Summary Of the Markets Today:

- The Dow closed up 39 points or 0.11%,

- Nasdaq closed up 0.92%,

- S&P 500 closed up 0.28%,

- Gold $1847 down $18.30,

- WTI crude oil settled at $79 down $0.42,

- 10-year U.S. Treasury 3.807% up 0.046 points,

- USD $103.88 up $0.64,

- Bitcoin $24,138 – 24H Change up $1,900.83 – Session Low $22,071

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our Economic Forecast for February 2023

Today’s Economic Releases:

Industrial production continued its modest moderation in January 2023 showing growth of 0.8% year-over-year (down from 1.1% last month). The index was negatively affected by the utility portion of industrial production which declined from 9.1% last month to -8.9% this month – The output of utilities fell as a swing from unseasonably cool weather in December to unseasonably warm weather in January depressed the demand for heating.

Retail and food services sales for January 2023 are up 6.4% above January 2022 (blue line on the graph below). However, after inflation adjustment (red line on the graph below), sales improved from -0.8% year-over-year to 1.1% year-over-year. Retail trade sales (without food services) were up 3.9% above last year. Food services and drinking places were up 25.2% from January 2022, while general merchandise stores were up 4.5% from last year.

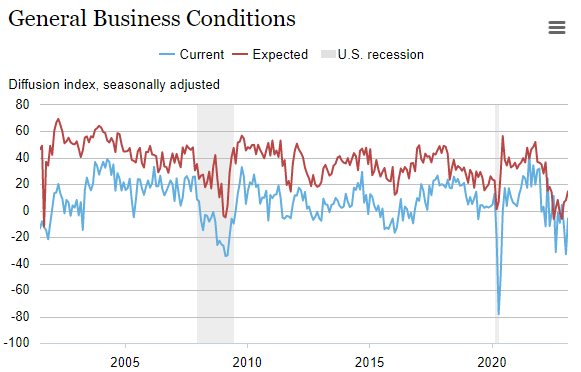

The Empire State Manufacturing Survey headline general business conditions index climbed twenty-seven points but remained negative at -5.8. New orders declined modestly, while shipments held steady. Delivery times shortened, and inventories edged higher. Employment levels declined for the first time since early in the pandemic, and the average workweek shortened for a third consecutive month.

A summary of headlines we are reading today:

- Spanish Port Denies Maersk Tanker Entry Over Russian Oil Links

- U.S. Shoots Down Iranian-Made Drone Conoco Gas Field In Syria

- U.S. Weighs 200% Tariff On Russian Aluminum

- Retail Sales Jump By Most In Nearly Two Years

- Oil Falls After EIA Confirms Massive Crude Inventory Build

- Natural Gas Futures Contracts Suggest Europe’s Energy Crisis Isn’t Over

- Stocks close slightly higher, Nasdaq notches 3-day win streak as investors weigh retail sales and inflation data: Live updates

- Retail sales jump 3% in January, smashing expectations despite inflation increase

- Biggest Hedge Fund Bear Unleashes Epic Shorting Frenzy, Buys Millions In Puts On Dozens Of Meme And Crypto Stocks

These and other headlines and news summaries moving the markets today are included below.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Alberta Is Fighting To Send Its Oil AbroadDespite efforts from Canada’s Prime Minister Justin Trudeau to move away from tar sands – long hailed as the world’s most destructive oil operation – Alberta, the country’s largest oil-producing region, is pushing to open new energy corridors with the U.S. to export its fossil fuels. As the global demand for oil and gas continues, and countries look closer to home to secure their energy needs, Alberta believes it can promote its tar sands as a means of providing the energy needed until enough green alternatives are being… Read more at: https://oilprice.com/Energy/Crude-Oil/Alberta-Is-Fighting-To-Send-Its-Oil-Abroad.html |

