Summary Of the Markets Today:

- The Dow closed down 249 points or 0.73%,

- Nasdaq closed down 1.02%,

- S&P 500 closed down 0.88%,

- Gold $1873 down $18.15,

- WTI crude oil settled at $78 down $0.80,

- 10-year U.S. Treasury 3.667% up 0.031 points,

- USD $103.26 down $0.14,

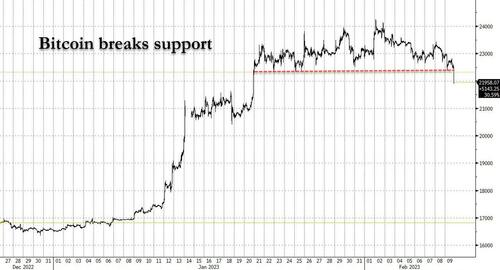

- Bitcoin $21,950 – 24H Change down $910.28 – Session Low $21,880

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our Economic Forecast for February 2023

Today’s Economic Releases:

The Atlanta Fed’s Wage Growth Tracker Was 6.1 Percent in January, the same as in December. For people who changed jobs, the Tracker in January was 7.3 percent, compared to 7.7 percent in December. For those not changing jobs, the Tracker was 5.4 percent, compared to the 5.3 percent reading in December.

In the week ending February 4, the unemployment insurance weekly initial claims 4-week moving average was 189,250, a decrease of 2,500 from the previous week’s unrevised average of 191,750.

A summary of headlines we are reading today:

- U.S. Slaps Sanctions On Firms Selling Iranian Oil Products In Asia

- Exxon Unveils New Trading Division To Compete With Shell And BP

- Tesla’s Huge Model 3 Discounts Lift Car Sales In China

- Oil Prices Continue To Slide On Rising US, EU Inventories

- Dow closes nearly 250 points lower, Nasdaq sheds 1% as Alphabet shares slide: Live updates

- Yahoo to lay off 20% of staff by year-end, beginning this week

- Bitcoin slips further below $23,000, and judge extends SBF’s bail restrictions: CNBC Crypto World

- Beware: The Fed Thinks It’s Different This Time

- Cryptos Tumble After Kraken Agrees To Shutter Crypto-Staking Ops To Settle SEC Charges

- Market Extra: Retail investors are more bullish on stocks than at any point since the Fed started hiking rates. Here’s why that could be a problem.

These and other headlines and news summaries moving the markets today are included below.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Carbon Capture Is Coming Under Fire For UnderperformingThere has been a lot of hype around carbon capture and storage (CCS) technology in the last few years. Many energy companies and governments have touted CCS as the potential savior of oil and gas in a decarbonized world. As political powers around the globe race to decarbonize their economies in the transition away from fossil fuels to green alternatives, CCS has been seen as a way of bridging the gap in the transition, as renewable energy operations continue to expand. CCS technologies are being incorporated into oil and gas projects to help reduce… Read more at: https://oilprice.com/Energy/Energy-General/Carbon-Capture-Is-Coming-Under-Fire-For-Underperforming.html |

|

U.S. Slaps Sanctions On Firms Selling Iranian Oil Products In AsiaStepping up efforts to pressure Iran’s revenues, the U.S. Department of the Treasury on Thursday imposed sanctions on nine companies for producing, selling, and shipping Iranian petroleum and petrochemicals in Asia. The Department of the Treasury’s Office of Foreign Assets Control (OFAC) sanctioned six Iran-based petrochemical manufacturers or their subsidiaries and three firms in Malaysia and Singapore involved in facilitating the sale and shipment of petroleum and petrochemicals on behalf of Triliance Petrochemical Co. Ltd.,… Read more at: https://oilprice.com/Latest-Energy-News/World-News/US-Slaps-Sanctions-On-Firms-Selling-Iranian-Oil-Products-In-Asia.html |

