Summary Of the Markets Today:

- The Dow closed up 132 points or 0.41%,

- Nasdaq closed up 0.31%,

- S&P 500 closed up 0.56%,

- Gold $1980 down $15.60,

- WTI crude oil settled at $69 down $0.79,

- 10-year U.S. Treasury 3.376% down 0.028 points,

- USD index $103.11 up $0.58,

- Bitcoin $27,867 down $485,

- Baker Hughes Rig Count: U.S. up 4 to 758 rigs

Click here to read our Economic Forecast for March 2023

Today’s Economic Releases:

New orders for manufactured durable goods in February 2023 fell 1.0% from January – the year-over-year growth was 2.3% (0.9% inflation adjusted). The decline in new orders is likely to weigh on economic growth in the near term. However, it is also likely to lead to lower inventories and higher production in the future. This could help to boost economic growth in the second half of the year.

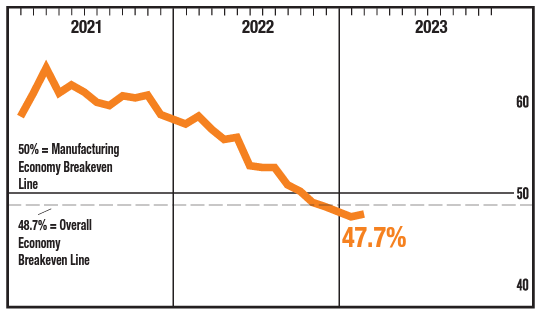

The February 2023 Manufacturing ISM® Report On Business® showed that the manufacturing sector contracted for the third consecutive month, with the Manufacturing PMI® improving to 47.7% from 47.4% in January. The five subindexes that directly factor into the Manufacturing PMI® were:

- Production: 47.3%

- New Orders: 47.0%

- Supplier Deliveries: 47.6%

- Inventories: 43.1%

- Prices: 51.3%

A summary of headlines we are reading today:

- Is A Global Tin Shortage Looming?

- Protests In France Force Exxon To Shut Port Jerome Refinery

- Latin America’s Bid To Challenge China’s Dominance In The Lithium Market

- Spain Calls On Importers Not To Sign New LNG Deals With Russia

- Why The Price Of Premium Gasoline Is Rising

- Deutsche Bank is not the next Credit Suisse, analysts say as panic spreads

- Wyoming abortion ban blocked due to Obamacare-era amendment

- A nuclear plant that leaked 400,000 gallons of radioactive water will be shut down after second incident

- Hundreds Of Funds On Brink Of Losing ESG Ratings

- The Fed Is Pushing The Accelerator & The Brake Pedals At The Same Time

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Elon Musk Responds To Worries Over Altitude Changes In Starlink SatellitesElon Musk’s SpaceX recently launched the first batch of its next-generation Starlink internet satellites that already appear to be in trouble. In a Wednesday tweet, Musk said there were “some issues” with “V2 Mini” satellites that were blasted into orbit last month. “Lot of new technology in Starlink V2, so we’re experiencing some issues, as expected,” Musk wrote. The billionaire was responding to a Twitter conversation with some users pointing out “significant” altitude changes of some of the V2 Minis. Musk said, “Some sats will… Read more at: https://oilprice.com/Energy/Energy-General/Elon-Musk-Responds-To-Worries-Over-Altitude-Changes-In-Starlink-Satellites.html |

|

Petrobras Ready To Be Last Oil Producer StandingPetrobras could be the last man standing when it comes to crude oil production amid the energy transition, the state-run oil company’s CEO Jean Paul Prates said in an interview in Rio de Janeiro. “We will get market share,” Prates said, according to Bloomberg, referring to Brazil’s state-run oil company. The comments come with respect to the energy transition and whether there is cause for concern for an oil company such as Petrobras. But Prates isn’t worried. “We may be the last to produce oil in the world,”… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Petrobras-Ready-To-Be-Last-Oil-Producer-Standing.html |

|

Is A Global Tin Shortage Looming?Via AG Metal Miner Cornish Metals plans to begin tin mining at its wholly-owned South Crofty site by 2026. According to the Vancouver-headquartered company, the start of mining will also coincide with an expected deficit in tin. Indeed, market analysts predict that there will be a significant shortfall in the global tin supply by the same year, which could drastically impact the tin price. Plans are now underway at South Crofty to start dewatering the mine by June. According to Cornish Metals CEO Richard Williams last week, the current aim is to… Read more at: https://oilprice.com/Metals/Commodities/Is-A-Global-Tin-Shortage-Looming.html |