|

Spanish Port Denies Maersk Tanker Entry Over Russian Oil LinksA ship operated by giant shipping company Maersk Tankers has been denied entry into a Spanish port after its oil cargoes were found to have previously been carried by a vessel that was formerly Russian flagged. According to Spanish officials, Spain’s northeastern Tarragona port refused entry to the Maersk Magellan tanker after the ship picked up an oil cargo that had originated from the Cameroon-registered Nobel tanker. Trade in oil products linked to Russia has become complicated ever since G7 nations imposed a price cap on Russian… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Spanish-Port-Denies-Maersk-Tanker-Entry-Over-Russian-Oil-Links.html |

|

Iran And Russia Strengthen Military Ties With New Weapons DealsThe news of Iran’s planned purchase of Russian Sukhoi Su-35 advanced fighter jets is the latest sign of deepening relations between Tehran and Moscow. This development is significant, as in recent years, similar contracts were canceled for the sale of Russian Su-35s to Algeria, Egypt and Indonesia under pressure from the United States and the threat of economic sanctions (The Eurasian Times, November 7, 2022). As a result, these countries bought US F-15 fighter jets or French Rafale fighters instead. Thus far, China is the only country that… Read more at: https://oilprice.com/Geopolitics/International/Iran-And-Russia-Strengthen-Military-Ties-With-New-Weapons-Deals.html |

|

Glencore To Pay Out $7 Billion In Dividends And BuybacksGlencore will hand out over £5.8bn ($7bn) to shareholders in dividends and buybacks after the commodities giant posted another period of bumper revenues and profits powered by its coal and trading divisions. Glencore announced it will make a record payout to shareholders of $5.1bn dividend, a top up payment of $500m and buyback of $1.5bn. Revenues have soared 26 percent to $255.9bn, while core profits climbed 60 percent to a record $34.1bn, which included $18.6bn from the energy business that features coal production. Overall, profit on metals… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Glencore-To-Pay-Out-7-Billion-In-Dividends-And-Buybacks.html |

|

New Natural Gas Deals Pull Azerbaijan Closer To EuropeThroughout 2022, Baku pursued a more activist foreign policy due to developments in the South Caucasus and the surrounding regions. First of all, Russian President Vladimir Putin’s war against Ukraine has been the single major event to influence Azerbaijani foreign policy in the past year. While the Russo-Ukrainian war has caused a great deal of international uncertainty, it has also given rise to new opportunities. Economically, Azerbaijan’s significance as a gas supplier to Europe has risen. Cargo freights have surged through Azerbaijan… Read more at: https://oilprice.com/Geopolitics/International/New-Natural-Gas-Deals-Pull-Azerbaijan-Closer-To-Europe.html |

|

U.S. Shoots Down Iranian-Made Drone Conoco Gas Field In SyriaThe Pentagon has revealed that on Tuesday US forces fired on and took down an alleged ‘Iranian-made’ drone that was threating a base in Syria where US troops are stationed. The base is located in northeastern Syria, and the drone flew toward Mission Support Site Conoco, named for the huge gas field that US-backed forces have for years occupied in Deir Ezzor province. US forces have occupied the major Conoco gas field, among Syria’s largest which chiefly supplied Syria’s population, for years under the guise of a ‘counter-ISIS’… Read more at: https://oilprice.com/Latest-Energy-News/World-News/US-Shoots-Down-Iranian-Made-Drone-Conoco-Gas-Field-In-Syria.html |

|

Scientists Use Nano Carbons To Convert Methane Into HydrogenUniversity of Surrey researchers have found that a type of metal-free catalysts could contribute to the development of cost-effective and sustainable hydrogen production technologies. The results entitled ‘First-Principles Microkinetic Modeling Unraveling the Performance of Edge-Decorated Nanocarbons for Hydrogen Production from Methane’ have been published at ACS Applied Materials & Interfaces. The study has shown promising results for the use of edge-decorated nano carbons as metal-free catalysts for the direct conversion of methane,… Read more at: https://oilprice.com/Energy/Energy-General/Scientists-Use-Nano-Carbons-To-Convert-Methane-Into-Hydrogen.html |

