Summary Of the Markets Today:

- The Dow closed up 5 points or 0.02%,

- Nasdaq closed down 0.66%,

- S&P 500 closed down 0.47%,

- Gold $1845 up $7.90,

- WTI crude oil settled at $78 up $0.67,

- 10-year U.S. Treasury 4.004% up 0.09 points,

- USD $104.43 down $0.44,

- Bitcoin $23,409 – 24H Change up $138.67 – Session Low $23,062

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our Economic Forecast for March 2023

Today’s Economic Releases:

The headlines say construction spending during January 2023 was 5.7% above January 2022. If one inflation adjusts this data, construction spending is down 9.3% year-over-year (blue line on the graph below). This decline is across the board – private, public, residential, and nonresidential.

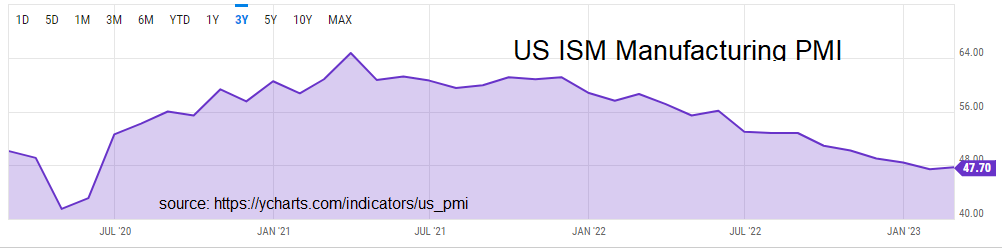

The February Manufacturing PMI registered 47.7%, 0.3 percentage points higher than the 47.4% recorded in January. Regarding the overall economy, this figure indicates a third month of contraction after a 30-month period of expansion. In the last two months, the Manufacturing PMI has been at its lowest level since May 2020, when it registered 43.5%. The New Orders Index remained in contraction territory at 47%, 4.5 percentage points higher than the figure of 42.5 percent recorded in January.

A summary of headlines we are reading today:

- Goldman Sees Oil Price Spike In 2024 As Spare Capacity Runs Thin

- Small Nuclear Reactors Get Boost As Western Cities Vote ‘Yes’

- Hydrogen Cars Could Soon Compete With Electric Vehicles

- Oil Rebounds On Smaller Than Expected Crude Build

- S&P 500 and Nasdaq close lower to begin March as the 10-year Treasury yield touches 4%: Live updates

- David Einhorn says investors should be ‘bearish on stocks and bullish on inflation’

- Bitcoin rises to start March, and another ex-FTX exec pleads guilty: CNBC Crypto World

- Cannabis Watch: Cannabis company Green Thumb beats revenue estimate but posts loss on noncash impairment

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Middle East Producers Cannot Afford To Significantly Hike Oil PricesAs the OPEC+ meeting in the first days of February only confirmed the oil group is intent on maintaining its strategy and will avoid sudden and drastic moves, Saudi Arabia was facing a peculiar dilemma with its March 2023 official formula prices. In the weeks before OSPs get usually released, there has been an incessant stream of surveys, opinion pieces, and news claiming Saudi Aramco should cut prices into Asia. The oddity of the situation was that there wasn’t really any indication as to why formula prices ought to be cut. The cash-to-futures… Read more at: https://oilprice.com/Energy/Oil-Prices/Middle-East-Producers-Cannot-Afford-To-Significantly-Hike-Oil-Prices.html |

|

Gasoline Prices: Why Do We Pay What We Pay At The Pump?Gasoline prices can be unpredictable, fluctuating from day to day and even hour to hour. While it may seem like the cost of gasoline is arbitrary, there are actually several factors that impact how much you pay at the pump. In this article, we will explore the different factors that affect gasoline prices, including oil prices, refining costs, distribution costs, taxes, and more. Oil Prices Oil prices are perhaps the most well-known factor impacting gasoline prices. This is because gasoline is made from crude oil. As the price of crude oil… Read more at: https://oilprice.com/Energy/Gas-Prices/gasoline-prices-explained.html |

