Summary Of the Markets Today:

- The Dow closed up 7 points or 0.02%,

- Nasdaq closed up 2.00%,

- S&P 500 up 1.05%,

- Gold $1968 up $22.50,

- WTI crude oil settled at $77 down $1.91,

- 10-year U.S. Treasury 3.413% down 0.114 points,

- USD $101.17 down $0.93,

- Bitcoin $23,741 up $750.42 – Session Low 22,853

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our Economic Forecast for February 2023

Today’s Economic Releases:

Construction spending during December 2022 was 7.7% above December 2021. However, when construction spending is inflation adjusted, it is DOWN 9.2% year-over-year. Construction is paying the price for the Fed’s inflation-fighting increase of the federal funds rate – and is a drag on the economy.

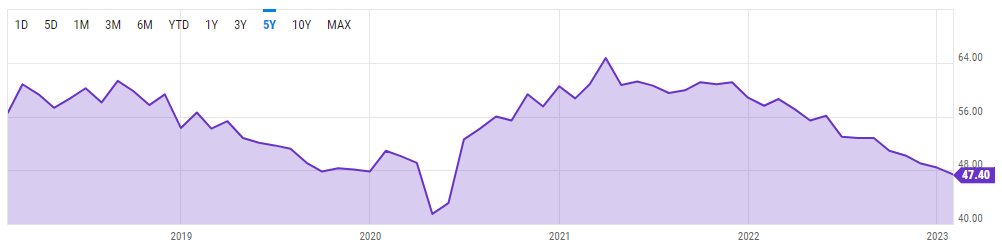

The January 2023 Manufacturing PMI registered 47.4%, 1 percentage point lower than the seasonally adjusted 48.4% recorded in December. Regarding the overall economy, this figure indicates a second month of contraction after a 30-month period of expansion. The Manufacturing PMI figure is the lowest since May 2020, when it registered a seasonally adjusted 43.5%. The New Orders Index remained in contraction territory at 42.5%, 2.6 percentage points lower than the seasonally adjusted figure of 45.1% recorded in December. The Production Index reading of 48% is a 0.6-percentage point decrease compared to December’s seasonally adjusted figure of 48.6%. Yes, manufacturing is currently a drag on the economy.

graph source: https://ycharts.com/indicators/us_pmi

The number of job openings increased to 11.0 million on the last business day of December 2022. Over the month, the number of hires and total separations changed little at 6.2 million and 5.9 million, respectively. This is a sign of continued strength in employment. The graph below shows that the number of job openings (red line) continue to far exceed the number of jobs being added (blue line).

The Fed FOMC meeting statement hiked the federal funds rate by 25bps as fully expected to a range of 4.5%-4.75%..

A summary of headlines we are reading today:

- Germany’s Largest Gas Storage Facility Can’t Store Gas

- U.S. Manufacturing PMI Hits Lowest Since May 2020

- Nuclear Power Is Entering A New Era

- Space Politics: A Battle For Lunar Minerals Is Unfolding

- Oil Prices Inch Lower After EIA Confirms Crude Build

- Goldman: The Fed Is Approaching A “Critical Inflection Point”

- Full recap of the Federal Reserve’s rate hike and Chairman Jerome Powell’s news conference

- S&P 500 closes higher on Wednesday, Nasdaq adds 2% as investors look past Fed’s rate hike

- FedEx is laying off 10% of its officers and directors amid cooling demand

- Here’s what the Federal Reserve’s 25 basis point interest rate hike means for your money

- Stocks, Bonds, & Gold Soar As Powell Shrugs Off Loosening Financial Conditions

- The Fed: Fed lifts interest rates by a quarter percentage point and signals ‘ongoing increases’

These and other headlines and news summaries moving the markets today are included below.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

