarily reflected downward revisions to exports and consumer spending. Imports, which are a subtraction in the calculation of GDP, were revised down.

The weekly unemployment insurance weekly claims 4-week moving average was 198,250 – an increase of 2,000 from the previous week.

A summary of headlines we are reading today:

- Why U.S. Refiners Are Ramping Up Biofuel Production

- WTI Crude Gains As Banking Fears Ease, Kurdish Oil Exports Remain Suspended

- Researchers Create Catalyst That Cleans Dirty Water And Produces Hydrogen

- Shell Cancels Singapore Aviation Biofuel Project

- The Coal Price Crash Isn’t Over Yet

- Stocks close higher a second-straight day, Dow jumps more than 100 points: Live updates

- More home sellers are sitting out of the spring housing market

- Disney blocks Ron DeSantis’ Florida power play with a royal family clause

- Jobless claims edge up to 198,000, higher than expected

- 4 red flags for an IRS tax audit — including what one tax pro calls a ‘dead giveaway’

- ETF Wrap: Commercial real-estate worries weigh down property ETFs — but a ‘durable’ corner holds up relatively well

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Why U.S. Refiners Are Ramping Up Biofuel ProductionNo one knows exactly how many electric vehicles will hit the road in the coming decade, but one thing is certain: it’s going to be a lot. The precise rate of uptake depends on a lot of factors, from falling EV costs and improved technologies to policy support and incentives for manufacturers as well as drivers. What we do know is that reaching net zero emissions by mid-century will require an electric car fleet of over 300 million vehicles by 2030, and 60% of new car sales will have to be electric models. In reality, we’ll… Read more at: https://oilprice.com/Energy/Energy-General/Why-US-Refiners-Are-Ramping-Up-Biofuel-Production.html |

|

Canada’s Crypto Boom And The Energy Concerns It RaisesIn recent years, the rise of cryptocurrency mining has caused concern for those hoping for a green transition, as the sector increases its electricity use year on year, causing the energy demand in certain regions to rise rapidly. Until now, crypto production has relied mainly on electricity generated from fossil fuels, including using flared gas from operations using carbon capture and storage technologies. We are seeing an acceleration in the rollout of renewable energy projects, but some worry that if the demand for electricity continues… Read more at: https://oilprice.com/Energy/Energy-General/Canadas-Crypto-Boom-And-The-Energy-Concerns-It-Raises.html |

|

WTI Crude Gains As Banking Fears Ease, Kurdish Oil Exports Remain SuspendedWest Texas Intermediate (WTI) prices have gained 1.6% by midday Thursday, as banking crisis fears further eased and with no resolution in sight yet for the cut-off of the flow of Iraqi Kurdistan oil to Turkey. At 1:39 p.m. EST on Thursday, WTI was trading up 1.66% at $74.18, for a $1.21 gain on the day, while Brent crude was trading up 1.25% at $79.26, for a $0.98 gain on the day. Stock indexes were also trending higher on Thursday, while the dollar declined. Banking fears have not completely dissipated, however. While optimism is rising, fears… Read more at: https://oilprice.com/Latest-Energy-News/World-News/WTI-Crude-Gains-As-Banking-Fears-Ease-Kurdish-Oil-Exports-Remain-Suspended.html |

|

Chevron Bids Highest For Gulf Of Mexico Drilling RightsGulf of Mexico oil lease sale number 259 held on Wednesday attracted $264 million in bids for drilling rights in an area estimated to hold nearly 30 billion barrels of oil, with Chevron coming in with the highest bids, followed by BP, Shell and Equinor. Chevron turned up with seven of the 10 highest bids for blocks, with BP Exploration & Production Inc and Equinor Gulf of Mexico LLC representing the second and third highest bids. Chevron offered up $108 million for 75 tracts, followed by BP with $47 million in bids and Shell, with $20 million. … Read more at: https://oilprice.com/Latest-Energy-News/World-News/Chevron-Bids-Highest-For-Gulf-Of-Mexico-Drilling-Rights.html |

|

Researchers Create Catalyst That Cleans Dirty Water And Produces HydrogenResearchers in the Oregon State University College of Science have developed a dual-purpose catalyst that purifies herbicide-tainted water while also producing hydrogen. The project, which included researchers from the OSU College of Engineering and HP Inc. is important because water pollution is a major global challenge, and hydrogen is a clean, renewable fuel. Findings of the study, which explored photoactive catalysts have been published in the journal ACS Catalysis. OSU’s Kyriakos Stylianou said, “We can combine oxidation and… Read more at: https://oilprice.com/Energy/Energy-General/Researchers-Create-Catalyst-That-Cleans-Dirty-Water-And-Produces-Hydrogen.html |

