Summary Of the Markets Today:

- The Dow closed up 169 points or 0.50%,

- Nasdaq closed down 0.61%,

- S&P 500 closed up 0.22%,

- Gold $1875 closed down $3.20,

- WTI crude oil settled at $80 up $1.74,

- 10-year U.S. Treasury 3.745% up 0.062 points,

- USD $103.57 up $0.35,

- Bitcoin $21,713 – 24H Change down $255.56 – Session Low $21,579

- Baker Hughes Rig Count: U.S. +2 to 761 Canada +1 to 250

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our Economic Forecast for February 2023

Today’s Economic Releases:

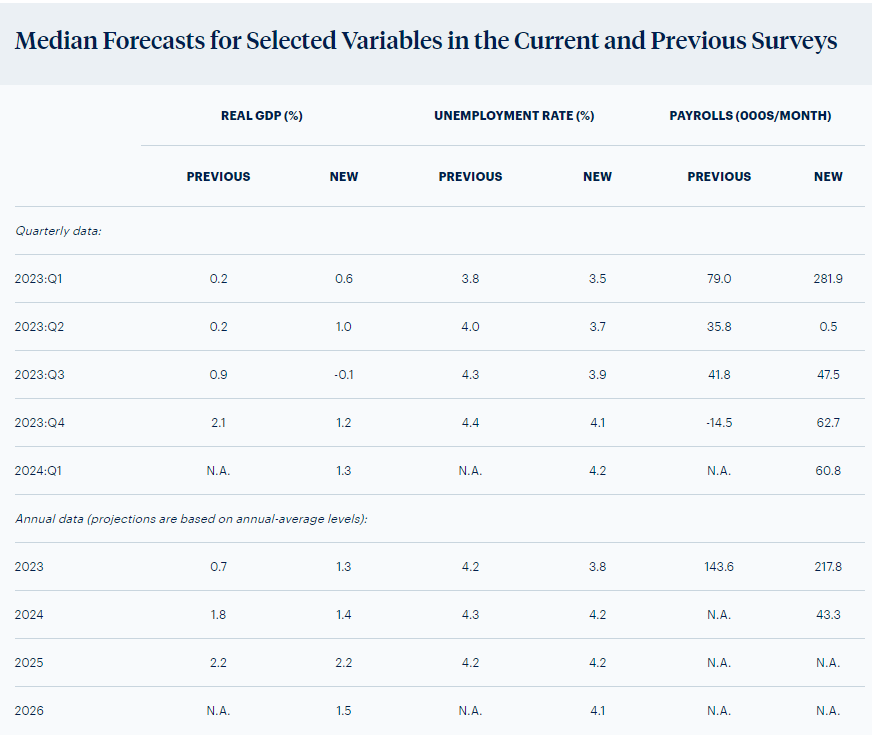

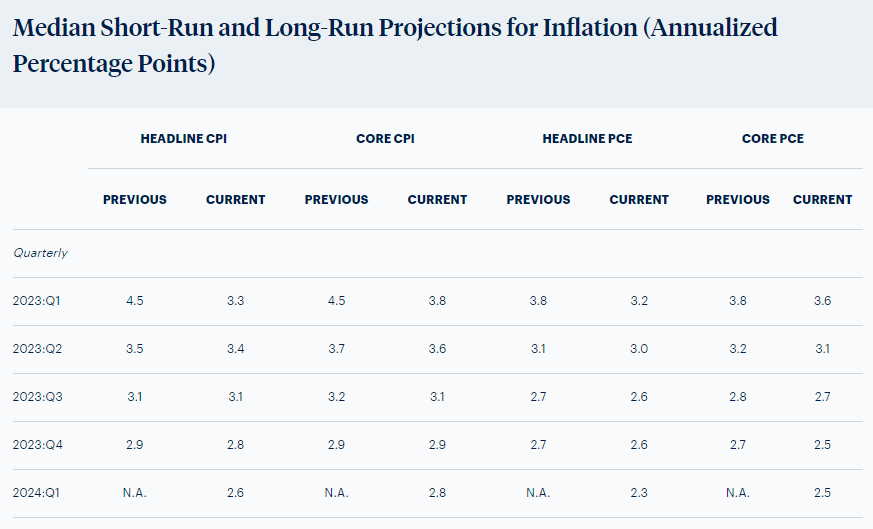

The outlook for the U.S. economy in 2023 looks somewhat better now than it did three months ago, according to 37 forecasters surveyed in the First Quarter 2023 Survey of Professional Forecasters. The forecasters predict the economy will expand at an annual rate of 0.6% this quarter and 1.0% in the second quarter of 2023, up from the previous predictions of 0.2% in each quarter. On an annual-average over annual-average basis, the forecasters expect real GDP to increase by 1.3% in 2023, up from the projection of 0.7% in the survey of three months ago.

The New York Fed’s Labor Market for Recent College Graduates page has been updated. Check out new 2022:Q4 data on unemployment, underemployment, and underemployed job types, as well as the annual update of data on wages and labor market outcomes by major.

A summary of headlines we are reading today:

- U.S. Oil Drilling Activity Picks Up Amid Rising Crude Prices

- BP Shares Have Jumped Nearly 20% This Week

- Oil Markets Balance Fed Fears With Chinese Demand Optimism

- Dow closes nearly 170 points higher, S&P 500 posts worst week since December: Live updates

- U.S. shoots down second ‘high altitude object’ days after Chinese spy balloon

- Investors will have their eyes on the consumer price index in the week ahead

- Texas Drops Citi From Huge Muni Transaction Over Gun Policy

- Market Snapshot: U.S. stocks trade mixed, S&P 500 heads for worst week since December

