Summary Of the Markets Today:

- The Dow closed up 195 points or 0.60%,

- Nasdaq closed down 0.47%,

- S&P 500 closed up 0.19%,

- Gold $1958 down $25.70,

- WTI crude oil settled at $73 up $3.75,

- 10-year U.S. Treasury 3.541% up 0.163 points,

- USD $102.85 down $0.26,

- Bitcoin $27,009 down $858

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our Economic Forecast for March 2023

Today’s Economic Releases:

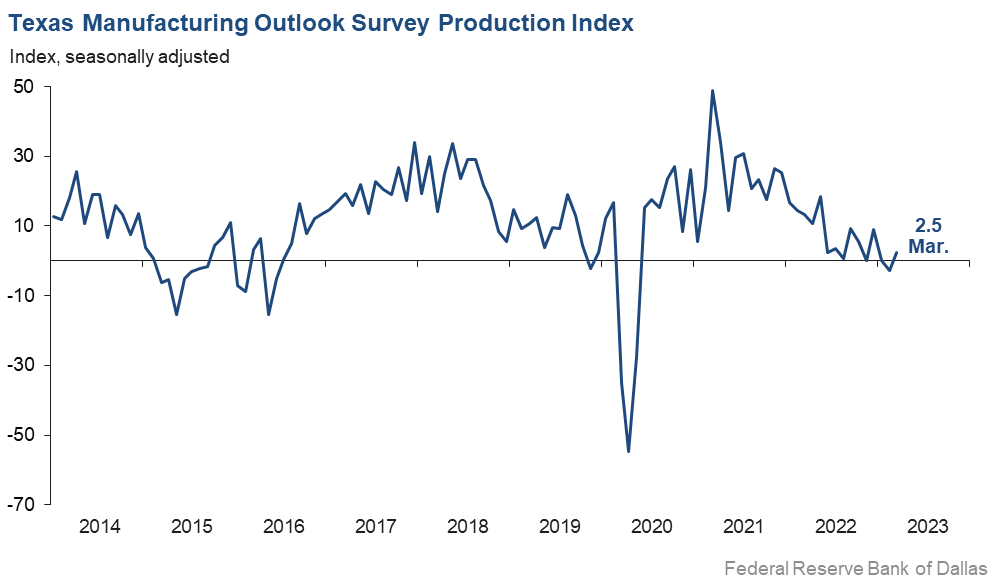

The Texas Manufacturing Outlook Survey expanded slightly in March after contracting in February. The production index, a key measure of state manufacturing conditions, moved up from -2.8 to 2.5, a reading suggestive of a modest increase in output. Other measures of manufacturing activity showed mixed signals this month. The new orders sub-index was negative for the 10th month in a row and came in at -14.3, little changed from February.

A summary of headlines we are reading today:

- Wind Industry To Install Record New Capacity By 2027

- $14 Billion In Oil And Gas Deal Signed This Week, And It’s Only Monday

- Is It Time To Refill The Strategic Petroleum Reserve?

- Drop In U.S. Gasoline Prices Likely To Be Temporary

- Disney layoffs will begin this week, CEO Bob Iger says in memo

- Dow closes nearly 200 points higher, S&P 500 notches third straight advance as bank shares jump: Live updates

- Chart analysts see danger ahead as tech comeback starts to lose steam

- Bitcoin falls below $27,000, and CFTC charges Binance for violating trading rules: CNBC Crypto World

- Chipotle to pay ex-employees $240,000 after closing Maine location that tried to unionize

- Bank Crisis’ Remedy Threatens To Put More Pressure On The Dollar

- Tech View: Nifty charts hint at indecisiveness. What should traders do Tuesday

- Market Snapshot: U.S. stocks mostly higher as bank sector stress wanes

- Biden calls for Congress to pass assault-weapons ban after Nashville school shooting