|

Protests In France Force Exxon To Shut Port Jerome RefineryAn extension of the current strikes at France’s Le Havre port has cut off crude oil deliveries to ExxonMobil’s nearby Port Jerome refinery, according to the CGT trade union. Exxon’s Port Jerome refinery—a 236,000 bpd refinery in northern France—and the Gravenchon petrochemicals plant will stop operations today, CGT said, according to Argus. The refinery was originally expected to close earlier this week as the strikes drug on, but the refinery received a shipment of crude oil from Libya. TotalEnergies’ Gonfreville… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Protests-In-France-Force-Exxon-To-Shut-Port-Jerome-Refinery.html |

|

Oil Rig Count Inches Higher As WTI Holds Below $70The total number of total active drilling rigs in the United States rose by 4 this week, according to new data from Baker Hughes published on Friday. The total rig count rose to 758 this week—88 rigs higher than the rig count this time in 2022 and 317 rigs lower than the rig count at the beginning of 2019, prior to the pandemic. Oil rigs in the United States increased by 4 this week, to 593. Gas rigs stayed the same at 162. Miscellaneous rigs also stayed the same. The rig count in the Permian Basin rose by 3, on top of last week’s 7-rig… Read more at: https://oilprice.com/Energy/Crude-Oil/Oil-Rig-Count-Inches-Higher-As-WTI-Holds-Below-70.html |

|

Total And BP Tap Wind Power To Decarbonize North Sea Oil OperationsCrown Estate Scotland has awarded offshore wind leases to 13 Companies, including BP and TotalEnergies, to support North Sea oil and gas decarbonization. On Friday, Crown Estate Scotland, an independent commercial organization responsible for managing the British seabed, announced that it had awarded leases to 13 companies, including Big Oil’s BP and TotalEnergies, and several UK renewable firms. The companies will develop offshore wind projects to supply power primarily to North Sea oil and gas platforms to reduce the sector’s emissions.… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Total-And-BP-Tap-Wind-Power-To-Decarbonize-North-Sea-Oil-Operations.html |

|

Latin America’s Bid To Challenge China’s Dominance In The Lithium MarketThe government of Bolivia has called on its neighbors, Argentina, Brazil and Chile, to work on setting a Latin America-wide policy on the exploitation of lithium. The idea is part of a broader initiative to form an OPEC-like cartel to collectively boost these countries’ bargaining power. President Luis Are spoke in La Paz, saying, “We must be united in the market, in a sovereign manner, with prices that benefit our economies, and one of the ways, already proposed by (Mexico’s) President Andres Manuel Lopez Obrador, is to think of… Read more at: https://oilprice.com/Metals/Commodities/Latin-Americas-Bid-To-Challenge-Chinas-Dominance-In-The-Lithium-Market.html |

|

North American LNG Projects Plagued By Price VolatilityNew U.S. and Canadian LNG export projects show signs of accelerating but volatile natural gas prices are making bets on future supply and demand difficult, industrial market intelligence provider Industrial Info Resources (IIR) said in new research on Friday. “But too much too fast could overwhelm the sector. Volatility in natural gas prices makes it difficult to bet on the future and exports take away from domestic needs,” IIR said in a statement. In Canada, the provincial government of British Columbia has allowed the US$7.2… Read more at: https://oilprice.com/Energy/Natural-Gas/North-American-LNG-Projects-Plagued-By-Price-Volatility.html |

|

Spain Calls On Importers Not To Sign New LNG Deals With RussiaThe Spanish government has urged importers of liquefied natural gas not to sign new deals to purchase Russian LNG as the biggest buyer of Russia’s LNG in Europe looks to reduce dependence on Moscow’s gas, sources familiar with the matter told Bloomberg on Friday. The government of Spain, via Deputy Prime Minister Teresa Ribera who is responsible for the country’s energy policy, sent a letter in the middle of March to Naturgy Energy, Repsol, TotalEnergies, Pavilion Energy, Enagás, Met Energy, Enet Energy, Energias de Portugal,… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Spain-Calls-On-Importers-Not-To-Sign-New-LNG-Deals-With-Russia.html |

|

German Grid Operators Unveil €128 Billion Plan For Green Energy ShiftAccording to Germany’s high voltage grid firms, the country will need to construct 14,197 kilometers of power transmission lines, costing billions of euros to enable the shift to net-zero. The companies have presented a rolling development plan for public consultation that calls for an additional investment of €128.3 billion ($137.72 billion) until 2045, with some measures completed as early as 2037. The development plan is broken down into €41.6 billion for onshore and €86.7 billion for offshore measures. It… Read more at: https://oilprice.com/Latest-Energy-News/World-News/German-Grid-Operators-Unveil-128-Billion-Plan-For-Green-Energy-Shift.html |