These and other headlines and news summaries moving the markets today are included below.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Engineers Reveal Flow Battery Cell BreakthroughGeorgia Institute of Technology engineers have now developed a more compact flow battery cell configuration that reduces the size of the cell by 75%. That corresponds to reducing the size and cost of the entire flow battery. The work could revolutionize how everything from major commercial buildings to residential homes that are battery-powered. The all-Georgia Tech research team published their findings in the paper, “A Sub-Millimeter Bundled Microtubular Flow Battery Cell With Ultra-high Volumetric Power Density,” in Proceedings of the… Read more at: https://oilprice.com/Energy/Energy-General/Engineers-Reveal-Flow-Battery-Cell-Breakthrough.html |

|

Tech Startups Look To Revitalize Tourism In Emerging MarketsAs emerging markets develop new attractions and tap into new visitor source markets, they are leveraging technology and sustainable development in line with emissions targets. Following sharp declines in 2020, international tourism figures rebounded in 2021 and were on track to reach approximately 65% of pre-pandemic levels in 2022. Notably, in September arrivals in the Middle East and the Caribbean surpassed 2019 levels by 3% and 1%, respectively. The recovery in travel demand is projected to create 126m jobs globally over the next decade, according… Read more at: https://oilprice.com/Energy/Energy-General/Tech-Startups-Look-To-Revitalize-Tourism-In-Emerging-Markets.html |

|

Russian Oil Price Cap Is Meeting Objectives: G7The Russian oil price cap mechanism is still meeting its objectives, a G7 price cap coalition official told Reuters on Friday. Any Russian production cuts that may be forthcoming will disproportionately hurt developing countries, the G7 official added. Earlier on Friday, Russia announced a 500,000 bpd crude oil production cut—crude oil production, not crude oil and condensate production—with Russia’s Deputy Prime Minister Alexander Novak preceding that with a warning that there was a risk of reduced crude oil production yet this… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Russian-Oil-Price-Cap-Is-Meeting-Objectives-G7.html |

