Summary Of the Markets Today:

- The Dow closed down 128 points or 0.38%,

- Nasdaq closed down 1.59%,

- S&P 500 closed down 1.04%,

- Gold $1879 closed down $52.20,

- WTI crude oil settled at $73 down $2.67,

- 10-year U.S. Treasury 3.536% up 0.138 points,

- USD $102.97 up $1.22,

- Bitcoin $23,368 down $125 – Session Low $23,257

- Baker Hughes Rig Count: U.S. -12 to 759 Canada +2 to 249

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our Economic Forecast for February 2023

Today’s Economic Releases:

Total nonfarm payroll employment rose by 517,000 in January 2023, and the unemployment rate declined from 3.5% to 3.4%. Job growth was widespread, led by gains in leisure and hospitality, professional and business services, and health care. Employment also increased in government, partially reflecting the return of workers from a strike. The household survey showed employment growth at 894,000 vs the establishment headline number of 517,000. The household survey increased the size of the workforce by 866,000. Interestingly, the all-in unemployment rate (U-6) worsened from 6.5% to 6.6%. This employment data is considered very good and suggests that the economy is not near a recession and that the Federal Reserve has a long way to go to cool inflation (as employment growth generally fans inflation). Wall Street does not want the federal funds rate to continue to increase to fight inflation, and the employment data shows that the rate will likely keep increasing in the foreseeable future.

Just a reminder that the above employment data are seasonally adjusted. Januarys historically have negative job growth due to the layoffs of seasonal jobs – as shown in the below NOT SEASONALLY ADJUSTED graph. The layoffs this January 2023 were less than normal causing the seasonally adjusted headline number to grow.

A summary of headlines we are reading today:

- Oil Prices Crash After Perky Jobs Data

- U.S. Drilling Activity Continues To Slow

- Oil Prices Under Pressure Despite Looming Fuel Embargo

- Here’s where the jobs are for January 2023 — in one chart

- Amazon stock hit hardest after tech earnings bonanza, despite misses by Apple and Alphabet

- Morgan Stanley’s Shalett advises investors to beware this bear market rally

- Stockman: What Inflation Would Look Like In A True Free-Market Economy

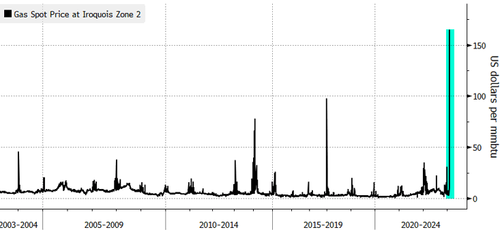

- New York NatGas Prices Erupt To 20-Year High Ahead Of Polar Vortex

- The Fed: ‘Wow,” Fed’s Daly says after killer jobs report, but it doesn’t alter Fed’s inflation-fighting plan

These and other headlines and news summaries moving the markets today are included below.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Iran-Azerbaijan Relations Under Stress Following Embassy AttackA gunman stormed the Azerbaijani Embassy in Tehran on January 27, killing one guard and wounding two others. Iran said the attack was motivated by personal reasons, but Baku described it as a “terrorist attack.” The incident led Azerbaijan to temporarily suspend its operations at its embassy in Tehran and evacuate its staff from the country. Iranian media said the attacker, who was arrested, was an Iranian man married to an Azerbaijani woman. The attacker was quoted as saying that his wife disappeared after entering the Azerbaijani… Read more at: https://oilprice.com/Geopolitics/International/Iran-Azerbaijan-Relations-Under-Stress-Following-Embassy-Attack.html |

|

Explained: The Sweden-Turkey NATO StalemateThe Turkish government insists that Sweden significantly change its permissive approach to the Partiya Karkaren Kurdistan (PKK, or Kurdish Workers’ Party) and other anti-Turkey groups as a condition for Ankara’s approval of Stockholm’s application for NATO membership. Western commentators have attributed the position of the Turkish government to upcoming Turkish elections, opposition to free speech, and/or visceral reaction to political provocateurs (Associated Press, January 19; Bloomberg, January 26; jonathanturley.org, January… Read more at: https://oilprice.com/Geopolitics/International/Explained-The-Sweden-Turkey-NATO-Stalemate.html |