The EU’s Response To Biden’s Inflation Reduction Act Is Finally HereWhen President Biden introduced his Inflation Reduction Act (IRA) last summer, he surprised the world with the extent of the climate commitments within it While supposedly aimed at inflation reduction, the legislation also provides extensive political support and funding for the green transition, providing tax cuts, subsidies, and other incentives for companies looking to use cleaner alternatives to fossil fuels. The EU has long been hailed as the leader in the switch to renewable energy, encouraging other countries worldwide to follow in its footsteps… Read more at: https://oilprice.com/Energy/Energy-General/The-EUs-Response-To-Bidens-Inflation-Reduction-Act-Is-Finally-Here.html |

|

Germany’s Largest Gas Storage Facility Can’t Store GasGermany’s natural gas storage facility in Rehden, Lower Saxony—Germany’s largest—cannot store any gas, a Lower Saxony supervisory authority said on Wednesday, according to Spiegel. The pore storage facility accounts for one-fifth o the total storage capacity available in Germany and is also one of the largest in Western Europe, with a working capacity of around 4 billion cubic meters on an underground area of around eight square kilometers, according to the facility’s website. The natural gas storage facility experienced… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Germanys-Largest-Gas-Storage-Facility-Cant-Store-Gas.html |

|

U.S. Manufacturing PMI Hits Lowest Since May 2020U.S. manufacturing PMI for January has come in at 47.4%, representing the third consecutive contraction of economic activity in the manufacturing sector, with the petroleum products and coal industry among the 15 showing contractions, according to data released Wednesday by the Institute for Supply Management (ISM). The U.S. January Manufacturing PMI of 47.4% comes in 1% lower than December’s seasonally adjusted 48.4%, indicating “a second month of contraction after a 30-month period of expansion”, the ISM reported. … Read more at: https://oilprice.com/Latest-Energy-News/World-News/US-Manufacturing-PMI-Hits-Lowest-Since-May-2020.html |

|

China’s Reopening Has Been A Boon For Metal MarketsVia AG Metal Miner The Chinese stock market reacted to Beijing’s about-face on COVID infections with a surge in prices, particularly in tech stocks. Due to a strong correlation with the stock market, metal prices have continued to rise since December. The expectation is that abandoning any meaningful attempt to control the spread of the virus will allow the economy to bounce back significantly following two years of harsh lockdowns. Currently, the world faces a recovering Chinese economy, a weak dollar, and the growing expectation… Read more at: https://oilprice.com/Metals/Commodities/Chinas-Reopening-Has-Been-A-Boon-For-Metal-Markets.html |

|

Iran And Russia Integrate Banking Systems To Skirt SWIFT SanctionsA top Iranian official announced this week that Iran and Russia had integrated their interbank communication and transfer systems to help enhance trade and financial operations in an effort to bypass strict economic sanctions on their financial infrastructure. With the signing of the agreement, 52 Iranian and 106 Russian banks are connected through the Russian Financial Message Transfer System, which will facilitate economic relations between the two countries, said Deputy Governor of the Central Bank of Iran Mohsen Karimi. “This system is immune… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Iran-And-Russia-Integrate-Banking-Systems-To-Skirt-SWIFT-Sanctions.html |

|

Nuclear Power Is Entering A New EraThe global energy crisis is putting an unprecedented squeeze on the nuclear power industry. The urgent need to shore up energy security in the context of the Russian war in Ukraine has convalesced with the equally urgent need to decarbonize the global energy mix as the line of no return for catastrophic climate change grows ever closer. For many countries, this has meant that public and private sector leaders have been forced to reconsider their attitudes toward nuclear energy, a proven emissions-free technology capable of producing a whole lot… Read more at: https://oilprice.com/Alternative-Energy/Nuclear-Power/Nuclear-Power-Is-Entering-A-New-Era.html |

|

UK Food Inflation Is Out Of ControlFood inflation has reached its highest level on record, with the sector predicting no stall in price increases throughout the year. Figures published in the British Retail Consortium’s (BRC) shop price index show food inflation rose to 13.8 percent in January, up from 13.3 percent in December. This rise has pushed it above the three-month average rate of 13.2 percent. The BRC also reported a rise in costs of ambient food, such as canned vegetables and soups, which rose to 11.3 percent in January, up from 11.0 percent in December. … Read more at: https://oilprice.com/Latest-Energy-News/World-News/UK-Food-Inflation-Is-Out-Of-Control.html |

