Summary Of the Markets Today:

- The Dow closed down 91 points or 0.28%,

- Nasdaq closed up 0.45%,

- S&P 500 closed down 0.15%,

- Gold $1919 up $51.60,

- WTI crude oil settled at $74 down $2.28,

- 10-year U.S. Treasury 3.534% down 0.163 points,

- USD $103.64 down $0.94,

- Bitcoin $24,383 – 24H Change up $3,291.55 – Session Low $21,136

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our Economic Forecast for March 2023

Today’s Economic Releases:

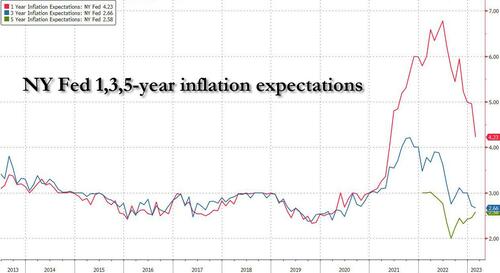

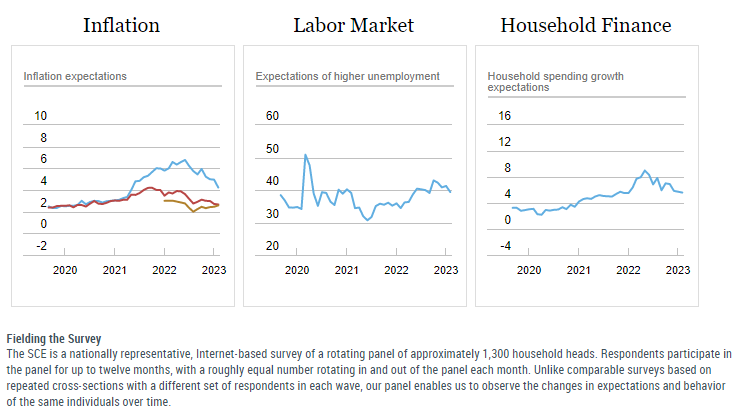

The Federal Reserve Bank of New York’s Center for Microeconomic Data today released the February 2023 Survey of Consumer Expectations, which shows that inflation expectations decreased sharply at the short-term horizon, remained unchanged at the medium-term horizon, and slightly increased at the long-term horizon. Expectations about year-ahead price increases for gas, food, cost of rent, college education, and medical care all declined. Labor market expectations improved, with unemployment expectations and perceived job loss risk decreasing and job finding expectations increasing. Expectations for voluntary job quits reached the highest level since the start of the pandemic. Households’ perceptions and expectations for current and future financial situations both improved.

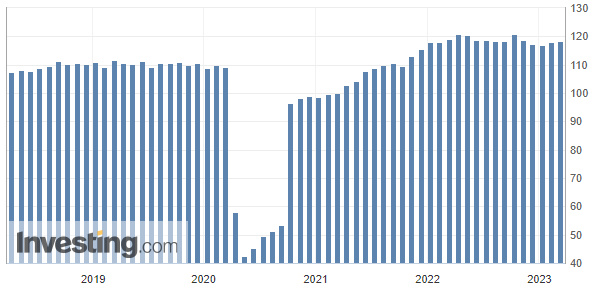

The Conference Board Employment Trends Index (ETI) rose in February to 118.29 from a downwardly revised 118.14 in January 2023. When the index increases, employment is likely to grow as well, and vice versa. Turning points in the index indicate that a turning point in the number of jobs is about to occur in the coming months. Frank Steemers, Senior Economist at The Conference Board stated:

The Employment Trends Index increased in February, but it has mainly been moving sideways over the past year. So far, job growth in 2023 has been strong, and the Index remaining quite high signals that solid job gains will likely continue over the next months. With such a strong labor market and wage growth still elevated, the Federal Reserve will likely continue to further increase interest rates in its mission to lower inflation.