|

EU Supports $100 Russian Diesel Price CapEU members have agreed to support a price cap level of $100 per barrel on Russian diesel sales to third-party countries, people familiar with the matter told Bloomberg on Friday afternoon. The EU’s ban on Russian seaborne crude oil products imports, including diesel and naphtha, is scheduled to go into effect on February 5. The EU’s proposal, submitted last week, called for capping the price of Russian diesel sold to third countries at $100 per barrel for products that trade at a premium and $45 for those that sell at a discount. Similarly… Read more at: https://oilprice.com/Latest-Energy-News/World-News/EU-Supports-100-Russian-Diesel-Price-Cap.html |

|

Oil Prices Crash After Perky Jobs DataCrude oil prices fell on Friday afternoon following reports of strong U.S. jobs data, with WTI crashing by more than 2.5% to $73.88 The U.S. January jobs report indicates that the jobs market is stronger than expected, with employers adding 517,000 in January. This compares to economists that had expected employers had added 185,000 jobs in January. The unemployment rate in the United States is at 3.4%–the lowest rate since 1969, despite the round of tech layoffs. The Fed’s aggressive interest rate hikes are not slowing hiring as some would… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Oil-Prices-Crash-After-Perky-Jobs-Data.html |

|

U.S. Drilling Activity Continues To SlowThe total number of total active drilling rigs in the United States fell 12 this week, according to new data from Baker Hughes published on Friday. The total rig count fell to 759 this week—146 rigs higher than the rig count this time in 2022 and 316 rigs lower than the rig count at the beginning of 2019, prior to the pandemic. Oil rigs in the United States fell by 10 this week, to 599. Gas rigs fell by 2, to 158. Miscellaneous rigs stayed the same at 2. The rig count in the Permian Basin fell by 3, while rigs in the Eagle Ford stayed the… Read more at: https://oilprice.com/Energy/Energy-General/US-Drilling-Activity-Continues-To-Slow.html |

|

EU Leaders Meet In Ukraine To Discuss Fresh Sanctions PackageLeaders of the European Union and Ukraine are holding a landmark meeting in Kyiv amid air-raid alerts in the capital and across Ukraine. The alerts on February 3 were lifted after less than two hours, and there were no immediate reports of any air strikes by Russia. In recent months, Russian missile strikes have caused extensive damage to Ukraine’s electricity grid in the depths of winter and claimed victims among civilians. The top-level meeting in Kyiv between Ukrainian President Volodymyr Zelenskiy and the EU leadership is expected to discuss… Read more at: https://oilprice.com/Latest-Energy-News/World-News/EU-Leaders-Meet-In-Ukraine-To-Discuss-Fresh-Sanctions-Package.html |

|

Rogue Trader Bets $80 Million Fed Will Start Slashing Rates By Year EndEarlier this week, we quoted Bloomberg trader and market commentator Vince Cignarella who said that “In More Than 40 Years Of Trading, Never Have I Witnessed A Market Fighting The Fed As Boldly As This One,” and judging by Powell’s remarkable verbal pivot yesterday, there was good reason for that: the market was spot on, and Powell appears to have conceded that inflation will run much hotter, as he refuses to push back against risk prices anymore. As Bloomberg reports, a trader has put on a massive bet that the Fed will soon cave on the promise… Read more at: https://oilprice.com/Finance/the-Economy/Rogue-Trader-Bets-80-Million-Fed-Will-Start-Slashing-Rates-By-Year-End.html |

|

Russia’s Oil And Gas Revenues Slump 46% Year-Over-YearRussia’s budget revenues from oil and gas plunged in January by 46% compared to the same month last year due to the sanctions on Russian oil exports, which led to a slump in the price of Russia’s flagship crude grade. Russian budget revenues from energy sales – including taxes and customs revenues – plummeted last month to the lowest level since August 2020, according to data from its finance ministry compiled by Reuters. In January 2023, the price of Russia’s flagship Urals grade averaged 42% lower than in the same… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Russias-Oil-And-Gas-Revenues-Slump-46-Year-Over-Year.html |

