Summary Of the Markets Today:

- The Dow closed down 614 points or 1.81% – markets reacted to weak economic data (see “Economic Releases” below),

- Nasdaq closed down 1.24%,

- S&P 500 down 1.56%,

- Gold $1906 down $4.30,

- WTI crude oil settled at $79 down $0.98,

- 10-year U.S. Treasury 3.375% down 0.16 points,

- USD $102.42 up $0.03,

- Bitcoin $20,757 down $335 – Session Low $20,476

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our Economic Forecast for January 2023

Today’s Economic Releases:

The Producer Price Index (PPI) for final demand continued to moderate in December 2022 increasing 6.2% year-over-year – declining from 7.3% in November. This continues to demonstrate that the Federal Reserve’s inflation-fighting methods are still working. For the last 13 years, the PPI and Consumer Price Index have correlated.

Advance estimates of U.S. retail and food services sales for December 2022 rose 6.0% above December 2021

If one inflation adjusts for this growth – retail sales have been contracting for the last 3 months (see the red line on the graph below). The primary reasons for the poor sales is gas stations and construction materials.

Industrial production growth slowed to 1.7% year-over-year in December 2022 – down from 2.2% in November. A look at the components of industrial production:

- Manufacturing is -0.4% year-over-year – down from +0.9% in November;

- Mining is +5.8% year-over-year – down from +6.8% in November;

- Utilities are +9.7% year-over-year – up from +4.2% in November (caused by cold weather energy demand)

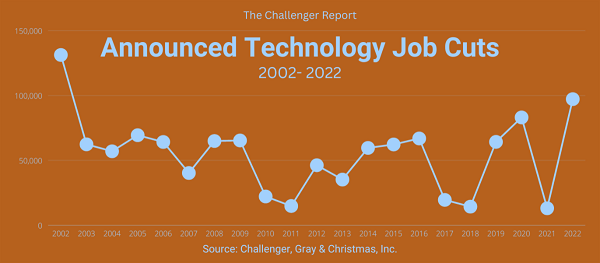

Microsoft announced today it would cut 10,000 workers amid economic uncertainty, echoing major Technology companies in recent weeks. With Microsoft’s planned reductions, Challenger, Gray & Christmas, Inc. has tracked 19,150 job cuts announced by companies in this sector through January 18th.

According to the Federal Reserve’s Beige Book of January 18, 2023:

Overall economic activity was relatively unchanged since the previous report. Five Districts reported slight or modest increases in overall activity, six noted no change or slight declines, and one cited a significant decline. On balance, contacts generally expected little growth in the months ahead. Consumer spending increased slightly, with some retailers reporting more robust sales over the holidays. Other retailers noted that high inflation continued to reduce consumers’ purchasing power, particularly among low- and moderate-income households. Auto sales were flat on average, but some dealers noted that increased vehicle availability had boosted sales. Tourism contacts reported moderate to robust activity augmented by strong holiday travel. Manufacturers indicated that activity declined modestly on average, and, in many Districts, reported that supply chain disruptions had eased. Housing markets continued to weaken, with sales and construction declining across Districts. Commercial real estate activity slowed slightly, on average, with more notable weakening in the office market. Nonfinancial services firms experienced stable demand on balance. Most bankers reported that residential mortgage demand remained weak, and some said higher borrowing costs had begun to dampen commercial lending. Energy activity continued to increase moderately, and agriculture conditions were generally unchanged or improving.

A summary of headlines we are reading today:

- EV Makers Brace For Another Tough Year

- UK Wind Farms Are Producing Too Much Energy

- Bed Bath & Beyond looks for capital infusion, buyer ahead of likely bankruptcy filing

- Party City files for bankruptcy with plans to restructure mounting debt

- Holiday sales fall short of expectations, set stage for tougher 2023 for retailers

- Beige Book Finds “Little Growth” Ahead”, Increasing Difficulty For Retailers To Pass Cost Increases

- Market Snapshot: Dow down 600 points in final hour of trade after weak economic data, hawkish Fed remarks erase inflation cheer