|

U.S. Weighs 200% Tariff On Russian AluminumVia Ag Metal Miner A potential aluminum shortage could be rearing its ugly head once again. This will prove especially true if the U.S. goes ahead with a proposed move to shut out all Russian aluminum unilaterally. Currently, the plan is to accomplish this via a tariff of up to 200%. Thus far, Russian metal producers have largely evaded the imposition of sanctions related to the country’s invasion of Ukraine. That said, they have been hit by increased tariffs across the EU. Moreover, the inability to make financial transactions has… Read more at: https://oilprice.com/Latest-Energy-News/World-News/US-Weighs-200-Tariff-On-Russian-AluminumChina-Is-The-Worlds-Biggest-Gold-Buy.html |

|

Retail Sales Jump By Most In Nearly Two YearsU.S. retail sales grew 3% M/M and 6.4% Y/Y in January, the fastest clip in nearly two years and a reversal from a two-month slump. The robust growth comes after another report that showed that U.S. inflation cooled slightly in January to 6.4% down from 6.5% in December, raising the specter that the Federal Reserve could continue increasing interest rates through summer. That clip came at the high end of estimates provided by economists polled by Reuters, with the consensus forecast that sales would only increase 1.8%, with estimates ranging… Read more at: https://oilprice.com/Energy/Energy-General/Retail-Sales-Jump-By-Most-In-Nearly-Two-Years.html |

|

Biden Administration Pushes A Made-In-America EV Charging NetworkThe Biden Administration on Wednesday announced actions to significantly expand the U.S. electric vehicle charger network to support its EV sales goals and back the Made-in-America manufacturing of components for charging stations. The latest set of actions is expected to help the Administration’s EV sales goals by building a national network of 500,000 electric vehicle chargers along America’s highways and in communities and have EVs make up at least 50% of new car sales by 2030. Under the Bipartisan Infrastructure Law, $7.5… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Biden-Administration-Pushes-A-Made-In-America-EV-Charging-Network.html |

|

One Of The World’s Hottest Oil Plays Prepares For New AuctionGuyana, one of the world’s hottest frontier oil plays, is expected to have its new oil production sharing agreement (PSA) model ready in time for its auction that runs through mid-April, according to Guyana’s VP. The oil and gas industry has been eagerly waiting for Guyana to draft new contract terms that have been a long time in coming after Guyana made it clear that oil companies wouldn’t be getting what it considered to be a sweetheart deal like the Exxon consortium did. Guyana expects the new contract model to be available… Read more at: https://oilprice.com/Latest-Energy-News/World-News/One-Of-The-Worlds-Hottest-Oil-Plays-Prepares-For-New-Oil-Auction.html |

|

Oil Falls After EIA Confirms Massive Crude Inventory BuildCrude oil prices fell today after the U.S. Energy Information Administration reported an inventory build of 16.3 million barrels for the week to February 10. This compared with a build of 2.4 million barrels for the previous week, extending a string of weekly builds, some of them quite sizeable, which have pushed inventories above the five-year seasonal average. In gasoline, the energy information authority estimated an inventory increase of 2.3 million barrels for the week to February 10. It compared with a build of 5 million barrels for the previous… Read more at: https://oilprice.com/Energy/Crude-Oil/Oil-Falls-After-EIA-Confirms-Massive-Crude-Inventory-Build.html |

|

Barclays Vows To Stop Financing Oil Sands ProjectsBarclays on Wednesday said it would no longer provide financing to oil sands companies or oil sands projects and tightened conditions for thermal coal lending in an updated policy, which fell short of announcing overall pledges or targets in funding oil and gas. In the annual report for 2022 published today, the UK-based banking giant vowed not to provide financing for any oil sands projects, compared to a previous policy which stated that it would only provide financing to oil sands exploration and production clients that had projects to… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Barclays-Vows-To-Stop-Financing-Oil-Sands-Projects.html |