|

Researchers Look To Turn Decommissioned Mines Into BatteriesThe International Institute for Applied Systems Analysis (IIASA) has offered a new technique called Underground Gravity Energy Storage that turns decommissioned mines into long-term energy storage solutions. Renewable energy sources are central to the energy transition toward a more sustainable future. However, as sources like sunshine and wind are inherently variable and inconsistent, finding ways to store energy in an accessible and efficient way is crucial. While there are many effective solutions for daily energy storage, the most common being… Read more at: https://oilprice.com/Energy/Energy-General/Researchers-Look-To-Turn-Decommissioned-Mines-Into-Batteries.html |

|

Exxon Unveils New Trading Division To Compete With Shell And BPExxon Mobil shares are rebounding back towards record highs this morning after The Wall Street Journal reports that the giant energy company will be combining business units as part of a continuing corporate reorganization that will cut costs and trim some jobs. After recently posting a record profit in 2022 (and facing wrath of The White House), the US oil company will, according to a memo sent to employees, form three new organizations under which it will wed several smaller units later this year such as its financial-services, procurement and… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Exxon-Unveils-New-Trading-Division-To-Compete-With-Shell-And-BP.html |

|

Zelenskiy: European Unity Is Fundamental To SecurityUkrainian President Volodymyr Zelenskiy has told EU leaders that a free Europe is not possible without a free Ukraine, as he pressed for more weapons to aid Kyiv’s defense against invading Russian forces. “Europe should not have gray zones, our whole continent should be open to European destiny,” Zelenskiy told an EU summit in Brussels on February 9, in which he also pressed for fast-tracked Ukrainian membership of the European Union. Zelenskiy said that Ukraine had “never wanted, never provoked” the full-scale war launched by… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Zelenskiy-European-Unity-Is-Fundamental-To-Security.html |

|

Turkish Steelmakers Remain Operational After EarthquakeVia AG Metal Miner According to MetalMiner sources, the earthquakes that struck Turkey and Syria on February 6 have not damaged the area’s steel manufacturing plants. The first jolt struck at 4:17 AM local time, just west of Gaziantep. The 7.8 magnitude quake caused widespread damage and destruction across both Turkey and Syria. To make matters worse, a second earthquake occurred at 1:24 PM near the city of Kahramanmara?. Various media outlets report that the incidents have claimed over 5,000 lives and injured more than 30,000. Unfortunately,… Read more at: https://oilprice.com/Metals/Commodities/Turkish-Steelmakers-Remain-Operational-After-Earthquake.html |

|

Tesla’s Huge Model 3 Discounts Lift Car Sales In ChinaAfter promising preliminary numbers, it now appears final that Tesla deliveries in China continued to buck the larger national trend of sales for January. The American EV manufacturer reported 66,051 China-made cars delivered for the month of January, up 18.4% from December 2022, according to final data from China’s Passenger Car Association. The data indicates 26,843 vehicles sold in China and 39,208 vehicles exported from China for the month. The spike in delivered vehicles was likely helped by price cuts that Tesla put into place at the… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Teslas-Huge-Model-3-Discounts-Lift-Car-Sales-In-China.html |

|

Bulgaria Remains Russia’s Number One European Oil BuyerThe prolonged political instability in Bulgaria will continue to impact critical energy security decisions and maintain the country’s status as Russia’s best client in Europe. Bulgaria, currently the third-largest buyer of Russian oil in the world, is heading for another round of general elections on April 2, since the parliament failed to form a regular cabinet following the October 2022 elections (Dnevnik.bg, February 2). This will be the fifth parliamentary poll in the past two years. The Bulgarian National Assembly will dissolve… Read more at: https://oilprice.com/Energy/Crude-Oil/Bulgaria-Remains-Russias-Number-One-European-Oil-Buyer.html |

|

Oil Prices Continue To Slide On Rising US, EU InventoriesAfter rebounding by some 5% earlier this week on China demand recovery optimism, crude oil prices have shed over 1% on Thursday, following U.S. inventory data showing increasing stockpiles. At 12.24 p.m. EST, Brent crude was trading down 1.09% on the day at $84.16 per barrel, while WTI was trading down 1.19% at $77.54 per barrel. On Wednesday, the EIA reported another inventory build, putting downward pressure on oil prices. That report came after three weeks of inventory builds. As of the latest EIA report, 455.1 million barrels, U.S. crude… Read more at: https://oilprice.com/Energy/Oil-Prices/Oil-Prices-Continue-To-Slide-On-Rising-US-EU-Inventories.html |