|

Turkmenistan Emerges As Transit Hub For Russian Deliveries To South AsiaThere is no keeping the Russians away from Turkmenistan at the moment. On January 19, Prime Minister Mikhail Mishustin traveled to Ashgabat for a two-day visit that culminated in much effusive talk of future cooperation. Ten days after that, it was the turn of the speaker of the Russian State Duma, Vyacheslav Volodin, to do the same. Volodin was ostensibly in town on some intra-parliamentary business. Since the Turkmen legislature is an institution of no actual significance, though, this aspect of the agenda was for show. And it wasn’t… Read more at: https://oilprice.com/Energy/Energy-General/Turkmenistan-Emerges-As-Transit-Hub-For-Russian-Deliveries-To-South-Asia.html |

|

Oil Pipeline From Russia To Europe Remains Operational Despite ShellingA pumping station on the Druzhba oil pipeline was shelled on Tuesday in a western Russian region bordering Ukraine and Belarus, but the pipeline carrying oil from Russia to Europe operated normally on Wednesday, Russia’s pipeline monopoly Transneft said. There have been reports about the shelling of a section of the pipeline in the Bryansk region in Russia. According to Russian media, the pumping station Novozybkovo on the Druzhba pipeline was targeted on January 31 by Ukraine. Representatives for Transneft told Russian news agencies… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Oil-Pipeline-From-Russia-To-Europe-Remains-Operational-Despite-Shelling.html |

|

Space Politics: A Battle For Lunar Minerals Is UnfoldingSpace has been commercialized. It’s now being militarized. Next could it be colonized? Some experts think we’re on track for an all-out space race between the United States and China to not only put boots on the moon but to set up camp there to extract rare minerals. There are international treaties that prevent governments from claiming territory in Space, but if history has taught us anything, it’s that a) treaties were made to be broken when the payout is high enough and b) human nature loves a loophole. “It is a fact:… Read more at: https://oilprice.com/Geopolitics/International/Space-Politics-A-Battle-For-Lunar-Minerals-Is-Unfolding.html |

|

Russia’s Economy Shrinks 2.7% Due To Western SanctionsWestern sanctions against Russia have been “very effective” in cutting off Russia’s war machine, a U.S. official asserted, amid growing questions about Moscow’s ability to circumvent the measures. In an interview with RFE/RL, Robin Dunnigan, a deputy assistant U.S. secretary of state, said the economic sanctions imposed after Russia invaded Ukraine in February 2022 were putting pressure on Moscow, and “we will see the results of that in the coming months and years.” Russia’s economy has been squeezed by the Western sanctions, contracting around… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Russias-Economy-Shrinks-27-Due-To-Western-Sanctions.html |

|

Russian Urals Traded At $49.48 in January, But The Kremlin Isn’t WorriedRussian Urals crude traded at $49.48 per barrel in January, with rising transportation costs compounding a discount that has seen the country’s flagship crude price drop by 42% year-on-year, according to Russian Finance Ministry figures cited by Turkey’s Anadolu Agency. Official figures released on Wednesday showed a drastic decline from $85.64 in January 2021 to this year’s price of under $49.5 per barrel, Anadolu Agency reported. While slightly different from the Russian Finance Ministry figures, Platts (part of… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Russian-Urals-Traded-At-4948-in-January-But-The-Kremlin-Isnt-Worried.html |

|

Oil Prices Inch Lower After EIA Confirms Crude BuildCrude oil prices inched lower today, after the U.S. Energy Information Administration reported a crude oil inventory build of 4.1 million barrels for the week to January 27. This compared with a modest inventory increase of half a million barrels for the previous week, which in turn followed two weeks of substantial inventory builds. In gasoline, the EIA estimated an inventory increase of 2.6 million barrels for the reporting period. It compared with a build of 1.8 million barrels for the previous week. Gasoline inventories are currently at a ten-year… Read more at: https://oilprice.com/Energy/Crude-Oil/Oil-Prices-Inch-Lower-After-EIA-Confirms-Crude-Build.html |