|

Goldman Sees Oil Price Spike In 2024 As Spare Capacity Runs ThinEvents in China, not Russia, drove oil prices this past year, and now that Chinese manufacturing activity is on the upswing, the next 12-18 months are likely to see another spike in oil prices, says Goldman Sachs. That could mean crude oil targeting prices above $100 per barrel in the fourth quarter of this year. The situation is “tighter” today, Jeff Currie, global head of commodities research at Goldman Sachs, told Bloomberg Surveillance Early Edition on Wednesday. The big event last year was not… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Goldman-Sees-Oil-Price-Spike-In-2024-As-Spare-Capacity-Runs-Thin.html |

|

The Rising Cost Of Energy: What It Means For You And Your HomeEnergy inflation has been one of the driving factors in the ongoing economic battle that has been unfolding over the past two years, but what is it and what can actually be done about it? Energy inflation is a term used to describe the increase in energy prices over time. This phenomenon can have a significant impact on households, as it affects the cost of living and purchasing power. In this article, we will explore what energy inflation is, how it impacts households, and what can be done about it. What is Energy Inflation? Energy inflation… Read more at: https://oilprice.com/Energy/Energy-General/The-Rising-Cost-Of-Energy-What-It-Means-For-You-And-Your-Home.html |

|

Small Nuclear Reactors Get Boost As Western Cities Vote ‘Yes’A consortium of cities in four western U.S. states has voted in favor of moving forward with a plan to build a demonstration small modular reactor (SMR) power plant in Idaho, which if successful, could lead to a six-reactor project coming online by 2030 and providing carbon-free power. The Tuesday vote by the Utah Associated Municipal Power Systems (UAMPS) consortium saw the plan approved nearly unanimously, in a 26-27 vote, lending a significant amount of impetus to the idea of SMR carbon-free power in the United States. Cities in Utah, Idaho,… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Small-Nuclear-Reactors-Get-Boost-As-Western-Cities-Vote-Yes.html |

|

Hydrogen Cars Could Soon Compete With Electric VehiclesWhile many automakers have been focused on developing battery electric vehicles (BEVs), another green alternative to traditional cars has been gaining momentum – the hydrogen-driven fuel cell electric vehicle (FCEV). Green hydrogen has been hailed as the clean fuel of the future in recent years, something that many automakers have considered while developing fuel cell cars. While there has been much talk about the rise of the FCEV, most companies are still in the early development stage. But now, some companies are ready to present their… Read more at: https://oilprice.com/Energy/Energy-General/Hydrogen-Cars-Could-Soon-Compete-With-Electric-Vehicles.html |

|

BP Gets Disappointing Results For Gulf Of Mexico Deepwater Appraisal WellBP, Chevron, and Talos Energy received disappointing results this week from its Puma West-2 appraisal well, Talos said. The Puma West-2 appraisal well was drilled to a depth of 25,995 feet followed by a sidetrack, which was drilled geologically down-dip to a total depth of 27,650 feet. While the appraisal wells did encounter hydrocarbons in multiple sands, additional hydrocarbons from a subsequent well or sidetrack are necessary before they consider moving forward with the project. The Puma West 2 wellbore was suspended temporarily with utility… Read more at: https://oilprice.com/Latest-Energy-News/World-News/BP-Gets-Disappointing-Results-For-Gulf-Of-Mexico-Deepwater-Appraisal-Well.html |

|

Investors Fear Change Of Strategy At Brazil’s Oil GiantPetrobras shares fell at the beginning of the week as investors worry the policies of recently installed President Lula da Silva could erode the profitability of the state-owned oil major. Investors and the Brazilian government alike enjoyed big paydays in 2022 as the Petrobras board approved the payout of big dividends last year. But now, Brasilia may decide to cut dividends in order to start subsidizing fuels again. The move could mark the return to the policies of 2011-2014 when the Dilma Rousseff-led government tried to shield Brazilians from… Read more at: https://oilprice.com/Energy/Energy-General/Investors-Fear-Change-Of-Strategy-At-Brazils-Oil-Giant.html |