|

Azeri Oil Exports From Turkey Expected To Be Delayed Until Next WeekShipments of Azeri crude oil from the southern Turkish port of Ceyhan are not expected to be restored until late next week, as assessment of the damage from Monday’s earthquakes continues, a source with knowledge of a preliminary estimate told Bloomberg on Thursday. Earlier estimates suggested that the terminal at Ceyhan hosting the pipeline from Azerbaijan was expected to return to operations on Wednesday or Thursday. The timeline seems to have been pushed by at least a week as authorities and stakeholders continue to assess damages… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Azeri-Oil-Exports-From-Turkey-Expected-To-Be-Delayed-Until-Next-Week.html |

|

Central Bank Buying Spree Lifts Gold PricesDespite continued rate rises from the US Federal Reserve, gold prices are recovering as other central banks around the world buy up the precious metal and investors foresee softer rate hikes. Prices have been propped up by robust purchasing from central banks across fast-growing economies including China, India and Turkey, which are looking to pivot from the US dollar. The precious metal slumped to a three-week low last week, dropping from $1,956 per ounce to $1,861 per ounce last week, amid sustained rate hikes from the Fed. The US central bank… Read more at: https://oilprice.com/Metals/Gold/Central-Bank-Buying-Spree-Lifts-Gold-Prices.html |

|

Australian Coal Shipment Arrives In China For The First Time In Two YearsThe first shipment of Australian coal to China in two years arrived this week as Beijing signaled it was warming up to restoring trade relations with its former major supplier of the fossil fuel. The news comes as the Chinese Foreign Ministry said it was ready to resume trade relations with Australia and even expand them, the Global Times reported. The statement followed another one, from China’s commerce minister, who said earlier this week, after talks with his Australian counterpart, that bilateral relations were improving. “At present,… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Australian-Coal-Shipment-Arrives-In-China-For-The-First-Time-In-Two-Years.html |

|

The Inevitable Battery Metal Supply Squeeze Could Be Closer Than We ThoughtDid you know that EVs need up to six times more minerals than conventional cars? EVs are mineral-intensive and are pushing up demand for critical battery metals. According to the International Energy Agency (IEA), lithium, nickel, and cobalt demand is expected to grow from 10%-20% to over 80% by 2030. As countries around the world pledge to go all-electric by 2035 and 2040, Visual Capitalist’s Tessa Di Grandi and Zack Aboulazm discuss whether we have enough mineral supply for EV demand? Factors such as geopolitical concentration of resources, quality… Read more at: https://oilprice.com/Energy/Energy-General/The-Inevitable-Battery-Metal-Supply-Squeeze-Could-Be-Closer-Than-We-Thought.html |

|

Embattled Adani Embarks On A Coal Fire Sale To Boost LiquidityIndia’s conglomerate Adani is offering coal cargoes at a discount to benchmarks in a move suggesting that the group’s traders are eager to sell the coal quickly and potentially boost the liquidity at Adani Group, sources familiar with the matter told Bloomberg on Thursday. The giant industrial conglomerate Adani has had a difficult few weeks after a short seller’s report accused the group of gross market manipulations, leading to a massive wipeout of the market capitalizations of the group’s listed units. Indian authorities… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Embattled-Adani-Embarks-On-A-Coal-Fire-Sale-To-Boost-Liquidity.html |

|

Why Biden’s State Of The Union Remarks About Oil And Gas Make SenseDuring the State of the Union address, President Biden wandered off script for a minute and ad-libbed, “We’re going to need oil for another decade.” This remark drew hoots from Republican lawmakers and doubting commentary from conservative influencers. But exactly what did he say that was wrong? Maybe more than a decade? Okay, he added that, after the hoots. But, as far as we can tell, he sent the right message. There are five ways to decarbonize our economy, three of which would directly affect consumption of fossil fuels. (1)… Read more at: https://oilprice.com/Energy/Energy-General/Why-Bidens-State-Of-The-Union-Remarks-About-Oil-And-Gas-Make-Sense.html |