These and other headlines and news summaries moving the markets today are included below.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Asia Set For Rapid Renewable Energy Expansion In 2023An easing of Covid-19-related restrictions and shifting supply chains have bolstered growth in Asia, even as inflation and climate change generate significant headwinds. While South-east Asian countries such as Thailand and Vietnam had lifted restrictions in 2021, the last quarter of this year saw Japan reopen its borders to foreign travellers and China begin to roll back Covid-19-contaiment policies, signalling a gradual return to economic normalcy in the Asia-Pacific region. The same issues stalling economic growth across the globe Read more at: https://oilprice.com/Alternative-Energy/Renewable-Energy/Asia-Set-For-Rapid-Renewable-Energy-Expansion-In-2023.html |

|

EV Makers Brace For Another Tough YearElectric vehicle (EV) makers are facing a conundrum due to the uncertain outlook of the EV market in 2023. On the one hand, governments worldwide are pushing for a transition to green, with plans to roll out bans on the sale of new fossil fuel-powered cars across several cities within the next decade, which is encouraging more consumers to switch to EVs. On the other, the current uncertain geopolitical and energy outlook has sent much of the world into a recession, with soaring inflation and concerns about energy security, meaning that many consumers Read more at: https://oilprice.com/Energy/Energy-General/EV-Makers-Brace-For-Another-Tough-Year.html |

|

UK Wind Farms Are Producing Too Much EnergyNational Grid forked out 82m to operators of wind farms last month to constrain supplies and reduce output amid blustery conditions, to prevent the UKs energy network from being overwhelmed. This is on top of 122m it has paid out over the first 11 months of 2022 as part of 1.34bn it spent to manage supplies last year. Contrary to popular perception, wind turbines do not thrive in stormy or overly windy conditions as National Grid typically tells producers to reduce output to stop power spiking across Read more at: https://oilprice.com/Latest-Energy-News/World-News/UK-Wind-Farms-Are-Producing-Too-Much-Energy.html |

|

China Vows To Crack Down On Illegal Iron Market ManipulationVia AG Metal Miner The global iron ore price may be in for a bit of a ride. Sector analysts foresee high price volatility in the first months of 2023, mainly due to the increasing number of coronavirus cases in China. Adding fuel to the fire is the fact that the government there has warned it will be paying close attention to the ore market changes. The iron ore price index steadily increased from last November onward. Since the start of 2023, it increased by US $11 per ton to more than $122 per ton. Compare this to the $80 Read more at: https://oilprice.com/Metals/Commodities/China-Vows-To-Crack-Down-On-Illegal-Iron-Market-Manipulation.html |

|

UKs Top Oil Producer To Cut Jobs Over Windfall TaxThe largest oil and gas producer in Britain’s North Sea, Harbour Energy, will reportedly move to cut jobs as a result of the UKs windfall tax, Reuters reported exclusively, citing company sources. While the number of cuts coming remains undetermined, Reuters said the company, which employs 1,700 people, had confirmed that cuts would be made at the headquarters in Aberdeen, Scotland. “Following changes to the EPL, we have had to reassess our future activity levels in the UK… As such, we have initiated a review of our UK Read more at: https://oilprice.com/Latest-Energy-News/World-News/UKs-Top-Oil-Producer-To-Cut-Jobs-Over-Windfall-Tax.html |

|

Scientists Make Major Breakthrough In Sustainable Hydrogen ProductionThe University of Michigan scientists developed a new kind of solar panel achieving 9% efficiency in converting water into hydrogen and oxygen mimicking a crucial step in natural photosynthesis. Outdoors, it represents a major leap in the technology, nearly 10 times more efficient than solar water-splitting experiments of its kind. But the biggest benefit is driving down the cost of sustainable hydrogen. This is enabled by shrinking the semiconductor, typically the most expensive part of the device. The team’s self-healing semiconductor Read more at: https://oilprice.com/Energy/Energy-General/Scientists-Make-Major-Breakthrough-In-Sustainable-Hydrogen-Production.html |

|

Disney slams Peltz for lack of media experience, but its board is light on it, tooDisney’s board is almost entirely made up of executives who lack media and entertainment experience. Read more at: https://www.cnbc.com/2023/01/18/disney-peltz-proxy-fight-board-also-light-on-media-experience.html |

|

Bed Bath & Beyond looks for capital infusion, buyer ahead of likely bankruptcy filingBed Bath & Beyond is looking for financing to keep it afloat during a bankruptcy process, and continued discussions with prospective buyers, according to people familiar. Read more at: https://www.cnbc.com/2023/01/18/bed-bath-beyond-seeks-capital-infusion-buyer-ahead-of-likely-bankruptcy.html |

|

Party City files for bankruptcy with plans to restructure mounting debtRetailer Party City has filed for Chapter 11 bankruptcy protection, toppled by a heavy debt load as inflation hits consumers’ wallets and dents sales. Read more at: https://www.cnbc.com/2023/01/18/party-city-files-for-bankruptcy-to-restructure-piling-debt.html |

|

Gun companies reckon with declining demand after the pandemic surgeLarge firearm manufacturers such as Sturm, Ruger are taking a hit as gun sales, which surged in recent years, return to pre-pandemic levels. Read more at: https://www.cnbc.com/2023/01/18/gun-companies-report-declining-demand-for-firearms.html |