|

Drax In Talks With UK Government For £2 Billion CCS ProjectBritish power giant Drax surged by 5% in early trading on Thursday after it disclosed that it was in talks with the government about a proposed carbon capture project. Britain intends to bolster its energy security and independence through investment to move towards more affordable and cleaner energy sources. One such initiative includes carbon capture and storage projects. Drax aims to capitalize on this push and develop a £2 billion CCS project alongside its 2.6 GW biomass power plant in northern… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Drax-In-Talks-With-UK-Government-For-2-Billion-CCS-Project.html |

|

Russia Launches Disinformation Campaign As NATO Gains StrengthOn March 23, the historic process of North Atlantic Treaty Organization (NATO) enlargement passed a critical milestone as Finnish President Sauli Niinistö signed into law legislation on accession to the Alliance approved by parliament. In response, the Kremlin merely expressed regret about this development and reiterated the absence of any threat from Russia to its North European neighbors (Rossiiskaya gazeta, March 16). The Russian Foreign Ministry described the accession, which will be finalized at the Vilnius summit in mid-July, as “counterproductive”… Read more at: https://oilprice.com/Geopolitics/International/Russia-Launches-Disinformation-Campaign-As-NATO-Gains-Strength.html |

|

Shell Cancels Singapore Aviation Biofuel ProjectShell has confirmed that it has stopped exploring a biofuels unit and a Group II base oil plant in Singapore. Although Shell will no longer pursue these particular projects, the company noted that it will maintain a presence in the region. Shell told Reuters, “We can confirm that we are stopping the exploration of two projects – a biofuels unit and a Group II base oil plant in Singapore,” adding, “We will continue supplying base oil and lubricants, as well as biofuels, to our customers in Singapore and the region.” In late 2021, Shell… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Shell-Cancels-Singapore-Aviation-Biofuel-Project.html |

|

OPEC+ To Stick To Its Current Oil Production PlansOPEC+ is set to meet on Monday, but delegates from the organization said that it would likely stick to its current production cut plan. Oil prices have sagged over the last couple of weeks, dragged down by the collapse of two US banks. Despite the low prices, OPEC+ has sent clear signals to the market: it is staying the course and will not react to the sudden price crash. Another factor that OPEC+ must weigh in its decision-making is the 450,000 bpd export loss from OPEC member Iraq—OPEC’s second-largest producer, from the Kurdistan… Read more at: https://oilprice.com/Energy/Energy-General/OPEC-To-Stick-To-Its-Current-Oil-Production-Plans.html |

|

Mercedes Signs Deal With Spanish Renewables GiantMercedes-Benz has signed a power purchase agreement (PPA) for 140 megawatts of wind energy with Spain’s Iberdrola. The agreement with Iberdrola will support Mercedes-Benz in meeting its renewable energy goals while shaving production costs and reducing carbon emissions, production chief Joerg Burzer said. The deal is expected to be in the hundreds of millions of euros. Investing in renewable energy through PPAs provides producers with secured financing while stabilizing energy prices, which will benefit the carmaker’s financial… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Mercedes-Signs-Deal-With-Spanish-Renewables-Giant.html |

|

The Coal Price Crash Isn’t Over YetCoal prices in the United States and the benchmark coal price in Australia have plummeted this winter amid milder-than-usual weather and the falling price of natural gas. Despite the recent slump in coal prices, they will have to fall even further to become competitive with natural gas for power generation again, according to The Wall Street Journal. Per data from the U.S. Energy Information Administration (EIA), the average weekly coal spot price in Central Appalachia stood at $88.80 per short ton, and that in the Illinois Basin was at… Read more at: https://oilprice.com/Energy/Energy-General/The-Coal-Price-Crash-Isnt-Over-Yet.html |

|

Kurdistan’s Oil Exports Could Be Shut In For Another WeekKurdistan’s oil exports could be suspended for several more days as officials from Kurdistan are set to return to Baghdad next week for a new round of talks on the resumption of crude exports from Kurdistan via a pipeline to the Turkish Mediterranean port of Ceyhan. The Kurdistan Regional Government hopes that talks next week could result in the resumption of Kurdistan’s oil exports, commodity analyst Giovanni Staunovo says, quoting the head of foreign media affairs for the Kurdish government. Kurdistan’s crude oil exports… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Kurdistans-Oil-Exports-Could-Be-Shut-In-For-Another-Week.html |