|

China Is The World’s Biggest Gold BuyerChina imported 1,343 tons of gold in 2022, the highest import level since 2018. Total gold imports for the year were up 64% over 2021. China ranks as the world’s biggest gold consumer. Gold demand in China picked up during the last half of the year as the government relaxed some COVID restrictions. China imported 157 tons of gold in December to close out a strong H2. The World Gold Council called it “a tale of two halves.” On-and-off lockdowns in major cities during the first half suppressed local gold demand and imports. As COVID-controlling… Read more at: https://oilprice.com/Metals/Gold/China-Is-The-Worlds-Biggest-Gold-Buyer.html |

|

Natural Gas Futures Contracts Suggest Europe’s Energy Crisis Isn’t OverEurope’s natural gas futures point to structurally higher prices for the rest of the year, as Europe will soon have to start filling inventories for the 2023/2024 winter. The TTF price, Europe’s benchmark, slipped on Monday to the lowest level since September 2021, and Europe looks confident that there will not be gas shortages this winter. However, the race to ensure supply for next winter hasn’t even started in earnest yet. Prices are set to hold higher than before the Russian invasion of Ukraine through the summer as… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Natural-Gas-Futures-Contracts-Suggest-Europes-Energy-Crisis-Isnt-Over.html |

|

FTX founder Sam Bankman-Fried’s two bond guarantors unsealed, both with ties to StanfordThe names of FTX co-founder Sam Bankman Fried’s bond guarantors were unsealed on Wednesday after a judge granted a motion to have their identities made public. Read more at: https://www.cnbc.com/2023/02/15/sam-bankman-frieds-two-bond-guarantors-revealed-after-unsealing-.html |

|

Ford F-150 Lightning EV production to be halted at least through end of next weekThe update comes a day after Ford confirmed production of the F-150 Lightning had been suspended over a potential battery issue. Read more at: https://www.cnbc.com/2023/02/15/ford-f-150-lightning-production-halted.html |

|

Google CEO tells employees some of company’s top products ‘were not first to market’ as A.I. pressure mountsGoogle leadership has faced criticism of late for its slow response to ChatGPT and emerging competition from Microsoft. Read more at: https://www.cnbc.com/2023/02/15/google-ceo-some-of-companys-top-products-were-not-first-to-market.html |

|

Stocks close slightly higher, Nasdaq notches 3-day win streak as investors weigh retail sales and inflation data: Live updatesInvestors digested retail sales and inflation data, which both were hotter than expected. Read more at: https://www.cnbc.com/2023/02/14/stock-market-today-live-updates.html |

|

Morgan Stanley says these stocks will benefit from an A.I. boomMorgan Stanley says that the artificial intelligence arms race offers prime trading opportunities for certain Asian tech stocks. Read more at: https://www.cnbc.com/2023/02/15/morgan-stanley-says-these-stocks-will-benefit-from-an-ai-boom.html |

|

Retail sales jump 3% in January, smashing expectations despite inflation increaseRetail sales were expected to increase 1.9% in January, according to Dow Jones. Read more at: https://www.cnbc.com/2023/02/15/retail-sales-january-2023-.html |

|

U.S. will default this summer unless Congress raises debt limit, CBO warnsTreasury will exhaust its emergency measures sometime between July and September unless Congress raises the debt ceiling, the Congressional Budget Office says. Read more at: https://www.cnbc.com/2023/02/15/debt-ceiling-us-is-projected-to-default-between-july-and-september-if-congress-doesnt-raise-limits-cbo-says.html |

|

Amazon cuts ties with EU distributors amid wider push to trim costsAmazon said the change will help it “control our costs and keep prices low for customers.” Read more at: https://www.cnbc.com/2023/02/15/amazon-cuts-ties-with-eu-distributors-amid-wider-push-to-trim-costs.html |

|

Key Republican subpoenas Alphabet, Amazon, Apple, Meta and Microsoft, citing alleged collusion with the government to suppress speechJordan wants to “understand how and to what extent the Executive Branch coerced and colluded with companies and other intermediaries to censor speech.” Read more at: https://www.cnbc.com/2023/02/15/jim-jordan-subpoenas-alphabet-amazon-apple-meta-and-microsoft-.html |