|

Homebuilder sentiment rises in January for the first time in a year, thanks to lower mortgage ratesLower mortgage rates are giving homebuilders greater confidence in the single-family housing market. Read more at: https://www.cnbc.com/2023/01/18/homebuilder-sentiment-in-january-rises-for-the-first-time-in-a-year.html |

|

Holiday sales fall short of expectations, set the stage for tougher 2023 for retailersHoliday sales fell short of industry expectations, as shoppers felt pinched by inflation and rising interest rates. Read more at: https://www.cnbc.com/2023/01/18/holiday-2022-sales-fall-short-of-expectations.html |

|

Holiday retail sales tanked, but trucking data shows e-commerce wasn’t the issueHoliday sales were a downer, but DHL Supply Chain is investing in e-commerce and says its trucking data shows that ‘large growth’ in internet retail continues. Read more at: https://www.cnbc.com/2023/01/18/holiday-sales-tanked-trucking-data-shows-e-commerce-wasnt-the-issue.html |

|

Amid inflation, more middle-class Americans struggle to make ends meetFinancial well-being is deteriorating overall but middle-class households have been particularly hard hit. Read more at: https://www.cnbc.com/2023/01/18/amid-inflation-more-middle-class-americans-struggle-to-make-ends-meet.html |

|

Southwest pilots’ union calls vote to authorize potential strike as contract talks sourSouthwest Airlines pilots’ union is calling a vote that would give it the power to call for a potential strike, weeks after the carrier’s holiday meltdown. Read more at: https://www.cnbc.com/2023/01/18/southwest-pilots-union-calls-vote-to-authorize-potential-strike.html |

|

Stocks making the biggest moves midday: Microsoft, Moderna, Mobileye, Chegg and moreThese are the stocks posting the largest moves in midday trading. Read more at: https://www.cnbc.com/2023/01/18/stocks-making-the-biggest-moves-midday-microsoft-moderna-mobileye-chegg-and-more.html |

|

Floods devastate Philippines as president declares ‘state of calamity’The Philippines is ranked among the most vulnerable countries to climate-related disasters, but it is a minor contributor to global climate change. Read more at: https://www.cnbc.com/2023/01/18/floods-devastate-philippines-president-declares-state-of-calamity-.html |

|

United results top estimates as demand remains resilient despite high faresUnited Airlines’ fourth-quarter profit topped Wall Street estimates thanks to strong demand and high fares. Read more at: https://www.cnbc.com/2023/01/17/united-airlines-ual-earnings-q4-2022.html |

|

GM reveals new Chevy Corvette E-Ray hybrid sports car, starting at over $104,000The 2024 Chevrolet Corvette E-Ray hybrid will be the quickest production version ever of the American sports car. Read more at: https://www.cnbc.com/2023/01/17/chevy-corvette-e-ray-hybrid-sports-car-unveiled.html |

|

Beige Book Finds “Little Growth” Ahead”, Increasing Difficulty For Retailers To Pass Cost IncreasesThere wasn’t too much excitement in the latest Fed Beige Book report which was based on information collected on or before January 9, 2023: it found that overall economic activity was relatively unchanged since the previous, Nov 30, 2022 report: five Districts reported slight or modest increases in overall activity, six noted no change or slight declines, and one cited a significant decline. Looking ahead, there wasn’t much excitement (or hope) either, with contacts expecting “little growth in the months ahead.” That said, if one reads the components of the report, one doesn’t get the impression that the economy was “relatively unchanged” – if anything, it sounds like the economy is sliding into a recession, especially for the low and moderate-income households: Consumer spending increased slightly, with some retailers reporting more robust sales over the holidays. These would be retailers targeting the 1%. Other retailers noted that high inflation continued to reduce consumers’ purchasing power, particularly among low- and moderate-income households. Auto sales were flat on average, but some dealers noted that increased vehicle availability had boosted sales. Tourism contacts reported moderate to robust activity augmented by strong holiday travel. Manufacturers indicated that activity declined modestly on average, and, … Read more at: https://www.zerohedge.com/markets/beige-book-finds-little-growth-ahead-increasing-difficulty-retailers-pass-cost-increases |

|

Secretive Surveillance Program Captured 150 Million International Money Transfers Spanning 20 Countries: Sen. WydenA secretive financial surveillance database established by the Arizona attorney general’s office in 2014 has ballooned into a behemoth tool used by more than 600 law-enforcement entities, which can search for more than 150 million money transfers between people in the US and more than 20 countries, according to internal program documents obtained by Sen. Ron Wyden (D-OR).

