Summary Of the Markets Today:

- The Dow closed down 345 points or 1.07%,

- Nasdaq closed down 1.76%,

- S&P 500 closed down 1.44%,

- Gold $1872 up $37.30,

- WTI crude oil settled at $77 up $0.80,

- 10-year U.S. Treasury 3.680% down 0.241 points,

- USD $104.62 down $0.69,

- Bitcoin $19,960 – 24H Change down $286.57 – Session Low $19,615

- Baker Hughes Rig Count: U.S. -3 to 746 Canada -23 to 223

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our Economic Forecast for March 2023

Today’s Economic Releases:

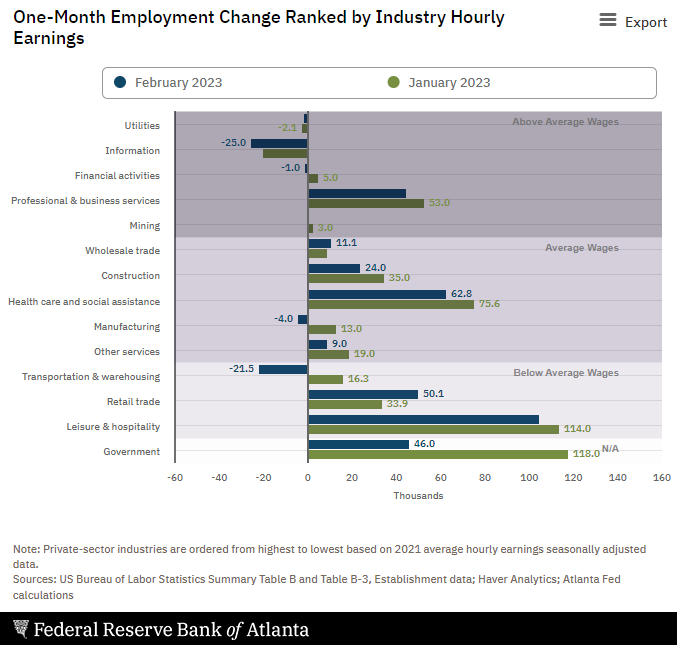

Total nonfarm payroll employment rose by 311,000 in February 2023, and the unemployment rate edged up from 3.4% to 3.6% (over the last year unemployment has ranged between 3.4% to 3.8%). Notable job gains occurred in leisure and hospitality, retail trade, government, and health care. Employment declined in information and in transportation and warehousing. The household survey shows employment grew 177,000 vs the establishment’s 311,000. Since employment continues to grow at a reasonable rate, the Federal Reserve is free to continue to increase its federal funds rate to fight inflation.

Yesterday, I attributed the market’s down day to Fed Chair Powell’s hawkish comments and the anticipation that today’s job report would be good. Whilst true, there was another event weighing on the market – Silicon Valley Bank announced that it sold off $21B worth of holdings at a $1.8B loss. Silicon Valley Bank is a major player for technology start-ups being considered the backbone of the US venture capital industry. Today, Silicon Valley Bank collapsed after a stunning 48 hours in which its capital crisis set off fears of a meltdown across the banking industry. Its failure marks the largest shutdown of a US bank since 2008. The bank is now in the hands of the Federal Deposit Insurance Corporation. The FDIC is acting as a receiver, which typically means it will liquidate the bank’s assets to pay back its customers, including depositors and creditors. This is not good news and potentially this is the straw that broke the camel’s back. This is affecting most bank stocks and trading has been halted for First Republic, PacWest Bancorp, and Signature Bank.

A summary of headlines we are reading today:

- Dealerships Struggle To Remain Relevant As Automakers Go Direct To Consumer

- Why Energy May Start To Follow Other Stocks & Why That Isn’t Good News

- Senator Manchin Threatens To Block Biden Nominees Over IRA Energy Provisions

- Bearish Sentiment Spikes As The Fed Reignites Recession Fears

- Platts Survey: OPEC+ Oil Production Fell By 80,000 Bpd In February

- Here’s how the second biggest bank collapse in U.S. history happened in just 48 hours

- Dow closes more than 300 points lower, posts worst week since June as Silicon Valley Bank collapse sparks selloff: Live updates

- A major inflation report and fallout from Silicon Valley Bank hang over markets in week ahead