A summary of headlines we are reading today:

- Oil Falls Again As Traders Remain Concerned About U.S. Banks

- Copper Prices Face Bearish Headwinds

- Bank Collapse Contagion Fears Spread To Oil Prices

- Russian Seaborne Exports Of Oil Products Dropped 10.4% In February

- Dow falls for a fifth day despite emergency backstop of Silicon Valley Bank: Live updates

- Mortgage rates tumble in the wake of bank failures

- 2-year Treasury yield posts biggest 3-day decline since aftermath of 1987 stock crash

- Bitcoin rallies to $24,000 even as regulators shut down Signature Bank: CNBC Crypto World

- 1-Year Inflation Expectations Tumble At Fastest Pace On Record

- Market Extra: VIX keeps climbing after government intervention fails to ease investor anxiety

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Satellite Waste Is Becoming A Huge ProblemHere we go again. Satellite companies that plan to put tens of thousands of satellites into orbit to create space-based internet and cellphone networks are about to reach the final frontier for human degradation of the environment, outer space. And, they are doing it in ways that threaten the radiation protection of the ozone layer. The so-called low Earth orbit satellites the companies are launching are designed to last for around five years and then fall back to Earth, disintegrating in the atmosphere as they fall. What they leave behind are… Read more at: https://oilprice.com/The-Environment/Global-Warming/Satellite-Waste-Is-Becoming-A-Huge-Problem.html |

|

Oil Falls Again As Traders Remain Concerned About U.S. BanksOil markets continued to be disrupted by the failure of Silicon Valley Bank and Signature Bank over the weekend, with oil prices losing nearly 3% just shy of the closing bell on Monday. On Monday at 3:36 p.m. EST, Brent crude was trading down 2.96% at $80.33, for a loss of $2.45 on the day. WTI was trading down 2.99% at $74.39, for a loss of $2.29 on the day. SVB, the go-to lender for tech startups backed by venture capitalists, failed dramatically on Friday, with shares plunging 60% before the SEC halted trading. Investors were spooked last… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Oil-Falls-Again-As-Traders-Remain-Concerned-About-US-Banks.html |

|

Copper Prices Face Bearish HeadwindsVia AG Metal Miner Recent price action suggests strong potential for the price of copper to shift away from the rally witnessed at the beginning of the year. Technical analysis (TA) indicates that copper prices have begun to form lower highs on shorter time frames. This is a strong indicator that a downtrend lies ahead. However, prices will continue to trade sideways until the price curve forms a lower low below the trend line. At that point, we expect copper’s downtrend to begin in earnest. Overall, the Copper Monthly Metals… Read more at: https://oilprice.com/Metals/Commodities/Copper-Prices-Face-Bearish-Headwinds.html |

|

Luxury Items Emerged As Top Investments In 2022As stock markets flailed and the age of zero interest was only slowly beginning to end, 2022 was not kind to investors. The year was also Wall Street’s worst since the Great Recession, causing most shareholders leaving markets owning less than what they started with. Those with more conservative investments, like a savings account, could have had the last laugh, had it not been for 2022’s rampant inflation that made even a stagnant account balance worth quite a bit less in real world terms. For more adventurous investors with the right amount of… Read more at: https://oilprice.com/Finance/the-Economy/Luxury-Items-Emerged-As-Top-Investments-In-2022.html |

|

Norway’s Oil Fund Held Over $260M In Failed SVB Banking GroupNorway’s oil fund held over $263 million in Signature Bank and SVB Financial Group, the owner of Silicon Valley Bank (SVB), which failed spectacularly over the weekend, sparking government intervention. MarketWatch reports that the Norwegian sovereign wealth fund (SWF) held around $263 million in SVB Financial Group and Signature Bank, based on last week’s valuations. “This is the biggest U.S. bank collapse since the financial crisis and we are closely monitoring the situation in the market,” Norges Bank Investment Management… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Norways-Oil-Fund-Held-Over-260M-In-Failed-SVB-Banking-Group.html |

|

High Taxes Stand In The Way Of UK Renewable DevelopmentRepresentatives of the renewable energy sector are pressing for changes ahead of this week’s budget. They say that a cap on revenue and a lack of incentives offered to oil explorers are blocking the development of renewable energy in Britain. The government has set goals to increase wind generation and become independent of imported energy following the Russian invasion of Ukraine, but could miss these targets without policy changes. Other countries being more willing to attract such investment brings about an urgency for these new standards.… Read more at: https://oilprice.com/Latest-Energy-News/World-News/High-Taxes-Stand-In-The-Way-Of-UK-Renewable-Development.html |