|

Freeport LNG Returns To Full PowerThe Freeport LNG export facility in Texas is receiving natural gas from pipelines at full capacity, suggesting that the liquefaction operations are back to full power, Reuters reported on Thursday, citing data from data provider Refinitiv. The Freeport LNG export facility in Texas was shut down in June last year when a fire broke out and damaged the plant. Two of the three trains at Freeport LNG have resumed full commercial operations in recent weeks after receiving regulatory approval in February. The third and final train… Read more at: https://oilprice.com/Energy/Energy-General/Freeport-LNG-Returns-To-Full-Power.html |

|

Russia Remains Heavily Reliant On Western Insurance For Its Oil ShipmentsRussia continues to rely on Western insurance for more than half of the oil cargoes it sells, which could give leverage to the West if it decides to toughen the sanctions against Moscow. On December 5th, the EU and G7 banned maritime transportation services from shipping Russia’s crude oil to third countries if the oil is bought above the price cap of $60 per barrel. At the same time, the EU imposed an embargo on seaborne imports of Russian oil into the bloc. Price caps for Russian oil products then came into effect on February 5,… Read more at: https://oilprice.com/Energy/Energy-General/Russia-Remains-Heavily-Reliant-On-Western-Insurance-For-Its-Oil-Shipments.html |

|

PetroChina Sees Chinese Fuel Demand Rising By 3% From Pre-Covid LevelsChina’s fuel demand is expected to rise by 3% in 2023 compared to the pre-Covid levels of 2019, state-owned giant PetroChina said on Thursday in an upbeat outlook on Chinese oil consumption this year. China’s natural gas demand is also expected to increase this year by 5.5% compared to 2022 when demand was depressed due to the Covid lockdowns, PetroChina executives said during an earnings briefing, as carried by Reuters. On Wednesday, PetroChina reported record revenues, net profit, and free cash flow for 2022. The company’s revenue… Read more at: https://oilprice.com/Latest-Energy-News/World-News/PetroChina-Sees-Chinese-Fuel-Demand-Rising-By-3-From-Pre-Covid-Levels.html |

|

Stocks close higher a second-straight day, Dow jumps more than 100 points: Live updatesThe S&P 500 touched its highest level since March 7. The three indexes ended the day with gains. Read more at: https://www.cnbc.com/2023/03/29/stock-market-today-live-updates.html |

|

More home sellers are sitting out of the spring housing marketNew listings in March were 20% lower than the same month last year, keeping home prices higher and competition strong. Read more at: https://www.cnbc.com/2023/03/30/more-home-sellers-are-sitting-out-of-the-spring-housing-market.html |

|

Disney blocks Ron DeSantis’ Florida power play with a royal family clauseFlorida Gov. Ron DeSantis’ attempt to strip Disney of self-governance have been thwarted by a document that invokes the British royal family. Read more at: https://www.cnbc.com/2023/03/30/disney-ron-desantis-royal-lives-clause.html |

|

Jobless claims edge up to 198,000, higher than expectedJobless claims rose by 7,000 from the previous period and were a bit higher than the 195,000 estimate. Read more at: https://www.cnbc.com/2023/03/30/jobless-claims-edge-up-to-198000-higher-than-expected-.html |

|

Avoid these stocks that can blow up your portfolio, Wolfe Research saysWolfe Research warns investors to avoid these stocks with a low earnings quality score and a high potential to blow up. Read more at: https://www.cnbc.com/2023/03/30/avoid-these-names-that-can-blow-up-your-portfolio-wolfe-research-says.html |

|

Sam Bankman-Fried pleads not guilty to latest round of federal fraud, bribery chargesSam Bankman-Fried pleaded not guilty in New York federal court Thursday to five additional charges related to the collapse of FTX and Alameda Research. Read more at: https://www.cnbc.com/2023/03/30/sam-bankman-fried-pleads-not-guilty-to-latest-round-of-federal-fraud-charges.html |

|

Ford hikes prices on its F-150 Lightning as production resumes after EV battery fireFord is resuming production of the F-150 Lightning after a February battery fire forced a halt. It’s also raising prices on the popular electric truck again. Read more at: https://www.cnbc.com/2023/03/30/ford-hikes-f-150-lightning-prices-resumes-production.html |

|

Biden calls for stricter banking regulations in the wake of SVB, Signature Bank failuresBiden is calling for a range of safeguards for the banking system in the wake of the failures of Silicon Valley Bank and Signature Bank. Read more at: https://www.cnbc.com/2023/03/30/silicon-valley-bank-joe-biden-calls-for-new-banking-regulations.html |