|

Oil Prices Inches Higher As Traders Await A Rebound In Chinese DemandOil is on course for a second straight week of losses, with investors hoping for clearer signs of recovering fuel demand in China to offset an economic slump across the West. Both major benchmarks were little changed in Friday morning’s early trading, with Brent Crude down 0.23 percent at $81.98 per barrel, while WTI Crude is down 0.29 percent at $75.66 per barrel. The lack of movement consolidates definitive downturns in prices this week, with Brent Crude dropping more than five percent in value – extending a one percent loss from… Read more at: https://oilprice.com/Energy/Crude-Oil/Oil-Prices-Inches-Higher-As-Traders-Await-A-Rebound-In-Chinese-Demand.html |

|

Europe’s Gas Prices Set For 6% Weekly Gain As Cold Weather Closes InEurope’s benchmark gas prices were set to post a 6% weekly gain on Friday, the biggest gain since early December, due to expected colder temperatures in eastern and southern Europe next week. Around noon in Amsterdam on Friday, the TTF price, Europe’s benchmark, had risen by 2.9% on the day to $64.20 (58.70 euros) per megawatt-hour (MWh), as weather forecasts point to lower-than-normal temperatures in some parts of Europe next week. The European benchmark prices have rebounded this week and jumped by 11% at over $65 (60… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Europes-Gas-Prices-Set-For-6-Weekly-Gain-As-Cold-Weather-Closes-In.html |

|

Oil Prices Under Pressure Despite Looming Fuel EmbargoOil prices are under pressure from a slew of bearish news coming out of the United States this week, but the looming EU embargo on Russian oil products could still change that.Oilprice Alert: Whether you are new to the oil and gas industry or an energy market veteran, you will regret not signing up for Global Energy Alert. Oilprice.com’s premium newsletter provides everything from geopolitical analysis to trading analysis, and all for less than a cup of coffee per week.Friday, February 3rd, 2023Whilst this week may not have been as volatile… Read more at: https://oilprice.com/Energy/Energy-General/Oil-Prices-Under-Pressure-Despite-Looming-Fuel-Embargo.html |

|

U.S. Oil Majors Are Outperforming Their European Counterparts1. US Oil Majors Pull Ahead of Their European Peers- As European oil companies press ahead with their renewable energy projects and adapt to continent-wide windfall taxes, US oil majors have been outperforming their peers in the high-price environment of the past 12 months. – While Shell’s 2022 net profits were comparable to ExxonMobil and Chevron, US majors trade at roughly 6 times their expected EBITDA for 2023, twice the average of Europeans. – This discrepancy has fueled speculation across the Atlantic Basin, boosted by a Citi analytical… Read more at: https://oilprice.com/Energy/Energy-General/US-Oil-Majors-Are-Outperforming-Their-European-Counterparts.html |

|

Iran Vows Revenge For Drone AttacksPolitics, Geopolitics & Conflict The above-mentioned attack on Iran’s Isfahan ministry of defense facility earlier this week was conducted using drone parts that Tehran claims were smuggled into Iran via the Kurdistan Region of Iraq by a Kurdish dissident group on behalf of a “foreign intelligence agency”. This will give Iran another (easier) target for revenge, Iraqi Kurdistan, which it has already been targeting for its alleged role in spurring protests in Iran. A day later, Tehran officially identified the “foreign… Read more at: https://oilprice.com/Energy/Energy-General/Iran-Vows-Revenge-For-Drone-Attacks.html |