|

The Real Reason Why Automakers Slashed EV PricesThe global electric vehicle (EV) market is reeling from one of the most dramatic collapses in monthly sales to date, with Rystad Energy research showing that only 672,000 units were sold in January, almost half of December 2022 sales and a mere 3% year-on-year increase over January 2022. The EV market share among all passenger car sales also tumbled to 14% in January, well down on the 23% seen in December. EV sales have been on a relatively consistent upward trajectory in recent years – aside from periods impacted by Covid-19 pandemic-related… Read more at: https://oilprice.com/Energy/Energy-General/The-Real-Reason-Why-Automakers-Slashed-EV-Prices.html |

|

UK Subsidies To Fossil Fuel Producers Far Exceed RenewablesFossil fuels received £20bn more UK support than renewables since 2015, according to new research commissioned by Liberal Democrats. The UK government has given £80bn in support to fossil fuel producers, surpassing the £60bn it has given to renewables. While fossil fuels were receiving this greater investment, renewable energy was not far behind, with 2020 being the first year when support for renewables exceeded that of fossils. Despite the uptick, however, 2021 saw a sharp increase in financial aid provided to fossil fuel companies,… Read more at: https://oilprice.com/Latest-Energy-News/World-News/UK-Subsidies-To-Fossil-Fuel-Producers-Far-Exceed-Renewables.html |

|

Russia Can’t Afford To Continue Exporting ArmsRussia’s share of global arms exports declined sharply in the most recent five-year period, as Western sanctions against Moscow and the Kremlin’s own need to conserve weaponry for its ongoing war effort in Ukraine limited sales abroad, new data from an influential research group showed. Russia’s share of global arms exports declined from 22 percent in the 2013-17 period to 16 percent in 2018-22, according to a report by the Stockholm International Peace Research Institute (SIPRI) published on March 13. Meanwhile, the United States remained… Read more at: https://oilprice.com/Geopolitics/International/Russias-Arms-Exports-Are-Plummeting.html |

|

Biden Greenlights Controversial Alaska Oil ProjectThe Biden Administration approved the controversial Alaska oil project known as Willow on Monday after rumors surfaced last week that the Administration was set to approve it. The massive oil Willow Project covers three drill sites in the National Petroleum Reserve in an area that is estimated to hold up to 600 million barrels of oil. The project has incited much controversy from climate activists and some of Biden’s supporters from the left, many of whom argue that the project is a major setback in fighting climate change, with the Interior… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Biden-Greenlights-Controversial-Alaska-Oil-Project.html |

|

Bank Collapse Contagion Fears Spread To Oil PricesOil prices have fallen over $2 on Monday, and were down as much as $4 in early trading, as fears of a contagion spread following the sudden collapse of Silicon Valley bank on Friday. By 10:20 a.m. EST on Monday, Brent crude had fallen 2.31% to $80.87, with WTI down 2.62% at $74.67. The Dow was also plunged over 243 points early on Monday, clawing back some of those losses by 10:20 a.m., for a 70 point downswing. Oil prices likely would have fallen even more had not Chinese demand data not provided a counterweight. Fears of a pending… Read more at: https://oilprice.com/Energy/Oil-Prices/Bank-Collapse-Contagion-Fears-Spread-To-Oil-Prices.html |

|

Strikes That Shut Down French LNG Terminals Expected To ContinueThe strikes in France against a labor market reform have shut down the LNG import terminals, and the impact will continue to be felt this week, French union representatives told Reuters on Monday. France is in the midst of massive protests and strikes in many sectors against a proposal by French President Emmanuel Macron to raise the retirement age by two years to 64. The strikes across France have disrupted power supply, refining operations, and fuel deliveries for more than a week of strikes and street protests against the pension reform. … Read more at: https://oilprice.com/Latest-Energy-News/World-News/Strikes-Shut-Down-French-LNG-Terminals.html |