|

Dow closes nearly 250 points lower, Nasdaq sheds 1% as Alphabet shares slide: Live updatesInvestors continued watching corporate earnings reports for signs of economic and consumer health. Read more at: https://www.cnbc.com/2023/02/08/stock-market-futures-open-to-close-news.html |

|

Yahoo to lay off 20% of staff by year-end, beginning this weekYahoo will lay off more than 20% of staff, or around 1,600 workers, with the company’s Yahoo for Business being slashed in half, the company said. Read more at: https://www.cnbc.com/2023/02/09/yahoo-will-lay-off-nearly-1000-employees-by-end-of-2023.html |

|

Biden’s billionaire tax is ‘dead on arrival’ in Congress, top Wall Street backers and Democratic strategists sayBiden’s billionaire tax would subject households with a net worth above $100 million to pay a minimum annual tax of 20% on gains of their “tradable assets.” Read more at: https://www.cnbc.com/2023/02/09/joe-bidens-billionaire-tax-is-dead-on-arrival.html |

|

FBI investigating Chinese spy balloon, but much of the evidence is still under waterThe spy balloon is believed to be just latest of Chinese surveillance airships that crossed air spaces of the U.S. and dozens of other countries. Read more at: https://www.cnbc.com/2023/02/09/fbi-investigates-chinese-spy-balloon.html |

|

Coinbase CEO Brian Armstrong is sounding the alarm on a potential ‘staking’ crackdown. Here’s what it says about cryptoAn SEC crackdown on staking would be bad news for exchanges like Coinbase, networks like Ethereum and crypto as an ecosystem. Read more at: https://www.cnbc.com/2023/02/09/coinbase-ceo-brian-armstrong-sounds-alarm-on-a-potential-staking-crackdown-.html |

|

Activist investor Nelson Peltz declares Disney proxy fight is over after Iger unveils restructuringNelson Peltz dropped his proxy fight against Disney after CEO Bob Iger unveiled a vast reorganization. Read more at: https://www.cnbc.com/2023/02/09/activist-investor-nelson-peltz-declares-disney-proxy-fight-is-over-after-iger-unveils-restructuring.html |

|

Crypto exchange Kraken settles with SEC for $30 million, will close U.S. staking operationCrypto exchange Kraken will settle with the SEC for $30 million and close its staking operation, which the SEC alleged was an unregistered offering. Read more at: https://www.cnbc.com/2023/02/09/crypto-exchange-kraken-settles-with-sec-over-us-staking-operation.html |

|

Anger grows in Turkey as earthquake death toll passes 20,000 and rescue hopes dwindleThousands spent the night in the debris-encrusted streets of Adiyaman with little shelter and huddled around small fires. Read more at: https://www.cnbc.com/2023/02/09/plight-of-homeless-deepens-as-turkey-syria-earthquake-death-toll-rises.html |

|

Bitcoin slips further below $23,000, and judge extends SBF’s bail restrictions: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, we explore the consumer shift away from centralized exchanges following the collapse of FTX. Read more at: https://www.cnbc.com/video/2023/02/09/bitcoin-slips-judge-bail-restrictions-cnbc-crypto-world.html |

|

Ukraine war live updates: Zelenskyy makes heartfelt call for EU membership; U.S. and UK jointly sanction Russian cybercrime groupThe Ukrainian leader addressed the European Parliament in his second known overseas trip since Russia invaded his country almost a year ago. Read more at: https://www.cnbc.com/2023/02/09/russia-ukraine-live-updates.html |

|

General Motors signs deal with GlobalFoundries for exclusive U.S. semiconductor productionGM has signed a long-term agreement with GlobalFoundries to establish exclusive production capacity of U.S.-produced semiconductor chips. Read more at: https://www.cnbc.com/2023/02/09/general-motors-globalfoundries-strike-semiconductor-deal.html |