|

Biden’s SPR Strategy Has Capped Oil PricesThe statement from the U.S. Energy Secretary that it will be difficult to refill the SPR despite oil prices being in the desired range has added downward pressure to oil prices and limited the potential for a rebound.Oilprice Alert: Whether you are new to the oil and gas industry or an energy market veteran, you will regret not signing up for Global Energy Alert. Oilprice.com’s premium newsletter provides everything from geopolitical analysis to trading analysis, and all for less than a cup of coffee per week.Friday, March 24th, 2023The… Read more at: https://oilprice.com/Energy/Energy-General/Bidens-SPR-Strategy-Has-Capped-Oil-Prices.html |

|

Traders Cautiously Optimistic After Major Selloff In CrudeU.S. West Texas Intermediate crude oil prices fell by 1% on Thursday after U.S. Energy Secretary Jennifer Granholm informed lawmakers that refilling the Strategic Petroleum Reserve (SPR) might take several years. Nonetheless, the market is still higher for the week and in a position to post a potentially bullish closing price reversal bottom. Granholm’s remarks raised concerns about a potential oversupply of oil, which was amplified by the Energy Department’s plan to release an additional 26 million barrels as part of its congressional mandate.… Read more at: https://oilprice.com/Energy/Energy-General/Traders-Cautiously-Optimistic-After-Major-Selloff-In-Crude.html |

|

Why The Price Of Premium Gasoline Is Rising1. China-Russia Relations Continue To Improve- The visit of Chinese President Xi Jinping to Russia this week highlighted increasing volumes of energy trade between the two countries as the latter was shunned by Europe. – February Chinese customs data shows that China’s crude oil imports from Russia rose to an all-time high of 2.01 million b/d, equivalent to almost 20% of all incoming oil. – Having already risen 42% year-on-year, steadily overtaking second-largest supplier Saudi Arabia, Russian exports into China are set to grow even further… Read more at: https://oilprice.com/Energy/Energy-General/Why-The-Price-Of-Premium-Gasoline-Is-Rising.html |

|

Fighting Continues In Yemen Despite Saudi-Iran DétentePolitics, Geopolitics & Conflict The U.S. Fed insists that the financial sector is “sound and resilient”, despite the banking crises that started with the collapse of two regional U.S. banks, was followed by a share crash and buyout bid for Credit Suisse, and then proceeded to put major pressure on other small U.S. banks. The Fed then raised interest rates 25 basis points on Wednesday, a step back from the earlier string of 75-basis-point hikes. The first agreement between Saudi Arabia and Iran after restoring diplomatic ties earlier… Read more at: https://oilprice.com/Energy/Energy-General/Fighting-Continues-In-Yemen-Despite-Saudi-Iran-Dtente.html |

|

Is It Time To Short This Soaring Solar Stock?One of the things I learned early in my trading career was that in that business, admitting and acknowledging mistakes is a good thing. That is so ingrained in me now that I have continued to do that as a writer on markets and trading, even though in that field of work one is expected to do the opposite. Apparently, we are all supposed to pretend that every call we ever made was spot on, but that is neither realistic nor helpful. So, I have no problem saying that last time I wrote about First Solar (FSLR) things didn’t go my way, to say the… Read more at: https://oilprice.com/Energy/Energy-General/Is-It-Time-To-Short-This-Soaring-Solar-Stock.html |

|

Deutsche Bank is not the next Credit Suisse, analysts say as panic spreadsCentral banks and regulators had hoped that the Credit Suisse rescue deal would help calm investor jitters about the stability of Europe’s banks. Read more at: https://www.cnbc.com/2023/03/24/deutsche-bank-is-not-the-next-credit-suisse-analysts-say-as-panic-spreads.html |

|

Stocks close higher Friday as investors try to shake off latest bank fears: Live updatesA plunge in shares of Deutsche Bank in Europe raised investor fears about the banking sector once again. Read more at: https://www.cnbc.com/2023/03/23/stock-futures-are-up-slightly-as-investors-weigh-bank-troubles-fed-decision.html |

|

Secondhand resale is getting cutthroat as platforms such as Depop and Poshmark boomThe consumer culture on indie reselling platforms has shifted as more sellers compete to capture demand and more inflation-weary customers hunt for deals. Read more at: https://www.cnbc.com/2023/03/24/depop-poshmark-secondhand-resale-cutthroat.html |