|

Ukraine war live updates: EU announces new Russia sanctions package; Ukrainian children sent to Russian ‘re-education’ camps, study saysA new report from the Conflict Observatory details the Kremlin’s systemic efforts to abduct Ukrainian children. Read more at: https://www.cnbc.com/2023/02/15/russia-ukraine-live-updates.html |

|

Founder who sold his startup to Google says the company has lost its mission, is mismanaged and has no sense of urgencyA former Google employee said the technology giant is inefficient, plagued by mismanagement and paralyzed by risk. Read more at: https://www.cnbc.com/2023/02/15/founder-who-sold-his-startup-to-google-says-the-company-has-lost-focus.html |

|

Elon Musk, who co-founded firm behind ChatGPT, warns A.I. is ‘one of the biggest risks’ to civilizationChatGPT “has illustrated to people just how advanced AI has become,” according to Musk. Read more at: https://www.cnbc.com/2023/02/15/elon-musk-co-founder-of-chatgpt-creator-openai-warns-of-ai-society-risk.html |

|

Raquel Welch, actor and international sex symbol, dies at 82The Golden Globe-winning actor died Wednesday morning following a brief illness, her management company said. Read more at: https://www.cnbc.com/2023/02/15/raquel-welch-actor-and-international-sex-symbol-dies-at-82.html |

|

‘Ohio Chernobyl’: East Palestine Town Hall Scrapped After Residents Report Health ProblemsNearly two weeks after a Norfolk Southern Railway freight train with 150 cars (20 of which were carrying hazardous materials) derailed in the small town of East Palestine, Ohio, resulting in a chemical disaster, the extent of the damage to the town and surrounding communities remains unclear. On Tuesday, Ohio Gov. Mike DeWine held a press conference for the Feb. 3 derailment. He said Norfolk Southern did not classify the train as a “high hazardous material train” despite multiple cars containing toxic chemical vinyl chloride.

There’s already an effort by lawmakers on Capitol Hill and federal agencies to investigate the derailment. Read more at: https://www.zerohedge.com/political/ohio-chernobyl-east-palestine-town-hall-scrapped-after-residents-report-health-problems |

|

With Nikki Haley Officially Announcing Her White House Run, Trump Camp Shifts To Attack ModeAuthored by Ross Muscato via The Epoch Times, Former President Donald Trump, a 2024 candidate for the White House, recently made accommodating, understanding, and gracious comments about the anticipated run for president of former South Carolina Gov. Nikki Haley, who served in his cabinet as Ambassador to the United Nations. Trump also, along with those comments, lightly suggested a Haley presidential campaign would be an exercise in disloyalty to him. Speaking with reporters while aboard his plane on Jan. 28, Trump said, “Nikki Haley called me the other day to talk with me—I talked with her for a while. But I said, ‘Look, go by your heart if you want to run.’ “She’s publicly said, ‘I would never run against my president; he was a great president.’” Read more at: https://www.zerohedge.com/political/nikki-haley-officially-announcing-her-white-house-run-trump-camp-shifts-attack-mode |

|

Biggest Hedge Fund Bear Unleashes Epic Shorting Frenzy, Buys Millions In Puts On Dozens Of Meme And Crypto StocksIn November 2021 – literally at the top of the post-covid bubble – when bitcoin and the Russell hit all-time highs and when the euphoria from the record central bank liquidity injection was absolutely everywhere, the world’s biggest hedge fund bear who had been net short for the past decade and somehow made money, while constantly betting against continued risk appreciation, Russell Clark – previously of Horseman Capital Management before changing the name of his investment vehicle to Russell Clark Capital, shuttered his hedge fund. What followed, naturally, was one of the most brutal bear markets in a generation that crushed bulls and rewarded bears… but not before Clark had “max-pained” out, and with his perfectly timed capitulation the title of biggest hedge fund bear was left vacant. Until today, because a quick look at the latest 13F from one of the original market permabears, Jim Chanos – who made his reputation by shorting Enron and dabbling in various credit bubble names before suffering a brutal, decade-long stretch of endlessly rising markets which drained his AUM, revealed that the hedge fund manager is making a solid push to regain the crown of the hedge fund world’s biggest bear. Why? Presenting Exhibit A: Chanos’ top holdings as of Dec 31. The table below shows that out of 60 positions, Chanos was long 11 names (he does not have to disclose his cash shorts, and we can only assume those are substantially mor … Read more at: https://www.zerohedge.com/markets/biggest-hedge-fund-bear-unleashes-epic-shorting-frenzy-buys-millions-puts-dozens-meme-and |