|

The World Bank May Return To Financing Natural Gas ProjectsThe World Bank could be open to funding gas projects in Mozambique to ensure greater energy access if the costs are the cheapest among energy sources, Victoria Kwakwa, World Bank Vice President for Eastern and Southern Africa, told Bloomberg in an interview published on Monday. Back in 2017, the World Bank Group said it would no longer finance upstream oil and gas after 2019. But the group noted that “In exceptional circumstances, consideration will be given to financing upstream gas in the poorest countries where there is a clear benefit… Read more at: https://oilprice.com/Energy/Energy-General/The-World-Bank-May-Return-To-Financing-Natural-Gas-Projects.html |

|

Top UK Pension Funds Intend To Vote Against BP And Shell DirectorsFollowing announcements from BP and Shell that they intend to continue supplying the oil and gas the world needs, some of the largest UK pension funds are threatening to vote against individual directors at the annual general meetings because of the companies’ reduced emissions targets. Universities Superannuation Scheme (USS) and Borders to Coast, which have a combined $157 billion (£130 billion) in assets under management, intend to vote against individual directors at Shell and BP at this spring’s annual general meetings of… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Top-UK-Pension-Funds-Intend-To-Vote-Against-BP-And-Shell-Directors.html |

|

Russian Seaborne Exports Of Oil Products Dropped 10.4% In FebruaryRussia’s exports of oil products by sea slipped by 10.4% in February as the EU embargo and the G7 price caps on Russian fuels came into force, Reuters has estimated based on data from industry sources. Total shipments of oil products from Russian ports dropped to 9.531 million tons last month, down from 11.781 million tons exported by sea in January, according to the data and to Reuters calculations. The biggest decline was seen in seaborne exports from Russia’s Black Sea ports and from the Azov Sea, where volumes slumped by 20.5%.… Read more at: https://oilprice.com/Energy/Energy-General/Russian-Seaborne-Exports-Of-Oil-Products-Dropped-104-In-February.html |

|

Dow falls for a fifth day despite emergency backstop of Silicon Valley Bank: Live updatesSome traders bet the financial shock from the Silicon Valley Bank fallout could cause the Federal Reserve to pause interest rate hikes. Read more at: https://www.cnbc.com/2023/03/12/stock-market-futures-open-to-close-news.html |

|

Something broke, but the Fed is still expected to go through with rate hikesMarkets still expect the Fed to keep up its inflation-fighting efforts, despite high-profile bank failures that have rattled the financial system. Read more at: https://www.cnbc.com/2023/03/13/something-broke-but-the-fed-is-still-expected-to-go-through-with-rate-hikes.html |

|

Mortgage rates tumble in the wake of bank failuresThe average rate on the popular 30-year fixed mortgage dropped to 6.57% Monday, according to Mortgage News Daily. Read more at: https://www.cnbc.com/2023/03/13/mortgage-rates-tumble-in-wake-of-bank-failures.html |

|

Charles Schwab shares drop 12% even as the firm defends financial positionSchwab defended its financial position, reiterating that it has plenty of access to liquidity and a low loan-to-deposit ratio. Read more at: https://www.cnbc.com/2023/03/13/charles-schwab-shares-head-for-worst-day-ever-as-fears-of-banking-crisis-deepen.html |

|

Play ultimate defense with these stocks that rise when volatility goes wild on Wall StreetAs economic uncertainty grows, investors can look at these defense stocks to beat the Street. Read more at: https://www.cnbc.com/2023/03/13/play-defense-with-these-stocks-that-rise-when-wall-street-is-volatile.html |

|

Jeffrey Gundlach says Fed will hike funds rate next week to save credibility — but shouldn’tWhile Gundlach sees more tightening ahead, he doesn’t think that’s the appropriate response right now as regulators’ rescue programs are inflationary in nature. Read more at: https://www.cnbc.com/2023/03/13/gundlach-says-fed-will-hike-rate-next-week-to-save-face-but-shouldnt.html |

|

First Republic drops 50%, leads decline in bank stocks despite government’s backstop of SVBFirst Republic Bank led a decline in bank shares Monday that came even after regulators’ extraordinary actions Sunday evening. Read more at: https://www.cnbc.com/2023/03/13/first-republic-drops-bank-stocks-decline.html |