- Bitcoin drops 2%, and crypto bank Signature tanks amid SVB, Silvergate troubles: CNBC Crypto World

- US Intel Chief Says China Should Know US Is Willing To Defend Taiwan

- Market Extra: SVB Financial bonds sink to 31 cents on the dollar after failure of Silicon Valley Bank

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Venture Capital Invested Billions In Emerging Market Agri-Tech Startups In 2022Even as global funding levels drop, agri-tech start-ups remain a key driver of investment in emerging markets as they work to make farming greener, more productive and more climate resilient. Global investment in agri-tech start-ups totaled $10.6bn in 2022, down 13% from 2021 – a record funding year for global start-ups – but ahead of the 2020 figure of $7bn. This matched a general downward trend in venture capital activity, as investors became more cautious amid global headwinds and deepening fears of recession. However, a focus… Read more at: https://oilprice.com/Finance/the-Economy/Venture-Capital-Invested-Billions-In-Emerging-Market-Agri-Tech-Startups-In-2022.html |

|

Why Illinois Needs To Reconsider Its Total Moratorium On Nuclear EnergyIllinois relies on nuclear energy for over half of its electricity production. The plants producing that power are mostly old and scheduled to be mothballed by 2050. But Illinois nevertheless maintains a decades-long, total moratorium on new nuclear power plant construction. Illinois’ shortsightedness is exceeded by its hubris. Federal government safety standards for construction and operation of nuclear plants is extraordinarily strict. How do Illinois politicians get off thinking they know better and should override those… Read more at: https://oilprice.com/Alternative-Energy/Nuclear-Power/Why-Illinois-Needs-To-Reconsider-Its-Total-Moratorium-On-Nuclear-Energy.html |

|

Dealerships Struggle To Remain Relevant As Automakers Go Direct To ConsumerCar dealerships and automakers are butting heads over changes to franchise laws that govern their relationship. The regulations aim to protect the independence of dealerships, but as sales models and vehicle service work evolve, tensions continue to rise between the two parties. Disagreements have arisen over various issues, such as Florida’s dealer association calling for an assessment of an automaker’s business practices by the Department of Highway Safety and Motor Vehicles. The situation is not any better in Virginia, where there… Read more at: https://oilprice.com/Energy/Energy-General/Dealerships-Struggle-To-Remain-Relevant-As-Automakers-Go-Direct-To-Consumer.html |

|

Why Energy May Start To Follow Other Stocks & Why That Isn’t Good NewsAs the Fed and other central banks around the world have raised rates, some areas of the stock market have posted big losses. Tech, for example, and anything to do with the worlds of crypto and the blockchain were hit hard at the end of last year, and while there has been some kind of a bounce in the early part of this year, even that is looking suspect now after this week’s acceptance by Fed Chair Jerome Powell that “higher for longer” is now expected. Energy, though, has moved in the opposite direction, gaining strength as other… Read more at: https://oilprice.com/Energy/Crude-Oil/Why-Energy-May-Start-To-Follow-Other-Stocks-Why-That-Isnt-Good-News.html |

|

U.S. Oil Drilling Activity Cools Off In The PermianThe total number of total active drilling rigs in the United States fell by 3 this week, according to new data from Baker Hughes published on Friday, after falling by 4 last week. The total rig count fell to 746 this week—83 rigs higher than the rig count this time in 2022 and 329 rigs lower than the rig count at the beginning of 2019, prior to the pandemic. Oil rigs in the United States decreased by 2 this week, to 590 after decreasing by 8 in the week prior. Gas rigs fell by 1 to 153. Miscellaneous rigs stayed the same. The rig count in… Read more at: https://oilprice.com/Energy/Energy-General/US-Oil-Drilling-Activity-Cools-Off-In-The-Permian.html |

|

Senator Manchin Threatens To Block Biden Nominees Over IRA Energy ProvisionsDemocratic Senator Joe Manchin on Friday threatened to hold up more of President Joe Biden’s nominees if the Administration doesn’t stick to the energy lane carved forward by the Inflation reduction act. In a Houston Chronicle opinion piece on Friday, Senator Manchin said that the Administration should stick with implementing the IRA that was passed, “not the law they wanted but did not get.” Machin added that “if they choose to continue down this path there will be consequences now and in the future.” Manchin… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Senator-Manchin-Threatens-To-Block-Biden-Nominees-Over-IRA-Energy-Provisions.html |

