Of course, the market decline today was caused by the realization that the federal funds rate will remain elevated longer and likely higher than the markets desire – see today’s economic releases below.

Summary Of the Markets Today:

- The Dow closed down 575 points or 1.72%,

- Nasdaq closed down 1.25%,

- S&P 500 closed down 1.53%,

- Gold $1819 down $36.40,

- WTI crude oil settled at $77 down $3.04,

- 10-year U.S. Treasury 3.972% down 0.011 points,

- USD $105.61 up $1.26,

- Bitcoin $22,060 – 24H Change down $273.69 – Session Low $22,032

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our Economic Forecast for March 2023

Today’s Economic Releases:

Federal Reserve Chairman Jerome Powell said interest rates are likely to head higher than central bank policymakers had expected. If the totality of the data were to indicate that faster tightening is warranted, the Federal Reserve would be prepared to increase the pace of rate hikes. The markets were hoping for a quick end to the federal funds rate increases and this speech seems to be geared to dampen this hope. Powell said the current trend shows that the Fed’s inflation-fighting job is not over and stated:

The latest economic data have come in stronger than expected, which suggests that the ultimate level of interest rates is likely to be higher than previously anticipated. If the totality of the data were to indicate that faster tightening is warranted, we would be prepared to increase the pace of rate hikes.

The CoreLogic Home Price Insights report shows home prices continued their gradual free fall in January 2023, with the 5.5% annual gain down for the ninth straight month and the lowest recorded since June 2020. Deceleration was particularly noticeable in the Western U.S. and other states and metro areas that saw substantial appreciation over the past few years. Three Northwestern states (along with Washington, D.C.) posted at least slight annual declines as migration patterns that began during the pandemic shifted, slowing demand and driving price decreases.

January 2023 sales of merchant wholesalers were up 1.0% from the revised December level and were up 3.6% (non-inflation adjusted) from the revised January 2022 level. Total inventories of merchant wholesalers were down 0.4% from the revised December level. Total inventories were up 15.8% from the revised January 2022 level. The January inventories/sales ratio for merchant wholesalers was 1.34. The January 2022 ratio was 1.20. This shows that inventory levels are elevated relative to sales (green line on the graph below) but this ratio is headed in the right direction as sales growth is improving and inventory growth is declining.

A summary of headlines we are reading today:

- EIA Lowers Forecast For Natural Gas Prices

- U.S. Oil Production To Grow Just 500,000 Bpd This Year

- Analysts See Upside In China Despite Conservative Growth Target

- The First New U.S. Nuclear Reactor Since 2016 Begins Splitting Atoms

- Oil Prices Remain Rangebound Despite A String Of Predictions

- Dow closes 570 points lower, turns negative for 2023 as Powell ignites higher rate fears: Live updates

- ‘You ain’t seen nothing yet:’ Florida Gov. Ron DeSantis touts state record and fuels 2024 speculation

- Goldman Expects Nearly 1 Million Drop In Tomorrow’s Job Openings

- Gold outlook: Fed commentary on rate hike to keep bullion on edge this week

- Futures Movers: Oil prices posts first loss in 6 sessions after disappointing China import data, Powell’s remarks

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

EIA Lowers Forecast For Natural Gas PricesThe Energy Information Administration has decreased its forecast for natural gas prices for 2023 and 2024 according to the latest edition of the Short-Term Energy Outlook released on Tuesday. The EIA now sees natural gas prices averaging $3.02 per MMBtu this year, down 11.2 percent from its previous forecast of $3.40 per MMBtu. For comparison, natural gas prices averaged $6.42 per MMBtu in 2022, the EIA estimates. The EIA has also lowered its forecast for natural gas prices for next year, to $3.89 per MMBtu, down from its estimate of $4.04 per… Read more at: https://oilprice.com/Latest-Energy-News/World-News/EIA-Lowers-Forecast-For-Natural-Gas-Prices.html |