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Everything You Need To Know About The Guyana-Venezuela Border DisputeExxonMobil’s swathe of world-class oil discoveries in offshore Guyana, estimated to contain over 11 billion barrels of oil, has captured the world’s attention. This includes considerable scrutiny from Nicolas Maduro the autocratic president of neighboring socialist Venezuela. A longstanding and bitter territorial dispute has embroiled the two South American countries, with Caracas claiming nearly 62,000 square miles or roughly three-quarters of Guyana’s territory, including territorial waters containing the Stabroek… Read more at: https://oilprice.com/Geopolitics/International/Everything-You-Need-To-Know-About-The-Guyana-Venezuela-Border-Dispute.html |

|

Wind Industry To Install Record New Capacity By 2027A new report from the Global Wind Energy Council (GWEC) has revealed that policies have set the scene for accelerated deployment of onshore and offshore wind, with the industry expected to install 136 GW a year to 2027. The report found that policy support continues to be the main driver of wind power development, with countries around the world setting ambitious targets for renewable energy sources such as wind. This includes state policies that offer incentives and tax credits for producers and consumers, making wind energy more… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Wind-Industry-To-Install-Record-New-Capacity-By-2027.html |

|

$5 Billion In Upstream Assets Is Up For Grabs In Southeast AsiaSoutheast Asia will be a hotbed for upstream mergers and acquisitions (M&A) in the next two years, with more than $5 billion of assets up for grabs, Rystad Energy research shows. The bulk of these opportunities are in Indonesia, where upwards of $2 billion of assets are on the market, followed by Malaysia and Vietnam which have approximately $1.4 billion and $1 billion for sale respectively. About $700 million of deals have already been completed in the region so far in 2023, the strongest start to Southeast Asia’s upstream M&A activity… Read more at: https://oilprice.com/Energy/Energy-General/5-Billion-In-Upstream-Assets-Is-Up-For-Grabs-In-Southeast-Asia.html |

|

Nearly 100,000 Prepayment Meters Forcibly Installed In UK HomesThe UK government on Monday said that more than 94,000 prepayment meters had been forcibly installed in homes last year, as household energy bill debt soars to dangerous heights.British Gas, Scottish Power and OVO Energy were named by the government as having forcibly installed the lion’s share of prepayment meters before regulators ordered a halt to the practice in February, describing the three utilities as “the most overzealous suppliers”. The government singled out Scottish Power as the “worst offender”, having… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Nearly-100000-Prepayment-Meters-Forcibly-Installed-In-UK-Homes.html |

|

$14 Billion In Oil And Gas Deal Signed This Week, And It’s Only MondayAs oil sector deal-making starts to show signs of recovery, Brookfield Renewable Partners will acquire Australia’s Origin Energy utility for over $10 billion, while the Permian basin has scored another victory with a $1.45-billion asset sale. On Monday, a consortium led by Brookfield said it had agreed to acquire Origin (OTCPK:OGFGF) in a $12.4-billion deal, including debt. The deal will render Origin Australia’s biggest energy retailer and integrated power provider. Separately, one of the consortium partners,… Read more at: https://oilprice.com/Energy/Energy-General/14-Billion-In-Oil-And-Gas-Deal-Signed-This-Week-And-Its-Only-Monday.html |

|

Portugal Bids To Boost Green Energy With First Hydrogen AuctionOn Monday morning, Portugal announced that it would launch a pioneering auction for rights to sell hydrogen for injection into its natural gas grid in the second half of this year. This will be the first auction in Europe and is part of the country’s efforts to reduce greenhouse gas emissions. The Portuguese government has set ambitious targets to reduce emissions by 2030 and is now looking to green hydrogen to meet those goals. Hydrogen can be produced from renewable sources such as wind and solar energy, and when injected into the natural gas… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Portugal-Bids-To-Boost-Green-Energy-With-First-Hydrogen-Auction.html |

|

Is It Time To Refill The Strategic Petroleum Reserve?There is a narrative that I hear from time to time that President Biden made billions of dollars for the country by selling oil from the Strategic Petroleum Reserve (SPR) last year at high prices and buying it back at low prices. The only problem is that the story is only half true. The Biden Administration did indeed sell a lot of oil from the SPR last year. Further, oil prices in 2022 were the highest they had been in years, averaging nearly $95 a barrel — the highest level since 2013. However, the Biden Administration hasn’t bought… Read more at: https://oilprice.com/Energy/Energy-General/Is-It-Time-To-Refill-The-Strategic-Petroleum-Reserve.html |