|

Norway Isn’t Worried About An Oil-Buying CartelNorway isn’t worried about The EU’s plan to join together to purchase natural gas from global markets, the country’s oil and energy minister said on Friday. The natural concern would be, of course, that a group of countries rallying together to collectively purchase natural gas would effectively act as an oil-buying cartel that could exert extended influence in the global markets. Norway’s oil and energy minister Terje Aasland told reporters on Friday that the arrangement could actually benefit Norway’s energy companies… Read more at: https://oilprice.com/Energy/Natural-Gas/Norway-Isnt-Worried-About-An-Oil-Buying-Cartel.html |

|

Norfolk Southern Disaster Prompts Rare Warning From Railroad AssociationFollowing yet another freight train derailment by Norfolk Southern (NS), the Association of American Railroads (AAR) has issued an advisory urging carriers to stop using specific railcars due to concerns about loose wheels. The latest incident occurred in Alabama, only hours before NS CEO Alan Shaw was scheduled to face lawmakers regarding the toxic chemical spill that took place in East Palestine, Ohio, on February 3rd. According to Trains, AAR spokeswoman Jessica Kahanek stated that Norfolk Southern had identified loose wheels on several cars,… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Norfolk-Southern-Disaster-Prompts-Rare-Warning-From-Railroad-Association.html |

|

Saudi Arabia And Iran Agree To Restore Diplomatic RelationsRegional rivals Saudi Arabia and Iran have agreed to resume diplomatic relations and re-open embassies and missions, Saudi Arabia, Iran, and China said in a joint statement on Friday, following a week of Saudi-Iranian talks in Beijing. “The three countries announced that an agreement has been reached between the Kingdom of Saudi Arabia and the Islamic Republic of Iran, that includes an agreement to resume diplomatic relations between them and re-open their embassies and missions within a period not exceeding two months, and the agreement includes… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Saudi-Arabia-And-Iran-Agree-To-Restore-Diplomatic-Relations.html |

|

Bearish Sentiment Spikes As The Fed Reignites Recession FearsOil prices are on course for their largest weekly decline since January after the head of the Federal Reserve reignited recession fears.Oilprice Alert: Whether you are new to the oil and gas industry or an energy market veteran, you will regret not signing up for Global Energy Alert. Oilprice.com’s premium newsletter provides everything from geopolitical analysis to trading analysis, all for less than a cup of coffee per week. Friday, March 10th, 2023The prospect of higher and potentially even faster U.S. interest rate hikes has scared… Read more at: https://oilprice.com/Energy/Energy-General/Bearish-Sentiment-Spikes-As-The-Fed-Reignites-Recession-Fears.html |

|

Russia Uses Ship-To-Ship Transfers To Boost Diesel Exports To Saudi ArabiaRussia is accelerating its exports of diesel to Saudi Arabia by both direct shipments and ship-to-ship transfers, Reuters reported on Friday, quoting trade sources and shipping data from Refinitiv. Using STS loadings, Russia is shortening the routes for tankers headed to Africa and Asia after Moscow is now banned from exporting fuels to the EU. Two cargoes of diesel loaded in the Primorsk port on the Baltic Sea in Russia have been transferred on another tanker heading to Saudi Arabia’s port of Ras Tanura, per shipping data from Refinitiv… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Russia-Uses-Ship-To-Ship-Transfers-To-Boost-Diesel-Exports-To-Saudi-Arabia.html |

|

Platts Survey: OPEC+ Oil Production Fell By 80,000 Bpd In FebruaryThe combined oil production of the OPEC+ group dropped in February by 80,000 barrels per day (bpd) as a small rise in Russia’s still resilient output failed to offset declines in Angola, Iraq, and Kazakhstan, according to the Platts survey by S&P Global Commodity Insights. Combined production from all 13 OPEC members fell by 60,000 bpd in February compared to January, while output in the non-OPEC group, led by Russia, went down by 20,000 bpd month over month, the survey found. Russian oil production increased by 10,000 bpd to 9.86 million… Read more at: https://oilprice.com/Energy/Energy-General/Platts-Survey-OPEC-Oil-Production-Fell-By-80000-Bpd-In-February.html |