|

Trump live updates: Threatening letter with nonhazardous white powder found at Manhattan DA’s officeA New York grand jury has been hearing evidence of hush money payment benefiting former President Donald Trump. Follow live updates on the probe. Read more at: https://www.cnbc.com/2023/03/24/trump-live-updates-grand-juries-probe-former-president.html |

|

CNBC Special Pro Talks: Investor who predicted the Silicon Valley Bank collapse gives his best betsHe’s the new ‘Big Short.’ Raging Capital Ventures Chairman & CIO William Martin famously warned of Silicon Valley Bank’s problems two months before its demise and profited on its collapse. Martin joins a CNBC Special Pro Talks with how he is investing for whatever comes next and to answer your questions. Read more at: https://www.cnbc.com/video/2023/03/24/cnbc-special-pro-talks-investor-who-called-svb-collapse-gives-his-best-bets.html |

|

Blue Origin says an overheated engine part caused last year’s cargo rocket failureJeff Bezos’ space company Blue Origin released findings from an investigation into the failed flight of a cargo mission last year. Read more at: https://www.cnbc.com/2023/03/24/blue-origin-ns-23-failure-cause.html |

|

Key lawmakers say upcoming hearings on bank failures aim to boost U.S. confidence in banking sectorLawmakers responsible for federal oversight say upcoming hearings on the failures of Silicon Valley Bank and Signature Bank will bolster confidence in banks. Read more at: https://www.cnbc.com/2023/03/24/svb-failure-congress-hearings-aim-to-increase-confidence-in-banks.html |

|

Wyoming abortion ban blocked due to Obamacare-era amendmentAbortion is legal in Wyoming again thanks to a state constitutional amendment pushed by conservatives opposed to Obamacare more than a decade ago. Read more at: https://www.cnbc.com/2023/03/24/wyoming-abortion-ban-blocked-due-to-obamacare-era-amendment.html |

|

Ether falls to cap off volatile week, and U.S. officials charge Do Kwon with fraud: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, Crypto World explores how crypto exchanges make money amid an industry wide downturn and regulatory reckoning. Read more at: https://www.cnbc.com/video/2023/03/24/ether-falls-volatile-week-officials-charge-do-kwon-fraud-crypto-world.html |

|

Rocket Lab targets $50 million launch price for Neutron rocket to challenge SpaceX’s Falcon 9Rocket Lab is targeting a $50 million launch price for its coming reusable launch vehicle called Neutron, to challenge Elon Musk’s SpaceX. Read more at: https://www.cnbc.com/2023/03/24/rocket-lab-neutron-launch-price-challenges-spacex.html |

|

This LA mansion is staring down an April 1 deadline before the seller loses millionsA new, local mansion tax takes effect in Los Angeles next month, levied upon a seller of any real property that trades for $5 million or more. Read more at: https://www.cnbc.com/2023/03/24/la-mansion-for-sale-faces-april-1-tax-deadline.html |

|

A nuclear plant that leaked 400,000 gallons of radioactive water will be shut down after second incidentRepairs are set to begin to fix the leaking of radioactive water from the facility this week, after a larger leak was discovered last November but only made public this month. Read more at: https://www.cnbc.com/2023/03/24/a-nuclear-plant-that-leaked-400000-gallons-of-radioactive-water-will-be-shut-down-after-second-incident.html |

|

Ukraine war live updates: Zelenskyy discusses reconstruction with World Bank; Russian strikes overnight kill civiliansUkraine’s military is signaling that a much-anticipated counteroffensive is coming “very soon” as Russian forces appear to lose momentum on the eastern front. Read more at: https://www.cnbc.com/2023/03/24/russia-ukraine-live-updates.html |

|

Zero Dark TrumpAuthored by Michael Shellenberger and Leighton Woodhouse via ‘Public’ Substack, Since he first announced last Saturday that he would be arrested by New York City police the following Tuesday, millions of Trump-obsessed Americans have now waited nearly a week for the big day to arrive. This may be the only chance in a lifetime for so-called journalists like us to write ledes like:

But even before the big day arrived, the overproduction of elites had created an overproduction of “deep fakes,” made by A.I., of Trump being arrested.

Deep fake by Read more at: https://www.zerohedge.com/technology/zero-dark-trump |

|

“It’s A Crisis Built On A Crisis We Never Solved” – Rick Santelli Rages “How Can Anyone Be Shocked?”When Rick Santelli speaks, traders listen as he channels the unvarnished truth that is so seldom allowed to leak out on to the airwaves and into the great unwashed’s eyes and ears.

This morning was one such episode as he and Joe Kernan had a brief discussion about the inevitability of the current crisis… and what happens next.