|

Equinor Closes In On $1 Billion Deal To Buy Suncor’s UK Oil AssetsNorwegian oil and gas major Equinor is nearing a deal to buy the UK North Sea assets of Canada’s Suncor Energy for around $1 billion, Reuters reported on Wednesday, citing sources with knowledge of the matter. Suncor Energy has a 40% stake in the Rosebank field, operated by Equinor, off the Shetland Islands. Equinor and partners are expected to make a final investment decision on the field’s development this year amid increased tax rates for operators in the UK North Sea and strong opposition from environmentalists to the development… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Equinor-Closes-In-On-1-Billion-Deal-To-Buy-Suncors-UK-Oil-Assets.html |

|

Oil Rebounds On Smaller Than Expected Crude BuildCrude oil prices gained slightly after the Energy Information Administration confirmed the API’s estimate of an inventory build for the week to February 25. Crude oil inventories added 1.2 million barrels in the reporting period, the EIA said, adding that at 480.2 million barrels they were 9 percent above the five-year average for this time of the year. A week earlier, the EIA estimated an inventory build of 7.6 million barrels for crude oil, following another one, of 16.3 million barrels, which was the result of data adjustment. In fuels,… Read more at: https://oilprice.com/Energy/Crude-Oil/Oil-Rebounds-On-Smaller-Than-Expected-Crude-Build.html |

|

Oil Demand Set To Climb As China’s Economy Finally ReboundsChina’s economy appears to be leaving behind the early faltering of the reopening, with manufacturing, construction, and export orders rebounding sharply in February, in a sign that the world’s top crude importer could soon start seeing a jump in oil demand. The Chinese manufacturing purchasing managers’ index (PMI) jumped to 52.6 in February from 50.1 in January, data from China’s National Bureau of Statistics showed on Wednesday. The surge in factory activity was the fastest in over a decade—the highest figure since… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Oil-Demand-Set-To-Climb-As-Chinas-Economy-Finally-Rebounds.html |

|

Supply Chain Snarls Finally Appear To Be EasingThe global economy is proving resilient in the first two months of 2023. Supply chain snarls are easing, while demand conditions are neither hot nor cold. The post–Covid-19 recovery is on shaky ground as the world awaits a China recovery. Bloomberg pointed out that “a large number” of container ships are “positioned near China, waiting for a renewed flow of exports as the world’s second-largest economy recovers from Covid Zero restrictions.” “It makes sense to be close to the main export centers, to be in a ready-to-go position,”… Read more at: https://oilprice.com/Finance/the-Economy/Supply-Chain-Snarls-Finally-Appear-To-Be-Easing.html |

|

Germany’s Natural Gas Bill Doubled In 2022 Despite Import Volumes FallingGermany paid more than double for natural gas last year compared to 2021 amid soaring prices in the energy crisis despite a 30% decline in import volumes, according to data from the Federal Office for Economic Affairs and Export Control, BAFA. Germany paid as much as $79 billion (74 billion euros) for natural gas imports, more than double compared to the $37.8 billion (35.4 billion euros) it spent on importing gas in 2021, showed the official data reported by Reuters. In 2022, the average price Germany paid at the border surged by 197.3%… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Germanys-Natural-Gas-Bill-Doubled-In-2022-Despite-Import-Volumes-Falling.html |

|

Russia Is Intent On Defending Its Oil Market Share In IndiaRussia has become the single biggest crude supplier to India over the past year as the world’s third-largest oil importer snaps up discounted Russian oil banned in the West. Russia has been redirecting most of its crude oil exports to China and India since the EU and the G7 announced plans to embargo seaborne oil imports from Russia and set a price cap on the crude if it is to be shipped to third countries using Western tankers and insurers. China’s reopening is set to lead to a jump in oil demand in the world’s… Read more at: https://oilprice.com/Energy/Energy-General/Russia-Is-Intent-On-Defending-Its-Oil-Market-Share-In-India.html |