|

U.S. And EU Look To Launch Trade Talks On Critical MineralsThe United States and the European Union could launch talks on critical materials trade when U.S. President Joe Biden welcomes European Commission President Ursula von der Leyen in the White House on Friday. The EU and the U.S. are in a spat over the subsidies in the U.S. Inflation Reduction Act, which Europe fears could prompt European clean energy manufacturing companies to relocate to America to benefit from the $370 billion in tax credits and loans earmarked for clean energy in the IRA. The European Commission presented last month its… Read more at: https://oilprice.com/Latest-Energy-News/World-News/US-And-EU-Look-To-Launch-Trade-Talks-On-Critical-Minerals.html |

|

Saudi Arabia Set To Supply Full Crude Oil Volumes To Asia In AprilSaudi Arabia’s oil giant Aramco will supply next month the full contracted volumes of crude to at least four refiners in North Asia, sources familiar with the plans told Reuters on Friday. Earlier this week, Saudi Arabia raised the official selling prices (OSPs) for most of its crude going to Asia in April, which was the second consecutive hike in oil prices to Saudi Arabia’s most prized export market. The supply of full volumes to at least four refiners in North Asia signals expectations from the world’s largest crude oil… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Saudi-Arabia-Set-To-Supply-Full-Crude-Oil-Volumes-To-Asia-In-April.html |

|

EU Reaches Provisional Agreement To Cut 2030 Energy Consumption By 11.7%The European Parliament and the Council presidency on Friday reached a provisional political agreement to reduce final energy consumption at EU level by 11.7% in 2030 compared to the forecast consumption. EU member states will benefit from flexibility in reaching the target, the EU Council said in a statement. Per the provisional agreement, the EU must collectively see its final energy consumption drop by at least 11.7% in 2030, compared with the energy consumption forecasts for 2030 made in 2020. This means that the EU’s final energy consumption… Read more at: https://oilprice.com/Latest-Energy-News/World-News/EU-Reaches-Provisional-Agreement-To-Cut-2030-Energy-Consumption-By-117.html |

|

Here’s how the second biggest bank collapse in U.S. history happened in just 48 hoursAs dust begins to settle on the biggest American bank failure since 2008, members of the VC community lament the role other investors played in SVB’s demise. Read more at: https://www.cnbc.com/2023/03/10/silicon-valley-bank-collapse-how-it-happened.html |

|

Dow closes more than 300 points lower, posts worst week since June as Silicon Valley Bank collapse sparks selloff: Live updatesRegional bank stocks tumbled in the wake of Silicon Valley Bank’s demise, with the SPDR S&P Regional Banking ETF last down about 6%. Read more at: https://www.cnbc.com/2023/03/09/stock-market-today-live-updates.html |

|

Just like that: Market pricing swings back to quarter-point Fed rate hikeOne bank implosion and a cooperative jobs report later, and the market has changed its mind. Read more at: https://www.cnbc.com/2023/03/10/just-like-that-market-pricing-swings-back-to-quarter-point-fed-rate-hike.html |

|

Silicon Valley Bank is shut down by regulators in biggest bank failure since global financial crisisThe tech-focused bank was closed by regulators on Friday after attempts to raise more capital failed. Read more at: https://www.cnbc.com/2023/03/10/silicon-valley-bank-is-shut-down-by-regulators-fdic-to-protect-insured-deposits.html |

|

A major inflation report and fallout from Silicon Valley Bank hang over markets in week aheadFebruary’s consumer inflation report should be a big driver for markets in the week ahead, as investors watch the fallout from the Silicon Valley Bank shutdown. Read more at: https://www.cnbc.com/2023/03/10/a-major-inflation-report-and-fallout-from-silicon-valley-bank-hang-over-markets-in-week-ahead.html |

|

Fintech startup Brex got billions of dollars in Silicon Valley Bank deposits Thursday, source saysCompanies including JPMorgan Chase, Morgan Stanley and First Republic have also seen heightened inflows Thursday as SVB’s stock tanked. Read more at: https://www.cnbc.com/2023/03/10/fintech-brex-got-billions-of-dollars-in-silicon-valley-bank-deposits-thursday.html |

|

FAA clears Boeing to resume deliveries of 787 Dreamliners after a weekslong pauseBoeing on Friday said it has completed the required analysis on its 787 Dreamliners. Read more at: https://www.cnbc.com/2023/03/10/boeing-to-resume-787-dreamliner-deliveries.html |