|

Lucid joins the EV discounting fray with $7,500 ‘credits’ on some of its Air luxury sedansLucid’s Air luxury sedan is too expensive for the new federal EV tax credits — so the company is offering $7,500 “credits” of its own on certain models. Read more at: https://www.cnbc.com/2023/02/09/lucid-offers-ev-discounts-air-sedans.html |

|

Redwood Materials scores a new $2 billion loan to build out battery recycling facility in NevadaFounded by ex-Tesla CTO JB Straubel, Redwood Materials is growing its battery recycling operations in and beyond Nevada. Read more at: https://www.cnbc.com/2023/02/09/redwood-materials-nabs-2-billion-loan-for-battery-recycling-in-nevada.html |

|

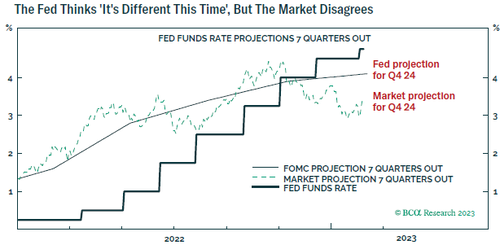

Beware: The Fed Thinks It’s Different This TimeBy Dhaval Joshi of BCA Research The four deadliest words in life are ‘it’s different this time’. Anyone who utters these words usually ends up being carried away, feet first. So, it’s especially worrying that the ‘it’s different this time’ narrative is coming from none other than the world’s most important central bank, the US Federal Reserve.

Through the past 75 years, the US unemployment rate has either not gone up meaningfully, or it has gone up by a lot. The US unemployment rate has never gone up by ‘just’ 1 percent. Yet when asked at last week’s press conference if the cost of killing inflation could be kept to the unemployment rate going up by ‘just’ 1 percent, Jay Powell answered: “Yeah, absolutely it’s possible… this is not a standard business cycle where you can look at the last ten times there was a global pandemic… it is unique” The Sequence Of Events Leading To Recession Is Always The Same It’s not every day that there’s a global pandemic. Then aga … Read more at: https://www.zerohedge.com/markets/beware-fed-thinks-its-different-time |

|

Cryptos Tumble After Kraken Agrees To Shutter Crypto-Staking Ops To Settle SEC ChargesUpdate (320pm ET): As Coindesk reported earlier, the SEC confirmed that it has indeed reached a settlement with Kraken under which the exchange will pay $30 million to settle allegations its broke securities rules, and would end its crypto staking program as it involved “unregistered securities.” It is unclear if Ethereum is among the alleged “securities”:

“Today’s action should make clear to the marketplace that staking-as-a-service providers must register and provide full, fair, and truthful disclosure and investor protection,” SEC Chair Gary Gensler said in a statement. * * * Bitcoin and the broader crypto universe tumbled…

Read more at: https://www.zerohedge.com/markets/cryptos-tumble-after-kraken-agrees-shutter-crypto-staking-ops-settle-sec-charges |

|

NTSB Says Fatal 2021 Tesla Wreck Was The Result Of “Excessive Speed” And “Alcohol Intoxication”A report from the U.S. National Transportation Safety Board this week has found that a 2021 fiery Tesla crash was the result of the vehicle’s driver speeding and being intoxicated. The crash killed two people. 69-year-old engineer Everett Talbot and 59-year-old Dr. William Varner were the victims of the crash which took place on April 17, 2021. The occupants were traveling in a 2019 Tesla Model S P100D which, after slamming into a tree, burst into flames. NTSB’s investigation concluded that the likely cause of the crash was: “the driver’s excessive speed and failure to control his car, due to impairment from alcohol intoxication in combination with the effects of two sedating antihistamines, resulting in a roadway departure, tree impact, and post-crash fire,” according to ABC. Recall, we wrote back in May 2021 that a close friend of one of the men who died in the Houston area fatal wreck ago said he believed the driver of the vehicle climbed into the back seat while “trying to save his own life”. We noted that when the NTSB issued their preliminary report on the wreck, they noted that “all aspects” were still under investigation. Read more at: https://www.zerohedge.com/markets/ntsb-says-fatal-2021-tesla-wreck-was-result-excessive-speed-and-alcohol-intoxication |

|

El-Erian Warns About Disinflationista’s “Dangerous Complacency”Authored by Mohamed El-Erian via Project Syndicate, There Is More Inflation Complexity Ahead As US inflation gradually eases, the claim that today’s inflationary pressures are the result of a temporary supply shock has re-emerged. While this thesis may be comforting, it could also encourage dangerous complacency, making an already serious problem much harder to solve.