|

U.S. Oil Drilling Activity Picks Up Amid Rising Crude PricesThe total number of total active drilling rigs in the United States rose by 2 this week, according to new data from Baker Hughes published on Friday. The total rig count rose to 761 this week—126 rigs higher than the rig count this time in 2022 and 314 rigs lower than the rig count at the beginning of 2019, prior to the pandemic. Oil rigs in the United States increased by 10 this week, to 609 after falling by 10 in the week prior. Gas rigs fell by 8, to 150. Miscellaneous rigs stayed the same at 2. The rig count in the Permian Basin fell… Read more at: https://oilprice.com/Energy/Energy-General/US-Oil-Drilling-Activity-Picks-Up-Amid-Rising-Crude-Prices.html |

|

Kazakhstan Delays Oil Pipeline RestartKazakhstan has delayed the startup of crude oil exports from its giant Tengiz oilfield by way of the Baku-Tbilisi-Ceyhan pipeline, four sources told Reuters on Friday. Kazakhstan energy company Kazmunaigaz (KMG) has pushed back the restart of crude oil exports from the giant Tengiz oilfield after BP declared force majeure on crude oil loadings from the Ceyhan port. “Force majeure was declared in Ceyhan, and (Tengiz) crude supplies to BTC were put on hold,” a market source told Reuters. Kazakhstan has banned the export of fuels, including gasoline,… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Kazakhstan-Delays-Oil-Pipeline-Restart.html |

|

Fraud Findings Force Trafigura To Fire Head Of Nickel And Cobalt TradingThe global nickel trading market is once again in the spotlight. Having been at the epicenter of a massive short-squeeze that almost shuttered the London Metal Exchange (and remains mired in litigation), Bloomberg reports that the nickel market has been rocked once again as one of the world’s largest commodity traders, Trafigura Group, is facing more than half a billion dollars in losses after discovering metal cargoes it bought didn’t contain the metal they were supposed to. The giant commodity trader has recorded a $577 million impairment… Read more at: https://oilprice.com/Metals/Commodities/trafigura-fires-head-of-nickel-trading.html |

|

BP Shares Have Jumped Nearly 20% This WeekInvestors seem to have liked BP’s latest strategy update that told of its goal to produce more oil and gas in the short term as the UK-based supermajor is once again worth more than £100 billion ($121 billion) on the London stock exchange for the first time in three years. BP’s (LON: BP) shares in London have jumped by nearly 19% since this past Tuesday when the company said it would invest more in resilient oil and gas projects than previously planned and would pump more hydrocarbons for longer to meet the world’s… Read more at: https://oilprice.com/Latest-Energy-News/World-News/BP-Shares-Have-Jumped-Nearly-20-This-Week.html |

|

Andurand: Putin Has Lost The Energy WarTop energy trader Pierre Andurand has closed out all his positions in the natural gas market because last year’s high prices probably won’t be repeated, with Russia losing the gas war as Europe seems to have moved past the worst of the power crisis. According to Andurand, Russian President Vladimir Putin failed to achieve his objectives—Europe has indeed found alternate natural gas supplies, with European benchmark natural gas prices now high, but well below the 300 euro per MW hour price that it achieved in August. “I think… Read more at: https://oilprice.com/Energy/Energy-General/Andurand-Putin-Has-Lost-The-Energy-War.html |

|

Has Natural Gas Finally Bottomed Out?A few weeks ago, I had a go at catching the falling knife that is natural gas right now. For all of two trading days it looked like that might have been a good call as natty popped around 10%, but then it quickly resumed its drop… As I have said here many times before, though, my contrarian trading style means that there is always a danger of something like that, so I set up trades to allow for it. In this case, I moved my initial stop up a bit on that two-day jump, so while I did lose money, it was a relatively small amount. That is why,… Read more at: https://oilprice.com/Energy/Natural-Gas/Has-Natural-Gas-Finally-Bottomed-Out.html |