|

SBF pleads not guilty to latest charges, and OKX to turn over some frozen FTX assets: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, Alex McDougall, the CEO of Stablecorp, weighs in on all of this month’s digital asset developments, including the collapse of crypto-friendly banks Silvergate and Signature as well as the CFTC’s lawsuit against Binance. Read more at: https://www.cnbc.com/video/2023/03/30/sbf-pleads-not-guilty-okx-to-turn-over-some-frozen-ftx-assets-crypto-world.html |

|

Ukraine war live updates: Kyiv says nearly 500 children have died in the conflict; Russia detains WSJ reporterThe battle for Bakhmut in eastern Ukraine continues to astound onlookers, both for the destructiveness of the fighting there and high losses on both sides. Read more at: https://www.cnbc.com/2023/03/30/ukraine-war-live-updates-latest-news-on-russia-and-the-war-in-ukraine.html |

|

4 red flags for an IRS tax audit — including what one tax pro calls a ‘dead giveaway’While the chances of an IRS audit are usually slim, certain items on your tax return may trigger a red flag at the federal agency, according to tax experts. Read more at: https://www.cnbc.com/2023/03/29/these-are-some-of-the-top-red-flags-for-an-irs-audit-tax-pros-say.html |

|

On ‘Ivy Day,’ college hopefuls hear from Harvard, Princeton — but here’s the school more students want to attendOn March 30, college hopefuls will hear from some of the schools at the very top of their wish lists. Read more at: https://www.cnbc.com/2023/03/30/ivy-day-dartmouth-harvard-princeton-announce-admissions-decisions.html |

|

Judge strikes down Obamacare coverage of preventive care for cancer, diabetes, HIV, and other conditionsChristian businesses sued the government arguing the Obamacare mandate violates their religious freedom because it covers of drugs that prevent HIV infection. Read more at: https://www.cnbc.com/2023/03/30/obamacare-judge-overturns-coverage-of-some-preventive-care.html |

|

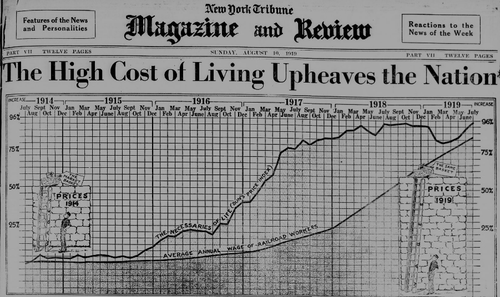

How Bidenflation Was MadeVia Political Calculations blog, In late 2020, the policymakers of the Biden administration and its partisan supporters started crafting a new COVID stimulus package. What they wrought set off a chain of events that ultimately led to the cost of living and banking system crisis we face today.

It didn’t have to be that way. When they started their discussions, the participants had modest goals for what an additional stimulus would look like. Considering the federal government had just enacted its fourth Covid relief package on 27 December 2020, totaling $900 billion, no one at the time was … Read more at: https://www.zerohedge.com/personal-finance/how-bidenflation-was-made |

|

Block Shares Rebound After Company Issues Response Addressing Short Seller ClaimsBlock Shares Rebound After Company Issues Response Addressing Short Seller ClaimsShares of payment company Square are edging back toward territory it traded in prior to Hindenburg Research’s March 23 report on the company. Today, shares are higher by about 3% after the company issued a more detailed response to the report.

The company said in a response publicized on Thursday that its “compliance and risk teams placed just 2.4% of Cash App accounts on a watch list last year”, according to Bloomberg on Thursday. As part of the response, the company also admitted that it had 39 million unique users by social security number, differing from the 51 million user number they have highlighted.

|

|

They Just Keep “Doubling, Tripling Down On Narratives That Are Manifestly Untrue” – Jim Kunstler Crushes The ‘Lying Legacy Media’Via Greg Hunter’s USAWatchdog.com, Renowned author and journalist James Howard Kunstler (JHK) has been complaining and pointing out that the American public is told one lie after another by the Lying Legacy Media (LLM), the government, and the medical community.

This kind of lying, according to JHK, is pure treason by all parties, from the 600 million CV19 bioweapon/vax injections, to the crumbling banking system, to the war in Ukraine. Let’s start with the genocide of the CV19vax. JHK says,

|

|

Bolsonaro Returns To Brazil From Florida, Faces Down Multiple Criminal InvestigationsFormer Brazilian President Jair Bolsonaro returned to Brazil on Thursday for the first time since far-left rival Luiz Inácio Lula da Silva returned to the presidency, and at a moment no less than five Supreme Court investigations linger over his head, any one of which could send him to prison. As AFP outlines, this includes “four for alleged crimes during his term (2019-2022), and one over accusations he incited a riot by supporters who invaded the presidential palace, Congress, and the Supreme Court on January 8, protesting his election loss.”