Nearly two years into the current bout of inflation, the concept of “transitory inflation” is making a comeback as the COVID-related supply shocks dissipate. This comes at a time when it is critically important to keep an open mind about the trajectory of inflation, including by avoiding an over-simplified transitory narrative that risks obfuscating the real issues facing the US economy. “Transitory” is a comforting notion suggesting … Read more at: https://www.zerohedge.com/markets/el-erian-warns-about-disinflationistas-dangerous-complacency |

|

Mobile and broadband price rises to be investigatedThe regulator says price rises are “unclear and unpredictable” as customers face big jumps in charges. Read more at: https://www.bbc.co.uk/news/business-64584641?at_medium=RSS&at_campaign=KARANGA |

|

Half-term border queues warning due to strikesUK Border Force staff based at Calais, Dunkirk and Dover will walk out next Friday, which could cause delays. Read more at: https://www.bbc.co.uk/news/business-64585145?at_medium=RSS&at_campaign=KARANGA |

|

Strikes Update: How Friday 10 February’s walkouts will affect youWhat you need to know about the ambulance workers’ strike and other industrial action, by the BBC’s Zoe Conway. Read more at: https://www.bbc.co.uk/news/business-64579672?at_medium=RSS&at_campaign=KARANGA |

|

Chart Check: Carborundum Universal hits record highs in February; should you buy, sell or hold?The stock price started its upmove from Rs 251 (October 2020) to Rs 1,029 (January 2022), making a series of higher bottoms and higher tops. During the move the stock continuously traded above the averages,” Bharat Gala, President – Technical Research, Ventura Securities. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/chart-check-carborundum-universal-hits-record-highs-in-february-should-you-buy-sell-or-hold/articleshow/97765770.cms |

|

MRF declares 2nd interim dividend of Rs 3 per share. Check record date & other details hereOther income during the quarter rose marginally at Rs 71 crore as against Rs 69 crore in the previous year period. The company’s total income rose 15% year-on-year to Rs 5,716 crore for the December quarter. The same was Rs 4,989 crore in the same quarter of last year Read more at: https://economictimes.indiatimes.com/markets/stocks/news/mrf-declares-2nd-interim-dividend-of-rs-3-per-share-check-record-date-other-details-here/articleshow/97767901.cms |

|

Worst to first! 4 reasons why IT stocks are selling like hot cakes on Dalal StreetMany long term investors have been busy cherry-picking high quality names among IT stocks after they were hammered on fears related to recession, margin compression and deal wins. Mphasis, Tech Mahindra, Wipro, LTTS and LTIMindtree are still down at least 30% from their 52-week high levels. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/worst-to-first-4-reasons-why-it-stocks-are-selling-like-hot-cakes-on-dalal-street/articleshow/97756931.cms |

|

Earnings Results: BorgWarner stock rallies after analyst pounds the table, saying its an ‘indirect play on EV growth’BorgWarner stock jumps after 2023 outlook calling for near doubling in EV sales prompts upgrade to ‘strong buy’ at CFRA. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7194-E37072E129C7%7D&siteid=rss&rss=1 |

|

Market Extra: Retail investors are more bullish on stocks than at any point since the Fed started hiking rates. Here’s why that could be a problem.A popular survey of retail investors’ sentiment shows they’re more bullish than at any point since March 2022, around the time when the Federal Reserve began its campaign of interest-rate hikes. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7195-C23C046BA60D%7D&siteid=rss&rss=1 |

|

Yahoo to cut more than 20% of staff in strategic shiftYahoo intends to lay off more than 20% of its staff as it changes the way it approaches its work in advertising technology Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7195-A9295A3C7742%7D&siteid=rss&rss=1 |

< …

< …