|

Can Solid-State Batteries Replace Lithium-Ion Technology?Via AG Metal Miner Lithium-ion is having a bad day – or year. In fact, depending on the source, “years” might be more appropriate. Lithium-ion (Li-ion) has powered batteries for portable consumable electronics, electric vehicles (EVs), and other products for over two decades. But now, with Tesla cars and millions of other products using the technology, the potential hazards are much more apparent. So while the surging lithium price remains problematic, countries like the U.S. also see the batteries as a major fire risk. Almost… Read more at: https://oilprice.com/Energy/Energy-General/Can-Solid-State-Batteries-Replace-Lithium-Ion-Technology.html |

|

Exxon Reconsidering Its Role In Europe Thanks To Windfall TaxesExxon Mobil Corp has said it will be taking a look at the oil supermajor’s role in Europe in light of the new windfall profit taxes. Exxon’s Chief Executive Darren Woods made the announcement during a CERAWeek panel on Tuesday, adding that the windfall profit taxes serve to discourage investments. Meanwhile, the U.S. supermajor is sinking more money into its U.S. operations. He referred to Europe’s windfall tax move as the proverbial “stick” in the carrot and stick scenario. Meanwhile, back home in the United States,… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Exxon-Reconsidering-Its-Role-In-Europe-Thanks-To-Windfall-Taxes.html |

|

Will China’s Belt And Road Initiative Deliver Positive Outcomes for Indonesia?“It is not merely talk, but it is about actually building something. From airports to railways, these are industries we can see and touch. This is exactly the sort of courage and real action the world needs right now.” So said Indonesian President Joko “Jokowi” Widodo about China’s Belt and Road Initiative (BRI) at the inaugural Belt and Road Forum for International Cooperation (BRF) in 2017 (BRF, May 14, 2017; Jakarta Globe, May 16, 2017). This year marks the tenth anniversary of this ambitious, globe-spanning… Read more at: https://oilprice.com/Geopolitics/International/Will-Chinas-Belt-And-Road-Initiative-Deliver-Positive-Outcomes-for-Indonesia.html |

|

U.S. Oil Production To Grow Just 500,000 Bpd This YearOil production in the United States will grow by an average of 500,000 barrels per day this year, most of which will come from the prolific Permian Basin, the President of Oxy Energy Services at Occidental Petroleum Corp said today at CERAWeek, according to Reuters. Frederick Forthuber, President of Oxy Energy Services, acknowledged that U.S. oil output has moderated and will remain slower as companies focus on shareholder returns while battling inflation. Between 80% and 80% of this anticipated oil production increase will come from the Permian… Read more at: https://oilprice.com/Latest-Energy-News/World-News/US-Oil-Production-To-Grow-Just-500000-Bpd-This-Year.html |

|

Can eFuels Save The Combustion Engine?With many automakers transitioning from petrol-powered vehicles to electrified ones, Porsche and Ferrari are pursuing a new strategy by concentrating on the advancement of eFuels to preserve gas-powered engines. This decision follows the European Commission’s delay last week of the proposed 2035 ban on new internal combustion engine vehicles as the commission prepares to carve out a role for eFuels after 2035. “Porsche and Ferrari’s status as national icons was enough to move their governments to challenge the EU plan last week just days before… Read more at: https://oilprice.com/Energy/Energy-General/Can-eFuels-Save-The-Combustion-Engine.html |

|

Morgan Stanley Has A New Favorite CarmakerMorgan Stanley analyst Adam Jonas, one of Tesla’s biggest bulls, has just named Ferrari as a top pick for his firm. Morgan Stanley raised its price target on Ferrari to $310 from $280 on Monday, while Jonas set an overweight rating on the company. He notes that the luxury automaker avoids much of the “EV hype and EV risk.” “We believe RACE is the best positioned company in our coverage in a highly uncertain macroeconomic and geopolitical tape,” wrote Jonas and peers in their note. “In addition… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Morgan-Stanley-Has-A-New-Favorite-Carmaker.html |

|

Analysts See Upside In China Despite Conservative Growth TargetChina has set a 5% growth target, which is in line with market expectations following last week’s blowout PMI. While some may view the goal as conservative, it leaves room for upside growth surprises and bodes well for Chinese equities overall. However, Hong Kong stocks are expected to continue outperforming their onshore peers. The 5% target is below the 5.3% consensus in a Bloomberg survey and the 5.5% objective for 2022, as well as targets set by most provinces. Despite this, Citigroup notes that China grew 8.1% in 2021 versus… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Analysts-See-Upside-In-China-Despite-Conservative-Growth-Target.html |