|

Saudi Aramco Looks To Invest In LNG Export Facility AbroadSaudi Aramco is interested in investing in an LNG export facility outside Saudi Arabia and is in early talks with developers aiming to secure a stake in a project in the United States or Asia, Bloomberg reported on Wednesday, quoting sources familiar with the matter. The Saudi oil giant, the world’s largest oil company by both production and market capitalization, prefers an LNG plant that could easily export the fuel to Asia, according to Bloomberg’s sources. Apart from investing in a stake, Aramco is also reportedly looking… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Saudi-Aramco-Looks-To-Invest-In-LNG-Export-Facility-Abroad.html |

|

S&P 500 and Nasdaq close lower to begin March as the 10-year Treasury yield touches 4%: Live updatesTraders struggled to recover their footing following a losing month and bond yields continued their climb. Read more at: https://www.cnbc.com/2023/02/28/stock-market-today-live-updates.html |

|

A year later, the Fed still has a long way to go in the fight against inflationSo after a year of inflation fighting, how are things going? In short, OK. Read more at: https://www.cnbc.com/2023/03/01/a-year-later-the-fed-still-has-a-long-way-to-go-in-the-fight-against-inflation.html |

|

Elon Musk is set to reveal ‘Master Plan Part 3’ at Tesla Investor Day after the bellTesla investors could get updates on an affordable electric vehicle, which CEO Elon Musk first teased in 2020, among other initiatives. Read more at: https://www.cnbc.com/2023/03/01/tesla-2023-investor-day-after-the-bell-master-plan-part-3-teased.html |

|

Biden administration lawyer may have saved student loan forgiveness plan at Supreme CourtThe Supreme Court could rule within months on a $400 billion student loan forgiveness plan by the Biden administration. Read more at: https://www.cnbc.com/2023/03/01/supreme-court-biden-loan-forgiveness-plan-chances.html |

|

CNBC Pro Talks: Find out what one of Wall Street’s Biggest Bulls, Brian Belski, is buying in this marketBMO Capital Markets Chief Investment Strategist Brian Belski tells CNBC the S&P 500 could hit 4,800 by year-end, one of the most bullish price targets on Wall Street. With his thesis, he is putting money to work and shares how he is investing, live from the New York Stock Exchange. Read more at: https://www.cnbc.com/video/2023/03/01/cnbc-pro-talks-what-brian-belski-is-buying-in-this-market.html |

|

David Einhorn says investors should be ‘bearish on stocks and bullish on inflation’Greenlight Capital’s David Einhorn said Wednesday he’s keeping his negative stance on the stock market as inflation and interest rates could shoot higher. Read more at: https://www.cnbc.com/2023/03/01/david-einhorn-says-investors-should-be-bearish-on-stocks-and-bullish-on-inflation.html |

|

How Trump allies and wealthy donors helped to fuel the GOP fight against ESG investing platformsThe GOP fight against ESG investing at firms like BlackRock has ties to allies of former President Trump, wealthy Republican donors and state treasurers. Read more at: https://www.cnbc.com/2023/03/01/esg-investing-gop-opposition-has-ties-to-trump-allies-wealthy-donors.html |

|

Ukraine war live updates: Russian mercenary boss says ‘fierce resistance’ seen in Bakhmut; Kyiv says its fighters are under ‘insane pressure’Ukraine’s president signaled Kyiv is preparing its soldiers for counteroffensives and praised soldiers for defending the country under “insane pressure.” Read more at: https://www.cnbc.com/2023/03/01/ukraine-war-live-updates-latest-news-on-russia-and-the-war-in-ukraine.html |

|

Rail unions tell Biden officials workers have fallen ill at Norfolk Southern derailment siteLeaders from 12 unions met with Transportation Secretary Pete Buttigieg and Amit Bose, administrator of the Federal Railroad Administration, in Washington. Read more at: https://www.cnbc.com/2023/03/01/norfolk-southern-derailment-labor-unions-biden-officials.html |

|

Bitcoin rises to start March, and another ex-FTX exec pleads guilty: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, Hany Rashwan, CEO of 21Shares, discusses how institutions are thinking about crypto investing. Read more at: https://www.cnbc.com/video/2023/03/01/bitcoin-rises-march-another-ex-ftx-exec-pleads-guilty-crypto-world.html |