|

How To Balance Your Energy Portfolio For 2023These days, I spend quite a lot of time teaching people about markets and trading and mentoring them as they start to invest their own money. Everyone is different in terms of their level of knowledge and their ability to grasp complex concepts quickly when we first meet, but there are some subjects that I cover where it seems almost nobody fully understands what is involved. One such subject is hedging. Even those who know what it means, in theory, have problems understanding its practical applications, and most think of it as a tool to be used… Read more at: https://oilprice.com/Energy/Energy-General/How-To-Balance-Your-Energy-Portfolio-For-2023.html |

|

Geopolitical Risks On The Rise In The Middle EastMuch attention is now duly focused on the Middle East (again), with what is widely believed to be an Israeli attack on an Iranian armaments facility–the level of destruction of which remains disputed. With Netanyahu back on the throne in Tel Aviv, we expect more hard-handed Israeli meddling, which in turn could back Iran into a corner. The concern is twofold: Combined with a resurgence of war-like activities between Israel and the Palestinian Territories, concentrated Israeli attacks on Iranian targets could lead to a wider war in the Middle… Read more at: https://oilprice.com/Energy/Energy-General/Geopolitical-Risks-On-The-Rise-In-The-Middle-East.html |

|

Here’s where the jobs are for January 2023 — in one chartLeisure and hospitality saw an increase of 128,000 jobs in the month, led by 99,000 jobs in restaurants and bars alone. Read more at: https://www.cnbc.com/2023/02/03/heres-where-the-jobs-are-for-january-2023-in-one-chart.html |

|

Biden administration expands EV tax credits in boost for Tesla, Cadillac, othersThe EV tax credit change follows Tesla CEO Elon Musk publicly criticizing the former standards as well as GM and Ford lobbying to adjust the guidelines. Read more at: https://www.cnbc.com/2023/02/03/biden-ev-tax-credits-tesla-suv.html |

|

Amazon stock hit hardest after tech earnings bonanza, despite misses by Apple and AlphabetDespite Amazon’s mixed fourth-quarter earnings report, analysts were encouraged by the company’s potential for long-term growth and efforts to tame expenses. Read more at: https://www.cnbc.com/2023/02/03/amazon-stock-hit-hardest-after-tech-earnings-bonanza.html |

|

Ford CEO Jim Farley’s frustration builds as he vows to transform the automakerCEO Jim Farley wants Ford to become a far more efficient company, and he needs it to happen quickly. Read more at: https://www.cnbc.com/2023/02/03/ford-ceo-jim-farley-frustrated-after-bad-earnings.html |

|

Morgan Stanley’s Shalett advises investors to beware this bear market rallyInvestors should be happy with the gains they reaped from a January rally that wasn’t justified by fundamentals, according to Lisa Shalett. Read more at: https://www.cnbc.com/2023/02/03/morgan-stanleys-shalett-advises-investors-to-beware-this-bear-market-rally.html |

|

Blinken tells China its spy balloon was ‘irresponsible’ after canceling Beijing tripSecretary of State Antony Blinken will postpone his trip to China next week after a suspected Beijing-operated spy balloon looming over parts of Montana. Read more at: https://www.cnbc.com/2023/02/03/us-secretary-of-state-blinken-postpones-high-stakes-trip-to-china-after-us-discovers-suspected-spy-balloon-.html |

|

Stocks fall on Friday, but S&P 500 notches winning week as strong 2023 continuesTraders assessed a strong U.S. jobs report that suggest higher rates for longer, as well as disappointing tech earnings. Read more at: https://www.cnbc.com/2023/02/02/stock-futures-fall-after-earnings-reports-from-apple-alphabet-disappoint-investors.html |

|

Biden’s student loan forgiveness plan heads to the Supreme Court. How that affects the payment pauseFederal student loan bills may not resume until August or September, said higher education expert Mark Kantrowitz. Here’s what borrowers need to know. Read more at: https://www.cnbc.com/2023/02/03/how-supreme-court-hearings-affect-student-loan-payment-pause.html |

|

Don’t risk an audit. Here are four reasons the IRS may flag your returnWhile the odds of an audit have been low, your return may get flagged for several reasons, tax experts say. Here’s what filers need to know. Read more at: https://www.cnbc.com/2023/02/03/dont-risk-an-audit-here-are-four-reasons-the-irs-may-flag-your-return.html |