|

Energy Transfer Acquires Lotus Midstream To Expand Permian Market ShareEnergy Transfer LP announced on Monday that it had acquired pipeline operator Lotus Midstream in a $1.45 billion cash-and-stock deal to boost its presence in the Permian Basin. The acquisition is expected to solidify Energy Transfer as one of the top midstream companies in the region and provide greater access to crucial markets for both producers and consumers. The acquisition includes Lotus Midstream’s Centurion Pipeline assets, giving Energy Transfer access to more than 1,000 miles of pipelines and related infrastructure in West Texas.… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Energy-Transfer-Acquires-Lotus-Midstream-To-Expand-Permian-Market-Share.html |

|

EU Members Clash Over Nuclear Energy’s Role In Climate PolicyThe European Union needs to work on a divide among its member countries regarding the role of nuclear energy in achieving their renewable energy goals. This disagreement may delay the progress of one of the EU’s primary climate policies. On Wednesday, negotiators from EU countries and the European Parliament will engage in their final round of discussions to establish more ambitious EU objectives to expand renewable energy throughout the next decade. These goals are crucial for Europe’s commitment to reduce CO2 emissions by 2030… Read more at: https://oilprice.com/Alternative-Energy/Nuclear-Power/EU-Members-Clash-Over-Nuclear-Energys-Role-In-Climate-Policy.html |

|

Drop In U.S. Gasoline Prices Likely To Be TemporaryAlthough the national average U.S. gasoline price fell slightly by 0.3 cents per gallon last week, declines are likely to be temporary, according to Patrick De Haan, head of petroleum analysis at fuel-saving app GasBuddy. U.S. gasoline prices fell for a second consecutive week last week, as oil prices were under intense selloff with the banking sector jitters in the United States and Europe. Last week, the average price of gasoline in America dropped by 0.3 cents from a week ago to $3.40 per gallon on Sunday, according to GasBuddy data compiled… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Drop-In-US-Gasoline-Prices-Likely-To-Be-Temporary.html |

|

WTI Breaks $70 As Kurdistan Halts Oil ExportsOil prices rose by 2% early on Monday, with the U.S. benchmark up above $70 a barrel again, driven up by a halt to Kurdistan’s 400,000-bpd of crude exports and signs of easing concerns about the global banking sector. As of 10:17 a.m. EDT on Monday, WTI Crude, the U.S. benchmark, traded at $70.76, up by 2.31% on the day. The international benchmark, Brent Crude, was up by 2.04 % at $76.41. Oil was rising at the start of the week after Kurdistan’s crude oil exports – around 400,000 bpd shipped through an Iraqi-Turkey pipeline… Read more at: https://oilprice.com/Energy/Oil-Prices/WTI-Breaks-70-As-Kurdistan-Halts-Oil-Exports.html |

|

China Energy Considers $1 Billion Floating Solar Project In ZimbabweChina Energy Engineering Corp. is considering building a 1,000-megawatt floating solar plant on Zimbabwe’s Kariba dam at the cost of nearly $1 billion. This ambitious project is expected to provide clean and renewable energy to the region, helping Zimbabwe move towards a greener future. The proposed solar farm would be the largest of its kind in Africa and one of the biggest in the world. It would cover an area of over 2,500 hectares, making it larger than some cities in Zimbabwe. The solar megaproject could generate power for… Read more at: https://oilprice.com/Latest-Energy-News/World-News/China-Energy-Considers-1-Billion-Floating-Solar-Project-In-Zimbabwe.html |

|

Kurdistan’s 400,000-Bpd Oil Exports Still Shut-In As Talks With Iraq FailKurdistan’s crude oil exports from the Turkish port of Ceyhan continue to be shut in for a fourth day after the semi-autonomous region in northern Iraq and the federal government in Baghdad failed to reach an agreement during the weekend on the resumption of crude flows. Officials from the federal Iraqi government and the Kurdistan Regional Government met on Sunday in Baghdad, but no breakthrough in talks has been achieved, sources with knowledge of the matter told Bloomberg on Monday. If the crude oil exports, at around… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Kurdistans-400000-Bpd-Oil-Exports-Still-Shut-In-As-Talks-With-Iraq-Fail.html |