|

2-year Treasury yield posts biggest 3-day decline since the aftermath of 1987 stock crashU.S. Treasury yields declined on Monday as investors assessed the state of the economy after the collapse of Silicon Valley Bank. Read more at: https://www.cnbc.com/2023/03/13/us-treasury-yields-investors-assess-the-state-of-the-economy.html |

|

Bitcoin rallies to $24,000 even as regulators shut down Signature Bank: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, William Quigley, the co-founder of Tether and WAX Blockchain, discusses the fallout in the crypto industry from the closure of Signature Bank and Silicon Valley Bank. Read more at: https://www.cnbc.com/video/2023/03/13/bitcoin-rallies-24000-regulators-shut-down-signature-bank-crypto-world.html |

|

Wall Street is surprised by First Republic’s falling stock. Here’s how the bank compares to SVBSome Wall Street analysts believe the drop in the stock is an “overreaction,” but the company could still be subject to a bank run. Read more at: https://www.cnbc.com/2023/03/13/first-republics-falling-stock-surprises-some-heres-how-it-compares-with-svb-.html |

|

‘That’s how capitalism works,’ Biden says of SVB, Signature Bank investors who lost money in failed banks“Investors in the banks will not be protected,” Biden said. “They knowingly took a risk and when the risk didn’t pay off, the investors lose their money.” Read more at: https://www.cnbc.com/2023/03/13/thats-how-capitalism-works-biden-says-of-svb-signature-bank-investors-who-lost-money-in-failed-banks.html |

|

GOP presidential contenders cast blame for Silicon Valley Bank collapseWhile Trump slammed Biden and Democrats, Florida Gov. Ron DeSantis suggested that diversity, equity, and inclusion initiatives were to blame for SVB’s failure. Read more at: https://www.cnbc.com/2023/03/13/svb-collapse-trump-desantis-haley-ramaswamy-weigh-in.html |

|

First Republic tells CNBC the bank isn’t seeing that many depositors leave, JPMorgan funding workingJim Herbert, First Republic’s executive chairman, told Cramer that the bank was not seeing massive outflows of deposits and was operating as usual. Read more at: https://www.cnbc.com/2023/03/13/frc-tells-cnbc-the-bank-isnt-seeing-that-many-depositors-leave-jpm-funding-working.html |

|

1-Year Inflation Expectations Tumble At Fastest Pace On RecordSo much has changed in just a few days: one week ago people cared about boring stuff like seasonally adjusted payrolls (a product of White House administration propaganda as much as actual data) and the readjusted Consumer Price Index (also a product of White House administration propaganda as much as actual data). Well, nothing like a bank crisis to clear one’s head of goal-seeked data that would make Beijing blush. And also – apparently – there is nothing like a bank crisis to send inflation expectations plummeting. Earlier today, in breach of today’s data vacuum, the NY Fed published its latest Survey of Consumer Expectations, which showed that inflation expectations collapsed at the 1-year horizon, plunging by 0.8% to 4.2%, the lowest since May 2021…

… and the biggest monthly drop on record for the series! One can only imagine what the read would have been if the poll had taken place after the collapse of SIVB and SBN … Read more at: https://www.zerohedge.com/markets/1-year-inflation-expectations-tumble-fastest-pace-record |

|

WHO Chief Says Quest For COVID Origins Remains “Morally Imperative”Authored by Aldgra Fredly via The Epoch Times, The chief of the World Health Organization (WHO) said it is “morally imperative” to find the origins of the COVID-19 pandemic, which has caused millions of deaths worldwide as Beijing continues to obfuscate sharing crucial data with the world.

Marking three years into the pandemic, WHO director-general Tedros Adhanom Ghebreyesus said on Saturday that “all hypotheses” around COVID-19 must be explored in order to prevent future outbreaks.