The database is called TRAC, or Transational Record Analysis Center, and was established as part of a settlement reached with Western Union to combat human trafficking and drug runners from Mexico. The data includes the full names of both the sender and the recipient, along with the amount of the transaction, the Wall Street Journal reports. “It’s a law-enforcement investigative tool,” said Rich Lebel, TRAC … Read more at: https://www.zerohedge.com/political/secretive-surveillance-program-captured-150-million-international-wire-transfers-spanning |

|

Outrage Ensues As DeSantis Engineers Conservative Overhaul Of Progressive CollegeAuthored by Darlene McCormick Sanchez via The Epoch Times (emphasis ours), Florida Gov. Ron DeSantis’ announcement that he intends to turn a flailing liberal public university into the Sunshine State’s answer to Hillsdale College has drawn fierce criticism from progressives.

A journalism student attending a Florida university said students were forced to affirm the professor’s anti-white, anti-Christian, and anti-American views in their writings, or receive failing grades. (Courtesy of unnamed student) A plethora of headlines shows that the Republican governor has struck a nerve. “Ron DeSantis’s New College Coup is Doomed to Fail,” wrote the Chronicle of Higher Education, and “A Fl … Read more at: https://www.zerohedge.com/political/outrage-ensues-desantis-engineers-conservative-overhaul-progressive-college |

|

“The Compensation Isn’t Going To Be There”: JPMorgan’s Raghavan Warns Bonuses Will “Absolutely” FallVis Raghavan of J.P. Morgan confirmed this week that his firm isn’t immune to the “anemic” year that investment banking had in 2022. As a result, he told Bloomberg from Davos that bonuses would “absolutely” fall. Raghavan, who is the company’s global investment-banking co-head who also oversees Europe, the Middle East and Africa, said:

Raghavan said the company’s markets desks had a “mixed year” and, despite anemic dealmaking and lower demand for equities, posted strong performances in “commodities, rates and macro, as well as volatility-based equity trades”. The firm’s investment banking revenue was down 57% year over year, per its earnings report last week. But Reghavan is optimistic the company is now at “steady state”, telling Bloomberg:

Read more at: https://www.zerohedge.com/markets/compensation-isnt-going-be-there-jp-morgans-raghavan-warns-bonuses-will-absolutely-fall |

|

Train strikes: Cheaper to settle, minister admitsIt would have cost the UK less if the disputes had been settled months ago, admits rail minister. Read more at: https://www.bbc.co.uk/news/business-64317725?at_medium=RSS&at_campaign=KARANGA |

|

Royal Mail restarts limited overseas post after cyber-attackCustomers should still not post any new parcels overseas, the firm said, following last week’s cyber-attack. Read more at: https://www.bbc.co.uk/news/business-64324000?at_medium=RSS&at_campaign=KARANGA |

|

Strikes update: How nurses’ strikes on Thursday will affect youWhat you need to know about the nurses’ strike and other industrial action, by the BBC’s Zoe Conway. Read more at: https://www.bbc.co.uk/news/business-64311738?at_medium=RSS&at_campaign=KARANGA |

|

After 2 years of goldilocks period, will FY24 Budget be a boon or bane for ITC?If the quantum of hike in tax is around this level, then Jefferies believes ITC can absorb it by passing on to consumers and not seeing any major hit to volumes. The sector has seen a notable recovery in legal cigarette volumes this year, while most other parts of consumption have seen sharp inflation in the past three years. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/after-2-years-of-goldilocks-period-will-fy24-budget-be-a-boon-or-bane-for-itc/articleshow/97078584.cms |

|

Nykaa, LIC, 2 Adani stocks among MFs’ top 10 large-cap bets in DecMutual funds invested most in these 10 large-cap stocks in December month. >> For more such web stories click on the ET icon below Read more at: https://economictimes.indiatimes.com/markets/web-stories/nykaa-lic-2-adani-stocks-among-mfs-top-10-largecap-bets-in-dec/articleshow/97084227.cms |

|

Ashish Kacholia picked 2 new stocks, raised bets on 4 others in December quarterIn the December quarter, Kacholia added two new stocks — Goldiam International and Raghav Productivity Enhancers — to his kitty. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/ashish-kacholia-picked-2-new-stocks-raised-bets-on-4-others-in-december/articleshow/97078706.cms |

|

Market Snapshot: Dow down 600 points in final hour of trade after weak economic data, hawkish Fed remarks erase inflation cheerU.S. stock indexes trade sharply lower on Wednesday afternoon, after data on falling retail sales in the holiday shopping season raised concerns that consumer spending and economic growth are losing momentum as the Federal Reserve raises interest rates. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-717F-D3C590D1E0FA%7D&siteid=rss&rss=1 |

|

The Margin: Going to Davos has an exorbitant costThe World Economic Forum is known for its big-name attendees — and for exorbitant prices for food and lodging. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-717F-3169A4845C14%7D&siteid=rss&rss=1 |