|

Russia’s Seaborne Oil Exports Hold Above 3 Million Bpd Despite Output CutRussia’s crude oil exports by sea have held above the 3 million barrels per day (bpd) mark in the past six weeks, after the EU ban on fuel imports from Russia took effect and after Moscow said it would lower its production by 500,000 bpd, tanker-tracking data compiled by Bloomberg shows. In the most recent week to March 24, Russia’s seaborne crude oil exports fell by 123,000 bpd but were still above 3 million bpd, at 3.11 million bpd, per the data cited by Bloomberg’s Julian Lee. While weekly shipments can be very volatile,… Read more at: https://oilprice.com/Energy/Energy-General/Russias-Seaborne-Oil-Exports-Hold-Above-3-Million-Bpd-Despite-Output-Cut.html |

|

Russia Could Seek Compensation Over Nord Stream SabotageRussia could demand compensation for damages over the sabotaged Nord Stream gas pipelines in the Baltic Sea, a senior Russian diplomat told Russian news agency RIA Novosti in an interview. “We do not rule out raising the issue of compensation for damages as a result of the explosion of the Nord Stream gas pipelines,” Dmitry Birichevsky, Head of the Economic Cooperation Department at the Russian Foreign Ministry, was quoted as saying. The official did not specify with whom Russia would seek compensation. Russia will… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Russia-Could-Seek-Compensation-Over-Nord-Stream-Sabotage.html |

|

Here’s why the U.S. had to sweeten terms to get the SVB sale doneThe winning bidder in the government’s auction of Silicon Valley Bank’s main assets got several concessions to make the deal happen. Read more at: https://www.cnbc.com/2023/03/27/heres-why-the-us-had-to-sweeten-terms-to-get-the-svb-sale-done.html |

|

Disney layoffs will begin this week, CEO Bob Iger says in memoDisney CEO Bob Iger notified employees in a memo that job losses will begin this week. Read more at: https://www.cnbc.com/2023/03/27/disney-layoffs-bob-iger-memo.html |

|

Dow closes nearly 200 points higher, S&P 500 notches third straight advance as bank shares jump: Live updatesRegional banks rose broadly, led by a surge in First Republic shares. Read more at: https://www.cnbc.com/2023/03/26/stock-futures-are-up-slightly-as-wall-street-looks-to-build-on-winning-week.html |

|

Binance and founder Changpeng Zhao violated compliance rules to attract U.S. users, CFTC allegesThe CFTC alleged that Binance violated federal law to solicit U.S. users for millions in revenue, a potentially existential threat to the exchange. Read more at: https://www.cnbc.com/2023/03/27/binance-and-founder-changpeng-zhao-sued-by-cftc-for-allegedly-violating-trading-rules.html |

|

Chart analysts see danger ahead as tech comeback starts to lose steamThe recent comeback in technology stocks is beginning to lose its luster, and that could mean trouble for the broader market. Read more at: https://www.cnbc.com/2023/03/27/chart-analysts-see-danger-ahead-as-tech-comeback-starts-to-lose-steam.html |

|

Shooting at Nashville Christian school leaves at least 3 children and 3 adults dead, officials sayA 28-year-old woman with two “assault-type rifles and a handgun” opened fire inside the Covenant School on Burton Hills Boulevard in Nashville, police said. Read more at: https://www.cnbc.com/2023/03/27/shooting-at-nashville-christian-school-leaves-at-least-3-children-and-2-adults-dead-officials-say.html |

|

Bitcoin falls below $27,000, and CFTC charges Binance for violating trading rules: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, Samir Tabar, the new CEO of Bit Digital, discusses his outlook for the industry following the collapse of crypto-friendly banks Signature and Silvergate. Read more at: https://www.cnbc.com/video/2023/03/27/bitcoin-falls-below-27000-and-cftc-charges-binance-for-violating-trading-rules-cnbc-crypto-world.html |

|

A deadline looms for rules governing deep-sea mining, but a rushed decision may be riskyThe conversation about regulating deep-sea mining in international waters has become especially urgent ahead of a rulemaking deadline. Read more at: https://www.cnbc.com/2023/03/27/deep-seabed-mining-in-international-waters-deadline-pushes-rulemaking.html |

|

Labcorp to pay $2.1 million to settle DOJ lawsuit for allegedly overbilling Defense DepartmentA former Labcorp employee turned whistleblower sued the diagnostic testing company in 2018 on behalf of the federal government under the False Claims Act. Read more at: https://www.cnbc.com/2023/03/27/labcorp-to-pay-2point1-million-to-settle-defense-department-overbilling-allegations.html |