Then the veteran pit trader took it to ’11’…

|

|

Hundreds Of Funds On Brink Of Losing ESG RatingsThe Financial Times reports that Environmental, social, and governance (ESG) investing is on the verge of a significant transformation, as index provider MSCI is set to remove the ESG ratings from hundreds of funds. This change is part of a major overhaul of the MSCI’s rating methodology. According to unpublished research by BlackRock Inc.’s iShares unit, cited by FT, MSCI intends to downgrade the ESG rating of hundreds of funds. The adjustments, scheduled to be implemented by the end of April, will apply to all exchange-traded and mutual funds worldwide. Index providers are pushing the changes to tighten the requirements for what qualifies as an ESG-compliant fund amid pressure from regulators concerned about “greenwashing.” One of the highest-profile greenwashing scandals has been Deutsche Bank AG and its asset management arm, DWS Group, in Frankfurt, Germany, which exaggerated green investments in ESG products. Read more at: https://www.zerohedge.com/markets/hundreds-funds-brink-losing-esg-ratings |

|

The Fed Is Pushing The Accelerator & The Brake Pedals At The Same TimeAuthored by Simon White, Bloomberg macro strategist, Collapsing velocity will lead to financial conditions continuing to tighten even as the Fed rapidly expands its balance sheet. When banks are in trouble, it has a geared impact on the rest of the economy. In 2008, money velocity (essentially, how many times each dollar changes hands in a given period) collapsed as banks stopped lending; central banks responded by cutting rates to zero and massively expanding their balance sheets. To no avail, however, and velocity kept falling until 2020 when it started to rise again – it’s no coincidence we now have an inflation problem. The remedy has created a new nightmare for policymakers as banks around the world are reeling from the fastest rate-hiking cycles seen for several decades. Central banks are now back in the game of trying to arrest the fall in velocity – deteriorating their balance sheets – to avert the deep recession that would result. The signs are so far it is not working. The Fed over the last two weeks has effectively reversed two-thirds of QT, if we look at the size of its balance sheet. But the key metric to watch is reserves – these are the higher-velocity part of the central bank’s liabilities, as they are the other side of the coin of bank deposits. Yet even reserves are 30% higher. Read more at: https://www.zerohedge.com/markets/fed-pushing-accelerator-brake-pedals-same-time |

|

Firms hit back at Bank governor in prices rowWetherspoon boss Tim Martin says bank managers are “breathing down the neck” of business owners. Read more at: https://www.bbc.co.uk/news/business-65067723?at_medium=RSS&at_campaign=KARANGA |

|

Deutsche Bank share slide reignites worries among investorsWorries over the financial strength of the sector persist, with Deutsche Bank shares down 14% at one point. Read more at: https://www.bbc.co.uk/news/business-65064378?at_medium=RSS&at_campaign=KARANGA |

|

Bank governor warns firms raising prices ‘hurts people’Andrew Bailey tells the BBC price rises will fuel inflation and hurt the least well off. Read more at: https://www.bbc.co.uk/news/technology-65056733?at_medium=RSS&at_campaign=KARANGA |

|

BNP Paribas Arbitrage sells Bharti Airtel shares worth Rs 105 croreThe shares were sold at an average price of Rs 762.55 per piece, taking the transaction value to Rs 105.41 crore. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/bnp-paribas-arbitrage-sells-bharti-airtel-shares-worth-rs-105-crore/articleshow/98978569.cms |

|

HAL OFS successful despite tough markets as QIBs, retail investors show high interestThe retail portion of the OFS also received an overwhelming response, with the government getting bids for 14,50,924 shares against 11,70,357 shares on offer for the category. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/hal-ofs-successful-despite-tough-markets-as-qibs-retail-investors-show-high-interest/articleshow/98977703.cms |

|

Banking: Deutsche Bank, First Republic weigh on bank stocksDeutsche Bank credit default swaps jitters weigh on big U.S. banks; First Republic stock moves lower as investors await official word of second capital injection. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-71C1-3845BCEA0C7C%7D&siteid=rss&rss=1 |

|

Metals Stocks: Gold posts a 4th straight weekly gain as bank jitters spread to Deutsche BankGold futures end Friday with a loss, failing to hold above the key $2,000-an-ounce level, but prices scored a fourth consecutive weekly gain. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-71C1-14ACAA4D706D%7D&siteid=rss&rss=1 |

|

Retirement Weekly: Does your personality determine your success as an investor?Your portfolio reflects your personality Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-71C1-4E3E95DC7EED%7D&siteid=rss&rss=1 |