|

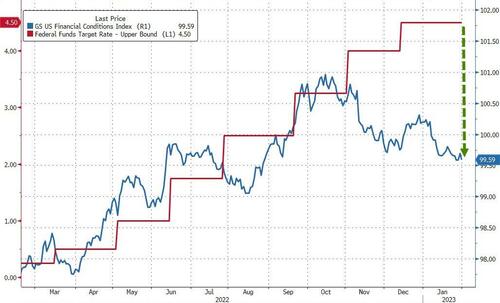

Goldman: The Fed Is Approaching A “Critical Inflection Point”Cutting to the chase, ahead of the Fed’s decision (due at 2pm, Powell press conference 2:30pm, no projections so no new dots so no way to push back more on market expectations for sub-5% terminal rate), the key question – as Goldman puts it – is “what the FOMC will signal about further hikes this year” since 25bps tomorrow is in the bag and what matters to stocks is i) will this be the final rate hike and ii) how long will the Fed keep rates here before starting to cut. “The Fed is approaching a critical inflection point and whether they finish… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Goldman-The-Fed-Is-Approaching-A-Critical-Inflection-Point.html |

|

Big Oil Speaks Out Against Trudeau’s “Just Transition” BillCanada has big plans for its energy workers as the government hopes to launch a ‘Just Transition bill’ to help workers employed in oil and gas operations to transition smoothly to the green energy sector. Many countries worldwide are developing initiatives to provide retraining and support for workers looking to move into the renewables industry, as the number of jobs in fossil fuels has decreased in recent years. But this would be one of the first policies to actively address the situation, pointing towards Canada’s aims for… Read more at: https://oilprice.com/Energy/Crude-Oil/Big-Oil-Speaks-Out-Against-Trudeaus-Just-Transition-Bill.html |

|

Meta shares jump 14% on better-than-expected revenueFacebook-parent Meta reported earnings after the bell. Here are the results. Read more at: https://www.cnbc.com/2023/02/01/facebook-parent-meta-earnings-q4-2022.html |

|

Full recap of the Federal Reserve’s rate hike and Chairman Jerome Powell’s news conferenceThe Federal Reserve raised rates by 25 basis points, or 0.25 percentage point, as was widely expected. Read more at: https://www.cnbc.com/2023/02/01/live-updates-fed-rate-hike-february.html |

|

S&P 500 closes higher on Wednesday, Nasdaq adds 2% as investors look past Fed’s rate hikeInvestors assessed a quarter-point rate hike from the Federal Reserve at the conclusion of its latest policy meeting. Read more at: https://www.cnbc.com/2023/01/31/stock-market-futures-open-to-close-news.html |

|

FedEx is laying off 10% of its officers and directors amid cooling demandThe corporate job cuts come as the shipping giant tries to reduce costs amid cooling consumer demand. Read more at: https://www.cnbc.com/2023/02/01/fedex-lays-off-officers-directors-amid-cooling-demand.html |

|

CNBC Pro Talks: Top investor Karen Firestone sees value in these ‘in therapy’ stocks making their way out of the doghouse2023 started off with a bang for the markets as investors piled into stocks that took a beating last year. Now earnings are coming into focus, and some are wondering if they bought too much too fast. Aureus Asset Management CEO Karen Firestone has been sharing her investment thesis on CNBC’s “Halftime,” and now she shares her favorite stocks for the near and long-term with CNBC Pro, and offers advice on finding sell discipline and gauging risk. Read more at: https://www.cnbc.com/video/2023/02/01/cnbc-pro-talks-top-investor-karen-firestone-on-2023s-market-comeback.html |

|

Rivian to lay off 6% of its workforce as EV price war concerns growThe CEO of EV maker Rivian told employees that the company will make the layoffs as the company refocuses to conserve cash. Read more at: https://www.cnbc.com/2023/02/01/rivian-to-lay-off-six-percent-of-workforce-ev-price-war.html |