|

Ukraine war live updates: Russia stirs outrage with plan for tactical nukes in Belarus; Ukrainian town now ‘post-apocalyptic’Russia provoked outrage with its plan to station tactical nuclear weapons in Belarus, as announced by Russian President Vladimir Putin over the weekend. Read more at: https://www.cnbc.com/2023/03/27/ukraine-war-live-updates-latest-news-on-russia-and-the-war-in-ukraine.html |

|

Chipotle to pay ex-employees $240,000 after closing Maine location that tried to unionizeChipotle Mexican Grill has agreed to pay $240,000 to the former employees of an Augusta, Maine, location that tried to unionize. Read more at: https://www.cnbc.com/2023/03/27/chipotle-to-pay-ex-employees-closing-location-union.html |

|

Jay-Z is now worth $2.5 billion—Warren Buffett once said ‘he’s the guy to learn from’The Brooklyn-born artist became rap’s first billionaire back in 2019. Read more at: https://www.cnbc.com/2023/03/27/jay-z-billionaire-net-worth-increase.html |

|

Alibaba founder Jack Ma back in China after months abroad in sign Beijing may be warming to techAlibaba founder Jack Ma has been spotted in China in a potential sign that Beijing is warming to technology giants again after a crackdown on the sector. Read more at: https://www.cnbc.com/2023/03/27/alibaba-founder-jack-ma-back-in-china-after-months-abroad.html |

|

Bank Crisis’ Remedy Threatens To Put More Pressure On The DollarAuthored by Simon White, Bloomberg macro strategist, The dollar is at risk from further deterioration in the Fed’s balance sheet as it moves to stabilize the US banking system. Markets are taking a breather this morning after the histrionics of last week. Nonetheless, problems remain, with several smaller US banks still at risk after the decimation of sentiment in the wake of SVB’s collapse. The calm is being aided by reports that one particularly beleaguered lender, First Republic, will receive more support from the Fed. The central bank is expected to extend its lending programs to help banks in First’s position. There are two principal ways the Fed can use its balance sheet to ease:

How it eases depends on the securities the banking system uses to “make position”. Ultimately, to ensure there are no crunch points, the Fed has to deal in these securities in times of difficulty. The poorer the quality of the assets on the banking-sector’s balance sheet exposes the Fed’s balance sheet to greater deterioration. As the dollar is a liability of the Fed, its value is debased the more the Fed takes on poorer quality collateral. The chart below elegantly shows the long-term decline in the dollar’s real value. There is almost a 1-1 relationship between the degradation in the Fed’s balance sheet – as captured by the percentage of high-quality assets – and the r … Read more at: https://www.zerohedge.com/markets/bank-crisis-remedy-threatens-put-more-pressure-dollar |

|

Shocking Satellite Images Reveal Mississippi Town “Lies In Ruins”Maxar Technologies tweeted shocking before and after satellite imagery of the EF4 tornado devastation across Rolling Fork, Mississippi. Maxar collected images before the storm unleashed a deadly twister that leveled parts of the town on Friday night, killing at least 23 people.

Here’s more from Maxar:

|

|

Dismal 2Y Auction Sees Record Tail As Demand Crumbles Amid Bone-Crushing Daily SwingsWith 2Y yields swinging like a drunken sailor every day in the past three weeks, and regularly clocking at least 20bps in intraday moves as the bipolar market prices 4 rate cuts one day, and multiple rate hikes the next…

… it wasn’t a stretch to expect that today’s 2Y auction would be brutal, and it was. Pricing at a high yield of 3.954%, today’s 2Y auction saw the lowest yield since the 3.31% in August, and was the first sub-4% yield since September. What was more notable, however, is that high yield tailed the When Issued 3.954% by a whopping 2.7bps, which was the biggest tail since our records began in October 2015. Read more at: https://www.zerohedge.com/markets/dismal-2y-auction-sees-record-tail-demand-crumbles-amid-bone-crushing-daily-swings |