|

Lyft Stock Sheds $2 Billion After Massive Earnings MissLyft is trailing behind competitor Uber as disappointing forecasts have caused investors to lose confidence. Shares in the ride-hailing company dropped more than 30 percent this week after it reported lower-than-expected first-quarter profit forecasts of $975m (£805m). Initially, analysts forecasted it would be at $1.09bn (£900m), according to Refinitiv data. Lyft also announced its first-quarter earnings before interest, taxes, depreciation, and amortization (EBITDA) to between $5m and $15m, a decrease from S&P Capital IQ analyst… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Lyft-Stock-Sheds-2-Billion-After-Massive-Earnings-Miss.html |

|

The First Major Oil Supply Disruption Of 2023In what is set to be the first major supply disruption of 2023, Russia has announced a 500,000 bpd voluntary production cut due to growing pressure from price caps and embargoes. Oilprice Alert: Whether you are new to the oil and gas industry or an energy market veteran, you will regret not signing up for Global Energy Alert. Oilprice.com’s premium newsletter provides everything from geopolitical analysis to trading analysis, all for less than a cup of coffee per week.Friday, February 10th, 2023After months of macro-driven price swings,… Read more at: https://oilprice.com/Energy/Energy-General/The-First-Major-Oil-Supply-Disruption-Of-2023.html |

|

Enbridge Books Q4 Loss Due To Goodwill Impairment ChargeCanada’s pipeline operator Enbridge (NYSE: ENB) reported on Friday a loss for the fourth quarter of 2022, compared to a profit for the same period of 2021, due to a non-cash goodwill impairment of US$1.86 billion (C$2.5 billion) in its gas transmission reporting unit. Enbridge, which moves large volumes of oil and gas in North America –including on the Mainline transportation system which moves more than 50% of all Canadian crude oil exports – booked a loss of US$794 million (C$1.067 billion) for the fourth quarter of 2022, versus earnings… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Enbridge-Books-Q4-Loss-Due-To-Goodwill-Impairment-Charge.html |

|

Oil Markets Balance Fed Fears With Chinese Demand OptimismApril West Texas Intermediate crude oil futures edged lower on Thursday but were then pushed higher on Friday morning by a surprise announcement that Russia would cut production in March. The catalysts behind the selling pressure on Thursday were an easing of the supply destruction premium after oil infrastructure appeared to have avoided serious damage from the earthquake that devastated parts of Turkey and Syria, growing U.S. Inventories, and worries about Federal Reserve rate hikes. Nonetheless, the market remained supported by optimism over… Read more at: https://oilprice.com/Energy/Energy-General/Oil-Markets-Balance-Fed-Fears-With-Chinese-Demand-Optimism.html |

|

Fossil Fuel Emissions To Peak In 20251. Fossil Emissions Are Set to Peak in 2025 As Energy Industries Adapt- A new Rystad Energy study indicates carbon dioxide emissions from fossil fuel usage will peak in 2025, hitting 39 gigatonnes before trending lower. – One signal of the upcoming plateau is the expectation that CO2 emissions from electricity and heat generation will peak (14.4 GT) this year, with industry emissions beginning to fall by 2027. – Interestingly, Chinese carbon emissions are expected to start their four-year plateau in 2023, too, with India, other parts of Asia, and… Read more at: https://oilprice.com/Energy/Energy-General/Fossil-Fuel-Emissions-To-Peak-In-2025.html |

|

Seymour Hersh Investigation Unlikely To Change NarrativePolitics, Geopolitics & Conflict U.S. journalist Seymour Hersh published an investigation this week into the explosions on the NordStream pipeline in September last year, claiming that American divers planted explosives under three of the four pipelines during a NATO Baltic Sea exercise in the summer, detonating them remotely. Hersh also claimed that Norway was complicit in the scheme. The U.S. has categorically denied the claims, which Hersh sources to unnamed “insiders”, while Russia is hoping (futilely) that Hersh will testify… Read more at: https://oilprice.com/Energy/Energy-General/Seymour-Hersh-Investigation-Unlikely-To-Change-Narrative.html |