|

Output At Huge Kazakh Oilfield Dips On Unscheduled MaintenanceThe giant Tengiz oilfield in Kazakhstan saw its oil production drop by 11% in early March compared to February due to unscheduled maintenance at the massive field that typically pumps more than 600,000 barrels per day (bpd), industry sources told Reuters on Tuesday. U.S. supermajor Chevron holds a 50% interest in Tengizchevroil (TCO), the operator of the Tengiz oilfield, the world’s deepest producing supergiant oil field and the largest single-trap producing reservoir in existence. The Tengizchevroil joint venture… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Output-At-Huge-Kazakh-Oilfield-Dips-On-Unscheduled-Maintenance.html |

|

Offshore Oil And Gas Is Back With More Than $200 Billion In New InvestmentThe offshore oil and gas (O&G) sector is set for the highest growth in a decade in the next two years, with $214 billion of new project investments lined up. Rystad Energy research shows that annual greenfield capital expenditure (capex) will break the $100 billion threshold in 2023 and in 2024 – the first breach for two straight years since 2012 and 2013. As global fossil fuel demand remains strong and countries look for carbon-friendly production sources, offshore is back in the spotlight. Offshore activity is expected to account… Read more at: https://oilprice.com/Energy/Crude-Oil/Offshore-Oil-And-Gas-Is-Back-With-More-Than-200-Billion-In-New-Investment.html |

|

Russia Has Started Exporting Diesel To Saudi ArabiaRussia started exporting diesel to Saudi Arabia—its ally in the OPEC+ group—in February, after Moscow’s key fuel export outlet, the EU, enacted an embargo on seaborne imports of Russian oil products on February 5, Reuters reported on Tuesday, quoting traders and ship-tracking data. Ahead of the EU ban on Russian petroleum products, Russia began to divert its oil product cargoes to North Africa and Asia, while Europe is ramping up imports of diesel from the Middle East and Asia to offset the loss of Russian barrels, of which it… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Russia-Has-Started-Exporting-Diesel-To-Saudi-Arabia.html |

|

Is India Drifting Away From The U.S.?India last week stepped up its negotiations with the U.S. aimed at continuing to import as much oil from Russia as it requires, regardless of current and future sanctions against Moscow. This runs in tandem with India’s ongoing refusal to vote in favor of United Nations resolutions that condemn Russia for its invasion of Ukraine. As recently as December, on a visit to Moscow, India’s Foreign Minister, Subrahmanyam Jaishankar, stated: “For us, Russia has been a steady and time-tested partner and, as I said, any objective evaluation… Read more at: https://oilprice.com/Energy/Crude-Oil/Is-India-Drifting-Away-From-The-US.html |

|

The First New U.S. Nuclear Reactor Since 2016 Begins Splitting AtomsThe Vogtle Unit 3 nuclear power reactor has safely reached initial criticality, a milestone toward full commercial operations expected later this year in what would be the first new nuclear reactor in the United States starting activity since 2016. Vogtle Unit 3 has safely reached initial criticality, Georgia Power, Southern Nuclear, and Westinghouse Electric Company said this week. Initial criticality is a key step during the startup testing sequence and demonstrates that – for the first time – operators have safely started… Read more at: https://oilprice.com/Latest-Energy-News/World-News/The-First-New-US-Nuclear-Reactor-Since-2016-Begins-Splitting-Atoms.html |

|

Oil Prices Remain Rangebound Despite A String Of PredictionsDespite months of rumors regarding a rebound in global oil demand, oil prices are decidedly range-bound at the moment as they await a major development to break through resistance.Chart of the Week- The US downstream landscape remains hamstrung by widespread refinery maintenance that peaked in February at 1.5 million b/d of offline capacity, just as gasoline demand is set to pick up amidst the summer quality change. – US gasoline prices have already shown a slight uptick and are expected to grow further as refiners need to replace cheap butane… Read more at: https://oilprice.com/Energy/Energy-General/Oil-Prices-Remain-Rangebound-Despite-A-String-Of-Predictions.html |