|

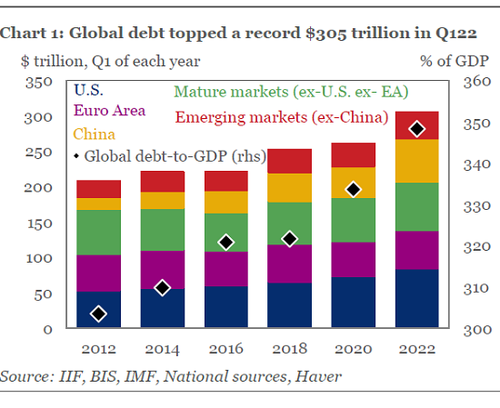

The Everything Bubble And Global BankruptcyAuthored by Charles Hugh Smith via OfTwoMinds blog, The resulting erosion of collateral will collapse the global credit bubble, a repricing/reset that will bankrupt the global economy and financial system. Scrape away the complexity and every economic crisis and crash boils down to the precarious asymmetry between collateral and the debt secured by that collateral collapsing. It’s really that simple. In eras of easy credit, both creditworthy and marginal borrowers are suddenly able to borrow more. This flood of new cash seeking a return fuels red-hot demand for conventional assets considered “safe investments” (real estate, blue-chip stocks and bonds), demand which given the limited supply of “safe” assets, pushes valuations of these assets to the moon.

In the euphoric atmosphere generated by easy credit and a soaring asset valuations, some of … Read more at: https://www.zerohedge.com/markets/everything-bubble-and-global-bankruptcy |

|

Civil servants to strike in AprilThe PCS union said 130,000 members voted to strike on 28 April in a continued row over pay, pensions and job security. Read more at: https://www.bbc.co.uk/news/business-65091905?at_medium=RSS&at_campaign=KARANGA |

|

NFT: Plans for Royal Mint produced token dropped by governmentPlans for a government-backed digital token, ordered to be created by Rishi Sunak, have been axed. Read more at: https://www.bbc.co.uk/news/uk-politics-65094297?at_medium=RSS&at_campaign=KARANGA |

|

Heathrow strike forces BA Easter flight cancellationsThe move is due to a planned 10-day strike by some Heathrow security workers in the Unite union. Read more at: https://www.bbc.co.uk/news/business-65091012?at_medium=RSS&at_campaign=KARANGA |

|

Troubled Silicon Valley Bank acquired by First CitizensCustomers of SVB will automatically become customers of First Citizens, which is headquartered in Raleigh, North Carolina. The 17 former branches of SVB will open as First Citizens branches Monday, the FDIC said. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/troubled-silicon-valley-bank-acquired-by-first-citizens/articleshow/99039459.cms |

|

Symphony shares to trade ex-buyback this weekThe company will buy back about 10,00,000 equity shares through the tender offer route at Rs 2,000 per share from all the eligible shareholders as on record date. The buyback amount excludes expenses to be incurred for various charges, costs, and taxes. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/symphony-shares-to-trade-ex-buyback-this-week/articleshow/99041458.cms |

|

Tech View: Nifty charts hint at indecisiveness. What should traders do TuesdayOn the Monthly Option front, Maximum Call OI is at 18,000, then 17,000 strike, while Maximum Put OI is at 17,000, then 16500 strike. Call writing is seen at 17000, then 17250 strikes, while Put writing is seen at 17,000, then 16,800 strikes. Options data suggests an immediate trading range in between 16,800 to 17,200 zones. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/tech-view-nifty-charts-hint-at-indecisiveness-what-should-traders-do-on-tuesday/articleshow/99036650.cms |

|

Market Snapshot: U.S. stocks mostly higher as bank sector stress wanesU.S. stocks trade higher on Monday as traders welcome waning signs of banking sector stress. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-71C2-8666147C1FA5%7D&siteid=rss&rss=1 |

|

Biden calls for Congress to pass assault-weapons ban after Nashville school shootingPresident Joe Biden makes remarks Monday after police say a shooter killed three students and three adults at a private Christian school in Nashville. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-71C3-37ED8E46AB0B%7D&siteid=rss&rss=1 |

|

First Citizens skyrockets on Silicon Valley Bank deal. What’s next for the stock?First Citizens’ stock skyrocketed Monday, fueled by the company’s agreement to assume all the deposits and loans of Silicon Valley Bridge Bank from the FDIC. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-71C3-45A355D17F03%7D&siteid=rss&rss=1 |