|

Samsung launches new Galaxy S23 smartphone lineup with improved camera, gaming capabilitiesSamsung launched its new Galaxy S23 smartphone lineup Wednesday. The S23 will go head-to-head with Apple’s iPhone 14. Read more at: https://www.cnbc.com/2023/02/01/samsung-galaxy-s23-smartphone-lineup-to-take-on-apples-iphone-14.html |

|

Adani abandons $2.5 billion share sale in big blow to Indian tycoonGautam Adani’s flagship firm called off its $2.5 billion share sale in a dramatic reversal as a rout sparked by a U.S. short-seller wiped billions more off the stocks. Read more at: https://www.cnbc.com/2023/02/01/adani-abandons-2point5-billion-share-sale-in-big-blow-to-indian-tycoon.html |

|

Celsius opens some withdrawals, and how governments are building blockchain tech: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, Daniela Barbosa of Hyperledger Foundation discusses why government agencies are building blockchain networks. Read more at: https://www.cnbc.com/video/2023/02/01/celsius-withdrawals-governments-blockchain-tech-crypto-world.html |

|

Ukraine war live updates: U.S. reportedly readying $2 billion aid package for Ukraine; Kyiv signals reforms ahead of EU summitUkraine’s President Volodymyr Zelenskyy said Tuesday that Kyiv is preparing new reforms as it prepares for a summit with top EU officials at the end of the week Read more at: https://www.cnbc.com/2023/02/01/ukraine-war-live-updates-latest-news-on-russia-and-the-war-in-ukraine.html |

|

Here’s what the Federal Reserve’s 25 basis point interest rate hike means for your moneyEverything from mortgages and credit cards to student and car loans will be affected by the latest rate hike from the Federal Reserve. Read more at: https://www.cnbc.com/2023/02/01/what-a-federal-reserve-quarter-point-interest-rate-hike-means-for-you.html |

|

The Fed just raised interest rates 25 basis points—why they’ll stay high and what it means for your moneyThe Federal Reserve’s eighth-consecutive rate hike will make most loans and credit card debt more expensive. Read more at: https://www.cnbc.com/2023/02/01/fed-chair-jerome-powell-raises-interest-rates-warns-about-inflation.html |

|

Here are JPMorgan’s top stock picks heading into FebruaryThe firm published its monthly U.S. Analyst Focus List on Wednesday, which highlights some of its analysts’ favored stock ideas. Read more at: https://www.cnbc.com/2023/02/01/here-are-jpmorgans-top-stock-picks-heading-into-february.html |

|

Stocks, Bonds, & Gold Soar As Powell Shrugs Off Loosening Financial ConditionsAfter some initial volatility, US equity markets are charging higher…

…and bond yields lower…

After Fed Chair Powell appeared to shrug off the fact that financial conditions have dramatically loosened recently… Read more at: https://www.zerohedge.com/markets/stocks-bonds-gold-soar-powell-shrugs-loosening-financial-conditions |

|

Wall Street Reacts To The Fed’s 25bps Rate HikeAs usual, the only thing to kneejerk almost as fast as stonks after the FOMC statement release is the barrage of bite-sized comments from the strategist/economist peanut gallery. And since today is no difference, with the digital ink on the FOMC statement still wet so to speak, here is the first barrage of sell-side reactions. Omair Sharif of Inflation Insights

Ben Jeffery at BMO Capital Markets says:

Priya Misra at TD Securities says

|

|

Watch: Will Fed Chair Powell Call The Market’s ‘Dovish’ Bluff?For the last six weeks, since the prior FOMC meeting, the market has ignored every Fed Speaker’s hawkish jawboning against the market’s “unwarranted easing” of financial conditions in the face of The Fed’s “higher for longer” narrative. After the expected 25bps hike and a mixed basket from the statement, the market, simply put, expects a ‘hawkish’ Powell in rhetoric but believe he and his pals are ‘all bark, and no bite’.