|

The Kremlin Will Not Recognize Any Price Cap On Russia’s OilThe Kremlin does not and will not recognize any price cap on its oil, Kremlin spokesman Dmitry Peskov said on Tuesday after the U.S. said the Western price cap was working well. “We do not and will not recognize any cap,” Peskov told reporters in Moscow as carried by Russian news agency Interfax. Russia has taken its own measures in response to the price cap and is working to ensure that the mechanism doesn’t harm its interests, Putin’s spokesman said. On Monday, U.S. Energy Envoy Amos Hochstein said that the price… Read more at: https://oilprice.com/Latest-Energy-News/World-News/The-Kremlin-Will-Not-Recognize-Any-Price-Cap-On-Russias-Oil.html |

|

Dow closes 570 points lower, turns negative for 2023 as Powell ignites higher rate fears: Live updatesStocks sold off Tuesday after comments from Federal Reserve Chair Jerome Powell suggested that rates may need to go higher for longer to curb high inflation. Read more at: https://www.cnbc.com/2023/03/06/stock-market-today-live-updates.html |

|

Fed Chair Powell says interest rates are ‘likely to be higher’ than previously anticipatedCiting earlier data showing that inflation has reversed the deceleration in late 2022, Powell warned of tighter monetary policy ahead. Read more at: https://www.cnbc.com/2023/03/07/fed-chair-powell-says-interest-rates-are-likely-to-be-higher-than-previously-anticipated.html |

|

Treasury Secretary Yellen warns that losses tied to climate change could ‘cascade through the financial system’Treasury Secretary Janet Yellen said a “delayed and disorderly transition” to a net-zero emissions economy could create shocks to the financial system. Read more at: https://www.cnbc.com/2023/03/07/yellen-warns-climate-change-is-causing-major-financial-losses-in-us-.html |

|

Rivian shares fall as EV maker looks to raise $1.3 billion amid growing demand concernsThe EV maker had $12.1 billion on hand as of the end of 2022, enough to fund its operations through 2025. Read more at: https://www.cnbc.com/2023/03/07/rivian-notes-fundraise-ev-demand.html |

|

First Solar is trading at levels not seen in more than a decade. Here’s where it could go next — and whether you should buy itSolar technology company First Solar has seen its shares skyrocket over the past few weeks — and many believe this is just the start for the company. Read more at: https://www.cnbc.com/2023/03/07/fslr-is-trading-at-levels-not-seen-since-2008-heres-where-it-could-go-next-.html |

|

Biden FCC nominee Gigi Sohn withdraws, citing ‘cruel attacks’ in battle with cable and media industriesGigi Sohn is withdrawing her nomination to serve as telecommunications regulator to the Federal Communications Commission Read more at: https://www.cnbc.com/2023/03/07/biden-fcc-nominee-gigi-sohn-withdraws-citing-cruel-attacks-.html |

|

‘You ain’t seen nothing yet:’ Florida Gov. Ron DeSantis touts state record and fuels 2024 speculationDeSantis, if he runs, is widely expected to be former President Donald Trump’s top rival for the Republican presidential nomination. Read more at: https://www.cnbc.com/2023/03/07/florida-gov-ron-desantis-fuels-2024-speculation-in-speech-touting-state-record.html |

|

WeightWatchers stock surges 70% after company agrees to buy obesity treatment platformWeightWatchers has agreed to acquire telehealth obesity treatment company Sequence. Read more at: https://www.cnbc.com/2023/03/07/weightwatchers-stock-surges-sequence-deal.html |

|

Ukraine war live updates: Ukraine vows to fight on in Bakhmut and inflict steep losses on Russia; China defends ties to MoscowUkraine vowed to continue defending Bakhmut and will send reinforcements into the city in Donetsk, despite Russian forces effectively surrounding it. Read more at: https://www.cnbc.com/2023/03/07/live-updates-latest-news-on-russia-and-the-war-in-ukraine.html |