|

Warren Buffett’s ‘secret sauce’ for investing success: Be ‘business pickers’ not ‘stock pickers’Warren Buffett says the “secret sauce” of his investing success is picking businesses, not stocks, in his latest shareholder letter. Read more at: https://www.cnbc.com/2023/03/01/warren-buffetts-secret-sauce-for-investing-success.html |

|

New TikTok ban bill passes key House committee on a party-line voteThe bill would grant President Joe Biden poses to impose sanctions on Chinese companies that threaten U.S. national security and collect Americans’ personal data. Read more at: https://www.cnbc.com/2023/03/01/new-tiktok-ban-bill-passes-key-house-committee-on-a-party-line-vote.html |

|

Mortgage demand from homebuyers drops to a 28-year lowMortgage demand dropped for the third straight week as interest rates moved higher again. Read more at: https://www.cnbc.com/2023/03/01/mortgage-demand-falls-interest-rates-rise.html |

|

These Were The Best And Worst Performing Assets In February And YTDAfter a very strong start to the year for financial markets, February saw much of the early momentum go into reverse, with losses across equities, credit, sovereign bonds, and commodities. That, as DB’s Henry Allen explains in his monthly performance review note, came “amidst growing concern about the persistence of inflation, which in turn led investors to ramp up their expectations for central bank rate hikes.” When all was said and done, it was an awful month for bonds, with Bloomberg’s global aggregate bond index experiencing its worst February performance since its inception in 1990 just one month after its best-ever January. At the same time, February also marked a recovery for the US Dollar, while European equities proved resilient amidst the broader losses elsewhere. Furthermore, the YTD performance of financial assets is still generally positive, with most of those tracked by Deutsche Bank still higher over 2023 so far. Below we excerpt from DB’s Month in Review, starting with the high-level macro overview Having just experienced a strong rally in January, the initial mood in markets was pretty positive as February began. However, that all changed on the third day of the month, when the US jobs report for January was released. It showed that nonfarm payrolls had risen by credibility-busting 517k in January, marking the strongest job growth in six months. Furthermore, the unemployment rate fell to a 53-year low of 3.4%. The data raised fears that inflation would prove more persistent than previously thought. This led to a sharp re-appraisal on how fast the Fed would be … Read more at: https://www.zerohedge.com/markets/these-were-best-and-worst-performing-assets-february-and-ytd-0 |

|

Woody Harrelson Doubles Down, Slams COVID Mandates: US Is “Not A Free Country”Authored by Steve Watson via Summit News, Following a 30-second bit on SNL where he branded big pharma as a ‘cartel’ forcing its drugs on people with government consent, actor Woody Harrelson has further spoken out against COVID mandates.

In an interview with the New York Times, Harrelson warned that America is no longer a free country, branding COVID protocols as “rather absurd.”

When asked what was “ab … Read more at: https://www.zerohedge.com/covid-19/woody-harrelson-doubles-down-slams-covid-mandates-us-not-free-country |

|

CCP Mouthpiece Threatens Elon Musk Over COVID Lab-Leak CommentsAuthored by Gary Bai via The Epoch Times, Elon Musk, CEO of Twitter and Tesla, stood in the crosshairs of the Chinese Communist Party (CCP) when he chipped in on the discussion on the origin of COVID-19 and brought attention to the theory that the virus leaked from a Chinese laboratory. The world’s richest person joined in comments about a Wall Street Journal article on Sunday, Feb. 26, which reported that a classified intelligence report by the Energy Department said the virus likely leaked from the Wuhan Institute of Virology (WIV). The Chinese regime denies the lab leak theory and has accused its proponents of being conspiracy theorists.

Musk’s CommentsThe billionaire hopped on discussions on Twitter following the news, with some users accusing Dr. Anthony Fauci, former hea … Read more at: https://www.zerohedge.com/geopolitical/ccp-mouthpiece-threatens-elon-musk-over-covid-lab-leak-comments |

|

Corporate Insider-Buyers’ Strike Accelerates In FebruaryIn early January we noted that while the average investor continues to pour money into the equity markets like there’s no tomorrow (aka, a reckoning for the everything bubble), corporate insiders are notably doing just the opposite.