|

Dow closes nearly 170 points higher, S&P 500 posts worst week since December: Live updatesInvestors are evaluating the latest batch of earnings reports from corporations. Read more at: https://www.cnbc.com/2023/02/09/stock-market-today-live-updates.html |

|

Amazon is the latest threat to Facebook as ad targeting suffersBrands are shifting ad budgets away from Facebook and toward Amazon now that targeting users across social networks has become more difficult. Read more at: https://www.cnbc.com/2023/02/10/amazon-is-the-latest-threat-to-facebook-as-ad-targeting-suffers.html |

|

U.S. shoots down second ‘high altitude object’ days after Chinese spy balloonThe object was destroyed by a missile from an F-22 fighter plane off the northeastern coast of Alaska. Read more at: https://www.cnbc.com/2023/02/10/us-shoots-down-second-high-altitude-object-on-bidens-orders.html |

|

Google employees criticize CEO Sundar Pichai for ‘rushed, botched’ announcement of GPT competitor BardIn addition to a slide in its stock, Alphabet is facing criticism from employees following the announcement of its ChatGPT competitor this week. Read more at: https://www.cnbc.com/2023/02/10/google-employees-slam-ceo-sundar-pichai-for-rushed-bard-announcement.html |

|

Investors will have their eyes on the consumer price index in the week aheadInvestors are hoping to see inflation cooled for another month. Read more at: https://www.cnbc.com/2023/02/10/investors-will-have-their-eyes-on-the-consumer-price-index-in-the-week-ahead.html |

|

FBI finds another classified document in search of Mike Pence’s home, his spokesman saysThe search of Pence’s home came after classified documents were found at President Joe Biden’s home in Delaware. Read more at: https://www.cnbc.com/2023/02/10/fbi-searching-ex-trump-vp-pence-home-for-classified-docs.html |

|

Here’s what’s happening with home prices as mortgage rates fallHome price gains have been weakening over the past six months, but an increase in demand may change the picture. Read more at: https://www.cnbc.com/2023/02/10/home-prices-mortgage-rates-fall.html |

|

Why you won’t see many car ads during Sunday’s Super BowlThe only automakers expected to advertise during Sunday’s game between the Eagles and Chiefs on Fox are GM, Kia, and Stellantis’ Ram and Jeep brands. Read more at: https://www.cnbc.com/2023/02/10/gm-jeep-kia-super-bowl-ads.html |

|

Ether drops after SEC’s staking crackdown, and Goldman outlines blockchain vision: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, Mathew McDermott, global head of digital assets for Goldman Sachs, discusses big banks’ strategy for crypto’s underlying technology. Read more at: https://www.cnbc.com/video/2023/02/10/ether-sec-staking-crackdown-goldman-blockchain-vision-crypto-world.html |

|

Ukraine war live updates: Russia launches new missile strikes; Moldova’s government collapsesExplosions hit the Ukrainian capital of Kyiv Friday morning amid reports that Russia is launching another major offensive. Read more at: https://www.cnbc.com/2023/02/10/ukraine-war-live-updates-latest-news-on-russia-and-the-war-in-ukraine.html |

|

How to delete yourself from the internetIt’s possible to get online information scrubbed through Google and paid internet removal services, but it can be time-consuming and only partially effective. Read more at: https://www.cnbc.com/2023/02/10/how-to-delete-yourself-from-the-internet.html |

|

TV prices sink ahead of the Super Bowl — here are the best dealsHistorically, TV prices approach their lowest point right before Super Bowl Sunday. This year, the deals are even better. Read more at: https://www.cnbc.com/2023/02/10/tv-prices-sink-ahead-of-the-super-bowl-here-are-the-best-deals.html |