|

Global brands look to boost media investment in women’s sports through a new partnership, The Women’s Sports ClubGlobal brands like Nike, Coca-Cola and Delta are coming together to elevate investment in women’s sports. Read more at: https://www.cnbc.com/2023/03/07/womens-sports-club-media-investment.html |

|

A new nuclear reactor in the U.S. starts up. It’s the first in nearly seven yearsA new nuclear reactor at the Vogtle plant in Georgia started splitting atoms. Full operation will begin in May or June, Georgia Power says. Read more at: https://www.cnbc.com/2023/03/07/a-new-nuclear-reactor-in-the-us-starts-up-for-first-time-in-seven-years.html |

|

Used vehicle prices rising at an unseasonably strong rateCox Automotive reports wholesale used vehicle prices increased 4.3% in February from January — marking the largest increase between the two months since 2009. Read more at: https://www.cnbc.com/2023/03/07/used-vehicle-prices-rising-at-an-unseasonably-strong-rate.html |

|

Starbucks CEO Howard Schultz agrees to testify at Senate hearing after subpoena threatSince Howard Schultz returned to the helm of the company in April last year, Starbucks has taken a more aggressive approach to oppose a union push. Read more at: https://www.cnbc.com/2023/03/07/starbucks-ceo-howard-schultz-agrees-to-testify-at-senate-panel-after-subpoena-threat.html |

|

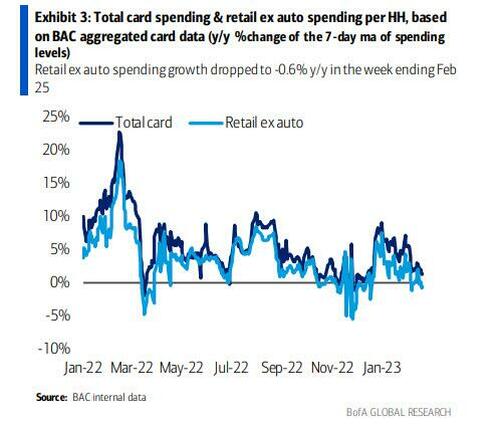

Goldman Expects Nearly 1 Million Drop In Tomorrow’s Job OpeningsIn his most hawkish speech since Jackson Hole, Fed Chair Powell made it very clear: if economic data keeps coming in as hot as February, the Fed will not only hike higher for longer, but may revert back to 50bps rate hikes (or even higher) at the next FOMC. Which begs the question: what will the barrage of economic data that starts with tomorrow’s ADP and JOLTs reports, goes through Friday’s Nonfarm Payrolls, and culminates with next week’s CPI, PPI and retail sales, show? Well, as we have previously noted, January’s data was a one-time outlier across the board: not just jobs and inflation, but also retail sales. In fact, last Friday we showed that the latest BofA card data indicated a sharp slowdown in retail spending after the January splurge.

Also, three weeks ago we Read more at: https://www.zerohedge.com/markets/goldman-expects-nearly-1-million-drop-tomorrows-job-openings |

|

Solar Energy Production Could Require Most Of The Global Silver Reserves By 2050Authored by Michael Maharrey via SchiffGold.com, Silver demand was at record levels in 2022 and there is reason to believe it will continue to run hot over the next several decades. One reason is the rapidly increasing demand for silver in the green energy sector. In fact, an Australian study projects solar cells may use most of the world’s silver reserves by 2050.

Due to its outstanding electrical conductivity, silver is an important element in the production of solar panels. It is used to conduct electrical charges out of the solar cell and into the system. Each solar panel only uses a small amount of silver, but with the demand for solar panels growin … Read more at: https://www.zerohedge.com/commodities/solar-energy-production-could-require-most-global-silver-reserves-2050 |

|

Two Americans Kidnapped In Mexican Border Town Dead, Two Others Found AliveTwo of four Americans kidnapped in a Mexican border town last Friday when their white minivan was ambushed in a shootout were found dead, according to AP News, citing a top Mexican official. The other two were found alive, with one wounded.