|

Kyiv presses criminal charges against Wagner group chief; Germany announces more tanks for UkraineEU officials are likely to pour some cold water on Ukraine’s membership hopes, as many reforms are still required in order to meet the bloc’s requirements. Read more at: https://www.cnbc.com/2023/02/03/russia-ukraine-live-updates.html |

|

Vince McMahon open to leaving WWE for good if he sells the company, CEO Nick Khan saysWWE Chairman Vince McMahon is open to leaving the company forever if he finds the right sale, CEO Nick Khan told CNBC. Read more at: https://www.cnbc.com/2023/02/03/vince-mcmahon-open-to-leaving-wwe.html |

|

Airbnb is making a simple, but big booking change bringing it closer to hotel check-inAirbnb is looking to further curb bad behavior on its platform by requiring that all hosts and users officially verify their identities. Read more at: https://www.cnbc.com/2023/02/03/airbnb-will-soon-push-all-vacationers-and-hosts-to-verify-identity.html |

|

Hong Kong is giving away 500,000 flights this year—here’s what to knowOn Thursday, Hong Kong’s leader John Lee announced the city is giving away 500,000 flights in an effort to revive its economy after strict pandemic policies. Read more at: https://www.cnbc.com/2023/02/03/hong-kong-plane-ticket-giveaway-hello-hong-kong.html |

|

Stockman: What Inflation Would Look Like In A True Free-Market EconomyAuthored by David Stockman via InternationalMan.com, There is nothing more substantive than Bernanke’s original finger-in-the-air proposition that the Fed needed a 200 basis point cushion in the inflation rate in order to steer the economy clear of the dreaded 0.0% inflation line, the other side of which allegedly amounted to a black hole of deflationary demise.

But here’s the thing. There is not a shred of historical evidence that the US economy needs a 2.00% inflation guardrail to thrive, or any fixed rate of inflation at all. For instance, even during the most difficult period of the 20th century—from 1921 to 1946 when the US economy experienced the Roaring Twenties boom, the Great Depression bust and the WWII rebound—there was abundant net economic growth over the period as a whole, accompanied by zero inflation. Read more at: https://www.zerohedge.com/markets/stockman-what-inflation-would-look-true-free-market-economy |

|

Germany Open To Idea West Behind Nord Stream Sabotage With “Aim Of Blaming It On Russia”In surprising bit of candid investigative reporting out of mainstream media, The Times asked the question this week: who attacked the Nord Stream pipelines? In an honest and objective fashion, the premier British paper writes, “In this global whodunnit, the US, Russia, and even Britain have all been suspects.” Naturally, the collective West rushed to blame Russia for sabotaging its own natural gas delivery infrastructure in the immediate aftermath of the Sept. 26 blasts underneath the Baltic Sea. The most important twist to the West’s narrative that is featured in the Times report concerns Germany. Its officials say they are now “open to theories” that the sabotage attack was conducted by a Western country “with the aim of blaming it on Russia.”

Image: Danish Defense Command/Handout Read more at: https://www.zerohedge.com/geopolitical/germany-open-idea-west-behind-nord-stream-sabotage-aim-blaming-it-russia |

|

Warning Shot Fired!Authored by James Rickards via DailyReckoning.com, Another warning shot across the bow just happened…

I warned my readers a few weeks ago about how the Federal Reserve, in cooperation with giant global banks, has launched a 12-week pilot project to test the message systems and payment processes on the new CBDC dollar. A pilot project is not research and development. That’s already done. The pilot means that what I call “Biden Bucks” are here, and the backers just want to test the plumbing before they roll the system out on the entire population. That project is due to be completed next month. In other words, Biden Bucks are getting closer to becoming a reality for us all. Now there is another big development to keep you up to speed… This month, the Digital Dollar Project (DDP) released an updated version of its white paper called “Exploring a U.S. CBDC.” … Read more at: https://www.zerohedge.com/political/warning-shot-fired |