|

Disney CEO Bob Iger’s potential willingness to sell Hulu is a reversal in strategyDisney CEO Bob Iger said “everything was on the table” with regard to Hulu’s ownership. Read more at: https://www.cnbc.com/2023/02/10/disney-iger-hulu-strategy-comcast.html |

|

Ukraine Almost Solely Reliant On Intelligence From US For HIMARS Rocket StrikesAuthored by Dave DeCamp via AntiWar.com, The Washington Post reported Thursday that Ukraine is reliant on coordinates provided or confirmed by the US and its allies to launch strikes using the US-provided HIMARS rocket systems, a revelation that demonstrates Washington’s deep involvement in the war. The HIMARS is a precision-guided artillery system, one that Ukraine has employed quite a bit in its fight against Russia. One example is a January 1 HIMARS strike on a facility housing Russian forces in Donetsk that killed at least 89 Russian soldiers, one of the deadliest Ukrainian attacks of the war.

Image via defense.govCiting three unnamed Ukrainian officials and one unnamed US official, the Post reported that Ukraine also … Read more at: https://www.zerohedge.com/military/ukraine-almost-solely-reliant-intelligence-us-himars-rocket-strikes |

|

Texas Drops Citi From Huge Muni Transaction Over Gun PolicyTexas has punted Citigroup from the syndicate that’s set to manage the Lone Star state’s largest-ever municipal bond offering, saying the bank’s policies for gun retailers discriminate against the firearms industry, Bloomberg has reported. On Thursday, the Texas Natural Gas Securitization Finance Corp. board reconstituted the lineup of banks that will handle the $3.4 billion offering, jettisoning Citi from a list that was first made in May 2022. The move comes in the wake of last month’s determination by Texas Attorney General Ken Paxton that Citi’s retailer rules violate a 2021 Texas law that bars the state from contracting with companies that impose anti-gun policies. Read more at: https://www.zerohedge.com/markets/over-gun-policy-texas-drops-citi-huge-muni-transaction |

|

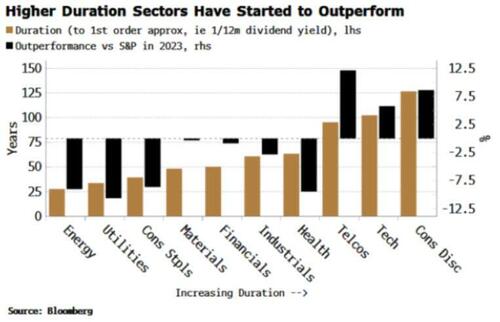

Disinflation Trades To Soon Hit The Rocks As Prices Stay StickyAuthored by Simon White, Bloomberg macro strategist, Trades favoring disinflation are soon set to reverse as price increases prove more entrenched than anticipated. This year, higher-duration sectors, such as tech, telcos and consumer discretionary have led stocks’ advance, while low-duration ones such as energy and utilities have underperformed. This is a reversal of the trend from late 2021, where investors started to shun high-duration stocks as inflation began to rise rapidly.

Duration is the ultimate driver of investor preferences in an inflationary cycle such as the current one. This year growth has begun to outperform value again, and cyclicals are outpacing defensives, but these obscure the bigger picture of how long-duration assets are best avoided when inflation risk is high. Investors re-embracing higher-duration stocks is a signal they are also embracing the disinflationary narrative, one endorsed by the Fed and priced in to inflation swaps. Read more at: https://www.zerohedge.com/markets/disinflation-trades-soon-hit-rocks-prices-stay-sticky |

|

Biden Ordered Shootdown Of Unidentified Object Over Alaska Deemed “Threat To Civilian Aviation”A US official has said Friday that the US military engaged and shot down an unidentified object flying over Alaska on Thursday night, upon the order given by President Biden. It’s unconfirmed whether the unidentified object was a balloon, “but it was traveling at an altitude that made it a potential threat to civilian aircraft,” according to The New York Times, which first reported it Friday afternoon.