|

Bitcoin drops 2%, and crypto bank Signature tanks amid SVB, Silvergate troubles: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, Patrick Hillmann, chief strategy officer of Binance, addresses all the recent allegations against the company. Read more at: https://www.cnbc.com/video/2023/03/10/bitcoin-drops-crypto-bank-signature-tanks-svb-silvergate-troubles-cnbc-crypto-world.html |

|

Crypto bank Signature slides on Friday amid troubles at Silicon Valley Bank, SilvergateSignature Bank shares dropped as much as 32% on Friday and were halted amid a sell-off in bank stocks that continued for a second day. Read more at: https://www.cnbc.com/2023/03/10/crypto-bank-signature-slides-on-friday-amid-troubles-at-silicon-valley-bank-silvergate.html |

|

Ukraine war live updates: Biden hosts top EU official as Ukraine reels from hypersonic missile attacksUkrainian emergency services are rushing to repair critical energy infrastructure in the areas hit by the latest wave of Russian missiles and drones. Read more at: https://www.cnbc.com/2023/03/10/russia-ukraine-live-updates.html |

|

31% of new cars sold for above sticker price last month. These 10 models have the biggest premiumsEven though new car buyers are paying less of a premium than a year ago, the average sale is 8.8% above the manufacturer’s suggested retail price, or MSRP. Read more at: https://www.cnbc.com/2023/03/10/new-cars-selling-for-the-biggest-premiums-above-sticker-price.html |

|

Luxury home sales plunge 45%, with Miami and the Hamptons hit hardestTight supply and higher rates are pushing luxury home prices higher. Read more at: https://www.cnbc.com/2023/03/10/luxury-home-sales-plunge-miami-hamptons.html |

|

Payrolls rose 311,000 in February, more than expected, showing solid growthNonfarm payrolls were expected to increase by 225,000 in February, while the unemployment rate was projected to hold at 3.4%, according to Dow Jones. Read more at: https://www.cnbc.com/2023/03/10/jobs-report-february-2023.html |

|

Mexican Cartel Issues ‘Unusual’ Apology For Killing AmericansThe Associated Press reports that alleged members of a Mexican drug cartel penned a letter apologizing for the kidnapping of four Americans and the killing of two of them last week. The letter also claimed that the five perpetrators of the violent attack had been handed over to Mexican police. “We have decided to turn over those who were directly involved and responsible in the events, who at all times acted under their own decision-making and lack of discipline,” the letter reads. The AP obtained the letter through a Tamaulipas state law enforcement official. It added those involved in the attack on the Americans had gone against the Gulf cartel’s rules, which include “respecting the life and well-being of the innocent.” Images posted on Twitter show five men on the pavement with their hands tied — next to a small pickup truck, with a handwritten letter of apology on the windshield. Read more at: https://www.zerohedge.com/geopolitical/mexican-cartel-issues-unusual-apology-killing-americans |

|

A Monetary Policy ‘Cargo Cult’Authored by Michael Every via Rabo bank, Forget about geopolitics for once; or rather, don’t forget about it, but it isn’t the prime focus even as the Wall Steet Journal says ‘US, China plunge further into a spiral of hostility’. Forget about politics, despite a headline-grabbing White House budget that won’t pass Congress, and how some in Congress just argued against how we used to think journalism should be done. Forget about the climate, as Oilprice.com argues ‘Investors Start To Realize The Energy Transition Will Take Decades’, and that: “According to analysts, there is a broader understanding among the public and governments that until a clean energy system is ready, oil and gas will continue to play a prominent role in global energy supply and, like it or not, we are stuck with fossil fuels for our current energy needs. Right now, fossil fuels account for just over 80% of global energy supply.” Which implies messier geopolitics and politics, and higher inflation. Forget about economic data like US initial claims data spiking to 211K, the highest since….. December, when it last didn’t mean anything. Focus instead on the sudden sell-off in the US banking sector, which has seen a massive bull steepening of its yield curve and a serious reappraisal of the odds that the Great Pivot in the Sky may bring forth the abundance of riches that it usually does when the correct correction ceremony is performed. Read more at: https://www.zerohedge.com/markets/monetary-policy-cargo-cult |

|

‘Contained’ 2.0? Treasury Sec Yellen Says Banking System Is “Resilient”Remember when Ben Bernanke told the world that the subprime crisis – that would eventually collapse the global financial system – was “contained”? And don’t forget, Janet Yellen exclaimed proudly that there would never be another financial crisis “in our lifetimes” in 2017, only to see the repo crisis and the reaction to COVID lockdown policies prompt the biggest response by The Fed ever. Having earlier commented during her appearance before Congress that Treasury was “monitoring” several banks as Silicon Valley Bank failed, the Treasury Department released this statement:

Some of them don’t look very “resilient”… Read more at: https://www.zerohedge.com/markets/contained-20-treasury-sec-yellen-says-banking-system-resilient |

|

US Intel Chief Says China Should Know US Is Willing To Defend TaiwanAuthored by Dave DeCamp via AntiWar.com, Director of National Intelligence (DNI) Avril Haines said Thursday that China should know the US is willing to go to war over Taiwan, pointing to comments made by President Biden that he would defend the island in the event of a Chinese attack. Haines made the remarks at a House Intelligence Committee hearing when asked by Rep. Chris Stewart (R-UT) if she thinks the US should change its policy of “strategic ambiguity” over the question of defending Taiwan. “I think it is clear to the Chinese what our position is, based on the president’s comments,” she said.

Read more at: https://www.zerohedge.com/geopolitical/us-intelligence-chief-says-china-should-know-us-willing-defend-taiwan |

|

Booths is retailer embroiled in fake British beef caseProducts were labeled as British, when they were sourced from South America and Europe instead. Read more at: https://www.bbc.co.uk/news/business-64913809?at_medium=RSS&at_campaign=KARANGA |

|

Silicon Valley Bank: Regulators take over as failure raises fearsRegulators take over Silicon Valley Bank as the collapse raises wider fears about the banking sector. Read more at: https://www.bbc.co.uk/news/business-64915616?at_medium=RSS&at_campaign=KARANGA |

|

UK economy rebounds as Rishi Sunak says confidence is returningThe economy grew by more than expected in January, helped by higher school attendance. Read more at: https://www.bbc.co.uk/news/business-64904333?at_medium=RSS&at_campaign=KARANGA |

|

SVB rivals field calls from startups seeking new home for fundsAccording to sources, JPMorgan has received dozens of client calls seeking to switch from SVB to the company. But, news is not all good for potential beneficiaries Read more at: https://economictimes.indiatimes.com/markets/stocks/news/svb-rivals-field-calls-from-startups-seeking-new-home-for-funds/articleshow/98549504.cms |

|

SVB Financial shares slide again on concerns over balance sheetSVB claimed its deposits were dropping faster than expected owing to increased spending by clients, mainly technology and healthcare startups Read more at: https://economictimes.indiatimes.com/markets/stocks/news/svb-financial-shares-slide-again-on-concerns-over-balance-sheet/articleshow/98544402.cms |

|

NSE moves 2 more Adani stocks to stage-II long-term surveillance frameDuring instances of high volatility in stocks, exchanges move them to short-term or long-term additional surveillance framework to safeguard investors from speculative trades. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/nse-moves-2-more-adani-stocks-to-stage-ii-long-term-surveillance-frame/articleshow/98548801.cms |

|

Yellen says banking system ‘resilient’ as she meets regulators in response to Silicon Valley Bank closureJanet Yellen says she’s confident regulators are taking action after the closure of Silicon Valley Bank, and that the U.S. banking system is resilient. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-71B1-ABDBEDACEB70%7D&siteid=rss&rss=1 |

|

Market Extra: What is a stock-trading halt and why do exchanges order them?Shares of Silicon Valley Bank parent SVB Financial Group were halted shortly after markets opened on Friday and never reopened. Back in January, shares of nearly 200 securities were halted because of a glitch on the New York Stock Exchange. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-71B1-54D8AD77D2FD%7D&siteid=rss&rss=1 |

|

Market Extra: SVB Financial bonds sink to 31 cents on the dollar after failure of Silicon Valley BankHeavy trading in SVB Financial debt push its 10-year bonds as low as 31 cents on the dollar on Friday after the failure of its subsidiary Silicon Valley Bank, according to BondCliq data. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-71B1-42A7E8FADB16%7D&siteid=rss&rss=1 |

File image, US intel chiefs: BloombergIn September 2022, President Biden was asked if America …

File image, US intel chiefs: BloombergIn September 2022, President Biden was asked if America …