In the six weeks or more since, the apparent buyers’ strike by corporate insiders has continued. Bloomberg’s Elena Popina reports that as US stocks slid last month, only about 450 corporate executives scooped up shares of their own firms and more than four times as many insiders sold, data compiled by the Washington Service show. That’s the highest ratio of sellers versus buyers since April 2021. Read more at: https://www.zerohedge.com/markets/corporate-insider-buyers-strike-accelerates-february |

|

Bank of England boss says UK interest rates may rise furtherAndrew Bailey warns doing too little on interest rates now could mean doing more later on. Read more at: https://www.bbc.co.uk/news/business-64810682?at_medium=RSS&at_campaign=KARANGA |

|

Court bid to protect against ‘ghost landlords’ failsProperty owners welcome a ruling that defines who a landlord is, but campaigners say it lets down tenants. Read more at: https://www.bbc.co.uk/news/business-64811243?at_medium=RSS&at_campaign=KARANGA |

|

BA-owner and EasyJet hold millions of unclaimed travel vouchersBA owners IAG and EasyJet issued vouchers instead of cash when flights were canceled during the pandemic. Read more at: https://www.bbc.co.uk/news/business-64810681?at_medium=RSS&at_campaign=KARANGA |

|

Hype in new-age stocks busted after correction: Raamdeo Agrawal“Some of them will be very successful and some of the companies are very unique. There are no me-too companies in that particular segment,” said the value investor whose team has been meeting the management of new-age companies. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/hype-in-new-age-stocks-busted-after-correction-raamdeo-agrawal/articleshow/98333628.cms |

|

Stocks to buy today: 6 short-term trading ideas by experts for 1 March 2023India’s VIX moved up by 1.05% from 13.87 to 14.02 levels on Tuesday. Volatility has been slightly falling from the last three sessions with a little bounce in the previous session.On the weekly options front, the maximum Call OI is placed at 17,400 and then towards 17,500 strikes while the maximum Put OI is placed at 17,000 and then towards 17,300 strikes. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/stocks-to-buy-today-6-short-term-trading-ideas-by-experts-for-1-march-2023/articleshow/98324827.cms |

|

4 Indian stocks that fit in Benjamin Graham’s idea of value investingWarren Buffett’s guru Benjamin Graham, best known for his book ‘The Intelligent Investor’, believed in focusing on the real-life performance of the companies he owned and the dividends received, rather than on changing market sentiments. Based on the idea of Graham, a custom screen made by MarketSmith emphasizes securities that are cheap on a PE and price-to-book basis but still show signs of financial stability. It may be most effective in the later stages of bear markets when good companies’ stock prices have been driven down to values under their intrinsic worth. Here are 4 stocks that match Graham’s idea of stock picking, as listed on MarketSmith: Read more at: https://economictimes.indiatimes.com/markets/stocks/news/4-indian-stocks-that-fit-in-benjamin-grahams-idea-of-value-investing/stock-picking-ideas/articleshow/98324120.cms |

|

Cannabis Watch: Cannabis company Green Thumb beats revenue estimate but posts loss on noncash impairmentCEO Ben Kovler says the company grew its cash from the previous quarter but that ‘nothing is a straight line’ when it comes to state-by-state legalization. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-71A7-3E9F581DCF40%7D&siteid=rss&rss=1 |

|

The Margin: TikTok’s screen time limit for teens: How it works, and how to get around itTikTok says it’s promoting conversations about ‘digital well-being’ in its new 60-minute screen limit for teens Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-71A7-270FFCD3B940%7D&siteid=rss&rss=1 |

|

Laid-off Meta cafeteria workers ask for the same severance as the company’s employeesThe workers and their union supporters plan to rally at the company’s headquarters in Menlo Park, Calif., on Wednesday afternoon. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-71A7-22076A1E244A%7D&siteid=rss&rss=1 |