US Air Force file imageThe president gave the shootdown order “out of an abundance of caution,” the unnamed US official said, coming on the heels of the dramatic Chinese ‘spy’ balloon shootdown off the American east coast last Saturday. The scant details given to the Times didn’t reveal any information that might point to the nature of the flying object, or if it was possibly a weather or spy balloon (China still insists last week’s balloon was purely for weather research … Read more at: https://www.zerohedge.com/political/biden-ordered-shootdown-unidentified-object-over-alaska-deemed-threat-civilian-aviation |

|

RMT union rejects latest offers in rail disputeThe union calls the deals from both Network Rail and the train operating companies “dreadful”. Read more at: https://www.bbc.co.uk/news/business-64600975?at_medium=RSS&at_campaign=KARANGA |

|

UK economy avoids recession but not out of woods – HuntThe economy saw zero growth in the final three months of 2022 but strike action took a toll in December. Read more at: https://www.bbc.co.uk/news/business-64584295?at_medium=RSS&at_campaign=KARANGA |

|

Energy bills extra support ruled out by chancellorJeremy Hunt says the government does not “have the headroom” to give household additional help. Read more at: https://www.bbc.co.uk/news/business-64594707?at_medium=RSS&at_campaign=KARANGA |

|

Delhivery Q3 preview: Express delivery vertical may drive sales growthAnalysts will watch out the trend on freight costs and employee expenses as these make for a chunk of the total expenditure for the company. In the second quarter, freight handling and services cost rose 24% on year to Rs 1,436 crore. Staff expenses on the other hand, declined nearly 21% on year to Rs 353 crore. Read more at: https://economictimes.indiatimes.com/markets/stocks/earnings/delhivery-q3-preview-express-delivery-vertical-may-drive-sales-growth/articleshow/97793080.cms |

|

Telecom, auto among 4 sectors that may lead next leg of rally on D-St: Gurmeet Singh Chawla“As per the Budget, capital investment outlay is being increased steeply for the third year in a row by 33% to Rs 10 lakh crore ($122 bn), which would be 3.3% of GDP. This will be almost three times the outlay in 2019-20. GDP growth, consumer market growth, and the export opportunity presented will continue to drive the market higher in the long term.” Read more at: https://economictimes.indiatimes.com/markets/expert-view/etmarkets-smart-talk-telecom-auto-among-4-sectors-that-may-lead-next-leg-of-rally-on-d-st-gurmeet-singh-chawla/articleshow/97789319.cms |

|

Rs 45,000 crore-bet! YES Bank among top 9 FII stock picks in Q3. What should investors do?“We believe the outperformance of the value stocks is likely to continue in H1CY23 and would be led by a pickup in the credit growth as well as a recovery in the domestic-cyclical stocks, which would be in line with the pickup in the domestic economy,” said Axis analyst Neeraj Chadawar. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/rs-45000-crore-bet-yes-bank-among-top-9-fii-stock-picks-in-q3-what-should-investors-do/articleshow/97789838.cms |

|

The Margin: Tom Brady will start as an NFL broadcaster in 2024 as part of his $375 million Fox dealBrady will become Fox’s lead color commentator for NFL games alongside Kevin Burkhardt. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-718C-FE265C335A8C%7D&siteid=rss&rss=1 |

|

Crypto: Why crypto is dead at Super Bowl LVIIUnlike Super Bowl 2022, which was dubbed the ‘crypto bowl’ this year’s game won’t feature any crypto ads Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7197-0E82B769BDB2%7D&siteid=rss&rss=1 |

|

Market Snapshot: U.S. stocks trade mixed, S&P 500 heads for worst week since DecemberU.S. stocks were mixed Friday afternoon, as investors weigh a report on consumer sentiment and recent warnings from Fed officials that its battle to tame high inflation is not done. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7196-48C63D845A25%7D&siteid=rss&rss=1 |