|

New York NatGas Prices Erupt To 20-Year High Ahead Of Polar VortexNew Yorkers will feel the wrath of Old Man Winter today as temperatures will plummet into the teens and single digits by this weekend. Heating demand will soar as millions turn up their thermostats to stay warm. The result so far has been the largest spike in New York natural gas prices in two decades. Bloomberg data shows next-day NatGas deliveries via the Iroquois Gas pipeline that transports Canadian NatGas into New York jumped to $164.80 per million British thermal units (MMBtu), a 14x increase from Wednesday prices. This is the highest print for NatGas at the New York hub dating back to 2003.

Earlier, we quoted Upstate New York meteorologist Ben Frechette who warned, “the coldest airmass on the entire planet will be over New England by Friday night – the only comparable air currently exists over central Siberia.” Read more at: https://www.zerohedge.com/commodities/new-york-natgas-prices-erupt-20-year-high-ahead-polar-vortex |

|

FTSE 100 closes at record highThe stock index closes at a high as global inflation and interest rate fears ease. Read more at: https://www.bbc.co.uk/news/business-64517179?at_medium=RSS&at_campaign=KARANGA |

|

Pregnant women to get more protection against being made redundantNew law will aim to cover expectant mothers from the moment they tell their boss they are pregnant. Read more at: https://www.bbc.co.uk/news/uk-politics-64496473?at_medium=RSS&at_campaign=KARANGA |

|

Twitter: Number of staff suing goes up daily – lawyerOne former senior manager tells the BBC the treatment of workers by Elon Musk was “unjustifiable”. Read more at: https://www.bbc.co.uk/news/technology-64512053?at_medium=RSS&at_campaign=KARANGA |

|

Two entities offload GMR Airports Infra shares worth Rs 330 cr via block dealAccording to block deal data available with the BSE, two entities — C/D Investors Fund LP and H/D Investors Fund LP — sold a total of 8,86,58,600 shares, amounting to a combined stake of 1.5 per cent in the company Read more at: https://economictimes.indiatimes.com/markets/stocks/news/two-entities-offload-gmr-airports-infra-shares-worth-rs-330-cr/articleshow/97586157.cms |

|

Nifty forms bullish candle. What traders should do next weekNifty today formed a bullish candle with a longer lower shadow on the daily and weekly scale, which indicates buying interest on declines. Now, it needs to hold above 17,850 zones, for an up move towards 17,950 then 18,081 zones whereas supports are placed at 17,777 and 17,650 zones, said Chandan Taparia of Motilal Oswal. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/nifty-forms-bullish-candle-what-traders-should-do-next-week/articleshow/97583969.cms |

|

Mark Mobius says Adani’s debt pile ‘scared us away’ from share saleThe selloff deepened after Bloomberg reported this week that units of Credit Suisse Group AG and Citigroup Inc. have stopped accepting some securities issued by Adani’s companies as collateral for margin loans to wealthy clients. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/mark-mobius-says-adanis-debt-pile-scared-us-away-from-share-sale/articleshow/97572849.cms |

|

The Fed: ‘Wow,” Fed’s Daly says after killer jobs report, but it doesn’t alter Fed’s inflation-fighting planThe San Francisco Federal Reserve chief said the huge increase in new U.S. jobs in January was a “wow” report, but it doesn’t change inflation-fighting plan. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7190-567134541047%7D&siteid=rss&rss=1 |

|

The Ratings Game: GoPro’s stock sinks back below $1 billion market cap after poor outlookGoPro Inc.’s market cap slipped back below $1 billion again on Friday after the sports-camera maker’s forecast fell short of Wall Street expectations. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7190-2873069D9E0E%7D&siteid=rss&rss=1 |

|

Coronavirus Update: Omicron subvariant that’s dominant in U.S. extends lead over other variants in latest week, CDC data showsThe omicron subvariant that became dominant in the U.S. several weeks ago continued to extend its lead over other variants in the latest week Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-718F-DD25BDE65218%7D&siteid=rss&rss=1 |