|

CBO Estimates US Treasury Default As Early As JulyWhile Janet Yellen continues to ‘hope’, the nonpartisan Congressional Budget Office is out with its first public opinion on the risk of default by the US federal government if lawmakers fail to raise the debt ceiling.

More ominously, they warn that lower tax receipts could bring the ‘x date’ even closer…

CBO concludes that if the debt limit was not raised or suspended, the Treasury would not be authorized to issue additional debt other than to replace maturing securities. That restriction would ultimately lead to delayed payments for some government activities, a default on the government’s debt obligations, or both. T … Read more at: https://www.zerohedge.com/political/cbo-estimates-us-treasury-default-early-july |

|

McDonald’s puts up prices on five menu itemsThe fast food chain says rising food and energy costs mean its prices are going up. Read more at: https://www.bbc.co.uk/news/business-64651800?at_medium=RSS&at_campaign=KARANGA |

|

Lufthansa tech failure leaves planes groundedThe airline’s systems are back up after a major IT failure disrupted thousands of passenger’s journeys. Read more at: https://www.bbc.co.uk/news/business-64652835?at_medium=RSS&at_campaign=KARANGA |

|

UK inflation: Price rises slow but remain close to 40-year highUK inflation, a measure of the cost of living, fell to 10.1% in the year to January. Read more at: https://www.bbc.co.uk/news/business-64637705?at_medium=RSS&at_campaign=KARANGA |

|

Up 150% in 1 year! This multibagger stock to trade ex-split on ThursdayKCD Industries India engages in the commercial services business and mainly operates in the real estate and infrastructure sectors. The company offers opportunities to customers as per their property requirements. Its land development program includes planners, engineers, architects, legal & financial advisors who plan and come up with cost-effective solutions before customers associate with any of its properties. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/up-150-in-1-year-this-multibagger-stock-to-trade-ex-split-on-thursday/articleshow/97947707.cms |

|

Eicher Motors shares climb over 5% after Q3 results. Should you buy, sell or hold?The company’s revenue from operations surged 29% to Rs 3,721 crore for the quarter under review against Rs 2,880 crore in the corresponding quarter of last year. Meanwhile, margins improved to 23% in the third quarter as compared to 20% in the same quarter of last year. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/eicher-motors-shares-climb-over-5-after-q3-results-should-you-buy-sell-or-hold/articleshow/97943271.cms |

|

The Moneyist: I’ll inherit $40,000 from my grandmother. Should my husband and I boost our kids’ college savings accounts, or pay off credit cards and student loans?‘We also have a very old house that really needs some work.’ Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7199-AA501B057160%7D&siteid=rss&rss=1 |

|

: After IPO, Bausch + Lomb turns to an industry favorite to run the companyThe company’s stock was up about 9% in trading on Thursday after the company made the announcement that Brent Saunders will return to Bausch + Lomb as CEO. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-719A-6D5D79428EE0%7D&siteid=rss&rss=1 |

|

Market Snapshot: Dow trades modestly lower, S&P 500 wavers as traders digest strong retail sales dataU.S. stock indexes struggled for direction in the final hour of trade Wednesday as investors digested strong retail sales data in the wake of inflation data on Tuesday that suggested the Federal Reserve may have to raise interest rates higher than previously thought to bring down inflation. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7199-EBE07E75E2B1%7D&siteid=rss&rss=1 |