Read more at: https://www.zerohedge.com/political/bolsonaro-returns-brazil-florida-faces-down-multiple-criminal-investigations |

|

Probe into meat ‘falsely labeled’ as British at supermarketsThe Food Standards Agency has launched an investigation into claims a supplier mislabelled meat. Read more at: https://www.bbc.co.uk/news/business-65125811?at_medium=RSS&at_campaign=KARANGA |

|

CPTPP: UK set to join Asia’s trade club but what is it?It may sound like an official has leaned on their keyboard – but it’s an acronym we’ll hear more often. Read more at: https://www.bbc.co.uk/news/explainers-55858490?at_medium=RSS&at_campaign=KARANGA |

|

Warning UK car industry under threat without helpAn industry veteran says the UK needs to follow the US and EU in helping with the shift to electric cars. Read more at: https://www.bbc.co.uk/news/business-65123902?at_medium=RSS&at_campaign=KARANGA |

|

Ahead of Market: 10 things that will decide stock action on FridayU.S. stock index futures rose on Thursday as easing fears of a banking crisis shifted the focus back to key consumer spending data due later in the week that could shape expectations for the Federal Reserve’s future policy path. At 5:03 a.m. ET, Dow e-minis were up 145 points, or 0.44%, S&P 500 e-minis were up 15.75 points, or 0.39%, and Nasdaq 100 e-minis were up 32.5 points, or 0.25%. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/ahead-of-market-10-things-that-will-decide-stock-action-on-friday/articleshow/99116128.cms |

|

Tax sops removal may prompt MFs to make fund-of-funds, international funds cost competitiveAccording to the new rules that come into effect from April 1, mutual funds with less than 35% investment in equities will be taxed short-term capital gains (STCG) based on income tax slab levels, similar to how bank fixed deposits are taxed. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/tax-sops-removal-may-prompt-mfs-to-make-fund-of-funds-international-funds-cost-competitive/articleshow/99114522.cms |

|

13 years of outperformance! This Rs 1400 cr money manager reveals his 3-step approachThe future looks bright for both PMS and MF because financialization of the savings has already started. Equity as a culture is improving and as the per capita income, affordability, and awareness increases for PMS, the size is going to probably become 2x, 3x, 4x, 5x, 10x over a period of time, says Rajesh Kothari, Managing Director, AlfAccurate Advisors Pvt Ltd. Read more at: https://economictimes.indiatimes.com/markets/expert-view/etmarkets-pms-talk-13-years-of-outperformance-this-rs-1400-cr-money-manager-reveals-his-3-step-approach/articleshow/99111565.cms |

|

Vitaliy Katsenelson’s Contrarian Edge: Banks managed credit risk, but not interest-rate risk. Now we’re all paying the price.Silicon Valley Bank’s failure is just a glimpse of what’s to come for the financial sector and the economy, writes Vitaliy Katsenelson. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-71C3-C27B63BF12F2%7D&siteid=rss&rss=1 |

|

Will TikTok get banned in the U.S.? ‘Odds are below 50%,’ one analyst saysAfter TikTok’s CEO endured a bipartisan grilling in a House hearing, some analysts say a prohibition is still unlikely. Others disagree. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-71C5-512187BED710%7D&siteid=rss&rss=1 |

|

ETF Wrap: Commercial real-estate worries weigh down property ETFs — but a ‘durable’ corner holds up relatively wellExchange-traded funds with exposure to commercial real estate have slid this month, with the recent stress in the banking sector exacerbating concerns over the property market. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-71C6-C50CEBAAD663%7D&siteid=rss&rss=1 |

Via AP: Brazil’s former President Jair Bolsonaro greets supporters outside the Liberal Party’s headquarters in Brasilia on Thursday. He spent three months in Florida, quiet and keeping a low profile, as politicians in both Brazil and the US (Democrats) called for him to be booted from the US amid questions over his visa status. He had flown to Flori …

Via AP: Brazil’s former President Jair Bolsonaro greets supporters outside the Liberal Party’s headquarters in Brasilia on Thursday. He spent three months in Florida, quiet and keeping a low profile, as politicians in both Brazil and the US (Democrats) called for him to be booted from the US amid questions over his visa status. He had flown to Flori …