Tedros said the WHO would continue to push for equitable ac … Read more at: https://www.zerohedge.com/covid-19/who-chief-says-quest-covid-origins-remains-morally-imperative |

|

Barclays Joins Goldman In Expecting A Fed ‘Pause’ Next Week “Due To Financial Market Turbulence”Update (1300ET): Hours after Goldman’s Jan Hatzius confirmed the bank’s new expectation that The Fed will not hike rates in March (next week), let alone consider a 50bps rise; Barclays’ Marc Giannoni and the Economics Research team is out with a report forecasting no hike at the upcoming FOMC meeting, justified by risk management considerations as financial stability concerns move to the forefront. The market is now pricing in a coin-toss (0 or 25bps) for March, but expects the full 25bps in May…

Their flip-flop – from forecasting a 50bps hike just last week – to a pause is driven by the financial market turbulence over the weekend, and signs of a sudden intensification of risk aversion (outweighing their interpretation of incoming data, including from the US labor market, in combination with Chair Powell’s willingness to consider a return to aggressive hikes). Additionally, Barclays lowers its terminal rate expectation to 5.1%…

|

|

Mayor Of Seoul Calls For South Korea To Develop Nuclear WeaponsAuthored by Charles Kennedy via OilPrice.com, South Korea should develop and build nuclear weapons as a means to defend itself from the growing nuclear threat from North Korea, the mayor of Seoul, Oh Se-hoon, said in an exclusive interview with Reuters published on Monday.

South Korea doesn’t have a domestic nuclear weapons program, but the recent tensions over increased threats from North Korea have intensified calls from some politicians in South Korea that the south needs to be able to defend itself.

|

|

Silicon Valley Bank: Biden says US banking system is safeUS authorities say they will guarantee all customer deposits after two banks collapse and spark crisis fears. Read more at: https://www.bbc.co.uk/news/world-us-canada-64935170?at_medium=RSS&at_campaign=KARANGA |

|

Silicon Valley Bank: Shares fall as fears persist about failed US bankStock markets ended lower despite efforts to limit the fallout from Silicon Valley Bank’s collapse. Read more at: https://www.bbc.co.uk/news/business-64941010?at_medium=RSS&at_campaign=KARANGA |

|

HSBC swoops in to rescue UK arm of Silicon Valley BankThe Bank of England and government worked all night to secure a deal involving no taxpayer money. Read more at: https://www.bbc.co.uk/news/business-64937251?at_medium=RSS&at_campaign=KARANGA |

|

SVB collapse largest among bank failures in US since 2008On Friday, a California regulator shut Silicon Valley Bank and appointed the FDIC as a receiver. Read more at: https://economictimes.indiatimes.com/markets/web-stories/svb-collapse-largest-among-bank-failures-in-us-since-2008/articleshow/98613270.cms |

|

Blackstone sells entire stake in Sona BLW Precision for Rs 4,916 cr via block dealShares of Sona BLW were under pressure for the past few days, reacting to reports of a block deal. In the last five days, the stock has lost about 10.66% Read more at: https://economictimes.indiatimes.com/markets/stocks/news/blackstone-sells-entire-stake-in-sona-blw-precision-for-rs-4916-cr-via-block-deal/articleshow/98613541.cms |

|

Tata, RIL most valued business groups in India. Adani slides to 3rd spotThe sell-off in Adani Group stocks since January 25, after the Hindenburg report, resulted in the group’s total market value sliding to the third position among Indian conglomerates. Read more at: https://economictimes.indiatimes.com/markets/web-stories/tata-ril-most-valued-business-groups-in-india-adani-slides-to-3rd-spot/articleshow/98607694.cms |

|

Futures Movers: Oil ends lower as SVB collapse stirs recession fearsOil prices decline Monday, with crude feeling pressure as investors sort through fears of a financial crisis following the collapse of Silicon Valley Bank. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-71B2-EF18E852D667%7D&siteid=rss&rss=1 |

|

Market Extra: VIX keeps climbing after government intervention fails to ease investor anxietyGovernment intervention isn’t keeping market anxiety at bay. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-71B3-9807A18973D1%7D&siteid=rss&rss=1 |

|

Silicon Valley VCs vow to work with SVB if a new owner is foundHundreds of venture-capital firms, including Sequoia Capital and RRE Ventures, have pledged to work again with Silicon Valley Bank if a new owner is found. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-71B3-9DFFCFDDBED6%7D&siteid=rss&rss=1 |