So, is it possible that Powell can deliver a Jackson Hole 2.0-esque conference call that the market will believe… or have animal spirits taken over? Watch live here (press conference due to start at 1430ET): Read more at: https://www.zerohedge.com/markets/watch-willk-fed-chair-powell-call-markets-dovish-bluff |

|

Fed Hikes 25bps As Expected, Maintains Hawkish “Ongoing Increases” LanguageThe Fed hiked 25bps as fully expected and the statement had 3 key highlights:

As Inflation Insights suggests:

While everyone expects a ‘hawkish’ rhetoric from Powell in the presser, we suspect it won’t be ‘hawkish’ enough. * * * Since the last FOMC meeting on December 14th, a lot has changed for markets. While the dollar is lower and bonds are flat; gold, stocks, and crypto have all rallied strongly in an ‘easing’-like move… Read more at: https://www.zerohedge.com/markets/fed |

|

British Steel considering 800 job cuts in LincolnshireThe plans, which have not been formally submitted, come as the firm struggles with high energy prices. Read more at: https://www.bbc.co.uk/news/business-64489196?at_medium=RSS&at_campaign=KARANGA |

|

Fed announces smaller rate rise as inflation coolsThe US central bank announces its smallest rate rise in nearly a year. Read more at: https://www.bbc.co.uk/news/business-64489859?at_medium=RSS&at_campaign=KARANGA |

|

Adani calls off share sale after price plungesGautam Adani, one of Asia’s richest people, has seen his firms lose more than $90bn in market value. Read more at: https://www.bbc.co.uk/news/business-64490221?at_medium=RSS&at_campaign=KARANGA |

|

Nifty forms long-legged Doji candle on Budget day. What traders should do on Thursday expiryThe PCR ratio for the near week expiry stands at 0.54 and for the next week expiry at 0.68. The overall writing data suggests negative bias as Call writing is higher than Put writing. The immediate or temporary bounce back cannot be ruled out as PCR ratio drops near to 0.50 levels, said analysts Read more at: https://economictimes.indiatimes.com/markets/stocks/news/nifty-forms-long-legged-doji-candle-on-budget-day-what-traders-should-do-on-thursday-expiry/articleshow/97529302.cms |

|

From Prashant Jain to Nilesh Shah, how D-St veterans are rating Sitharaman’s BudgetNirmala Sitharaman’s Budget announcements cheered Dalal Street bulls and analysts alike as most of them see it as delivering on all fronts. >> For more such web stories click on the ET icon below Read more at: https://economictimes.indiatimes.com/markets/web-stories/from-prashant-jain-to-nilesh-shah-how-d-st-veterans-are-rating-sitharamans-budget/articleshow/97523819.cms |

|

Banks pocket $12 million in fees in Adani’s mega share saleThe fees are equivalent to around 0.5% of the 200 billion rupees raised in Adani Enterprises Ltd.’s offering, said the people, who asked not to be identified as the information is private. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/banks-pocket-12-million-in-fees-in-adanis-mega-share-sale/articleshow/97527427.cms |

|

Futures Movers: U.S. oil prices end at 3-week low as EIA reports a 6th straight weekly rise in U.S. crude suppliesOil futures finish lower on Wednesday after the Energy Information Administration reported a increase in U.S. crude supplies for a sixth week in a row. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-718C-A5C436BDF0CE%7D&siteid=rss&rss=1 |

|

Coronavirus Update: WHO’s draft pandemic treaty provides ‘glimmer of hope’ after trauma of COVID-19, policy expert saysWHO’s treaty on pandemic prevention and preparedness provides a “glimmer of hope” and pushes for more equitable solutions, one policy expert says. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-718C-D944E2F89E42%7D&siteid=rss&rss=1 |

|

The Fed: Fed lifts interest rates by a quarter percentage point and signals ‘ongoing increases’The Federal Reserve on Wednesday raised its benchmark rate to a range of 4.5%-4.75%. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-718C-AD6A6EBF9159%7D&siteid=rss&rss=1 |