Tamaulipas Gov. Americo Villarreal Anaya said that one of the individuals found alive had been injured in last week’s violent abduction. “Right now, the ambulances and the rest of the security personnel are going to give the corresponding support,” he said, providing few details about the wounded person’s injuries and no information about where the US citizens were found. Read more at: https://www.zerohedge.com/geopolitical/two-americans-kidnapped-mexican-border-town-dead-2-others-found-alive |

|

Swimming Downstream In The “Lithium Triangle”Via Global Macro Monitor,

There’s a big push among many resource-producing nations to move down the supply chain, taking advantage of the near- and re-shoring craze. Rather than merely supplying the raw materials upstream in the supply chain, for example, the resource producers are looking to move into higher-value-added activities, such as manufacturing batteries, and eventually, the EVs that pack those lithium batteries.

Bloomberg reports tha … Read more at: https://www.zerohedge.com/commodities/swimming-downstream-lithium-triangle |

|

RMT members suspend strike action at Network RailThe announcement follows a new pay offer to the union – but other staff are still set to walk out. Read more at: https://www.bbc.co.uk/news/business-64883158?at_medium=RSS&at_campaign=KARANGA |

|

Emergency coal power plants used for first time as UK sees cold snapTwo coal-fired power stations have begun making electricity again to keep up with demand during the cold weather. Read more at: https://www.bbc.co.uk/news/business-64879044?at_medium=RSS&at_campaign=KARANGA |

|

State pension: Deadline extended for National Insurance top-upsPeople now have until the end of July to plug gaps in their National Insurance record from 2006 to 2016. Read more at: https://www.bbc.co.uk/news/business-64881745?at_medium=RSS&at_campaign=KARANGA |

|

Shades of wealth! Four smallcap financial stocks have turned multibaggers since last Holi. Do you own any?Bernstein said that the operating environment for Indian banks remains the best in a decade, maintaining its bullish view on the sector. The brokerage sees HDFC Bank, Axis Bank and SBI to outperform, while it expects Kotak Mahindra Bank and ICICI Bank to perform in line with the market. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/shades-of-wealth-four-smallcap-financial-stocks-have-turned-multibaggers-since-last-holi-do-you-own-any/articleshow/98469653.cms |

|

No-go area? FIIs sell old economy stocks worth Rs 10,000 crore in FebruaryNSDL data shows that the worst sell-off was in the oil and gas sector, with a net outflow of Rs 4,973 crore, followed by power (Rs 2,848 crore) and metals (Rs 2,642 crore). Read more at: https://economictimes.indiatimes.com/markets/stocks/news/no-go-area-fiis-sell-old-economy-stocks-worth-rs-10000-crore-in-february/articleshow/98467007.cms |

|

Gold outlook: Fed commentary on rate hike to keep bullion on edge this weekCorrection in the dollar index from resistance levels was one of the major reasons for the recovery in gold and silver, currency and commodity expert Anuj Gupta said. Bullion is also taking positive cues from stronger-than-expected business activity in China which is the largest commodity importer in the world, Gupta said. Read more at: https://economictimes.indiatimes.com/markets/commodities/news/gold-outlook-fed-commentary-on-rate-hike-to-keep-bullion-on-edge-this-week/articleshow/98444727.cms |

|

Personal Finance Daily: Most Americans are confident about keeping their jobs for now and tenants say background checks, application fees, consumer-report inaccuracies and eviction records are holding them backTuesday’s top personal finance stories. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-71AD-66D34C9FA278%7D&siteid=rss&rss=1 |

|

Futures Movers: Oil prices posts first loss in 6 sessions after disappointing China import data, Powell’s remarksOil ends lower Tuesday on weaker-than-expected import data from China and remarks from the Fed’s chairman that raised the potential for more aggressive interest-rate hikes. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-71AC-9F80D69A39CB%7D&siteid=rss&rss=1 |

|

The Big Move: ‘I’m nervous about closing costs’: I’m 31, a first-time homebuyer in Austin. Should I buy a home now and refinance later? Or rent and wait for rates to fall?‘Should I wait to get a house and stay in an apartment … or should I move forward and get my first property now then refinance when interest rates decrease? Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-71AD-273CF0061EC5%7D&siteid=rss&rss=1 |